Aqueous Polyurethane Resin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435010 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Aqueous Polyurethane Resin Market Size

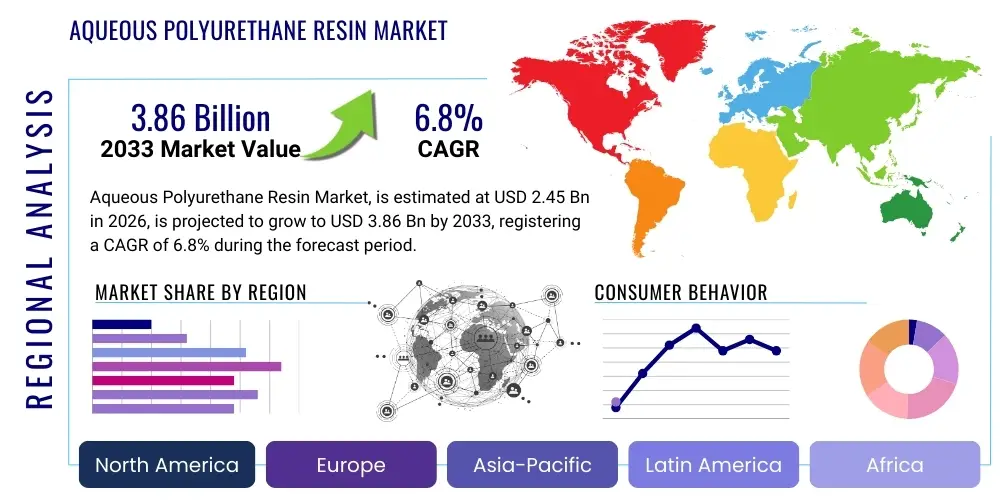

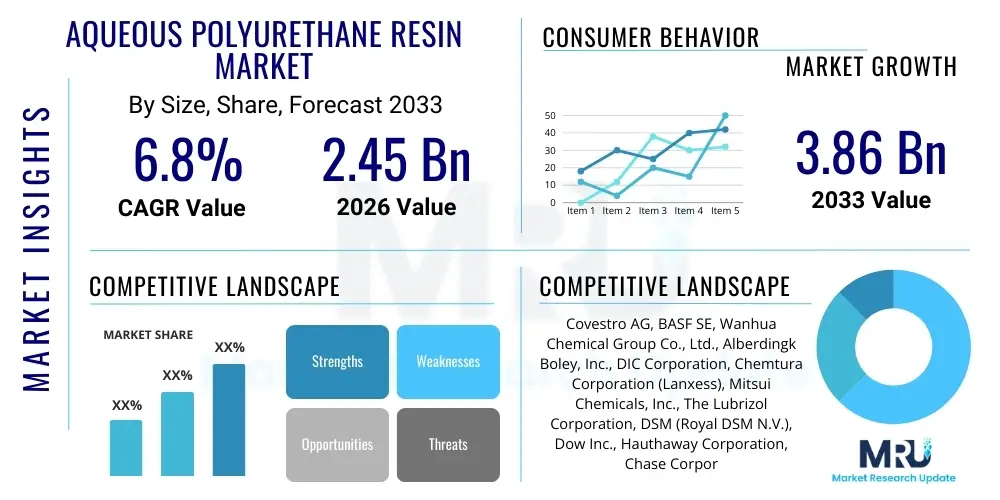

The Aqueous Polyurethane Resin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.45 Billion in 2026 and is projected to reach USD 3.86 Billion by the end of the forecast period in 2033.

Aqueous Polyurethane Resin Market introduction

Aqueous Polyurethane Resins (PUDs), also known as waterborne polyurethanes, represent a class of polymers dispersed in water rather than traditional organic solvents. This distinction is critical as it addresses increasing environmental concerns and stringent regulatory frameworks limiting Volatile Organic Compound (VOC) emissions, particularly in North America and Europe. PUDs offer an exceptional balance of mechanical properties, including high elasticity, excellent abrasion resistance, and superior adhesion to diverse substrates, making them a preferred substitute for solvent-based polyurethane systems in numerous high-performance applications. Their inherent benefits—low toxicity, non-flammability, and ease of application—are driving significant adoption across industrialized and emerging economies.

The primary applications for aqueous polyurethane resins span high-end coatings, adhesives, sealants, and binders. In the automotive sector, PUDs are utilized for interior finishes and protective coatings due to their durability and aesthetic appeal. The textile and synthetic leather industries rely heavily on PUDs for finishing and binding agents, providing enhanced tactile properties and longevity while meeting demanding performance standards. Furthermore, the construction and architectural sectors use these resins in flooring and protective surface treatments, capitalizing on their resistance to chemicals and moisture. The shift towards sustainable manufacturing processes globally is accelerating the substitution rate of solvent-based systems with waterborne alternatives.

Key drivers underpinning the market expansion include the stringent implementation of environmental regulations by bodies such as the Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA), mandating lower VOC content in industrial products. Continuous innovation in resin chemistry, focusing on achieving equivalent or superior performance compared to solvent systems, further strengthens market penetration. Benefits such as reduced worker exposure risks, simplified cleanup procedures, and improved fire safety on manufacturing floors also contribute substantially to the growing commercial acceptance of aqueous polyurethane resins across diverse industrial landscapes.

Aqueous Polyurethane Resin Market Executive Summary

The Aqueous Polyurethane Resin Market is characterized by robust growth fueled primarily by global sustainability mandates and significant technological advancements aimed at enhancing performance characteristics. Business trends show a strong inclination towards consolidation and strategic partnerships among major chemical manufacturers to expand production capacity and optimize distribution networks, especially in high-growth regions like Asia Pacific. Manufacturers are heavily investing in R&D to develop specialty PUDs tailored for niche applications, such as UV-curable waterborne systems and bio-based polyurethanes, which offer enhanced environmental profiles and unique performance attributes demanded by modern industries, including consumer electronics and medical devices. This focus on premium, environmentally conscious products is reshaping the competitive dynamics, prioritizing innovation over mere cost competitiveness.

Regionally, Asia Pacific maintains its dominant position, largely driven by rapidly expanding manufacturing bases in China, India, and Southeast Asia, particularly in the footwear, textile, and construction industries. While North America and Europe exhibit slower growth rates in overall volume, these regions lead in value-added products, driven by the strictest environmental policies and the highest demand for specialized, high-performance, low-VOC coatings in the automotive and aerospace sectors. Regulatory divergence, however, necessitates localized product portfolios, prompting global players to establish regional innovation hubs to meet specific geographical compliance requirements efficiently.

Segment trends reveal that the coatings application segment continues to hold the largest market share, bolstered by increased demand for durable and aesthetically pleasing finishes in furniture, industrial equipment, and protective packaging. By raw material type, the polyether-based segment is experiencing rapid adoption due to its excellent hydrolytic stability and flexibility, making it ideal for flexible substrates and outdoor applications. The synthetic leather segment, driven by ethical and performance advantages over natural leather, represents one of the fastest-growing application areas, propelling the demand for high-solid content PUD dispersions optimized for luxurious tactile finishes and high wear resistance.

AI Impact Analysis on Aqueous Polyurethane Resin Market

User inquiries regarding AI's impact on the Aqueous Polyurethane Resin Market commonly focus on how artificial intelligence can optimize formulation complexity, accelerate new product development cycles, and enhance supply chain resilience for raw materials. Key themes identified include the expectation that AI will dramatically reduce the time needed to synthesize novel PUD chemistries (e.g., optimizing cross-linking densities or dispersion stability) through predictive modeling. Users are also concerned with AI’s role in optimizing manufacturing processes, specifically managing the delicate balance of dispersion stability during scale-up and ensuring consistent quality control across batches. The consensus is that AI offers powerful tools for material informatics, enabling researchers to explore a vast chemical space more efficiently, thereby leading to the faster commercialization of higher-performing, environmentally friendly aqueous systems, specifically those incorporating advanced bio-based polyols or specialized additives.

- AI-driven predictive modeling accelerates the discovery of optimal PUD formulations, reducing laboratory trial iterations.

- Machine learning algorithms enhance real-time quality control in PUD manufacturing, ensuring consistent particle size and stability.

- AI optimizes complex polymerization reaction parameters (temperature, pressure, catalyst load) for improved yield and efficiency.

- Supply chain AI identifies and mitigates risks related to volatile raw material pricing and global logistics bottlenecks for polyols and isocyanates.

- Data analytics supports the development of specialized PUDs by correlating performance requirements (e.g., scratch resistance, flexibility) with molecular structure.

DRO & Impact Forces Of Aqueous Polyurethane Resin Market

The market dynamics are governed by a robust framework of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive environment and future trajectory. The primary drivers are environmental legislation and the inherent performance benefits of waterborne technology, which offer a competitive edge over solvent-based alternatives. Restraints mainly revolve around the higher initial production costs associated with PUDs and the technical challenge of achieving performance parity with solvent systems, particularly regarding fast curing times and high gloss finishes in certain industrial applications. Opportunities lie within the expansion into specialized, high-value markets, such as aerospace coatings, medical textiles, and electronics encapsulation, where stringent safety and environmental standards justify the use of premium PUD formulations. These forces create a compelling, albeit challenging, landscape for market participants.

The impact forces influencing the market demonstrate a clear trend toward sustainability as the central competitive differentiator. The pressure from consumers and regulatory bodies to reduce VOC emissions is irreversible, meaning companies failing to transition their product lines to waterborne technologies face significant market alienation and regulatory penalties. Technological substitution risk remains low due to the versatility and adaptability of polyurethane chemistry itself; however, the ongoing development of alternative low-VOC binders (e.g., acrylics and epoxies) requires continuous PUD innovation to maintain market superiority. Furthermore, the volatility of key raw material prices, particularly MDI and TDI, exerts significant pressure on manufacturing margins, demanding optimized procurement and hedging strategies to maintain profitability.

The convergence of technological necessity and regulatory pressure means that R&D investment is mandatory for survival. Companies must not only meet current performance specifications but also anticipate future requirements, particularly concerning bio-content integration and fully recyclable formulations. The market’s long-term health depends on mitigating the complexity of waterborne formulations and overcoming the lingering perception that PUDs are inherently inferior in certain critical performance areas compared to solvent-based alternatives. Successful market participants will be those that leverage scale, deep material science expertise, and robust intellectual property portfolios focusing on next-generation PUD technologies.

Segmentation Analysis

The Aqueous Polyurethane Resin market is meticulously segmented based on chemistry, application, and end-use industry, reflecting the diverse requirements of the global manufacturing sector. Segmentation by chemistry, encompassing polyether, polyester, and polycarbonate polyols, reveals varying properties such as hydrolytic stability, abrasion resistance, and cost efficiency, guiding selection for specific application requirements. Polyester-based PUDs, for instance, are widely favored for their superior tensile strength and hardness, essential for durable coatings and synthetic leather. Conversely, segmentation by application highlights the dominance of the coatings and adhesives segments, driven by industrial and consumer demand for high-performance, environmentally compliant binding and protective solutions. This structured segmentation allows market players to focus their strategic efforts on high-growth, high-margin niche areas while addressing core volume applications.

- By Raw Material/Type:

- Polyether PUDs (Excellent flexibility and hydrolytic stability)

- Polyester PUDs (High mechanical strength and hardness, used in synthetic leather)

- Polycarbonate PUDs (Superior thermal and UV stability, high-end applications)

- By Application:

- Coatings (Wood, Automotive, Industrial, Architectural)

- Adhesives and Sealants (Packaging, Footwear, Construction)

- Synthetic Leather Production

- Textile Finishing and Processing

- Plastics and Elastomers

- By End-Use Industry:

- Automotive and Transportation (Interior and Exterior Coatings)

- Footwear and Textile (Finishes, Binders)

- Construction (Flooring, Waterproofing)

- Furniture and Woodworking (Decorative and Protective Coatings)

- Packaging and Graphics

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Aqueous Polyurethane Resin Market

The value chain for Aqueous Polyurethane Resins commences with the upstream supply of core chemical intermediates, specifically polyols (polyether, polyester, polycarbonate) and isocyanates (MDI, TDI, HDI). The stability of this upstream segment is critical, as fluctuations in crude oil and natural gas prices directly impact the cost of these petrochemical derivatives, leading to margin volatility for resin manufacturers. Key suppliers focus on high-purity, specialty intermediates to ensure optimal polymerization and dispersion stability downstream. Vertical integration, where major chemical companies control both raw material production and resin synthesis, is a common strategic approach used to mitigate supply chain risks and ensure cost competitiveness in high-volume markets.

Midstream activities involve the synthesis and dispersion of PUDs, a technically intensive process requiring specialized reactors and sophisticated mixing equipment to create stable waterborne dispersions. Manufacturers focus on optimizing process parameters, such as minimizing solvent co-use and maximizing solid content, to improve product efficiency and reduce environmental impact. Distribution channels are bifurcated: direct sales channels handle large-volume industrial clients (e.g., major automotive OEMs or synthetic leather manufacturers), providing technical support and customized formulations; indirect channels utilize specialized chemical distributors and regional agents to serve smaller businesses, job coaters, and geographically dispersed end-users, ensuring efficient last-mile delivery and technical service.

The downstream segment encompasses the formulators and end-users who integrate the PUDs into final products like coatings, adhesives, and textile finishes. Success in the downstream market depends heavily on the technical support offered by resin suppliers, enabling formulators to adapt PUDs seamlessly into existing production lines. The final consumption is driven by the end-use industry requirements, such as enhanced durability in architectural coatings or specific regulatory compliance in footwear manufacturing. Effective market penetration requires tailored product lines that address the distinct performance criteria and processing limitations across various end-user applications.

Aqueous Polyurethane Resin Market Potential Customers

The potential customer base for Aqueous Polyurethane Resins is extremely broad and highly diversified, extending across industrial manufacturing, consumer goods, and infrastructure development, unified by the common need for high-performance, low-VOC polymeric solutions. Major customers include multinational automotive manufacturers who utilize PUDs for robust, scratch-resistant interior and exterior protective coatings, driven by strict mandates for vehicle lightweighting and interior air quality. Large-scale textile and synthetic leather producers are pivotal buyers, leveraging PUDs to create durable, comfortable, and environmentally sustainable materials for apparel, upholstery, and footwear, aiming to reduce dependence on traditional, solvent-heavy processes.

The construction and woodworking sectors represent significant commercial opportunities. Building material suppliers and flooring manufacturers seek PUD-based coatings and sealants for residential and commercial flooring applications due to their superior resistance to foot traffic, chemicals, and moisture, while simultaneously adhering to indoor air quality regulations. Furthermore, smaller, specialized industrial coaters and formulators who serve niche markets—such as electronics encapsulation, specialized medical devices, and high-performance packaging—constitute an important segment, demanding highly customized PUD chemistries for precision applications and demanding performance specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.45 Billion |

| Market Forecast in 2033 | USD 3.86 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Covestro AG, BASF SE, Wanhua Chemical Group Co., Ltd., Alberdingk Boley, Inc., DIC Corporation, Chemtura Corporation (Lanxess), Mitsui Chemicals, Inc., The Lubrizol Corporation, DSM (Royal DSM N.V.), Dow Inc., Hauthaway Corporation, Chase Corporation, VCM Polyurethanes Pvt. Ltd., Stahl Holdings B.V., Indofil Industries Limited, K-Flex (Pud-Chem), Jiangsu Huayang Chemical Co., Ltd., Shanghai Chem-Tex Co., Ltd., Perstorp Group, Bayer MaterialScience (Now Covestro) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aqueous Polyurethane Resin Market Key Technology Landscape

The technological landscape of the Aqueous Polyurethane Resin market is rapidly evolving, driven by the imperative to achieve high performance with minimized environmental footprint. A critical area of focus is the development of PUDs with high solid content, often exceeding 50% or 60%, which allows for thicker application layers and faster drying times, directly addressing a primary constraint relative to solvent-based systems. This involves advanced emulsification techniques and carefully controlled polymerization processes to maintain low viscosity and dispersion stability even at high concentrations. Furthermore, the industry is increasingly leveraging specialized chain extenders and cross-linkers, such as carbodiimides, to enhance the chemical resistance, thermal stability, and mechanical strength of the final coating or adhesive film, broadening the applicability of PUDs in demanding industrial environments where previously only solvent systems sufficed.

Another significant technological advancement is the rise of UV-curable Aqueous Polyurethane Dispersions (UV-PUDs). These systems combine the environmental benefits of waterborne technology with the high throughput and immediate physical properties provided by UV curing. UV-PUDs are finding strong adoption in wood coatings, plastic finishing, and graphic arts, offering exceptional hardness, gloss, and resistance within seconds of UV exposure. This hybrid technology necessitates specialized chemistry where functional groups capable of UV polymerization are incorporated into the PUD backbone, presenting complex synthetic challenges that leading players are actively overcoming through proprietary methods and novel photoinitiator systems compatible with aqueous environments.

Furthermore, the push for circular economy principles is catalyzing research into bio-based and recyclable PUDs. Manufacturers are exploring the use of sustainable polyols derived from natural oils (e.g., castor oil or soybean oil) and agricultural waste streams to replace traditional petrochemical components, thereby reducing the carbon intensity of the final product. While full performance parity remains a challenge for certain bio-based PUDs, significant breakthroughs are being made, particularly for flexible applications like synthetic leather and soft-touch coatings. Investment in supercritical fluid technology for PUD synthesis is also being explored to potentially eliminate the need for organic co-solvents entirely, ensuring the PUD market remains at the forefront of sustainable polymer science.

Regional Highlights

The geographical analysis reveals distinct market dynamics driven by differing regulatory frameworks, industrial growth rates, and consumer awareness concerning environmental impacts. Asia Pacific (APAC) holds the largest market share and is projected to be the fastest-growing region throughout the forecast period. This growth is underpinned by massive manufacturing activities in China, India, and ASEAN nations, particularly in footwear, automotive components, and infrastructure construction, where the adoption of PUDs is driven by both cost efficiency and increasingly enforced local environmental standards. While often lagging North America and Europe in per capita consumption of specialized PUDs, APAC’s sheer volume of industrial production ensures its dominance.

Europe represents a mature but high-value market, characterized by the most stringent environmental policies globally, such as REACH regulations, making the transition to low-VOC PUDs non-negotiable across nearly all industrial applications. Germany, France, and Italy are key contributors, driven by advanced manufacturing sectors, including premium automotive finishes and high-specification architectural coatings. European manufacturers prioritize performance and sustainability equally, leading to high demand for specialized products like UV-PUDs and bio-based systems. The market here is highly competitive, emphasizing quality certifications and technical service capabilities.

North America is also a significant market, primarily driven by regulatory frameworks from the EPA and state-level organizations like the California Air Resources Board (CARB). The demand is strong in automotive refinishing, wood furniture, and construction adhesives. Innovation in North America is focused on optimizing application efficiency, achieving faster throughput, and developing hybrid PUD systems that offer the benefits of both polyurethane and acrylic chemistries. Latin America and the Middle East & Africa (MEA) are emerging markets, showing promising growth as industrialization accelerates and global players expand their footprint. Growth in these regions is closely tied to infrastructure investment and the local adoption of global manufacturing standards.

- Asia Pacific (APAC): Dominates consumption volume; driven by rapid industrialization in China, India, and Southeast Asia (footwear, textile, construction boom).

- Europe: High-value market focused on specialty PUDs; growth enforced by strict environmental mandates (REACH) and high demand in automotive and architectural sectors.

- North America: Strong adoption rates fueled by EPA and CARB regulations; focus on hybrid systems and fast-cure technologies for industrial coatings.

- Latin America (LATAM): Growing market potential linked to infrastructure projects and increasing local manufacturing capabilities in Brazil and Mexico.

- Middle East & Africa (MEA): Emerging market driven by construction sector investment and rising adoption of protective coatings in the oil & gas and industrial infrastructure sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aqueous Polyurethane Resin Market.- Covestro AG

- BASF SE

- Wanhua Chemical Group Co., Ltd.

- Alberdingk Boley, Inc.

- DIC Corporation

- Chemtura Corporation (Lanxess)

- Mitsui Chemicals, Inc.

- The Lubrizol Corporation

- DSM (Royal DSM N.V.)

- Dow Inc.

- Hauthaway Corporation

- Chase Corporation

- VCM Polyurethanes Pvt. Ltd.

- Stahl Holdings B.V.

- Indofil Industries Limited

- K-Flex (Pud-Chem)

- Jiangsu Huayang Chemical Co., Ltd.

- Shanghai Chem-Tex Co., Ltd.

- Perstorp Group

- Reichhold LLC (Acquired by DIC Corporation)

Frequently Asked Questions

Analyze common user questions about the Aqueous Polyurethane Resin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers for the growth of the Aqueous Polyurethane Resin Market?

The market is primarily driven by stringent global environmental regulations, particularly those restricting Volatile Organic Compound (VOC) emissions, coupled with the superior performance properties of PUDs, such as high abrasion resistance and flexibility, making them ideal replacements for solvent-based systems in coatings and adhesives.

How do Aqueous Polyurethane Resins (PUDs) differ chemically from solvent-based polyurethanes?

PUDs are dispersed in water using specialized emulsifiers and polymerization techniques, minimizing or eliminating the need for organic co-solvents. Solvent-based polyurethanes require significant amounts of organic solvents (e.g., MEK or toluene) for dissolution, leading to high VOC content during application.

Which application segment accounts for the largest share in the PUD Market?

The Coatings application segment holds the largest market share. PUDs are extensively used in high-performance coatings for wood, automotive interiors, industrial floors, and architectural surfaces due to their durability, chemical resistance, and compliance with green building standards.

What is the significance of UV-curable Aqueous Polyurethane Dispersions (UV-PUDs)?

UV-PUDs are a critical hybrid technology combining the environmental safety of waterborne systems with the speed and high performance of UV curing. They enable instant physical properties, high throughput, and superior chemical resistance, particularly valued in wood and plastics finishing.

Which region shows the highest growth rate potential for Aqueous Polyurethane Resins?

Asia Pacific (APAC) is projected to exhibit the highest growth rate. This accelerated expansion is attributed to the rapid scale-up of manufacturing across construction, footwear, and automotive industries, coupled with gradually tightening environmental standards in economies such as China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Aqueous Polyurethane Resin Market Statistics 2025 Analysis By Application (Wood Coating, Leather Finishing, Adhesive, Automotive Finishing), By Type (Aqueous Polyurethane Dispersion, Aqueous Polyurethane Emulsion), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Aqueous Polyurethane Resin Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Flexible, Rigid), By Application (Paint, Adhesive, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager