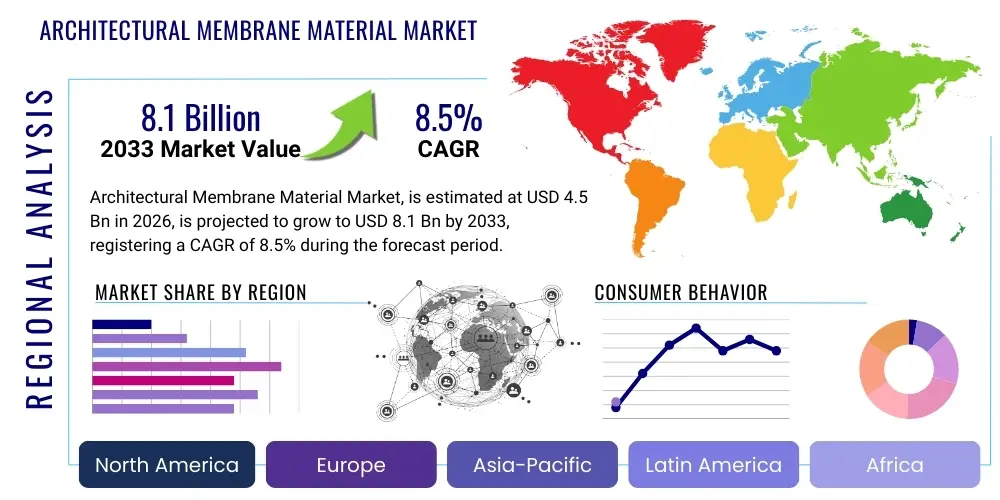

Architectural Membrane Material Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439045 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Architectural Membrane Material Market Size

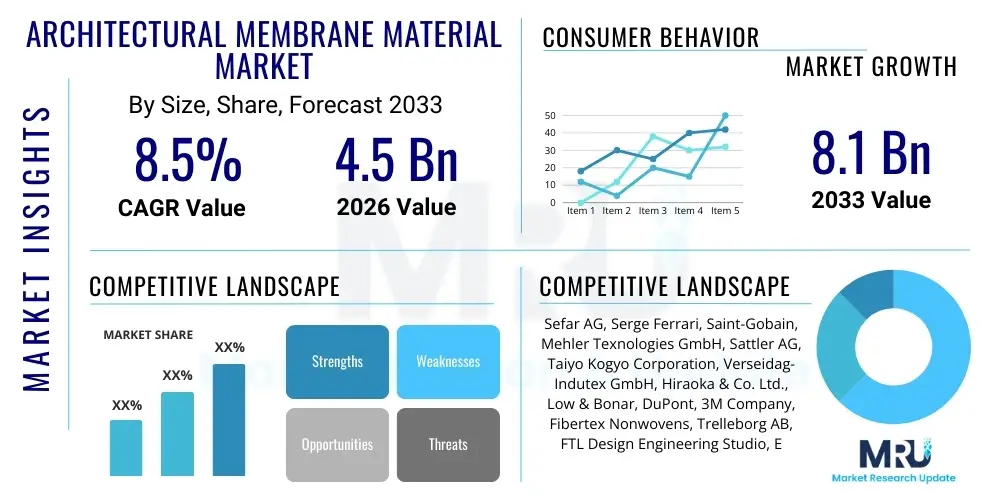

The Architectural Membrane Material Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 8.1 Billion by the end of the forecast period in 2033.

Architectural Membrane Material Market introduction

The Architectural Membrane Material Market encompasses highly specialized, flexible, and often transparent materials utilized in modern construction for roofing, facades, tensile structures, and temporary enclosures. These materials, including polymers such as Polytetrafluoroethylene (PTFE), Ethyl Tetrafluoroethylene (ETFE), and Polyvinyl Chloride (PVC) coated fabrics, are valued for their exceptional properties such as high tensile strength, lightweight nature, durability, UV resistance, and excellent light transmission capabilities. Unlike conventional construction materials, architectural membranes enable highly creative and expansive designs, particularly in large-span applications like sports stadiums, airport terminals, and exhibition centers, where aesthetics, cost efficiency, and structural integrity are paramount.

The core product offering in this market revolves around high-performance textiles and films engineered to withstand diverse environmental conditions while contributing positively to a building's energy profile. Major applications span structural architecture, including permanent and semi-permanent structures, shading devices, and decorative elements. The primary benefits driving market adoption include reduced construction time, lower overall structural load, superior fire resistance in advanced materials like PTFE, and the ability to create visually stunning, naturally lit environments. Furthermore, many modern membranes offer self-cleaning properties and long operational lifespans, minimizing maintenance costs.

Driving factors sustaining market growth include the global surge in infrastructure development, particularly in emerging economies focused on modernizing public facilities and commercial spaces. The increasing focus on sustainable building practices and green architecture heavily favors lightweight, energy-efficient materials like ETFE, which offer excellent insulation and transparency, reducing the need for artificial lighting. Technological advancements in coatings and fabric manufacturing processes, enhancing material performance in terms of longevity, flexibility, and environmental tolerance, further solidify the market's upward trajectory. The demand for iconic and technologically advanced building envelopes remains a key stimulant for innovation and material deployment.

Architectural Membrane Material Market Executive Summary

The Architectural Membrane Material Market exhibits robust growth, fueled predominantly by global infrastructure investments and a pronounced shift towards aesthetic and sustainable construction methodologies. Business trends highlight increasing consolidation among key material manufacturers focusing on vertical integration and strategic partnerships with design engineering firms to offer complete turnkey solutions. There is a strong emphasis on developing bio-based or recycled polymeric membranes to align with stringent environmental regulations and corporate sustainability goals, impacting supply chain dynamics significantly. Manufacturers are also prioritizing the integration of smart functionalities, such as embedded sensor technology and photovoltaic capabilities, turning passive building envelopes into active energy generators.

Regionally, Asia Pacific is anticipated to dominate market growth due to rapid urbanization, mega-project development (e.g., new smart cities, international airports), and substantial government spending on public infrastructure, notably in China, India, and Southeast Asian nations. North America and Europe, while mature, demonstrate stable demand driven by renovation projects, the adoption of advanced materials like high-performance PTFE and ETFE, and strict building codes requiring energy-efficient envelopes. The Middle East and Africa continue to be high-potential regions, leveraging architectural membranes for heat management and creating striking designs in hospitality and entertainment sectors.

Segment trends reveal that the ETFE segment is experiencing the fastest expansion due to its superior light transmission and exceptional thermal performance, making it highly desirable for environmentally conscious designs. By application, the roofing and facade segments collectively hold the largest market share, driven by the necessity for durable, lightweight, and weather-resistant coverings for large commercial and institutional buildings. Within end-users, the commercial sector, encompassing large-scale retail, offices, and entertainment venues, remains the primary consumer, although the industrial sector's need for specialized protective covers and enclosures also contributes significantly to demand, emphasizing materials offering high chemical and thermal resistance.

AI Impact Analysis on Architectural Membrane Material Market

Common user questions regarding AI's impact on the architectural membrane market frequently revolve around its role in optimizing structural design efficiency, enhancing material failure prediction, and automating quality control during membrane fabrication. Users are keenly interested in how Artificial Intelligence can streamline the complex processes involved in designing tensile structures, which traditionally require intensive finite element analysis and iterative manual adjustments. Key themes summarize expectations that AI will revolutionize design by allowing rapid prototyping and testing of numerous structural forms, thus reducing material waste and optimizing structural loads. Concerns often center on the initial investment required for sophisticated AI-driven software and the need for upskilling architects and engineers to effectively utilize these new tools for performance-based design outcomes.

- AI-driven optimization of complex tensile structure geometries, significantly reducing design cycles.

- Predictive maintenance analytics using machine learning models to forecast membrane degradation and structural failure points based on environmental sensor data.

- Automation of material cutting, welding, and quality inspection processes in manufacturing, ensuring millimeter-level precision.

- Enhanced building information modeling (BIM) integration, allowing AI to suggest optimal membrane material based on project-specific climate, budget, and aesthetic requirements.

- Supply chain optimization and inventory management using AI to predict material demand fluctuations in global construction cycles.

DRO & Impact Forces Of Architectural Membrane Material Market

The market is primarily driven by global infrastructure modernization, the intrinsic advantages of membrane materials such as lightweight architecture and cost-effective spanning of large areas, and the push for sustainable building envelopes like ETFE and self-cleaning PTFE. However, growth is restrained by the high initial cost of specialized fluoropolymer materials (PTFE, ETFE) compared to traditional roofing systems and the requirement for highly specialized installation expertise and sophisticated engineering analysis, which limits their adoption in smaller-scale construction projects. Opportunities arise from technological innovations introducing hybrid materials with enhanced thermal insulation and solar energy harvesting capabilities, opening new markets in facade applications and energy-efficient retrofitting. The enduring impact forces involve intense regulatory pressure mandating energy efficiency in commercial buildings, coupled with the cyclical nature of the construction industry and volatility in raw material polymer prices, necessitating agile sourcing strategies.

Segmentation Analysis

The Architectural Membrane Material Market is comprehensively segmented based on the material type, the specific application area, and the end-user sector, reflecting the diverse requirements of the modern construction industry. Analysis of the Material segment shows that high-performance materials like PTFE and ETFE command premium pricing due to their longevity and performance attributes, whereas PVC continues to hold a significant market share based on its cost-effectiveness and versatility. The Application segment highlights the dominance of large-span structures, such as sports facilities and transportation hubs, where the unique benefits of tensile architecture are most pronounced. Understanding these segments is crucial for manufacturers to tailor product development and marketing efforts towards specific engineering challenges, such as the need for highly durable materials in harsh industrial environments or aesthetic, highly transparent films in public architectural projects.

- Material: PVC, PTFE, ETFE, TPO, HDPE, Other Polymers and Composites

- Application: Roofing, Facades (Wall Cladding), Tents & Canopies, Industrial Covers, Stadiums & Sports Facilities, Airports & Transportation Hubs, Entertainment & Exhibition Centers, Architectural Structures

- End-User: Commercial Construction (Offices, Retail), Residential Construction (Limited), Industrial (Warehouses, Storage), Infrastructure (Public Works, Transportation)

Value Chain Analysis For Architectural Membrane Material Market

The value chain for architectural membrane materials is complex, beginning with the upstream supply of base polymers, technical fabrics, and specialized coatings. Key upstream activities involve petrochemical companies providing resins (PVC, HDPE) and specialized chemical manufacturers supplying fluoropolymers (PTFE, ETFE), followed by the weaving or knitting of high-strength base fabrics (fiberglass, polyester). The midstream phase is crucial, encompassing sophisticated coating, lamination, and fabrication processes where raw materials are transformed into performance membranes, requiring precision equipment and proprietary chemical formulations to achieve characteristics like UV stability and fire retardancy. Manufacturers often invest heavily in R&D here to enhance material properties and meet increasingly strict performance specifications.

Downstream activities involve specialized distributors and agents who manage the logistics of large, often customized membrane rolls. The final stages involve the critical role of specialized tensile architecture design firms and installation contractors. These entities bridge the gap between material manufacturing and the final structural installation, providing detailed engineering, pattern cutting, and tensioning services essential for the structural integrity and aesthetic outcome of the project. Direct sales are common for highly customized, large infrastructure projects, facilitating close collaboration between the client, material manufacturer, and engineering consultant, ensuring specifications are met precisely.

The distribution channel is segmented into direct sales (for large-scale, complex projects requiring bespoke material solutions and engineering support) and indirect sales (through authorized distributors and fabricators who serve smaller or regional projects). Indirect channels offer localized inventory and expertise, whereas direct channels allow for maximum quality control and tailored material development. Effective channel management is vital, as the success of membrane architecture heavily depends on precise installation and adherence to engineering tolerances. Specialized training for fabricators and installers is therefore a critical component managed either directly by the key material suppliers or via certified partner networks to maintain quality standards across the value chain.

Architectural Membrane Material Market Potential Customers

Potential customers for architectural membrane materials are diverse, encompassing major stakeholders in the infrastructure, commercial, and industrial sectors globally. The primary buyers are large construction developers and project owners focusing on public-facing, high-impact structures such as international airport authorities, organizers of major sporting events (requiring stadium roofing), and governmental bodies commissioning public infrastructure projects like train stations and convention centers. These customers prioritize materials offering long lifespan, low maintenance, and unique aesthetic flexibility to create landmark structures. Furthermore, the specialized nature of these materials means that engineering consultants and architects frequently act as strong influencers, specifying particular polymers and coatings based on performance modeling.

Another significant group of end-users includes commercial real estate developers building shopping malls, office complexes, and entertainment venues where natural light and energy efficiency are key design considerations; ETFE films are particularly favored here. Industrial buyers represent a specialized niche, purchasing membrane materials for protective covers, storage domes, and highly durable enclosures requiring chemical resistance or specific thermal properties, such as those used in mining or agricultural sectors. The procurement decisions are often governed by a total cost of ownership model, weighing the initial material expense against the long-term benefits of reduced structural loads, energy savings, and minimal repair requirements over several decades.

The purchasing process often involves multiple layers of approval, starting with architectural specifications, followed by engineering validation for structural load capacities, and culminating in procurement based on competitive bids from certified fabricators. Because architectural membranes are highly technical products, customers typically require material certification, proven case studies, and long-term warranties provided by the manufacturer. The trend towards sustainable and smart building solutions is increasing the customer base interested in bio-based membranes, recyclable polymers, and materials that can integrate technology like thin-film photovoltaics, making public sector entities and environmentally conscious corporations increasingly important buyers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 8.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sefar AG, Serge Ferrari, Saint-Gobain, Mehler Texnologies GmbH, Sattler AG, Taiyo Kogyo Corporation, Verseidag-Indutex GmbH, Hiraoka & Co. Ltd., Low & Bonar, DuPont, 3M Company, Fibertex Nonwovens, Trelleborg AB, FTL Design Engineering Studio, Enduro Composites, Solvay SA, AGC Inc., MakMax, PFEIFER Seil- und Hebetechnik GmbH, Chemours Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Architectural Membrane Material Market Key Technology Landscape

The technological landscape of the Architectural Membrane Material Market is characterized by continuous advancements aimed at improving material lifespan, functional integration, and environmental performance. A primary area of innovation involves surface treatment technologies, particularly the development of high-performance coatings, such as TiO2 (titanium dioxide), which provides photocatalytic or "self-cleaning" properties to membranes like PTFE and PVC, significantly reducing maintenance costs and preserving aesthetic appeal over time. Furthermore, the evolution of polymeric compounding allows for tailored material characteristics, including enhanced fire retardancy, improved thermal break capabilities, and increased resistance to biological growth, broadening the scope of applications in diverse and challenging climates.

In terms of structural application, significant technological progress is evident in the development of pneumatic foil systems, such as multi-layered ETFE cushions. These systems use internal air pressure to create highly insulated, lightweight, and dynamic architectural elements. Advancements in structural engineering software and Computer Numerical Control (CNC) fabrication technology enable highly precise pattern cutting and welding of membrane panels, minimizing structural tolerances and ensuring optimum tensile loading. This precision fabrication is critical for maintaining the intended form and long-term stability of complex tensile structures, moving the industry toward industrialized, modular construction methods.

Future technological trends are focused on integrated functionality, leading to the rise of 'smart membranes.' This includes embedding thin-film photovoltaic (PV) materials directly into the membrane structure (Building-Integrated Photovoltaics - BIPV) to generate power without compromising light transmission or architectural aesthetics. Additionally, the incorporation of responsive materials, such as electrochromic films, allows membranes to dynamically adjust transparency in response to sunlight intensity, optimizing interior thermal comfort and reducing energy consumption. These technological leaps are transforming architectural membranes from static enclosures into active, energy-contributing components of the modern building envelope.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, driven by massive urbanization, high levels of governmental investment in infrastructure (including high-speed rail, smart cities, and exhibition centers), and preparations for international sporting events. China and India are the primary growth engines, focusing on cost-effective yet durable materials like PVC and increasingly adopting ETFE for iconic architectural projects.

- North America: This region is characterized by high adoption rates of advanced materials (PTFE and ETFE) due to stringent energy codes and a mature market favoring innovation in sustainable and aesthetic design. The demand is strong in commercial renovation, high-end institutional buildings, and specialized sports facilities, emphasizing long-term durability and performance over initial cost.

- Europe: The European market is highly regulated, placing immense emphasis on sustainability, low carbon footprint, and energy efficiency. This drives demand for high-performance, recyclable materials and multi-layered foil systems. Germany, the UK, and France lead in adopting these materials for commercial centers and environmentally certified buildings, focusing on retrofitting existing structures with advanced membrane facades.

- Middle East & Africa (MEA): Growth is primarily fueled by large-scale commercial and hospitality mega-projects, especially in the UAE and Saudi Arabia, where architectural membranes are essential for managing extreme heat and maximizing daylight while minimizing solar gain. The lightweight nature is also beneficial for rapid construction in often remote or demanding environments.

- Latin America (LATAM): The market is emerging, with demand concentrated in public infrastructure and large commercial developments in Brazil and Mexico. The adoption is sensitive to economic conditions, but there is rising interest in membrane materials for stadium construction and temporary event structures due to their speed of deployment and cost advantages over traditional materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Architectural Membrane Material Market.- Sefar AG

- Serge Ferrari

- Saint-Gobain

- Mehler Texnologies GmbH

- Sattler AG

- Taiyo Kogyo Corporation

- Verseidag-Indutex GmbH

- Hiraoka & Co. Ltd.

- Low & Bonar

- DuPont

- 3M Company

- Fibertex Nonwovens

- Trelleborg AB

- FTL Design Engineering Studio

- Enduro Composites

- Solvay SA

- AGC Inc.

- MakMax

- PFEIFER Seil- und Hebetechnik GmbH

- Chemours Company

Frequently Asked Questions

Analyze common user questions about the Architectural Membrane Material market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between PTFE and ETFE architectural membranes?

PTFE (Polytetrafluoroethylene) is typically used as a fiberglass-coated fabric offering extremely high durability, self-cleaning capabilities, and excellent fire resistance, commonly used in permanent tensioned structures. ETFE (Ethyl Tetrafluoroethylene) is a high-transparency film, lighter than glass, known for superior light transmission and exceptional thermal properties, often deployed in multi-layered pneumatic cushion systems.

How does the use of architectural membranes contribute to sustainable building practices?

Architectural membranes significantly contribute to sustainability by reducing the overall structural load of a building due to their lightweight nature, thereby minimizing foundation requirements. Materials like ETFE offer high light transmission, drastically cutting down on artificial lighting needs, and many modern membranes are increasingly recyclable, lowering the environmental impact across the building lifecycle.

Which geographical region exhibits the highest growth potential for architectural membrane materials?

The Asia Pacific (APAC) region is projected to demonstrate the highest growth potential, driven by unprecedented levels of urbanization, massive government investment in new infrastructure projects (airports, stadiums), and increasing adoption of modern, aesthetic building techniques in large economies like China and India.

What are the main restraints hindering the widespread adoption of advanced architectural membranes?

The primary restraints include the high initial material cost associated with specialized fluoropolymers (PTFE, ETFE) compared to traditional roofing materials, alongside the necessity for highly specialized engineering design expertise and certified installation teams, which limits use in conventional or smaller-scale construction projects.

What role does technology play in the future development of the membrane materials market?

Technology is crucial, focusing on developing 'smart membranes' incorporating features like Building-Integrated Photovoltaics (BIPV) for energy generation, self-healing coatings for enhanced durability, and advanced sensor integration for real-time monitoring of structural integrity and thermal performance, transforming materials into active building components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager