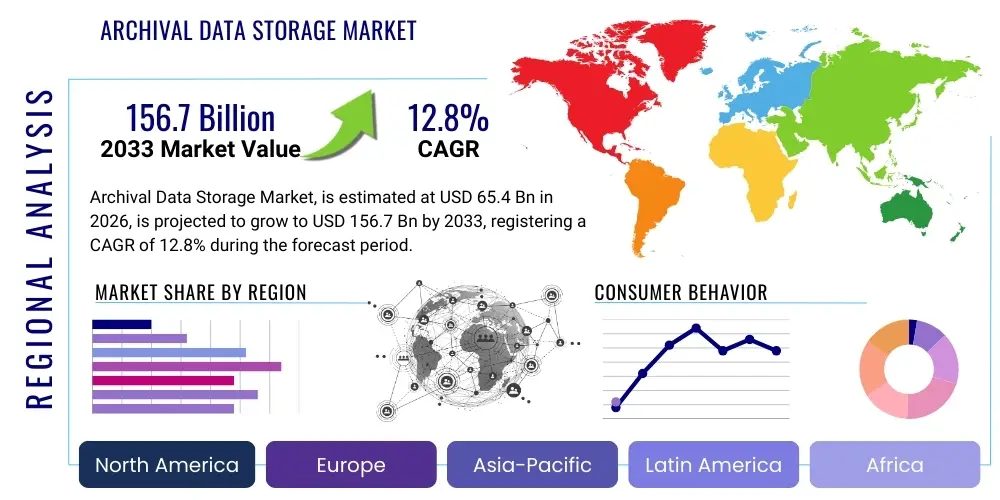

Archival Data Storage Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437705 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Archival Data Storage Market Size

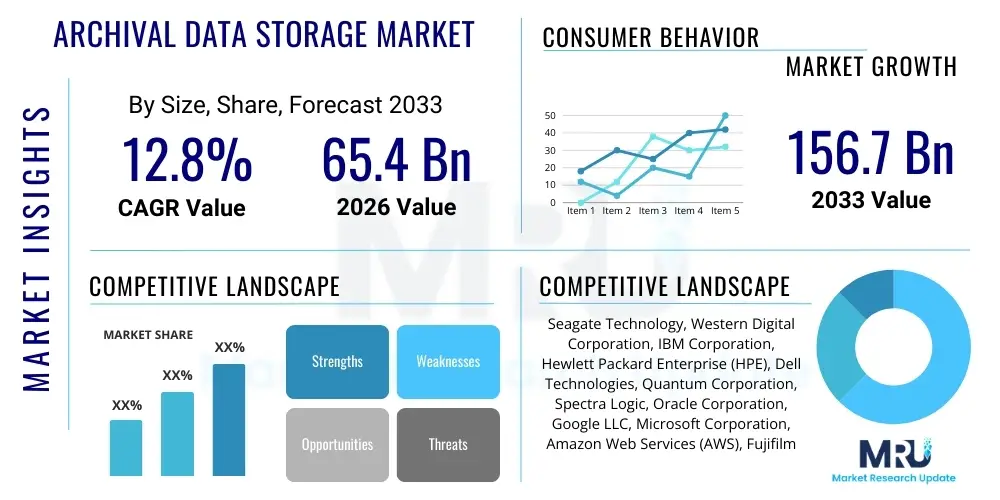

The Archival Data Storage Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 65.4 Billion in 2026 and is projected to reach USD 156.7 Billion by the end of the forecast period in 2033.

Archival Data Storage Market introduction

The Archival Data Storage Market encompasses technologies and solutions designed for the long-term retention of data that is infrequently accessed but must be preserved for regulatory compliance, historical record-keeping, or future analytical purposes. This market spans various mediums, including magnetic tapes, optical disks, hard disk drives (HDDs), and specialized cloud-based cold storage services, catering to the increasing global imperative to manage massive volumes of unstructured data. Archival solutions prioritize cost efficiency, data longevity, and integrity over high-speed access, making them distinct from primary or secondary operational storage systems. The fundamental objective is to provide a reliable, secure, and economically viable repository for data that satisfies legal hold requirements and organizational knowledge preservation needs.

Key applications driving the demand for advanced archival storage include sectors such as Financial Services (for audit trails and transaction history), Healthcare (for electronic patient records and imaging data), Media and Entertainment (for film libraries and high-resolution assets), and Government agencies (for public records and national archives). The intrinsic benefits of robust archival strategies include significantly reduced operational expenditure compared to keeping cold data on expensive, high-performance storage, enhanced regulatory adherence (such as GDPR, HIPAA, and SOX), and improved disaster recovery capabilities. By effectively segregating rarely accessed data, organizations can optimize their primary infrastructure performance and reduce their overall data footprint complexity. The constant creation of Big Data and the need for data governance mandates worldwide are primary accelerants for this market.

The market is predominantly driven by the exponential growth of digital data generated across all enterprise verticals, often necessitating retention periods spanning decades. Furthermore, the stringent and evolving global regulatory landscape requires mandatory data retention policies, forcing organizations to invest in scalable and reliable archival solutions. Technological advancements, particularly in automated tape libraries and highly durable optical storage, coupled with the competitive pricing of hyperscale cloud archival tiers, are making long-term storage more accessible and efficient. The shift toward cloud-native archival is also accelerating, as enterprises seek flexibility, immediate scalability, and reduced hardware management overhead.

Archival Data Storage Market Executive Summary

The Archival Data Storage Market is poised for substantial expansion, characterized by a fundamental shift toward software-defined storage architectures and increasing adoption of hybrid cloud models for data preservation. Key business trends indicate intensified competition among technology providers focusing on improving data accessibility metrics within archival tiers, alongside breakthroughs in storage density, especially in magnetic tape and specialized high-density HDDs. Regional growth analysis shows North America maintaining its leadership due to early adoption of cloud archival services and robust regulatory environments, while the Asia Pacific region is expected to demonstrate the highest Compound Annual Growth Rate (CAGR), fueled by rapid digitization in emerging economies and escalating compliance mandates across industries like telecommunications and BFSI. This growth is further supported by governmental initiatives encouraging data localization and the establishment of large-scale data centers.

Segment trends reveal that the Tape Storage segment, despite being mature, continues to dominate in terms of capacity deployed due to its superior cost-per-terabyte ratio and longevity, particularly for cold, rarely accessed backups and deep archives maintained by large enterprises and cloud providers. However, the Cloud Archival segment is experiencing the fastest acceleration, driven by the convenience, scalability, and OpEx model offered by major providers such as Amazon Web Services Glacier and Microsoft Azure Archive Storage. From an application perspective, the BFSI and Healthcare sectors remain the largest consumers of archival solutions, mandated by strict regulatory compliance requirements such as tracking financial transactions and maintaining long-term patient records. Furthermore, the increasing complexity of data types, including video surveillance footage, IoT sensor data streams, and high-resolution media files, necessitates diversified archival strategies capable of handling petabyte-scale growth seamlessly.

The market landscape is undergoing consolidation, where major storage vendors are integrating advanced data management features, including AI-driven indexing, automated data lifecycle management, and enhanced encryption capabilities directly into their archival offerings. This strategic integration addresses user concerns regarding data retrieval speed and security within deep archives. Investment in sustainable storage technologies, minimizing power consumption per terabyte, is also emerging as a critical competitive differentiator, aligning with global corporate sustainability goals. The necessity of maintaining immutable copies of data for cybersecurity resilience (ransomware protection) further cements the strategic importance of robust archival storage solutions, compelling medium and large enterprises to allocate dedicated IT budgets toward these solutions.

AI Impact Analysis on Archival Data Storage Market

Common user questions regarding AI’s impact on archival data storage frequently revolve around whether AI will dramatically change data retention periods, how AI can automate the process of classification and retrieval, and the infrastructure demands imposed by training large language models (LLMs) which often require accessing vast, historical datasets. Users are keenly interested in leveraging AI for automated metadata generation, intelligent tiering, and ensuring compliance through automatic data expiry monitoring. The core concern centers on balancing the low-cost requirement of archival storage with the emerging need for rapid, AI-driven analysis of historical data, potentially blurring the traditional lines between "cold" and "warm" data tiers. Specifically, there is high expectation that AI will transform archival storage from a passive retention utility into an active, strategic asset that supports predictive analytics and business intelligence, requiring vendors to rethink retrieval speed and index completeness.

The introduction of sophisticated AI and machine learning algorithms significantly affects archival data storage by transforming unstructured, dormant data into actionable, searchable assets. AI models require continuous access to massive historical archives for training and inferencing, compelling enterprises to implement solutions that enable faster indexing and retrieval from deep storage tiers without incurring excessive costs. AI-driven data governance tools are streamlining the classification of data at ingest, automatically determining appropriate retention policies, and optimizing the migration of data across different storage classes (hot, warm, cold). This automation reduces human error, ensures regulatory consistency, and improves overall storage efficiency by preventing the unnecessary retention of obsolete data. Furthermore, AI is crucial in enhancing the security and integrity of archived data by continuously monitoring access patterns and identifying anomalous behavior indicative of potential data breaches or tampering attempts.

Another major impact of AI lies in predictive maintenance and operational optimization of the storage infrastructure itself. AI algorithms analyze performance metrics and failure rates of archival hardware (such as tape drives or HDDs) to anticipate potential issues, thereby increasing system uptime and reducing the risk of data loss. For large-scale cloud providers, AI is essential for optimizing power consumption and cooling in cold storage data centers, addressing the sustainability challenge inherent in storing petabytes of data. As the volume of data generated by AI applications (e.g., synthetic data, model checkpoints) continues to grow exponentially, archival solutions must evolve to provide high-density, low-power storage options specifically optimized for long-term AI-related assets, validating the need for innovative technologies like DNA data storage in the distant future.

- AI-Driven Data Classification: Automation of metadata tagging and policy enforcement for optimized tiering and compliance adherence.

- Enhanced Data Retrieval: Utilization of ML models to improve indexing speed and precision, reducing latency for accessing deep archive assets required for training models.

- Predictive Analytics Support: Archival data shifts from passive retention to an active source for training Large Language Models (LLMs) and performing historical trend analysis.

- Ransomware and Security Enhancement: AI systems monitor data integrity and immutability, providing advanced protection against tampering and unauthorized data deletion.

- Infrastructure Optimization: ML models predict hardware failures (e.g., tape wear, HDD degradation) and optimize energy consumption in cold storage environments.

DRO & Impact Forces Of Archival Data Storage Market

The Archival Data Storage Market is profoundly influenced by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and structural Impact Forces. The primary drivers revolve around regulatory compliance mandates and the relentless increase in global data volume, compelling mandatory, long-term retention across regulated industries. Key restraints include the inherent complexity of data migration projects and the rising initial capital expenditure associated with implementing large-scale, proprietary archival solutions, coupled with ongoing concerns regarding long-term data format obsolescence. Significant opportunities are emerging from the integration of hybrid cloud archival solutions, the development of sustainable, low-power storage mediums, and the increasing market demand for immutable storage to combat sophisticated ransomware threats. These forces collectively shape the competitive dynamics and technological evolution within the archival data management ecosystem, demanding continuous innovation in cost efficiency, security protocols, and data accessibility.

The powerful drivers sustaining market growth include the rise of digital evidentiary requirements and legal discovery processes, particularly in highly litigious sectors such as pharmaceuticals and legal services, necessitating verifiable and easily retrievable archives. Furthermore, the massive proliferation of high-resolution content, including 4K/8K video surveillance, media production assets, and complex scientific research datasets, mandates scalable, cost-effective storage solutions that traditional primary storage cannot economically provide. Impact forces such as rapid data monetization strategies, where historical archives are repurposed for generating new insights through analytics, necessitate greater interoperability between cold storage and analytical platforms. The pressure to reduce the Total Cost of Ownership (TCO) for large datasets continuously pushes organizations towards deep storage solutions like tape and specialized cloud tiers, accelerating the adoption curve for these low-cost mediums.

However, the market faces structural constraints related to vendor lock-in, where proprietary archival formats or reliance on single cloud providers can hinder future data portability and migration efforts. Another significant restraint is the 'time-to-first-byte' latency associated with retrieving data from deep archival tiers, which can sometimes conflict with business needs requiring faster access for analytics or urgent compliance audits. Opportunities abound in developing sophisticated object storage solutions optimized for archival purposes, offering robust APIs and multi-cloud compatibility, mitigating vendor lock-in concerns. Moreover, the demand for 'zero-trust' archival environments, incorporating advanced cryptographic methods and air-gapping capabilities, presents a lucrative market segment focusing entirely on cybersecurity resilience and data immutability, especially crucial for governmental and critical infrastructure entities.

Segmentation Analysis

The Archival Data Storage Market is broadly segmented based on Storage Medium, Deployment Model, Organization Size, and Industry Vertical, providing a multi-dimensional view of market dynamics and adoption patterns. The Storage Medium segmentation is pivotal, differentiating between established, high-capacity mediums like Magnetic Tape and highly scalable, rapidly adopted solutions such as Cloud Storage, while also including niche but growing segments like Optical and High-Density HDDs. The Deployment Model segmentation highlights the ongoing transition from traditional On-premise archives to versatile Hybrid and Public Cloud solutions, reflecting changing IT infrastructure preferences driven by scalability and cost management requirements. Understanding these segments is crucial for technology providers to tailor products that meet specific longevity, performance, and budget constraints across various enterprise scales and regulated environments.

The segmentation by Organization Size distinguishes between the demands of Large Enterprises, which prioritize massive scale, advanced automation, and complex regulatory compliance, and Small and Medium-sized Enterprises (SMEs), which often favor simpler, managed cloud-based archival services due to limited IT resources and budget constraints. Analysis by Industry Vertical reveals concentrated demand in sectors facing severe regulatory pressures, notably BFSI, Healthcare, and Government, alongside significant consumption in Media and Entertainment due to the persistent need to archive valuable intellectual property assets. These verticals dictate specific requirements regarding data immutability, retrieval speed SLAs, and integration with existing data governance frameworks. The comprehensive segmentation analysis assists market participants in identifying high-growth niches, optimizing go-to-market strategies, and developing specialized archival solutions that address unique industry challenges, such as the long retention cycles required in pharmaceutical research or the high throughput demands in geophysical data archiving.

- By Storage Medium:

- Magnetic Tape (Tape Libraries, LTO)

- Cloud Storage (Cold Storage, Glacier/Archive Tiers)

- Hard Disk Drive (High-Density Archival HDDs)

- Optical Storage (Blu-ray, specialized archival discs)

- By Deployment Model:

- On-premise

- Cloud (Public, Private)

- Hybrid

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Life Sciences

- Government and Defense

- Media and Entertainment

- IT and Telecommunication

- Manufacturing

- Others (Education, Retail)

Value Chain Analysis For Archival Data Storage Market

The Value Chain for the Archival Data Storage Market begins with the upstream suppliers responsible for core components, primarily the manufacturers of storage media, including magnetic tape media, high-density platter technology for HDDs, and specialized optical media. This upstream segment is capital-intensive and focused on maximizing storage density, reliability, and longevity while minimizing power consumption. Key suppliers include material science companies and specialized component manufacturers. Following the media production, the value chain involves Original Equipment Manufacturers (OEMs) and major system vendors who integrate these components into complete archival solutions, such as automated tape libraries, specialized archival appliances, and software-defined storage platforms. Innovation at this stage focuses on automation, intelligent indexing software, and seamless integration capabilities with enterprise data management frameworks.

The midstream of the value chain is dominated by system integrators, managed service providers (MSPs), and hyperscale cloud providers (e.g., AWS, Azure, Google Cloud) who deliver archival solutions directly to end-users through various deployment models. Hyperscale providers offer highly scalable, subscription-based public cloud archival services, leveraging their massive economies of scale. Conversely, integrators and MSPs focus on delivering customized, hybrid, or on-premise solutions, often incorporating third-party software for data migration, policy management, and security. Distribution channels are varied: direct sales are common for large enterprise deployments (tape libraries, appliances), while indirect channels, including value-added resellers (VARs) and distributors, are crucial for reaching SMEs and facilitating the sale of cloud subscription services. The efficacy of the distribution channel is increasingly measured by its ability to provide comprehensive post-implementation support and data lifecycle management consultation.

The downstream segment encompasses the end-users across various industry verticals, where the archived data is ultimately retained, governed, and occasionally retrieved for compliance or analytical purposes. The critical focus at this stage is data governance, ensuring compliance with local and international retention laws, and implementing robust disaster recovery and ransomware protection protocols. The direct channel engagement involves large financial institutions or government entities contracting directly with solution providers for bespoke, high-security archival systems. Indirect channels facilitate the consumption of cloud archival tiers or packaged software solutions through channel partners, simplifying the complexity for organizations lacking dedicated archival expertise. Continuous maintenance, data refresh strategies (migrating data across generations of technology), and auditing services form the final, essential components of the archival storage value proposition.

Archival Data Storage Market Potential Customers

The primary customers for archival data storage solutions are organizations facing mandatory, long-term data retention requirements driven by regulatory, legal, and operational continuity needs. Large Enterprises across regulated sectors constitute the largest segment of end-users, requiring petabyte-scale capacity and complex data lifecycle management tools. Specific buyers within these organizations include Chief Information Officers (CIOs), Data Governance Officers, Compliance Managers, and Directors of Infrastructure Operations, all prioritizing security, cost efficiency, and proven data longevity. For instance, pharmaceutical companies require decades-long archives for clinical trial data, while banks must retain detailed transaction records spanning beyond ten years to satisfy financial audit regulations. These customers often procure high-density solutions, including automated tape systems and secure private cloud archives.

Medium-sized enterprises (MEs) represent a rapidly expanding customer base, particularly those undergoing digital transformation and migrating legacy paper records or magnetic media onto digital archival platforms. These entities generally prefer flexible, subscription-based cloud archival services (e.g., AWS S3 Glacier or Azure Archive) or simple, scalable hybrid solutions that require minimal capital investment and in-house IT management overhead. Their focus centers on simplifying compliance requirements and ensuring adequate protection against data loss and ransomware attacks without deploying extensive on-premise infrastructure. This segment is highly sensitive to total cost of ownership (TCO) and ease of deployment, making managed services highly attractive.

Beyond traditional corporate users, hyperscale cloud providers themselves are massive consumers of archival technology, utilizing deep archival hardware (primarily tape libraries and specialized high-density HDDs) to support their own public cloud cold storage offerings, thereby acting as both providers and super-consumers in the market. Furthermore, specialized institutions such as national libraries, scientific research facilities (e.g., astronomical observatories, genomics labs), and major media broadcasters are critical niche customers. These institutions require unique solutions tailored to preserving extremely high-volume, often proprietary, or rare data formats over multiple generations, placing a premium on media longevity and data verification tools. The convergence of IoT data streams and smart city initiatives is also generating new customer demand for long-term sensor data retention.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.4 Billion |

| Market Forecast in 2033 | USD 156.7 Billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Seagate Technology, Western Digital Corporation, IBM Corporation, Hewlett Packard Enterprise (HPE), Dell Technologies, Quantum Corporation, Spectra Logic, Oracle Corporation, Google LLC, Microsoft Corporation, Amazon Web Services (AWS), Fujifilm Holdings Corporation, Sony Corporation, Pure Storage, Commvault Systems, Hitachi Vantara, Cohesity, Veritas Technologies, Iron Mountain, Backblaze |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Archival Data Storage Market Key Technology Landscape

The Archival Data Storage Market relies on a sophisticated technology landscape characterized by ongoing advancements in storage media density, software-defined storage architecture, and integration with advanced data management platforms. Magnetic Tape technology, particularly the Linear Tape-Open (LTO) format, remains foundational due to its unparalleled cost efficiency and proven data longevity (30+ years), with continuous innovation focused on increasing capacity (e.g., LTO-9 and LTO-10 roadmap) and improving drive speeds. High-density Hard Disk Drives (HDDs), leveraging technologies like Heat-Assisted Magnetic Recording (HAMR) and Shingled Magnetic Recording (SMR), are crucial for 'nearline' archives that require faster retrieval speeds than tape but still prioritize density and energy efficiency over primary storage performance. The shift to object storage interfaces (like S3) for both cloud and on-premise archives is a major technological trend, facilitating scalability and simplifying integration across hybrid environments.

Cloud Archival services represent a major technological segment, utilizing proprietary cold storage architectures that often combine specialized hardware (sometimes tape) with highly optimized software for massive data management, geographic redundancy, and security. Key technological differentiation in this space involves retrieval speed tiers, ranging from immediate access (high cost) to several hours (lowest cost), allowing users to balance TCO and latency. Furthermore, software-defined storage (SDS) is playing a critical role, decoupling the data management layer from the underlying hardware. SDS solutions enable automated policy management, intelligent tiering, and data verification across heterogeneous storage platforms, simplifying the complexity of multi-generational archiving and ensuring data immutability for compliance and ransomware protection. Advanced encryption protocols, including strong end-to-end encryption and the use of immutable ledgers for audit trails, are standard technological necessities.

Emerging and future technologies are also influencing the landscape, most notably the continuous research and development in Optical Storage to achieve greater longevity and resistance to environmental factors, and the highly experimental but transformative potential of DNA Data Storage, which promises unprecedented density for truly long-term, petabyte-scale cold archives spanning centuries. While not yet commercially viable for mainstream archival, these areas represent the cutting edge of data preservation science. Furthermore, advanced networking technologies are essential for managing the movement of large archival datasets, requiring high-throughput, low-latency interconnects between primary storage systems, archival gateways, and cloud endpoints. The convergence of these technological domains ensures that archival solutions remain robust, compliant, and capable of handling the exponential increase in global data volumes.

Regional Highlights

The global Archival Data Storage Market exhibits distinct regional adoption patterns influenced by data regulation, technological maturity, and economic factors.

- North America: This region maintains market dominance driven by the early and widespread adoption of cloud technologies, the presence of major hyperscale cloud providers, and extremely stringent regulatory frameworks (e.g., HIPAA, SEC rules) demanding long-term, compliant data retention. The US leads in market size due to the high concentration of technology firms, financial institutions, and sophisticated defense contractors who require massive, highly secure archival infrastructure.

- Europe: The European market is heavily influenced by the General Data Protection Regulation (GDPR), which imposes strict rules not only on data privacy but also on data retention periods and the right to erasure, making robust archival and governance solutions mandatory. Western European countries, particularly Germany and the UK, show high adoption rates for hybrid archival solutions, balancing local control with the scalability of regional cloud archives.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid digitization initiatives in China, India, and Southeast Asia, escalating regulatory requirements across the banking and telecommunications sectors, and substantial government investment in regional data center infrastructure. The market here is characterized by a strong demand for cost-effective, high-density tape solutions alongside accelerating cloud archival adoption among SMEs.

- Latin America (LATAM): This region exhibits steady growth, primarily driven by the increasing need for data localization and regulatory compliance in major economies like Brazil and Mexico. The market often favors hybrid or localized cloud archival solutions to manage costs while addressing intermittent bandwidth challenges characteristic of certain sub-regions.

- Middle East and Africa (MEA): Growth in MEA is concentrated around Gulf Cooperation Council (GCC) countries, driven by large-scale government digitization programs (Vision 2030 in Saudi Arabia) and expansion of the oil and gas sector, which generates vast amounts of seismic data requiring long-term archiving. Data sovereignty and security requirements often lead to a preference for on-premise or sovereign cloud archival setups.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Archival Data Storage Market.- IBM Corporation

- Hewlett Packard Enterprise (HPE)

- Dell Technologies

- Quantum Corporation

- Spectra Logic

- Seagate Technology

- Western Digital Corporation

- Oracle Corporation

- Google LLC

- Microsoft Corporation

- Amazon Web Services (AWS)

- Fujifilm Holdings Corporation

- Sony Corporation

- Commvault Systems

- Veritas Technologies

- Hitachi Vantara

- Cohesity

- Pure Storage

- Iron Mountain

- Backblaze

Frequently Asked Questions

Analyze common user questions about the Archival Data Storage market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for growth in the Archival Data Storage Market?

The primary market driver is the exponential growth of global digital data coupled with increasingly strict governmental and industry-specific regulatory mandates, such as GDPR and HIPAA, which enforce mandatory, long-term data retention periods for compliance and legal purposes. The need for ransomware resilience also significantly accelerates demand for immutable archival solutions.

How does Cloud Archival compare to traditional Magnetic Tape storage in terms of TCO?

Magnetic Tape traditionally offers the lowest total cost of ownership (TCO) per terabyte for deep, cold archives due to extremely low media and energy costs, making it ideal for petabyte-scale retention. Cloud Archival provides higher scalability, accessibility, and operational flexibility (OpEx model), but the TCO can be higher if retrieval frequency and egress charges are not carefully managed.

What role does Artificial Intelligence play in modern archival data management?

AI transforms archival management by enabling automated data classification, intelligent policy-based tiering, and rapid metadata indexing, turning passive archives into searchable, strategic assets. AI is also used for optimizing storage infrastructure performance and enhancing data integrity checks for advanced security.

Which industry vertical is the largest consumer of Archival Data Storage solutions?

The Banking, Financial Services, and Insurance (BFSI) sector, along with the Healthcare and Life Sciences sector, are the largest consumers. This is due to stringent statutory requirements for retaining transaction records, audit trails, and long-term electronic patient records (EPRs) spanning regulatory compliance periods often exceeding ten years.

What is the key technological challenge in maintaining archival data over very long periods?

The key technological challenge is data format obsolescence, where the hardware or software required to read archived data becomes unavailable or unsupported after several decades. Solutions involve implementing regular data migration strategies (data refresh) and utilizing open-standard data formats to ensure long-term accessibility and readability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager