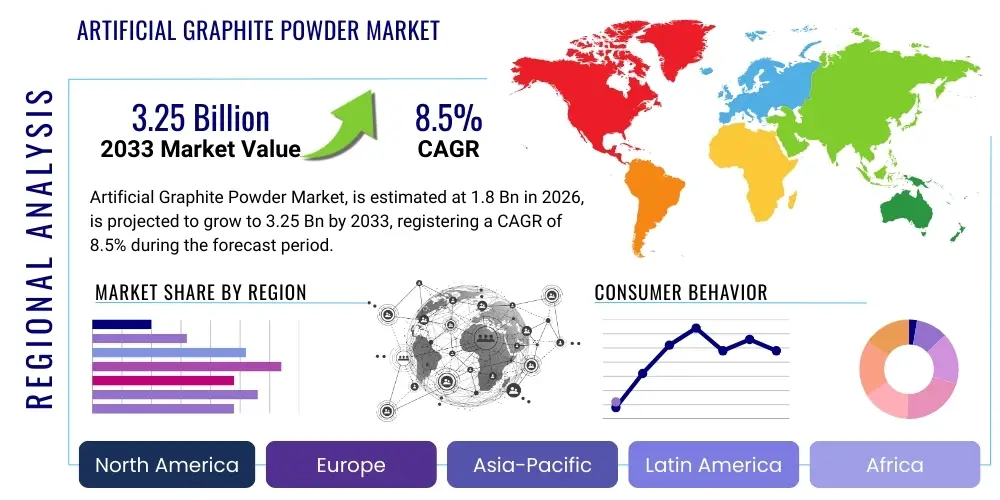

Artificial Graphite Powder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439950 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Artificial Graphite Powder Market Size

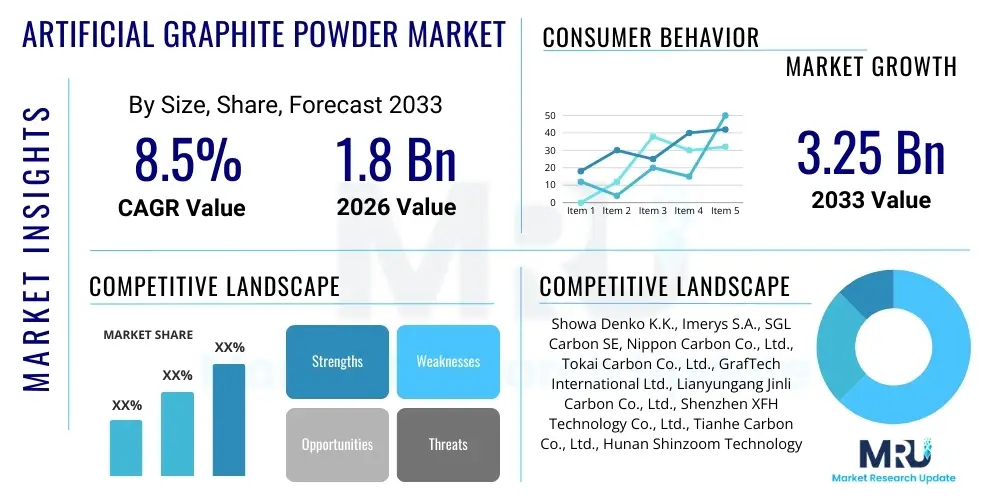

The Artificial Graphite Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.25 Billion by the end of the forecast period in 2033.

Artificial Graphite Powder Market introduction

The Artificial Graphite Powder Market encompasses high-purity carbon materials manufactured synthetically, typically through the high-temperature graphitization of carbon precursors such such as petroleum coke or coal tar pitch, predominantly utilizing the Acheson process or related techniques. This specialized material exhibits superior crystallinity, excellent thermal and electrical conductivity, high lubricity, and exceptional chemical inertness, distinguishing it from naturally mined graphite. These properties make artificial graphite a crucial component across numerous industrial sectors, particularly those requiring high performance and reliability under extreme conditions, such as high heat or chemical exposure.

The product is widely used as the primary anode material in lithium-ion batteries, which represent the single largest application segment driving market expansion, especially within electric vehicles (EVs) and grid-scale energy storage systems. Furthermore, artificial graphite powder is essential in the production of specialty lubricants, advanced refractory materials used in steel and aluminum manufacturing, carbon brushes for electric motors, and various polymer composites requiring enhanced conductivity or strength. Its high structural integrity and consistency, achieved through stringent manufacturing controls, offer performance advantages that natural graphite often cannot match in critical applications, positioning it as a strategic material globally.

Major driving factors influencing the market trajectory include the accelerating global shift toward electric mobility, requiring vast quantities of stable and high-performance anode materials, coupled with significant governmental incentives promoting renewable energy infrastructure deployment. The continuous technological advancements focused on improving specific capacity and charging speed in Li-ion batteries necessitate refined artificial graphite grades. Additionally, the growing demand for high-quality synthetic graphite in sophisticated industrial processes, such as powder metallurgy and chemical processing, further underpins the robust market growth anticipated throughout the forecast period.

Artificial Graphite Powder Market Executive Summary

The Artificial Graphite Powder Market is poised for significant expansion, fundamentally driven by the revolutionary increase in demand from the lithium-ion battery manufacturing sector, particularly in Asia Pacific, which dominates global electric vehicle (EV) production. Business trends indicate a strong move towards capacity expansion and vertical integration among key manufacturers, aiming to secure reliable raw material supply chains and optimize production efficiency through enhanced graphitization technologies. Strategic alliances and long-term supply agreements between graphite powder suppliers and major battery gigafactories are becoming standard practice to stabilize pricing and ensure timely material delivery, reflecting the critical nature of this input material. Investment in novel production methods, such as plasma graphitization, is gaining traction to improve energy efficiency and material characteristics.

Regional trends highlight the undisputed centrality of the Asia Pacific region, specifically China, which is not only the largest consumer but also the dominant producer of artificial graphite powder globally, capitalizing on abundant raw materials and established manufacturing infrastructure. However, North America and Europe are exhibiting accelerating growth due to aggressive policy mandates supporting domestic EV manufacturing and energy storage build-out, spurring significant investments in local battery supply chains, including anode material production facilities. This regional diversification is motivated by supply chain resilience concerns and geopolitical shifts, gradually balancing the production footprint away from over-reliance on a single geographic region.

Segment trends reveal that the battery grade segment, encompassing material used for anodes, maintains the highest growth rate and market share, overshadowing traditional applications such as metallurgy and refractories. Within battery materials, the shift towards higher-density artificial graphite and composite materials, including silicon-graphite blends, indicates technological maturation aimed at increasing energy density in next-generation battery cells. Capacity optimization and process innovation are concentrated on achieving consistent particle size distribution, high purity levels, and minimal defects, critical performance metrics essential for battery safety and longevity, thus ensuring specialized segments continue to drive value creation within the broader market structure.

AI Impact Analysis on Artificial Graphite Powder Market

Common user questions regarding the impact of AI on the Artificial Graphite Powder Market primarily revolve around optimizing energy-intensive production processes, improving quality control, and forecasting material demands driven by the volatile EV market. Users are keenly interested in how AI can reduce the immense energy consumption associated with the graphitization phase, which is a major cost driver and environmental liability. Furthermore, there are expectations that AI-driven predictive modeling can enhance supply chain responsiveness, matching fluctuating demand from large-scale battery manufacturing operations with optimized production schedules, thereby minimizing inventory risks and reducing lead times for high-specification materials. The application of machine learning for advanced material design and process parameter tuning, aiming to tailor graphite characteristics precisely for specific battery chemistries, is another key theme explored by industry stakeholders seeking competitive advantages.

AI's role in process optimization centers on utilizing real-time sensor data from graphitization furnaces to dynamically adjust power inputs, temperature profiles, and precursor material ratios. This machine learning approach minimizes energy wastage, shortens cycle times, and ensures uniform product quality across large batches. By automating the monitoring of critical material characteristics, such as purity, crystal structure, and particle size distribution, AI systems can immediately flag deviations, dramatically reducing the incidence of non-conforming product batches and improving overall operational efficiency and yield rates. These technological enhancements are crucial for maintaining profitability in a highly competitive commodity market requiring extreme precision.

Beyond manufacturing, AI is revolutionizing material discovery and development within the artificial graphite domain. Deep learning algorithms are used to simulate the performance of novel carbon precursors and doping strategies, accelerating the research and development cycle for next-generation anode materials, particularly those designed to work effectively with silicon composites or solid-state electrolytes. This predictive capability allows manufacturers to develop specialized graphite grades faster than traditional empirical testing methods, addressing the urgent industry need for higher energy density solutions. The integration of AI tools promises to enhance material traceability and environmental reporting, aligning production practices with increasingly stringent sustainability mandates across global supply chains.

- AI optimizes energy consumption in graphitization by real-time process parameter adjustment.

- Machine learning enhances quality control and uniformity by analyzing sensor data for crystal structure and purity.

- Predictive analytics improves supply chain resilience and inventory management against fluctuating EV demand.

- AI accelerates material research for high-density anodes, including novel silicon-graphite composites.

- Computer vision systems enhance defect detection and particle size analysis, improving yield rates.

- Automated systems enable precise tracking of environmental metrics and energy usage for sustainability compliance.

DRO & Impact Forces Of Artificial Graphite Powder Market

The dynamics of the Artificial Graphite Powder Market are significantly shaped by a combination of robust drivers and critical restraints, balanced by emerging opportunities and powerful impact forces that influence strategic decisions. The primary driver is the exponentially increasing global demand for lithium-ion batteries, specifically for use in electric vehicles and large-scale renewable energy storage, which relies heavily on artificial graphite as the standard anode material due to its proven stability and performance characteristics. Complementing this is the sustained requirement for high-purity graphite in industrial applications such as specialty refractories, electrodes, and nuclear reactors, where material integrity is paramount. However, the market faces considerable restraints, notably the intensely high energy requirement of the graphitization process, which leads to substantial production costs and a significant carbon footprint, pushing manufacturers to seek cleaner, more efficient technological alternatives.

A significant opportunity arises from the development of advanced anode materials, including the blending of artificial graphite with silicon to create composite anodes capable of achieving significantly higher energy density, addressing one of the current limitations of Li-ion technology. Furthermore, geographical diversification of the supply chain presents a key opportunity, as Western governments and corporations strive to establish localized production capabilities outside of Asia, driven by supply security concerns and trade disputes. This trend opens avenues for new facility investments in North America and Europe, supported by substantial governmental subsidies aimed at building resilient domestic battery ecosystems. Overcoming regulatory hurdles related to carbon emissions and developing sustainable sourcing practices for precursor materials remain critical for capitalizing on these opportunities.

The overall impact forces are dominated by technological momentum and geopolitical policies. The technological push toward solid-state batteries or alternative anode chemistries, though currently distant, poses a potential disruptive force in the long term, compelling artificial graphite producers to innovate constantly. Geopolitical forces, including trade tariffs, environmental regulations targeting carbon emissions (such as the European Green Deal), and subsidies favoring local production (like the US Inflation Reduction Act), directly affect the cost structure, trade flows, and regional competitiveness of artificial graphite manufacturing. These forces necessitate substantial capital investment in process efficiency and cleaner production technologies to ensure market sustainability and compliance, dictating the pace and location of future market expansion.

Segmentation Analysis

The Artificial Graphite Powder Market is comprehensively segmented based on its key attributes, including the type of application, the specific grade of material produced, and the manufacturing process employed. Analyzing these segments provides a detailed understanding of the market dynamics, allowing stakeholders to identify high-growth areas and tailor their product portfolios to meet specific end-user requirements. The market is primarily categorized by application into battery manufacturing, which is the most rapidly expanding segment, and traditional industrial uses such as metallurgical operations, chemical processing, and mechanical applications. The grade segmentation often reflects particle size, purity level, and crystal structure, directly correlating with the performance characteristics demanded by specialized end-users, differentiating standard industrial grades from ultra-high purity battery grades.

- By Application:

- Lithium-ion Batteries (Anode Material)

- Refractories

- Electrodes and Anodes (Non-Battery)

- Lubricants and Friction Products

- Foundry Applications

- Others (e.g., Polymer Composites, Nuclear)

- By Grade:

- Battery Grade (High Purity)

- Industrial Grade (Standard Purity)

- High-Density Grade

- By Manufacturing Process:

- Acheson Process

- Graphitization Furnaces (Lecarbo Process, Castner Process variations)

- Advanced Thermal Treatment

- By End-Use Industry:

- Automotive and Transportation (EVs)

- Energy Storage Systems (Grid and Consumer Electronics)

- Metallurgy

- Chemical and Petrochemical

- Aerospace and Defense

Value Chain Analysis For Artificial Graphite Powder Market

The value chain for the Artificial Graphite Powder Market is complex and highly integrated, beginning with the upstream sourcing of crucial carbonaceous precursors, primarily petroleum coke, pitch coke, and coal tar pitch. Upstream analysis focuses on the supply stability and quality of these raw materials, which are derivatives of the oil refining and coal processing industries. Fluctuations in crude oil pricing and energy market dynamics directly impact the cost of these precursors, influencing the overall production economics of artificial graphite. Manufacturers often enter into long-term contracts with refineries and coking plants to ensure a steady supply of consistent quality precursors, which is critical for maintaining the high purity required for battery applications. The preliminary step involves calcination of these precursors to remove volatile impurities, an energy-intensive process preceding graphitization.

The core manufacturing stage involves the specialized, high-temperature graphitization process, demanding substantial capital investment in specialized furnaces and energy infrastructure. This stage adds significant value by transforming amorphous carbon into highly crystalline artificial graphite powder, tailoring its specific surface area, particle morphology, and electrical conductivity to meet stringent customer specifications. The distribution channel is crucial, characterized by both direct and indirect sales. Direct sales are prevalent for large-volume customers, such as major battery manufacturers and integrated steel mills, where producers work closely with end-users for customized specifications and just-in-time delivery. Indirect sales, involving specialized chemical distributors, cater to smaller industrial users and regional markets, ensuring broad market reach for standard industrial grades.

Downstream analysis highlights the critical role of material integration into final products. For the largest segment, this involves anode slurry preparation and subsequent cell assembly by battery manufacturers. Performance verification and quality assurance at the cell level dictate the precise requirements for the graphite powder. The stringent quality demands from the automotive sector regarding battery longevity, safety, and rapid charging capability put immense pressure on artificial graphite suppliers to maintain impeccable product consistency. The downstream market feedback drives continuous innovation in particle engineering and surface treatments, ensuring the final product meets the demanding performance requirements of the rapidly evolving electric vehicle and stationary energy storage markets.

Artificial Graphite Powder Market Potential Customers

Potential customers for Artificial Graphite Powder span a wide array of high-technology and heavy industrial sectors, fundamentally defined by the requirement for superior conductivity, lubricity, and thermal stability. The single most significant customer group comprises manufacturers of lithium-ion batteries, including global giants producing cells for electric vehicles (OEMs like Tesla, Volkswagen, BYD, etc., and dedicated battery makers like CATL, LG Energy Solution, and Panasonic), as well as consumer electronics and grid storage integrators. These customers require high volumes of ultra-high purity, battery-grade artificial graphite powder specifically engineered to optimize charge/discharge cycling efficiency and safety characteristics under operational stresses. The relentless demand growth in this sector is the main driver of capacity expansion globally.

Another major customer segment involves the metallurgical and foundry industries, particularly producers of steel, aluminum, and specialized alloys. Artificial graphite powder is essential here for use in refractory linings, ladle furnace additions, and as a carbon raiser, contributing to thermal insulation and chemical reaction control during high-temperature metal processing. These industrial customers prioritize materials with excellent thermal shock resistance and high purity to prevent contamination of the final metal product. Furthermore, the chemical processing industry uses artificial graphite for high-performance sealing materials, gaskets, and chemical processing equipment due to its exceptional chemical inertness and resistance to corrosive environments, making it indispensable in handling aggressive chemicals where conventional materials would fail.

Specialty application sectors also form a crucial customer base, including manufacturers of advanced mechanical components, such as carbon brushes and sliding contacts for electric motors, and producers of lubricants and greases requiring high-performance solid lubricants to reduce friction and wear in extreme conditions. The aerospace and defense sectors represent a premium niche, demanding specialized artificial graphite materials for lightweight composites and thermal management systems due to their high strength-to-weight ratio and superior thermal dissipation capabilities. These customers are driven by performance specifications and reliability, often willing to pay a premium for custom-engineered grades that meet stringent industry standards for critical applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.25 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Showa Denko K.K., Imerys S.A., SGL Carbon SE, Nippon Carbon Co., Ltd., Tokai Carbon Co., Ltd., GrafTech International Ltd., Lianyungang Jinli Carbon Co., Ltd., Shenzhen XFH Technology Co., Ltd., Tianhe Carbon Co., Ltd., Hunan Shinzoom Technology Co., Ltd., Graphite India Limited, HEG Limited, Nanjing Wotai Chemical Co., Ltd., Ningxia Oriental Tantalum Industry Co., Ltd., Qingdao Haida Graphite Co., Ltd., Inner Mongolia Xinghe Graphite Co., Ltd., JFE Chemical Corporation, Koppers Inc., Cabot Corporation, Asbury Carbons Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Artificial Graphite Powder Market Key Technology Landscape

The technological landscape of the Artificial Graphite Powder Market is primarily centered around optimizing the graphitization process to reduce energy consumption, enhance material purity, and achieve precise control over particle morphology, crucial for high-performance battery applications. The dominant technique remains the Acheson process, which involves heating carbon materials to temperatures exceeding 2500 degrees C, requiring immense electrical power. Current technological advancements focus on modifying furnace designs, such as utilizing continuous or plasma graphitization furnaces, which promise shorter cycle times and potentially lower energy input per ton of production compared to traditional batch furnaces. Improving furnace insulation and optimizing power supply management are persistent areas of research aimed at boosting economic efficiency and minimizing the environmental footprint associated with this energy-intensive operation.

Material science innovation is equally significant, particularly in tailoring the properties of artificial graphite powder to meet the increasingly demanding specifications of lithium-ion battery manufacturers. Key areas include surface modification techniques, such as amorphous carbon coating or physical vapor deposition, designed to enhance the Solid Electrolyte Interphase (SEI) layer formation on the anode surface, thereby improving cycling stability, first-cycle efficiency, and rapid charge capability. Furthermore, manufacturers are investing heavily in technologies that allow for precise particle size distribution control and spherical shaping of the graphite powder, as particle sphericity significantly affects the packing density of the electrode and ultimately the battery's volumetric energy density. These advancements ensure artificial graphite remains competitive against emerging anode chemistries.

Another critical area involves precursor material optimization. While petroleum coke remains the standard, increasing emphasis is being placed on developing methods to utilize alternative or recycled carbon sources, aligning with circular economy principles and supply chain resilience goals. Advanced analytical techniques, including high-resolution microscopy and specialized spectroscopy, are integral to the quality control process, enabling manufacturers to rapidly verify crystal structure perfection and impurity levels down to parts-per-million sensitivity. This technological rigor ensures that the artificial graphite meets the ultra-high purity standards demanded by premium battery and aerospace applications, cementing the technological edge for producers investing in state-of-the-art process control systems and material characterization tools.

Regional Highlights

- Asia Pacific (APAC): APAC is the global powerhouse for artificial graphite production and consumption, primarily due to the overwhelming concentration of lithium-ion battery manufacturing capacity in China, South Korea, and Japan. China dominates the market both in terms of production volume and technological development, leveraging cost advantages and an established supply chain infrastructure. The rapid expansion of electric vehicle markets across the region ensures APAC remains the high-growth center, driving innovation in battery-grade materials.

- North America: This region is characterized by accelerating investment in localized battery supply chains, spurred by government policies aimed at reducing reliance on Asian imports and promoting domestic EV manufacturing. The US and Canada are focusing on establishing new graphitization facilities and securing domestic sources for precursors, creating a significant growth trajectory, particularly for high-purity battery anodes.

- Europe: Europe is experiencing robust demand driven by the establishment of multiple gigafactories (Battery value chain localization) and stringent carbon reduction targets. Regulations emphasizing sustainable sourcing and low-carbon manufacturing are influencing purchasing decisions, potentially favoring producers who can demonstrate energy-efficient or green production methods, leading to strong localized growth opportunities and technology adoption.

- Latin America: This region holds potential due to its abundance of natural resources and emerging manufacturing sectors, although artificial graphite production is currently limited. Growth is primarily tied to exports to global industrial consumers and slow domestic adoption in specialty industrial applications, making it a smaller, developing market.

- Middle East and Africa (MEA): The MEA region's market presence is relatively nascent, mainly centered around specialized industrial applications like refractories in primary metal production and petro-chemical processing. Future growth is anticipated to be linked to regional energy transition projects and diversification away from oil economies, which may include localized battery assembly or metal manufacturing expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Artificial Graphite Powder Market.- Showa Denko K.K.

- Imerys S.A.

- SGL Carbon SE

- Nippon Carbon Co., Ltd.

- Tokai Carbon Co., Ltd.

- GrafTech International Ltd.

- Lianyungang Jinli Carbon Co., Ltd.

- Shenzhen XFH Technology Co., Ltd.

- Tianhe Carbon Co., Ltd.

- Hunan Shinzoom Technology Co., Ltd.

- Graphite India Limited

- HEG Limited

- Nanjing Wotai Chemical Co., Ltd.

- Ningxia Oriental Tantalum Industry Co., Ltd.

- Qingdao Haida Graphite Co., Ltd.

- Inner Mongolia Xinghe Graphite Co., Ltd.

- JFE Chemical Corporation

- Koppers Inc.

- Cabot Corporation

- Asbury Carbons Inc.

Frequently Asked Questions

Analyze common user questions about the Artificial Graphite Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Artificial Graphite Powder?

The predominant driver is the massive global expansion of the Lithium-ion battery market, particularly for Electric Vehicles (EVs) and grid-scale Energy Storage Systems (ESS). Artificial graphite is the essential, high-performance anode material due to its stable cycling, purity, and superior charge rate capability compared to natural alternatives.

How does the production of artificial graphite impact the environment?

The primary environmental concern stems from the high energy intensity of the graphitization process, requiring temperatures up to 3000 degrees C, which results in significant energy consumption and associated carbon emissions. Manufacturers are actively investing in process optimization and renewable energy sources to mitigate this environmental footprint.

Which geographical region dominates the global supply of artificial graphite powder?

The Asia Pacific region, specifically China, dominates both the production and consumption of artificial graphite powder. This dominance is attributed to established manufacturing infrastructure, favorable raw material access, and the high concentration of global Li-ion battery gigafactories within the region.

What is the technological future for artificial graphite anodes in batteries?

The future involves developing hybrid anode materials, primarily Silicon-Graphite composites, which utilize artificial graphite's stability while incorporating silicon to significantly boost energy density. Research also focuses on surface coatings and advanced particle morphology control to improve battery life and charging speed.

What is the difference between natural and artificial graphite powder in commercial use?

Artificial graphite is manufactured synthetically, offering ultra-high purity, superior consistency, and tailored particle size and shape (often spherical), making it ideal for high-end applications like Li-ion battery anodes and specialty electrodes. Natural graphite, while cheaper, often lacks the same purity and requires extensive, costly purification for battery use.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager