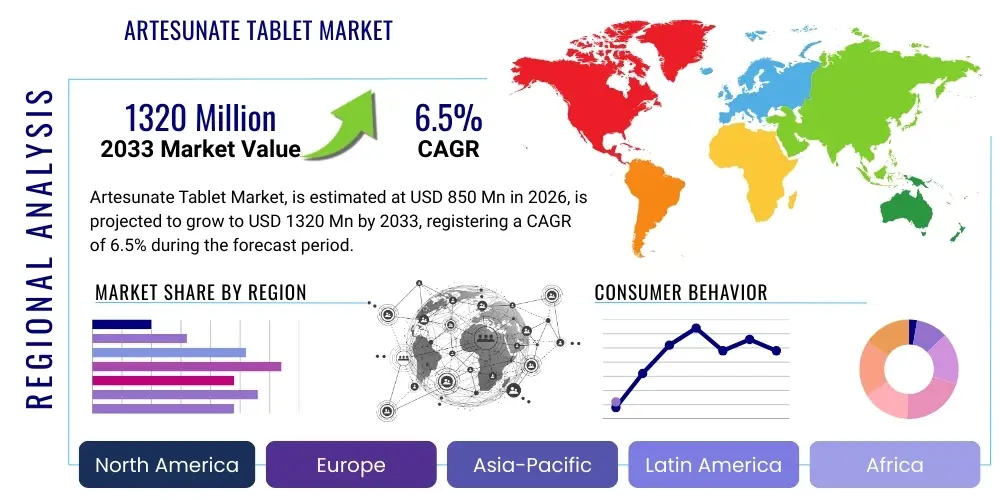

Artesunate Tablet Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437279 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Artesunate Tablet Market Size

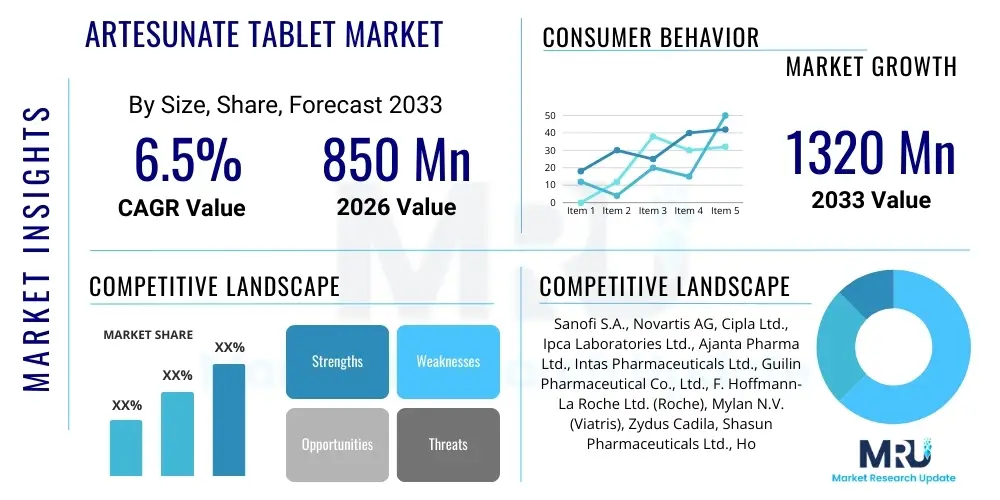

The Artesunate Tablet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1320 Million by the end of the forecast period in 2033.

Artesunate Tablet Market introduction

The Artesunate Tablet Market primarily encompasses the global supply and demand for artesunate-based antimalarial treatments. Artesunate, a potent, semi-synthetic derivative of artemisinin, serves as a critical component in Artemisinin Combination Therapies (ACTs), which are mandated by the World Health Organization (WHO) as the first-line treatment for uncomplicated Plasmodium falciparum malaria. The product’s fast-acting nature and high efficacy against drug-resistant strains drive its widespread adoption, particularly across endemic regions in Sub-Saharan Africa, Southeast Asia, and parts of Latin America. The market dynamics are intrinsically linked to global health initiatives focused on malaria eradication and control, necessitating substantial public sector investment and procurement.

Artesunate tablets are typically administered orally, often in combination with a partner drug to protect against the development of resistance and ensure complete parasite clearance. Major applications are centered on therapeutic interventions for acute malaria episodes. Beyond malaria, research is ongoing to explore potential applications of artemisinin derivatives in oncology and treating certain viral infections, though these uses remain nascent. The principal benefits of artesunate include its rapid clearance rate of parasites from the blood, its relatively low toxicity profile compared to older antimalarials, and its availability in various dosages suitable for both adults and children, often provided through co-packaged formulations.

Driving factors for sustained market growth include the persistent high global prevalence of malaria, despite intense eradication efforts, especially in highly populated tropical regions. Furthermore, continuous donor funding from organizations such as the Global Fund to Fight AIDS, Tuberculosis and Malaria, and the U.S. President’s Malaria Initiative (PMI) ensures stable demand and procurement volumes. The continuous threat of drug resistance to existing non-artemisinin treatments further solidifies the position of ACTs, specifically those using high-quality artesunate formulations, as the cornerstone of malaria management strategies globally. Regulatory approvals and prequalification by stringent bodies like the WHO are crucial for market entry and large-scale public procurement.

Artesunate Tablet Market Executive Summary

The Artesunate Tablet Market is defined by pronounced geographical disparities in consumption, dominated by high-burden malaria countries, and characterized by a reliance on large-scale governmental and non-governmental organization (NGO) procurement rather than traditional retail sales. Business trends indicate a strong push toward backward integration by major pharmaceutical manufacturers to secure stable artemisinin supply, often involving sourcing from centralized suppliers or investing in synthetic biology platforms to produce pharmaceutical-grade artemisinin precursors. Furthermore, there is a strategic shift towards developing fixed-dose combination (FDC) tablets, which improve patient compliance and simplify treatment protocols, enhancing overall public health outcomes and streamlining distribution logistics.

Regional trends are overwhelmingly focused on Africa, particularly West and Central Africa, which collectively account for the majority of global malaria cases and, consequently, the highest demand for artesunate. However, the Asia Pacific region, specifically India and Southeast Asian countries like Vietnam and Thailand, remains critical, serving both as key manufacturing hubs and secondary consumption markets facing unique challenges related to emerging drug resistance patterns. Ensuring supply chain resilience in these regions is paramount, involving improvements in cold chain logistics and last-mile distribution to rural health facilities.

Segment trends highlight the dominance of the standard dosage segments (typically 50mg and 100mg Artesunate combined with a partner drug) designed for uncomplicated malaria treatment. The institutional segment—comprising national malaria control programs and international aid agencies—remains the largest purchasing segment by volume. Technological advancements focus on improving the oral bioavailability of artesunate and extending patent life through novel formulation technologies. Economic trends suggest that price sensitivity remains high due to the massive procurement volumes, pressuring manufacturers to optimize production costs while maintaining stringent quality standards required for WHO prequalification.

AI Impact Analysis on Artesunate Tablet Market

User queries regarding AI’s influence on the Artesunate Tablet market generally revolve around how artificial intelligence can mitigate drug resistance, optimize complex global supply chains reaching remote endemic areas, and accelerate the discovery of next-generation artemisinin combination therapies (ACTs). Users are highly concerned about AI's potential role in predictive modeling for malaria outbreaks, which directly influences procurement and inventory management of artesunate tablets by national health systems. The consensus is that AI will not impact the active ingredient itself but revolutionize the periphery—from raw material yield optimization in synthetic or natural production to patient-specific dosing recommendations and public health logistics, ensuring the right quantity of artesunate reaches the affected population precisely when needed.

- AI-driven predictive modeling for malaria incidence, optimizing procurement quantities and minimizing stockouts in high-risk zones.

- Accelerated drug discovery and repositioning through machine learning, identifying novel partner drugs for artesunate to combat emerging parasite resistance.

- Optimization of the artemisinin supply chain, including precision agriculture for Artemisia annua or yield enhancement in synthetic biology production using AI algorithms.

- Enhanced quality control and detection of counterfeit artesunate tablets through AI image analysis and blockchain integration in the distribution channel.

- Development of personalized treatment protocols and resistance surveillance systems utilizing AI to analyze genomic data of local parasite strains.

DRO & Impact Forces Of Artesunate Tablet Market

The market for Artesunate Tablets is profoundly shaped by global health policy, endemic disease patterns, and pharmacological research dynamics. Key market drivers include the sustained commitment from international health bodies and governments to eradicate or control malaria, ensuring massive, reliable procurement contracts. Restraints primarily center on the constant evolutionary threat of drug resistance, particularly to artemisinin itself, which necessitates continuous R&D investment and poses risks to long-term efficacy. Opportunities arise from expanding access to formal healthcare in previously underserved regions and developing superior, heat-stable, and highly bioavailable formulations.

The primary impact forces stem from regulatory mandates, particularly the strict adherence to WHO guidelines requiring ACTs as the standard of care, effectively shutting out non-ACT monotherapies. This regulatory pressure dictates market competition and pricing. Secondly, the epidemiological force of malaria morbidity and mortality directly controls the demand volume; any successful reduction in incidence could eventually restrain growth, but current prevalence levels sustain robust demand. Geopolitical stability and public funding cycles significantly influence procurement budgets, acting as powerful external impact forces that determine the viability of large-scale supply contracts necessary for manufacturer profitability.

These dynamics create a complex operating environment where manufacturers must balance cost efficiency for high-volume procurement with the significant investment required for continuous quality control and resistance monitoring. Furthermore, the reliance on a single natural source (artemisinin) or complex synthetic routes makes the supply chain vulnerable to environmental or industrial disruptions, highlighting the need for diversification and strategic stockpiling. The continuous battle between pharmaceutical innovation and parasitic evolution is the defining long-term challenge facing the stability and efficacy of the Artesunate Tablet Market.

Segmentation Analysis

The Artesunate Tablet Market is meticulously segmented based on Dosage, Application, and Distribution Channel, reflecting the diverse clinical needs and complex procurement landscape inherent to malaria treatment. Segmentation by Dosage allows manufacturers and procurement agencies to tailor supplies for specific patient demographics, such as pediatric formulations requiring lower doses (e.g., 50mg) versus adult treatments (e.g., 100mg or 200mg). The dominance of combination therapies means that formulations often include a fixed dose of the partner drug, crucial for preventing resistance and maximizing clinical efficacy across varied endemic settings globally.

Segmentation by Application is straightforward, with the overwhelming majority of artesunate use dedicated to the Treatment of Uncomplicated P. falciparum Malaria. However, the 'Other Infections' segment includes exploratory research and clinical trials investigating the immunomodulatory and anti-proliferative properties of artemisinin derivatives, particularly in adjunct cancer therapy or treating specific parasitic infections beyond malaria. While currently small, advancements in this segment represent a significant long-term growth opportunity, contingent upon robust clinical validation and regulatory approval for new indications.

The Distribution Channel segmentation is critical, distinguishing between high-volume, public sector procurement channels (Institutional/Hospital Pharmacies) and smaller, but growing, private sector segments (Retail and Online Pharmacies). The Institutional channel, supported by national governments and large NGOs like UNICEF and MSF, dictates market pricing and volume. Conversely, the growth of Retail and Online Pharmacies in urbanized endemic regions provides greater accessibility for private patients capable of self-paying, though regulatory monitoring is essential to prevent misuse and the development of monotherapy resistance.

- By Dosage:

- 50 mg

- 100 mg

- 200 mg

- Other Dosages (including pediatric formulations)

- By Application:

- Uncomplicated Malaria Treatment (Dominant Segment)

- Severe Malaria Treatment (Often uses IV formulation, but impacts oral post-treatment protocol)

- Other Infections (e.g., experimental oncology applications)

- By Distribution Channel:

- Hospital Pharmacies and Institutional Procurement

- Retail Pharmacies

- Online Pharmacies and E-commerce

Value Chain Analysis For Artesunate Tablet Market

The Artesunate Tablet value chain is complex, starting with the cultivation and extraction of artemisinin (the precursor) or its synthetic production, followed by complex pharmaceutical synthesis, manufacturing, and highly regulated global distribution. Upstream analysis focuses on the supply of artemisinin, whether derived from Artemisia annua farming (often concentrated in China, Vietnam, and East Africa) or produced synthetically through microbial fermentation (synthetic biology). Securing consistent quality and quantity of this precursor is a major challenge, subject to agricultural cycles and technological scaling barriers. Manufacturers must ensure that raw materials meet stringent WHO Good Manufacturing Practice (GMP) standards before converting artemisinin into the active pharmaceutical ingredient (API), dihydroartemisinin (DHA), and subsequently synthesizing artesunate.

Midstream activities involve the formulation and tableting process, where the artesunate API is combined with excipients and the partner drug (e.g., mefloquine, amodiaquine, or pyronaridine) to create the final ACT tablet. This stage requires advanced manufacturing facilities adhering to global quality standards (e.g., WHO Prequalification, US FDA, EMA), as poor formulation can drastically reduce bioavailability and efficacy. Quality assurance and control are paramount at this stage to prevent substandard and falsified medicines from entering the market, a critical concern in endemic regions.

Downstream analysis highlights the vital role of the distribution channel, which is bifurcated into direct and indirect channels. The direct channel involves large institutional buyers—National Malaria Control Programs (NMCPs) and NGOs—who purchase massive quantities directly from prequalified manufacturers. The indirect channel relies on wholesalers, distributors, and regional medical stores to supply private clinics and retail pharmacies. Due to the humanitarian nature of the market, efficient logistics, often subsidized by global health funds, are necessary to ensure the tablets reach the remote, last-mile health centers where they are most needed, demanding sophisticated supply chain management optimized for fragile regions.

Artesunate Tablet Market Potential Customers

The primary customers for Artesunate Tablets are large governmental and non-governmental procurement entities operating within malaria-endemic areas. The largest buyers are national ministries of health in countries such as Nigeria, the Democratic Republic of Congo, India, and Mozambique, which utilize these drugs for their publicly funded malaria control and treatment programs. These entities require extremely large volumes and prioritize WHO prequalification, competitive pricing, and guaranteed stability of supply to manage nationwide distribution effectively, making them the cornerstone of the market demand structure.

International and supranational organizations represent the second major customer base. These include the Global Fund, UNICEF, the Clinton Health Access Initiative (CHAI), and Médecins Sans Frontières (MSF). These groups often act as procurers or funders, ensuring that high-quality, subsidized artesunate tablets are distributed across multiple developing nations, frequently leveraging bulk purchasing power to drive down prices through tenders and pooled procurement mechanisms. Their demand is highly sensitive to funding cycles and epidemiological data, making their annual procurement volumes variable but consistently high.

Finally, individual patients and private healthcare providers in regions where private medical services are accessible constitute the tertiary customer segment. While the majority of artesunate tablets are dispensed for free or at heavily subsidized rates through public programs, private hospitals, clinics, and urban retail pharmacies cater to a segment of the population preferring private care or quick access outside of public health services. These buyers prioritize brand reputation, immediate availability, and potentially novel formulations, though the overall volume remains significantly lower than institutional procurement.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1320 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sanofi S.A., Novartis AG, Cipla Ltd., Ipca Laboratories Ltd., Ajanta Pharma Ltd., Intas Pharmaceuticals Ltd., Guilin Pharmaceutical Co., Ltd., F. Hoffmann-La Roche Ltd. (Roche), Mylan N.V. (Viatris), Zydus Cadila, Shasun Pharmaceuticals Ltd., Holley-Cotec Pharmaceuticals, Bliss GVS Pharma Ltd., Hetero Drugs Ltd., GSK plc, Fosun Pharma, Shin Poong Pharmaceutical Co. Ltd., Alkem Laboratories Ltd., Macleods Pharmaceuticals Ltd., Sumitomo Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Artesunate Tablet Market Key Technology Landscape

The technology landscape governing the Artesunate Tablet market is primarily characterized by advancements in pharmaceutical synthesis, formulation science, and, increasingly, sustainable raw material sourcing. A significant technological shift involves the move from relying exclusively on artemisinin extracted from the Artemisia annua plant to semi-synthetic production methods. Synthetic biology, leveraging genetically modified yeast to produce artemisinic acid (a precursor readily converted to artemisinin), offers a stabilized, high-purity, and potentially more scalable supply source compared to traditional agriculture, mitigating price volatility and seasonal crop failures that have historically plagued the market.

Formulation technology is another key area of innovation. Given that artesunate is often administered in combination, fixed-dose combination (FDC) tablets represent a major technological focus. FDCs must ensure that both active ingredients are released optimally, maintaining stability and bioavailability under diverse climatic conditions, especially high heat and humidity prevalent in endemic areas. Manufacturers employ specialized excipients and coating techniques to enhance shelf life and stability, which is essential for WHO Prequalification and large-scale distribution across challenging logistical environments.

Furthermore, technology is being deployed to combat the endemic issue of substandard and falsified (SF) artesunate medicines. Technologies such as high-resolution anti-counterfeiting measures, spectral analysis integrated into packaging, and the utilization of distributed ledger technology (blockchain) for tracking supply chain provenance are becoming increasingly important. These measures aim to guarantee the quality and authenticity of legitimate artesunate tablets supplied through institutional channels, thereby safeguarding patient health and maintaining treatment efficacy against malaria.

Regional Highlights

The global consumption and production landscape of the Artesunate Tablet Market is highly skewed, reflecting the geographic distribution of malaria endemicity and pharmaceutical manufacturing capabilities. The region of Middle East and Africa (MEA) is unequivocally the largest consumer market globally, driven by the fact that the African continent bears over 90% of the world's malaria burden. Institutional procurement, funded heavily by international aid, dominates this region, characterized by extensive governmental distribution networks and a critical focus on public health intervention. Countries like Nigeria, DRC, and Uganda represent core demand centers, requiring robust, continuous supply to manage seasonal malaria spikes and epidemic risks.

Asia Pacific (APAC) plays a dual role: it is both a significant consumption market, particularly in countries like India, Indonesia, and Southeast Asia where resistance monitoring is crucial, and the primary global manufacturing hub. Countries such as China and India possess the necessary chemical synthesis expertise and large-scale GMP facilities to produce APIs and finished dosage forms for global export. The regional market growth is supported by domestic malaria control programs and the region's importance in supplying prequalified products to Africa. The technological sophistication of APAC manufacturers often sets the benchmark for quality and cost efficiency worldwide.

North America and Europe, while having negligible domestic consumption of artesunate tablets due to the non-endemic nature of malaria, are crucial in terms of funding, research, and regulatory oversight. These regions house the headquarters of major global pharmaceutical companies involved in ACT manufacturing (e.g., Novartis, Sanofi), as well as key procurement agencies and donors (e.g., Global Fund, USAID). Their role is predominantly focused on R&D for next-generation antimalarials, setting global quality standards (EMA, FDA prequalification), and financing the massive humanitarian procurement contracts that drive demand in MEA.

Latin America represents a smaller, but regionally significant, consumption market concentrated in countries like Brazil, Colombia, and Peru, primarily for managing regional malaria strains. Demand is stable but highly localized, and often managed through regional health initiatives (e.g., PAHO). The market structure here typically mirrors the high-volume public procurement models seen elsewhere, but often focuses on specific ACTs tailored to the local parasitic ecosystem.

- Middle East and Africa (MEA): Dominant consumption region; high reliance on institutional procurement; market driven by the severe malaria burden in Sub-Saharan Africa.

- Asia Pacific (APAC): Key manufacturing and supply hub (China, India); significant consumption market due to endemic areas in Southeast Asia; focus on combating artemisinin resistance strains.

- Europe: Central to R&D and pharmaceutical headquarters; stringent regulatory standards (EMA prequalification); critical source of global health funding.

- North America: Major source of donor funding (PMI, USAID); leadership in pharmaceutical innovation and research into synthetic biology artemisinin production.

- Latin America: Stable, localized demand focused on regional public health programs; management of specific regional malaria strains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Artesunate Tablet Market.- Sanofi S.A.

- Novartis AG

- Cipla Ltd.

- Ipca Laboratories Ltd.

- Ajanta Pharma Ltd.

- Intas Pharmaceuticals Ltd.

- Guilin Pharmaceutical Co., Ltd.

- F. Hoffmann-La Roche Ltd. (Roche)

- Mylan N.V. (Viatris)

- Zydus Cadila

- Shasun Pharmaceuticals Ltd.

- Holley-Cotec Pharmaceuticals

- Bliss GVS Pharma Ltd.

- Hetero Drugs Ltd.

- GSK plc

- Fosun Pharma

- Shin Poong Pharmaceutical Co. Ltd.

- Alkem Laboratories Ltd.

- Macleods Pharmaceuticals Ltd.

- Sumitomo Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Artesunate Tablet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the Artesunate Tablet Market?

The primary driving factor is the sustained and increasing global institutional demand, fueled by massive public health funding from organizations like the Global Fund and WHO, enforcing Artemisinin Combination Therapies (ACTs) as the mandated first-line treatment for uncomplicated P. falciparum malaria worldwide.

How does drug resistance impact the long-term viability of artesunate?

Drug resistance poses the most significant restraint, necessitating continuous research into novel partner drugs for combination therapies. While resistance to artesunate itself is monitored, the market relies on developing new ACT formulations that remain highly effective against evolving parasite strains, driving R&D investment.

Which geographical region accounts for the highest consumption of artesunate tablets?

The Middle East and Africa (MEA), specifically Sub-Saharan Africa, accounts for the highest consumption of artesunate tablets, directly correlating with the high endemic burden of malaria in this region, which necessitates large-scale, ongoing institutional procurement.

What role does synthetic biology play in the artesunate supply chain?

Synthetic biology technology offers a stable and scalable alternative source for artemisinin precursors, reducing the market's dependence on traditional agricultural cultivation of Artemisia annua. This technology helps stabilize supply, mitigate price volatility, and ensures consistent quality for pharmaceutical synthesis.

What is the key difference between institutional and retail distribution channels in this market?

The institutional channel (NGOs, government) dominates, characterized by high-volume tenders, bulk purchasing, and subsidized distribution, whereas the retail channel (private pharmacies) caters to smaller, higher-margin private patient sales in urban centers, focusing more on brand and immediate availability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager