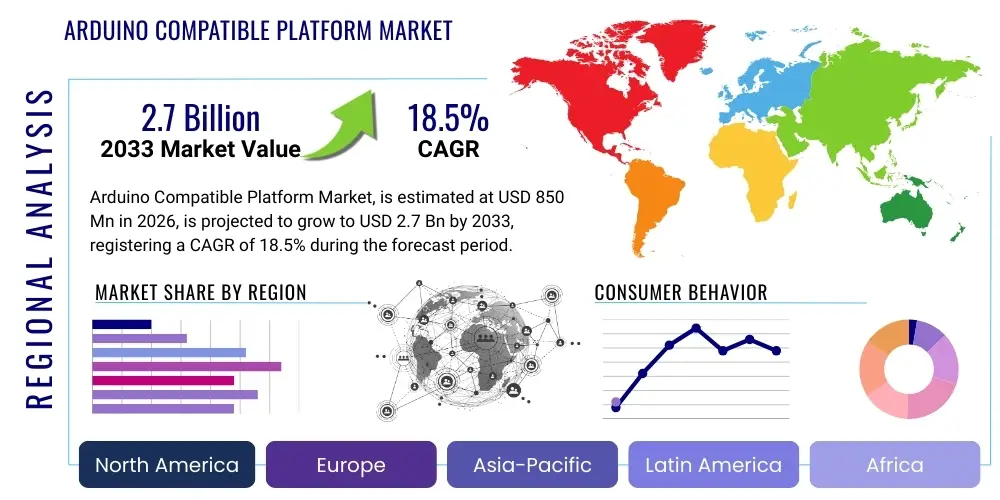

Arduino Compatible Platform Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436571 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Arduino Compatible Platform Market Size

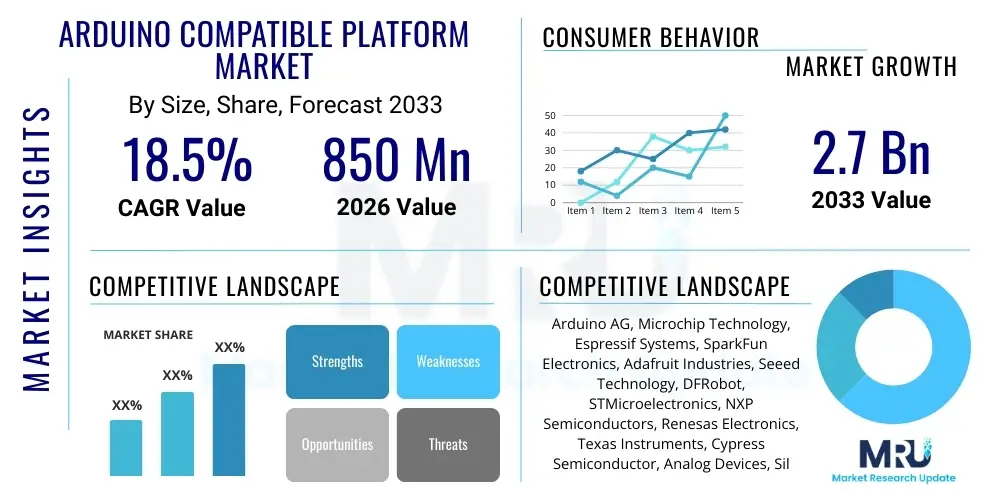

The Arduino Compatible Platform Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 2.7 Billion by the end of the forecast period in 2033.

Arduino Compatible Platform Market introduction

The Arduino Compatible Platform Market encompasses hardware and software ecosystems designed around the open-source principles of the original Arduino project, facilitating rapid prototyping and development across various technological domains. These platforms utilize microcontrollers, standardized development environments (IDEs), and a vast array of shields and modules, lowering the barrier to entry for electronics development for hobbyists, educators, and professional engineers alike. Key products include microcontrollers (like the ATmega series, SAMD, and ESP32), single-board computers, and various compatible expansion boards used for connectivity, sensing, and actuation. The fundamental appeal lies in their accessibility, robust community support, and flexibility, making them instrumental in the burgeoning fields of Internet of Things (IoT), robotics, and educational technology.

Major applications of Arduino compatible platforms span consumer electronics, industrial automation (Industry 4.0 prototyping), smart home devices, and advanced educational tools used in STEM curricula. The platforms are favored for projects requiring low-power consumption, real-time control, and integration with cloud services. The primary benefits include reduced development time due to extensive pre-written libraries and a straightforward programming language (based on C/C++), cost-effectiveness compared to proprietary industrial solutions, and interoperability across different hardware manufacturers adhering to the Arduino standard.

Driving factors propelling market expansion include the exponential growth of the global IoT landscape, which relies heavily on accessible prototyping tools for sensor network deployment and device connectivity testing. Furthermore, increasing government and private sector investment in technical education and maker spaces globally continues to stimulate demand. The continuous evolution of semiconductor technology, resulting in more powerful yet cheaper microcontrollers capable of running complex algorithms, also significantly contributes to the platform’s adoption in commercial products and advanced research settings.

Arduino Compatible Platform Market Executive Summary

The Arduino Compatible Platform Market is characterized by robust growth, driven primarily by accelerating adoption in industrial IoT (IIoT) applications and educational sectors globally. Key business trends indicate a shift towards integrating more powerful microcontrollers capable of supporting Edge AI and TinyML functionalities, moving these platforms beyond simple prototyping into deployment-ready solutions. Market competition remains intense, dominated by established original equipment manufacturers (OEMs) alongside numerous niche open-source hardware providers. Strategic partnerships between hardware manufacturers and cloud service providers (like AWS and Azure) are becoming prevalent to enhance seamless data logging and remote management capabilities, ultimately fostering a more cohesive ecosystem.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, fueled by rapidly industrializing economies, significant manufacturing activity, and large youth populations increasingly focused on STEM education and vocational training. North America and Europe maintain substantial market shares due to high technological maturity, strong presence of maker communities, and early adoption of IIoT standards. Regional segmentation reveals varying demand patterns; while mature markets focus on high-performance boards for complex industrial monitoring, developing regions prioritize cost-effective and basic boards for educational purposes and localized agricultural monitoring systems.

Segment trends highlight the dominance of the microcontroller board segment, particularly those featuring advanced connectivity options such as Wi-Fi, Bluetooth Low Energy (BLE), and LoRa. The software and services segment, including IDEs and cloud integration tools, is expected to exhibit the highest CAGR as complexity in integrated projects increases. End-user demand is polarizing: the Industrial End-user segment requires ruggedized, high-reliability components, while the Hobbyist/DIY segment focuses on maximizing cost-performance ratio. Overall, the market trajectory is highly positive, supported by the foundational principles of open-source innovation and the universal need for rapid, flexible electronic prototyping.

AI Impact Analysis on Arduino Compatible Platform Market

User queries regarding the impact of Artificial Intelligence (AI) on the Arduino Compatible Platform Market predominantly center on three major themes: the feasibility of running AI models on resource-constrained microcontrollers (TinyML), the required hardware specifications for Edge AI tasks, and the integration pathways for transferring data from Arduino sensors to powerful cloud-based AI processing engines. Users are concerned about whether traditional Arduino boards possess sufficient processing power and memory (RAM/Flash) to execute meaningful machine learning inferences directly at the device level, thereby reducing latency and bandwidth requirements, which is crucial for real-time applications like predictive maintenance or local image processing. There is a clear expectation that future Arduino compatible boards must inherently support AI acceleration and provide simplified software libraries for model deployment.

The integration of AI, specifically through TinyML (Tiny Machine Learning), is fundamentally transforming the value proposition of Arduino compatible platforms. This shift allows devices to process sensor data locally, making intelligent decisions without constant communication with the cloud, which is revolutionary for battery-operated or remote IoT deployments. This capability opens up new markets in sophisticated acoustic event detection, gesture recognition, and environmental monitoring where low power consumption and instantaneous response times are critical. Consequently, market demand is rapidly shifting towards higher-performance microcontrollers (e.g., those based on ARM Cortex-M architecture or specialized AI accelerator chips) that retain the Arduino ease-of-use ethos.

This evolving technological synergy requires the development of specific AI-optimized hardware platforms and complementary software frameworks, such as TensorFlow Lite Micro, tailored for the Arduino ecosystem. The market must respond by providing comprehensive documentation and streamlined workflows that enable developers to train models in a cloud environment and deploy the optimized inference code directly onto the small footprint of an Arduino compatible device. This democratization of edge intelligence is one of the most powerful drivers currently shaping product development and feature roadmaps across the entire compatible platform market, ensuring future relevance in advanced IoT deployments.

- AI drives the demand for higher-performance, memory-rich microcontrollers (e.g., ESP32, SAMD-based boards).

- TinyML adoption facilitates local processing and decision-making, significantly reducing data latency and improving efficiency in IoT applications.

- New software frameworks (e.g., TensorFlow Lite Micro integration) are essential for deploying machine learning models directly onto resource-constrained Arduino hardware.

- AI integration expands applications into sophisticated areas such as predictive maintenance, anomaly detection, and voice/gesture recognition at the edge.

- Increased focus on power efficiency for running inference models, crucial for long-term, battery-operated AIoT deployments.

- The AI impact necessitates specialized shields and modules featuring digital signal processors (DSPs) or dedicated neural processing units (NPUs).

DRO & Impact Forces Of Arduino Compatible Platform Market

The market dynamics of Arduino Compatible Platforms are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively exert significant impact forces on growth trajectory and competitive intensity. Primary drivers include the massive expansion of the global IoT ecosystem, creating an insatiable need for flexible, affordable, and readily available prototyping tools. Furthermore, the strong emphasis on STEM education worldwide ensures a continuously expanding user base, converting students and hobbyists into professional developers familiar with the platform. Restraints primarily involve the inherent limitations of microcontrollers, particularly concerning processing power and memory, which restricts their application in highly complex or computationally intensive commercial products, often necessitating a transition to more powerful, albeit less accessible, industrial single-board computers. Additionally, fragmentation within the compatible market due to numerous manufacturers can occasionally lead to inconsistencies in documentation and library support, presenting integration challenges for large-scale enterprise deployments.

Opportunities are predominantly found in the development of specialized niche platforms tailored for specific industrial segments, such as ruggedized, high-temperature boards for industrial automation or ultra-low power boards for remote environmental sensing. The growing integration of 5G and LPWAN (Low Power Wide Area Network) technologies offers platforms new avenues for long-range, high-density sensor networking applications. The market structure, defined by open-source principles, fosters rapid innovation, allowing smaller players to quickly introduce novel hardware iterations or specialized application shields, keeping the overall platform highly dynamic and responsive to emerging technological needs.

The competitive intensity is moderated by the platform’s open-source nature, which encourages collaboration but also ensures continuous downward pressure on hardware pricing. Supplier power is high for core component manufacturers (semiconductor firms like Microchip or Espressif) but low for standard peripheral providers. Buyer power is moderate; while hobbyists are price-sensitive, industrial buyers prioritize reliability and technical support. The threat of substitutes remains substantial, primarily from more powerful single-board computers (like Raspberry Pi) for higher-end applications and specialized industrial programmable logic controllers (PLCs) for critical infrastructure, compelling Arduino compatible platforms to continuously enhance their processing capabilities and maintain their simplicity advantage.

Segmentation Analysis

The Arduino Compatible Platform Market is systematically segmented based on Component, Type, End-User, and Application, providing a granular view of market dynamics and targeted opportunities. Component segmentation examines the distinction between core microcontroller boards, essential shields/modules (for connectivity, sensing, and power management), and the requisite software/services required for development and deployment. The Type segmentation often differentiates between official Arduino boards and third-party compatible variants, reflecting variations in cost and specific hardware features. This comprehensive structure allows market participants to tailor their offerings—whether high-reliability boards for industrial clients or low-cost, feature-rich bundles for educational institutions—to maximize penetration within specific user demographics and functional requirements.

From an End-User perspective, the market is broadly divided into Industrial Users (IIoT, automation, manufacturing), Educational Institutions (K-12, university research labs), and Hobbyists/DIY Enthusiasts. Each segment requires platforms with distinct characteristics; Industrial users demand robust reliability, certifications, and long-term supply guarantees, whereas educational and hobbyist users prioritize ease of use, extensive community resources, and cost-effectiveness. The fastest growth is observed in the Industrial segment, driven by digital transformation initiatives seeking accessible prototyping tools before scaling up to enterprise-grade solutions. Application segmentation, covering areas like smart home, health monitoring, robotics, and environmental sensing, shows that complex, multi-sensor integration projects increasingly drive demand for higher memory and advanced communication capabilities.

Analyzing these segments reveals critical trends: the rising importance of connectivity, pushing demand for boards integrated with Wi-Fi 6, LoRa, or even cellular capabilities; and the necessity for enhanced security features, especially for platforms deployed in commercial IoT ecosystems. The segmentation by Type further highlights the market strength of open-source innovation, as third-party providers often rapidly integrate new semiconductor advances (e.g., RISC-V architectures) or add specialized peripheral features (e.g., built-in displays or battery management systems) faster than official entities, driving intense segment competition and accelerating product obsolescence cycles.

- Component:

- Microcontroller Boards (Core Processors)

- Shields and Modules (Connectivity, Sensor, Actuator, Power)

- Software and Services (IDEs, Libraries, Cloud Integration Tools)

- Type:

- Official Arduino Boards

- Third-Party Compatible Boards/Clones

- End-User:

- Industrial/Commercial (IIoT, Automation, Embedded Systems)

- Educational Institutions (STEM, Research Laboratories)

- Hobbyists and DIY Enthusiasts

- Healthcare and Consumer Electronics

- Application:

- Internet of Things (IoT) Prototyping and Deployment

- Robotics and Automation

- Environmental and Agricultural Monitoring

- Smart Home and Building Automation

- Wearable Technology and Health Monitoring Systems

Value Chain Analysis For Arduino Compatible Platform Market

The value chain for the Arduino Compatible Platform Market begins with the highly specialized upstream segment, dominated by semiconductor manufacturers and component suppliers. This initial stage involves the fabrication of critical microcontrollers (e.g., AVR, ARM Cortex-M, ESP series), memory chips, and passive components. Key upstream activities include semiconductor research and development, chip design, wafer fabrication, and packaging. The quality and cost of these core components directly influence the final product's performance and market price. Because the platform relies heavily on standardized, low-cost microcontrollers, the bargaining power of these major semiconductor suppliers remains significant, though the open nature of the platform encourages sourcing flexibility and competitive pressure among chip makers.

Midstream activities encompass the actual design and manufacturing of the compatible boards and accompanying peripherals (shields and modules). This involves PCB layout design, component sourcing, surface-mount technology (SMT) assembly, quality control testing, and firmware flashing. This segment is highly diversified, ranging from official Arduino manufacturers ensuring strict adherence to standards, to numerous third-party providers (often based in Asia Pacific) focusing on cost optimization and specialized feature integration. Software development, including the creation and maintenance of the Integrated Development Environment (IDE), core libraries, and operating system kernels (where applicable), also forms a crucial midstream activity, essential for user accessibility and platform functionality.

The downstream segment focuses on distribution channels and end-user engagement. Direct channels involve sales through proprietary websites and specialized maker stores, offering tailored support and community resources. Indirect distribution channels utilize major e-commerce platforms (Amazon, eBay, specialized electronics distributors) and large-scale industrial supply houses, crucial for reaching a global user base and fulfilling bulk industrial orders. Potential customers include students purchasing kits, small businesses prototyping IoT devices, and large corporations integrating sensor networks. The value chain concludes with post-sales support, community forums, and educational content, which are disproportionately important in the open-source market, driving platform loyalty and continuous improvement through user feedback.

Arduino Compatible Platform Market Potential Customers

The primary consumers of Arduino Compatible Platforms are segmented across three major categories: educational users, individual developers/hobbyists, and commercial/industrial enterprises. Educational institutions, ranging from secondary schools implementing basic coding and electronics lessons to university research labs conducting complex robotics and IoT research, represent a large and continually renewable customer base. These buyers seek platforms that are durable, widely supported by teaching materials, and cost-effective for large classroom deployment, focusing on the accessibility that Arduino's open-source framework provides.

Individual developers and the thriving global community of hobbyists constitute the foundational support structure of the market. These users purchase platforms for personal projects, rapid prototyping, learning new skills, or developing small-scale consumer products before potential commercialization. Their buying decisions are heavily influenced by platform features (connectivity, processing speed), community support, and overall component flexibility, often driving demand for the latest, most powerful compatible boards that push the boundaries of low-cost computing.

The fastest-growing segment, Commercial and Industrial users, deploys these platforms for proof-of-concept testing, creating customized sensor network nodes, and low-volume embedded applications, especially within the context of Industry 4.0 and IIoT. These enterprises, including system integrators, manufacturing facilities, and smart city developers, require high reliability, long-term supply commitments, and robust technical documentation, often leading them to prefer officially recognized or highly reputable third-party industrial-grade compatible boards. These customers are crucial as they transition from prototyping to large-scale deployment, offering significant opportunities for module and service providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 2.7 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Arduino AG, Microchip Technology, Espressif Systems, SparkFun Electronics, Adafruit Industries, Seeed Technology, DFRobot, STMicroelectronics, NXP Semiconductors, Renesas Electronics, Texas Instruments, Cypress Semiconductor, Analog Devices, Silicon Labs, Rockchip. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Arduino Compatible Platform Market Key Technology Landscape

The technology landscape supporting the Arduino Compatible Platform Market is centered on three core pillars: microcontroller architectures, standardized communication protocols, and sophisticated software development ecosystems. At the heart of the platform are diverse microcontroller families, shifting progressively from the traditional 8-bit AVR architecture to more powerful 32-bit options based on ARM Cortex-M series (e.g., SAMD, STM32) and the increasingly popular low-power Wi-Fi-enabled ESP32/ESP8266 chips. This migration to 32-bit processing is critical, enabling higher clock speeds, increased memory capacity, and the execution of more complex tasks, including efficient integration of TinyML algorithms at the edge. Technological advancements also focus heavily on miniaturization and power efficiency, crucial for embedding these platforms into smaller, battery-dependent IoT devices.

Connectivity standards are another foundational element. While basic platforms rely on serial communication (UART, I2C, SPI), modern compatible boards prominently feature integrated wireless technologies. Wi-Fi and Bluetooth Low Energy (BLE) are standard for short-range local networking, but the growing demand for wide-area networking in industrial and environmental monitoring has accelerated the integration of LPWAN technologies like LoRa and NB-IoT. This technological push for ubiquitous connectivity is directly addressing the need for scalable, low-cost sensor network deployment across vast geographical areas. Furthermore, security hardware, such as crypto-authentication chips and secure bootloaders, is becoming mandatory, elevating the platforms’ suitability for commercial IoT deployment where data integrity and device security are paramount.

The software landscape is defined by the open-source Arduino IDE, which serves as the primary gateway for development. However, specialized vendors are increasingly offering proprietary or enhanced development environments that integrate seamlessly with professional tools like PlatformIO or specialized cloud platforms. Crucial technological advancements include the maturation of robust, extensive library ecosystems supporting thousands of sensors and modules, significantly reducing development time. Moreover, the integration of containerization and over-the-air (OTA) update mechanisms is enhancing the long-term maintainability and scalability of deployed compatible devices, moving them closer to professional embedded systems standards. This continuous evolution in hardware power and software robustness ensures the platform remains relevant amidst rising expectations for IoT device performance and security.

Regional Highlights

The global Arduino Compatible Platform market exhibits distinct growth patterns influenced by regional technological maturity, industrialization rates, and educational policies. North America holds a significant market share, characterized by high adoption rates in research and development, particularly in robotics, advanced IoT startups, and the presence of a robust maker culture. The region benefits from early technological adoption and substantial private sector investment in embedded systems and AIoT prototyping. Demand here often centers on high-performance, specialized boards capable of handling complex data processing and secure cloud connectivity.

Europe, driven by Industry 4.0 initiatives, shows strong demand in industrial automation and manufacturing sectors, where Arduino compatible platforms are utilized for initial feasibility studies and deploying customized machine monitoring solutions. Western European countries emphasize reliability and adherence to strict regulatory standards, fostering demand for certified and robust industrial-grade compatible hardware. The emphasis on technical education across the EU also ensures a steady pipeline of developers familiar with the ecosystem, sustaining long-term market interest.

Asia Pacific (APAC) is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is primarily attributed to fast-paced industrialization in countries like China, India, and South Korea, coupled with massive consumer electronics manufacturing bases that utilize these platforms for product testing and rapid iteration. Furthermore, large government initiatives promoting science and technology education in densely populated nations create an immense base of student and hobbyist users, making APAC both a key manufacturing hub and the largest consumer market by volume. Finally, Latin America and the Middle East & Africa (MEA) are emerging markets, where adoption is accelerating due to increasing access to affordable technology and localized efforts to establish maker spaces and develop regional technological expertise, focusing heavily on basic connectivity and localized agricultural monitoring applications.

- North America: Leads in R&D and high-end IoT prototyping; strong presence of established tech companies and robust maker culture.

- Europe: High adoption in Industry 4.0 applications and educational institutions; emphasis on industrial certification and reliable performance.

- Asia Pacific (APAC): Fastest growing region due to mass manufacturing, rapid IoT deployment, and extensive STEM education programs; major manufacturing hub for third-party compatible boards.

- Latin America: Growing utilization in educational and small business sectors; increasing focus on smart agriculture and localized infrastructure monitoring.

- Middle East and Africa (MEA): Nascent market showing potential in smart city initiatives and educational technology adoption, fueled by improving internet penetration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Arduino Compatible Platform Market.- Arduino AG

- Microchip Technology Inc.

- Espressif Systems (Shanghai) Co., Ltd.

- SparkFun Electronics

- Adafruit Industries

- Seeed Technology Co., Ltd.

- DFRobot

- STMicroelectronics N.V.

- NXP Semiconductors N.V.

- Renesas Electronics Corporation

- Texas Instruments Incorporated

- Cypress Semiconductor (now part of Infineon Technologies)

- Analog Devices, Inc.

- Silicon Labs

- Rockchip (Fuzhou Rockchip Electronics Co., Ltd.)

- M5Stack Technology Co., Ltd.

- Pololu Corporation

- GlobalFoundries Inc.

- Tinkerforge GmbH

- Digilent Inc.

Frequently Asked Questions

Analyze common user questions about the Arduino Compatible Platform market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between official Arduino and compatible platforms?

The primary difference lies in manufacturing source and branding. Official Arduino boards are produced by Arduino AG, adhering strictly to quality control and design standards, while compatible platforms (clones or variants) are manufactured by third-party companies, often introducing specialized features or optimizing for lower cost, leveraging the open-source hardware design.

How is Edge AI impacting the future design of Arduino compatible boards?

Edge AI, particularly TinyML, necessitates boards with significantly greater processing power, increased RAM/Flash memory, and sometimes dedicated hardware acceleration (NPUs) to run machine learning inference models locally. Future designs prioritize integration of powerful 32-bit microcontrollers (like ESP32 or SAMD) to support low-latency intelligent IoT applications.

Which sector drives the largest commercial demand for Arduino compatible platforms?

The Industrial IoT (IIoT) sector drives the largest commercial demand. Companies utilize these platforms for rapid prototyping, developing customized sensor networks for automation, monitoring industrial equipment health, and implementing initial proofs-of-concept before transitioning to highly specialized industrial controllers for mass deployment.

What are the main connectivity standards integrated into modern Arduino compatible platforms?

Modern platforms integrate standard connectivity protocols like Wi-Fi and Bluetooth Low Energy (BLE) for local networking. Increasingly crucial for wide-area deployment are LPWAN technologies such as LoRa, NB-IoT, and Cat-M, enabling long-range, low-power data transmission required for remote environmental and agricultural monitoring.

What are the main limitations restricting the use of Arduino compatible platforms in high-scale commercial projects?

The main limitations include lower processing power and memory capacity compared to commercial industrial PCs, lack of standard industrial certifications (e.g., specific UL or explosion-proof ratings), and concerns regarding long-term component supply guarantees and dedicated 24/7 technical support required for mission-critical enterprise deployments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager