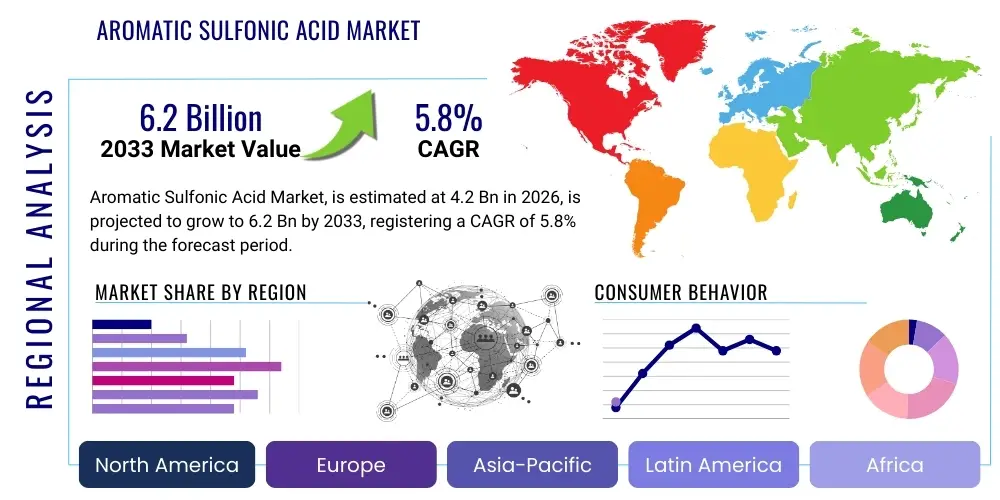

Aromatic Sulfonic Acid Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439447 | Date : Jan, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Aromatic Sulfonic Acid Market Size

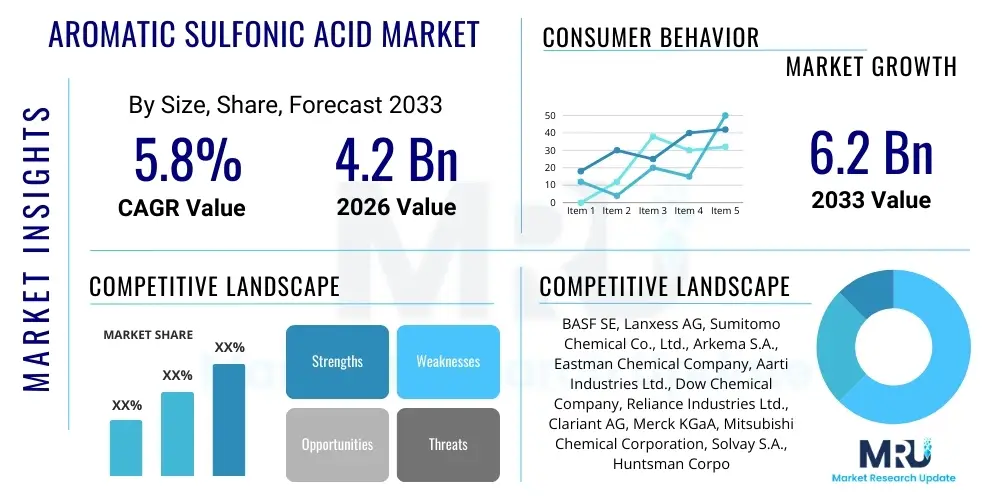

The Aromatic Sulfonic Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Aromatic Sulfonic Acid Market introduction

The Aromatic Sulfonic Acid market encompasses a critical segment within the specialty chemicals industry, involving organic compounds characterized by a sulfonyl group (-SO2OH) directly attached to an aromatic ring. These versatile chemical intermediates are pivotal in numerous industrial processes due to their strong acidic properties, high reactivity, and excellent solubility. The market's growth is inherently linked to the expansion and innovation within its diverse application sectors, driving a steady demand for these essential building blocks.

Major applications for aromatic sulfonic acids span across a broad spectrum of industries, including the production of dyes and pigments, pharmaceuticals, detergents, agrochemicals, and various specialty chemicals. In the textile industry, they are crucial for synthesizing vibrant and durable dyes. For the pharmaceutical sector, these compounds serve as key intermediates in the synthesis of active pharmaceutical ingredients (APIs) and other therapeutic agents. Their surfactant properties make them indispensable in the formulation of detergents and cleaning agents, enhancing their emulsifying and cleaning efficiencies.

The primary benefits of aromatic sulfonic acids include their effectiveness as strong acids and excellent solubility promoters, which are critical in many chemical reactions and formulations. They act as catalysts, solubilizers, and emulsifying agents, facilitating processes that might otherwise be inefficient or impossible. Driving factors for the market's sustained expansion include the increasing global demand for specialty chemicals, the continuous growth of end-use industries such as textiles and pharmaceuticals, and the rising emphasis on improved product performance and formulation efficacy across various consumer and industrial applications.

Aromatic Sulfonic Acid Market Executive Summary

The Aromatic Sulfonic Acid market is currently experiencing robust business trends driven by the escalating demand from diverse industrial sectors. Manufacturers are focusing on process optimization, enhancing production capacities, and developing new derivatives to cater to specific application requirements. There is a notable emphasis on sustainable production practices, including greener synthesis routes and waste reduction, as environmental regulations become more stringent globally. Furthermore, strategic collaborations and mergers and acquisitions are shaping the competitive landscape, allowing companies to consolidate market share and expand their product portfolios, addressing a wider array of customer needs and market opportunities.

Regionally, the market exhibits significant variances in growth and consumption patterns. Asia Pacific stands out as the dominant and fastest-growing region, primarily due to rapid industrialization, burgeoning textile and pharmaceutical industries, and increasing disposable incomes in countries like China and India. North America and Europe, while mature markets, continue to demonstrate stable demand, driven by innovation in specialty chemicals and a strong focus on advanced pharmaceutical research and development. Latin America, the Middle East, and Africa are emerging as promising markets, propelled by economic development, infrastructure projects, and increasing investments in their respective industrial bases, creating new avenues for market expansion.

In terms of segmentation trends, the Dodecylbenzenesulfonic Acid (DBSA) segment continues to hold a substantial share, primarily owing to its extensive use in detergent and surfactant formulations. However, segments like Naphthalenesulfonic Acid and Toluenesulfonic Acid are also witnessing steady growth, fueled by their critical roles in dye synthesis and pharmaceutical intermediates, respectively. The application segments such as detergents and surfactants, followed by dyes and pigments, consistently contribute significantly to market revenue. The pharmaceutical application segment is poised for accelerated growth, driven by an aging global population and increasing healthcare expenditure, leading to higher demand for pharmaceutical intermediates.

AI Impact Analysis on Aromatic Sulfonic Acid Market

User inquiries regarding the impact of AI on the Aromatic Sulfonic Acid market frequently revolve around themes of operational efficiency, supply chain optimization, and the potential for accelerated research and development. Common questions often explore how AI can enhance synthesis processes, improve predictive maintenance of manufacturing equipment, and contribute to the discovery of novel aromatic sulfonic acid derivatives or more sustainable production methods. Concerns are also raised about the initial investment required for AI integration, the need for specialized skills, and the ethical implications of data usage, reflecting a cautious yet optimistic outlook on AI's transformative potential in this specialized chemical sector.

- AI can significantly optimize chemical synthesis processes, leading to higher yields and reduced energy consumption through predictive modeling and real-time process control.

- Predictive maintenance powered by AI algorithms can minimize equipment downtime in production facilities, thereby improving operational efficiency and reducing maintenance costs.

- Supply chain management can be revolutionized by AI, enabling more accurate demand forecasting, inventory optimization, and robust logistics planning, which reduces lead times and enhances responsiveness.

- AI-driven material discovery platforms can accelerate the research and development of novel aromatic sulfonic acid derivatives with enhanced properties or new applications, fostering innovation.

- Quality control processes can be made more precise and consistent through AI-powered anomaly detection in production data, ensuring higher product purity and adherence to specifications.

- Environmental impact assessment and mitigation strategies can be improved by AI models that analyze production data to identify areas for waste reduction and energy efficiency, aligning with sustainability goals.

DRO & Impact Forces Of Aromatic Sulfonic Acid Market

The Aromatic Sulfonic Acid market is propelled by several key drivers, primarily stemming from the robust growth across its end-use industries. The escalating global demand for detergents and cleaning agents, driven by urbanization and improved hygiene standards, forms a significant impetus. Concurrently, the expansion of the textile industry, particularly in emerging economies, necessitates a consistent supply of aromatic sulfonic acids for dye and pigment synthesis. Furthermore, the pharmaceutical sector's continuous innovation and increasing need for complex chemical intermediates to develop new drugs and therapies also substantially contribute to market expansion, ensuring sustained demand for these versatile compounds.

However, the market also faces considerable restraints that could impede its growth trajectory. Stringent environmental regulations concerning chemical waste disposal, emissions, and the use of certain chemicals pose significant challenges for manufacturers, often requiring substantial investments in compliance technologies and sustainable practices. The inherent volatility in raw material prices, such as benzene and sulfur, which are key inputs for aromatic sulfonic acid production, can significantly impact manufacturing costs and profit margins. Moreover, competition from alternative chemical intermediates or processes in specific applications, though limited for core uses, can also present a restraint in niche segments.

Opportunities within the Aromatic Sulfonic Acid market largely center on innovation and market expansion. There is a growing scope for research and development into sustainable production methods, including bio-based alternatives and more energy-efficient synthesis routes, aligning with global sustainability initiatives. The development of novel aromatic sulfonic acid derivatives tailored for high-performance applications in emerging sectors like advanced materials or specialized agrochemicals offers significant growth potential. Furthermore, geographic expansion into untapped or rapidly industrializing markets, particularly in Africa and parts of Southeast Asia, represents a lucrative opportunity for market players to diversify their revenue streams and increase their global footprint. These dynamic forces collectively shape the market's evolution, demanding strategic adaptation from industry participants.

Segmentation Analysis

The Aromatic Sulfonic Acid market is comprehensively segmented to provide a granular understanding of its diverse components and dynamics. This segmentation typically includes analysis by type of aromatic sulfonic acid, application areas, and end-use industries, offering insights into specific product demand, sectoral consumption patterns, and regional market behaviors. These classifications allow for a detailed assessment of market opportunities, competitive landscapes, and strategic positioning for various stakeholders across the value chain. Understanding these segments is crucial for manufacturers, suppliers, and end-users to identify high-growth areas and tailor their strategies effectively within this complex chemical market.

- By Type:

- Benzenesulfonic Acid

- Toluenesulfonic Acid

- Naphthalenesulfonic Acid

- Xylenesulfonic Acid

- Dodecylbenzenesulfonic Acid (DBSA)

- Other Aromatic Sulfonic Acids (e.g., Anthraquinonesulfonic Acid, Cumene Sulfonic Acid)

- By Application:

- Dyes and Pigments:

- Textile Dyes

- Food Dyes

- Printing Inks

- Coatings and Paints

- Pharmaceuticals:

- Active Pharmaceutical Ingredients (APIs)

- Pharmaceutical Intermediates

- Detergents and Surfactants:

- Household Cleaners

- Industrial Cleaners

- Personal Care Products

- Agrochemicals:

- Pesticides

- Herbicides

- Fungicides

- Plastics and Polymers:

- Catalysts for Polymerization

- Polymer Additives

- Other Applications:

- Corrosion Inhibitors

- Ion Exchange Resins

- Chemical Reagents

- Rubber Chemicals

- Dyes and Pigments:

- By End-Use Industry:

- Textile Industry

- Pharmaceutical Industry

- Agriculture Sector

- Personal Care & Cosmetics Industry

- Chemical Manufacturing

- Food & Beverage Industry

- Oil & Gas Industry

- Pulp and Paper Industry

Value Chain Analysis For Aromatic Sulfonic Acid Market

The value chain for the Aromatic Sulfonic Acid market commences with upstream activities involving the sourcing and processing of essential raw materials. Key raw materials include aromatic hydrocarbons such as benzene, toluene, and naphthalene, which are typically derived from crude oil refining and petrochemical processes. Sulfur trioxide or concentrated sulfuric acid are also critical inputs for the sulfonation reaction. Suppliers of these base chemicals, often large petrochemical companies or sulfur producers, form the initial link in the chain. The quality and consistent supply of these raw materials are paramount to the production of high-grade aromatic sulfonic acids, influencing both cost and final product performance.

Midstream activities involve the chemical synthesis and purification of various aromatic sulfonic acids. Manufacturers utilize established sulfonation processes, often employing batch or continuous reactors, followed by neutralization, washing, and drying steps to achieve the desired product purity and form. This stage is capital-intensive, requiring specialized chemical engineering expertise and stringent quality control measures to ensure product specifications are met. Innovation in this segment focuses on improving reaction efficiency, reducing energy consumption, and developing greener synthesis routes to enhance sustainability and cost-effectiveness, thereby adding significant value to the final product.

Downstream analysis highlights the intricate distribution channels and the diverse end-user applications for aromatic sulfonic acids. Products are distributed through both direct sales channels to large industrial clients and indirect channels via chemical distributors, agents, and wholesalers who cater to smaller businesses and niche markets. The choice of distribution channel often depends on the scale of demand, geographic reach, and specific client requirements. End-users span multiple sectors, including textile, pharmaceutical, agrochemical, and detergent industries, where aromatic sulfonic acids are formulated into finished products or used as critical intermediates, underscoring their broad industrial importance and the complex network connecting producers to final consumers.

Aromatic Sulfonic Acid Market Potential Customers

The primary potential customers for aromatic sulfonic acids are diverse industrial entities that utilize these compounds as crucial intermediates or performance additives in their manufacturing processes. Major buyers include chemical manufacturers specializing in the production of dyes and pigments, where aromatic sulfonic acids are indispensable for imparting color and enhancing fastness properties to textiles, inks, and coatings. These customers typically require large volumes and consistent quality, forming long-term supply agreements with manufacturers to ensure stable production of their own end products, reflecting a high demand from the vibrant and evolving colorant industry.

Another significant segment of potential customers comprises pharmaceutical companies and contract manufacturing organizations (CMOs). These entities use aromatic sulfonic acids as key building blocks for synthesizing a wide array of active pharmaceutical ingredients (APIs), excipients, and other fine chemicals critical to drug development and production. The stringent quality requirements and regulatory standards within the pharmaceutical sector necessitate high-purity aromatic sulfonic acids, leading these buyers to seek out suppliers with robust quality assurance systems and comprehensive regulatory support. This segment is characterized by a demand for specialized derivatives and reliable supply chains for critical drug components.

Furthermore, detergent and surfactant manufacturers represent a substantial customer base, particularly for products like Dodecylbenzenesulfonic Acid (DBSA), which is a major component in household and industrial cleaning agents. Agrochemical companies also constitute important buyers, as they utilize aromatic sulfonic acids in the synthesis of pesticides, herbicides, and fungicides, essential for agricultural productivity. Other significant end-users include producers of specialty polymers, corrosion inhibitors, and ion exchange resins, each leveraging the unique chemical properties of aromatic sulfonic acids to enhance the performance and functionality of their respective products, indicating a broad and varied customer landscape driven by specific industrial needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Lanxess AG, Sumitomo Chemical Co., Ltd., Arkema S.A., Eastman Chemical Company, Aarti Industries Ltd., Dow Chemical Company, Reliance Industries Ltd., Clariant AG, Merck KGaA, Mitsubishi Chemical Corporation, Solvay S.A., Huntsman Corporation, Stepan Company, Sanyo Chemical Industries, Ltd., Akzo Nobel N.V., SABIC, Covestro AG, Daicel Corporation, Dorf Ketal Chemicals. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aromatic Sulfonic Acid Market Key Technology Landscape

The Aromatic Sulfonic Acid market is underpinned by a diverse and evolving technological landscape, primarily centered around sulfonation processes. Traditional methods involve the reaction of aromatic compounds with concentrated sulfuric acid or oleum. However, modern advancements emphasize more efficient, environmentally friendly, and selective sulfonation techniques. Key technologies include continuous sulfonation reactors, which offer better control over reaction conditions, improved yields, and reduced by-product formation compared to conventional batch processes. These continuous systems often incorporate sophisticated process automation and control systems, enhancing operational safety and product consistency, which are crucial for high-volume production demands.

Another significant technological area involves the use of sulfur trioxide (SO3) as a sulfonating agent. Gas-phase SO3 sulfonation, particularly in falling film reactors, is a highly effective method that allows for precise control over the reaction, minimizing charring and improving product purity, especially for heat-sensitive aromatic compounds. This technology is particularly valuable for producing high-quality linear alkylbenzene sulfonic acids (LABSA), a critical component in the detergent industry. Furthermore, advancements in catalysis are exploring the use of solid acid catalysts or enzymatic methods for sulfonation, aiming to reduce the use of corrosive reagents and simplify downstream separation processes, thereby offering greener and more sustainable alternatives to conventional methods.

The integration of process analytical technology (PAT) and real-time monitoring systems is also transforming the production landscape. PAT allows for in-line or at-line measurement of critical process parameters and product attributes, enabling immediate adjustments and ensuring optimal reaction performance and consistent product quality. Beyond production, advancements in purification techniques, such as membrane filtration and advanced crystallization methods, contribute to achieving higher purity grades required for specialized applications like pharmaceuticals and electronics. These technological improvements collectively drive efficiency, reduce environmental impact, and enhance the overall competitiveness of aromatic sulfonic acid manufacturers in a demanding global market.

Regional Highlights

- North America: This region represents a mature market with stable demand, driven by a strong presence of pharmaceutical and specialty chemical industries. Innovation in R&D, stringent environmental regulations necessitating advanced processing, and robust manufacturing infrastructure contribute to its consistent market share.

- Europe: Characterized by high environmental awareness and strict regulations, Europe focuses on sustainable production methods and high-value applications. The region's well-established chemical, textile, and pharmaceutical industries ensure steady consumption, with a growing emphasis on green chemistry initiatives.

- Asia Pacific (APAC): The largest and fastest-growing market, APAC is fueled by rapid industrialization, urbanization, and increasing consumer demand in emerging economies like China, India, and Southeast Asian countries. Expansion of textile, pharmaceutical, and detergent manufacturing facilities significantly drives market growth.

- Latin America: This region exhibits emerging market potential, driven by developing industrial bases, increasing agricultural output, and rising disposable incomes. Countries like Brazil and Mexico are key contributors, with growing investments in chemical and manufacturing sectors.

- Middle East and Africa (MEA): While currently a smaller market, MEA is poised for growth, supported by investments in petrochemical industries, infrastructure development, and diversification efforts away from oil-dependent economies. The region presents new opportunities for market penetration and expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aromatic Sulfonic Acid Market.- BASF SE

- Lanxess AG

- Sumitomo Chemical Co., Ltd.

- Arkema S.A.

- Eastman Chemical Company

- Aarti Industries Ltd.

- Dow Chemical Company

- Reliance Industries Ltd.

- Clariant AG

- Merck KGaA

- Mitsubishi Chemical Corporation

- Solvay S.A.

- Huntsman Corporation

- Stepan Company

- Sanyo Chemical Industries, Ltd.

- Akzo Nobel N.V.

- SABIC

- Covestro AG

- Dorf Ketal Chemicals

- Adeka Corporation

Frequently Asked Questions

Analyze common user questions about the Aromatic Sulfonic Acid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of Aromatic Sulfonic Acids?

Aromatic sulfonic acids are primarily used in the production of dyes and pigments, pharmaceuticals, detergents and surfactants, and agrochemicals due to their strong acidic and surfactant properties.

Which factors are driving the growth of the Aromatic Sulfonic Acid market?

Market growth is driven by increasing demand from diverse end-use industries like textiles, pharmaceuticals, and detergents, coupled with global urbanization and rising hygiene standards.

What are the key challenges faced by manufacturers in this market?

Manufacturers face challenges such as stringent environmental regulations, volatility in raw material prices, and competition from alternative chemical intermediates in certain niche applications.

How is the Aromatic Sulfonic Acid market segmented?

The market is segmented by type (e.g., Benzenesulfonic Acid, DBSA), by application (e.g., Dyes, Pharma, Detergents), and by end-use industry (e.g., Textile, Pharmaceutical, Agriculture).

Which region holds the largest share in the Aromatic Sulfonic Acid market?

Asia Pacific currently holds the largest market share and is also the fastest-growing region, driven by rapid industrialization and significant expansion in key end-use industries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager