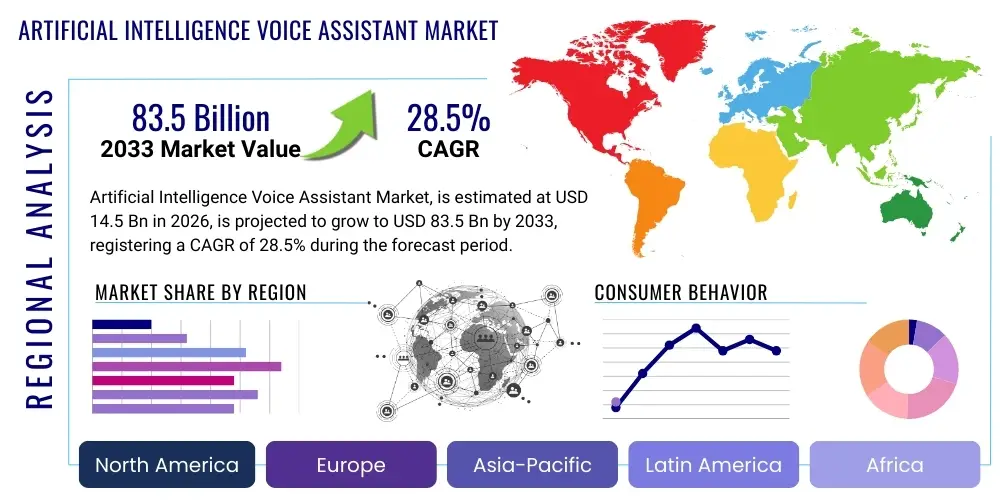

Artificial Intelligence Voice Assistant Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438184 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Artificial Intelligence Voice Assistant Market Size

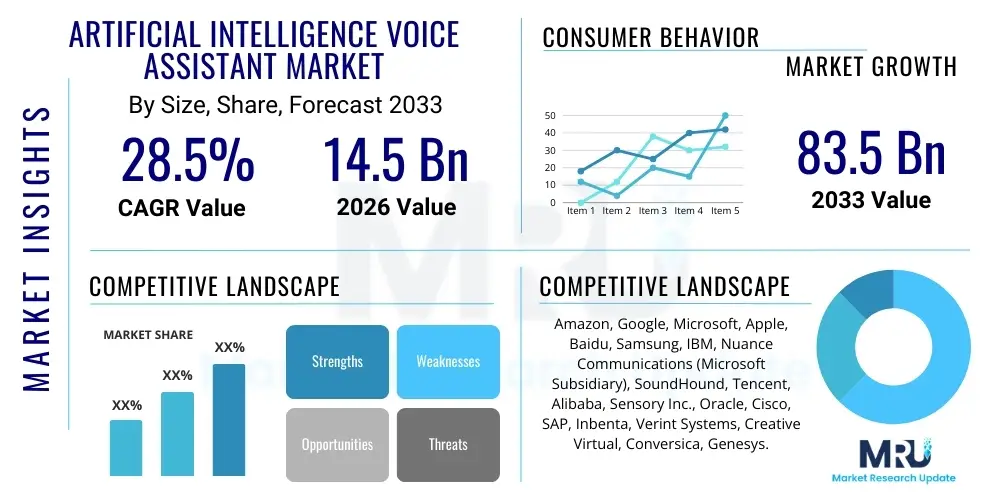

The Artificial Intelligence Voice Assistant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at $14.5 Billion in 2026 and is projected to reach $83.5 Billion by the end of the forecast period in 2033. This robust expansion is fueled by the accelerating adoption of smart devices, the increasing integration of sophisticated Natural Language Processing (NLP) capabilities across various enterprise solutions, and the critical need for frictionless human-computer interaction in both commercial and consumer settings. The continuous innovation in machine learning algorithms is significantly enhancing the accuracy and conversational depth of AI voice assistants, positioning them as essential tools for digital transformation and improved customer experience.

Artificial Intelligence Voice Assistant Market introduction

The Artificial Intelligence Voice Assistant Market encompasses software and hardware solutions that utilize AI, primarily through natural language understanding (NLU) and automated speech recognition (ASR), to execute user commands, provide information, and facilitate tasks via voice input. These intelligent systems process spoken language, interpret intent, and generate coherent, contextually relevant responses, effectively bridging the gap between human language and digital interfaces. Core components include advanced deep learning models, sophisticated acoustic modeling, and extensive knowledge graphs that enable personalized interactions. The market covers applications ranging from simple query answering in smart speakers to complex task management within enterprise resource planning (ERP) systems and intricate navigation in modern automotive interfaces, establishing a pervasive digital ecosystem powered by voice.

Major applications driving market traction include smart home automation, where voice assistants manage appliances, security, and entertainment systems, and the automotive sector, focusing on safer, hands-free operation and sophisticated infotainment. In the enterprise landscape, voice assistants are deployed for customer service (chatbots and virtual agents), operational efficiency enhancements, and employee support, drastically reducing response times and operational costs. The compelling benefits of AI voice assistants—such as enhanced accessibility for users with disabilities, unparalleled convenience, and the capacity to handle high volumes of concurrent requests—are critical factors bolstering widespread adoption across diverse demographic and technological segments globally. Furthermore, the convergence of 5G networks and edge computing capabilities is paving the way for low-latency, real-time voice processing, further improving user satisfaction.

Driving factors critical to the market’s trajectory include the massive proliferation of internet-of-things (IoT) devices, making voice interaction a seamless necessity across connected ecosystems. Significant investments by major technology conglomerates (GAFAM) in research and development focused on improving multilingual capabilities and reducing error rates are accelerating innovation. Additionally, the growing consumer expectation for instant, personalized, and convenient digital services across mobile devices and home electronics necessitates the deployment of highly capable AI voice assistants. Regulatory frameworks focusing on data privacy and security, while presenting a constraint, also drive innovation towards trust-centric AI solutions, ensuring sustainable market growth.

Artificial Intelligence Voice Assistant Market Executive Summary

The Artificial Intelligence Voice Assistant Market is experiencing an exponential growth phase characterized by rapid technological maturation and deepening penetration across critical end-use verticals. Key business trends indicate a strong move toward hybrid models, where voice capabilities are seamlessly integrated into existing applications (ambient computing), rather than relying solely on dedicated smart speaker hardware. Furthermore, the transition from transactional interactions to genuinely conversational AI capable of maintaining context and exhibiting emotional intelligence is a major focus for competitive advantage. Strategic partnerships between hardware manufacturers and AI developers are becoming crucial for creating interoperable and platform-agnostic voice ecosystems. Privacy and data security remain central competitive differentiators, pushing companies toward robust, ethical AI development frameworks.

Regionally, North America maintains market dominance due to high consumer disposable income, early adoption of smart home technology, and the presence of leading technological innovators such as Google, Amazon, and Apple. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by rapid smartphone penetration, urbanization, and specific demands for multilingual voice solutions in large markets like China and India. Europe exhibits strong growth driven by enterprise adoption across the BFSI and healthcare sectors, emphasizing GDPR compliance and secure communication protocols. Emerging markets in Latin America and MEA are increasingly adopting AI voice assistants, particularly in mobile commerce and telecommunications, seeking cost-effective customer engagement solutions.

Segment trends reveal that the Solutions component segment, specifically the underlying software platforms and APIs, holds the largest market share, reflecting the high value placed on sophisticated backend technology. By application, the Smart Home segment continues to lead, although the Automotive and Healthcare segments are showing remarkable acceleration due to regulatory shifts and increasing demand for remote patient monitoring and vehicular safety features, respectively. Cloud-based deployment remains the predominant mode, offering scalability and reduced infrastructure costs, though the demand for edge computing voice models is rising sharply, especially in latency-sensitive industrial applications. The integration of generative AI is set to redefine the market, shifting capabilities from merely reactive execution to proactive, predictive assistance.

AI Impact Analysis on Artificial Intelligence Voice Assistant Market

User inquiries frequently center on how generative AI (GenAI) and large language models (LLMs) fundamentally alter the functionality and utility of traditional voice assistants, often questioning the future competitiveness of existing proprietary systems against open-source LLM frameworks. Common concerns revolve around data privacy when integrating advanced learning models, the capability of these new systems to handle complex, multi-turn, and emotionally nuanced conversations, and the potential for AI assistants to become truly proactive and personalized rather than just responsive tools. Users are keen to understand the shift from basic command execution to complex reasoning and creative task completion, which is vital for enterprise applications requiring synthesis and decision support. Furthermore, questions related to deployment—specifically the feasibility of running these large models locally on edge devices to ensure speed and data sovereignty—are highly prevalent, reflecting a desire for improved performance and security.

The integration of advanced AI, particularly transformer architectures and LLMs, is transforming AI voice assistants from simple information retrieval tools into comprehensive conversational interfaces capable of high-level reasoning and content generation. This paradigm shift addresses key user expectations by enabling assistants to summarize long documents, write emails, generate creative content, and debug code based on spoken instructions, dramatically expanding their utility beyond basic scheduling or smart home control. The immediate impact is observed in enhanced contextual understanding and coherence across extended conversational threads, mitigating the frustration associated with previous generation assistants that often lost context quickly. This improved conversational fluency is accelerating enterprise adoption, particularly in roles requiring significant human interaction and knowledge synthesis, positioning AI voice assistants as indispensable productivity multipliers.

However, this transition also necessitates addressing the technical challenges related to computational cost and ethical deployment. While the aspiration is for highly intelligent, proactive assistants, the increased complexity requires robust ethical AI governance frameworks to manage potential biases in training data and prevent the generation of harmful or misleading information (hallucinations). Furthermore, optimizing these large models for speed and size to function effectively on consumer and enterprise hardware without constant cloud reliance is a significant technological hurdle. Companies are actively investing in model quantization and distillation techniques to deploy powerful, yet efficient, AI voice capabilities directly onto edge devices, promising a new era of low-latency, private, and highly personalized voice interactions.

- Generative AI Integration: Enables complex reasoning, content creation, and highly personalized responses, moving beyond predefined scripts.

- Contextual Memory Enhancement: LLMs drastically improve the ability of assistants to maintain context and history across extended, multi-turn conversations.

- Proactive Assistance Shift: Transitioning from purely reactive command execution to proactive suggestions and task initiation based on user patterns and external data.

- Multimodality and Sensory Fusion: Combining voice input with visual and textual data processing for richer, integrated interaction experiences (e.g., analyzing images while listening to instructions).

- Edge AI Optimization: Focus on deploying smaller, optimized models directly on devices to reduce latency, improve privacy, and minimize cloud reliance.

- Accuracy and Error Reduction: Significant reduction in word error rate (WER) and natural language understanding (NLU) failure rates due to deeper neural network training.

- Ethical AI Governance: Heightened focus on bias mitigation, data provenance, and transparency protocols to build user trust in increasingly sophisticated AI systems.

DRO & Impact Forces Of Artificial Intelligence Voice Assistant Market

The market for AI Voice Assistants is dynamically shaped by powerful growth drivers, persistent operational constraints, significant emerging opportunities, and competitive impact forces that dictate strategic positioning. Key drivers include the massive increase in global connectivity, the integration of 5G networks enabling faster data transmission necessary for complex voice processing, and the declining cost of sensor and processing technologies. The consumer expectation for personalized, immediate service across all digital touchpoints—from banking to retail—mandates the adoption of sophisticated conversational interfaces. Furthermore, the global push towards automation in industrial and service sectors to mitigate labor shortages and improve efficiency strongly supports the deployment of voice-activated workflows. These factors collectively create sustained, upward pressure on market valuation and adoption rates.

However, market expansion is constrained by several critical factors. Prominent among these is the pervasive concern regarding data privacy and security; users remain skeptical about the constant listening capabilities of voice assistants and the handling of sensitive biometric and conversational data. Technical restraints include the persistent challenge of accurately processing complex regional accents, dialects, and non-native speech, leading to performance inconsistency across global markets. Furthermore, the high initial investment required for deploying and maintaining advanced, enterprise-grade conversational AI platforms, along with the need for specialized AI talent, acts as a barrier for small and medium-sized enterprises (SMEs). Managing model drift and ensuring continuous learning capabilities also present ongoing operational hurdles.

Opportunities for exponential growth lie in penetrating highly regulated and specialized sectors such as healthcare (diagnostic assistance, elderly care) and finance (algorithmic trading, secure transaction verification). The development of highly personalized synthetic voices and emotional AI capable of detecting user sentiment opens avenues for deeply empathetic and engaging user experiences. Furthermore, geographical expansion into underserved linguistic markets, particularly those with complex tonal languages, presents lucrative prospects for specialized AI developers. Impact forces shaping the competitive landscape include regulatory oversight (e.g., AI Act in Europe), which demands transparency and accountability, and the dominance of platform giants that control key ecosystems (iOS, Android, Alexa). The continual advancement in open-source LLM technology exerts pressure on proprietary models, driving down the cost of entry and fostering greater innovation and competition among smaller players focusing on niche applications and localized solutions.

Segmentation Analysis

Segmentation analysis reveals a highly diversified and rapidly evolving market structure, defined by technology, deployment model, component type, and application vertical. The complexity arises from the modular nature of voice assistant solutions, which allows companies to mix and match backend AI components (like ASR and NLP engines) with specialized application interfaces. Understanding these segments is crucial for strategic market entry and product differentiation, as the needs of a smart home user differ drastically from those of a healthcare professional utilizing a voice assistant for electronic health record (EHR) management. The transition toward a service-based economy is evident, with professional services related to integration and customization growing faster than initial solution deployment.

In terms of Components, the Solutions segment currently commands the largest revenue share, primarily driven by the ongoing investment in refining core software features, including intent recognition, dialogue management, and backend integration APIs. However, the Services segment, particularly Consulting and System Integration, is experiencing the highest growth CAGR. This acceleration is due to the increasing complexity of integrating conversational AI into legacy enterprise IT infrastructures and the specialized requirement for training and fine-tuning models using proprietary enterprise data to achieve optimal performance and domain specificity. Effective integration services ensure that voice assistants provide genuine business value rather than acting as isolated technological novelties, making professional expertise indispensable.

From an application perspective, the Smart Home category is characterized by volume adoption and aggressive pricing models, whereas the BFSI (Banking, Financial Services, and Insurance) and Healthcare sectors are dominated by high-value, secure deployments. BFSI relies heavily on voice assistants for secure identity verification, automated fraud detection, and personalized wealth management advice, demanding robust security features and regulatory compliance. The Automotive sector is also a high-growth segment, driven by manufacturers seeking to differentiate vehicle models through advanced, integrated voice command systems that control navigation, climate, and communications, reducing driver distraction and enhancing safety.

- By Component:

- Solutions (Software Platforms, Development Kits, APIs)

- Services (Consulting, System Integration, Maintenance and Support, Managed Services)

- By Deployment:

- Cloud-Based

- On-Premise/Edge

- By Technology:

- Speech Recognition (ASR)

- Natural Language Processing (NLP)

- Machine Learning/Deep Learning

- Text-to-Speech (TTS)

- By Application:

- Smart Home (Consumer Electronics)

- Automotive

- Healthcare

- Retail and E-commerce

- BFSI (Banking, Financial Services, and Insurance)

- Education

- Others (Government, Travel, Hospitality)

- By Language:

- English

- Mandarin

- Spanish

- Others (German, French, Japanese, etc.)

Value Chain Analysis For Artificial Intelligence Voice Assistant Market

The value chain for the Artificial Intelligence Voice Assistant Market spans fundamental research to end-user interaction, characterized by deep interdependencies between specialized technology providers. The upstream activities are dominated by hardware and core technology providers, including semiconductor manufacturers supplying high-performance chipsets optimized for AI inference (ASIC/GPU), and specialized firms developing proprietary speech recognition and natural language processing engines (NLU/NLG). This phase involves significant R&D investment in acoustic modeling, massive data collection and labeling for training large language models, and the continuous refinement of core AI algorithms to improve accuracy and reduce latency. Licensing of these core technologies forms the foundation upon which commercial voice assistants are built, creating high barriers to entry for new competitors lacking fundamental AI IP.

Midstream activities involve solution development, integration, and distribution. Software platform providers (like Amazon Alexa or Google Assistant platforms) aggregate core technologies, adding sophisticated dialogue management frameworks, application programming interfaces (APIs), and developer toolkits. System integrators and independent software vendors (ISVs) then customize these platforms for specific vertical applications, integrating them into enterprise systems such as CRM, ERP, and IoT environments. The distribution channel is bifurcated: direct distribution is common for consumer-facing hardware (smart speakers, mobile apps), while complex enterprise solutions rely on indirect channels, involving specialized IT consulting firms and value-added resellers (VARs) who provide implementation expertise and ongoing support tailored to organizational needs.

Downstream activities center on deployment, user interaction, and data feedback loops. For consumers, the distribution is primarily through large e-commerce platforms and retail electronics chains. For enterprises, deployment occurs directly via cloud services or private data centers. Crucially, the downstream process includes continuous data feedback, where user interactions are logged, anonymized, and fed back into the upstream R&D cycle to retrain and improve model performance. Direct channels offer faster feedback and proprietary control over the entire user experience, essential for platform dominance. Indirect channels ensure market penetration into specialized industries that require localized support and complex, often multi-vendor, integration, highlighting the necessity of strong partner ecosystems to achieve scale and industry-specific capability.

Artificial Intelligence Voice Assistant Market Potential Customers

Potential customers for AI Voice Assistant technology are highly diverse, spanning individual consumers seeking convenience to multinational corporations optimizing critical business functions. Consumer end-users are primarily driven by the desire for hands-free control, instant information access, and the simplification of daily routines, making them major buyers of smart speakers, smart displays, and mobile applications integrating voice assistants. These customers value ease of use, ecosystem integration, and affordability, leading to intense competition among the major tech giants that control the consumer AI landscape. The purchasing decision is heavily influenced by brand loyalty and the availability of third-party skills or integrations within the assistant’s ecosystem.

In the enterprise sector, potential customers are organizations across every major vertical seeking operational efficiency and enhanced customer relationship management. The BFSI sector utilizes voice assistants for secure banking inquiries, automated customer support during peak hours, and internal compliance checks. Healthcare providers are key buyers, deploying voice solutions for clinical documentation, hands-free data entry in sterile environments, and engaging in remote patient monitoring and elderly care management. Retail and e-commerce companies leverage voice assistants extensively for personalized product recommendations, inventory checks, and streamlining the purchasing process, aiming to reduce cart abandonment and improve conversion rates across digital channels.

Moreover, the automotive industry represents a high-growth customer segment, where manufacturers are increasingly embedding sophisticated AI assistants directly into vehicle infotainment systems to manage navigation, communication, and vehicle diagnostics safely and intuitively. Government and public sector entities also represent significant potential customers, using voice assistants for disseminating public information, managing citizen inquiries, and internal knowledge management systems. These diverse end-users are united by a common need for high accuracy, seamless integration with existing systems, robust data security (especially in regulated industries), and the ability to handle domain-specific jargon and complex query structures effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 Billion |

| Market Forecast in 2033 | $83.5 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amazon, Google, Microsoft, Apple, Baidu, Samsung, IBM, Nuance Communications (Microsoft Subsidiary), SoundHound, Tencent, Alibaba, Sensory Inc., Oracle, Cisco, SAP, Inbenta, Verint Systems, Creative Virtual, Conversica, Genesys. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Artificial Intelligence Voice Assistant Market Key Technology Landscape

The technological backbone of the Artificial Intelligence Voice Assistant market is characterized by a sophisticated interplay of specialized AI disciplines, primarily focusing on enabling seamless conversion of speech to intent and then to action. Automated Speech Recognition (ASR) is the foundational layer, converting acoustic signals into accurate text transcripts. Modern ASR relies heavily on deep neural networks, particularly recurrent neural networks (RNNs) and transformer models, which are trained on vast datasets of spoken language to achieve exceptionally low word error rates (WER), even in noisy environments or with varied accents. This continuous improvement in ASR accuracy is critical, as any error in the initial transcription cascades through the entire processing pipeline, directly impacting the user experience and the utility of the assistant.

Following successful transcription, Natural Language Processing (NLP) and Natural Language Understanding (NLU) take over, forming the intelligent core of the voice assistant. NLU engines interpret the meaning and intent behind the transcribed text, resolving ambiguities and extracting critical entities. The recent infusion of large language models (LLMs) has dramatically enhanced the contextual understanding and conversational memory of these systems, allowing them to handle complex, multi-turn dialogues and generalize knowledge across different domains. This shift from rule-based or shallow parsing to deep learning-driven semantic analysis is fueling the market's transition from task automation to genuine conversational intelligence, driving greater user adoption in complex enterprise settings where nuanced understanding is essential.

Finally, the response generation relies on Natural Language Generation (NLG) and Text-to-Speech (TTS) technologies. NLG frameworks structure the assistant's reply in a coherent and contextually appropriate manner, often leveraging generative models for highly natural conversational flow. High-fidelity TTS technology then converts the generated text back into synthesized speech. Advances in TTS, including the use of deep learning (such as Tacotron and WaveNet architectures), have resulted in increasingly human-like, expressive, and personalized synthetic voices, which are vital for establishing trust and improving user engagement. The convergence of these specialized technologies—ASR, NLU, and TTS—optimized by continuous machine learning and robust cloud infrastructure, defines the competitive edge in the current market landscape.

Regional Highlights

Geographically, the Artificial Intelligence Voice Assistant Market exhibits distinct patterns of maturity, growth drivers, and adoption rates across major global regions. North America, specifically the United States, represents the largest revenue-generating market, primarily due to the established presence of global tech giants (Amazon, Google, Apple) who dominate the consumer and platform segments. High consumer disposable income, early and widespread adoption of smart home technology, and significant corporate investments in enterprise AI solutions—particularly across BFSI, tech, and healthcare sectors—solidify the region’s lead. North American enterprises are focused on integrating AI voice capabilities into existing cloud infrastructure to streamline internal operations and enhance remote customer interaction, driving demand for sophisticated integration services and secure, cloud-native voice platforms.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, characterized by explosive growth in smartphone usage, rapid urbanization, and a massive, diverse linguistic landscape. Countries like China and India are major contributors, with local tech giants (Baidu, Alibaba, Tencent) heavily investing in voice assistant technology tailored to specific regional dialects and use cases, such as mobile commerce and local language content consumption. Government initiatives supporting smart city projects and digitalization efforts in sectors like education and finance further accelerate demand. Unlike North America, APAC growth is heavily influenced by mobile-first strategies and the need for robust multilingual processing capabilities to serve highly fragmented markets effectively.

Europe holds a substantial market share, driven primarily by strong enterprise adoption in Western economies like Germany, the UK, and France. The European market prioritizes data sovereignty and adherence to stringent regulatory frameworks such as GDPR, making secure, on-premise, and private cloud voice solutions highly sought after. The focus here is less on smart speaker proliferation and more on vertical-specific AI assistants deployed within automotive manufacturing, specialized healthcare diagnostics, and multilingual customer service operations. Latin America and the Middle East & Africa (MEA) are emerging regions, where adoption is accelerating, especially in the telecommunications and retail sectors, as organizations seek to leapfrog traditional customer service channels using cost-effective, AI-driven voice engagement tools to reach large, digitally native populations.

- North America: Market leader; driven by consumer technology giants, high smart home penetration, and mature enterprise integration in finance and technology. Strong focus on large-scale LLM deployment and cloud infrastructure security.

- Asia Pacific (APAC): Fastest-growing market; fueled by high mobile penetration, increasing regional urbanization, demand for multilingual support, and heavy investment by local ecosystem players (e.g., Baidu, Alibaba).

- Europe: Stable growth; characterized by rigorous regulatory compliance (GDPR), strong demand for secure, vertical-specific enterprise solutions (Automotive, BFSI), and preference for data privacy-preserving AI models.

- Latin America (LATAM): Emerging market; growth concentrated in telecommunications, retail, and mobile banking, driven by the need for automated customer engagement and service scalability.

- Middle East & Africa (MEA): Nascent growth; rapid expansion in government services, smart city initiatives (e.g., Saudi Arabia, UAE), and increasing adoption within financial services and energy sectors requiring specialized Arabic language models.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Artificial Intelligence Voice Assistant Market.- Amazon (Alexa)

- Google (Google Assistant)

- Microsoft (Cortana, Nuance Communications)

- Apple (Siri)

- Baidu (DuerOS)

- Samsung (Bixby)

- IBM

- SoundHound

- Tencent

- Alibaba

- Sensory Inc.

- Oracle

- Cisco

- SAP

- Inbenta

- Verint Systems

- Creative Virtual

- Conversica

- Genesys

- Kore.ai

Frequently Asked Questions

Analyze common user questions about the Artificial Intelligence Voice Assistant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between traditional voice assistants and new generative AI-powered assistants?

The primary difference lies in conversational depth and capability. Traditional assistants rely on predefined scripts and rule-based systems for intent matching, limiting them to transactional tasks. Generative AI assistants, powered by LLMs, can understand context over long conversations, reason, synthesize new information, and generate creative or unique responses, enabling complex tasks and highly human-like interactions.

How are data privacy and security challenges being addressed in the AI Voice Assistant market?

Companies are addressing security through several methods: implementing robust encryption protocols for data transmission, offering options for edge processing where data is processed locally on the device (reducing cloud exposure), and adopting Privacy-Enhancing Technologies (PETs) like federated learning and differential privacy, ensuring compliance with global regulations like GDPR and CCPA.

Which application segment is expected to drive the highest revenue growth in the next five years?

While Smart Home remains the largest by volume, the Healthcare and BFSI (Banking, Financial Services, and Insurance) segments are expected to drive the highest revenue growth. These sectors require high-value, secure, and specialized AI solutions for critical tasks such as clinical documentation, fraud detection, and personalized customer support, justifying significant investment in bespoke enterprise-grade voice platforms.

What technological advancements are crucial for improving voice assistant performance in multilingual environments?

Crucial advancements include developing highly sophisticated, language-agnostic transformer models capable of transferring knowledge across languages (zero-shot learning), improving acoustic modeling for regional dialects, and implementing multilingual NLP pipelines that can seamlessly switch between languages within a single conversation, critical for global market acceptance.

Why is the Asia Pacific (APAC) region expected to achieve the fastest Compound Annual Growth Rate (CAGR)?

APAC’s accelerated CAGR is driven by three main factors: rapid increase in smartphone penetration creating a massive user base, aggressive government digitalization mandates (Smart Cities), and substantial local investment by tech firms to develop voice assistants optimized for the region's diverse, complex linguistic market and mobile-centric consumption patterns.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager