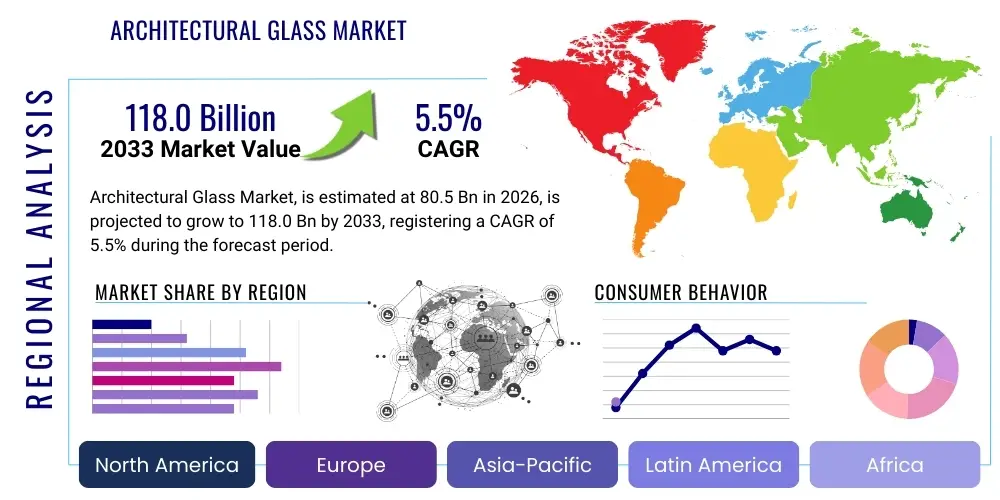

Architectural Glass Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439440 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Architectural Glass Market Size

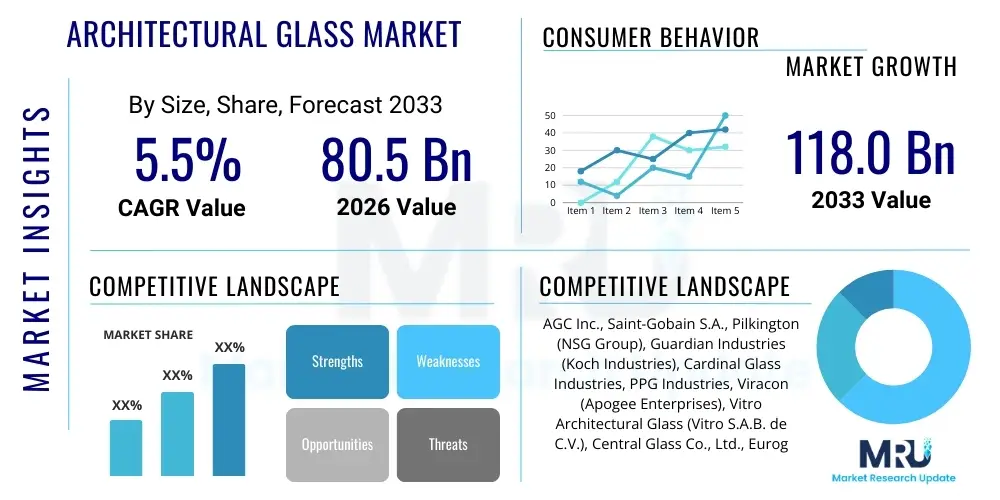

The Architectural Glass Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 80.5 Billion in 2026 and is projected to reach USD 118.0 Billion by the end of the forecast period in 2033.

Architectural Glass Market introduction

The architectural glass market encompasses a wide array of glass products specifically designed and manufactured for use in building and construction applications, ranging from residential homes to vast commercial complexes and critical infrastructure projects. These products are integral to modern architecture, contributing significantly to both the aesthetic appeal and the functional performance of buildings. Architectural glass is no longer merely a transparent barrier; it has evolved into a sophisticated building material capable of controlling light, heat, sound, and even generating energy, alongside enhancing structural integrity and safety. Its application extends beyond traditional windows and doors to include advanced facades, curtain walls, interior partitions, skylights, balustrades, and various decorative elements, embodying a fusion of design versatility and engineering prowess.

The primary benefits driving the adoption of architectural glass are multifaceted, focusing heavily on sustainability, occupant comfort, and operational efficiency. Modern architectural glass solutions, such as low-emissivity (Low-E) glass and insulated glass units (IGUs), significantly improve a building's thermal performance by minimizing heat transfer, thereby reducing energy consumption for heating and cooling. This directly supports green building initiatives and stringent energy efficiency regulations globally. Beyond energy savings, architectural glass maximizes natural light penetration, creating brighter, more inviting interior spaces that can positively impact occupant well-being and productivity. Its aesthetic versatility allows architects unprecedented freedom in design, enabling the creation of visually striking, transparent, and light-filled structures that redefine urban landscapes. Furthermore, advancements in glass technology have led to enhanced safety features, including impact resistance, fire resistance, and sound insulation, contributing to safer and quieter indoor environments. The capability for self-cleaning coatings, solar control, and integration with smart technologies further elevates the value proposition of architectural glass.

Several pivotal factors are driving the robust expansion of the architectural glass market. Rapid urbanization and the concurrent boom in construction activities, particularly in emerging economies, are creating substantial demand for new buildings and renovation projects. There is a global paradigm shift towards sustainable building practices and green architecture, fueled by increasing environmental consciousness and supportive government policies, which mandates the use of energy-efficient and eco-friendly materials like advanced architectural glass. Technological innovations continue to push the boundaries of glass functionality, introducing products with superior thermal insulation, solar control, acoustic performance, and enhanced durability. The rising preference for aesthetically pleasing and transparent designs in both commercial and residential sectors further stimulates market growth. Additionally, the growing adoption of smart building concepts, where glass can integrate sensors, electrochromic layers, and digital displays, is opening new avenues for market expansion, positioning architectural glass as a cornerstone of future-ready urban infrastructure.

Architectural Glass Market Executive Summary

The architectural glass market is experiencing dynamic growth, propelled by evolving business trends centered on sustainability, customization, and digital integration. Global construction activities remain a primary catalyst, with a significant shift towards high-performance glass products that enhance energy efficiency and reduce environmental impact. The industry is witnessing increased investment in research and development to introduce innovative coatings, smart glass functionalities, and specialized glass types that cater to diverse architectural demands, from extreme weather resistance to advanced security features. Manufacturers are focusing on expanding their production capabilities and supply chain resilience to meet the escalating global demand, particularly for value-added glass solutions. Collaboration between glass producers, fabricators, architects, and construction firms is becoming more prevalent, fostering integrated design and construction approaches that optimize the use of architectural glass in complex projects.

Regional trends reveal Asia Pacific as the undeniable powerhouse of the architectural glass market, driven by extensive urbanization, burgeoning residential and commercial construction sectors, and significant infrastructure development in countries like China, India, and Southeast Asian nations. This region benefits from a large population base and rapid economic growth, leading to a sustained demand for new buildings. North America and Europe demonstrate a strong emphasis on regulatory compliance related to energy efficiency and environmental performance, stimulating the adoption of advanced, high-performance glass solutions for both new constructions and extensive renovation projects. These regions also lead in the integration of smart glass technologies and sustainable building certifications. Latin America, the Middle East, and Africa are emerging as high-potential markets, characterized by ambitious construction mega-projects, diversification of economies away from traditional sectors, and increasing foreign investments, which are gradually boosting the demand for modern architectural glass products, albeit with varying levels of technological adoption and market maturity across different countries within these regions.

Segmentation trends indicate a pronounced shift towards specialized glass types that offer superior functional benefits. Low-emissivity (Low-E) glass and insulated glass units (IGUs) dominate the market due to their unparalleled thermal performance and energy-saving capabilities, aligning perfectly with global green building mandates. Laminated glass is also experiencing robust growth, primarily driven by increasing demand for enhanced safety, security, and acoustic insulation in commercial and high-rise residential buildings. The aesthetic and structural versatility of tempered glass continues to make it a popular choice for various applications, including interior partitions, doors, and balustrades. Moreover, the smart glass segment, though nascent, is projected for significant expansion as technological advancements reduce costs and improve functionality, enabling dynamic control over light, glare, and privacy. From an application perspective, facades and curtain walls represent a major segment, while residential and commercial buildings remain the largest end-use categories, consistently demanding innovative glass solutions that balance performance, aesthetics, and sustainability. The market is also seeing increasing penetration in niche applications such as solar control systems, soundproofing, and integrated photovoltaic glass, which underscores the versatility and evolving role of architectural glass.

AI Impact Analysis on Architectural Glass Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize the architectural glass market, specifically questioning its role in manufacturing efficiency, product innovation, and market forecasting. Common themes revolve around the potential for AI to optimize glass production processes, predict material demand and market shifts, enhance quality control, and facilitate the development of next-generation smart glass solutions. There is considerable interest in how AI could lead to more sustainable manufacturing practices, personalize glass products for specific architectural needs, and improve supply chain management, thereby reducing costs and waste. Users also often express expectations regarding AI's ability to drive predictive maintenance for glass-integrated building systems and offer advanced design assistance to architects and engineers, ultimately influencing material selection and building performance simulations.

- AI-driven process optimization enhances manufacturing efficiency, reduces waste, and improves the consistency and quality of architectural glass production.

- Predictive analytics powered by AI allows for more accurate demand forecasting, inventory management, and optimization of supply chain logistics, minimizing delays and costs.

- AI algorithms assist in the design and development of novel glass compositions and coatings, accelerating the innovation cycle for energy-efficient and multi-functional glass.

- Advanced computer vision and machine learning enable superior quality control systems, detecting minute flaws and imperfections in glass panels with greater precision than human inspection.

- AI facilitates the integration of smart functionalities into architectural glass, enabling dynamic control over light, heat, and privacy, alongside advanced sensor integration for building automation.

- Personalized glass solutions can be designed and manufactured using AI, matching specific aesthetic, performance, and sustainability requirements for bespoke architectural projects.

- AI enhances building information modeling (BIM) by optimizing glass selection based on environmental factors, structural integrity, and energy performance, aiding architects and engineers in decision-making.

- Maintenance schedules for glass facades and smart glass systems can be optimized using AI-driven predictive maintenance, reducing operational costs and extending product lifespan.

DRO & Impact Forces Of Architectural Glass Market

The architectural glass market is significantly influenced by a confluence of drivers, restraints, opportunities, and pervasive impact forces that collectively shape its trajectory and competitive landscape. Key drivers include the global surge in urbanization, which fuels unprecedented construction activities across residential, commercial, and industrial sectors, creating a robust demand for modern building materials. Alongside this, the escalating emphasis on green building initiatives and energy efficiency mandates worldwide compels the adoption of advanced architectural glass solutions like Low-E and insulated glass units, designed to minimize energy consumption in buildings. Continuous technological advancements in glass manufacturing and coating technologies are consistently introducing innovative products with enhanced performance characteristics, ranging from improved thermal insulation and solar control to superior acoustic dampening and self-cleaning properties, further expanding the market's application scope. Moreover, the increasing architectural preference for transparency, natural light integration, and visually striking building facades ensures a sustained demand for high-quality, aesthetically versatile glass products that allow for intricate and creative designs, making glass a cornerstone of contemporary architecture.

Conversely, several restraints pose challenges to the market's growth. The inherent high manufacturing and installation costs associated with specialized architectural glass, particularly for high-performance and smart glass variants, can deter adoption in price-sensitive markets or for projects with limited budgets. The architectural glass industry is also susceptible to the volatility of raw material prices, such as silica sand, soda ash, and limestone, which can lead to fluctuating production costs and impact profit margins. Furthermore, the complexities associated with stringent building codes, environmental regulations, and specific performance standards across different regions and countries necessitate significant investment in compliance and testing, adding to the operational burden for manufacturers. Economic downturns or slowdowns in the construction sector, often influenced by geopolitical instabilities or global financial crises, can directly curtail investment in new building projects, thereby impacting market demand for architectural glass, leading to potential project delays or cancellations. This economic sensitivity remains a critical external factor influencing market performance.

Despite these restraints, the architectural glass market is abundant with significant opportunities. The accelerating integration of smart glass technologies, including electrochromic, thermochromic, and photochromic glass, which offer dynamic control over light, glare, and privacy, presents a substantial growth avenue as these solutions become more cost-effective and functionally advanced. The relentless pursuit of energy-efficient building solutions continues to drive demand for ultra-high-performance glass products that can further reduce a building's carbon footprint and operational costs, aligning with global sustainability goals. The expansion into emerging markets, particularly in Asia Pacific, Latin America, and the Middle East, where rapid infrastructure development and urbanization projects are underway, offers vast untapped potential for market penetration and growth for architectural glass manufacturers. Additionally, the development of specialized glass applications such as integrated photovoltaic (BIPV) glass, which can generate electricity, and advanced fire-rated or ballistic-resistant glass, catering to niche segments requiring enhanced safety and security, represents promising opportunities for diversification and market expansion. These opportunities are often tied to innovation and the ability of manufacturers to adapt to evolving architectural and functional requirements, ensuring a dynamic future for the industry.

Segmentation Analysis

The architectural glass market is comprehensively segmented to reflect the diverse range of products, applications, and end-uses that characterize this dynamic industry. This segmentation provides a granular view of market dynamics, allowing stakeholders to identify key growth areas, understand competitive landscapes, and formulate targeted strategies. The market can be broadly categorized by glass type, application, and end-use, with further sub-segmentations offering deeper insights into specialized product offerings and their specific market demands. This structured approach helps in analyzing consumer preferences, technological adoption rates, and regional market saturation, which are crucial for strategic planning in the construction and building materials sector. Each segment reflects unique performance requirements, aesthetic considerations, and regulatory compliance standards, contributing to a complex yet highly differentiated market environment where innovation and specialization drive value.

- By Type

- Low-E Glass

- Laminated Glass

- Insulated Glass Units (IGUs)

- Tempered Glass

- Wired Glass

- Reflective Glass

- Coated Glass (including solar control, self-cleaning)

- Smart Glass (Electrochromic, Thermochromic, Photochromic)

- By Application

- Facades and Curtain Walls

- Windows and Doors

- Interior Partitions and Railings

- Skylights and Canopies

- Balustrades

- Shopfronts

- Solar Control Systems

- Soundproofing Applications

- Integrated Photovoltaic (BIPV) Glass

- By End-Use

- Residential Buildings

- Commercial Buildings (Offices, Retail, Hospitality)

- Industrial Buildings

- Institutional Buildings (Healthcare, Educational, Government)

- Infrastructure Projects (Airports, Stations)

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Architectural Glass Market

The value chain for the architectural glass market is a complex ecosystem, starting from the extraction of raw materials and culminating in the final installation and after-sales service in construction projects. At the upstream stage, the process begins with the procurement of essential raw materials such as silica sand, soda ash, limestone, dolomite, and other minor additives. These raw materials are then processed through energy-intensive melting and forming stages, typically using the float glass method, to produce large sheets of raw or "clear" glass. Key upstream activities involve managing supplier relationships, ensuring consistent quality of raw materials, and optimizing manufacturing processes to reduce energy consumption and environmental impact. The efficiency and cost-effectiveness at this initial stage are crucial, as they significantly influence the overall production cost and quality of the final architectural glass products. Investments in advanced melting technologies and sustainable sourcing practices are paramount for upstream players to maintain a competitive edge and address growing environmental concerns within the industry.

Moving downstream, the raw glass sheets undergo a series of fabrication and processing steps to transform them into specialized architectural glass products. This midstream segment involves various value-adding activities such as cutting, grinding, polishing, tempering (for safety glass), laminating (for enhanced security and acoustic performance), insulating (to create IGUs for thermal efficiency), and applying advanced coatings (Low-E, solar control, self-cleaning). Fabricators often work closely with architects and contractors to customize glass solutions according to specific project requirements, integrating design aesthetics with functional performance. This stage also includes the manufacturing of associated hardware and framing systems, which are essential for the installation of architectural glass. The downstream segment is characterized by a high degree of specialization and technical expertise, with innovation in fabrication techniques and coating technologies driving product differentiation and market competitiveness. Efficient production schedules, quality assurance, and adherence to specific architectural specifications are critical success factors for fabricators in this part of the value chain.

The distribution channel for architectural glass is multifaceted, involving both direct and indirect routes to market. Direct distribution typically occurs when large architectural glass manufacturers supply directly to major construction companies, real estate developers, or large-scale projects, often involving custom orders and specialized installation support. This direct model allows for closer collaboration, better quality control, and tailored solutions. Indirect distribution, which constitutes a significant portion of the market, involves a network of distributors, wholesalers, retailers, and glass contractors who procure architectural glass products from manufacturers and fabricators, then supply them to smaller construction firms, local builders, interior designers, or individual customers for renovation and smaller-scale projects. These intermediaries play a vital role in market penetration, inventory management, and providing local logistical support and installation services. The choice of distribution channel often depends on the scale of the project, the complexity of the glass product, and the geographical reach of the manufacturer. Effective channel management, including robust logistics, efficient warehousing, and strong partner relationships, is essential for ensuring timely delivery and widespread availability of architectural glass products across diverse market segments, making it a critical aspect of the market's overall efficiency and customer satisfaction.

Architectural Glass Market Potential Customers

The potential customer base for the architectural glass market is expansive and diverse, reflecting the universal need for advanced building materials in modern construction. At the forefront are large-scale construction companies and real estate developers who are constantly engaged in constructing new commercial buildings such as office complexes, shopping malls, hotels, and residential high-rises. These entities require bulk quantities of various architectural glass types, from energy-efficient facades to safety-compliant interior glazing, and often seek customized solutions that meet stringent design and performance specifications. Their purchasing decisions are heavily influenced by factors such as cost-effectiveness, sustainability credentials, structural integrity, aesthetic appeal, and adherence to building codes and project timelines. The rapid urbanization and development of smart cities across the globe continue to make these professional construction and development firms the largest and most consistent buyers in the market, driving demand for innovative and high-performance glass solutions that contribute to the creation of iconic and functional urban landscapes.

Another significant segment of potential customers includes architects and interior designers, who, while not direct buyers of the physical product, wield immense influence over material selection and specifications for their projects. They are key decision-makers who recommend specific types of architectural glass based on design vision, functional requirements, environmental performance goals, and client preferences. Their expertise in material properties, aesthetic integration, and compliance with building regulations makes them crucial partners for architectural glass manufacturers seeking to promote their innovative products and influence market trends. Manufacturers and distributors actively engage with architectural and design firms through product showcases, technical consultations, and continuing education programs to ensure their products are specified in upcoming projects. Furthermore, government agencies and public sector entities engaged in infrastructure development projects, such as airports, railway stations, hospitals, and educational institutions, represent another substantial customer group. These projects often prioritize durability, safety, energy efficiency, and long-term maintenance considerations, requiring specialized architectural glass solutions that meet high public standards and regulatory requirements, often procured through competitive bidding processes that emphasize both performance and value.

Beyond these large-scale and institutional buyers, the market also caters to individual homeowners and smaller contractors involved in residential construction, renovation, and remodeling projects. While their individual purchase volumes may be smaller, their collective demand for windows, doors, skylights, shower enclosures, and interior glass elements contributes significantly to the market's overall revenue. This segment is increasingly seeking energy-efficient, aesthetically pleasing, and durable glass solutions for their homes, driven by factors such as rising energy costs, a desire for enhanced comfort, and an appreciation for modern design. Retailers and specialized glass fabricators often serve this customer base, providing a range of standard and semi-customized glass products along with installation services. Additionally, companies specializing in solar panel installations are emerging as crucial customers for integrated photovoltaic (BIPV) glass, which combines architectural aesthetics with renewable energy generation. The expanding applications of architectural glass in diverse sectors underscore the broad spectrum of potential customers, each with unique needs and purchasing motivations that shape the market's evolving demand landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 80.5 Billion |

| Market Forecast in 2033 | USD 118.0 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AGC Inc., Saint-Gobain S.A., Pilkington (NSG Group), Guardian Industries (Koch Industries), Cardinal Glass Industries, PPG Industries, Viracon (Apogee Enterprises), Vitro Architectural Glass (Vitro S.A.B. de C.V.), Central Glass Co., Ltd., Euroglas GmbH (Glas Trösch Group), Schott AG, Xinyi Glass Holdings Limited, China Southern Glass Holding Co., Ltd., Taiwan Glass Industry Corporation, Fuyao Glass Industry Group Co., Ltd., Sisecam Flat Glass, Glaston Corporation, Trulite Glass & Aluminum Solutions, Asahi India Glass Ltd. (AIS), Bendheim |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Architectural Glass Market Key Technology Landscape

The architectural glass market is fundamentally driven by continuous innovation in its technological landscape, encompassing advancements in manufacturing processes, material science, and functional coatings that significantly enhance product performance and application versatility. At the core are sophisticated coating technologies, notably magnetron sputtering (MSVD) and pyrolytic deposition. MSVD allows for the precise application of multiple ultra-thin layers of metallic and dielectric materials in a vacuum chamber, creating high-performance Low-E coatings, solar control coatings, and self-cleaning surfaces that offer exceptional thermal insulation, UV protection, and reduced maintenance. Pyrolytic coatings, applied during the glass manufacturing process while the glass is still hot, bond directly to the glass surface, offering superior durability and scratch resistance, often used for robust solar control and reflective properties. These coating technologies are crucial for meeting stringent energy efficiency standards and providing multi-functional glass solutions, making buildings more sustainable and comfortable for occupants while expanding the aesthetic possibilities for architects, allowing for more complex and performant building envelopes that respond dynamically to environmental conditions and integrate seamlessly with smart building systems for optimized operation.

Beyond coatings, significant technological strides have been made in glass processing techniques, including advanced tempering, lamination, and insulating glass unit (IGU) manufacturing. Tempering technology, which involves rapid cooling after heating, dramatically increases the strength and safety of glass, making it suitable for high-impact areas and structural applications where occupant safety is paramount. Lamination technology, employing interlayers such as polyvinyl butyral (PVB) or ethylene-vinyl acetate (EVA), bonds multiple glass panes together to enhance security, acoustic insulation, and UV protection, preventing shattering into dangerous shards upon impact. The development of advanced interlayers has also enabled structural glazing applications and highly transparent, low-iron glass for enhanced clarity. IGU manufacturing has evolved to include inert gas filling (argon, krypton), warm-edge spacers, and triple or even quadruple glazing, further optimizing thermal performance by minimizing heat transfer across the building envelope. These combined processing advancements allow for the creation of architectural glass products that offer superior thermal efficiency, enhanced safety features, and exceptional noise reduction capabilities, critical for modern urban environments and energy-conscious designs where occupant comfort and building performance are top priorities, thereby driving innovation across the entire spectrum of architectural applications, from residential windows to complex commercial facades that demand the highest standards of structural integrity and environmental responsiveness.

The emergence of smart glass technologies represents a transformative frontier in the architectural glass market. Electrochromic glass, for instance, can dynamically change its tint or opacity in response to an electrical current, allowing occupants to control daylighting, glare, and privacy with the flick of a switch or automated systems. Thermochromic and photochromic glass offer similar functionality, responding to temperature changes or UV light exposure, respectively, to automatically adjust their properties. These intelligent glass solutions contribute significantly to energy savings by reducing the need for artificial lighting and air conditioning, while simultaneously enhancing occupant comfort and user experience. Furthermore, nanotechnology is increasingly being applied to develop self-cleaning glass surfaces (hydrophilic or hydrophobic coatings that use sunlight and rain to break down and wash away dirt), anti-reflective glass, and UV-filtering glass, offering added convenience and performance benefits. Digital printing on glass is another evolving technology that enables intricate patterns, graphics, and even photovoltaic elements to be integrated directly onto glass surfaces, opening up new aesthetic and functional possibilities for bespoke architectural designs and building-integrated photovoltaics. These cutting-edge technologies are not only enhancing the functionality and sustainability of architectural glass but also transforming its role from a passive building component into an active, intelligent element that interacts with its environment and occupants, paving the way for truly adaptive and high-performance building envelopes in the future, marking a significant leap in the evolution of building materials and pushing the boundaries of what glass can achieve in modern architecture and construction, ultimately contributing to a more sustainable built environment through advanced material science and smart integration.

Regional Highlights

- North America: This region is characterized by a strong emphasis on sustainable building practices, stringent energy efficiency regulations, and a high adoption rate of advanced architectural glass. The market benefits from significant investments in commercial and institutional construction, alongside a robust demand for renovation and retrofitting projects that incorporate high-performance, energy-saving glass solutions. Innovation in smart glass and sophisticated coatings is a key driver, catering to a technologically advanced consumer base.

- Europe: Europe stands out for its well-established green building policies, strong environmental consciousness, and a rich architectural heritage that influences glass demand. The region prioritizes high-performance insulated glass units and Low-E glass for both new constructions and the vast renovation market, driven by strict thermal performance standards and a focus on reducing carbon emissions. Germany, France, and the UK are leading markets, with a growing interest in specialized and aesthetic glass applications.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for architectural glass, fueled by rapid urbanization, massive infrastructure development, and a booming construction sector in countries like China, India, and Southeast Asian nations. The demand is driven by both large-scale commercial and residential projects, with an increasing shift towards adopting energy-efficient and aesthetically advanced glass solutions as economic prosperity rises and environmental awareness grows.

- Latin America: This region exhibits steady growth in the architectural glass market, primarily influenced by expanding urban centers, increasing investments in commercial and hospitality sectors, and a rising middle class driving residential construction. Brazil and Mexico are key markets, characterized by a growing appetite for modern building designs and functional glass products, though pricing and local manufacturing capabilities remain significant considerations.

- Middle East and Africa (MEA): The MEA region is witnessing substantial growth due to ambitious construction mega-projects, diversification efforts from oil-dependent economies, and increasing tourism infrastructure development. Countries like UAE, Saudi Arabia, and Qatar are investing heavily in iconic architectural structures that utilize large quantities of high-performance and decorative architectural glass, often demanding advanced solar control and aesthetic customization to suit challenging climatic conditions and luxury design preferences.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Architectural Glass Market.- AGC Inc.

- Saint-Gobain S.A.

- Pilkington (NSG Group)

- Guardian Industries (Koch Industries)

- Cardinal Glass Industries

- PPG Industries

- Viracon (Apogee Enterprises)

- Vitro Architectural Glass (Vitro S.A.B. de C.V.)

- Central Glass Co., Ltd.

- Euroglas GmbH (Glas Trösch Group)

- Schott AG

- Xinyi Glass Holdings Limited

- China Southern Glass Holding Co., Ltd.

- Taiwan Glass Industry Corporation

- Fuyao Glass Industry Group Co., Ltd.

- Sisecam Flat Glass

- Glaston Corporation

- Trulite Glass & Aluminum Solutions

- Asahi India Glass Ltd. (AIS)

- Bendheim

Frequently Asked Questions

Analyze common user questions about the Architectural Glass market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate of the Architectural Glass Market?

The Architectural Glass Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033, reaching an estimated USD 118.0 Billion by the end of the forecast period.

What are the primary factors driving the demand for architectural glass?

Key drivers include rapid urbanization and construction booms, increasing adoption of green building initiatives, continuous technological advancements in glass functionality, and a rising architectural preference for aesthetic transparency and natural light in modern designs.

Which types of architectural glass are most in demand?

High-performance glass types such as Low-E glass, insulated glass units (IGUs), and laminated glass are most in demand due to their superior energy efficiency, safety, and acoustic performance, aligning with modern building standards and sustainability goals.

How does AI impact the architectural glass market?

AI significantly impacts the market by optimizing manufacturing processes, enhancing quality control, improving demand forecasting, accelerating innovation in smart glass development, and aiding in personalized architectural design and energy performance simulations.

Which region holds the largest share in the Architectural Glass Market?

Asia Pacific (APAC) currently holds the largest share and is the fastest-growing region in the Architectural Glass Market, driven by extensive urbanization and substantial construction and infrastructure development across its major economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Architectural Glass Market Statistics 2025 Analysis By Application (Residential Buildings, Commercial Buildings, Industrial Buildings), By Type (Low-e, Special, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Architectural Glass Curtain Wall Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Framed glass curtain wall, Concealed glass curtain wall), By Application (Construction company, Household, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager