Apron Feeder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432302 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Apron Feeder Market Size

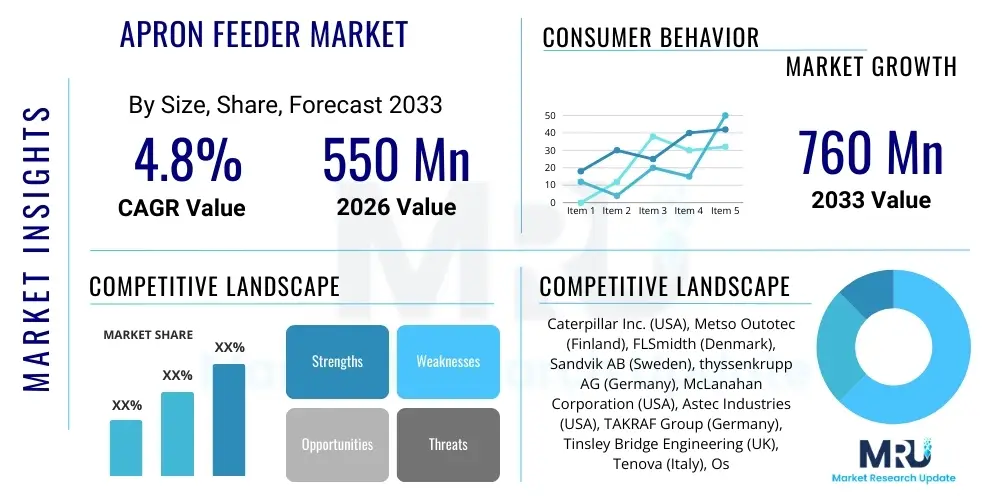

The Apron Feeder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. This consistent expansion is driven primarily by sustained global demand for key minerals and metals, necessitating increased investment in primary crushing and material handling circuits across emerging and established mining geographies. The apron feeder, being essential for regulating the flow of highly abrasive, sticky, and large-lump materials, maintains critical importance in high-tonnage processing plants, justifying steady market growth.

The market is estimated at $550 million USD in 2026 and is projected to reach $760 million USD by the end of the forecast period in 2033. This valuation reflects both the procurement of new, advanced heavy-duty feeders for greenfield mining projects and the substantial aftermarket revenue generated from maintenance, replacement parts, and retrofitting services for existing installed bases. Technological advancements focusing on enhanced durability, reduced maintenance downtime, and integration with intelligent monitoring systems further contribute to the premium valuation of modern apron feeder units.

Apron Feeder Market introduction

The Apron Feeder Market encompasses the manufacturing, supply, and servicing of robust mechanical equipment designed for controlled volumetric feeding of bulk materials into primary processing machinery, typically crushers, screens, or conveyor belts. Apron feeders are specifically engineered to handle the toughest material conditions, including large, heavy, highly abrasive, or impact-prone feed materials commonly encountered in large-scale mining, quarrying, and heavy aggregate operations. Unlike belt feeders, apron feeders utilize overlapping, heavy-duty steel pans (flights) attached to dual strand chains, providing unmatched structural integrity and resistance to material impact and wear, thereby ensuring consistent operational performance in demanding environments.

Major applications for apron feeders are predominantly found within the mineral processing sector, where they serve as the crucial link between the dump hopper (receiving raw material from haul trucks) and the primary crusher. Their ability to manage surge loads and deliver a consistent, regulated flow rate is fundamental to optimizing the efficiency and throughput of the entire crushing circuit. Key benefits include high impact resistance, exceptional material handling capacity for large particle sizes, and unparalleled durability, translating into lower operational risks and minimized unplanned downtime. This reliability is highly valued in remote mining operations where maintenance access is challenging.

Driving factors for market expansion include the global surge in infrastructure development, which fuels demand for industrial metals and construction aggregates, compelling mining companies to invest in high-capacity material handling systems. Furthermore, the increasing depth and complexity of mining operations worldwide necessitate feeders capable of enduring higher stresses and throughputs. Regulatory pressures mandating improved operational safety and reduced environmental footprints also drive demand for modern, energy-efficient feeder designs incorporating variable frequency drives (VFDs) and predictive maintenance capabilities, ensuring the sustained growth trajectory of the market.

Apron Feeder Market Executive Summary

The Apron Feeder Market demonstrates robust growth, anchored by persistent investment in global mining infrastructure and the increasing demand for high-tonnage processing solutions necessary for resource extraction. Business trends indicate a strong shift toward digitalization, with manufacturers incorporating smart sensors, remote diagnostics, and condition monitoring systems to enhance feeder uptime and optimize maintenance schedules. The aftermarket services segment, encompassing critical wear parts like steel pans, chains, and sprockets, remains a significant revenue contributor due to the non-negotiable nature of feeder durability in continuous operation environments. Furthermore, consolidation among major equipment suppliers and strategic partnerships aimed at offering integrated material handling solutions are defining the competitive landscape, pushing for improved design standardization and reduced total cost of ownership (TCO).

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive coal, iron ore, and base metal mining activities in China, India, and Australia, coupled with significant infrastructure projects demanding aggregates. North America and Europe show stable, modernization-driven demand, focusing less on new projects and more on replacing aging fleets with high-efficiency, environmentally compliant models. Latin America presents high potential, particularly in Chile and Peru, given the vast reserves of copper and other industrial minerals requiring robust, large-scale feeding solutions. These regional dynamics highlight the necessity for customized feeder designs catering to specific geological and climatic conditions, influencing localized competitive strategies.

Segment trends reveal that the Heavy-Duty Apron Feeder segment (handling capacities exceeding 3,000 tons per hour and high lump sizes) dominates the revenue share, driven by large-scale open-pit mining operations globally. However, the Medium-Duty segment is also gaining traction, particularly in smaller quarrying operations and mobile crushing plants. In terms of end-use, the mining sector remains the principal consumer, followed by the aggregates and cement industries. The market is increasingly segmenting based on the integration of advanced features, such as specialized liner materials (e.g., manganese steel or hard-facing overlays) designed to maximize resistance against extreme abrasion and impact, thus extending operational life significantly.

AI Impact Analysis on Apron Feeder Market

Common user questions regarding AI’s influence on the Apron Feeder Market often revolve around how artificial intelligence can mitigate the high operational costs and unpredictability associated with heavy machinery maintenance and failure. Users frequently inquire about the feasibility of using machine learning algorithms to predict chain failure, wear rates of pan liners, or motor anomalies based on vibration, acoustic, and thermal data collected in real-time. Key themes center on achieving 'zero unplanned downtime,' optimizing throughput under varying material conditions, and enabling completely autonomous operation of the feeder within the primary crushing circuit. The expectation is that AI integration will shift maintenance paradigms from time-based to condition-based, dramatically improving asset utilization and extending component life, thereby justifying the substantial initial investment required for digitalization.

The implementation of AI and machine learning (ML) models allows apron feeder operators to analyze vast streams of sensor data—including current draw, vibration analysis, temperature readings, and belt speed fluctuations—to establish baseline performance metrics and identify subtle deviations indicative of impending mechanical failure. This sophisticated diagnostic capability moves beyond simple alarm triggers; ML can correlate multiple factors (e.g., slight temperature increase combined with irregular chain noise patterns) that human operators might overlook. By providing prescriptive maintenance recommendations, AI minimizes secondary damage, reduces the inventory of spare parts required, and ensures that maintenance actions are executed precisely when required, optimizing resource allocation.

Furthermore, AI-driven process optimization is crucial for maximizing the feeder’s contribution to overall plant efficiency. Apron feeders often feed primary crushers, and optimal crusher performance depends entirely on a consistent, controlled feed rate. ML models can analyze the downstream crusher’s performance (e.g., power draw, product gradation) and adjust the feeder's speed (via VFD control) in real time to prevent overloading or starving the crusher, irrespective of changes in material density or lump size entering the hopper. This level of dynamic control, mediated by sophisticated algorithms, is unattainable through traditional manual or fixed-rate controls, translating directly into higher average plant throughput and energy efficiency savings.

- Predictive Maintenance: AI algorithms analyze vibration and thermal data to forecast component failure (e.g., bearings, chains), shifting to condition-based monitoring.

- Throughput Optimization: Machine learning models dynamically adjust feeder speed (VFD) based on real-time downstream crusher load and material characteristics to maximize efficiency.

- Autonomous Operation: Integration with robotic systems and plant control centers for hands-free speed and material flow management, improving safety and precision.

- Wear Rate Modeling: Using sensor data to precisely calculate the degradation of wear parts (pans, liners), optimizing inventory and scheduling timely replacement.

- Energy Efficiency: AI identifies patterns of power consumption wastage and suggests operational adjustments to minimize electricity usage per ton of material processed.

DRO & Impact Forces Of Apron Feeder Market

The Apron Feeder Market is primarily driven by significant global capital expenditures in the mining sector, specifically targeting base metals (copper, iron ore) and industrial minerals critical for electrification and infrastructure build-out, which necessitate the deployment of reliable, high-capacity primary material handling systems. Opportunities arise from technological advancements, particularly the integration of Internet of Things (IoT) sensors and digital twinning capabilities, enabling enhanced operational monitoring and substantial gains in maintenance efficiency. However, the market faces considerable restraints, including the inherently high capital cost of heavy-duty feeders, which often leads potential buyers to explore refurbishments or low-cost alternatives, and the highly cyclical nature of the commodity markets, which can abruptly stall major greenfield projects, impacting demand volatility. These forces collectively define the strategic investment and innovation priorities for market participants.

Key drivers include the imperative for mining companies to increase operational safety and reduce manual intervention in hazardous high-impact zones, making remotely monitored, durable apron feeders indispensable components of modern, automated mines. Furthermore, the global trend towards processing lower-grade ore bodies means mines must handle significantly higher volumes of material to achieve required output targets, directly boosting demand for larger, more robust feeders designed for extreme tonnages. The persistent expansion of urban centers and associated demand for construction materials also underpins steady demand from the aggregates and cement industries, ensuring market stability even during minor downturns in the metallic mining sector.

Impact forces are predominantly shaped by stringent environmental regulations, which necessitate equipment designed for minimal spillage, dust containment, and optimized energy usage, pressuring manufacturers to innovate material containment and drive mechanisms. The availability and price volatility of key raw materials (high-grade steel alloys) required for feeder construction also exert pressure on profitability. Opportunities lie in the rapidly expanding aftermarket segment, where providers can secure long-term service contracts offering predictive maintenance packages and proprietary wear parts, ensuring recurring revenue streams independent of new equipment sales cycles. Additionally, emerging markets in Africa and Southeast Asia represent untapped potential for infrastructure-driven mining growth.

Segmentation Analysis

The Apron Feeder Market is segmented primarily based on Capacity, Type of Drive System, and End-Use Application, reflecting the diverse requirements across the heavy material handling industry. Segmentation by capacity—categorizing feeders into Heavy-Duty (HDAF), Medium-Duty (MDAF), and Light-Duty (LDAF)—is crucial as it determines the structural specifications, pan thickness, chain size, and overall capital cost, catering specifically to the scale of operations ranging from primary crushing in large mines to secondary feeding in quarrying. The distinction by drive system, predominantly Variable Frequency Drives (VFDs) versus fixed-speed or hydraulic systems, highlights the industry's shift towards operational flexibility and energy optimization, driven by the desire for precise material flow control essential for maximizing crusher efficiency.

The End-Use Application segmentation—dominated by Mining, followed by Aggregates/Quarrying, and Cement/Steel—provides critical insights into the demand characteristics, including typical material abrasiveness, impact loads, and regulatory environment. For instance, feeders used in primary copper ore crushing are designed for massive impact and highly abrasive wear, demanding specialized liner materials, whereas those in the aggregates sector might prioritize mobility or modularity. This detailed segmentation allows manufacturers to tailor their product offerings, sales strategies, and service models to specific market vertical needs, ensuring optimized solutions for bulk material handling challenges across diverse industrial settings globally.

- By Capacity

- Heavy-Duty Apron Feeders (HDAF) (typically >3,000 TPH)

- Medium-Duty Apron Feeders (MDAF) (1,000 TPH to 3,000 TPH)

- Light-Duty Apron Feeders (LDAF) (Less than 1,000 TPH)

- By Drive System

- Variable Frequency Drive (VFD) Systems

- Fixed-Speed Electric Drives

- Hydraulic Drives

- By Pan Width/Size

- Small (Up to 1,500 mm)

- Medium (1,501 mm to 2,500 mm)

- Large (Above 2,500 mm)

- By End-Use Application

- Mining (Iron Ore, Copper, Gold, Coal, Industrial Minerals)

- Quarrying and Aggregates

- Cement and Steel Industry

Value Chain Analysis For Apron Feeder Market

The value chain for the Apron Feeder Market commences with upstream activities centered on the procurement and processing of high-quality raw materials, primarily specialized steel alloys (manganese steel, quenched and tempered steel plates) required for the chains, pans, and structural components that must withstand extreme impact and abrasion. Key suppliers in this segment include specialty metal producers and large forging houses. Efficiency and cost control at this stage are paramount, as material costs constitute a significant portion of the total equipment manufacturing expenditure. Manufacturers often engage in long-term contracts with steel mills to ensure material quality compliance and stability of supply, focusing on materials with superior wear characteristics to enhance the feeder's lifespan.

The midstream segment involves the core manufacturing process, including design engineering, heavy fabrication, precision machining of components (like sprockets and bearing housings), assembly, and rigorous quality assurance testing. Leading manufacturers invest heavily in proprietary design expertise related to pan overlap geometry and chain tensioning systems to prevent material hang-up and premature wear. Distribution channels are typically a combination of direct sales for large, complex mining projects (where custom engineering is required) and indirect channels utilizing authorized distributors or local agents who provide regional support, installation, and crucial after-sales services, particularly in geographically fragmented markets like Africa and Southeast Asia.

Downstream activities focus on installation, commissioning, and, most critically, the aftermarket support. The success of an apron feeder operation is heavily dependent on the quality and responsiveness of maintenance services, including the supply of replacement wear parts (pans, liners, rollers, chains). This aftermarket segment represents a high-margin opportunity, often exceeding the profitability of initial equipment sales, thus forming a vital component of the overall value proposition. Direct distribution (manufacturer-to-mine site) is common for high-cost, proprietary wear parts, ensuring compatibility and quality control, while standard components might utilize indirect, localized spare parts networks to ensure minimal downtime for the end-user.

Apron Feeder Market Potential Customers

The primary consumers (End-Users/Buyers) of apron feeders are major multinational mining corporations and regional aggregates producers whose operations necessitate the continuous, controlled feeding of large, heavy, and abrasive bulk materials into primary processing machinery. These customers prioritize equipment reliability, durability, high capacity, and the assurance of low operational downtime, as feeder failure can halt the entire processing plant, incurring massive financial losses. Large-scale customers, such as those operating iron ore or copper mines, typically procure heavy-duty feeders custom-designed for multi-million-ton annual throughput, emphasizing Total Cost of Ownership (TCO) over initial price.

A secondary, yet significant, customer base comprises engineering, procurement, and construction (EPC) firms specializing in developing large mining and industrial processing plants. These firms purchase feeders as part of integrated, turnkey project solutions on behalf of the ultimate owner. Additionally, mid-tier quarrying operators and cement manufacturers represent steady customers for medium-duty feeders, particularly those focused on handling limestone, shale, and crushed rock. These customers increasingly seek modular or mobile apron feeder units that can be rapidly deployed or repositioned within their operational footprint, balancing capacity with flexibility.

The key decision-makers among potential customers include mine managers, maintenance superintendents, and procurement specialists who conduct exhaustive technical evaluations based on material characteristics (lump size, density, moisture content), required throughput rate, maintenance accessibility, and vendor track record for technical support and spare parts availability. The shift towards automation means that plant optimization engineers also play a growing role, favoring feeders that integrate seamlessly with advanced plant control systems and provide comprehensive condition monitoring data for proactive maintenance strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million USD |

| Market Forecast in 2033 | $760 Million USD |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc. (USA), Metso Outotec (Finland), FLSmidth (Denmark), Sandvik AB (Sweden), thyssenkrupp AG (Germany), McLanahan Corporation (USA), Astec Industries (USA), TAKRAF Group (Germany), Tinsley Bridge Engineering (UK), Tenova (Italy), Osborn Engineered Products (South Africa), Deister Machine Company (USA), Hewitt Robins International (UK), General Kinematics (USA), Binder+Co AG (Austria), Schenck Process (Germany), West River Conveyors (USA), Eriez Manufacturing (USA), KHD Humboldt Wedag (Germany), L&T Construction Equipment (India) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Apron Feeder Market Key Technology Landscape

The technological landscape of the Apron Feeder Market is characterized by innovations focused on maximizing operational longevity, reducing wear, and enhancing automation and control. A critical advancement involves the widespread adoption of Variable Frequency Drives (VFDs) coupled with high-efficiency motors. VFDs provide precise control over the feeder's speed and torque, allowing operators to dynamically adjust the feed rate to match the instantaneous capacity of the downstream primary crusher, optimizing the entire circuit's performance and significantly reducing energy consumption. This controlled start and stop capability also minimizes mechanical shock loading on the gearbox and chain systems, thereby extending the overall lifespan of the expensive components and reducing maintenance frequency.

Another major technological focus is the development of advanced wear-resistant materials and modular designs. Manufacturers are increasingly utilizing specialized alloy steel, such as manganese steel castings or proprietary hard-facing overlays, for the feeder pans and side skirts, which are the primary points of contact for abrasive materials. Modular designs, featuring standardized, interchangeable components, facilitate quicker and safer maintenance procedures, reducing the plant’s costly mean time to repair (MTTR). Furthermore, the trend toward large-capacity feeders necessitates robust engineering solutions for handling extreme lump sizes, involving optimized chain selection (e.g., forged steel mining chains) and improved roller support systems to distribute immense static and dynamic loads effectively across the chassis.

Digitalization technologies, encompassing IoT sensors and integrated telemetry systems, represent the leading edge of innovation. Modern feeders are equipped with sensors monitoring bearing temperature, chain tension, vibration levels, and motor power draw. This data is transmitted to centralized plant management systems, enabling sophisticated condition monitoring and predictive maintenance protocols. The integration of digital twins, where a virtual model of the feeder runs parallel to the physical asset, allows maintenance teams to simulate failure scenarios and test operational adjustments before applying them in the field. These technologies enhance operational visibility, ensuring the feeder operates within optimal parameters and minimizing the risks associated with catastrophic failure in high-stress applications.

Regional Highlights

Regional dynamics play a crucial role in shaping the Apron Feeder Market, reflecting variances in mining activity, infrastructure investment cycles, and regulatory environments. The global market is highly dependent on localized mineral extraction rates, which dictate the need for new heavy equipment. Understanding these regional consumption patterns is vital for suppliers seeking to optimize their supply chain and establish appropriate service networks, particularly in regions where rapid industrialization fuels resource demand.

- Asia Pacific (APAC): APAC is the dominant market region due to massive iron ore mining in Australia, extensive coal extraction in Indonesia and India, and colossal infrastructure projects across China and India. The region exhibits strong demand for heavy-duty, high-capacity feeders to serve large, often state-owned, mining operations, focusing on cost-efficiency and high throughput. Australia, with its mature and highly mechanized mining sector, drives demand for technologically advanced and automated feeder systems.

- North America: This market is mature, characterized by demand centered on modernization, replacement, and strict safety compliance. Key drivers include renewed investment in copper and gold mining, particularly in the US and Canada, and substantial government-led infrastructure spending, which boosts the aggregates and quarrying segments. Demand focuses heavily on VFD-equipped feeders that offer improved energy efficiency and enhanced remote diagnostic capabilities.

- Latin America (LATAM): LATAM presents high growth potential, primarily driven by world-leading copper and iron ore production in countries like Chile, Peru, and Brazil. The market is characterized by the need for extremely robust, large-sized feeders capable of operating reliably in often remote and challenging high-altitude environments. Capital expenditure is highly correlated with global commodity prices for base metals.

- Europe: Europe represents a relatively stable market, primarily focused on quarrying, aggregates, and specialized industrial minerals. Demand is driven by strict environmental regulations, emphasizing highly efficient, low-noise, and low-vibration feeder designs. Replacement of aging equipment and the adoption of smaller, mobile feeders for demolition and recycling applications are key trends.

- Middle East and Africa (MEA): This region is emerging, driven by significant mineral wealth (platinum, chromium, gold, phosphates) in South Africa and North Africa. The market requires durable, reliable feeders suitable for harsh desert conditions and often challenging logistics. Market growth is heavily reliant on foreign direct investment into large-scale mining concessions and associated infrastructure development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Apron Feeder Market.- Caterpillar Inc. (USA)

- Metso Outotec (Finland)

- FLSmidth (Denmark)

- Sandvik AB (Sweden)

- thyssenkrupp AG (Germany)

- McLanahan Corporation (USA)

- Astec Industries (USA)

- TAKRAF Group (Germany)

- Tinsley Bridge Engineering (UK)

- Tenova (Italy)

- Osborn Engineered Products (South Africa)

- Deister Machine Company (USA)

- Hewitt Robins International (UK)

- General Kinematics (USA)

- Binder+Co AG (Austria)

- Schenck Process (Germany)

- West River Conveyors (USA)

- Eriez Manufacturing (USA)

- KHD Humboldt Wedag (Germany)

- L&T Construction Equipment (India)

Frequently Asked Questions

Analyze common user questions about the Apron Feeder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function and key advantage of an apron feeder over a belt feeder?

The primary function of an apron feeder is to provide a controlled, reliable feed rate for primary processing machinery, particularly when handling large, highly abrasive, or high-impact materials. Its key advantage over a belt feeder is its use of heavy-duty, overlapping steel pans and chains, which offer superior resistance to impact and wear, minimizing downtime in aggressive bulk material handling applications.

Which end-use segment drives the highest demand for heavy-duty apron feeders globally?

The Mining segment drives the highest demand for heavy-duty apron feeders globally. Large-scale mining operations, especially those dealing with hard rock minerals like iron ore, copper, and gold, require high-capacity feeders capable of managing extreme surge loads and delivering thousands of tons per hour (TPH) to primary crushers.

How is digital technology impacting the operational efficiency and maintenance of apron feeders?

Digital technology, including IoT sensors, VFDs, and predictive maintenance software powered by AI, significantly improves operational efficiency by allowing dynamic adjustment of feed rate based on downstream performance and dramatically reducing unplanned downtime through early detection of mechanical anomalies like bearing or chain wear.

What is the projected Compound Annual Growth Rate (CAGR) for the Apron Feeder Market through 2033?

The Apron Feeder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033, driven by sustained global investment in mineral extraction capacity and infrastructure development projects across emerging economies, particularly in the Asia Pacific region.

What are the key considerations when selecting the appropriate apron feeder capacity for a new mining project?

Key considerations involve the maximum required throughput (tons per hour), the maximum lump size of the material, its abrasiveness and density, and the expected surge load capacity. These factors dictate the necessary pan width, chain strength, and overall structural robustness, directly influencing the choice between light, medium, or heavy-duty models.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager