AR and VR Training Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438106 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

AR and VR Training Market Size

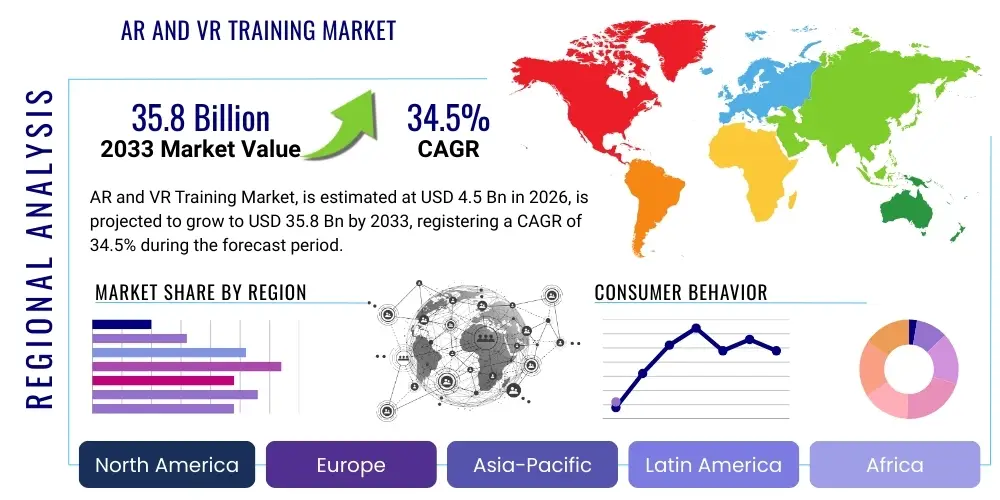

The AR and VR Training Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 34.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 35.8 Billion by the end of the forecast period in 2033.

AR and VR Training Market introduction

The AR and VR Training Market encompasses the deployment of immersive technologies, specifically Augmented Reality (AR) and Virtual Reality (VR), to deliver realistic, simulation-based educational and professional development programs across various industries. These immersive tools offer significant advantages over traditional training methodologies by providing hands-on, risk-free environments for complex skill acquisition, drastically reducing the cost and logistical complexity associated with physical training setups. The core product involves sophisticated hardware, such as head-mounted displays and haptic feedback devices, coupled with specialized software platforms designed for content creation, learning management, and real-time performance tracking.

Major applications span highly regulated and high-risk sectors, including healthcare (surgical training, patient care simulations), manufacturing (equipment maintenance, assembly line processes), military and defense (flight simulation, tactical training), and energy (offshore drilling procedures, safety protocols). The primary benefit derived from adopting AR/VR training solutions is the elevated engagement level of trainees, leading to superior knowledge retention and faster skill mastery compared to conventional methods like classroom lectures or standard e-learning modules. This market is fundamentally driven by the accelerating demand for workforce upskilling in the face of rapid technological change and the growing corporate emphasis on minimizing operational errors through high-fidelity simulation.

Furthermore, the market's trajectory is strongly influenced by the continuous advancements in hardware miniaturization, increased processing power, and the decreasing cost of VR and AR equipment, making these solutions more accessible to Small and Medium-sized Enterprises (SMEs). The development of sophisticated content creation tools, often utilizing photogrammetry and 3D modeling software, is lowering the barrier to entry for customized training module development. This confluence of technological maturity, established use cases in critical industries, and the proven efficacy in maximizing learning outcomes solidifies the AR and VR Training Market as a pivotal segment within the global corporate learning and development landscape.

AR and VR Training Market Executive Summary

The global AR and VR Training Market is poised for exponential growth, largely driven by fundamental shifts in corporate learning strategies prioritizing experiential and immersive education. Business trends indicate a strong move towards subscription-based software models (SaaS) for training content delivery, allowing organizations greater flexibility and scalability while reducing large upfront investment in perpetual licenses. Key technological innovation focuses on integrating high-resolution displays and sophisticated tracking systems to enhance immersion and reduce common issues like motion sickness. Strategic alliances between hardware manufacturers (like Meta, HTC) and specialized content developers are becoming crucial for expanding application libraries tailored to specific industrial needs, creating a holistic ecosystem.

Regionally, North America currently dominates the market due to early adoption across its robust defense, healthcare, and technology sectors, supported by substantial venture capital investment in immersive technology startups. However, Asia Pacific is projected to register the highest growth rate, fueled by rapid industrialization, large manufacturing bases (particularly in China, India, and Japan), and governmental initiatives promoting digital transformation in education and vocational training. Europe maintains a strong position, particularly in automotive manufacturing and regulated technical sectors, with a focused emphasis on ethical standards and data privacy within training platforms.

Segmentation trends highlight the increasing importance of the Software component, specifically Learning Management Systems (LMS) integrated with AR/VR capabilities, as companies seek seamless deployment and analytics of training performance data. While Virtual Reality (VR) remains dominant for fully immersive, high-risk scenario training (e.g., surgical or military), Augmented Reality (AR) is rapidly gaining traction in operational training, such as guiding technicians through complex maintenance tasks (on-the-job assistance). The manufacturing and healthcare sectors continue to be the largest consumers, but adjacent sectors like retail, transportation, and construction are experiencing high adoption rates as hardware costs continue to decline and content libraries diversify.

AI Impact Analysis on AR and VR Training Market

Common user questions regarding AI's impact on AR and VR training frequently revolve around how AI can personalize learning experiences, improve content realism, and automate assessment processes. Users are concerned about whether AI-driven simulation adjustments can truly mirror real-world variability and how AI algorithms can effectively manage learner cognitive load during high-intensity virtual tasks. Expectations are high for AI to transition training from standardized modules to dynamic, adaptive curricula that respond in real-time to individual learner deficiencies. The core theme is the expectation of hyper-personalized, ultra-efficient training delivered through intelligently optimized virtual environments, ensuring maximum retention and transferability of skills to the physical workplace while automating much of the current manual supervision required by instructors.

- AI integration facilitates adaptive learning pathways, automatically adjusting the complexity and sequence of training modules based on the learner's real-time performance data and cognitive state analysis.

- Generative AI (GenAI) significantly accelerates content creation, allowing for the automated generation of diverse virtual scenarios, character behaviors, and environmental variations, drastically reducing development time and cost.

- AI-driven performance analytics provide granular, objective feedback by tracking minute details of trainee interaction, posture, gaze, and response latency, far surpassing traditional assessment capabilities.

- Predictive modeling capabilities, powered by machine learning, forecast potential skill decay or future training requirements for specific employees or operational roles based on historical simulation data.

- Natural Language Processing (NLP) enhances conversational agents and virtual instructors within the training environment, offering realistic, context-aware coaching and support to trainees.

- AI optimizes resource allocation within large training programs by identifying knowledge gaps across the organization and recommending targeted interventions, ensuring efficient use of immersive training assets.

- Edge AI deployment in standalone VR headsets enables faster, localized processing of sensor data for real-time haptic feedback and interaction rendering without relying solely on cloud infrastructure.

DRO & Impact Forces Of AR and VR Training Market

The dynamics of the AR and VR Training Market are shaped by a powerful confluence of drivers necessitating technological adoption, restraints impeding rapid mass deployment, and opportunities offering significant market expansion. The dominant driver is the critical need for safe, risk-free training environments in high-consequence industries such as aviation, energy, and medicine, where physical training is prohibitively expensive or dangerous. This need aligns with the opportunity presented by the rapidly maturing ecosystems of hardware and content creation tools, particularly the emergence of affordable, consumer-grade VR headsets that lower the entry barrier for corporate adoption. Simultaneously, the market faces significant restraint due to the substantial initial investment required for high-fidelity simulation hardware and the continuous challenge of developing specialized, industry-specific content that meets rigorous compliance standards, often requiring specialized 3D artists and instructional designers.

Another crucial driver is the proven effectiveness of immersive learning in improving knowledge retention and reducing training time compared to conventional methods. As the global workforce ages and companies face increasing talent gaps, AR/VR solutions offer a scalable mechanism for rapid upskilling and knowledge transfer. However, this growth is tempered by the restraint concerning technological integration hurdles, including network latency issues and ensuring compatibility across diverse enterprise IT infrastructures. The potential for motion sickness or discomfort associated with prolonged use of current-generation HMDs remains a minor but persistent restraint affecting broad acceptance among certain user groups.

Impact forces on the market are heavily weighted towards technological shifts, particularly the move towards mixed reality (MR) solutions that blend AR and VR capabilities, offering dynamic spectrum of immersion depending on the training requirement. Regulatory impact, especially concerning data security and user privacy, acts as a significant external force, compelling providers to adhere to stringent standards, particularly in sensitive sectors like healthcare and defense. The sustained opportunity lies in the burgeoning industrial metaverse, where complex digital twins of physical assets can serve as persistent, collaborative training grounds, significantly enhancing the fidelity and realism of simulation-based learning and paving the way for advanced remote collaboration features.

Segmentation Analysis

The AR and VR Training Market is analyzed comprehensively across several dimensions, including the nature of the components deployed, the underlying technology utilized, and the application sectors benefiting from these immersive solutions. Understanding these segments is crucial for mapping competitive strategies and identifying areas of high growth potential. The component segment differentiates between the physical hardware devices required for interaction and immersion, the software platforms necessary for content management and delivery, and the services essential for implementation, maintenance, and custom content development. This structure allows organizations to strategically invest in the specific parts of the value chain most critical to their operations, often leading to a bundled approach combining customized software solutions with standardized hardware procurement.

Technology segmentation is defined by the degree of immersion offered. VR solutions provide a fully enclosed, distraction-free environment ideal for complex, scenario-based learning where focus is paramount, while AR utilizes overlays onto the real world, making it highly effective for operational guidance, machinery repair, and on-the-job assistance. The convergence of these technologies into Mixed Reality (MR) is becoming increasingly relevant, offering dynamic transitions between virtual and real environments. Furthermore, application segmentation reveals where the highest value is being created, with large, multinational industrial and technical sectors showing the greatest capacity for investment and the most pressing need for high-fidelity, standardized training solutions.

- Component:

- Hardware

- Head-Mounted Displays (HMDs)

- Sensors and Tracking Devices

- Input Devices (Haptic Feedback Controllers, Gloves, Treadmills)

- High-Performance Workstations/Mobile Devices

- Software

- Content Creation Tools and SDKs (Unity, Unreal Engine)

- Simulation Platforms

- Learning Management Systems (LMS) Integration Software

- Custom Application Development Software

- Services

- Consulting and Implementation Services

- Content Customization and Development Services

- Maintenance and Support Services

- Training-as-a-Service (TaaS)

- Hardware

- Technology:

- Augmented Reality (AR)

- Marker-based AR (e.g., QR codes, image recognition)

- Markerless AR (e.g., SLAM, location-based AR)

- Web-based AR Solutions

- Virtual Reality (VR)

- Non-Immersive Systems (Desktop-based)

- Semi-Immersive Systems (Projector-based CAVE systems)

- Fully Immersive Systems (High-Fidelity HMDs)

- Mixed Reality (MR)

- Augmented Reality (AR)

- Application:

- Manufacturing and Industrial

- Assembly and Quality Control Training

- Equipment Maintenance and Repair Procedures

- Safety and Compliance Training

- Healthcare and Medical

- Surgical and Clinical Procedure Simulation

- Patient Care and Empathy Training

- Anatomy and Diagnostic Education

- Military and Defense

- Flight and Vehicle Simulation

- Tactical and Scenario-based Combat Training

- Technical Equipment Operation and Maintenance

- Education (K-12 and Higher Education)

- Science and Engineering Labs

- Historical and Cultural Field Trips

- Vocational Skill Development

- Energy (Oil, Gas, and Renewables)

- Plant Operation Procedures and Safety

- Remote Inspection and Repair Guidance

- Retail and Customer Service

- Store Layout and Planogram Training

- Customer Interaction Simulation

- Transportation and Logistics

- Aerospace and Aviation

- Manufacturing and Industrial

Value Chain Analysis For AR and VR Training Market

The value chain for the AR and VR Training Market starts with upstream activities dominated by fundamental technology providers, including semiconductor manufacturers, optical component creators, and operating system developers (e.g., Android, Windows Mixed Reality). This phase involves significant R&D investment focused on enhancing display resolution, reducing latency, and optimizing battery life for portable HMDs. Key upstream players also include 3D modeling software vendors and game engine developers (Unity, Unreal) whose tools are essential for the foundational creation of immersive content environments and interaction frameworks, providing the infrastructure upon which training applications are built.

Midstream activities represent the core of the market, focusing on content development, platform integration, and system assembly. This segment is characterized by specialized content creators who translate instructional design principles into virtual experiences, working closely with industry experts to ensure simulation fidelity. System integrators and original equipment manufacturers (OEMs) assemble the hardware and bundle the proprietary software, often customizing the solution for specific enterprise clients. The transition in this phase is increasingly moving towards highly scalable, cloud-based content delivery networks that facilitate rapid updates and global deployment of training modules, necessitating robust security protocols.

Downstream analysis highlights the crucial role of distribution channels and end-user engagement. Direct distribution is common for large enterprise contracts, involving direct sales teams and consulting services provided by the solution vendors (e.g., Microsoft HoloLens Enterprise Sales). Indirect distribution relies heavily on strategic partnerships with value-added resellers (VARs), corporate learning management system providers, and specialized IT consultants who facilitate the deployment, integration, and ongoing support for clients who lack internal AR/VR expertise. Potential customers are heavily influenced by demonstration capability and return-on-investment evidence, making strong sales engineering and localized support services vital for market penetration and sustained growth in the corporate learning sector.

AR and VR Training Market Potential Customers

Potential customers, or end-users, of AR and VR Training solutions are predominantly large organizations operating in environments characterized by high risk, high asset complexity, or high regulatory requirements where traditional training methods are insufficient or overly costly. These buyers prioritize solutions that offer measurable improvements in safety compliance, reductions in operational downtime, and verifiable acceleration of skill mastery among their technical personnel. The primary customer groups are concentrated in industries that mandate standardized, repeatable, and high-fidelity training simulations to minimize human error and ensure operational readiness, representing significant procurement power and a recurring need for content updates and platform maintenance services.

The ideal buyer profile often includes Chief Learning Officers (CLOs), Heads of Training and Development, and departmental safety managers within industrial complexes. In specialized fields like healthcare, decision-making often involves heads of surgical training, hospital administrators, and academic deans seeking accredited simulation environments. These customers require evidence-based results proving the efficacy of immersive training over existing methods. Procurement decisions are influenced not only by technology features but also by the vendor's ability to provide secure, scalable, and easy-to-integrate platforms that comply with established IT and data privacy regulations, making robust customer support and technical documentation non-negotiable requirements for securing major contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 35.8 Billion |

| Growth Rate | 34.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eon Reality, HTC, Microsoft, Google, Oculus (Meta Platforms), Axon Park, Upskill, Pico Interactive, Samsung, Sony, Varjo, Vuzix, PTC, Immersion Corporation, Strivr, HP, Lenovo, Bosch, Autodesk, 3D Systems, ForgeFX, Accenture, Deloitte (Consulting Services), Valve Corporation, Schell Games. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

AR and VR Training Market Key Technology Landscape

The AR and VR Training market relies on a rapidly evolving technology landscape centered around enhanced visual fidelity, improved spatial tracking, and seamless integration with existing enterprise systems. Crucial technology includes high-resolution, high field-of-view (FoV) displays, often utilizing Micro-OLED or QLED technology, which are essential for reducing the screen door effect and maximizing the realism necessary for tasks requiring fine motor skills or detailed visual inspection. Advanced inside-out tracking systems, such as Simultaneous Localization and Mapping (SLAM), have become standard, eliminating the need for external base stations and significantly simplifying the setup and deployment process in dynamic corporate training environments.

Another pivotal technological component is the development of sophisticated haptic feedback devices, ranging from gloves and suits to specialized controllers, which allow trainees to physically feel resistance, texture, and force feedback within the virtual environment. This tactile realism is critical for procedural training in areas like surgery, equipment assembly, and vehicle maintenance, where the sense of touch is integral to skill development. The convergence of 5G and edge computing is also transforming the landscape, enabling complex, graphics-intensive simulations to be streamed to lightweight, untethered devices with ultra-low latency, thereby expanding the accessibility and portability of high-end training solutions to remote or distributed workforces.

Furthermore, the software ecosystem is heavily reliant on professional-grade game engines (Unity and Unreal Engine) optimized for real-time rendering and interactive physics simulation, providing the foundational tools for content creation. The incorporation of biometric sensors (gaze tracking, heart rate monitors) and AI-driven behavior analysis tools within the headsets allows the platform to gather unprecedented data on learner engagement and cognitive load. This data feedback loop is essential for continuous course optimization and personalized instruction, cementing the role of data analysis as a core technological differentiator in the highly competitive AR/VR training market, moving the focus beyond mere visualization towards deep learning insights.

Regional Highlights

- North America (United States, Canada): Dominates the global market share, attributed to the high concentration of technology innovation centers, strong government investment in defense and military simulation programs, and early corporate adoption across the medical and aerospace sectors. The US remains the largest revenue generator, driven by robust venture capital funding directed towards immersive learning startups and high spending on corporate professional development programs. Regulatory compliance requirements in industries like finance and healthcare necessitate high-fidelity, auditable training records, further boosting demand for sophisticated VR solutions.

- Europe (Germany, UK, France, Scandinavia): Represents a mature market characterized by stringent safety and quality standards, particularly in the manufacturing (automotive, machinery) and energy sectors. Germany stands out due to its strong tradition of vocational training and industry 4.0 initiatives, integrating AR solutions for maintenance and technical guidance. The UK and France show strong demand in higher education and defense applications. The region prioritizes data privacy and ethical AI integration in training platforms, influencing vendors to develop GDPR-compliant solutions.

- Asia Pacific (China, Japan, South Korea, India): Expected to register the highest Compound Annual Growth Rate (CAGR) due to rapid industrial expansion, massive workforce training demands, and increasing governmental support for digital education infrastructure. China is a key driver, benefiting from large-scale manufacturing operations adopting VR for safety and procedural training, alongside significant investments in 5G infrastructure enabling mobile VR deployments. Japan and South Korea lead in adopting advanced consumer and industrial AR/VR hardware technologies, focusing heavily on simulation for complex technological roles and advanced research environments.

- Latin America (Brazil, Mexico): Emerging market segment with growth primarily concentrated in resource extraction industries (mining, oil & gas) and manufacturing. Adoption is accelerating as infrastructure improvements enhance connectivity and as organizations seek cost-effective alternatives to sending trainers and personnel to remote sites. Price sensitivity remains a factor, driving demand for scalable, mid-range VR solutions and cloud-based content delivery models rather than fully customized, high-end installations.

- Middle East and Africa (MEA): Poised for accelerated growth, particularly in the Gulf Cooperation Council (GCC) countries, driven by mega-projects in construction, infrastructure, and the energy sector. Government-led initiatives aiming for economic diversification and localized workforce development (Saudization, UAE Vision 2030) are fueling significant investments in advanced simulation centers and technical training academies utilizing VR technology for rapid skill transfer, particularly in high-risk environments like offshore drilling and pipeline maintenance operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the AR and VR Training Market.- Eon Reality (Global leader in VR/AR knowledge transfer solutions and platform provider)

- HTC Corporation (Developer of Vive series hardware and enterprise-focused VR ecosystems)

- Microsoft Corporation (Provider of HoloLens AR device and Mixed Reality platform integration services)

- Google LLC (Developing AR core platforms and educational content tools)

- Oculus (Meta Platforms, Inc.) (Mass market hardware provider increasingly targeting enterprise training solutions)

- Axon Park (Specialist in scalable VR training content development and deployment)

- Upskill (Focusing on industrial Augmented Reality applications for operational assistance and training)

- Pico Interactive (A key competitor in the standalone VR headset market with a strong enterprise focus, especially in APAC)

- Samsung Electronics Co., Ltd. (Involved in mobile AR/VR and specialized industrial display solutions)

- Sony Corporation (Developing high-fidelity tracking technology and immersive display components)

- Varjo Technologies Oy (Producer of high-resolution, professional-grade VR/XR headsets for simulation)

- Vuzix Corporation (Manufacturer of smart glasses and waveguide-based AR solutions for enterprise)

- PTC Inc. (Providing AR software solutions via Vuforia for industrial maintenance and training)

- Immersion Corporation (Specialized in haptic technology integration for realistic tactile feedback in simulations)

- Strivr (A leading platform providing end-to-end VR training solutions, specializing in soft skills and operational procedures)

- HP Development Company, L.P. (Offering VR-ready workstations and specialized HMDs like the Reverb series)

- Lenovo Group Ltd. (Developing affordable AR/VR hardware solutions for education and corporate use)

- Bosch Sensortec GmbH (Supplier of essential sensor components for spatial tracking and interaction)

- Autodesk, Inc. (Providing 3D modeling and rendering software crucial for high-fidelity content creation)

- 3D Systems Corporation (Involved in rapid prototyping and high-fidelity modeling used in simulation content)

- ForgeFX (Custom simulation software development specializing in industrial and complex procedural training)

- Accenture PLC (Offering comprehensive consulting and integration services for enterprise XR adoption)

- Deloitte Touche Tohmatsu Limited (Strategic advisory and implementation services for immersive learning initiatives)

- Valve Corporation (Influencing hardware standards and core VR software development via SteamVR)

- Schell Games (Content developer specializing in highly engaging educational and enterprise VR applications)

Frequently Asked Questions

Analyze common user questions about the AR and VR Training market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the AR and VR Training Market between 2026 and 2033?

The AR and VR Training Market is projected to experience a robust growth rate, estimated at a CAGR of 34.5% over the forecast period, driven primarily by corporate investment in experiential learning technologies and hardware cost efficiencies.

Which industry segment currently utilizes AR and VR solutions most extensively for training purposes?

The Manufacturing and Healthcare industries are the most extensive users, deploying these technologies for complex procedural training, surgical simulations, equipment maintenance, and critical safety protocol instruction due to the high-risk and technical nature of their operations.

How does the integration of Artificial Intelligence (AI) enhance the effectiveness of AR and VR training programs?

AI significantly enhances training effectiveness by enabling adaptive learning paths, real-time performance analytics, automated scenario generation, and sophisticated behavioral tracking, leading to personalized and highly efficient skill development outcomes.

What are the primary factors restraining the rapid, widespread adoption of AR and VR training in corporate environments?

Key restraints include the relatively high initial capital expenditure required for high-fidelity hardware, the technical complexity associated with content creation and customization, and integration challenges with existing enterprise IT and Learning Management Systems (LMS).

Which geographical region is anticipated to exhibit the fastest growth in the AR and VR Training Market during the forecast period?

The Asia Pacific (APAC) region is forecasted to achieve the highest growth rate, propelled by aggressive industrialization, large-scale workforce development needs, increasing governmental support for digital infrastructure, and rapid adoption across manufacturing and educational sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager