Artificial Intelligence (AI) in BFSI Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434237 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Artificial Intelligence (AI) in BFSI Market Size

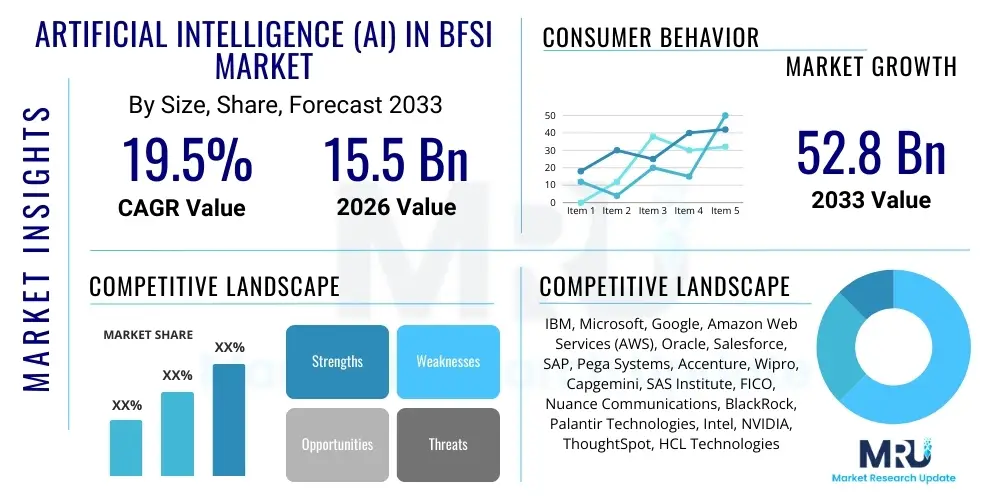

The Artificial Intelligence (AI) in BFSI Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.5% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 52.8 Billion by the end of the forecast period in 2033.

Artificial Intelligence (AI) in BFSI Market introduction

The integration of Artificial Intelligence (AI) within the Banking, Financial Services, and Insurance (BFSI) sector represents a fundamental shift in operational paradigms, risk management strategies, and customer engagement models. AI systems, encompassing machine learning, natural language processing (NLP), and sophisticated robotic process automation (RPA), are essential for processing the massive volumes of structured and unstructured data characteristic of the financial industry. This technology is actively employed across front, middle, and back-office functions, delivering significant improvements in efficiency, accuracy, and scalability. The primary product offerings in this market include AI-powered platforms, specialized software solutions for risk modeling, and predictive analytics tools designed for complex financial decision-making.

Major applications of AI in BFSI span critical areas such as personalized wealth management advisory services, automated underwriting processes in insurance, and real-time fraud detection systems that mitigate financial losses. Furthermore, AI enhances compliance mechanisms by continuously monitoring regulatory changes and transactional data for anomalies indicative of money laundering or other illicit activities, thereby reducing regulatory penalties and bolstering institutional integrity. The versatility of AI allows financial institutions to move from reactive defense mechanisms to proactive, predictive strategies across their entire value chain, fostering resilience in an increasingly volatile global market environment.

The market is predominantly driven by the pervasive need for enhanced operational efficiency and competitive differentiation. Financial institutions are under constant pressure to reduce overhead costs, optimize resource allocation, and accelerate service delivery, objectives that AI is uniquely positioned to address. Key driving factors include the rapid digitization of financial services (FinTech proliferation), the exponential rise in cyber threats necessitating advanced security solutions, and evolving customer expectations for seamless, personalized, and instantaneous services delivered through digital channels. The benefits derived from AI adoption—ranging from superior customer experience and reduced turnaround times to highly precise risk assessment—ensure its continued investment trajectory across global financial hubs.

Artificial Intelligence (AI) in BFSI Market Executive Summary

The Artificial Intelligence in BFSI market is characterized by robust growth, propelled by sustained digital transformation initiatives and the imperative for superior risk management capabilities. Current business trends indicate a strong focus on deploying specialized AI models for vertical-specific applications, moving beyond general-purpose automation. There is a noticeable shift towards explainable AI (XAI) solutions to ensure transparency and trust in critical areas like credit scoring and claims processing, addressing growing regulatory scrutiny concerning algorithmic bias. Strategic partnerships between established financial institutions and specialized AI start-ups are becoming commonplace, accelerating time-to-market for innovative AI solutions such as conversational AI interfaces and advanced predictive compliance tools.

Regionally, North America continues to dominate the market due to high levels of technological maturity, substantial venture capital investment in FinTech, and a highly competitive banking landscape demanding rapid innovation. Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by massive untapped customer bases undergoing rapid digital adoption, particularly in emerging economies like India and China, where mobile-first financial strategies rely heavily on AI infrastructure. European growth is steady, largely driven by regulatory mandates such as PSD2 and GDPR, which necessitate AI-powered solutions for enhanced data security, open banking compliance, and cross-border fraud detection protocols.

Segment trends highlight the Machine Learning (ML) technology segment as the largest contributor to market revenue, given its utility in credit risk modeling, algorithmic trading, and personalized marketing. Within the application segment, Fraud Detection and Risk Management remain critical growth areas as financial crime scales in complexity and frequency. Moreover, the shift towards Cloud deployment is accelerating rapidly, offering scalability and flexibility necessary for handling fluctuating computational demands associated with complex AI workloads, particularly appealing to smaller banks and insurance providers looking to adopt AI without significant upfront infrastructure investment.

AI Impact Analysis on Artificial Intelligence (AI) in BFSI Market

Users frequently inquire about how AI technologies, particularly generative AI and advanced predictive models, will fundamentally alter the competitive landscape, operational efficiency, and employment structure within the BFSI sector. Key concerns revolve around data privacy, the potential for algorithmic bias in lending decisions, and the regulatory challenges associated with deploying autonomous decision-making systems. Users expect AI to revolutionize customer interaction through hyper-personalized services, drastically reduce human error in compliance processes, and enable near real-time assessment of systemic risk, thus fostering greater financial stability. They are keenly interested in knowing which AI applications yield the highest return on investment (ROI) and how existing legacy systems can be integrated effectively with modern AI architectures without compromising security or regulatory adherence.

The impact of AI is transforming the BFSI market from a service-driven industry to a data-and-algorithm-driven ecosystem. AI fundamentally shifts competitive advantage from scale and branch network size to data management proficiency and algorithmic superiority. For consumers, this translates into fairer pricing models, highly tailored product recommendations (e.g., dynamic insurance pricing based on behavior), and instantaneous processing of complex transactions, greatly improving the overall digital experience. Internally, financial institutions leverage AI to consolidate and rationalize data silos, thereby improving the accuracy of financial forecasting, optimizing capital allocation strategies, and significantly lowering the cost-to-serve ratio by automating high-volume, repetitive tasks previously managed by human operators, focusing human capital on complex, relationship-oriented advisory roles.

Furthermore, AI significantly strengthens the resilience of the financial system against internal and external threats. In fraud detection, AI systems continuously learn from new attack vectors, ensuring defenses evolve faster than criminal methodologies. In risk management, AI models process alternative data sources and execute sophisticated scenario planning, providing a more holistic and forward-looking view of market, credit, and operational risks than traditional statistical methods. This reliance on sophisticated AI for mission-critical functions necessitates robust governance frameworks to ensure accountability, auditability, and ethical operation, solidifying AI as not just a technological tool, but a core component of future financial stability regulation.

- AI enhances personalized customer experience through sophisticated recommendation engines and conversational interfaces.

- It significantly reduces operational costs by automating back-office processes such as data entry, reconciliation, and report generation.

- AI-driven risk models provide predictive capabilities for credit default and market volatility, improving portfolio management accuracy.

- Advanced AI techniques, including deep learning, are instrumental in minimizing false positives in real-time fraud and Anti-Money Laundering (AML) monitoring.

- AI facilitates regulatory technology (RegTech) by continuously monitoring and interpreting evolving compliance requirements across multiple jurisdictions.

- Generative AI is accelerating content creation for marketing materials, policy summaries, and internal knowledge bases within BFSI firms.

- The deployment of explainable AI (XAI) addresses transparency requirements, mitigating risks associated with black-box decision-making models.

DRO & Impact Forces Of Artificial Intelligence (AI) in BFSI Market

The AI in BFSI market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DROs), forming critical impact forces that shape adoption patterns and strategic investment. A major driver is the accelerating volume and velocity of digital data generated across transactions, social media, and IoT devices, necessitating AI for meaningful extraction and utilization. This is coupled with intensified competitive pressure from FinTech disruptors and tech giants entering the financial space, compelling established institutions to rapidly innovate. Restraints primarily revolve around the inherent complexities of integrating AI with legacy IT infrastructures, particularly in highly regulated banking environments where system downtime is unacceptable. Additionally, the shortage of data science expertise coupled with high development costs for customized AI solutions acts as a significant impediment, especially for smaller market participants struggling with limited budgets and talent pools.

Opportunities for market expansion are abundant, particularly in underserved application areas such as dynamic capital requirements modeling, advanced catastrophe modeling in insurance, and the widespread adoption of AI in regulatory reporting and compliance (RegTech). The increasing global focus on ethical AI and the need for explainability present an opportunity for vendors specializing in transparent and bias-mitigating algorithms. Impact forces highlight the critical nature of data privacy regulations (like GDPR and CCPA), which while acting as a restraint on data utilization, simultaneously drive the demand for privacy-preserving AI techniques, such as federated learning, which allow data to be processed locally without centralized exposure, creating a new avenue for secure AI deployment across multinational financial entities.

The most profound impact force is the regulatory environment. While stringent financial regulations sometimes slow down the deployment of novel technologies due to lengthy approval processes, they also mandate continuous improvement in fraud prevention and data security, thereby creating a guaranteed market for robust, compliant AI solutions. Furthermore, the rising customer acceptance of digital channels and personalized services exerts a potent market force, pushing institutions to invest heavily in front-end AI technologies like chatbots and virtual assistants. Ultimately, the successful navigation of these forces depends on strategic investment in data governance and ethical AI frameworks, transforming restraints into controlled adoption drivers essential for long-term market sustainability and growth.

Segmentation Analysis

The Artificial Intelligence (AI) in BFSI market is meticulously segmented across multiple dimensions, including components, technology types, specific applications, deployment models, and organizational size, allowing for detailed market analysis and targeted strategic planning. The component segmentation differentiates between AI software solutions (platforms, modules, APIs) and AI services (implementation, consulting, maintenance, and managed services), reflecting the ongoing need for expert support in deploying and optimizing complex models. Technology segmentation focuses on the underlying core AI capabilities, such as advanced machine learning algorithms (deep learning, reinforcement learning), Natural Language Processing (NLP) for text analysis, and Computer Vision primarily utilized in insurance claims processing and document verification. This layered segmentation provides a granular view of investment priorities within the sector.

Application segmentation reveals where AI provides the most immediate value, with Fraud Detection and Risk Management consistently holding leading shares due to their critical nature in financial stability and loss prevention. Other high-growth applications include automated trading and investment advisory, and customer service automation via conversational AI. Deployment model segmentation highlights the increasing preference for cloud-based solutions over traditional on-premise infrastructure. Cloud deployment offers superior elasticity and access to scalable computational power necessary for resource-intensive AI training and inference, appealing particularly to mid-market financial institutions seeking agility and rapid scaling without heavy capital expenditure on internal hardware, driving further segment shifts.

- Component

- Solutions (Platform/Software)

- Services (Professional Services, Managed Services)

- Technology

- Machine Learning (ML)

- Natural Language Processing (NLP)

- Computer Vision

- Robotic Process Automation (RPA)

- Other AI Techniques (Expert Systems, Deep Learning)

- Application

- Fraud Detection and Anti-Money Laundering (AML)

- Risk Management (Credit Risk, Market Risk, Operational Risk)

- Customer Service and Experience (Chatbots, Virtual Assistants)

- Wealth Management and Algorithmic Trading

- Process Automation and Operations

- Compliance and Regulatory Reporting (RegTech)

- Deployment Mode

- Cloud

- On-Premise

- Enterprise Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

Value Chain Analysis For Artificial Intelligence (AI) in BFSI Market

The value chain for the AI in BFSI market begins with upstream activities focused on foundational technological components and data acquisition. Upstream involves raw data aggregation from internal and external financial systems, followed by the development and training of core AI models by specialized software providers and data scientists. Key upstream participants include cloud infrastructure providers (offering computational power and storage) and data vendors specializing in high-quality, sanitized financial datasets necessary for robust model training. The successful execution of this stage requires significant expertise in data engineering, governance, and regulatory compliance to ensure the input data meets necessary ethical and quality standards before model deployment.

Moving downstream, the chain focuses on the implementation, customization, and end-user application of the AI solutions within the operational framework of BFSI institutions. Downstream activities are dominated by system integrators, consulting firms, and managed service providers who deploy the models, integrate them with legacy banking systems, and provide ongoing maintenance and performance optimization. Distribution channels are varied, including direct sales from major software vendors (like IBM or Oracle), specialized partnerships with independent software vendors (ISVs), and increasingly, cloud marketplaces (indirect channels like AWS or Azure) which offer AI models as accessible, scalable services. Direct channels are generally preferred for large-scale, highly customized enterprise deployments, while indirect channels facilitate broader adoption, particularly among SMEs seeking rapid deployment capabilities.

The efficiency of the value chain is highly dependent on the smooth transition between model development (upstream) and operational use (downstream), often mediated by specialized RegTech and FinTech firms acting as intermediaries. The shift towards Platform-as-a-Service (PaaS) and Software-as-a-Service (SaaS) delivery models is streamlining the chain by reducing the reliance on extensive on-premise integration efforts. Ultimately, the value captured at the end-user level is measured by the improvement in efficiency, reduction in risk exposure, and enhancement of customer satisfaction, reinforcing the importance of robust post-deployment support and iterative model refinement to maintain optimal performance in a continuously changing financial landscape.

Artificial Intelligence (AI) in BFSI Market Potential Customers

Potential customers for AI solutions in the BFSI market encompass a broad spectrum of organizations requiring enhanced operational efficiency, superior risk management, and competitive digital transformation. The primary end-users are commercial banks, investment banks, insurance carriers (life, health, property, and casualty), asset management firms, and various non-banking financial companies (NBFCs). Commercial and retail banks are heavy users, seeking AI for applications ranging from personalized mobile banking features and chatbot customer support to complex credit scoring and loan origination process automation. These institutions are driven by the need to streamline high-volume transactions and manage colossal datasets generated by millions of daily customer interactions across diverse digital and physical channels.

Insurance companies constitute another critical customer base, leveraging AI, particularly machine learning and computer vision, for rapid claim processing, fraud detection in claims submissions, and dynamic pricing of policies based on comprehensive risk profiles. Asset management firms and investment banks utilize AI extensively for algorithmic trading strategies, portfolio optimization, and regulatory compliance related to market surveillance, requiring high-speed data processing and predictive analytical capabilities that only specialized AI systems can provide effectively. The adoption intensity varies significantly by enterprise size, with large, globally operating financial institutions typically deploying holistic, integrated AI platforms, while SMEs often focus on niche, cloud-based SaaS solutions targeting specific, immediate pain points like basic automation or limited fraud detection.

In addition to traditional financial entities, governmental and regulatory bodies involved in financial oversight, such as central banks and financial intelligence units (FIUs), are increasingly becoming crucial indirect consumers of AI capabilities. While not purchasing solutions directly for profit generation, they utilize sophisticated AI for systemic risk modeling, market manipulation detection, and macro-prudential surveillance, ensuring broader financial stability. This segment's demand is driven by mandates to preemptively identify and mitigate risks that could affect the entire economy, emphasizing the pervasive necessity of AI across the entire financial ecosystem, transcending mere competitive advantage to become a core component of financial safety and governance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 52.8 Billion |

| Growth Rate | CAGR 19.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IBM, Microsoft, Google, Amazon Web Services (AWS), Oracle, Salesforce, SAP, Pega Systems, Accenture, Wipro, Capgemini, SAS Institute, FICO, Nuance Communications, BlackRock, Palantir Technologies, Intel, NVIDIA, ThoughtSpot, HCL Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Artificial Intelligence (AI) in BFSI Market Key Technology Landscape

The technology landscape of AI in BFSI is dominated by several sophisticated computational techniques designed to handle high-stakes financial data processing and decision-making. Machine Learning (ML), particularly deep learning neural networks, forms the core of predictive analytics, credit scoring, and algorithmic trading systems. ML algorithms are essential for identifying complex, non-linear patterns in financial data that human analysts or traditional statistical models might miss, enabling superior accuracy in fraud detection and market forecasting. Natural Language Processing (NLP) is critical for extracting insights from unstructured textual data, such as contract documents, customer emails, transcripts of phone calls, and regulatory filings. NLP tools enhance compliance checks, automate due diligence, and power intelligent chatbots and virtual assistants, significantly improving efficiency in front-office operations and customer relationship management.

The rise of Computer Vision (CV) is notable, primarily impacting the insurance sector by automating damage assessment through image analysis of claims (e.g., auto accidents or property damage) and accelerating identity verification processes through facial recognition and document scanning in banking onboarding. Furthermore, Robotic Process Automation (RPA), often augmented with AI capabilities (Intelligent Automation), is deployed to streamline back-office clerical tasks, such as data migration, invoice processing, and regulatory report generation. These technologies are increasingly delivered through cloud-native architectures, leveraging highly optimized hardware components like Graphical Processing Units (GPUs) and Tensor Processing Units (TPUs) provided by major cloud vendors to handle the intense computational demands of training and running large-scale deep learning models efficiently and cost-effectively, ensuring scalability across the enterprise.

Ethical AI and Explainable AI (XAI) are rapidly becoming mandatory technological components rather than optional add-ons, driven by regulatory demands for transparency. Financial institutions cannot deploy black-box models for critical decisions like loan approvals or insurance underwriting without the ability to articulate the rationale behind the outcomes. Therefore, AI vendors are focusing significant R&D efforts on developing intrinsic explainability frameworks, leveraging techniques such as SHAP (SHapley Additive exPlanations) and LIME (Local Interpretable Model-agnostic Explanations) to make complex AI decisions auditable and understandable by human compliance officers and regulators. This shift towards transparent and secure computational environments is central to the future technological direction of the BFSI AI market.

Regional Highlights

North America maintains its dominant position in the AI in BFSI market, primarily driven by the presence of major technology hubs, high levels of digital readiness, and a substantial concentration of major global financial institutions. The region, particularly the United States, benefits from a highly competitive FinTech landscape and robust venture capital funding directed towards AI innovation in financial services. Regulatory flexibility, compared to some other regions, has also accelerated the adoption curve for advanced AI applications, including complex algorithmic trading platforms and large-scale predictive risk modeling solutions. Financial institutions in this region are prioritizing investment in sophisticated anti-fraud and cyber security AI tools due to the high frequency and severity of large-scale financial crimes targeting centralized data stores, ensuring continuous, high-value demand for cutting-edge AI software and services.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is attributable to the massive population adopting mobile financial services for the first time, especially in nations like China, India, and Southeast Asian countries. Governments and central banks in these regions are actively promoting digital finance inclusion and the use of AI for credit scoring the previously 'unbanked' population, utilizing alternative data sources processed by ML models. Furthermore, the burgeoning insurance markets across APAC are leveraging AI for faster claims settlement and tailored product development, responding to dynamic demographic shifts and increasing urbanization demands. The sheer scale of data generated by the vast digital user base provides a fertile ground for training powerful, regional-specific AI models.

Europe represents a mature market characterized by stringent data privacy regulations, notably GDPR, which significantly influences the deployment of AI. European financial institutions are focused heavily on utilizing AI for regulatory compliance (RegTech) and operational resilience. The push towards Open Banking, facilitated by directives like PSD2, has necessitated AI-driven solutions for secure data sharing and cross-institution fraud monitoring, ensuring that innovation occurs within a robust, controlled framework. While growth is steady, it is moderated by necessary investments in data governance and explainable AI capabilities, ensuring ethical and transparent use of algorithms. Meanwhile, the Middle East and Africa (MEA) and Latin America (LATAM) regions are showing incremental growth, often focusing on cloud-based AI solutions for basic automation and localized customer service improvements, driven primarily by government initiatives to modernize financial infrastructure and enhance regional economic stability through digital inclusion strategies.

- North America: Market leader due to advanced technological infrastructure, high FinTech investment, and early adoption of deep learning for risk management and trading.

- Asia Pacific (APAC): Fastest-growing region, driven by large-scale digital transformation, government initiatives for financial inclusion, and immense mobile financial services adoption.

- Europe: Strong focus on RegTech and compliance-driven AI adoption, primarily centered around GDPR and Open Banking requirements, emphasizing Explainable AI (XAI).

- Latin America (LATAM): Growing adoption of cloud-based AI solutions aimed at improving operational efficiency and expanding credit access in emerging economies.

- Middle East and Africa (MEA): Market growth fueled by modernization projects in banking sectors, focusing on customer service automation and localized fraud prevention solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Artificial Intelligence (AI) in BFSI Market.- IBM Corporation

- Microsoft Corporation

- Google LLC (Alphabet Inc.)

- Amazon Web Services (AWS)

- Oracle Corporation

- Salesforce.com, Inc.

- SAP SE

- Pega Systems Inc.

- Accenture plc

- Wipro Limited

- Capgemini SE

- SAS Institute Inc.

- FICO (Fair Isaac Corporation)

- Nuance Communications, Inc. (Microsoft Subsidiary)

- BlackRock, Inc.

- Palantir Technologies Inc.

- Intel Corporation

- NVIDIA Corporation

- ThoughtSpot, Inc.

- HCL Technologies Limited

Frequently Asked Questions

Analyze common user questions about the Artificial Intelligence (AI) in BFSI market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of AI driving market growth in the BFSI sector?

The primary applications driving significant market growth are sophisticated fraud detection and Anti-Money Laundering (AML) systems, advanced credit and operational risk modeling, and enhancing customer experience through personalized services and intelligent automation via chatbots and virtual assistants. These applications directly address critical needs for security, regulatory compliance, and cost efficiency.

How is regulatory compliance affecting the adoption and technology choice of AI in BFSI?

Stringent regulations like GDPR and new financial governance rules necessitate that AI solutions be transparent, auditable, and free from algorithmic bias. This regulatory environment is driving demand for Explainable AI (XAI) and privacy-preserving techniques such as federated learning, ensuring that AI deployment meets mandatory ethical and legal standards.

Which technological segment holds the largest market share in the AI in BFSI industry?

The Machine Learning (ML) segment holds the largest market share due to its core applicability across critical financial functions, including predictive modeling for risk assessment, algorithmic trading, and personalized product recommendations. Deep learning, a subset of ML, is increasingly vital for processing unstructured data and complex pattern recognition.

What are the key differences between Cloud and On-Premise deployment trends for AI in BFSI?

Cloud deployment is rapidly accelerating, favored by institutions (especially SMEs) for its scalability, lower operational costs, and access to necessary computational power (GPUs/TPUs) without major capital expenditure. On-Premise deployment is still preferred by large financial institutions handling highly sensitive, mission-critical data, driven by strict internal security policies and specific regulatory requirements.

What role does the shortage of skilled AI talent play in restraining market expansion?

The scarcity of specialized data scientists and AI engineers capable of developing and managing complex financial algorithms poses a significant restraint. This shortage increases competition for talent, drives up costs, and forces many financial institutions to rely heavily on outsourced managed services and professional consulting firms for their AI development needs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager