Arab Thobe and Abaya Fabric Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438604 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Arab Thobe and Abaya Fabric Market Size

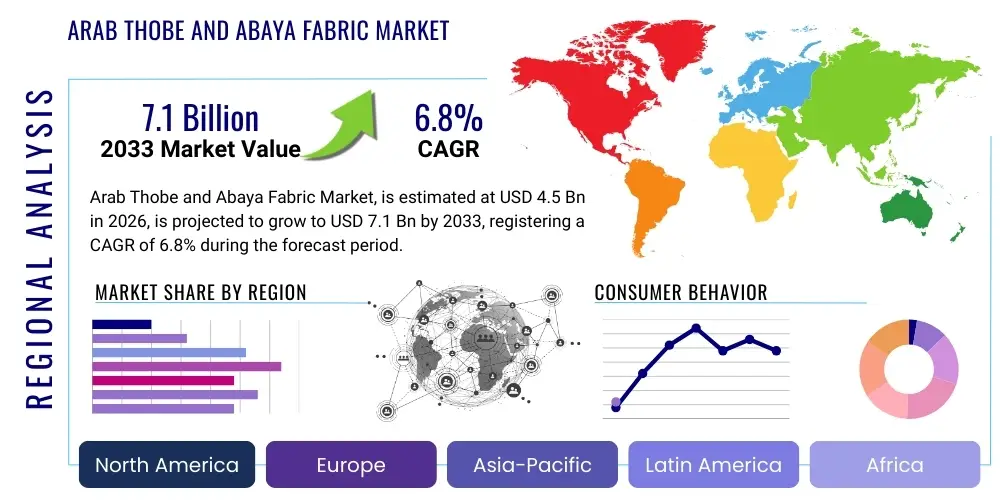

The Arab Thobe and Abaya Fabric Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.1 Billion by the end of the forecast period in 2033. This robust growth is primarily fueled by consistent demographic expansion across the Gulf Cooperation Council (GCC) countries, coupled with evolving consumer preferences that demand higher quality, luxurious, and technologically advanced fabrics for traditional wear. The market's valuation reflects not just the volume of fabric consumption but also the increasing average selling price driven by the premiumization trend, especially within the Abaya sector where intricate detailing and designer collaborations necessitate specialized, high-cost materials.

Arab Thobe and Abaya Fabric Market introduction

The Arab Thobe and Abaya Fabric Market encompasses the specialized textiles utilized in the manufacturing of the traditional male garment (Thobe or Dishdasha) and the traditional female outer garment (Abaya). These fabrics are crucial components of cultural identity across the Middle East and North Africa (MENA) region, extending into parts of Asia where Muslim populations adhere to modest dress standards. The fabrics typically range from high-quality natural fibers like cotton, wool, and silk, to advanced synthetic blends, notably polyester and tri-acetate, specifically engineered for breathability, wrinkle resistance, and drape suitable for the region's diverse climate conditions.

Major applications of these fabrics include daily wear, formal religious occasions, specialized wedding attire, and high-fashion couture lines, catering to distinct segments requiring varying levels of luxuriousness and performance characteristics. Key driving factors propelling this market include the sustained cultural significance of the garments, rising disposable income enabling investment in premium fabrics, the rapid expansion of organized retail and e-commerce platforms, and constant innovation in fabric technology focusing on comfort, stain resistance, and temperature regulation, particularly critical for warm desert climates.

The core benefits derived from these specialized fabrics center on performance and aesthetic appeal. For Thobes, the focus is on light weight, exceptional whiteness retention, and non-crease properties, which enhance the professional appearance demanded in business and social settings. For Abayas, the benefit lies in achieving optimal opacity, drape, and texture, allowing for diverse fashion expressions while maintaining modesty standards. Continuous product development by fabric mills, often based in East Asia and Europe, ensures a steady supply of innovative textiles that meet the exacting standards of traditional tailors and mass manufacturers across the Arab world.

Arab Thobe and Abaya Fabric Market Executive Summary

The Arab Thobe and Abaya Fabric Market is currently experiencing a dynamic shift defined by premiumization and digital transformation. Business trends indicate a movement away from commoditized, standard polyester blends towards higher-margin, specialized fabrics incorporating silk, linen, Tencel, and advanced polyester variants that offer enhanced softness and durability. Manufacturers are increasingly prioritizing supply chain resilience and ethical sourcing, driven by consumer awareness and global compliance requirements. The competitive landscape is characterized by established Asian textile giants and specialized European high-end suppliers, all vying for market share through strategic partnerships with regional garment manufacturers and luxury fashion houses. Investments in vertically integrated operations are becoming a key competitive advantage, allowing firms to control quality from fiber inception to finished fabric.

Regionally, the market is overwhelmingly dominated by the GCC bloc, specifically Saudi Arabia and the UAE, which serve as the primary consumption and fashion trendsetting hubs. Saudi Arabia, benefiting from Vision 2030 initiatives and a large young population, drives significant volume in Thobe fabrics, while the UAE and Kuwait lead the luxury and experimental segments of the Abaya market, often utilizing imported premium silks and specialized wool blends. Emerging markets in North Africa, such such as Egypt and Morocco, represent future growth opportunities, particularly for mid-range, cost-effective fabric solutions, although logistical complexities and local protectionist policies sometimes restrain international supplier penetration.

Segment trends highlight the dominance of Synthetic Fabrics, particularly polyester, due to their cost-effectiveness and performance characteristics like wrinkle resistance, though the fastest growth is anticipated in Blended Fabrics, which combine the performance of synthetics with the luxury and comfort of natural fibers. By End-User, the Female segment (Abaya) is demonstrating stronger revenue growth due to faster fashion cycles, greater stylistic diversification, and a higher willingness to pay for designer textiles. In contrast, the Male segment (Thobe) remains volume-driven, with innovation focused primarily on technological finishes that improve comfort and cleanliness, such as anti-odor and rapid-dry treatments.

AI Impact Analysis on Arab Thobe and Abaya Fabric Market

User inquiries regarding AI's influence in the Arab Thobe and Abaya Fabric Market frequently revolve around personalization capabilities, supply chain optimization, and the integration of smart textiles. Consumers and businesses are concerned with how AI can accurately predict niche regional fashion trends—for instance, subtle shifts in Thobe collar designs or Abaya silhouette preferences across Riyadh versus Dubai—and how this real-time forecasting affects fabric inventory management. A major thematic concern is the feasibility of AI-driven digital sampling, where users expect high-fidelity virtual renderings of how different fabric textures and drapes will appear on a consumer’s body shape, minimizing the reliance on costly and time-consuming physical samples. Additionally, stakeholders are keen on utilizing AI for enhanced quality control, particularly in detecting minute defects in high-value, dark-colored Abaya fabrics which are notoriously challenging for traditional vision systems.

AI’s influence is rapidly transforming the fabric design and selection process. Machine learning algorithms are now being trained on decades of regional sales data, meteorological information, and social media trends to generate hyper-accurate predictions regarding color palette popularity, desired fabric weight per season, and textural preferences across distinct geographic zones. This predictive capability significantly reduces waste associated with overstocking unpopular fabric types and allows manufacturers to execute just-in-time production planning. Furthermore, AI tools are enabling smaller boutiques and specialized tailors to offer mass customization by using customer-uploaded body scans and style preferences to recommend the ideal fabric type and required meterage, streamlining the often manual consultation process.

In the supply chain, AI is central to enhancing transparency and efficiency, especially crucial for fabrics sourced internationally from East Asia and Europe. Users expect AI-powered systems to track raw material provenance, predict potential disruptions (such as shipping delays or quality inconsistencies in dyed batches), and automatically re-route logistics to maintain inventory levels for high-demand items like premium Japanese Thobe textiles. The adoption of AI in manufacturing also extends to predictive maintenance for weaving looms and finishing machinery, reducing downtime and ensuring consistent output quality, which is paramount in a market where small textural variations can significantly impact perceived fabric value and market acceptance.

- AI-driven trend forecasting enhances inventory accuracy and reduces dead stock of seasonal colors and textures.

- Predictive analytics optimizes textile machinery maintenance, ensuring high throughput and consistent fabric quality.

- Machine learning algorithms facilitate personalized fabric recommendations for customers based on fit, climate, and usage intent.

- AI systems are integrated into digital supply chains to track raw fiber origins, improving transparency and ethical sourcing validation.

- Computer vision and deep learning models automate and enhance quality control, especially in detecting subtle defects in dark, highly reflective fabrics.

- Generative design tools assist in rapid prototyping of new patterns and finishes, accelerating time-to-market for innovative textiles.

DRO & Impact Forces Of Arab Thobe and Abaya Fabric Market

The Arab Thobe and Abaya Fabric Market is governed by a robust interplay of cultural obligations, economic growth, and technological hurdles. The primary drivers include the mandatory and continuous demand for traditional attire mandated by strong cultural norms and religious practices across the MENA region, coupled with steady population growth and increasing consumer affluence in key GCC nations which facilitates the demand for luxury and imported fabrics. However, the market faces significant restraints, notably the highly volatile pricing of raw materials such as polyester feedstocks and high-grade cotton, which directly impacts manufacturing margins. Additional constraints arise from complex and disparate import regulatory frameworks and tariff structures across various Arab states, complicating cross-regional trade for international suppliers. Opportunities exist in pioneering sustainable textile alternatives, developing high-performance smart fabrics tailored for extreme heat, and leveraging digital distribution models to bypass traditional, often fragmented, wholesale channels. These factors together exert a complex set of impact forces that necessitate strategic agility for market participants.

Drivers: A paramount driver is the non-discretionary nature of Thobe and Abaya consumption; these garments are essential daily wear and are subject to wear-and-tear replacement cycles, ensuring baseline volume demand. The shift towards status-driven consumerism, particularly among the middle and upper classes in the GCC, fuels the demand for premium, imported fabrics (e.g., specialized Korean, Japanese, and Italian materials) that signal quality and exclusivity. Furthermore, aggressive efforts by regional governments to diversify their economies and promote local fashion industries, often including subsidies or incentives for textile manufacturing, indirectly stimulate demand for specialized domestic and imported input fabrics, driving market expansion and innovation in local design aesthetics.

Restraints: The market is significantly constrained by dependency on a limited number of specialized international fabric mills, which creates supply chain bottlenecks and vulnerability to geopolitical instability or trade disputes. High logistical costs and long lead times for specialized finishes further exacerbate operational challenges. Moreover, while traditional tailoring remains strong, the increasing penetration of mass-produced, ready-to-wear Thobes and Abayas, utilizing standardized, often lower-cost fabrics, presents strong downward price pressure on highly customized fabric segments. Intellectual property risks, especially regarding patented fabric finishes and unique textures, remain a concern for premium fabric manufacturers entering the region, requiring careful legal navigation and protection strategies.

Opportunities: Significant market opportunities lie in the green textile revolution; developing certified organic cotton blends, recycled polyester fabrics (rPET), and fabrics dyed with eco-friendly processes aligns with global sustainability trends and appeals to younger, environmentally conscious consumers. The development of functional textiles—such as those offering integrated UV protection, advanced moisture management, or microbial resistance tailored specifically for the hygienic and climatic needs of the region—represents an untapped, high-value niche. Expanding e-commerce platforms and digital tools for fabric sourcing allow international players to directly access smaller tailors and fashion designers, streamlining the business-to-business transaction process and unlocking previously inaccessible market segments beyond the established wholesalers.

Segmentation Analysis

The Arab Thobe and Abaya Fabric Market is segmented primarily based on Fabric Type, Material Source, End-User, and Application, each revealing distinct growth trajectories and competitive dynamics. Understanding these segments is vital for businesses aiming to optimize product portfolios and distribution strategies, catering precisely to the nuanced demands of the conservative yet highly fashion-conscious consumer base. The complexity of segmentation stems from the fact that fabric choice is deeply regionalized; for instance, thick wool blends might be favored for winter wear in Saudi Arabia’s mountainous regions, while ultra-lightweight, synthetic blends are mandatory in the humidity of coastal Qatar or the UAE.

The segmentation by Fabric Type, encompassing natural, synthetic, and blended categories, reveals the ongoing dominance of synthetics due to their functional superiority and cost efficiency, particularly in mass-market Thobe production. However, the rapid growth of the blended segment signifies consumer willingness to invest in textiles that offer the best of both worlds—the luxury feel of cotton or silk coupled with the practical, easy-care properties of polyester. End-User segmentation (Male vs. Female) shows divergence: the male segment prioritizes performance and consistency, driving demand for technologically finished fabrics, while the female segment emphasizes aesthetic variety, leading to increased demand for unique patterns, elaborate textures, and specialized, flowing drapes for Abayas. This granular segmentation approach informs targeted marketing efforts, such as promoting high-absorbency cotton blends during the Hajj season or introducing new stain-resistant silk blends for formal Abaya wear.

- By Fabric Type:

- Natural Fabrics (Cotton, Linen, Silk, Wool)

- Synthetic Fabrics (Polyester, Viscose, Rayon, Nylon)

- Blended Fabrics (Poly-Cotton, Silk-Polyester blends)

- By Material Source:

- Imported Fabrics (South Korea, Japan, China, Italy)

- Domestic/Regional Fabrics (Local GCC manufacturing)

- By End-User:

- Male (Thobe/Dishdasha)

- Female (Abaya/Sheila)

- By Application:

- Daily Wear

- Formal Wear

- Religious Ceremonial Wear

- By Distribution Channel:

- Wholesalers & Distributors

- Direct Sales (Fabric Mills to Manufacturer)

- Online Retail & E-commerce

- Traditional Tailoring Shops & Boutiques

Value Chain Analysis For Arab Thobe and Abaya Fabric Market

The value chain for the Arab Thobe and Abaya Fabric Market is complex and predominantly internationalized, beginning with the upstream sourcing of specialized raw materials. The upstream segment involves the procurement of high-grade raw fibers—petroleum-derived polyester chips, premium long-staple cotton, or raw silk—often sourced from global commodity markets in China, India, or specialized regions like Korea and Japan. This phase includes initial processing such as spinning, texturizing, and chemical pre-treatment, which dictate the fundamental characteristics of the yarn. Because high-performance characteristics (like superior whiteness, non-yellowing, and permanent crease resistance) are mandatory, this upstream segment is critical and often involves highly specialized chemical suppliers and technology licensors, maintaining stringent quality controls necessary for end-product acceptance in the discerning GCC market.

The midstream segment involves the core manufacturing processes: weaving or knitting the yarn into grey fabric, followed by critical finishing stages—dyeing, printing, and applying functional treatments (e.g., UV protection, wrinkle-free finishes). The majority of high-quality finished fabrics are imported into the Arab world, primarily from specialized mills in East Asia (e.g., South Korea and Japan are key for premium Thobe fabrics) or European textile hubs (for high-fashion Abaya silks). Quality assurance at this stage is paramount, focusing on achieving the specific opacity, drape, and color fastness required by regional standards. Vertical integration, where major fabric suppliers control both weaving and finishing, is increasing, aiming to capture higher margins and ensure product consistency.

The downstream distribution channel is bifurcated into direct and indirect routes. Direct sales involve large, international fabric mills selling bulk volumes directly to major regional garment manufacturers or large-scale retail chains that operate their own production facilities. Indirect distribution relies heavily on regional wholesalers and established distributors, who maintain extensive inventories and act as intermediaries, supplying thousands of independent, traditional tailors and smaller fashion boutiques across the GCC and MENA. E-commerce platforms are emerging as increasingly important direct channels for smaller design houses to source specialized, lower-volume, or imported textiles, bypassing the legacy wholesaler model, enhancing market access, and ultimately streamlining the route-to-market for innovative fabrics.

Arab Thobe and Abaya Fabric Market Potential Customers

Potential customers for the Arab Thobe and Abaya Fabric Market are highly diverse, spanning from individual consumers engaging traditional tailors to multinational retail corporations operating mass production facilities. The primary end-users are regional garment manufacturers specializing in traditional wear, who require fabrics in bulk volumes with strict adherence to specifications regarding weight, color matching (especially for standardized white Thobes), and technical finishes. These commercial customers prioritize cost-effectiveness, supply consistency, and minimum order quantities that align with their production scale. High-end fashion houses and boutique designers represent another crucial customer segment; they require smaller, specialized batches of premium, often imported, fabrics such as Italian silk, specialized wool crepes, and technologically advanced blended textiles, focusing less on unit cost and more on exclusivity, texture, and brand provenance.

The second major group of customers includes the vast network of independent, small-to-medium-sized traditional tailoring shops, or kheyat. These tailors rely heavily on local fabric wholesalers to provide a diverse selection of materials that their individual clientele can touch, feel, and select before customization. These customers prioritize accessible inventory, rapid fulfillment, and local credit terms. Finally, the consumer themselves represents an indirect but powerful customer segment. While they typically purchase the fabric through the tailor or a retail shop, their purchasing decisions are heavily influenced by climate (leading to seasonal preference shifts), social occasion (driving demand for heavy formal fabrics or light daily wear), and regional fashion norms, ultimately determining the success of any specific fabric type or finish within the market.

Emerging potential customers also include international modest wear brands and e-commerce platforms that are expanding their footprint within the MENA region. These entities require global supply chain integration and specific fabric certifications related to ethical production and sustainability, reflecting a newer dimension of customer requirements beyond traditional performance metrics. Tailoring to these varied customer needs—from bulk standardized synthetics for mass production to curated, luxury natural fibers for couture—is essential for comprehensive market penetration and sustained revenue generation across all price points.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Toray Industries, Teijin Frontier Co. Ltd., Mitsubishi Chemical Corporation, Mitsui & Co. Ltd., Saudi Industrial Investment Group (SIIG), Alok Industries Limited, Grasim Industries Limited, Sateri, Far Eastern New Century Corporation (FENC), KCT Group, PTT Global Chemical Public Company Limited, Reliance Industries Limited, Luthai Textile Co. Ltd., Huafu Fashion Co. Ltd., Arvind Limited, Raymond Limited, Shandong Ruyi Technology Group, Sinopec Yizheng Chemical Fibre Company, Indo Rama Synthetics, Marubeni Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Arab Thobe and Abaya Fabric Market Key Technology Landscape

The technological evolution within the Arab Thobe and Abaya Fabric Market is focused on enhancing performance, comfort, and longevity while maintaining traditional aesthetics. A critical area of development involves functional finishes designed specifically for the region's harsh climate. This includes advanced moisture management systems, utilizing hydrophilic and hydrophobic treatments to wick away sweat quickly from the body (essential for Thobes) and ensure rapid drying. Furthermore, non-crease and permanent press technologies remain vital, reducing the need for extensive ironing, a highly valued attribute for daily wear Thobes, achieved through cross-linking polymerization treatments applied during the finishing process. These chemical and mechanical treatments extend the lifespan and maintain the pristine appearance of the garments, directly responding to high consumer expectations for polished traditional attire.

Nanotechnology is playing an increasingly important role, particularly in stain and water repellency for both Thobes and Abayas, protecting expensive, high-quality fabrics from environmental damage and spills. For Thobe fabrics, the focus includes optical brighteners and specialized UV stabilizers to prevent yellowing or degradation from intense sunlight exposure, maintaining the dazzling white color standard highly demanded in the GCC. For Abaya fabrics, technology is concentrating on optimizing black depth and color fastness, ensuring the deep black remains rich and does not fade or develop a reddish tint after multiple washes, a common consumer complaint with low-quality synthetic textiles. This necessitates the use of high-dispersion dyes and sophisticated heat setting processes.

Beyond traditional finishing, the market is beginning to explore the integration of smart textile features. While still nascent, there is research into fabrics that passively regulate temperature through phase change materials (PCMs) integrated into the fiber structure, offering enhanced thermal comfort without altering the drape or feel of the garment. Furthermore, sustainable technologies, such as closed-loop recycling processes for polyester and waterless dyeing techniques, are being adopted by leading international suppliers to meet the growing demand for environmentally responsible textiles from regional buyers, driving compliance and ethical innovation throughout the production chain.

Regional Highlights

The Middle East and Africa (MEA) region is the definitive epicenter of the Arab Thobe and Abaya Fabric Market, accounting for the vast majority of consumption volume and value. Within the MEA, the Gulf Cooperation Council (GCC) countries—Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, and Oman—dominate the market landscape. Saudi Arabia is the largest market by volume, driven by its large, young population and the continuous requirement for both daily and formal Thobes and Abayas. The market in KSA exhibits a high demand for premium Japanese and Korean synthetic blends for Thobes, valuing breathability, whiteness, and crease resistance above all else. The UAE, particularly Dubai, leads the market in fashion innovation and luxury segments, serving as a hub for designer Abayas which demand sophisticated fabrics like European silks, high-end wool, and intricate lace or embroidered textiles, often imported directly through specialized textile trade zones.

Beyond the core GCC market, other regional centers offer distinct consumption patterns. North African countries, including Egypt and Morocco, represent significant volume markets, though their demand tends towards more price-sensitive fabrics, utilizing robust local cotton production capabilities and standardized synthetic blends. These regions present opportunities for mid-market suppliers focused on cost-efficiency and localized color preferences outside the typical black/white palette of the Gulf. Meanwhile, Asian manufacturing hubs, particularly South Korea, Japan, and China, are critical for the supply side, as they possess the specialized finishing technology required to produce the high-performance fabrics demanded by GCC consumers. These APAC nations are technically suppliers, but their output quality sets the global benchmark for Thobe and Abaya textiles.

The regional dynamics are further influenced by distribution infrastructure. Developed markets like the UAE have highly sophisticated logistics for receiving high-value imports, facilitating the quick turnover necessary for fast fashion Abaya trends. Conversely, in rapidly growing but less logistically developed markets, reliance on established wholesale networks and local customs procedures dictates the speed and cost of entry for new fabric suppliers. Understanding these varying logistical and preference nuances is critical for successful regional strategy implementation, necessitating a tailored product mix for each nation based on climate, income levels, and predominant fashion trends.

- Saudi Arabia (KSA): Largest consumer market; high demand for performance synthetic Thobe fabrics; standardization of white color quality; strong driver of volume growth.

- United Arab Emirates (UAE): Hub for luxury Abaya fashion and imported high-end silks/blends; fast fashion cycle influence; high technological adoption in retail.

- Qatar and Kuwait: Strong per capita expenditure on premium, customized garments; preference for exclusive and high-quality Japanese and Korean imports.

- North Africa (Egypt, Morocco): Emerging volume market; driven by local production of cotton and price sensitivity; potential for mid-range synthetic/cotton blends.

- Asia Pacific (APAC): Critical supply region (Japan, South Korea, China); technologically advanced manufacturers providing specialized finishes and functional properties essential to the Arab market.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Arab Thobe and Abaya Fabric Market.- Toray Industries

- Teijin Frontier Co. Ltd.

- Mitsubishi Chemical Corporation

- Mitsui & Co. Ltd.

- Saudi Industrial Investment Group (SIIG)

- Alok Industries Limited

- Grasim Industries Limited

- Sateri

- Far Eastern New Century Corporation (FENC)

- KCT Group

- PTT Global Chemical Public Company Limited

- Reliance Industries Limited

- Luthai Textile Co. Ltd.

- Huafu Fashion Co. Ltd.

- Arvind Limited

- Raymond Limited

- Shandong Ruyi Technology Group

- Sinopec Yizheng Chemical Fibre Company

- Indo Rama Synthetics

- Marubeni Corporation

Frequently Asked Questions

Analyze common user questions about the Arab Thobe and Abaya Fabric market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the most demanded fabrics for Thobes in the GCC region?

The most demanded Thobe fabrics are high-performance synthetic blends, primarily specialized polyester, sourced predominantly from Japan and South Korea. These fabrics are favored for their superior whiteness, excellent drape, breathability, and non-crease properties, essential for the hot climate and formal requirements of the Gulf region.

How is sustainability impacting the sourcing of Abaya and Thobe textiles?

Sustainability is driving increased demand for certified eco-friendly materials such as organic cotton, recycled polyester (rPET), and sustainable viscose fibers. Leading manufacturers are investing in closed-loop production systems and water-saving dyeing technologies to meet ethical sourcing mandates and appeal to younger, environmentally conscious consumers.

What is the current growth trend concerning synthetic versus natural fabrics?

While synthetic fabrics (polyester) still dominate the market by volume due to their cost and performance, the fastest growth rate is observed in high-end natural and blended fabrics (such as silk-polyester blends). This shift reflects rising disposable incomes allowing consumers to prioritize comfort, luxury feel, and better drape over simple cost savings.

Which geographical market presents the largest growth opportunity in the forecast period?

Saudi Arabia is projected to present the largest volume growth opportunity due to its large and expanding population base and ongoing economic diversification initiatives. However, the UAE offers the highest growth potential in the value segment, driven by rapid fashion cycles and the continuous demand for imported, luxurious, and technologically finished textiles for Abayas.

What are the key technological requirements for specialized Thobe fabrics?

Key technological requirements include advanced non-crease finishes for wrinkle resistance, superior UV protection and optical brightening to prevent yellowing, and high-tech moisture-wicking and quick-dry treatments. These technologies ensure the garment maintains a pristine appearance and offers maximum comfort in high heat and humidity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager