Aromatic Ketone Polymers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439284 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Aromatic Ketone Polymers Market Size

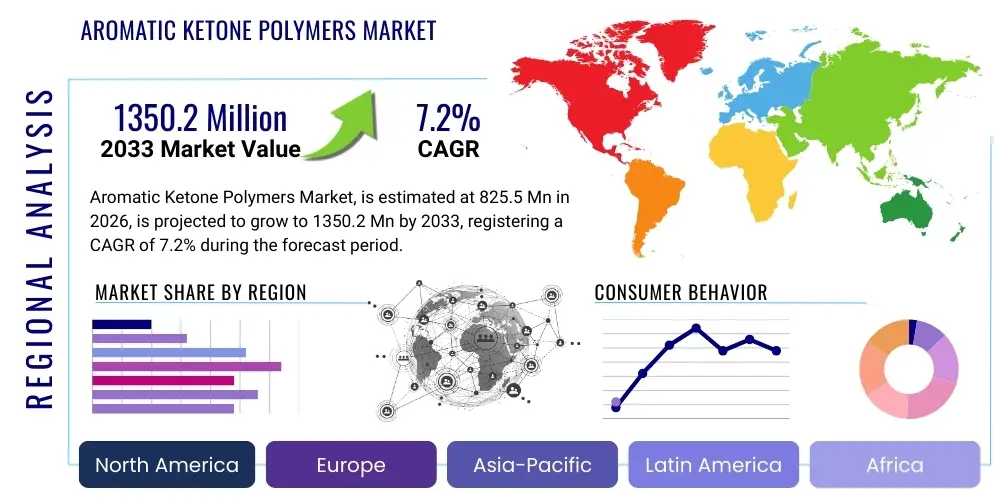

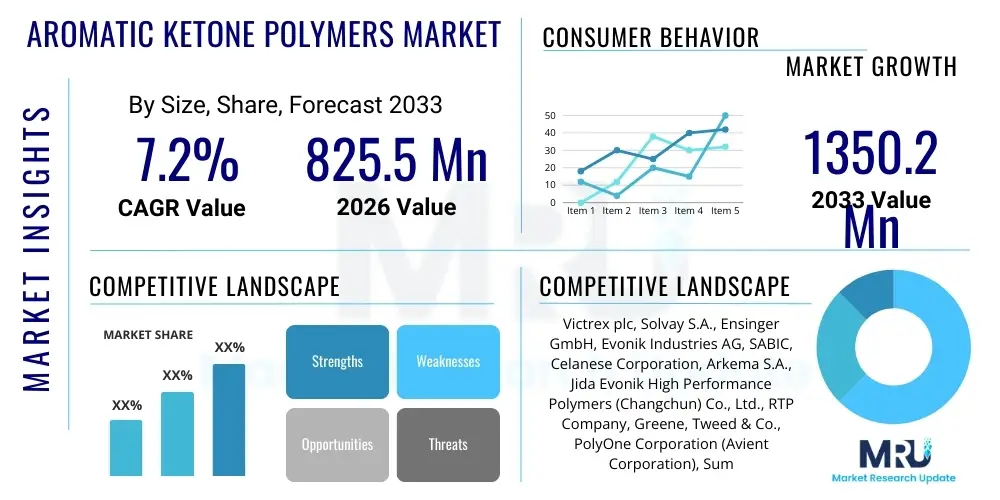

The Aromatic Ketone Polymers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 825.5 million in 2026 and is projected to reach USD 1350.2 million by the end of the forecast period in 2033.

Aromatic Ketone Polymers Market introduction

Aromatic Ketone Polymers constitute a highly specialized and critically important class of high-performance thermoplastic materials, renowned for their unparalleled combination of mechanical strength, exceptional thermal stability, and robust chemical resistance. Within this category, Polyether Ether Ketone (PEEK), Polyether Ketone (PEK), and Polyether Ketone Ketone (PEKK) stand out as the most prominent members, each offering distinct advantages tailored to specific industrial requirements. These advanced polymers are meticulously engineered to perform flawlessly in some of the most arduous and challenging operating environments, where conventional polymeric materials or even certain metals often fail to meet the rigorous demands of sustained performance, durability, and reliability. Their intrinsic molecular structure, characterized by rigid aromatic rings interconnected by flexible ether and ketone linkages, imparts the unique properties that differentiate them in the highly competitive materials landscape.

The extensive utility of Aromatic Ketone Polymers spans a broad spectrum of vital industries, driving innovation across aerospace, medical and healthcare, automotive, electrical and electronics, and the oil and gas sectors. In the aerospace industry, these polymers are instrumental in ongoing lightweighting initiatives, offering substantial weight savings over metallic components while maintaining or even surpassing their mechanical performance, crucial for enhancing fuel efficiency and reducing emissions. They are utilized in structural parts, interior components, and fluid handling systems that must endure extreme temperature fluctuations, radiation exposure, and aggressive hydraulic fluids. Within the medical and healthcare domain, their inherent biocompatibility, resistance to repeated sterilization cycles (such as autoclaving), and excellent wear properties make them indispensable for long-term implantable devices like spinal fusion cages, orthopedic joint replacements, and high-precision surgical instruments. Furthermore, their radio-translucency is a significant advantage in medical imaging applications.

The myriad benefits associated with the adoption of Aromatic Ketone Polymers are a primary catalyst for their market expansion. These include a superior strength-to-weight ratio, which is critical for performance-driven applications, coupled with outstanding fatigue and creep resistance, ensuring component integrity over extended operational periods under stress. Their low flammability, excellent dielectric properties, and inherent resistance to hydrolysis and harsh chemical agents further broaden their applicability. These attributes collectively contribute to a longer service life for components, significantly reducing maintenance frequency and associated costs, and enabling optimal operational efficiency even under the most severe conditions. The market's growth is predominantly propelled by several key driving factors: the escalating global demand for high-performance materials capable of operating in extreme conditions; continuous and rapid technological advancements in polymer synthesis and processing techniques, which lead to the development of novel grades and more efficient manufacturing methods; the robust expansion and innovation within the aerospace and medical device industries; and the persistent industry-wide focus on achieving lightweighting and enhanced fuel efficiency in the automotive and transportation sectors, particularly with the advent of electric vehicles.

Aromatic Ketone Polymers Market Executive Summary

The Aromatic Ketone Polymers market is currently navigating a period of significant expansion and strategic evolution, underpinned by a compelling demand for advanced materials across a multitude of high-stakes industries. Prevailing business trends underscore a strong, unwavering commitment to extensive research and development initiatives, aimed at not only innovating entirely new polymer grades but also refining existing ones to unlock enhanced properties and superior performance characteristics. This R&D thrust often encompasses the exploration of novel processing methodologies, such as additive manufacturing (3D printing), which is rapidly transforming how complex components are designed and produced, thereby broadening the application horizons and improving the overall cost-effectiveness of these materials. Moreover, the industry landscape is witnessing a surge in strategic collaborations, joint ventures, and targeted mergers and acquisitions among leading market players. These strategic maneuvers are primarily designed to fortify market positions, diversify and enhance product portfolios, and achieve greater operational efficiencies throughout the intricate global supply chain. A burgeoning, albeit nascent, trend within the market is the increasing focus on sustainable practices, with growing interest and preliminary efforts directed towards the development of bio-based high-performance polymers or advanced recycling technologies that can manage the end-of-life cycle of these durable materials, aligning with broader global environmental stewardship goals.

Analyzing regional dynamics reveals Asia Pacific as the undeniable powerhouse for growth within the Aromatic Ketone Polymers market, exhibiting the most rapid expansion rate globally. This phenomenal growth is primarily attributable to the region's burgeoning manufacturing capabilities, substantial government and private sector investments in critical infrastructure development, and the explosive expansion of its automotive, electrical and electronics, and medical device industries, particularly in economic giants like China, India, and South Korea. Conversely, North America and Europe steadfastly maintain their positions as established and dominant markets. These regions are characterized by highly mature aerospace, medical, and automotive sectors that possess deeply embedded requirements for the most advanced and reliable high-performance materials. Their market dominance is further reinforced by the prevalence of sophisticated technological adoption, robust innovation ecosystems, and stringent regulatory frameworks that actively encourage and often mandate the use of highly durable, safe, and reliable polymers, ensuring consistent demand for premium solutions.

From a segmentation perspective, Polyether Ether Ketone (PEEK) continues to command the largest market share, a testament to its long-standing reputation for exceptional performance, extensive track record, and broad applicability across numerous industries. However, other specialized polyketones, including PEK and PEKK, are rapidly gaining significant traction. This ascent is fueled by ongoing material science advancements that are optimizing their specific property profiles, making them increasingly suitable for highly niche and demanding applications, especially within the aerospace sector where they contribute to lighter yet stronger composite structures. In terms of physical form, traditional granules and powders remain dominant, serving as primary inputs for conventional molding and extrusion processes. Nevertheless, there is a discernable and accelerating trend towards the greater adoption of films and pre-impregnated composite forms. This shift is largely propelled by continuous advancements in manufacturing technologies, particularly in areas like filament winding and automated fiber placement, coupled with a surging demand for integrated, ready-to-use material solutions that streamline fabrication processes. The end-use industries of aerospace and medical consistently emerge as high-growth segments, demonstrating a sustained and robust appetite for these advanced polymers for their critical, high-value components.

AI Impact Analysis on Aromatic Ketone Polymers Market

The profound integration of Artificial Intelligence (AI) is set to catalyze a significant paradigm shift across the entire value chain of the Aromatic Ketone Polymers market, fundamentally altering processes from initial material discovery and sophisticated design iterations to highly optimized manufacturing and intricate supply chain management. Common user inquiries and industry discussions frequently center on the transformative potential of AI in accelerating the development of novel, high-performance polymer formulations, essentially shortening the notoriously long R&D cycles. There is a palpable interest in AI's capacity to accurately predict material performance characteristics under a diverse array of extreme operating conditions, thereby reducing the need for costly and time-consuming physical testing. Furthermore, a key area of focus is how AI can streamline complex and multi-stage production processes, leading to substantial reductions in manufacturing costs, minimization of material waste, and an overall enhancement in operational efficiency and output consistency.

Beyond material and process optimization, users are keenly interested in AI's multifaceted role in improving the stringent quality control protocols essential for high-performance polymers. AI-powered vision systems and analytical tools can detect microscopic defects and inconsistencies that human inspection might miss, ensuring superior product quality. The application of AI in enabling predictive maintenance for sophisticated polymer processing equipment is another area of high expectation, promising to minimize costly downtime, extend machinery lifespan, and ensure uninterrupted production flows. Additionally, AI's analytical prowess is anticipated to revolutionize market analysis and logistics, providing deeper insights into demand forecasting, optimizing inventory levels, and streamlining distribution networks. The long-term aspirations include leveraging AI to identify entirely novel applications for Aromatic Ketone Polymers or even to engineer "smart" polymers with adaptive or self-healing properties, thereby continuously pushing the boundaries of material science and solidifying the competitive advantage for early adopters of these advanced technologies.

- Accelerated Material Discovery: AI algorithms, utilizing machine learning and deep learning, can analyze vast datasets of chemical structures and experimental results to predict the properties of new Aromatic Ketone Polymer formulations, significantly shortening research and development cycles and identifying optimal compositions for specific applications.

- Process Optimization & Efficiency: AI-driven models can continuously monitor and analyze production parameters (temperature, pressure, flow rates) in real-time, enabling dynamic adjustments to optimize polymerization, compounding, and molding processes, leading to higher yields, reduced energy consumption, and lower manufacturing costs.

- Enhanced Quality Control: AI-powered vision systems and sensor networks can detect subtle defects, inconsistencies, and deviations from specifications in Aromatic Ketone Polymer products during manufacturing, ensuring superior quality, reducing waste, and improving batch-to-batch repeatability.

- Predictive Maintenance: Machine learning applications can analyze data from manufacturing equipment sensors to predict potential failures, allowing for proactive maintenance, minimizing costly downtime, extending equipment lifespan, and ensuring continuous, uninterrupted production.

- Supply Chain & Logistics Optimization: AI can forecast market demand with greater accuracy, optimize inventory management, and streamline logistics operations for raw materials and finished polymer products, leading to reduced holding costs and improved responsiveness to market fluctuations.

- Advanced Product Design & Simulation: AI-driven simulation tools can predict the performance of Aromatic Ketone Polymer components under various stress conditions (thermal, mechanical, chemical) before physical prototyping, reducing design iterations and accelerating time-to-market for new products.

- Customization and Personalization: AI can facilitate the rapid design and production of highly customized Aromatic Ketone Polymer parts, especially through additive manufacturing, catering to niche requirements in medical implants or complex aerospace components.

- Sustainability Initiatives: AI can assist in developing and optimizing advanced recycling processes for Aromatic Ketone Polymers, by identifying optimal separation and reprocessing methods, contributing to circular economy principles and reducing environmental impact.

DRO & Impact Forces Of Aromatic Ketone Polymers Market

The Aromatic Ketone Polymers market operates under the influence of a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting the impact forces that dictate its growth trajectory and competitive landscape. A primary driver is the pervasive and escalating global demand for exceptionally high-performance, lightweight, and inherently durable materials across critical industrial sectors such as aerospace and defense, advanced medical devices, and the evolving automotive industry. In these demanding environments, conventional materials, including many engineering plastics and even certain metals, simply fall short of meeting the increasingly stringent operational requirements, particularly concerning extreme temperatures, corrosive chemicals, and high mechanical stresses. The ongoing trend towards greater design complexity and ever-higher performance benchmarks for modern engineering applications, synergistically coupled with a universal industrial push for enhanced energy efficiency and extended product lifecycles, further galvanizes the widespread adoption of these advanced polymeric solutions. Additionally, continuous technological advancements, especially in sophisticated processing techniques like high-precision additive manufacturing and innovative composite fabrication methods, are systematically expanding the practical application possibilities for Aromatic Ketone Polymers, simultaneously making them more accessible and cost-effective for a broader range of end-users.

Despite these powerful drivers, the market faces significant restraints that temper its growth rate and market penetration. The foremost challenge remains the inherently high cost of Aromatic Ketone Polymers when compared to more conventional engineering plastics, which inevitably limits their pervasive adoption in more price-sensitive or high-volume applications where cost-performance ratios are paramount. The manufacturing processes for these specialized polymers are complex, capital-intensive, and often energy-demanding, requiring highly specialized equipment, rigorous process control, and a skilled workforce, all of which contribute to elevated production expenses. Furthermore, the global supply chain for key raw materials, such as specific monomers and precursors, can be relatively concentrated and prone to price volatility, introducing an element of risk and uncertainty for polymer producers. The market also contends with intense competition from an array of alternative high-performance materials, including advanced fiber-reinforced composites, specialized technical ceramics, and high-strength alloys. These competing materials can, in certain niche applications, offer comparable performance attributes, thus necessitating continuous innovation in Aromatic Ketone Polymers to maintain a distinct competitive edge and justify their premium pricing.

Notwithstanding the existing challenges, the Aromatic Ketone Polymers market is replete with significant growth opportunities that promise to reshape its future landscape. The burgeoning demand emanating from rapidly industrializing emerging economies, particularly across the Asia Pacific region, presents vast untapped potential as these nations accelerate their infrastructure development, expand their manufacturing bases, and modernize their industrial capabilities. The continuous expansion into novel application sectors, such as renewable energy systems (e.g., wind turbine components, solar panel frames), the rapidly evolving electric vehicle (EV) market (for lightweight battery enclosures, power electronics), and next-generation communication devices, offers fresh and lucrative avenues for substantial market growth. Concurrently, ongoing, intensive research and development efforts are diligently focused on creating more cost-effective and energy-efficient production methodologies, exploring entirely new polymer grades with superior or custom-tailored properties, and pioneering sustainable end-of-life solutions, including advanced chemical and mechanical recycling techniques. These initiatives are expected to unlock previously inaccessible market segments, address environmental concerns, and drive a new wave of innovations that will define the future trajectory and sustained expansion of the Aromatic Ketone Polymers market.

Segmentation Analysis

The Aromatic Ketone Polymers market is meticulously segmented across various crucial parameters to offer a comprehensive and granular understanding of its intricate structure, underlying dynamics, and inherent growth opportunities. These detailed segmentations are indispensable analytical tools, vital for deciphering nuanced market trends, pinpointing high-growth areas, and formulating highly targeted, effective strategic interventions. The primary segmentation categories encompass the specific polymer type, the physical form in which the polymer is supplied, its diverse range of applications, and the various end-use industries it serves. Each of these categories provides unique and critical insights into the prevailing market demand patterns, supply-side characteristics, and the competitive forces at play within distinct sub-markets. This exhaustive breakdown facilitates an in-depth analysis of how different product attributes, material specifications, and exacting end-user requirements intricately influence market share distribution, pricing strategies, and overall growth rates across the global landscape, enabling stakeholders to make informed decisions.

- By Type: This segmentation differentiates the market based on the specific chemical composition and structure of the aromatic ketone polymer, directly influencing its performance characteristics and suitability for various applications.

- Polyether Ether Ketone (PEEK): The most widely recognized and commercially dominant type, prized for its excellent balance of mechanical properties, high-temperature resistance, and chemical inertness. Used extensively in aerospace, medical implants, and automotive.

- Polyether Ketone (PEK): Offers slightly higher glass transition and melting temperatures than PEEK, providing enhanced performance in even more extreme thermal environments, often targeted for very high-temperature applications.

- Polyether Ketone Ketone (PEKK): Known for its superior compressive strength and excellent adhesion properties, often preferred in aerospace composites and additive manufacturing due to its tunable crystallization rate.

- Polyether Ketone Ether Ketone Ketone (PEKEKK): A less common but highly specialized variant offering a unique combination of properties, often developed for niche, ultra-high-performance applications.

- Other Aromatic Ketone Polymers: Includes emerging or less commercially prevalent aromatic polyketones with specific property profiles, often undergoing R&D for future applications.

- By Form: This category distinguishes the market based on the physical state in which the polymer is supplied to manufacturers, impacting processing methods and final product attributes.

- Granules: The most common form, used in standard thermoplastic processing techniques like injection molding and extrusion for producing a wide array of parts.

- Powder: Utilized for specialized processing methods such as rotational molding, coatings, and particularly critical for powder bed fusion (SLS/HSS) additive manufacturing processes.

- Films: Thin sheets of polymer used for electrical insulation, barrier layers, and flexible printed circuits in electronics, aerospace, and medical applications requiring high performance and flexibility.

- Fibers: Extruded filaments used for weaving, braiding, or as reinforcement in advanced composites, offering high strength-to-weight ratios for aerospace and sporting goods.

- Composites: Pre-impregnated materials (prepregs) or compounded pellets where aromatic ketone polymers are combined with reinforcing fibers (e.g., carbon fiber, glass fiber) to achieve superior mechanical properties.

- Stock Shapes (Rods, Plates, Tubes): Semi-finished products that are machined into final components, offering versatility for prototyping and low-volume, high-precision applications.

- By End-Use Industry: This segmentation highlights the major sectors that consume Aromatic Ketone Polymers, reflecting the critical needs met by these advanced materials.

- Aerospace & Defense: For lightweight, high-temperature resistant components, interior parts, electrical connectors, and fluid systems in aircraft, rockets, and drones.

- Medical & Healthcare: For biocompatible implants (spinal, orthopedic, dental), surgical instruments, and sterilization-resistant medical devices.

- Automotive: Utilized for under-the-hood components, electrical insulation, brake systems, transmission parts, and structural elements for lightweighting and durability, increasingly important in electric vehicles.

- Electrical & Electronics: For high-performance connectors, insulators, circuit board components, and semiconductor manufacturing equipment due to excellent dielectric properties and thermal stability.

- Oil & Gas: For seals, bearings, downhole components, and pumps that operate under high pressure, high temperature, and corrosive chemical environments.

- Industrial: For wear plates, gears, bearings, compressor parts, and chemical processing equipment requiring excellent mechanical strength, abrasion, and chemical resistance.

- Food & Beverage: For processing equipment components that require high hygiene standards, chemical resistance to cleaning agents, and high-temperature performance.

- Other Industries: Includes applications in nuclear, marine, renewable energy (wind, solar), and textile machinery, leveraging unique polymer attributes.

- By Application: This category focuses on the specific functions or parts for which Aromatic Ketone Polymers are used within various industries.

- Bearings & Bushings: Utilized for their low friction, high wear resistance, and ability to operate without lubrication at elevated temperatures.

- Gears: Employed in applications requiring high mechanical strength, quiet operation, and resistance to fatigue.

- Seals & Gaskets: Chosen for their chemical inertness, high-temperature stability, and excellent elastic recovery under harsh conditions.

- Connectors & Insulators: Critical in electronics for their high dielectric strength, thermal resistance, and dimensional stability.

- Medical Implants & Devices: Essential for biocompatibility, radiolucency, and mechanical properties mimicking bone in long-term bodily contact.

- Structural Components: Used in aerospace and automotive for lightweighting and high strength requirements.

- Wire & Cable Insulation: Provides superior electrical insulation and thermal protection in demanding environments.

- Pump & Valve Components: For their chemical resistance and durability in corrosive fluid handling systems.

- Coatings: Applied as protective layers for corrosion resistance, wear resistance, and non-stick properties in various industrial equipment.

- 3D Printing Filaments: Growing application for rapid prototyping, complex part production, and customized medical devices.

Value Chain Analysis For Aromatic Ketone Polymers Market

The value chain for Aromatic Ketone Polymers is inherently intricate and extends across multiple interdependent stages, each contributing distinct value and involving specialized stakeholders. The upstream segment represents the foundational phase, primarily focused on the rigorous synthesis and purification of highly specialized monomers, which serve as the essential chemical building blocks for these advanced polymers. Key precursors typically include hydroquinone, 4,4'-difluorobenzophenone, and terephthaloyl chloride, among others. Manufacturers operating in this segment are predominantly highly specialized chemical companies with deep expertise in fine chemical synthesis and purification techniques. They supply these critical monomers to polymer producers, initiating the subsequent polymerization process. This initial stage demands significant capital investment in state-of-the-art chemical synthesis facilities, coupled with exceptionally stringent quality control measures to ensure the uncompromising purity and consistent chemical composition of both the monomers and the resulting polymers, as even minor impurities can drastically affect the final material properties.

Moving into the midstream, the core activity involves the transformation of these raw monomers into various commercial forms of Aromatic Ketone Polymers by specialized polymer producers. This complex process typically employs advanced polymerization techniques such as nucleophilic aromatic substitution, conducted under precisely controlled conditions. The resulting polymers are then processed into different primary forms, including high-purity granules, fine powders, or highly stable resins. This stage is characterized by intense technological sophistication and often involves proprietary synthesis routes and material formulations, with leading players holding extensive patent portfolios that protect their innovative processes and product differentiation. Subsequent to basic polymer production, these materials are often further converted into semi-finished products by specialized converters. This can include producing thin films for electronic applications, durable fibers for advanced textiles or composites, or various stock shapes such as rods, sheets, and tubes, which are then used as feedstock for further manufacturing processes, catering to diverse industrial requirements.

The downstream segment of the value chain is dedicated to the component manufacturing phase, where the semi-finished polymer products are meticulously transformed into final, functional components for a vast array of end-use industries. This stage often involves highly precise engineering and sophisticated manufacturing technologies, including advanced injection molding for intricate parts, extrusion for profiles, compression molding for large components, and increasingly, additive manufacturing (3D printing) for complex geometries and customized designs. These processes require specialized machinery, tooling, and skilled operators capable of handling the unique processing characteristics of Aromatic Ketone Polymers. The distribution channels for these high-value polymers are dual-pronged, encompassing both direct sales and indirect networks. Direct sales are particularly prevalent for large-volume orders and highly specialized applications, where polymer manufacturers engage in close, collaborative partnerships with major end-users (e.g., aerospace OEMs, leading medical device manufacturers). These direct relationships often involve extensive technical support, co-development initiatives, and customized material solutions. Indirect channels, conversely, leverage a network of authorized distributors, local agents, and specialized material suppliers who cater to a broader base of smaller to medium-sized enterprises (SMEs) or specific regional markets, providing ready access to a wider range of product forms, localized inventory, and essential technical assistance. The efficiency and robustness of these multifaceted distribution channels are paramount for ensuring broad market penetration and effectively delivering these high-performance materials to a diverse customer base, coupled with the necessary application-specific technical guidance.

Aromatic Ketone Polymers Market Potential Customers

The discerning clientele for Aromatic Ketone Polymers encompasses a broad and sophisticated spectrum of end-users, predominantly situated within high-performance industries that possess an unyielding demand for materials exhibiting exceptional thermal endurance, superior mechanical integrity, and robust chemical resistance. The aerospace and defense sector stands out as a particularly significant and strategically vital customer segment, consistently leveraging these polymers for an extensive range of critical applications. This includes the fabrication of lightweight structural components that contribute directly to improved fuel efficiency, intricate interior parts, advanced electrical connectors, and sophisticated fluid handling systems for both commercial aircraft and cutting-edge military platforms, including satellites and unmanned aerial vehicles (UAVs). The intrinsic ability of these polymers to withstand extreme temperature fluctuations, sustained radiation exposure, and highly corrosive hydraulic fluids makes them utterly indispensable, contributing directly to extended operational lifespans and enhanced safety protocols across various aviation and defense platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 825.5 million |

| Market Forecast in 2033 | USD 1350.2 million |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Victrex plc, Solvay S.A., Ensinger GmbH, Evonik Industries AG, SABIC, Celanese Corporation, Arkema S.A., Jida Evonik High Performance Polymers (Changchun) Co., Ltd., RTP Company, Greene, Tweed & Co., PolyOne Corporation (Avient Corporation), Sumitomo Chemical Co., Ltd., DSM (Covestro AG), Daikin Industries, Ltd., Asahi Kasei Corporation, Lehmann & Voss & Co. KG (LEHVOSS Group), Saint-Gobain S.A., PBI Performance Products Inc., Panjin Zhongrun High Performance Polymers Co., Ltd., ZYEX Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aromatic Ketone Polymers Market Key Technology Landscape

The technological landscape underpinning the Aromatic Ketone Polymers market is a dynamic and continuously evolving domain, characterized by persistent innovation aimed at fundamentally enhancing material properties, substantially improving processing efficiencies, and significantly expanding the application versatility of these advanced materials. At its core, the synthesis of these high-performance polymers relies on sophisticated and often proprietary polymerization techniques, predominantly nucleophilic aromatic substitution reactions. Ongoing research and development efforts are intensely focused on optimizing these complex reaction conditions, including catalyst systems, solvent choices, and temperature profiles, with the primary objective of achieving higher purity levels, precise control over molecular weight distribution, and ultimately, improved scalability for industrial production. Furthermore, the development of highly specialized compounding technologies plays a crucial role, allowing for the meticulous incorporation of various fillers, such as carbon fiber, glass fiber, and other advanced reinforcing agents, alongside specific additives. This compounding enables the creation of customized polymer grades with finely tuned mechanical, thermal, electrical, or tribological properties, ensuring that the material precisely matches the exacting demands of specific end-use requirements.

Regional Highlights

- North America: This region stands as a highly mature and significant market for Aromatic Ketone Polymers, characterized by substantial and consistent demand originating from its robust aerospace and defense, advanced medical, and innovative automotive industries. The market here is defined by high levels of investment in research and development, fostering rapid technological advancements, and a strong tendency for early adoption of cutting-edge materials. The United States, with its dominant position in high-tech manufacturing and stringent quality standards, is the principal contributor to the market in this region, followed by Canada and Mexico which also show steady growth.

- Europe: A leading market driven by a strong manufacturing base in the automotive, industrial machinery, and medical device sectors. Countries such as Germany, France, the United Kingdom, and Switzerland are key contributors. The region's stringent environmental regulations and a pervasive industrial focus on lightweighting, energy efficiency, and reducing carbon footprints are significant drivers for the adoption of high-performance polymers. Europe also boasts a robust innovation ecosystem with strong academic-industrial collaborations in material science.

- Asia Pacific (APAC): Positioned as the fastest-growing region globally for Aromatic Ketone Polymers, APAC's expansion is fueled by its rapidly burgeoning manufacturing bases, extensive industrialization initiatives, and substantial governmental and private investments in infrastructure development. The increasing demand from its massive automotive, thriving electronics, and expanding medical device industries, particularly in economic powerhouses like China, India, Japan, and South Korea, is propelling market growth. The region's focus on technological self-reliance and export-oriented manufacturing further amplifies the need for high-performance materials.

- Latin America: An emerging market for Aromatic Ketone Polymers, demonstrating increasing industrial activities and a growing focus on diversified manufacturing capabilities. Investments in infrastructure projects, coupled with the expansion of the automotive and oil & gas sectors in countries like Brazil and Mexico, are creating new and promising opportunities for these advanced polymers. While smaller in scale compared to developed regions, the market shows strong potential for steady growth driven by modernization.

- Middle East & Africa (MEA): This region exhibits growing demand, particularly from its expansive oil & gas sector. Driven by continuous exploration, production, and refining activities, there is a critical need for high-performance materials that can withstand extremely harsh operating environments of high pressure, high temperature, and corrosive chemicals. Furthermore, ongoing economic diversification efforts in countries like Saudi Arabia and UAE, involving significant investments in industrial, construction, and infrastructure projects, are also contributing to increasing opportunities for Aromatic Ketone Polymers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aromatic Ketone Polymers Market.- Victrex plc

- Solvay S.A.

- Ensinger GmbH

- Evonik Industries AG

- SABIC

- Celanese Corporation

- Arkema S.A.

- Jida Evonik High Performance Polymers (Changchun) Co., Ltd.

- RTP Company

- Greene, Tweed & Co.

- PolyOne Corporation (Avient Corporation)

- Sumitomo Chemical Co., Ltd.

- DSM (Covestro AG)

- Daikin Industries, Ltd.

- Asahi Kasei Corporation

- Lehmann & Voss & Co. KG (LEHVOSS Group)

- Saint-Gobain S.A.

- PBI Performance Products Inc.

- Panjin Zhongrun High Performance Polymers Co., Ltd.

- ZYEX Ltd.

Frequently Asked Questions

Analyze common user questions about the Aromatic Ketone Polymers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are Aromatic Ketone Polymers and their primary applications?

Aromatic Ketone Polymers, encompassing types such as PEEK, PEK, and PEKK, are a class of high-performance thermoplastics distinguished by their exceptional mechanical strength, superior thermal stability, and robust chemical resistance. Their primary applications span critical sectors including aerospace (for lightweight, high-temperature components), medical (biocompatible implants, surgical instruments), automotive (under-the-hood parts, electrical insulation), and electrical/electronics (high-performance connectors and insulators), owing to their ability to endure and perform reliably in the most extreme operating environments.

Why are Aromatic Ketone Polymers considered high-performance materials?

These polymers earn their high-performance classification due to a unique confluence of properties. They offer an outstanding strength-to-weight ratio, excellent fatigue and creep resistance ensuring longevity under stress, high continuous use temperatures often exceeding 260°C, and broad chemical inertness against a wide array of aggressive substances. Additionally, their low flammability, superior dielectric strength, and resistance to hydrolysis and radiation enable them to outperform conventional materials and even certain metals in demanding engineering applications, contributing to enhanced safety, durability, and operational efficiency.

What are the main factors driving the growth of the Aromatic Ketone Polymers market?

The market's growth is primarily propelled by several interconnected factors. A surging global demand for lightweight, high-strength, and durable materials across critically important industries like aerospace, medical, and automotive is a key driver. Furthermore, continuous advancements in polymer science and sophisticated processing technologies, including additive manufacturing, are expanding application possibilities. The relentless focus on energy efficiency, reduced emissions, and extended product lifecycles in the transportation sector, coupled with the robust expansion of high-tech manufacturing in emerging economies, significantly fuels their adoption.

What are the key challenges faced by the Aromatic Ketone Polymers market?

Despite their exceptional properties, the Aromatic Ketone Polymers market encounters notable challenges. The most prominent restraint is the inherently high initial material cost compared to more conventional engineering plastics, which can limit widespread adoption in price-sensitive applications. Additionally, their manufacturing processes are complex, capital-intensive, and require specialized equipment and expertise. The market also faces intense competition from alternative advanced materials, such as high-performance composites and specialized metals, which can offer comparable performance in specific niche areas, necessitating ongoing innovation to maintain a competitive edge and justify their premium pricing.

How is additive manufacturing impacting the Aromatic Ketone Polymers market?

Additive manufacturing (3D printing) is profoundly transforming the Aromatic Ketone Polymers market by enabling unprecedented design freedom and accelerating product development. Technologies like FDM, SLS, and HSS are now capable of processing polymers such as PEEK and PEKK, allowing for the creation of highly complex geometries, customized components, and lightweight structures that were previously impossible with traditional methods. This innovation facilitates rapid prototyping, on-demand production, and tailored solutions for high-value applications in aerospace, medical implants, and specialized industrial parts, significantly reducing lead times, material waste, and tooling costs while fostering greater design flexibility and functional integration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager