Aqueous Polyurethane Dispersion Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432543 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Aqueous Polyurethane Dispersion Market Size

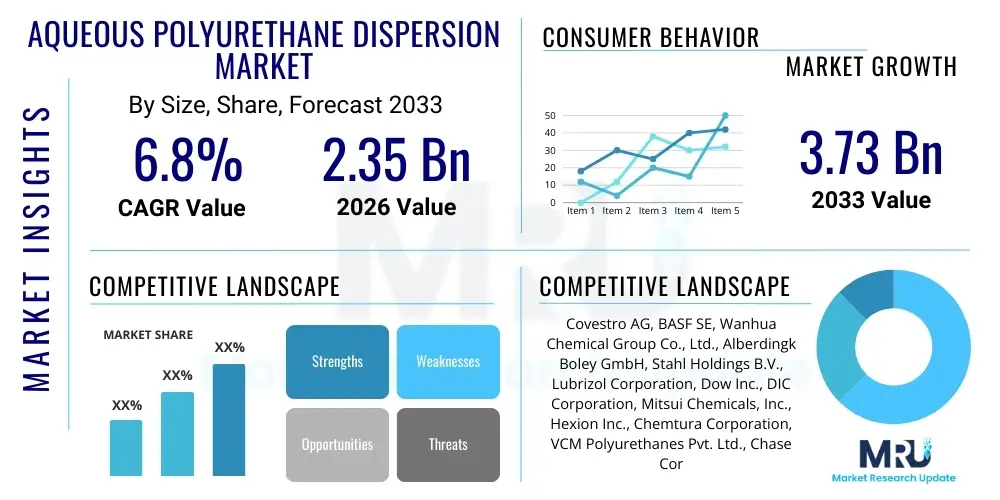

The Aqueous Polyurethane Dispersion Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.35 Billion in 2026 and is projected to reach USD 3.73 Billion by the end of the forecast period in 2033.

Aqueous Polyurethane Dispersion Market introduction

Aqueous Polyurethane Dispersions (PUDs) represent a crucial segment within the global specialty chemicals industry, characterized by their sustainable profile and high performance across diverse applications. PUDs are thermoplastic polyurethanes finely dispersed in water, offering an environmentally compliant alternative to traditional solvent-borne polyurethanes, which are increasingly restricted due to volatile organic compound (VOC) emissions regulations. The core product is synthesized through various polymerization techniques, predominantly involving polyols, isocyanates, and chain extenders in an aqueous medium. This water-based nature provides significant advantages, including reduced flammability, lower toxicity, and ease of cleaning, positioning PUDs as a preferred choice in environmentally conscious industries. The versatility of PUD chemistry allows for tailor-made material properties, such as excellent abrasion resistance, flexibility, adhesion, and chemical resistance, enabling their successful deployment where durability and aesthetic finish are paramount, such as in high-traffic flooring or premium automotive interiors.

Major applications of Aqueous Polyurethane Dispersions span coatings, adhesives, sealants, elastomers, and textile finishing. In the coatings sector, PUDs are widely utilized for wood, metal, and plastic substrates, particularly in architectural and automotive coatings, where the demand for durable, scratch-resistant, and aesthetically pleasing finishes drives market penetration. The footwear and textile industries heavily rely on PUDs for synthetic leather production and protective finishes, capitalizing on their superior mechanical properties and soft touch. Furthermore, the adhesive segment benefits immensely from PUDs, offering strong bonding solutions with low environmental impact for packaging, lamination, and construction. The ongoing shift toward green chemistry and stringent regulatory frameworks, especially in North America and Europe concerning air quality standards, are key driving factors accelerating the adoption of PUDs over solvent-based counterparts, cementing their status as a necessary material for future sustainable manufacturing processes.

The primary benefits associated with Aqueous Polyurethane Dispersions include their excellent film-forming properties at room temperature, superior mechanical performance comparable to solvent-borne systems, and their inherent compliance with health and environmental standards. Key driving factors underpinning the market growth encompass the rigorous implementation of environmental protection laws globally, particularly mandates reducing VOC content in industrial products. Additionally, rapid urbanization and infrastructure development, especially in the Asia Pacific region, boost the demand for high-performance protective coatings in construction and automotive manufacturing. Continuous innovation in PUD technology, focusing on developing high-solid content and bio-based dispersions, further expands their applicability and enhances their competitive edge against other waterborne technologies like acrylics and epoxies, making them indispensable components in modern material science.

Aqueous Polyurethane Dispersion Market Executive Summary

The Aqueous Polyurethane Dispersion (PUD) Market is poised for robust expansion, primarily fueled by global sustainability mandates and technological advancements in waterborne chemistry. Current business trends indicate a strong prioritization of high-performance, low-VOC solutions across end-use industries, necessitating rapid product reformulation by manufacturers. Key players are increasingly investing in proprietary dispersion technologies to achieve higher solids content and enhanced cross-linking capabilities, which bridge the performance gap with traditional solvent systems. Consolidation activities, including mergers and strategic partnerships, are observed as companies seek to secure raw material supply chains and expand their geographical footprint, particularly targeting high-growth emerging economies. The automotive and construction sectors remain the foundational pillars of demand, although specialized applications in medical devices and electronics coatings are emerging as high-value niche segments exhibiting exceptional growth potential, reflecting a broader diversification strategy within the PUD industry.

Regional dynamics highlight the Asia Pacific (APAC) region as the undisputed leader in market size and growth rate, driven by expansive manufacturing bases, particularly in China and India, and increasing governmental pressure to adopt greener chemicals across textiles, footwear, and consumer electronics manufacturing. North America and Europe, characterized by mature markets, exhibit steady growth primarily due to stringent environmental regulations enforced by bodies like the EPA and REACH, compelling immediate substitution of solvent-based chemicals. These regions are also leaders in technological innovation, focusing on bio-based PUDs derived from sustainable feedstocks, addressing consumer and corporate demands for circular economy principles. Investment flows are concentrated on localizing production facilities in APAC to mitigate logistical costs and capitalize on localized supply chain efficiencies, indicating a strategic shift toward regional self-sufficiency in PUD production and consumption.

Analysis of segment trends reveals that the solvent-free/NMP-free PUDs are experiencing the fastest uptake due to stricter health and safety standards related to reproductive toxins and hazardous air pollutants. Application-wise, the coatings segment maintains dominance, driven by widespread use in wood furniture protection and industrial maintenance coatings. However, the adhesive segment is registering accelerated growth, particularly in flexible packaging and automotive assembly, where lightweighting trends necessitate high-strength, water-based bonding agents. Segmentation by type, specifically based on the chemistry of the backbone (Polyether, Polyester, Polycarbonate), indicates increasing preference for Polycarbonate-based PUDs, despite their higher cost, owing to their superior chemical resistance, thermal stability, and durability, making them essential for high-end applications like aerospace and high-durability floor finishes where long service life is non-negotiable.

AI Impact Analysis on Aqueous Polyurethane Dispersion Market

User inquiries regarding AI's impact on the Aqueous Polyurethane Dispersion market frequently center on three main themes: optimizing polymerization synthesis, enhancing material performance prediction, and streamlining supply chain management for isocyanate and polyol raw materials. Users are particularly interested in how Artificial Intelligence can reduce the laborious and time-consuming nature of R&D for new PUD formulations, specifically querying the use of Machine Learning (ML) models to predict film properties (like gloss, hardness, and elasticity) based on raw material inputs and synthesis parameters. Another core concern revolves around using AI for predictive maintenance in large-scale PUD manufacturing plants and optimizing energy consumption during the dispersion process, which is often energy-intensive. Furthermore, users explore AI's role in ensuring compliance by rapidly screening new formulations against regional VOC and toxicity regulations, accelerating the speed-to-market for compliant and high-performance products.

AI is set to revolutionize the development and manufacturing lifecycle of Aqueous Polyurethane Dispersions by moving away from traditional trial-and-error methodologies towards data-driven predictive modeling. Machine learning algorithms, trained on vast datasets of monomer ratios, reaction conditions, and resultant physical properties, can significantly accelerate the identification of optimal formulation parameters, leading to the rapid creation of PUDs with specified characteristics, such as enhanced UV resistance or lower Minimum Film Forming Temperature (MFFT). This capability not only reduces the cost of R&D but also allows chemical companies to respond faster to bespoke customer requirements for specialized coatings and adhesives. The integration of AI-powered simulation tools enables chemists to virtually test thousands of variations before actual lab synthesis, ensuring that only the most promising candidates proceed to physical testing, thus conserving resources and boosting innovation efficiency within the highly competitive waterborne market segment.

Beyond the laboratory, AI’s impact is substantial in operational efficiency and market responsiveness. Predictive analytics are being deployed to optimize logistics and procurement, particularly for critical raw materials like MDI and TDI, minimizing price volatility exposure and ensuring stable production schedules despite global supply chain disruptions. In manufacturing, AI-driven process control systems monitor reaction kinetics in real-time, automatically adjusting parameters such as temperature and shear rate to maintain dispersion stability and particle size consistency, which are crucial for PUD quality. Moreover, AEO strategies leverage AI tools to analyze market feedback and competitor data, helping PUD producers tailor product features and marketing content to align precisely with evolving sustainability demands and regulatory shifts, ensuring that market reports and technical specifications are highly optimized for generative search engines and customer queries seeking specific green chemistry solutions.

- Accelerated formulation development using ML to predict PUD film properties (e.g., hardness, adhesion) based on input chemistry.

- Optimization of synthesis processes to ensure stable dispersion, controlled particle size distribution, and reduced batch-to-batch variability.

- Enhanced supply chain forecasting for key raw materials (isocyanates, polyols) to mitigate procurement risks and cost fluctuations.

- Implementation of predictive maintenance in manufacturing facilities to maximize uptime and reduce operational expenditures.

- AI-driven sustainability screening, ensuring immediate regulatory compliance (VOC, toxicity) for new product formulations.

- Personalized material recommendation systems for end-users based on application requirements (substrate, desired durability, environmental conditions).

DRO & Impact Forces Of Aqueous Polyurethane Dispersion Market

The Aqueous Polyurethane Dispersion market is significantly influenced by a confluence of accelerating drivers centered on environmental compliance, market restraining factors primarily related to performance limitations in certain demanding applications, and substantial opportunities arising from technological breakthroughs and emerging geographic markets. The primary driving force remains the global regulatory push toward reducing Volatile Organic Compound (VOC) emissions, necessitating the substitution of solvent-borne systems, particularly in developed economies. Restraints include the higher cost structure associated with specialized water-based manufacturing processes compared to traditional solvent systems, alongside technical challenges such as achieving the exact levels of chemical resistance and high-temperature performance required in specific industrial coatings, demanding continuous investment in advanced stabilization and cross-linking technologies. Opportunities abound in the burgeoning demand for high-performance, bio-based PUDs and in the untapped potential of emerging markets in Southeast Asia and Latin America, where industrialization is rapidly increasing the need for modern coating materials, creating a dynamic environment where regulatory pressure acts as a constant impetus for innovation.

Key drivers include expanding regulatory support, exemplified by the EU’s Industrial Emissions Directive and analogous legislation globally, which mandates stringent limits on VOCs, thus naturally favoring waterborne technologies like PUDs. The rising consumer awareness regarding sustainable products and the corporate commitment to Environmental, Social, and Governance (ESG) criteria further amplify this demand, forcing major brands in automotive, furniture, and textile sectors to prioritize green supply chains using PUDs. Conversely, significant restraints persist concerning processing characteristics; PUDs often require more energy for water evaporation during the curing process compared to solvent systems, impacting efficiency in high-throughput manufacturing lines. Furthermore, achieving stability and consistency across wide temperature ranges in storage and transport remains a technical hurdle, particularly for high-solid content dispersions. The susceptibility of PUDs to freezing and their inherent sensitivity to shear forces during application necessitate specialized handling and formulation complexity, increasing operational challenges for smaller manufacturers attempting market entry.

The impact forces shaping the market trajectory are multifaceted, primarily driven by the substitution effect and competitive pressure. The impact force of regulatory mandates is high, directly translating into market share gains for PUDs at the expense of solvent-borne polyurethanes. Technological innovation, especially in developing PUDs capable of self-crosslinking or utilizing external low-temperature curing agents, acts as a pivotal force mitigating the performance restraints and expanding application scope into areas like aerospace and specialized electronics protection. Geopolitical instability and fluctuations in petrochemical prices (affecting isocyanate and polyol costs) exert a moderate, indirect impact, increasing the operational risk and forcing the industry toward bio-based alternatives to ensure cost stability and supply resilience. The combined high impact of regulatory drivers and technological opportunities creates a fundamentally bullish outlook for the PUD market, overshadowing the existing medium-impact restraints related to processing and initial cost structure.

Segmentation Analysis

The Aqueous Polyurethane Dispersion (PUD) Market segmentation provides a detailed framework for understanding the diverse applications and chemical compositions driving market dynamics. The primary segmentation criteria include the type of PUD backbone chemistry (Polyester, Polyether, Polycarbonate, others), the application type (Coatings, Adhesives & Sealants, Binders, Others), and the end-use industry (Automotive & Transportation, Building & Construction, Textiles & Leather, Electronics, Furniture & Wood). This structured analysis reveals differential growth rates, with Polycarbonate PUDs gaining traction due to superior durability, and the Coatings segment maintaining its dominance fueled by environmental regulations in architectural and industrial maintenance sectors. Geographic segmentation emphasizes the pivotal role of APAC in both consumption and production, while mature markets in the West drive innovation in niche, high-performance applications like flexible electronics encapsulation and sustainable fashion materials.

Segmentation by chemical composition is critical as the polyol backbone dictates the final performance characteristics. Polyester PUDs offer high tensile strength, good abrasion resistance, and excellent solvent resistance, making them ideal for synthetic leather and high-performance coatings, dominating the volume share due to their favorable cost profile. Polyether PUDs, conversely, provide superior hydrolysis resistance and flexibility, making them essential in applications requiring high elongation, such as flexible packaging adhesives and specialized textile coatings exposed to humid environments. The fastest growing segment, Polycarbonate PUDs, offers unparalleled resistance to thermal degradation, oxidation, and hydrolysis, positioning them as the material of choice for demanding applications like clear coatings in automotive headlights and high-durability flooring, justifying their premium price point and indicating a trend toward higher value-added PUD formulations in the global market.

Application segmentation confirms that Coatings remain the largest segment, encompassing decorative, protective, and specialty coatings utilized across industries ranging from wood finishing to industrial protective maintenance. The adhesives and sealants segment is experiencing rapid expansion, driven by the shift towards lightweighting in the automotive industry and the increasing demand for strong, water-based lamination adhesives in the packaging sector, substituting solvent-based glues under food contact regulations. The Binders segment, which includes applications in fiberglass sizing, non-woven materials, and composite manufacturing, also shows stable growth, supported by the increasing need for durable, non-toxic binding agents that offer flexibility and chemical inertness, reinforcing the PUD market's role as a fundamental supplier to multiple manufacturing ecosystems seeking sustainable chemical inputs.

- By Type:

- Polyester PUDs

- Polyether PUDs

- Polycarbonate PUDs

- Hybrid PUDs (e.g., Polyurethane/Acrylic)

- By Application:

- Coatings (Architectural, Automotive, Industrial, Wood & Furniture)

- Adhesives & Sealants (Lamination, Footwear, Automotive Assembly)

- Binders & Finishings (Textile Finishing, Fiber Sizing, Non-woven)

- Others (Elastomers, 3D Printing Materials)

- By End-Use Industry:

- Automotive & Transportation

- Building & Construction

- Textiles & Leather

- Footwear

- Electronics & Electrical

- Furniture & Wood Finishing

Value Chain Analysis For Aqueous Polyurethane Dispersion Market

The value chain for the Aqueous Polyurethane Dispersion market begins with the upstream segment, dominated by the supply of essential petrochemical derivatives: isocyanates (such as MDI, TDI, and HDI) and various types of polyols (Polyester polyols, Polyether polyols, and Polycarbonate polyols). This upstream segment is highly consolidated, characterized by large chemical manufacturers controlling the production of these key building blocks, making the PUD market sensitive to global crude oil price fluctuations and production capacities of these core raw materials. Manufacturers often integrate backward to secure proprietary polyol or specialized isocyanate derivatives tailored for waterborne synthesis, ensuring supply chain resilience and cost optimization. The quality and type of raw materials fundamentally dictate the final PUD properties, necessitating stringent quality control and specialized sourcing for high-performance applications, where purity is paramount.

The midstream involves the synthesis and processing of PUDs, where chemical companies transform raw monomers into stable aqueous dispersions via methods like the prepolymer mixing process, the acetone process, or the hot-melt process. This stage is technologically intensive, requiring specialized equipment for high-shear mixing, temperature control, and particle size distribution management to ensure dispersion stability and optimal film formation characteristics. Midstream players invest heavily in research and development to create solvent-free (NMP-free) and high-solid dispersions, responding to both regulatory pressure and end-user demand for higher efficiency. Distribution channels move the finished PUD products to the end-users, primarily through specialized chemical distributors and, for high-volume users, direct sales channels. Distributors play a crucial role, offering warehousing, technical support, and small-batch customization, particularly vital for regional formulators and smaller end-users who lack direct procurement capabilities.

The downstream segment encompasses the formulation and application of PUDs across diverse industries. Downstream users, such as coating formulators, adhesive manufacturers, and textile producers, purchase PUDs as intermediates and compound them with additives, pigments, and thickeners to create final products tailored for specific substrates (e.g., automotive clear coats or orthopedic adhesive tapes). Direct distribution is often favored by large chemical conglomerates supplying major automotive or construction companies, facilitating technical collaboration and ensuring stringent quality specifications are met. Conversely, indirect distribution via regional specialty chemical resellers serves the broader market of wood finishers, small-scale construction projects, and local textile manufacturers, leveraging the distributor network’s local knowledge and logistical efficiency. This structure emphasizes both direct technical partnership for critical applications and broad market reach through established third-party logistics and sales networks.

Aqueous Polyurethane Dispersion Market Potential Customers

The potential customer base for Aqueous Polyurethane Dispersions is extremely broad, spanning multiple sectors that prioritize high durability, flexibility, and, critically, environmental sustainability. Major end-users are concentrated in the Building and Construction sector, requiring PUDs for flooring finishes, protective coatings for structural steel, and durable wall coatings that minimize long-term maintenance costs while adhering to indoor air quality standards. Automotive manufacturers constitute another high-value customer segment, utilizing PUDs extensively in interior coatings (for dashboards and seating materials), exterior clear coats offering superior scratch resistance, and specialized adhesives for bonding lightweight composite materials. The demand here is driven by the industry’s push toward lower VOC cabins and enhanced vehicle longevity, making PUDs essential for achieving both regulatory compliance and consumer satisfaction regarding material quality.

The Textile and Footwear industries represent a significant consumer demographic, leveraging PUDs for synthetic leather production (PU leather), textile coatings, and fabric finishing. PUDs provide the necessary flexibility, water resistance, and abrasion resistance essential for modern apparel, performance sportswear, and high-quality footwear components, increasingly replacing traditional, solvent-heavy processes used in artificial leather manufacturing. Furthermore, the burgeoning Electronics and Electrical sector is rapidly adopting PUDs for encapsulating sensitive components, conformal coatings on PCBs, and durable insulation due to their excellent dielectric properties and resistance to thermal stress. These buyers are looking for materials that offer high-performance protection without the use of solvents that could degrade sensitive electronic parts, positioning PUDs as a critical material enabler for miniaturized and flexible electronic devices requiring superior environmental sealing.

In addition to these industrial giants, specialty consumers such as manufacturers of medical devices (e.g., surgical drapes, medical tubing coatings), furniture and wood product finishers (seeking durable, non-yellowing clear coats), and producers of specialized inks and 3D printing resins form important niche markets. These diverse potential buyers share the common requirement of needing a high-performance polymer that is non-toxic, easy to handle, and compliant with increasingly stringent health and safety regulations. The continued focus on sustainable sourcing means that customers are increasingly prioritizing suppliers capable of providing high-solid content, bio-based PUDs, ensuring that the PUD producer who can demonstrate superior technical support and regulatory expertise will capture the highest market share across these varied end-user domains, solidifying their competitive position in the global specialty chemical landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.35 Billion |

| Market Forecast in 2033 | USD 3.73 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Covestro AG, BASF SE, Wanhua Chemical Group Co., Ltd., Alberdingk Boley GmbH, Stahl Holdings B.V., Lubrizol Corporation, Dow Inc., DIC Corporation, Mitsui Chemicals, Inc., Hexion Inc., Chemtura Corporation, VCM Polyurethanes Pvt. Ltd., Chase Corporation, Jiangsu Keli Chemical Co., Ltd., Baxenden Chemicals Ltd., Lamberti S.p.A., Hauthaway Corporation, Lanxess AG, Perstorp Holding AB, Asahimas Chemical (AGC) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aqueous Polyurethane Dispersion Market Key Technology Landscape

The technological landscape of the Aqueous Polyurethane Dispersion market is characterized by intense research focusing on eliminating hazardous solvents and enhancing the performance profile to match or exceed traditional solvent-borne systems. The primary synthetic routes, including the Prepolymer Mixing Process and the Acetone Process, are continually refined to improve dispersion stability, particle size uniformity, and increase the solid content percentage, thereby reducing overall drying time and enhancing sustainability. A critical technological trend involves the development of NMP-free (N-Methyl-2-pyrrolidone-free) PUDs, responding to stringent European regulations classifying NMP as a substance of very high concern. Manufacturers utilize alternative hydrophilic internal emulsifiers or specialized non-hazardous co-solvents to achieve stable dispersions, ensuring compliance without sacrificing essential properties like film hardness and adhesion, which is crucial for high-end automotive coatings and performance textile finishes.

Another significant technological advancement centers on incorporating self-crosslinking mechanisms into PUD formulations. Traditional PUDs often rely on external crosslinking agents, which can be toxic or require high heat curing, limiting their application scope. Self-crosslinking PUDs, achieved through the introduction of functional groups that react upon drying (such as silane or carbodiimide groups), offer superior chemical and solvent resistance, dramatically increasing the longevity and robustness of the resultant film. This technology expands PUD applicability into highly demanding industrial sectors, including aerospace coatings and heavy-duty industrial maintenance. Furthermore, the development of hybrid PUDs, combining polyurethane with acrylic or epoxy chemistry, leverages the respective strengths of each polymer—PUDs providing toughness and flexibility, and acrylics offering UV resistance and low cost—resulting in high-performance materials for exterior architectural coatings and general-purpose adhesives.

The future technology trajectory is heavily focused on sustainability, emphasizing the use of bio-based polyols derived from natural oils (e.g., castor oil, soybean oil) to replace petroleum-based feedstocks. This shift aims to reduce the carbon footprint of PUD production, appealing to eco-conscious consumers and meeting corporate sustainability goals. Simultaneously, advancements in dispersion technology are leading to ultra-fine particle size PUDs, which form clearer, higher-gloss films, crucial for optical applications and premium wood finishes, while maintaining exceptional mechanical properties. The integration of nanotechnology, utilizing specialized nanoparticles within the PUD matrix, further boosts functional performance, enabling features such as antimicrobial activity, flame retardancy, and enhanced barrier properties for specialized packaging, underscoring a high-tech evolution that ensures PUDs remain at the forefront of sustainable polymer material science.

Regional Highlights

The global Aqueous Polyurethane Dispersion market demonstrates distinct growth patterns across key geographic regions, reflecting variations in regulatory environments, industrial growth rates, and technological adoption levels.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market globally, primarily driven by rapid industrialization, burgeoning construction activities, and the expansive growth of the textile, footwear, and automotive manufacturing sectors, particularly in China, India, and Southeast Asian nations. The region is transitioning from solvent-heavy processes to waterborne alternatives, fueled by increasing awareness of environmental hazards and emerging, though often less uniformly enforced, environmental regulations. Key manufacturers are establishing production hubs here to serve the massive local demand and mitigate complex global supply chain logistics, positioning APAC as both a dominant producer and consumer of PUDs, especially in the high-volume polyester PUD segment for synthetic leather.

- Europe: Europe is characterized by mature markets and extremely stringent environmental legislation, notably the REACH regulation and various VOC directives, making it a critical hub for high-performance, NMP-free, and bio-based PUD innovation. Market growth here is primarily substitution-driven, focusing on replacing residual solvent systems across industrial and architectural coatings. Countries like Germany and the Netherlands lead in R&D investment, specializing in Polycarbonate PUDs for high-durability industrial applications and pushing the frontier of sustainable chemistry, maintaining high prices but offering superior performance and regulatory compliance.

- North America: North America presents a highly regulated environment, with strict EPA standards driving the conversion to waterborne coatings and adhesives, particularly in California and other densely populated states. The market exhibits steady growth, fueled by strong demand in automotive refinishing, wood furniture coatings, and residential construction. Adoption is high across all major PUD types, with a strong focus on high-solids formulations to maximize efficiency. Key market players emphasize security of supply and technical service, catering to large domestic end-users who demand reliable, high-quality, and locally produced chemical inputs.

- Latin America (LATAM): The LATAM region, led by Brazil and Mexico, shows significant potential due to increasing foreign investment in automotive and consumer goods manufacturing, resulting in rising demand for performance coatings and adhesives. While environmental regulations are still developing compared to North America and Europe, the influence of global corporations operating in the region accelerates the adoption of PUDs. Market growth is sensitive to local economic stability but presents long-term opportunities as infrastructure modernization and industrial standards improve.

- Middle East and Africa (MEA): The MEA market is smaller but growing steadily, largely driven by large-scale infrastructure and construction projects in the Gulf Cooperation Council (GCC) countries. Demand is centered on protective coatings for oil and gas facilities, and high-durability architectural coatings suited for harsh climatic conditions. The limited local production capacity means the region relies heavily on imports from Europe and Asia, making supply chain logistics and import duties significant factors affecting the overall market price and growth rate.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aqueous Polyurethane Dispersion Market.- Covestro AG

- BASF SE

- Wanhua Chemical Group Co., Ltd.

- Alberdingk Boley GmbH

- Stahl Holdings B.V.

- Lubrizol Corporation

- Dow Inc.

- DIC Corporation

- Mitsui Chemicals, Inc.

- Hexion Inc.

- Chemtura Corporation

- VCM Polyurethanes Pvt. Ltd.

- Chase Corporation

- Jiangsu Keli Chemical Co., Ltd.

- Baxenden Chemicals Ltd.

- Lamberti S.p.A.

- Hauthaway Corporation

- Lanxess AG

- Perstorp Holding AB

- Asahimas Chemical (AGC)

Frequently Asked Questions

Analyze common user questions about the Aqueous Polyurethane Dispersion market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force for the growth of the Aqueous Polyurethane Dispersion market?

The main driver is the increasingly stringent global regulatory framework mandating the reduction of Volatile Organic Compound (VOC) emissions, particularly across North America and Europe, which necessitates the substitution of solvent-borne coatings and adhesives with environmentally compliant waterborne alternatives like PUDs.

How do Polyester PUDs differ from Polycarbonate PUDs in terms of application?

Polyester PUDs offer high mechanical strength and good solvent resistance, commonly used in general-purpose synthetic leather and basic coatings due to their cost-effectiveness. Polycarbonate PUDs, conversely, provide superior resistance to hydrolysis, oxidation, and heat, making them ideal for high-end, high-durability applications such as premium automotive clear coats and industrial floor finishes where longevity is critical.

Which application segment currently holds the largest market share for Aqueous Polyurethane Dispersions?

The Coatings segment holds the largest market share. PUDs are extensively used in architectural, wood finishing, and industrial protective coatings, driven by the need for durable, low-VOC finishes in both residential and commercial construction projects globally.

What are NMP-free PUDs and why are they important in the current market?

NMP-free PUDs are Aqueous Polyurethane Dispersions formulated without N-Methyl-2-pyrrolidone, a solvent classified as hazardous under European regulations (REACH). They are crucial for market access in regions with strict health and safety standards, representing a major technological advancement toward fully sustainable and non-toxic waterborne polymer solutions.

How is the Asia Pacific region dominating the PUD market?

APAC dominates the PUD market due to rapid industrial expansion, massive manufacturing bases in countries like China and India, and high volume consumption across the textiles, footwear, and construction industries. This region is both the largest consumer and a critical hub for low-cost, high-volume PUD production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager