Aquaponics and Hydroponics Systems and Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437838 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Aquaponics and Hydroponics Systems and Equipment Market Size

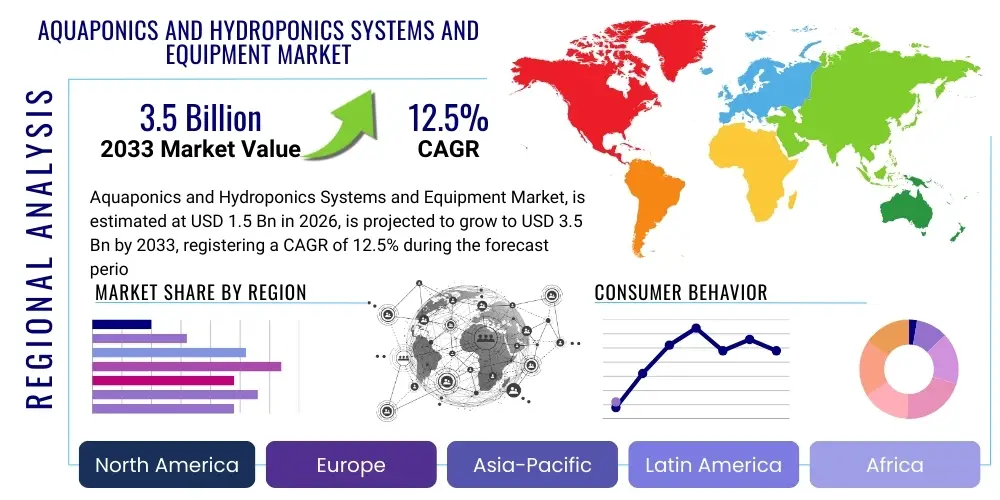

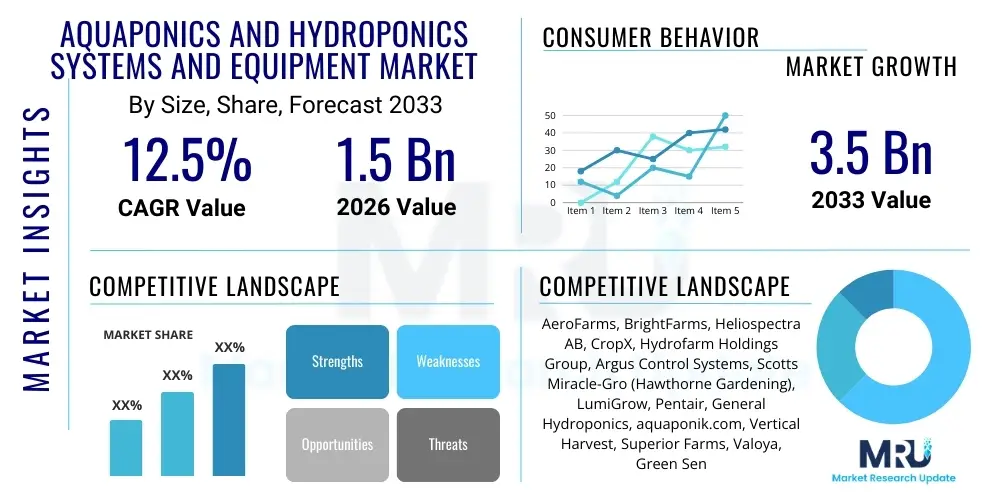

The Aquaponics and Hydroponics Systems and Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 3.5 Billion by the end of the forecast period in 2033.

Aquaponics and Hydroponics Systems and Equipment Market introduction

The Aquaponics and Hydroponics Systems and Equipment Market encompasses technologies and infrastructure crucial for soil-less cultivation methods, representing a transformative shift in global agriculture. Hydroponics involves growing plants using mineral nutrient solutions in water without soil, while aquaponics integrates aquaculture (raising fish) with hydroponics in a symbiotic environment, where fish waste provides nutrients for the plants, which in turn filter the water for the fish. These systems include essential components such as grow media, nutrient delivery systems, LED lighting, pumps, climate control sensors, and monitoring software, catering to both commercial-scale controlled environment agriculture (CEA) operations and smaller home-based setups. The fundamental product offering is focused on efficiency, resource conservation, and maximizing crop yield per unit area, particularly in urban environments or regions facing water scarcity and arable land constraints.

Major applications for these systems span diverse sectors, including high-density food production, pharmaceutical ingredient cultivation, and ornamental plant farming. Hydroponics is extensively used for high-value crops like leafy greens, tomatoes, peppers, and strawberries, delivering consistent, high-quality produce year-round, irrespective of external climate conditions. Aquaponics, while more complex to manage due to the integrated biological loop, is gaining traction for simultaneously producing sustainable protein (fish) and organic produce. The systems deliver significant benefits such as drastically reduced water consumption (up to 90% less than traditional farming), elimination of soil-borne pests and diseases, minimized reliance on chemical pesticides, and maximized crop cycles due to optimized nutrient delivery and climate control.

Driving factors propelling this market forward include rapid global population growth necessitating higher food production, increasing urbanization which restricts traditional farming land, and heightened consumer demand for locally sourced, pesticide-free, and sustainably produced food. Technological advancements, particularly in LED lighting spectral tuning and sophisticated Internet of Things (IoT) driven automation for precise climate and nutrient management, have significantly lowered operational barriers and increased the cost-effectiveness of these systems. Furthermore, governmental initiatives worldwide supporting climate-resilient agriculture and investment in CEA infrastructure are acting as powerful catalysts for market expansion throughout the forecast period.

- Product Description: Systems, equipment, and consumables required for soil-less farming (hydroponics) and integrated fish-plant farming (aquaponics), including infrastructure, climate control, and monitoring solutions.

- Major Applications: Commercial greenhouses, vertical farms, urban agriculture, research institutions, educational facilities, and home gardening.

- Core Benefits: Water efficiency, higher yields, reduced pesticide use, year-round production, and localized food security.

- Driving Factors: Population growth, water scarcity, urbanization, increasing demand for fresh produce, and technological advancements in automation and lighting.

Aquaponics and Hydroponics Systems and Equipment Market Executive Summary

The Aquaponics and Hydroponics Systems and Equipment market is experiencing robust secular growth driven by a necessity to decouple food production from increasingly volatile climate conditions and diminishing agricultural resources. Business trends highlight a strong movement towards fully automated, closed-loop systems, emphasizing scalability and data integration. Key industry players are focusing on developing proprietary nutrient solutions, energy-efficient lighting (specifically full-spectrum LEDs), and sophisticated sensor technology capable of real-time monitoring of pH, dissolved oxygen, and nutrient concentrations. Mergers and acquisitions are common as established agricultural technology firms seek to integrate specialized CEA expertise, positioning the market for consolidation and standardization of equipment protocols. Furthermore, the rising adoption of vertical farming architectures is creating massive demand for highly specialized components that maximize spatial efficiency, such as modular stacking systems and specialized piping configurations.

Regionally, North America and Europe currently dominate the market due to significant early adoption, high levels of technology investment, and favorable regulatory environments supporting sustainable agriculture initiatives. However, the Asia Pacific region, particularly China, Japan, and India, is projected to exhibit the highest growth rate (CAGR) due to rapid urbanization, increasing food security concerns, and governmental subsidies promoting CEA adoption to offset limited arable land. Regional trends also show a diversification of crops, moving beyond leafy greens to include root vegetables and fruits using deep water culture (DWC) and nutrient film technique (NFT) systems tailored to local dietary preferences. Infrastructure development and cold chain logistics improvements in emerging markets are critical enablers of commercial-scale output.

Segment trends indicate that equipment sales, especially for environmental control systems (HVAC and dehumidification), constitute a major revenue stream, followed closely by consumables like nutrient solutions and grow media (e.g., rockwool, coconut coir). By system type, deep water culture (DWC) and nutrient film technique (NFT) remain popular due to their relative simplicity and scalability for leafy vegetables, while drip systems are dominant for fruiting crops. In the aquaponics segment, recirculating aquaculture systems (RAS) components, including bioreactors and specialized biofilters, are experiencing accelerated demand. The trend toward integration, combining both hydroponics and aquaponics within hybrid indoor farms managed by centralized software platforms, signifies the market’s maturation toward holistic, resource-optimized food production models.

AI Impact Analysis on Aquaponics and Hydroponics Systems and Equipment Market

User inquiries regarding the role of Artificial Intelligence in controlled environment agriculture (CEA) frequently center on optimizing resource usage, predicting crop health, and automating complex decision-making processes. Key user concerns revolve around the cost-effectiveness of integrating AI solutions, the reliability of predictive models in diverse environments, and the necessary skill set required to manage AI-driven farms. Users are intensely interested in how AI can move systems beyond reactive management (responding to sensor alerts) to proactive, prescriptive management (predicting deficiencies or disease outbreaks days in advance). Expectations are high for AI to deliver truly autonomous farming operations, leading to maximum yield while minimizing energy expenditure and labor costs, effectively making CEA systems more accessible and profitable globally. The convergence of machine learning with advanced sensor data is viewed as the definitive technology for unlocking the next phase of market efficiency and scalability.

The application of AI is rapidly shifting the operational paradigm of advanced aquaponics and hydroponics facilities. Machine learning algorithms are now utilized to process massive datasets generated by IoT sensors—including spectral light intensity, humidity, CO2 levels, and root zone temperature—to create hyper-personalized environmental recipes for specific cultivars. This prescriptive analysis allows growers to fine-tune environmental parameters dynamically throughout the plant life cycle, maximizing photosynthetic efficiency and nutritional value. In hydroponics, AI-driven nutrient dosing pumps ensure perfect stoichiometric ratios, adapting in real-time based on plant uptake rates, minimizing nutrient waste and preventing phytotoxicity. For aquaponics, AI monitors fish behavior and water quality parameters to optimize feeding schedules and predict imbalances in the nitrogen cycle, ensuring the stability of the entire symbiotic ecosystem.

Furthermore, computer vision and deep learning models are revolutionizing pest and disease management and yield forecasting. High-resolution cameras capture images of plants, and AI algorithms instantly detect subtle visual changes indicative of stress, disease, or nutrient deficiency long before they are visible to the human eye. This allows for immediate, localized intervention, dramatically reducing the need for broad-spectrum treatments. AI also plays a critical role in labor management, automating tasks like harvesting sequence planning, predictive maintenance scheduling for pumps and HVAC systems, and optimizing energy consumption by integrating real-time electricity tariff data with equipment operation cycles. The integration of these intelligent systems transforms static infrastructure into dynamic, learning environments, enhancing the overall return on investment for high-capital CEA projects.

- Yield Prediction Optimization: AI models analyze historical data and current environmental conditions to accurately forecast harvest volumes and timelines, enhancing supply chain reliability.

- Resource Prescription: Machine learning dictates precise water, nutrient, and CO2 injection rates, minimizing waste and maximizing uptake efficiency.

- Automated Climate Control: Deep reinforcement learning fine-tunes HVAC, lighting, and humidity controls to maintain optimal microclimates while reducing energy footprint.

- Computer Vision for Health Monitoring: AI rapidly identifies early signs of pests, pathogens, or nutrient stress using spectral imaging, enabling pre-emptive treatment.

- Operational Robotics Integration: AI serves as the operational brain for automated tasks such as seeding, transplanting, and harvesting robots, improving labor efficiency.

- Aquaponics Stability Management: Predictive algorithms monitor the bioload and nitrogen cycle in aquaponics, ensuring the health of both the aquatic and terrestrial components simultaneously.

DRO & Impact Forces Of Aquaponics and Hydroponics Systems and Equipment Market

The market trajectory is significantly shaped by a confluence of internal market dynamics and external macroeconomic forces. The primary drivers include global food security imperatives, driven by a growing world population and the pressing issue of climate change volatility which severely impacts traditional outdoor agriculture. Restraints primarily involve the high initial capital investment required for establishing large-scale CEA facilities and the significant ongoing operational costs associated with energy consumption for lighting and climate control. Opportunities are abundant, particularly in emerging market penetration, integration of advanced automation technologies like AI and robotics, and expansion into specialty crop cultivation, such as medicinal herbs and high-value nutraceuticals. These dynamics collectively create impact forces that push the market toward technological innovation and resource efficiency, fundamentally altering the landscape of global food production and supply chains.

Driving factors are heavily weighted towards sustainability and technological feasibility. The increasing scarcity of arable land coupled with declining groundwater reserves mandates the adoption of ultra-efficient farming methods. Hydroponics and aquaponics offer solutions to these challenges by allowing food production in non-arable areas (e.g., urban rooftops, deserts, decommissioned warehouses) while consuming substantially less water. Furthermore, consumer preferences for fresh, locally grown, and pesticide-free produce are creating substantial market pull, encouraging retailers and food service providers to invest in reliable, proximal sources. Regulatory support in developed economies, including tax breaks and research grants for vertical farming, further accelerates the deployment of advanced systems and equipment, solidifying the market's positive growth outlook.

However, the market faces notable restraints, chiefly concerning the economics of operation. The electricity required to power LED grow lights, HVAC systems, and water pumps remains a substantial component of operating expenditure, especially in regions with high energy costs. This cost structure limits the competitiveness of CEA-grown commodity crops compared to field-grown alternatives, making high-value, fast-cycle crops the main focus. Another constraint is the need for highly skilled labor capable of managing the complex integrated systems, especially in aquaponics, where biological and chemical balances are critical. Overcoming these restraints necessitates continued innovation in energy storage, renewable energy integration, and further advancements in energy-efficient LED and HVAC technologies to achieve cost parity with conventional farming methods in the long term.

- Drivers: Growing global population, severe water scarcity, limited arable land, increasing urbanization, rising consumer demand for fresh and local produce, technological advancements in LED lighting and automation.

- Restraints: High initial capital expenditure, significant energy consumption for climate control and lighting, complexity of system management, need for highly specialized technical expertise.

- Opportunities: Integration of IoT and AI for optimization, expansion into emerging markets (APAC, Middle East), development of modular and containerized farming solutions, cultivation of high-value non-food crops (e.g., pharmaceuticals).

- Impact Forces: Shift from traditional agriculture dependency, intensification of R&D in energy efficiency, consolidation of the AgTech sector, emphasis on localized food security models.

Segmentation Analysis

The Aquaponics and Hydroponics Systems and Equipment Market is broadly segmented based on system type, component, crop type, and application, reflecting the diverse operational scales and cultivation objectives within the industry. Understanding these segments is critical for manufacturers tailoring equipment specifications and for investors assessing areas of highest potential return. The component segmentation, covering hardware (pumps, sensors, lighting) versus consumables (nutrients, grow media), provides insight into recurring revenue streams, whereas the system type segmentation differentiates between active and passive methods, such as deep water culture (DWC), nutrient film technique (NFT), and media-based aquaponic systems. The segmentation clearly illustrates the industry’s shift toward highly technical, integrated, and scalable solutions that address specific agricultural challenges, such as maximizing space utilization in vertical farms or managing integrated nutrient cycles in aquaponics.

Analyzing the crop type segmentation reveals market priorities, with leafy greens and vegetables currently dominating hydroponic installations due to their fast growth cycles and suitability for vertical stacking. However, there is a substantial expansion into fruits like tomatoes, berries, and specialized medicinal herbs, demanding more complex drip irrigation and substrate-based systems. This diversification drives demand for advanced environmental controls and customized nutrient recipes. Furthermore, the application segmentation highlights the bifurcation between commercial large-scale installations, which require robust, industrial-grade equipment and advanced automation, and small-scale domestic or educational setups, which prioritize ease of use and affordability, often utilizing prefabricated, plug-and-play kits.

Geographic segmentation remains crucial, with established markets setting the technology standard and emerging markets providing the highest growth volume potential. Overall, segmentation analysis confirms that the market is evolving towards specialized solutions. Equipment manufacturers must offer configurable, data-driven systems to meet the nuanced requirements of different crop types, operational scales, and climate conditions. This specialization is vital for achieving the high levels of precision farming that justify the substantial investment in controlled environment technology, ensuring sustained market viability and expansion across various agricultural niches.

- By System Type:

- Deep Water Culture (DWC)

- Nutrient Film Technique (NFT)

- Drip Systems

- Aeroponics Systems

- Media-Based Systems

- Recirculating Aquaculture Systems (RAS - for Aquaponics)

- By Component:

- Hardware (Pumps, HVAC, Water Heaters, Filtration Systems, Grow Lights, Sensors)

- Consumables (Nutrient Solutions, Grow Media, Seeds/Seedlings)

- Software & Services (Automation Software, AI Platforms, Consulting)

- By Crop Type:

- Leafy Greens & Herbs

- Fruits & Vegetables (Tomatoes, Cucumbers, Strawberries)

- Aquaculture (Tilapia, Trout, Catfish)

- Flower & Ornamental Plants

- Cannabis & Medicinal Herbs

- By Application:

- Commercial Greenhouses

- Vertical Farms

- Indoor Farms (Warehouse Conversion)

- Home/Hobby Farming

- Research & Education Institutes

Value Chain Analysis For Aquaponics and Hydroponics Systems and Equipment Market

The value chain for the Aquaponics and Hydroponics Systems and Equipment Market is characterized by high technological input and specialized manufacturing requirements. The upstream analysis begins with the raw material suppliers, predominantly providing polymers, specialized metals, LED chips, and electronic components necessary for constructing durable and efficient equipment. These raw materials are processed by component manufacturers specializing in high-efficiency pumps, HVAC systems, precise sensors, and spectrum-optimized lighting fixtures. A key differentiator at this stage is the integration of proprietary intellectual property, especially in nutrient formulation and LED spectrum design, giving specialized suppliers significant leverage. The cost structure is highly sensitive to fluctuations in global commodity prices and the availability of advanced microelectronics, influencing the final price point of automated systems.

Midstream activities involve the assembly and system integration phase, dominated by major market players who design, manufacture, and assemble the complete farming systems (e.g., vertical racks, NFT channels, climate control units). These integrators often provide customized solutions, installation, and initial operational setup, moving beyond simple component sales to offering complete farm solutions. Distribution channels are complex, involving both direct sales models, particularly for large commercial contracts where personalized consulting is mandatory, and indirect channels leveraging specialized distributors and e-commerce platforms for smaller, modular systems and recurring consumable sales. Effective logistics management is crucial for minimizing installation time and ensuring the timely replacement of critical components.

Downstream analysis focuses on the end-users—large commercial vertical farms, research facilities, and independent growers—who utilize the equipment to produce marketable goods. The success of the equipment is ultimately measured by the yield quantity, quality, and operational efficiency achieved by these growers. Post-sale services, including maintenance contracts, software updates, technical support, and biological consulting, form a critical part of the downstream value proposition, driving customer loyalty and recurring revenue. The integration of data analytics and cloud-based monitoring services connects the upstream manufacturers directly to the downstream performance metrics, facilitating continuous product improvement and optimization, completing the feedback loop that drives market innovation.

Aquaponics and Hydroponics Systems and Equipment Market Potential Customers

Potential customers for Aquaponics and Hydroponics Systems and Equipment are highly diverse, spanning large-scale agricultural enterprises, specialized research institutions, and urban consumers seeking local food solutions. The primary large-volume buyers are commercial vertical farms and modern greenhouses, which require vast quantities of industrial-grade equipment, including specialized LED grow lights, high-volume pumps, sophisticated climate control modules, and robust, often custom-engineered, growing infrastructure. These customers prioritize scalability, durability, integration with existing farm management software, and high energy efficiency to maximize their operational return on investment. Their purchasing decisions are driven by long-term cost of ownership and proven reliability under continuous operation, often involving multi-million dollar capital expenditure projects aimed at stabilizing year-round supply chains.

Another significant customer segment includes academic and governmental research institutions, alongside pharmaceutical and nutraceutical companies. These buyers require precision-controlled systems for experimental purposes, studying plant physiology, developing new crop varieties, or ensuring controlled production of specific bioactive compounds, such as medicinal cannabinoids or specialized botanical extracts. For these entities, the equipment requirements center on minute accuracy, detailed data logging capabilities, and the ability to precisely replicate environmental conditions. The equipment must be capable of supporting rigorous scientific protocols and often involves highly specialized aeroponics or custom recirculating systems to ensure contaminant-free and reproducible results for high-value research output.

Finally, smaller-scale buyers, including independent urban farmers, restaurants looking for hyper-local sourcing, and the growing segment of hobbyist gardeners, represent a high-frequency, smaller-ticket customer base. These users typically purchase modular, easy-to-assemble hydroponic kits or small-scale aquaponic setups. For this group, key purchasing factors include ease of installation, compact design, aesthetic appeal, and simplified automation that requires minimal technical knowledge. The proliferation of affordable, IoT-enabled starter kits and recurring sales of specialized nutrient formulations cater directly to this rapidly expanding customer base, democratizing access to soil-less agriculture and creating a robust, decentralized market for equipment consumables.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 3.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AeroFarms, BrightFarms, Heliospectra AB, CropX, Hydrofarm Holdings Group, Argus Control Systems, Scotts Miracle-Gro (Hawthorne Gardening), LumiGrow, Pentair, General Hydroponics, aquaponik.com, Vertical Harvest, Superior Farms, Valoya, Green Sense Farms, Nature’s Miracle, Logiqs BV, Grodan (Rockwool Group), Signify (Philips Lighting), GrowGeneration |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aquaponics and Hydroponics Systems and Equipment Market Key Technology Landscape

The technological landscape of the aquaponics and hydroponics market is rapidly converging around three core areas: precision environmental control, resource efficiency through spectral lighting, and data-driven automation. Advanced sensor technology, including Internet of Things (IoT) probes for real-time monitoring of pH, EC (electrical conductivity), dissolved oxygen, and nutrient uptake, forms the foundation of modern systems, enabling highly granular control over the growing environment. This sophisticated sensing infrastructure allows for the transition from manual adjustments to fully automated, dynamic nutrient delivery systems, ensuring plants receive optimal resources instantaneously. Furthermore, integration with cloud computing platforms allows for remote management and comparative analysis across multiple farming sites, driving operational standardization and best practice implementation across large corporate farms.

LED lighting technology represents the single most transformative innovation in the equipment segment, moving far beyond simple supplemental lighting. Modern LED fixtures offer full spectral tunability, allowing growers to adjust the intensity and wavelength of light (e.g., specific ratios of blue, red, and far-red light) to influence plant morphology, accelerate growth, enhance nutritional content, and improve color/texture. Energy efficiency improvements in LED technology continually reduce the operational expenditure restraint of indoor farming, making high-density cultivation more economically viable. Coupled with efficient insulation materials and closed-loop HVAC systems—which capture and recycle transpired moisture while precisely managing temperature and CO2 injection—these technologies create truly optimized and resource-independent growing environments essential for profitable vertical farming operations.

Finally, the proliferation of AI and Machine Learning (ML) integration is defining the competitive edge within the market. ML algorithms analyze complex input variables from sensors and light regimens to develop prescriptive 'growth recipes' for individual cultivars, automatically adjusting pumps, fans, and dosing systems without human intervention. This shift towards smart farming also includes the increasing deployment of robotic systems for tasks like planting, inspection, and harvesting. These automated solutions address the labor scarcity constraint while ensuring high throughput and consistency. The technological trajectory is clearly towards fully autonomous, predictive agricultural systems where human oversight focuses on high-level strategic decisions rather than repetitive operational tasks, leading to unprecedented efficiency levels in resource utilization and yield maximization.

Regional Highlights

- North America: North America, particularly the United States and Canada, leads the market in terms of investment value and technological sophistication. This dominance is driven by high consumer demand for locally sourced and non-GMO produce, significant private equity and venture capital funding in vertical farming startups (e.g., AeroFarms, BrightFarms), and robust governmental R&D support. The region is characterized by large-scale commercial implementations of sophisticated hydroponic systems and is a key adopter of advanced AI-driven automation software and high-efficiency LED lighting systems designed for multi-layered vertical installations. Water scarcity issues in Western states further accelerate the need for resource-efficient CEA technology, solidifying North America's position as a technological trendsetter.

- Europe: Europe represents a mature and highly conscious market, prioritizing sustainable and environmentally friendly agricultural practices. Countries like the Netherlands (a global leader in greenhouse technology), Germany, and the UK are major hubs for advanced hydroponics, focusing heavily on energy efficiency and carbon footprint reduction. The European market exhibits strong demand for high-quality, long-lasting equipment and nutrient solutions compliant with stringent EU food safety and environmental regulations. Innovation in the region often centers on optimizing hybrid systems that integrate greenhouses with supplementary artificial lighting and sophisticated heat recovery systems to minimize reliance on external energy sources.

- Asia Pacific (APAC): The APAC region is projected to register the fastest growth rate (CAGR) globally, primarily fueled by massive population density, limited arable land, and increasing concerns about food security, particularly in China, Japan, and India. While capital investment is generally lower per farm than in the West, the sheer volume of new installations, often subsidized by governments seeking self-sufficiency, drives massive demand for scalable, modular, and cost-effective equipment. Japan and South Korea lead in adopting highly controlled, fully automated plant factories, whereas countries like India and China are rapidly expanding conventional greenhouse hydroponics and introductory aquaponics systems.

- Latin America: This region presents a strong emerging market opportunity, driven by diverse climates and a significant agricultural sector looking to modernize. Demand is strongest for robust, easy-to-maintain hydroponic systems, particularly drip and NFT, used for high-value export crops like flowers, berries, and vegetables. Economic volatility and infrastructure challenges require suppliers to offer resilient, cost-optimized equipment packages, focusing on yield stability rather than peak automation complexity.

- Middle East and Africa (MEA): The MEA region, particularly the Gulf Cooperation Council (GCC) countries, represents a niche but highly capitalized market driven by extreme water scarcity and unfavorable climates. These regions are investing heavily in complex, industrial-scale hydroponic and aquaponic facilities, often integrated with desalination plants, to achieve localized food independence. Demand is concentrated on specialized, climate-resilient equipment, including robust cooling systems and advanced filtration, positioning the region as a critical consumer of high-end, bespoke CEA solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aquaponics and Hydroponics Systems and Equipment Market.- AeroFarms

- BrightFarms

- Heliospectra AB

- CropX

- Hydrofarm Holdings Group

- Argus Control Systems

- Scotts Miracle-Gro (Hawthorne Gardening)

- LumiGrow

- Pentair

- General Hydroponics

- aquaponik.com

- Vertical Harvest

- Superior Farms

- Valoya

- Green Sense Farms

- Nature’s Miracle

- Logiqs BV

- Grodan (Rockwool Group)

- Signify (Philips Lighting)

- GrowGeneration

Frequently Asked Questions

Analyze common user questions about the Aquaponics and Hydroponics Systems and Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between hydroponics and aquaponics systems?

Hydroponics is a soil-less method using water and mineral nutrient solutions exclusively to grow plants. Aquaponics is an integrated, symbiotic system combining hydroponics with aquaculture (raising fish), where fish waste provides nutrients for the plants, and the plants naturally filter the water for the fish, creating a highly sustainable, closed-loop environment.

How do LED grow lights impact the profitability of vertical farms?

LED grow lights, especially full-spectrum tunable models, are critical for vertical farm profitability by reducing energy consumption significantly compared to traditional High-Pressure Sodium (HPS) lamps, while also allowing growers to optimize light recipes to maximize yield, enhance crop quality, and shorten grow cycles, directly increasing output per square foot.

What are the main drivers of market growth in the Asia Pacific (APAC) region?

The APAC market growth is primarily driven by massive population density, resulting in limited availability of arable land, severe pressure on existing agricultural resources, rapid urbanization, and strong governmental initiatives in countries like China and India to achieve greater national food security through controlled environment agriculture.

What role does Artificial Intelligence (AI) play in modern hydroponic system management?

AI processes real-time sensor data (pH, EC, light, temperature) to provide prescriptive insights and automated control. It optimizes nutrient delivery, fine-tunes environmental parameters, predicts potential crop diseases or deficiencies, and manages energy use, transitioning farms toward autonomous and hyper-efficient operational models.

What are the major challenges restraining the widespread adoption of these systems?

The primary restraints are the high initial capital investment required to set up commercial-scale facilities, coupled with the ongoing, substantial operational cost associated with electricity consumption for climate control (HVAC) and artificial lighting. These factors often limit the cultivation focus to high-value, fast-cycle crops.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager