Armored Unmanned Underwater Vehicle Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432020 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Armored Unmanned Underwater Vehicle Market Size

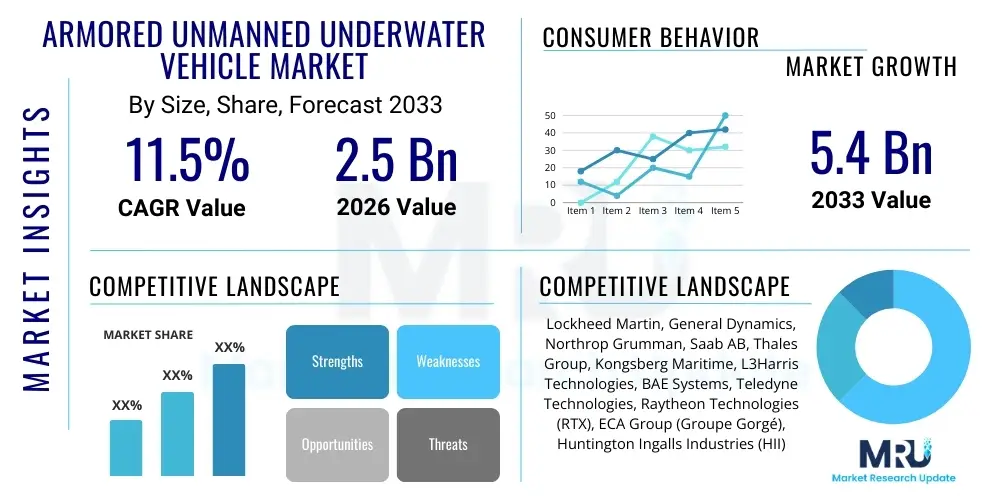

The Armored Unmanned Underwater Vehicle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 5.4 Billion by the end of the forecast period in 2033.

Armored Unmanned Underwater Vehicle Market introduction

The Armored Unmanned Underwater Vehicle (AUUV) market encompasses highly robust, autonomous submersible platforms designed for missions in challenging and potentially hostile maritime environments. Unlike conventional UUVs, AUUVs incorporate advanced protective layers, often utilizing composite materials, ceramic plating, or specialized pressure hull designs, to withstand extreme pressures, physical impact, acoustic detection, and potential weapon threats. These vehicles are primarily deployed by naval forces, homeland security agencies, and deep-sea energy companies requiring guaranteed operational integrity under adverse conditions, providing critical capabilities in surveillance, intelligence gathering, mine countermeasures, and critical infrastructure protection.

Key applications for AUUVs span military defense operations, including anti-submarine warfare (ASW) and reconnaissance missions near strategic choke points, where resilience against attack is paramount. Furthermore, in the commercial sector, armored UUVs are increasingly utilized for inspecting deep-sea oil and gas infrastructure, particularly pipelines and subsea wells, where harsh currents, abrasive environments, and the need for longevity necessitate hardened designs. The integration of high-end navigation systems, advanced sensing payloads, and sophisticated communication technologies enhances their operational range and data collection efficiency, positioning them as irreplaceable assets for sovereign defense and critical resource management.

The principal driving factors accelerating market expansion include escalating geopolitical tensions leading to increased naval expenditure, the necessity for prolonged underwater operational endurance without human risk, and rapid technological advancements in energy storage and materials science. The benefits derived from AUUVs—such as reduced operational costs compared to manned submarines, enhanced stealth capabilities, and the ability to operate in areas too dangerous for human divers—further solidify their demand across global defense and research sectors. As nations focus on maintaining maritime superiority and protecting exclusive economic zones, the procurement of robust, armored UUV systems remains a top strategic priority.

Armored Unmanned Underwater Vehicle Market Executive Summary

The Armored Unmanned Underwater Vehicle market is characterized by robust investment driven primarily by military modernization programs focused on asymmetric warfare capabilities and deep-sea asset protection. Business trends indicate a shift towards modular designs, allowing for easy payload interchangeability and rapid mission reconfiguration, catering to both military and high-value commercial inspection tasks. Strategic partnerships between traditional defense contractors and specialized robotics firms are becoming common, aiming to integrate Artificial Intelligence (AI) for enhanced autonomy and real-time decision-making, which is crucial for reducing operator load and improving mission success rates in complex environments.

Regional trends highlight North America and Asia Pacific as the dominant growth hubs. North America, driven by the substantial R&D budgets of the US Navy and supportive government policies, focuses on long-endurance, large-diameter AUUVs for persistent surveillance. Conversely, the Asia Pacific market is experiencing rapid adoption spurred by maritime territorial disputes and the necessity to secure extensive coastlines and strategic waterways, leading to significant procurement of smaller, more maneuverable armored vehicles suitable for littoral defense operations. Europe, while stable, emphasizes technological superiority, particularly in acoustic stealth and sophisticated sensor integration, positioning its companies as key innovators in specialized components.

Segment trends reveal that the Defense/Military application segment dominates the market share due to unparalleled requirements for vehicle durability and mission criticality. Furthermore, the Medium UUV segment (defined by size and endurance) is witnessing the fastest growth, balancing necessary payload capacity and operational flexibility. Technology segmentation shows significant investment flowing into advanced propulsion systems, such as fuel cells and high-density lithium-ion batteries, which are essential for fulfilling the extended mission durations demanded by armored vehicle weights. The market forecasts sustained high growth, underpinned by consistent investment in material science improvements to enhance vehicle survivability.

AI Impact Analysis on Armored Unmanned Underwater Vehicle Market

Users frequently inquire about how Artificial Intelligence will transform the operational capabilities and mission profiles of Armored UUVs. Key concerns revolve around the safety and reliability of autonomous decision-making in high-stakes military scenarios, the integration of complex sensor data fusion, and the development of robust machine learning algorithms capable of functioning reliably despite intermittent communication and potential jamming attempts. Expectations center on AI enabling true mission autonomy, specifically for tasks such as autonomous target identification, evasion maneuver execution under threat, predictive maintenance scheduling based on structural integrity monitoring, and optimizing energy consumption for extended operational periods. The core theme is leveraging AI to move AUUVs from pre-programmed systems to truly intelligent, adaptive warfighting and surveying platforms that require minimal human intervention.

- AI-driven sensor fusion enhances real-time environmental awareness and threat assessment, crucial for armored vehicle survivability.

- Machine learning algorithms enable sophisticated path planning and navigation optimization, minimizing acoustic signature and exposure to threats.

- Autonomous threat response and classification improve mission efficiency, allowing AUUVs to independently execute defensive or offensive maneuvers.

- Predictive maintenance analytics, powered by AI, monitor structural stress on the armored hull, reducing unexpected failures during long missions.

- Deep learning facilitates autonomous anomaly detection in deep-sea mapping and resource inspection data, accelerating post-mission analysis.

DRO & Impact Forces Of Armored Unmanned Underwater Vehicle Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the critical impact forces shaping the AUUV landscape. A primary driver is the accelerating maritime militarization globally, necessitating durable, stealthy, and persistent underwater surveillance and engagement platforms. The need to protect critical underwater infrastructure, such as fiber optic cables and oil pipelines, from physical damage or sabotage further mandates the deployment of highly resilient, armored systems. Opportunities are significant in developing advanced power sources, like closed-cycle diesel engines or compact nuclear power units, which could dramatically extend operational longevity, pushing AUUVs into the domain of truly persistent presence beneath the waves.

However, substantial restraints temper this growth trajectory. The initial acquisition cost of armored UUVs, given the specialized materials, complex integration of armor plating, and sophisticated sensor arrays, remains prohibitively high for many potential buyers outside of Tier 1 defense organizations. Furthermore, the inherent technological challenges associated with underwater communication and navigation, especially in deep-sea or cluttered littoral environments, pose significant operational hurdles. Regulatory complexities regarding the use of advanced military technologies and export controls also affect market expansion and cross-border collaboration, slowing the global diffusion of these advanced systems.

Impact forces are heavily skewed towards technological superiority and geopolitical pressures. The strategic shift towards unmanned systems is an irreversible force, driven by the goal of reducing human risk in dangerous environments. The impact of material science breakthroughs—particularly in developing lighter yet stronger composite armors—directly influences vehicle performance metrics like speed, depth rating, and payload capacity. Collectively, these forces demand continuous innovation, placing immense pressure on manufacturers to balance durability, stealth, and autonomous functionality while navigating a highly regulated and sensitive defense procurement environment, ensuring long-term viability and mission effectiveness.

Segmentation Analysis

The Armored Unmanned Underwater Vehicle market is segmented across several critical dimensions, including operational depth, size, application, and end-user. This multifaceted segmentation is essential for understanding the diverse requirements of the target market, which ranges from naval fleets requiring vehicles capable of traversing contested blue water environments to commercial entities focused on localized deep-sea infrastructure maintenance. The complexity of armored designs often means performance specifications vary widely between segments; for example, tactical defense AUUVs prioritize stealth and speed, whereas oil and gas inspection AUUVs focus on stability and high payload capacity for Nondestructive Testing (NDT) equipment. Analyzing these segments helps stakeholders tailor technology development and investment strategies to address the most lucrative and rapidly evolving areas of the market, ensuring products meet specific mission profiles.

- By Type (Size):

- Small UUV (Man-portable)

- Medium UUV (Tactical Grade)

- Large UUV (Strategic Grade/Gliders)

- By Depth Rating:

- Shallow Water (Up to 100m)

- Medium Depth (100m to 1,000m)

- Deep Water (Greater than 1,000m)

- By Application:

- Defense and Military (Reconnaissance, ASW, Mine Countermeasures)

- Commercial (Oil & Gas Inspection, Subsea Telecommunication Cable Maintenance)

- Scientific Research and Survey (Deep-sea mapping, Oceanography)

- By Technology/Propulsion System:

- Electric (Battery/Fuel Cell)

- Non-Electric (Autonomous Underwater Gliders/Hybrid Systems)

- By Material of Armor/Hull:

- High-Strength Steel Alloys

- Composite Materials (Carbon Fiber Reinforced Polymers)

- Ceramic Matrix Composites

Value Chain Analysis For Armored Unmanned Underwater Vehicle Market

The value chain for the Armored UUV market is highly specialized, beginning with upstream activities focused on the procurement and processing of advanced materials, particularly specialized alloys, stealth coatings, and composite fibers necessary for constructing the resilient, armored hulls. This stage also includes the design and manufacturing of critical, high-precision components such as advanced sensors (sonar, optical, magnetic), high-density power sources (Li-ion batteries and fuel cells), and robust navigation electronics capable of withstanding extreme pressure and shock. Efficiency and material science innovation at the upstream level directly determine the performance parameters and ultimate survivability of the final product, demanding strict quality control and specialized supplier relationships.

Midstream activities involve the complex integration and assembly of these components into the finished AUUV system. This process requires highly skilled engineering teams proficient in robotics, marine hydrodynamics, and software development, particularly for integrating AI-driven mission autonomy software and sophisticated acoustic processing capabilities. Validation and rigorous testing, often involving simulated and live environment trials, are essential steps at this stage, ensuring the armored vehicle meets stringent operational specifications set by defense or regulatory bodies. The supply chain is often tightly controlled due to the sensitive nature of the technology involved, frequently necessitating classified government involvement.

Downstream activities focus on distribution, deployment, and crucial post-sale support, including maintenance, system upgrades, and crew training for end-users like naval forces or specialized commercial fleets. Direct sales channels dominate the military segment, often involving competitive bidding processes and long-term support contracts handled directly by the prime defense contractor. Indirect channels, involving specialized maritime system integrators, are more common in the commercial sector, where integrators customize the basic platform with specific inspection or mapping payloads before delivery. The high cost and complexity of these vehicles necessitate robust maintenance services, often forming a significant recurring revenue stream for manufacturers, reinforcing the critical link between system longevity and comprehensive post-sale service frameworks.

Armored Unmanned Underwater Vehicle Market Potential Customers

The primary customers for Armored Unmanned Underwater Vehicles are governmental and military organizations, specifically naval forces and coast guard agencies across the globe. These entities utilize AUUVs for enhancing maritime domain awareness, conducting highly sensitive reconnaissance near adversarial coastlines, and performing critical tasks such as deep-sea mine countermeasures (MCM) where the armored protection ensures the integrity of the vehicle against accidental or intentional damage. Investment in these assets is directly correlated with national defense budgets and perceived geopolitical threats, making defense ministries the largest and most consistent purchasers of high-end armored platforms capable of prolonged, covert operations in contested waters.

Beyond the defense sector, the market serves specialized commercial industries requiring robust, reliable subsea assets for protecting and maintaining high-value infrastructure. Key commercial buyers include major international oil and gas corporations and offshore renewable energy developers who utilize AUUVs for detailed inspection of pipelines, risers, and wind farm foundations, particularly in deep or turbulent waters where conventional ROVs might struggle with resilience or efficiency. The need for continuous, reliable data collection under extreme environmental conditions drives these commercial entities to prioritize armored and durable UUV solutions, viewing the enhanced survivability as an essential factor for minimizing operational downtime and maximizing data quality.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 5.4 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lockheed Martin, General Dynamics, Northrop Grumman, Saab AB, Thales Group, Kongsberg Maritime, L3Harris Technologies, BAE Systems, Teledyne Technologies, Raytheon Technologies (RTX), ECA Group (Groupe Gorgé), Huntington Ingalls Industries (HII), Ocean Infinity, Boeing, Bluefin Robotics (General Dynamics Mission Systems), Fugro, ATLAS ELEKTRONIK GmbH, Subsea 7, Oceaneering International, Graal Tech srl |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Armored Unmanned Underwater Vehicle Market Key Technology Landscape

The technology landscape for the Armored Unmanned Underwater Vehicle market is defined by a commitment to enhancing resilience, endurance, and operational stealth. A major focus is on advanced materials science, specifically the development and implementation of next-generation composite hulls and ceramic matrix composites that offer superior strength-to-weight ratios compared to traditional steel alloys. These materials not only provide ballistic and shock protection required for armored status but also contribute significantly to reducing the vehicle's acoustic and magnetic signatures, enhancing stealth capabilities crucial for military operations. Furthermore, the integration of modular payload bays facilitates rapid configuration changes, allowing the same AUUV platform to switch efficiently between reconnaissance, weapons deployment, or inspection tasks, improving cost-effectiveness and operational flexibility.

Propulsion and energy storage represent another critical technological frontier. Given the heavy nature of armored hulls, achieving long mission endurance requires radical power solutions. High-energy density lithium-polymer and lithium-ion battery banks are standard, but the market is rapidly adopting closed-cycle diesel engines (CCDE) and advanced hydrogen fuel cells, which offer significantly extended operational periods for large-diameter AUUVs (LDUUVs). These specialized power systems enable multi-week missions, shifting the strategic role of AUUVs from tactical systems to strategic, persistent surveillance assets capable of crossing oceans autonomously, an essential capability demanded by global naval powers.

Crucially, the effectiveness of AUUVs hinges on sophisticated sensor and communication technology. Key systems include synthetic aperture sonar (SAS) for high-resolution underwater mapping, advanced Doppler velocity logs (DVL) for precise navigation, and integrated inertial navigation systems (INS) that minimize reliance on external, often unavailable, GPS signals underwater. Communication remains a challenge, necessitating the use of specialized acoustic modems and, increasingly, laser communication systems for high-bandwidth data transfer when the vehicle surfaces or is near a supporting vessel. The continuous refinement of AI algorithms for autonomous navigation and data processing ensures that the substantial armored investment translates into superior mission performance and actionable intelligence delivery.

Regional Highlights

- North America: North America, led by the United States, holds the largest market share, driven by aggressive investment from the U.S. Navy in long-endurance, large-diameter AUUV programs designed for deep-sea anti-submarine warfare (ASW) and strategic intelligence gathering. The region benefits from a robust ecosystem of established defense contractors, specialized marine robotics firms, and substantial government R&D funding specifically allocated to advanced autonomy and high-end materials research for armored platforms.

- Asia Pacific (APAC): The APAC region is projected to experience the fastest growth, fueled by intense maritime territorial disputes, the rapid expansion of naval fleets (especially in China, India, and South Korea), and the need to protect burgeoning offshore economic assets. Procurement often focuses on maneuverable medium-sized AUUVs suitable for littoral zone operations, demanding systems that offer high resilience against potential interference and attack in contested waterways.

- Europe: The European market maintains a strong position, focusing heavily on technological innovation, particularly in stealth features, sophisticated mine countermeasures (MCM) technologies, and standardized platform architectures (e.g., NATO requirements). Key expenditures are driven by modernization programs in the UK, France, and Germany, often involving international collaborations to share the high development costs associated with armored, deep-diving UUVs.

- Middle East and Africa (MEA): Growth in the MEA region is accelerating, primarily motivated by the critical requirement to secure vital oil and gas shipping lanes and coastal infrastructure against piracy and potential state-sponsored threats. Demand centers on surveillance and inspection AUUVs that prioritize ruggedness and operational reliability in the region’s challenging shallow-to-medium depth waters.

- Latin America: This region represents an emerging but steady market, where adoption is primarily driven by national coast guard mandates for enhancing maritime border security, combating illegal fishing, and conducting hydrographic surveys. Market focus is typically on more cost-effective, medium-sized armored platforms that offer essential protection against physical wear and tear in diverse oceanic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Armored Unmanned Underwater Vehicle Market.- Lockheed Martin

- General Dynamics

- Northrop Grumman

- Saab AB

- Thales Group

- Kongsberg Maritime

- L3Harris Technologies

- BAE Systems

- Teledyne Technologies

- Raytheon Technologies (RTX)

- ECA Group (Groupe Gorgé)

- Huntington Ingalls Industries (HII)

- Ocean Infinity

- Boeing

- Bluefin Robotics (General Dynamics Mission Systems)

- Fugro

- ATLAS ELEKTRONIK GmbH

- Subsea 7

- Oceaneering International

- Graal Tech srl

Frequently Asked Questions

Analyze common user questions about the Armored Unmanned Underwater Vehicle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between an Armored UUV and a standard UUV?

The primary distinction is the incorporation of enhanced protective materials, such as composite armor plating and shock-resistant hulls, designed to withstand extreme pressure, physical impacts, and potentially hostile actions, ensuring mission completion in dangerous environments where standard UUVs would fail.

Which factors are driving the fastest growth in the AUUV market?

Rapid growth is primarily driven by rising global geopolitical tensions, leading to increased defense spending on persistent maritime surveillance capabilities, coupled with technological advancements in AI for autonomous decision-making and high-density, long-endurance power systems essential for heavy armored platforms.

What are the key technological challenges currently facing armored UUV operations?

Key challenges include achieving reliable high-bandwidth communication underwater, ensuring the absolute precision of autonomous navigation systems without GPS reliance, and developing lightweight armor materials that do not excessively compromise speed, maneuverability, or payload capacity.

How is Artificial Intelligence (AI) being utilized to enhance Armored UUVs?

AI is crucial for enabling true mission autonomy, including sophisticated real-time threat detection, complex sensor data fusion for environmental mapping, optimization of stealth maneuvers, and predictive health monitoring of the armored hull and internal systems.

Which application segment holds the largest share in the Armored UUV market?

The Defense and Military application segment holds the largest market share globally, driven by mission-critical requirements for reconnaissance, anti-submarine warfare (ASW), and mine countermeasures (MCM) in contested and high-risk operational theaters.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager