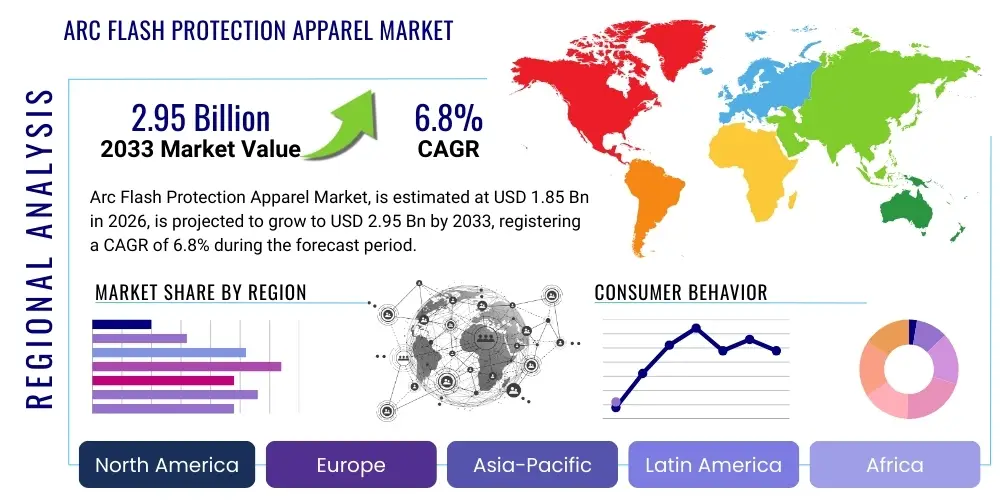

Arc Flash Protection Apparel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436842 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Arc Flash Protection Apparel Market Size

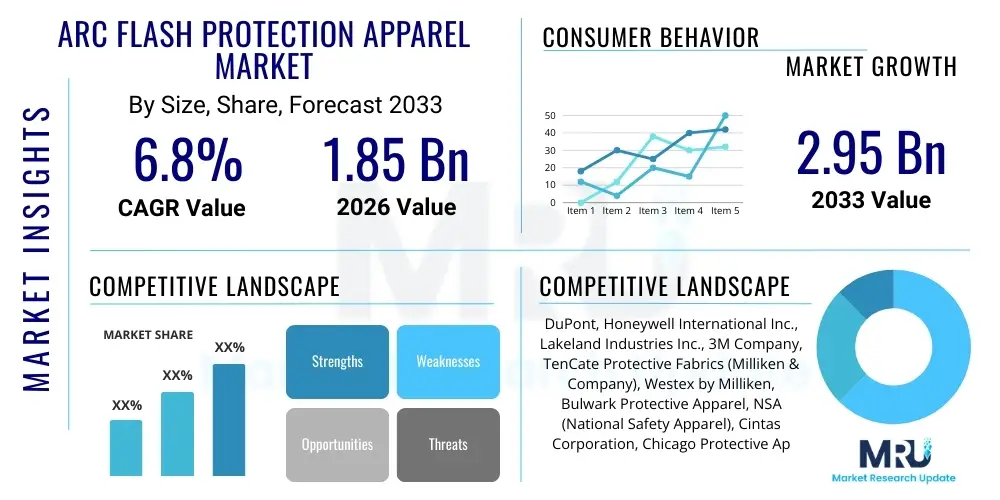

The Arc Flash Protection Apparel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.95 Billion by the end of the forecast period in 2033.

Arc Flash Protection Apparel Market introduction

The Arc Flash Protection Apparel Market encompasses specialized personal protective equipment (PPE) designed to mitigate severe burn injuries resulting from an electrical arc flash event. This protective clothing, fabricated primarily from flame-resistant (FR) materials like Nomex, modacrylic blends, and treated cottons, serves as a crucial line of defense for personnel working in environments with high electrical hazard exposure, such as utilities, manufacturing, oil and gas, and construction sectors. The design and manufacturing processes adhere strictly to international safety standards, predominantly NFPA 70E (Standard for Electrical Safety in the Workplace) and IEC 61482-1-2, which mandate specific Arc Thermal Performance Value (ATPV) or Energy Breakopen Threshold (EBT) ratings to ensure adequate thermal insulation against the intense heat generated by an arc fault.

The core product portfolio includes coveralls, jackets, pants, hoods, gloves, and face shields, categorized based on Hazard Risk Categories (HRC) ranging from 1 to 4. These garments are engineered not only for superior thermal protection but also for wearer comfort and mobility, facilitating adoption and compliance in demanding industrial settings. The fundamental benefit of arc flash apparel is the prevention of ignition and minimization of second and third-degree burn injuries, significantly enhancing worker safety and reducing costly workplace fatalities and insurance liabilities. The constant evolution of materials science is yielding lighter, more durable, and intrinsically flame-resistant fabrics that offer improved breathability and moisture management, addressing historical barriers to compliance related to heat stress.

Driving factors for sustained market expansion include stringent global regulatory frameworks, particularly those enforced by OSHA (Occupational Safety and Health Administration) and equivalent international bodies, which increasingly mandate the use of compliant PPE for electrical workers. Furthermore, rapid industrialization, especially in developing economies, necessitates massive infrastructure development in power generation and distribution, expanding the workforce exposed to electrical hazards. Corporate focus on Environmental, Social, and Governance (ESG) standards, emphasizing worker safety and wellbeing, also contributes significantly to the proactive adoption of high-performance arc flash protective solutions across multinational corporations.

Arc Flash Protection Apparel Market Executive Summary

The Arc Flash Protection Apparel Market is experiencing robust growth fueled by mandatory regulatory enforcement and a heightened global commitment to industrial safety protocols, particularly within the utility and heavy manufacturing sectors. Business trends indicate a strong shift towards multi-hazard protective solutions, where arc flash apparel also incorporates resistance to chemical splash or flash fire, driven by the desire for consolidated PPE inventories and enhanced cross-industry utility. Manufacturers are focusing heavily on integrating smart technologies, such as embedded sensors for monitoring thermal stress and garment usage, pushing the market toward premium, high-value technical textiles. Supply chain resilience, particularly in sourcing specialized, intrinsically flame-resistant fibers, remains a critical factor impacting competitive pricing and regional availability.

Regionally, North America maintains market dominance, largely attributable to the established, rigorous framework of NFPA 70E compliance and substantial investment in electrical infrastructure maintenance and expansion. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, spurred by rapid expansion of power generation capabilities, industrial modernization in countries like China and India, and the gradual adoption of international safety standards. Europe shows steady, mature growth, driven by harmonized EU directives and a focus on sustainability, leading to demand for eco-friendly, durable FR materials and rental/laundry service models.

Segment trends reveal that the 'Apparel Type' segment is dominated by arc flash suits and coveralls due to their comprehensive body protection requirements for high-risk tasks (HRC 3 and 4). Based on 'End-Use Industry,' the Utilities segment (power generation, transmission, and distribution) represents the largest consumer, owing to the inherent risk levels and the sheer volume of electrical maintenance personnel. Material innovation continues to favor inherently flame-resistant (IFR) fibers over chemically treated ones, given IFR's superior durability, sustained protective properties through repeated laundering, and overall long-term cost-effectiveness, cementing its position as the fastest-growing material type.

AI Impact Analysis on Arc Flash Protection Apparel Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the arc flash apparel domain frequently center on three critical areas: predictive safety, material innovation, and compliance optimization. Users are keen to understand how AI can move the industry beyond passive protection to proactive hazard mitigation, specifically asking about the application of machine learning for predicting arc flash probability based on environmental and operational data. There is also significant interest in AI's role in accelerating the development of novel flame-resistant materials by simulating molecular structures and thermal performance, thereby reducing lengthy R&D cycles. Furthermore, stakeholders seek clarification on how AI tools can automate and enhance NFPA 70E compliance tracking, ensuring the right garment (with the correct ATPV rating) is utilized for the defined task, minimizing human error in PPE selection and lifecycle management.

The implementation of AI and related technologies, such as Internet of Things (IoT) sensors embedded in smart PPE, is transforming the value proposition of arc flash apparel from a static safety barrier to a dynamic safety system. AI algorithms can process real-time environmental data (e.g., humidity, temperature) alongside historical equipment performance logs to provide hyper-accurate risk assessments prior to initiating maintenance tasks. This capability allows safety managers to dynamically adjust the required PPE rating, optimizing safety margins while preventing the unnecessary use of overly bulky HRC 4 suits in low-risk scenarios, thereby mitigating heat stress risks and improving worker productivity.

Moreover, AI is playing a crucial role in optimizing the supply chain and manufacturing precision of arc flash garments. Machine learning models analyze historical material usage, quality control metrics, and regulatory updates to optimize cutting patterns, minimize material waste of expensive FR fabrics, and ensure consistent protective characteristics across production batches. For large enterprises utilizing managed PPE programs, AI algorithms are instrumental in tracking the lifespan, wash cycles, and integrity of individual garments, alerting safety personnel when a specific item is approaching end-of-life or requires mandatory replacement, ensuring that all deployed apparel maintains its certified protective integrity in accordance with stringent safety standards.

- AI-driven predictive maintenance models forecast equipment failure, dynamically informing required PPE levels (ATPV rating) for maintenance crews.

- Integration of IoT sensors in apparel allows AI to monitor garment usage, washing cycles, and potential fabric degradation, ensuring mandatory compliance.

- Machine learning accelerates the R&D of novel flame-resistant polymers by simulating thermal performance and material composition under arc conditions.

- AI assists in optimizing inventory management by predicting regional demand for specific HRC categories based on planned infrastructure projects.

- Automated compliance checks utilize AI to cross-reference worker task permits with certified PPE logs, reducing human error in NFPA 70E adherence.

DRO & Impact Forces Of Arc Flash Protection Apparel Market

The Arc Flash Protection Apparel Market is principally driven by non-negotiable regulatory requirements and the rising industrial focus on zero-accident policies, which exert significant upward pressure on demand for high-performance PPE. However, this growth is partially restrained by the high capital cost associated with premium, multi-layered FR fabrics and the operational challenge of ensuring constant worker compliance, especially in hot environments where heat stress encourages non-use. Opportunities reside primarily in emerging markets undergoing massive infrastructure build-out and the continuous innovation in material science aimed at creating lighter, more comfortable, and sustainable protective garments. These factors interact through Porter's Five Forces, where buyer power is moderate (driven by bulk purchasing and stringent supplier selection), but supplier power is high for specialized FR textile manufacturers, and regulatory intensity ensures a strong barrier to entry for non-compliant materials, ultimately sustaining market profitability.

The primary driver is the stringent enforcement of occupational safety standards, such as NFPA 70E in North America and similar directives in Europe and Asia, which penalize non-compliance heavily. This regulatory environment mandates that companies perform incident energy analyses and equip personnel with appropriately rated arc flash PPE, creating a guaranteed baseline demand. Additionally, increasing electrification across all industries, coupled with the aging of existing electrical infrastructure globally, necessitates more frequent and higher-risk maintenance activities, directly boosting the required stock of protective clothing. The growing trend of outsourcing maintenance to specialized contractors further amplifies demand, as contractors must adhere strictly to client safety protocols, often demanding the highest HRC ratings.

Restraining the market are the significant initial investment costs for high-grade, inherently flame-resistant apparel and the logistical complexity of maintaining and laundering specialized PPE. For smaller enterprises, the cost barrier can lead to deferred upgrades or the selection of lower-cost, less durable, treated materials. Furthermore, the perceived discomfort and bulkiness of multi-layer arc flash suits often lead to worker reluctance and non-compliance, particularly in regions with high ambient temperatures, requiring continuous safety training and management oversight to mitigate. However, technological opportunities, including the development of nanotechnology-enhanced textiles offering high ATPV with reduced material weight, and the expansion of managed apparel services (rental and industrial laundry), are systematically addressing these restraints, offering pathways for sustained market penetration and compliance improvement.

Opportunities are strongly present in geographical expansion into high-growth, industrializing regions, such as Southeast Asia and Latin America, where safety standards are rapidly evolving towards global benchmarks. Product diversification into dual-hazard protection (arc flash and blast protection for oil and gas, for example) allows manufacturers to capture broader industrial demand. Furthermore, the sustainability trend provides a unique opportunity for market differentiation; manufacturers focusing on closed-loop recycling of FR fibers and utilizing materials with lower environmental impact during production stand to gain a competitive edge, appealing to corporate buyers prioritizing ESG metrics in their procurement processes.

Segmentation Analysis

The Arc Flash Protection Apparel Market is comprehensively segmented based on material type, apparel type, application (HRC level), and end-use industry. This structure provides a detailed understanding of procurement patterns and technological preferences across different industrial environments. The segmentation highlights the intrinsic link between the electrical hazard level of an environment, dictated by the required HRC rating, and the corresponding necessary investment in specialized materials. The shift towards inherently flame-resistant (IFR) fibers over chemically treated alternatives defines the material landscape, driven by superior longevity and sustained protection. Simultaneously, end-user demand dictates the distribution between comprehensive arc flash suits for high-risk utilities and more modular coveralls or single layers for lower-risk manufacturing tasks.

The 'Material Type' is critical as it determines the level of protection (ATPV), durability, and comfort. Intrinsically flame-resistant materials, which have flame-retardant properties built into their chemical structure, command a premium but offer superior value over the garment's lifespan compared to treated fabrics, which rely on chemical finishes that can degrade over time and repeated washing. Apparel types vary significantly, reflecting the need for tailored protection: while full arc flash suits (HRC 4) are vital for switching operations, everyday maintenance tasks often utilize simpler arc flash coveralls or shirts and pants (HRC 1 or 2). The trend toward lighter, single-layer protective garments that still meet high ATPV ratings is a key area of innovation within this segment.

Furthermore, segmentation by 'End-Use Industry' clearly identifies the largest consuming sectors and their distinct requirements. The Utilities sector demands the highest volume and range of HRC ratings due to the volatility and power of the electrical systems they manage. Conversely, the Manufacturing sector, while diverse, primarily requires HRC 1 and 2 protection for internal electrical maintenance teams. Understanding these segment-specific needs is vital for manufacturers to tailor their marketing and product development efforts, focusing on certifications (e.g., specific regional utility approvals) and bulk supply chain solutions relevant to each major customer category.

- By Material Type:

- Inherently Flame Resistant (IFR) Fibers (e.g., Aramid, Modacrylic, PBI)

- Treated Fabrics (e.g., Treated Cotton, FR Rayon Blends)

- By Apparel Type:

- Arc Flash Suits/Kits (HRC 3 & 4)

- Arc Flash Coveralls

- Arc Flash Jackets and Pants

- Arc Flash Hoods and Face Shields

- Gloves and Insulating Liners

- By Hazard Risk Category (HRC/ATPV):

- HRC 1 (4-8 cal/cm²)

- HRC 2 (8-25 cal/cm²)

- HRC 3 (25-40 cal/cm²)

- HRC 4 (>40 cal/cm²)

- By End-Use Industry:

- Utilities (Power Generation, Transmission, Distribution)

- Oil & Gas (Upstream, Midstream, Downstream)

- Manufacturing (Automotive, Heavy Machinery)

- Construction

- Chemical and Petrochemical

- Others (Mining, Transportation)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Arc Flash Protection Apparel Market

The value chain for Arc Flash Protection Apparel is complex, beginning with highly specialized upstream textile suppliers and concluding with sophisticated distribution networks and managed service providers. The upstream segment is dominated by a few global chemical and fiber manufacturers (e.g., DuPont, Lenzing) who produce proprietary inherently flame-resistant (IFR) fibers like Nomex and Kevlar. The intellectual property and technical complexity involved in fiber creation grant these suppliers significant leverage. Midstream, fabric manufacturers process these fibers into woven or knitted textiles, often incorporating dual-hazard protection features and high-performance finishes. This stage requires rigorous testing and certification (NFPA 70E, ASTM F1959) before the fabric proceeds to the garment assembly stage.

The downstream segment involves garment manufacturing, branding, and distribution. Manufacturers focus on ergonomic design, quality stitching (using FR threads), and compliance labeling. The distribution channel is crucial; it involves a mix of direct sales to major utilities and government bodies, and indirect sales through specialized industrial distributors and PPE safety dealers. These indirect channels often provide value-added services such as safety consulting, hazard analysis, and customized fitting services. Direct distribution is preferred for large, strategic accounts requiring tailored inventory and high-volume orders, ensuring tight control over quality and delivery timelines.

Service providers, including industrial laundry and managed PPE programs, form a vital part of the downstream value chain. These services ensure the proper maintenance, repair, and tracking of specialized arc flash apparel, which is critical since improper laundering can severely compromise the protective integrity of the garment, particularly chemically treated ones. The ability to offer these comprehensive lifecycle management services enhances customer loyalty and reinforces the relationship between manufacturers/distributors and major end-users. Overall, successful firms in this market manage the high cost of raw materials while maximizing efficiency in the fabrication and distribution process, backed by rigorous quality assurance across all stages.

Arc Flash Protection Apparel Market Potential Customers

The primary purchasers and end-users of Arc Flash Protection Apparel are organizations and entities responsible for the operation, maintenance, and construction of electrical infrastructure where incident energy calculations dictate the necessity of high-rated PPE. The most significant customer segment remains the Utilities sector, encompassing power generation plants (nuclear, thermal, renewable), electrical transmission tower crews, and local distribution co-ops. These entities purchase high volumes of HRC 2 and HRC 4 rated garments consistently, driven by workforce size and non-negotiable regulatory obligations under government-mandated safety programs. Their procurement cycle is often centralized and focuses on long-term contracts with suppliers capable of providing technical support and managed apparel services.

Secondary high-value customers include the Oil & Gas industry, particularly refinery and petrochemical operations, where workers face dual risks of arc flash and hydrocarbon flash fires. These customers prioritize multi-hazard protective apparel utilizing advanced materials like Aramid/Modacrylic blends that satisfy both NFPA 70E and NFPA 2112 (Standard on Flame-Resistant Garments for Protection of Industrial Personnel Against Flash Fire). Additionally, heavy manufacturing operations, such as automotive assembly lines and primary metal processing facilities, employ specialized electrical maintenance staff who require localized arc flash protection, contributing steady demand, typically for HRC 1 and 2 coveralls.

The emerging segment includes renewable energy projects (solar farms, wind turbines) and data center maintenance providers. As electrical infrastructure decentralizes and highly powerful systems are integrated into commercial and industrial settings, the need for trained personnel and compliant PPE expands rapidly. Procurement in these growing sectors is often project-based but is expected to transition to standardized long-term inventory management as operations mature. Government bodies, including military facilities and public transit systems maintaining electrical rail infrastructure, also represent crucial institutional buyers, often mandating specific proprietary fiber standards and high durability requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.95 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DuPont, Honeywell International Inc., Lakeland Industries Inc., 3M Company, TenCate Protective Fabrics (Milliken & Company), Westex by Milliken, Bulwark Protective Apparel, NSA (National Safety Apparel), Cintas Corporation, Chicago Protective Apparel, Tyndale Company, Oberon Company, Paulsen, ProGARM, VF Corporation (Red Kap), Cementex, Drägerwerk AG & Co. KGaA, Ansell Ltd., Saf-T-Gard International, Inc., M. L. Kishigo. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Arc Flash Protection Apparel Market Key Technology Landscape

The Arc Flash Protection Apparel market is fundamentally driven by advancements in technical textiles and smart garment integration. The core technology landscape revolves around achieving high Arc Thermal Performance Value (ATPV) ratings with reduced fabric weight and improved ergonomic properties. Key innovations center on developing new generations of inherently flame-resistant (IFR) fibers, such as proprietary meta-aramids and para-aramids (Nomex, Kevlar derivatives), and engineered modacrylic/cellulose blends. These materials are often blended to optimize the balance between thermal protection, moisture wicking, and overall comfort, addressing the historical challenge of heat stress which impacts compliance. Nanotechnology is emerging as a critical tool, enabling the creation of fabrics with enhanced mechanical strength and thermal stability at the fiber level, allowing for single-layer garments that achieve traditionally multi-layer protection ratings.

Beyond material science, the integration of smart technologies is rapidly defining the future of arc flash PPE. This includes embedded textile sensors (e-textiles) that monitor the wearer's physiological parameters, such as heart rate and core body temperature, providing real-time data to prevent heat-related illness. These sensors also track the physical condition and usage history of the garment itself, using passive RFID or NFC tags to log wash cycles and chemical exposure, ensuring the protective capacity remains certified. This digital ledger system is essential for rigorous compliance tracking, particularly in large utility companies managing thousands of individual PPE units.

Manufacturing techniques also represent a significant technological focus. Seamless construction and ergonomic patterning are being prioritized to improve the fit and mobility of multi-layer suits, which enhances worker performance and compliance. Furthermore, specialized FR threads and advanced seam sealing techniques are crucial to prevent thermal transfer points, ensuring the integrity of the garment’s protection envelope. Certification and testing technology—particularly calorimetric arc testing (ASTM F1959)—remain the non-negotiable standard, with advancements focused on making these testing processes more repeatable and accurate to support faster commercialization of new fabric blends.

Regional Highlights

The regional dynamics of the Arc Flash Protection Apparel Market are characterized by mature, highly regulated demand in North America and Europe, contrasted with rapidly accelerating regulatory adoption and infrastructural investment in the Asia Pacific (APAC) region.

North America

North America, led by the United States, commands the largest share of the global market. This dominance is due to the mandatory enforcement of NFPA 70E and OSHA regulations, which have established a culture of strict safety compliance across the utility, manufacturing, and electrical services sectors. The market is highly mature, characterized by high adoption rates of premium, inherently flame-resistant (IFR) materials, driven by large municipal and private utility companies (e.g., Duke Energy, Exelon). Procurement decisions are heavily influenced by proven durability, comprehensive managed apparel programs, and the capability of suppliers to offer full-service arc flash assessment and training. The US market consistently demands the highest quality HRC-rated apparel, pushing manufacturers to continuously innovate in comfort without compromising ATPV ratings. Canada mirrors this trend, adhering to similar strict safety protocols, ensuring robust, stable demand.

Europe

The European market exhibits steady growth, governed by harmonized directives such as the Personal Protective Equipment Regulation (EU) 2016/425 and specific regional standards (e.g., IEC 61482-1-2 for arc protection). The focus in Europe is twofold: high technical compliance and sustainability. Scandinavian and Western European nations increasingly prioritize environmentally conscious FR materials, driving demand for innovative fibers that minimize chemical usage and enhance recyclability. Utilities and heavy industry sectors, particularly in Germany, France, and the UK, are significant end-users. Unlike North America, the European market shows a higher propensity towards rental and industrial laundry service models for PPE, preferring operational expenditure over large capital outlay for garment maintenance, leading to robust development in the managed service segment.

Asia Pacific (APAC)

APAC is projected to be the fastest-growing market globally, driven by massive investments in new power generation and transmission infrastructure, alongside rapid industrialization, particularly in China, India, and Southeast Asia. While historical safety standards varied widely, there is a strong, observable trend toward adopting international benchmarks like NFPA 70E and localizing these mandates. The market is still heavily reliant on treated cotton and lower-cost alternatives, but the transition towards IFR materials is accelerating, spurred by multinational corporations setting global safety standards for their regional operations. China's enormous utility sector and India's infrastructural boom represent key growth vectors, albeit complicated by fragmented distribution networks and varying enforcement levels. The growth is substantial, requiring suppliers to establish strong local manufacturing or distribution partnerships.

Latin America (LATAM)

The LATAM market, while smaller, is growing moderately, primarily fueled by the substantial presence of the Oil & Gas and Mining sectors, particularly in countries like Brazil and Mexico. Demand is highly focused on multi-hazard protective gear. Regulatory adherence is increasing, often influenced by international corporate policies rather than strictly enforced local legislation, creating pockets of high demand for premium safety gear in specific industrial zones. Economic volatility, however, remains a factor that can occasionally slow investment in long-term PPE programs, favoring phased purchases.

Middle East & Africa (MEA)

MEA growth is concentrated around energy production—oil, gas, and major utility projects—where working in extreme heat conditions is common. This region demands highly specialized apparel that balances high arc protection with maximum breathability and thermal management to combat heat stress, making lightweight IFR fabrics essential. Significant construction projects related to urbanization and infrastructure development in the Gulf Cooperation Council (GCC) countries also contribute to steady, high-value demand for certified arc flash PPE.

- North America (Dominant Market): Characterized by stringent, mature regulations (NFPA 70E, OSHA), high adoption of premium IFR fibers, and large utility sector contracts. Strong focus on managed apparel services.

- Asia Pacific (Fastest Growth): Driven by rapid infrastructure development (power grid expansion) and accelerating adoption of international safety standards in industrializing nations like China and India.

- Europe (Steady, Sustainable Growth): Governed by EU PPE Regulation (2016/425); high demand for sustainable FR textiles, and a preference for rental and laundering services to manage compliance and maintenance costs.

- Latin America (Emerging Demand): Growth linked to Oil & Gas and Mining; regulation often driven by multinational corporate mandates; gradual increase in local government safety enforcement.

- Middle East & Africa (Niche High-Value): Demand centered in the energy sector (O&G, Utilities); strong requirement for high ATPV gear with enhanced thermal comfort features to mitigate heat stress.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Arc Flash Protection Apparel Market.- DuPont: A dominant force in the upstream segment, providing foundational FR materials like Nomex, Kevlar, and Protera. DuPont focuses heavily on material science innovation, supplying proprietary fibers that form the basis for many finished garments globally. Their competitive advantage lies in deep intellectual property and established global supply chain for high-performance aramid fibers.

- Honeywell International Inc.: A major supplier of integrated safety solutions, offering a comprehensive range of arc flash PPE, including garments, gloves, head protection, and arc flash safety kits. Honeywell leverages its broad industrial safety portfolio and global distribution network to serve major utility and manufacturing clients requiring consolidated safety procurement.

- Lakeland Industries Inc.: Specializes in industrial protective clothing, including a strong line of high-visibility and multi-layer arc flash suits and coveralls. Lakeland focuses on affordability and reliability, targeting sectors that require mandatory HRC compliance without excessive investment in proprietary fiber blends, maintaining a competitive edge through diverse product offerings.

- 3M Company: While not a primary garment manufacturer, 3M plays a crucial role in providing complementary arc flash safety products, notably high-performance face shields, electrical safety tapes, and related accessories. Their strength is derived from material science integration and global brand recognition in industrial safety equipment.

- TenCate Protective Fabrics (Milliken & Company): A leading global producer of specialized protective textiles, highly influential in the midstream supply chain. TenCate (now part of Milliken) develops innovative FR fabric technologies, such as Tecasafe Plus, which provide superior moisture management and comfort while meeting high ATPV requirements. They focus on supplying fabric to downstream garment manufacturers.

- Westex by Milliken: Focused exclusively on branded flame-resistant fabrics, Westex offers treated cotton and proprietary blends like Westex UltraSoft and Indura UltraSoft, widely used for HRC 1 and 2 garments. They emphasize durable FR treatment technologies and cost-effectiveness for bulk industrial usage, particularly in the utility and manufacturing sectors.

- Bulwark Protective Apparel (VF Corporation): A market leader in finished arc flash and flame-resistant apparel, providing extensive lines of coveralls, shirts, and pants. Bulwark emphasizes comfort, fit, and aesthetic appeal alongside strict compliance, making them a preferred brand for managed apparel programs in large corporations across North America.

- NSA (National Safety Apparel): A specialized US manufacturer known for its comprehensive, American-made arc flash clothing and accessories. NSA excels in customizing apparel solutions for specific end-user requirements, offering niche products like cooling vests integrated into arc flash suits and specialized HRC 4 kits.

- Cintas Corporation: Primarily a provider of managed services, including uniform rental, industrial laundry, and facility services. Cintas offers arc flash apparel as part of its rental program, appealing strongly to companies that prefer to outsource the complexity of PPE procurement, maintenance, repair, and compliance tracking, especially for treated fabrics.

- Chicago Protective Apparel (CPA): A focused manufacturer providing a wide range of PPE, with particular expertise in severe arc flash hazards (HRC 4 suits) and high-heat applications. CPA is recognized for durable, heavy-duty protection solutions tailored for high-energy utility environments.

- Tyndale Company: A managed apparel service provider specializing in corporate FR clothing programs, offering custom fittings, inventory management, and direct compliance oversight for utilities and oil & gas firms. Tyndale’s strength lies in its ability to streamline complex regulatory compliance for its clientele.

- Oberon Company: Highly specialized in arc flash face and head protection, including patented hood ventilation systems and specialized lens technologies that improve visibility and worker comfort during high-risk tasks, contributing heavily to worker compliance efforts.

- Paulsen: Known for innovative electric arc testing equipment and specialized arc flash protective gear, particularly focusing on hoods and switching suits. Paulsen's expertise is deeply rooted in the technical standards and testing methodologies of arc flash protection.

- ProGARM: A European manufacturer focused on high-quality, intrinsically flame-resistant and arc flash protective clothing, often integrated with high-visibility features. ProGARM emphasizes ergonomic design and advanced safety features compliant with both EU and international standards.

- VF Corporation (Red Kap): Through its workwear division, Red Kap supplies durable industrial workwear, including treated FR garments suitable for lower HRC requirements (HRC 1 and 2). They leverage mass production capabilities to provide cost-effective solutions to industrial maintenance teams.

- Cementex: Focuses primarily on insulated tools and electrical safety equipment, but also offers complementary arc flash PPE kits, specializing in gear required for working on live electrical circuits, reinforcing their position as a full-service electrical safety provider.

- Drägerwerk AG & Co. KGaA: A German multinational specializing in safety and medical technology, offering specialized protective equipment including respiratory and body protection, often integrating arc flash capabilities into their broader industrial safety offerings for sectors like petrochemicals.

- Ansell Ltd.: Although known globally for hand protection, Ansell provides specialized insulating rubber gloves and leather protectors essential for arc flash safety, playing a critical role in the hand protection segment of the overall arc flash PPE market.

- Saf-T-Gard International, Inc.: A distributor and manufacturer offering a wide array of safety products, including their own line of arc flash and electrical safety gear, serving as a comprehensive procurement hub for smaller and medium-sized industrial clients.

- M. L. Kishigo: A manufacturer specializing in high-visibility safety apparel, often integrating FR and arc flash properties (HRC 1/2) into their garments, serving the construction and transportation sectors where both visibility and electrical protection are mandated.

Frequently Asked Questions

Analyze common user questions about the Arc Flash Protection Apparel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between Inherently Flame Resistant (IFR) and Treated Arc Flash Apparel?

IFR apparel utilizes fibers (like Aramid or Modacrylic) whose flame resistance is built into their chemical structure and does not diminish over time or through repeated washing. Treated apparel, typically made of cotton, relies on a chemical finish applied to the fabric surface; this finish can degrade with wear and laundering, potentially reducing the garment's protective capacity, making IFR the generally preferred, long-term safety solution.

How is the necessary Arc Flash Protection rating (ATPV/HRC) determined for workers?

The required protection level is determined by performing an Arc Flash Risk Assessment (or Incident Energy Analysis) of the electrical equipment the worker will interact with, according to standards like NFPA 70E. This calculation yields the incident energy (in cal/cm²) that the worker could be exposed to, which is then matched to the corresponding Hazard Risk Category (HRC 1 through 4) and the garment's Arc Thermal Performance Value (ATPV).

Which end-use industry is the largest consumer of Arc Flash Protection Apparel globally?

The Utilities sector (including power generation, transmission, and distribution companies) constitutes the largest and most critical consumer segment globally. These operations involve constant interaction with high-voltage, high-amperage electrical systems, necessitating mandatory and frequent use of high-rated (HRC 2-4) arc flash PPE for maintenance, repair, and switching activities.

What are the primary factors restraining the growth of the premium Arc Flash Protection Apparel market?

The main restraints include the significantly high initial capital expenditure required for inherently flame-resistant (IFR) garments and the ongoing challenge of achieving 100% worker compliance, especially in warm climates. The bulkiness and perceived discomfort of multi-layered suits often contribute to heat stress concerns, leading to worker reluctance, a factor manufacturers are actively addressing through lightweight material innovation.

How does smart PPE technology enhance traditional Arc Flash Protection Apparel?

Smart PPE integrates embedded sensors (IoT and RFID) that enhance safety beyond passive protection. These technologies track the garment's lifecycle (wash cycles, repairs) to ensure continued protective integrity, monitor the wearer's thermal load (preventing heat stress), and can log usage data, thereby automating compliance documentation and enabling predictive maintenance alerts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager