APS Coating ESC Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437589 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

APS Coating ESC Market Size

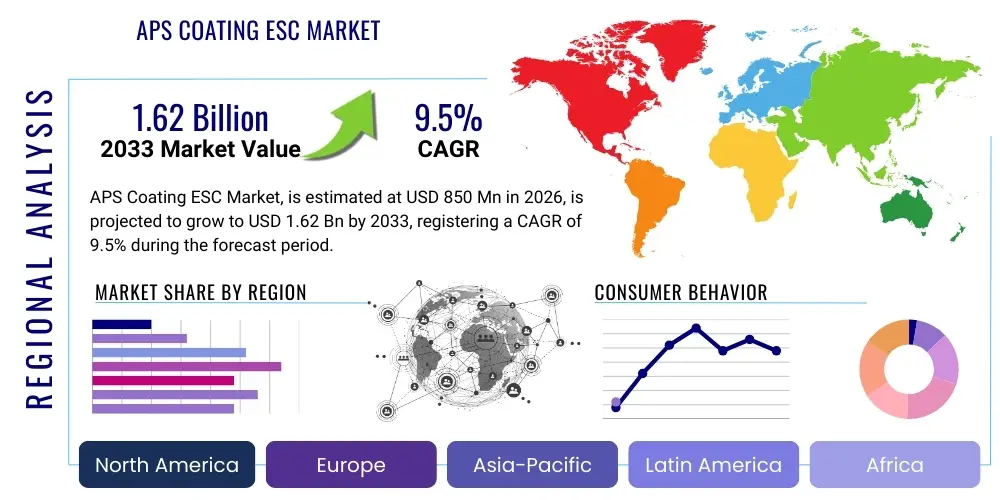

The APS Coating ESC Market, driven primarily by the escalating demand within advanced semiconductor fabrication processes, is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. This robust growth trajectory is underpinned by continuous technological advancements in deposition and etching equipment, necessitating extremely durable and precise electrostatic chucks (ESCs). The market is estimated at USD 850 Million in 2026, reflecting strong foundational investments in global chip production capacity, particularly for NAND, DRAM, and leading-edge logic devices.

The imperative for increased wafer processing throughput, coupled with the rising use of highly corrosive plasma chemistries, mandates the adoption of sophisticated protective coatings like Advanced Plasma Spray (APS) on critical components such as ESCs. These coatings are essential for maintaining component longevity, minimizing particle generation, and ensuring process stability, factors critical to achieving high yields in sub-10nm manufacturing nodes. This necessity positions the APS Coating ESC segment as a high-value niche within the broader semiconductor equipment maintenance and consumables sector.

By the end of the forecast period in 2033, the market is projected to reach USD 1.62 Billion. This significant valuation increase is directly correlated with the global expansion of fabrication plants (Fabs), particularly in Asia Pacific, and the ongoing transition to larger wafer sizes (e.g., 450mm research and 300mm mass production optimization). Furthermore, the integration of smart manufacturing principles and predictive maintenance models will further drive the demand for high-performance, durable ESC components, solidifying the market's high-growth potential throughout the projected timeline.

APS Coating ESC Market introduction

The Advanced Plasma Spray (APS) Coating Electrostatic Chuck (ESC) Market encompasses the manufacturing, sales, and service of ESCs that utilize specialized plasma coatings, predominantly alumina (Al2O3) or yttria (Y2O3), applied via the APS process. ESCs are vital components in semiconductor manufacturing equipment, serving to clamp wafers precisely during critical steps like plasma etching, PVD (Physical Vapor Deposition), and CVD (Chemical Vapor Deposition). The APS coating application enhances the dielectric strength, corrosion resistance, and thermal stability of the chuck surface, directly improving wafer clamping consistency and extending the lifespan of the chuck in harsh plasma environments. The precision required for these coatings, often in thicknesses measured in micrometers, is crucial for preventing arc formation and reducing defect rates in high-throughput processes.

Major applications for APS Coating ESCs span across various segments of the semiconductor industry, including memory production (DRAM, NAND), microprocessor manufacturing (CPUs, GPUs), and specialized sensor fabrication. These chucks are primarily integrated into dry etching systems, where plasma species rapidly degrade conventional materials. The benefits derived from employing APS coatings include enhanced uptime, reduced total cost of ownership (TCO) due to fewer replacement cycles, and superior process repeatability. Furthermore, the specialized coatings help mitigate metallic contamination, a critical concern in advanced CMOS manufacturing, thereby safeguarding high-value wafers against yield loss.

Driving factors for this specialized market segment include the relentless push toward device miniaturization, which mandates more aggressive and complex etching processes, increasing the demand for highly resilient ESC materials. The global surge in data centers, 5G adoption, automotive electronics, and IoT devices fuels sustained investment in semiconductor capacity expansion worldwide. This expansion inherently increases the installed base of etching and deposition equipment, creating a consistent replacement and upgrade cycle for high-performance consumables like APS Coating ESCs. Additionally, regulatory pressures regarding material purity and process reliability continue to favor high-grade, APS-coated components.

APS Coating ESC Market Executive Summary

The APS Coating ESC Market is characterized by intense technological competition and a strong dependency on the capital expenditure cycles of leading semiconductor manufacturers (Foundries and IDMs). Key business trends include vertical integration among material suppliers and equipment manufacturers to secure supply chain stability and intellectual property. Regional trends show the Asia Pacific region, specifically China, Taiwan, South Korea, and Japan, maintaining dominance in consumption due to housing the majority of global advanced fabrication facilities. Market growth is being propelled by the shift towards atomic layer etching (ALE) and three-dimensional (3D) device architectures, which impose greater thermal and chemical stress on ESC surfaces. Pricing pressure remains a key concern, balanced by the specialized nature of APS coating technology.

Segment trends reveal that the yttria (Y2O3) coated ESC segment is experiencing accelerated growth compared to alumina (Al2O3) due to its superior resistance to fluorine-based plasma chemistries, commonly used in deep silicon etching for 3D NAND and high-aspect-ratio structures. Application-wise, the Etching Equipment sector remains the largest consumer, reflecting the high wear rate associated with plasma etching processes. Furthermore, the OEM (Original Equipment Manufacturer) channel dominates sales, given the strict performance specifications and integration requirements of complex semiconductor tools. However, the aftermarket segment is expanding rapidly, driven by the need for cost-effective refurbishment and coating services for high-value chuck components.

In summary, the market exhibits high barriers to entry due to stringent quality control, necessary capital investment, and proprietary coating techniques. Strategic emphasis is being placed on developing ultra-high-density coatings and multi-layer structures to address emerging material challenges in extreme ultraviolet (EUV) lithography and advanced patterning schemes. Successful players are focusing on rapid prototyping, customized solutions for diverse plasma chemistries, and expanding their service networks globally to capture the recurring revenue streams associated with maintenance and refurbishment. The overall outlook remains bullish, directly tied to the fundamental long-term growth of the global semiconductor industry and the persistent demand for greater device performance.

AI Impact Analysis on APS Coating ESC Market

User queries regarding AI's impact on the APS Coating ESC Market primarily revolve around predictive maintenance, quality control during the coating process, and optimization of coating parameters for new semiconductor processes. Key themes include how Machine Learning (ML) can reduce coating defects, improve material utilization, and predict the end-of-life of ESCs in real-time within highly variable fabrication environments. Users are specifically concerned about leveraging AI for process stability—moving beyond traditional statistical process control (SPC) to achieve adaptive control of the plasma spray parameters (e.g., powder feed rate, gas mixture, power levels) to ensure uniform coating thickness and composition across large surface areas. Expectations center on AI significantly enhancing yield rates for both the ESC manufacturer and the semiconductor fab by optimizing material performance under operational stress.

The integration of Artificial Intelligence and advanced analytics is transforming how APS coating is applied and utilized. AI-driven vision systems and sensors are employed during the manufacturing phase of the ESC coating to detect minute surface defects, porosity variations, and non-uniformity that are invisible or difficult to quantify using traditional inspection methods. By analyzing real-time data streams from the plasma spray gun—including temperature profiles, particle velocity, and plasma plume characteristics—ML algorithms can instantly adjust process variables, minimizing material waste and ensuring the resulting coating meets the extremely tight specifications required for advanced semiconductor applications. This capability allows manufacturers to achieve zero-defect coating batches more consistently.

Furthermore, AI algorithms are critical in the end-user environment (the fabrication plant). By analyzing operational data such as accumulated plasma exposure time, RF power levels, gas flows, and temperature fluctuations recorded by the etching tool, predictive models can accurately forecast the degradation rate and remaining useful life (RUL) of the APS coating. This shift from reactive or time-based replacement to condition-based maintenance (CBM) optimizes tool uptime, prevents catastrophic failures, and allows Fabs to schedule chuck replacements precisely when necessary. This operational efficiency is highly valued, reinforcing the competitive advantage of suppliers who embed AI capabilities into their product and service offerings.

- AI-enhanced Predictive Maintenance (PdM) reduces unplanned tool downtime by forecasting ESC coating degradation.

- Machine Vision Systems automate defect detection during the APS process, ensuring high-quality surface finish and composition.

- AI optimizes complex plasma spray parameters (power, gas flow, distance) for enhanced coating uniformity and density.

- Data analytics correlate in-fab operational stress data (plasma exposure, temperature cycling) with coating failure modes.

- ML models enable adaptive process control, minimizing material usage and waste in the manufacturing of ESC components.

- Generative AI assists in simulating new coating material combinations and geometries to meet future corrosive challenges.

DRO & Impact Forces Of APS Coating ESC Market

The dynamics of the APS Coating ESC Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant impact forces. The primary driver is the accelerating complexity of semiconductor device architectures, necessitating materials that can withstand more aggressive and chemically diverse plasma environments used in 3D stacking and high-aspect-ratio etching. Coupled with this is the continuous global expansion of semiconductor manufacturing capacity, creating a persistent, high-volume replacement market for ESCs. However, the market faces significant restraints, notably the high initial cost and technical complexity associated with both manufacturing and integrating these specialized ESCs. Furthermore, the stringent qualification processes required by semiconductor fabs for new materials create a long lead time, potentially hindering rapid innovation adoption. These forces shape strategic investment decisions and market entry barriers.

Opportunities within this market are substantial, centered on the development of novel ceramic compositions, particularly those with enhanced resistance to radical fluorine and chlorine chemistries (e.g., specialized yttria variants). The growing aftermarket for refurbishment and recoating services represents a major revenue stream, allowing suppliers to capture value even after the initial sale of the tool. Geographically, emerging fab regions in Southeast Asia and Europe present untapped markets for advanced ESC solutions. The impact forces are strongly weighted toward technological innovation; failure to keep pace with the increasingly aggressive plasma processing requirements inherent in scaling semiconductor geometry will severely restrict a company's market viability. Conversely, successful material innovation provides a substantial competitive advantage, ensuring long-term contracts and sustained market share growth.

The regulatory environment, particularly concerning material safety and environmental impact, also acts as an underlying impact force. While not a direct restraint on technology, compliance requirements can influence material selection and manufacturing processes. Overall, the market is characterized by high sensitivity to global economic cycles and semiconductor capital expenditure. A slowdown in capacity expansion can immediately restrain growth, yet the fundamental requirement for higher performance and durability in etching tools ensures that the underlying demand for premium APS-coated components remains strong, pushing manufacturers toward continuous R&D investment to maintain technological leadership and satisfy the demanding requirements of leading-edge process nodes.

Segmentation Analysis

The APS Coating ESC Market is strategically segmented based on coating material, end-user application, and sales channel, reflecting the varied requirements across the semiconductor manufacturing ecosystem. Segmentation by material is critical as different plasma chemistries demand specific ceramic properties; alumina is cost-effective and suitable for less aggressive processes, whereas yttria offers superior resistance to corrosive fluorine plasmas prevalent in advanced silicon etching. Application segmentation highlights the dominance of etching equipment, which accounts for the majority of ESC usage due to the severe mechanical and chemical stress inherent in plasma removal processes. Understanding these segments is vital for suppliers to tailor product specifications and marketing strategies efficiently, ensuring alignment with the rigorous performance standards of high-volume manufacturing environments.

Further segmentation includes the distinction between OEM sales and the Aftermarket (service/refurbishment). OEM sales involve supplying new chucks directly to equipment manufacturers (e.g., Lam Research, Applied Materials) for integration into new tools, demanding strict adherence to initial design specifications. Conversely, the Aftermarket segment involves recoating and repairing used chucks for fabs, requiring rapid turnaround times and often customized repair protocols. The geographical segmentation underscores the concentration of demand in Asia Pacific, which dictates logistical and service network requirements for market participants. The precision and high cost of APS-coated ESCs ensure that market participants must maintain a global service footprint to effectively capture recurring aftermarket revenues and support installed bases worldwide.

This detailed market segmentation allows for precise market sizing and forecasting, revealing that the advanced Yttria segment, coupled with the high-throughput Etching application, represents the fastest-growing niche. Strategic investment is heavily skewed towards improving the adhesion and density of Yttria coatings and expanding regional service capabilities, particularly in emerging foundry hubs. The competitive landscape is shaped by the ability of vendors to navigate these varied segment demands, offering both high-volume standardized products for OEMs and flexible, quick-response repair services for end-users facing critical tool downtime pressures. This dual strategy is essential for maximizing both initial sales and long-term service revenue.

- By Coating Material:

- Alumina (Al2O3)

- Yttria (Y2O3)

- Other Advanced Ceramics (e.g., Hafnia, specialized mixed oxides)

- By Application:

- Etching Equipment (Deep Silicon Etch, Dielectric Etch, Metal Etch)

- PVD/CVD Equipment

- Ion Implantation

- By Sales Channel:

- Original Equipment Manufacturers (OEMs)

- Aftermarket (Refurbishment and Recoating Services)

- By Wafer Size:

- 200mm

- 300mm

Value Chain Analysis For APS Coating ESC Market

The value chain for the APS Coating ESC Market begins with upstream material procurement, involving the specialized sourcing and refining of high-purity ceramic powders (Al2O3, Y2O3, etc.). The quality and consistency of these powders are paramount, as they directly dictate the performance and integrity of the final coating. Key upstream players include specialized chemical suppliers and ceramic raw material processors, who must adhere to stringent purity standards (often 99.999% or higher) to avoid contamination of semiconductor wafers. The subsequent manufacturing phase involves the highly technical steps of ceramic base chuck fabrication, followed by the actual APS coating application, where specialized equipment and proprietary process knowledge are essential competitive assets. This complexity creates a significant choke point in the value chain, as only a few companies possess the necessary expertise and cleanroom capabilities to perform high-quality ESC coating.

Moving downstream, the distribution channel is primarily bifurcated into direct sales to Original Equipment Manufacturers (OEMs) and direct sales or service contracts with semiconductor fabrication plants (Fabs) for aftermarket services. OEMs (such as Applied Materials or Lam Research) integrate the coated ESCs into their new etching and deposition systems, requiring high-volume, standardized supply. This direct channel demands close collaboration on design and performance specifications. The indirect channel often involves local distributors or specialized service providers who handle the logistics and quick-turnaround refurbishment of used ESCs for Fabs. Given the high value and sensitive nature of the product, both direct and indirect sales require specialized handling, inventory management, and technical support.

The downstream end-users are the IDMs (Integrated Device Manufacturers) and pure-play foundries that operate the semiconductor fabrication equipment. Their procurement decisions are heavily influenced by yield performance, Mean Time Between Failure (MTBF), and the Total Cost of Ownership (TCO). A robust service network is crucial at this stage, as unexpected ESC failure can halt production lines costing millions per hour. Therefore, suppliers who can offer rapid, certified refurbishment services and maintain a global inventory of replacement parts gain a significant market advantage. The entire value chain is characterized by tight integration and high information transparency between tiers due to the mission-critical nature of the component, emphasizing quality control and certified material traceability from powder sourcing to final installation.

APS Coating ESC Market Potential Customers

Potential customers in the APS Coating ESC Market are primarily high-volume consumers of semiconductor processing equipment and components. These include major global Integrated Device Manufacturers (IDMs) such as Intel, Samsung Electronics, and Micron Technology, who operate large-scale fabrication facilities globally and require thousands of ESC replacements and recoating services annually to maintain their production lines for memory and logic devices. Their purchasing decisions are highly centralized, focusing on supplier certifications, coating lifespan guarantees, and compliance with proprietary process specifications. The shift towards advanced 3D device architectures, particularly 3D NAND and high-stack DRAM, ensures persistent demand from these players due to the highly corrosive processes involved in creating deep, narrow structures.

Another major segment of potential customers comprises pure-play semiconductor foundries, most notably TSMC, GlobalFoundries, and UMC. These foundries handle the manufacturing for numerous fabless companies, utilizing a diverse array of plasma chemistries and etching tools, which necessitates a flexible supplier base capable of providing highly customized ESC solutions. Foundries prioritize minimizing tool downtime and achieving the highest possible wafer yield, making the technical superiority and reliability of the APS coating the foremost purchasing criterion. They often negotiate long-term service contracts that cover both scheduled maintenance and emergency recoating, providing stable recurring revenue opportunities for ESC suppliers.

Finally, the original equipment manufacturers (OEMs) of semiconductor capital equipment, including market leaders like Applied Materials, Lam Research, and Tokyo Electron, represent the initial and largest customer group for new ESC sales. These OEMs purchase ESCs to integrate into their newly built etching and deposition tools before shipping them to the end-user fabs. Their potential customer relationship is based on strict quality assurance standards, the ability to scale production for large system builds, and competitive component pricing. Securing a design-win with a major OEM ensures a continuous revenue stream throughout the lifecycle of the sold equipment. These three tiers—IDMs, Foundries, and OEMs—collectively represent the entirety of the market's demand base for APS Coating ESC products and services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1.62 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Applied Materials, Lam Research, Tokyo Electron, Hitachi High-Tech, SCREEN Holdings, Kyocera, TOTO, NTK, CoorsTek, II-VI (Coherent), Entegris, Ferrotec, Morgan Advanced Materials, Saint-Gobain, Praxair Surface Technologies, Plasma-Therm, MKS Instruments, Semco Technologies, Versum Materials, Ulvac |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

APS Coating ESC Market Key Technology Landscape

The key technology landscape of the APS Coating ESC market revolves around achieving exceptionally dense, high-purity, and defect-free ceramic layers capable of enduring extreme thermal shock and chemical erosion. The foundational technology remains the Atmospheric Plasma Spray (APS) process itself, which utilizes high-velocity, high-temperature plasma jets to melt ceramic powders and deposit them onto the chuck surface. Continuous technological advancements focus on optimizing the plasma torch design and gas flow dynamics to improve particle velocity and temperature control, ensuring superior coating adhesion and minimized porosity. Advanced process control systems, often utilizing real-time spectroscopic analysis and pyrometry, are crucial for maintaining the precise temperature gradients required during the spray process to prevent residual stress that could lead to coating delamination in the fabrication environment. The integrity of the interface between the metal chuck body and the ceramic coating is a critical area of ongoing technological investment.

Current technological innovations are heavily focused on material science, particularly moving beyond standard Alumina coatings to advanced Yttria and Yttria-stabilized Zirconia (YSZ) compositions. Yttria, being highly resistant to the free fluorine radicals prevalent in complex etching processes (like those involving NF3 or C4F8), is the material of choice for sub-10nm manufacturing. Developing methods to mass-produce ultra-high purity (>99.999%) Yttria powders suitable for APS application, while maintaining excellent grain structure, is a significant technological challenge. Furthermore, the industry is exploring multi-layer coating structures, where thin buffer layers are applied between the base material and the top ceramic layer to manage thermal expansion mismatch, further extending the operational life and stability of the ESC in highly aggressive plasma environments.

Another crucial technological development involves integrated sensor technology within the ESC itself. "Smart" ESCs embed temperature and electric field sensors that can monitor the component's health and performance in situ. This integration requires proprietary bonding and encapsulation techniques to ensure the sensors survive the plasma environment and do not introduce contaminants. The data gathered from these sensors feeds into the predictive maintenance models often powered by AI, allowing fabs to monitor coating wear and degradation precisely. Finally, advanced metrology tools, including specialized Scanning Electron Microscopes (SEM) and X-ray Diffraction (XRD) techniques adapted for coating analysis, are essential technologies used by manufacturers to certify the final quality, composition, and thickness uniformity of the APS layer before deployment in high-stakes semiconductor tools, ensuring maximum reliability and performance.

Regional Highlights

- Asia Pacific (APAC): APAC is the unequivocal market leader, driven by the massive concentration of global semiconductor manufacturing capacity across Taiwan, South Korea, China, and Japan. This region holds the largest installed base of etching and deposition equipment, generating the highest demand for both new ESCs (via OEM sales) and aftermarket recoating services. The rapid expansion of 3D NAND and advanced foundry capacity, particularly in China and South Korea, ensures that APAC will remain the primary growth engine and technology adopter for high-performance Yttria-coated ESCs.

- North America: North America represents a mature, high-value market characterized by significant R&D spending and the presence of leading semiconductor equipment manufacturers (OEMs). Demand here is focused on next-generation coating technologies and materials qualification for advanced process nodes (e.g., 3nm and below). While manufacturing capacity is smaller than APAC, the region acts as a key innovation hub, setting the standards for component performance and quality, particularly concerning purity and integration requirements.

- Europe: Europe is a steady consumer, supported by specialized chip manufacturing (e.g., automotive, industrial IoT) and the presence of critical R&D facilities. The market is primarily driven by stability requirements and the push towards sustainable manufacturing practices. Recent strategic investments aimed at increasing European chip sovereignty (e.g., EU Chip Act initiatives) are expected to drive moderate growth in the consumption of APS Coating ESCs in the latter half of the forecast period.

- Middle East and Africa (MEA) and Latin America (LATAM): These regions currently represent negligible market share but are poised for future growth, primarily driven by localized government initiatives to establish regional semiconductor manufacturing hubs and packaging facilities. Demand is expected to remain low to moderate initially, focused mainly on specialized mature process nodes and relying heavily on imported equipment and international service support.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the APS Coating ESC Market.- Applied Materials

- Lam Research

- Tokyo Electron (TEL)

- Hitachi High-Tech

- SCREEN Holdings Co., Ltd.

- Kyocera Corporation

- TOTO Ltd.

- NTK Technical Ceramics (NGK Spark Plug Co., Ltd.)

- CoorsTek Inc.

- II-VI Incorporated (now Coherent Corp.)

- Entegris, Inc.

- Ferrotec Holdings Corporation

- Morgan Advanced Materials

- Saint-Gobain S.A.

- Praxair Surface Technologies (now Linde plc)

- Plasma-Therm LLC

- MKS Instruments, Inc.

- Semco Technologies

- Versum Materials (now Merck KGaA)

- Ulvac, Inc.

Frequently Asked Questions

Analyze common user questions about the APS Coating ESC market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Advanced Plasma Spray (APS) coating on Electrostatic Chucks?

The primary function is to provide an extremely durable, high-purity dielectric layer that protects the metallic ESC body from highly corrosive plasma environments in etching and deposition tools. This coating extends chuck lifespan, maintains consistent wafer clamping force, and minimizes particle contamination, crucial for high yield in advanced semiconductor manufacturing.

How does Yttria coating differ from Alumina coating in ESC applications?

Yttria (Y2O3) is significantly more chemically resistant to fluorine-based plasma chemistries (e.g., CF4, NF3) compared to Alumina (Al2O3). This superior resistance makes Yttria the material of choice for aggressive, high-aspect-ratio etching processes required for 3D NAND and DRAM, despite its higher material cost and more challenging application process.

Which segment dominates the demand for APS Coating ESCs geographically and why?

The Asia Pacific (APAC) region dominates the demand. This is due to the concentration of the world's largest semiconductor fabrication plants (fabs) in countries like Taiwan, South Korea, and China, which leads to the highest installed base of plasma processing equipment requiring frequent ESC replacement and recoating services.

What impact does the shift to 3D semiconductor architectures have on the APS Coating ESC market?

The shift necessitates the use of more aggressive and complex deep etching processes to create high-aspect-ratio features. This increases the wear and corrosion rates on ESC surfaces, driving higher demand for ultra-durable coatings, particularly advanced Yttria variants, and boosting the overall replacement and refurbishment market size.

What is the role of AI and predictive maintenance in the APS Coating ESC lifecycle?

AI analyzes operational data (plasma exposure, temperature) to predict coating degradation and remaining useful life (RUL) accurately. This enables semiconductor fabs to transition from time-based replacement to condition-based maintenance, minimizing tool downtime, optimizing yield, and maximizing the utilization cycle of the costly ESC component.

What are the typical barriers to entry for new companies in the APS Coating ESC manufacturing space?

Barriers include the requirement for massive capital investment in specialized cleanroom facilities and proprietary APS equipment, the need for ultra-high purity ceramic material sourcing, and the extremely long, rigorous qualification processes mandated by major semiconductor OEMs and end-user fabrication plants.

Why is the Aftermarket (refurbishment) segment growing faster than OEM sales in certain regions?

As the installed base of etching equipment ages, fabs increasingly seek cost-effective ways to extend component life. Refurbishment, which involves stripping and recoating used chucks, provides significant cost savings compared to purchasing new OEM chucks, driving rapid growth in specialized aftermarket services globally.

How does the APS process ensure the necessary high purity of the coating?

The APS process utilizes ultra-high-purity ceramic powders in a controlled inert or near-inert atmosphere within a clean environment. The high temperatures and velocities ensure a dense deposition, while stringent quality control checks, including plasma analysis and post-coating metrology, guarantee minimal inclusion of contaminants critical for advanced wafer processing.

What role do thermal management challenges play in ESC coating requirements?

ESCs require precise thermal control for wafer temperature stability during processing. The coating must maintain high dielectric strength and thermal conductivity characteristics to efficiently transfer heat, even under intense plasma bombardment, preventing localized heating spots that could induce defects or warping on the wafer surface.

What are "smart" ESCs and how do they benefit the semiconductor fabrication process?

"Smart" ESCs are integrated with embedded sensors (temperature, electrical) to monitor real-time operating conditions and coating health. They benefit the fab by providing continuous, accurate data feeds for predictive maintenance systems, allowing for proactive intervention and enhanced process monitoring, which significantly improves tool reliability and yield.

How is environmental concern influencing material development in the ESC market?

Environmental concerns drive manufacturers to develop more durable coatings and efficient recoating processes that minimize material waste and hazardous chemical usage. Longer-lasting coatings reduce the frequency of replacement and the associated energy and material consumption, supporting sustainability goals in semiconductor production.

What distinguishes APS from other coating technologies like CVD or PVD for ESCs?

APS offers higher deposition rates and the ability to apply thick, dense ceramic layers (>100µm) required for long-life dielectric protection in high-power plasma environments. Unlike CVD/PVD, which typically produce thinner films, APS provides the necessary bulk material to withstand both physical sputtering and deep chemical erosion over thousands of operational cycles.

Which sector consumes the largest share of APS Coating ESCs by application?

Plasma Etching Equipment consumes the largest share. Etching is inherently the most aggressive step in semiconductor manufacturing, subjecting the ESC to the highest degree of chemical corrosion and RF power cycling, thus necessitating the most frequent replacement or refurbishment of the APS-coated chuck.

What is the primary risk associated with poor quality APS coating application on ESCs?

The primary risk is coating failure (e.g., delamination, excessive porosity, or insufficient dielectric strength), leading to component arcing, metallic contamination of the wafer, and premature tool shutdown. This results in significant operational losses, scrapped wafers, and unplanned production halts in high-volume manufacturing environments.

How important is intellectual property (IP) protection in the APS Coating ESC market?

IP protection is extremely important. Proprietary knowledge regarding ceramic powder formulation, specialized plasma spray parameters, high-adhesion interlayers, and post-coating finishing techniques constitutes a major competitive advantage, creating high entry barriers and safeguarding market share for established players.

What is the projected growth rate (CAGR) for the APS Coating ESC Market?

The APS Coating ESC Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033, driven by continuous investment in advanced semiconductor fabrication capacity globally, particularly in 300mm wafer processing.

How do global trade tensions and supply chain stability affect this market?

Global trade tensions introduce volatility in the sourcing of specialized high-purity ceramic powders (like Yttria) and affect the procurement cycles of capital equipment. Companies are increasingly seeking regionalized or diversified supply chains to mitigate risks and ensure continuous access to critical raw materials and components.

What are the key technical specifications required for APS coating thickness uniformity?

Thickness uniformity is critical, often requiring deviations to be less than 1% across the entire active surface area of the chuck (e.g., 300mm wafer surface). Non-uniformity can lead to inconsistent thermal transfer, varying clamping forces, and localized electrical field distortion, ultimately impacting the wafer processing result.

What market opportunities are emerging related to extreme ultraviolet (EUV) lithography adoption?

EUV adoption requires increasingly complex and contamination-sensitive processes. While ESCs are less prominent directly in EUV scanners, the downstream etching and deposition steps for EUV-patterned wafers demand even higher purity and stricter tolerance from APS-coated components, creating a niche for ultra-clean, defect-free ESC solutions.

What is the relationship between Wafer Size and ESC market demand?

The transition to larger 300mm wafers significantly increases the surface area and material volume required for each ESC, inherently boosting the total market size in terms of revenue. The larger components also pose greater challenges for achieving uniform APS coating density and defect control, further specializing the manufacturing process.

Who are the primary end-users or buyers of APS Coating ESC services?

The primary end-users are major global semiconductor manufacturers, including Integrated Device Manufacturers (IDMs) like Intel and Micron, and pure-play Foundries such as TSMC and GlobalFoundries, who require these components to operate their high-volume production etching and deposition tools.

How does the total cost of ownership (TCO) factor into the decision to use APS-coated ESCs?

While APS-coated ESCs have a high upfront cost, their significantly extended lifespan and reduced rate of unscheduled downtime—compared to uncoated or lower-quality chucks—drastically lower the TCO over the equipment's operational cycle. Reliability and reduced maintenance frequency are critical cost-saving factors.

What are the challenges in coating refurbishment versus manufacturing a new ESC?

Refurbishment challenges include the effective removal of spent coating and deposited material without damaging the underlying ceramic/metal structure, ensuring the chuck can be precisely realigned, and applying a new coating that meets original OEM specifications for adhesion, density, and flatness.

Why is high-purity ceramic powder sourcing a critical bottleneck in the value chain?

High-purity ceramic powders (especially Yttria) are produced by specialized chemical refiners in limited global quantities. Any supply disruption or failure to meet the required purity level (essential to prevent wafer contamination) can severely impact ESC manufacturing schedules and production capacity globally.

How do competitive strategies differ between OEM suppliers and aftermarket service providers?

OEM suppliers focus on achieving design wins, large-scale production, and integrating proprietary technology early in the equipment design cycle. Aftermarket providers prioritize rapid service turnaround, customized repair solutions, global logistics, and cost-effective pricing to appeal directly to the fabrication plants for recurring revenue streams.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager