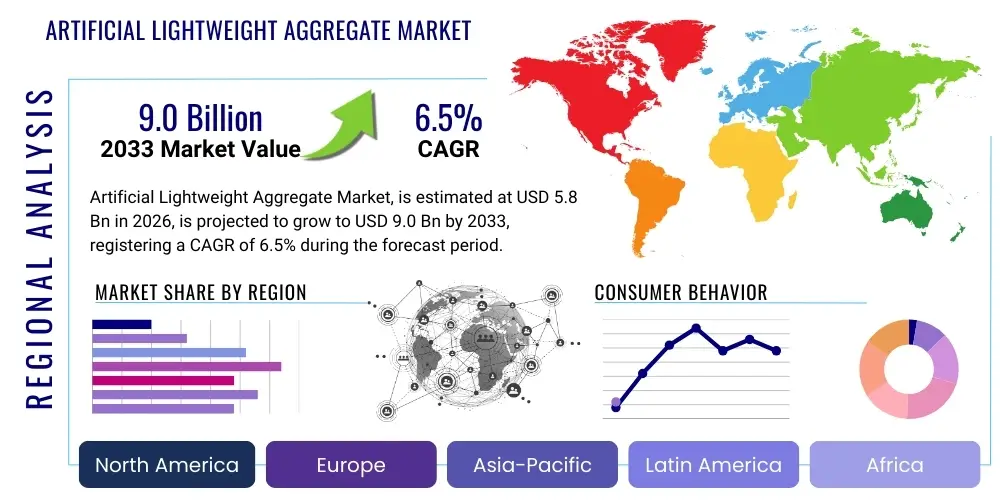

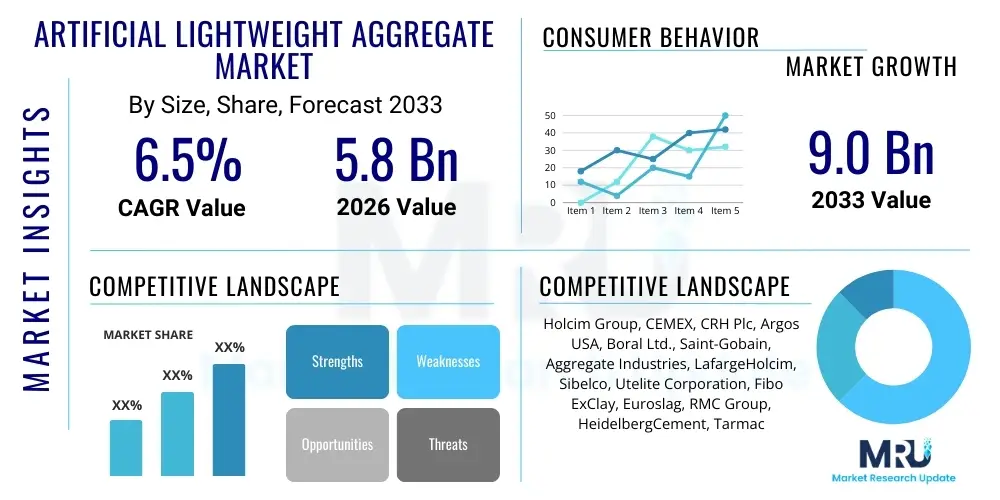

Artificial Lightweight Aggregate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437063 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Artificial Lightweight Aggregate Market Size

The Artificial Lightweight Aggregate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by increasing global infrastructure expenditure, particularly in emerging economies, and the sustained demand for high-performance, sustainable construction materials that reduce structural dead load and improve thermal efficiency. Market expansion is strategically driven by advancements in material processing technologies, allowing for the effective utilization of industrial waste streams, such as fly ash and slag, thereby aligning production with circular economy principles and bolstering profitability for manufacturers navigating stringent environmental regulations worldwide.

Artificial Lightweight Aggregate Market introduction

The Artificial Lightweight Aggregate (ALA) market encompasses manufactured granular materials designed to exhibit a low bulk density while maintaining sufficient structural integrity for various construction and geotechnical applications. These aggregates, which include materials like expanded clay, shale, slate (ExClay, ExShale, ExSlate), sintered fly ash, and processed slag, are typically created through thermal processing, such as sintering or rotary kiln firing, which introduces a porous internal structure. This reduced weight is the primary distinguishing feature, offering significant advantages over traditional natural aggregates like gravel or sand, particularly in reducing the dead load of structures, which subsequently lowers foundation costs and allows for greater design flexibility in large-scale projects like high-rise buildings and long-span bridges. The production process often involves high-temperature expansion of specific mineral components or controlled agglomeration of fine industrial residues.

Major applications of ALAs span the entire construction ecosystem, ranging from structural concrete used in high-strength, lightweight panels and beams, to non-structural concrete applications such as thermal insulating blocks and acoustic barriers. In geotechnical engineering, ALAs are highly valued as lightweight fill materials, reducing lateral earth pressure behind retaining walls and minimizing settlement risks in soft soil conditions, particularly vital for road embankment construction and slope stabilization projects. Furthermore, the material's superior thermal insulation properties make it an indispensable component in energy-efficient green building initiatives globally. The increasing demand for sustainable construction practices, coupled with stricter environmental mandates regarding waste management, is strongly propelling the adoption of aggregates derived from industrial by-products, positioning ALAs as critical facilitators of resource efficiency and sustainable urbanization.

Key market drivers include the accelerating pace of urbanization in Asia Pacific, necessitating robust and rapid construction methods, and the continuous innovation in concrete technology aimed at achieving higher strength-to-weight ratios. The benefits of ALAs—including enhanced fire resistance, improved sound absorption, reduced transportation costs due to lower density, and diminished seismic load risk—are increasingly recognized by engineers and architects. However, the market must continuously address challenges related to energy-intensive manufacturing processes and ensuring consistent quality control across diverse raw material inputs. Strategic initiatives focus on optimizing kiln efficiency and developing cleaner manufacturing techniques to solidify ALA’s position as a premium, high-performance building material in global construction supply chains.

Artificial Lightweight Aggregate Market Executive Summary

The global Artificial Lightweight Aggregate (ALA) market is characterized by robust growth, primarily fueled by global construction booms, rigorous implementation of sustainable building codes, and technological advancements enabling efficient utilization of industrial byproducts. Business trends indicate a strong shift towards optimizing production costs through large-scale, automated sintering and rotary kiln facilities, particularly focusing on using waste materials like fly ash and blast furnace slag, which simultaneously addresses waste disposal concerns and secures low-cost feedstock. The market structure is moderately consolidated, with major global construction material conglomerates driving research into specialty ALAs for high-performance concrete applications. Furthermore, the push for green infrastructure and the proven long-term economic benefits associated with reduced structural weight and improved energy efficiency are attracting significant private investment, promoting the development of regionally focused manufacturing hubs strategically located near major construction markets and industrial waste sources.

Regional trends highlight Asia Pacific (APAC) as the dominant growth engine, driven by massive investments in infrastructure development, affordable housing projects, and rapid urbanization, particularly in China and India, where the sheer volume of construction necessitates efficient, high-volume aggregate production. North America and Europe, while exhibiting slower volume growth, lead the market in terms of value and technological adoption, focusing intensely on high-specification ALAs for applications such as deep-sea oil rigs, bridge decks, and specialized geotechnical fills, driven by stringent quality standards and a mature green building movement. Regulatory harmonization across the European Union encourages the cross-border adoption of certified lightweight products, emphasizing the role of ALAs in meeting demanding energy performance targets for new and retrofitted buildings. The Middle East and Africa (MEA) region is expected to demonstrate significant potential, leveraging ALAs to construct thermally efficient structures necessary to cope with extreme climate conditions, while Latin America focuses on reducing seismic risk through lighter construction materials.

In terms of segmentation, the Fly Ash segment is anticipated to witness the highest CAGR, primarily due to the global availability of coal combustion residues and continuous technological refinement in converting this waste into reliable aggregate. Application segmentation strongly favors Structural Concrete, as the weight reduction benefits translate directly into substantial cost savings and enhanced performance in critical infrastructure. End-user analysis reveals the Building & Construction sector remains the primary consumer, although Infrastructure applications, particularly road and bridge construction where minimizing ground pressure is critical, are increasingly important drivers. Strategic focus areas for manufacturers include developing porous aggregates that maximize thermal resistance without compromising mechanical strength, thus catering directly to the rapidly expanding market for net-zero energy buildings and highly durable marine structures.

AI Impact Analysis on Artificial Lightweight Aggregate Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on the Artificial Lightweight Aggregate (ALA) market generally revolve around process optimization, quality control consistency, predictive maintenance, and supply chain efficiency. Users frequently ask: "How can AI optimize the sintering temperature profiles to minimize energy consumption while ensuring consistent aggregate expansion?" and "Can machine learning algorithms predict the long-term performance and durability of concrete mixes containing ALAs based on raw material variability?" There is also high interest in using AI for real-time monitoring of raw material composition, especially when utilizing highly variable industrial waste streams like fly ash and slag, to immediately adjust processing parameters. The overarching theme is the integration of AI to transition ALA production from empirical batch processes to highly optimized, data-driven continuous manufacturing, ensuring high quality, reduced waste, and significant energy savings, thereby enhancing the economic and environmental sustainability of the aggregates.

The primary expectation from integrating AI technologies is achieving unprecedented levels of operational efficiency and material predictability. Traditional ALA manufacturing is energy-intensive and highly sensitive to minor variations in feedstock composition and kiln conditions. AI, specifically through Industrial IoT (IIoT) sensors combined with sophisticated neural networks, allows producers to model complex non-linear relationships between inputs (chemical composition, moisture content, firing temperature, residence time) and outputs (density, porosity, crushing strength). This predictive capability minimizes off-spec product runs, drastically reduces reprocessing time, and contributes directly to lowering the carbon footprint associated with the manufacturing process. Furthermore, AI-driven demand forecasting and inventory management systems are proving crucial for optimizing the complex logistics involved in sourcing high-volume waste materials and distributing finished aggregate products to geographically disparate construction sites.

Consequently, the integration of AI tools, including predictive maintenance platforms and prescriptive analytics, is transforming the competitive landscape. Companies adopting these technologies gain a significant advantage in terms of cost competitiveness and ability to guarantee superior, consistent product quality, essential for high-specification projects like bridges and high-rise structures. This move towards intelligent manufacturing helps mitigate the market constraint related to the perceived variability of ALAs derived from waste streams. In the long term, AI will accelerate R&D by simulating the performance of novel raw material mixes and processing conditions, leading to the rapid commercialization of next-generation ALAs with tailored properties, such as enhanced thermal insulation or ultra-high strength ratios, solidifying the market's trajectory towards digitalization and sustainable optimization.

- AI-driven optimization of rotary kiln and sintering processes minimizes energy consumption and variability in aggregate expansion.

- Machine learning enhances real-time quality control by analyzing sensory data related to particle size distribution and density.

- Predictive maintenance algorithms reduce operational downtime and maintenance costs for capital-intensive thermal processing equipment.

- AI improves raw material blending strategies, ensuring consistent feedstock quality when utilizing variable industrial waste (fly ash, slag).

- Enhanced supply chain logistics and demand forecasting facilitated by AI optimize inventory levels and reduce transportation-related emissions.

- Accelerated material science R&D through computational simulation of novel aggregate compositions and performance characteristics.

DRO & Impact Forces Of Artificial Lightweight Aggregate Market

The Artificial Lightweight Aggregate (ALA) market is shaped by a critical interplay of Drivers, Restraints, and Opportunities, collectively forming the key Impact Forces that dictate market evolution and strategic direction. Primary drivers include the global push for reduced building dead load, which translates directly into structural cost savings and seismic resilience, and the compelling need for sustainable construction materials that effectively utilize vast quantities of industrial waste products, particularly coal combustion residuals and metallurgical slags, aligning with circular economy mandates. These strong demand drivers are partially counterbalanced by significant restraints, primarily the high capital expenditure required for establishing or upgrading specialized thermal processing facilities (rotary kilns, sintering plants), and the inherent fluctuations in the quality and availability of the secondary raw materials used, which complicates production standardization. However, the market possesses substantial growth opportunities driven by the emergence of 3D printing in construction, which requires specifically formulated, lightweight, and easily pumpable aggregates, and the continuous tightening of global energy efficiency and 'green building' certifications that favor materials with superior thermal properties, ensuring long-term market sustainability and innovation.

The key Impact Forces operating on the market involve technological advancement in processing, regulatory pressure, and the cost dynamics of alternative materials. Technological advancements in process control, particularly the implementation of AI and sensor networks, are mitigating the restraint of variable raw material quality, allowing producers to achieve higher product consistency and improve energy efficiency, thereby reducing operational costs. Regulatory frameworks across North America and Europe are increasingly mandating the use of materials with recycled content and improved thermal performance, transforming what might be considered a technical advantage into a regulatory necessity, thus forcibly driving market adoption. Conversely, the competitive pricing and established supply chains of traditional natural aggregates present a persistent barrier to entry, forcing ALA manufacturers to consistently justify their premium pricing based on life-cycle cost savings related to structural optimization and energy performance. Geopolitical stability affecting energy prices is also a significant force, given the high-temperature requirements of ALA production, making long-term fuel hedging and energy source diversification critical for maintaining competitive pricing.

The overall market trajectory is highly positive, driven by long-term structural shifts in the global construction industry toward sustainability and resilience. The opportunity to integrate ALAs into new construction methodologies, such as modular and prefabricated building systems where weight reduction is paramount for transport and assembly efficiency, further strengthens the market outlook. Strategic alignment of ALA producers with key infrastructure projects, especially those focused on upgrading seismically vulnerable structures or developing coastal protections using lightweight, durable marine concrete, represents a significant growth vector. Managing the inherent volatility in raw material supply, especially as coal consumption declines in developed markets, will be critical; this necessitates diversification into alternative feedstock sources like municipal solid waste incineration ash or specialty clays that can be efficiently processed, securing a robust future for the sector.

Segmentation Analysis

The Artificial Lightweight Aggregate (ALA) market is comprehensively segmented based on material type, which defines the source and production method; application, specifying the end use in construction and engineering; and end-user vertical, identifying the primary purchasing sector. This segmentation is crucial for stakeholders to analyze specific demand patterns, raw material dependencies, and tailored product development requirements. The material segmentation (e.g., Expanded Clay/Shale versus Fly Ash) reflects differing supply chain dynamics and mechanical/thermal performance characteristics, with industrial byproducts rapidly gaining share due to sustainability mandates. Application segmentation highlights the critical role of ALAs in high-value niches like structural concrete and geotechnical applications where reduced weight is an indispensable performance attribute, while end-user segmentation clearly indicates the dominance of the residential and commercial building segment but notes the growing strategic importance of public infrastructure projects requiring durable, lightweight solutions.

- By Material Type:

- Expanded Clay, Shale, & Slate (ExClay, ExShale, ExSlate)

- Sintered Fly Ash

- Expanded Slag (Foamed Slag)

- Perlite and Vermiculite (Exfoliated Minerals)

- Others (e.g., Sintered Sewage Sludge)

- By Application:

- Structural Concrete (Precast Elements, Bridge Decks, High-Rise Structures)

- Non-Structural Concrete (Concrete Blocks, Insulating Concrete)

- Geotechnical Applications (Embankments, Retaining Wall Backfill, Slope Stabilization)

- Road Construction (Lightweight Road Bases, Pavement Overlays)

- Horticulture (Soil Mixes, Hydroponics)

- Others (Refractory Applications, Filtration)

- By End-User:

- Building & Construction (Residential, Commercial, Industrial)

- Infrastructure (Roads, Bridges, Tunnels, Marine Structures)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Artificial Lightweight Aggregate Market

The value chain of the Artificial Lightweight Aggregate (ALA) market commences with raw material sourcing, which is bifurcated into primary natural resources (specific clay and shale deposits suitable for expansion) and secondary industrial byproducts (fly ash, slag, and occasionally processed mine spoils). Upstream analysis focuses heavily on securing consistent, high-quality feedstock, which is particularly challenging for waste-derived materials due to inherent variability in chemical and physical composition; efficient logistics for bulk transportation of these raw materials to centralized processing plants constitute a major cost center. Processing involves energy-intensive steps such as pre-treatment, granulation, and high-temperature thermal expansion using rotary kilns or sintering belts, requiring significant capital investment and advanced energy management systems to maintain product specification consistency (density, strength, porosity). The operational efficiency achieved at this manufacturing stage is the primary determinant of the final product's competitiveness and environmental footprint.

Downstream analysis involves distribution, marketing, and final application. The distribution channel is multifaceted, relying heavily on both direct sales to major ready-mix concrete suppliers and precast concrete manufacturers, as well as indirect channels through regional construction material distributors and aggregate merchants. Due to the reduced bulk density, ALAs offer significant advantages in transportation efficiency, particularly over long distances, which is a key selling point in landlocked or remote construction areas. Marketing efforts focus on educating structural engineers, architects, and public works authorities about the technical performance benefits, life-cycle cost reductions, and sustainability credentials of ALAs compared to conventional aggregates. The application phase sees ALAs incorporated into specialized lightweight concrete mixes, geotechnical fills, or high-performance cementitious products, often requiring specialized mixing and placement protocols to ensure optimal structural performance and thermal integrity.

The value capture largely occurs at the manufacturing stage through technological differentiation and efficient waste utilization, enabling producers to offer a premium product. Direct distribution channels ensure closer engagement with key structural concrete producers, facilitating tailored product development and faster market feedback regarding performance requirements in specific projects (e.g., seismic zones, marine environments). Indirect distribution broadens geographical reach, particularly for standard-grade insulating aggregates used in residential construction. Critical to the entire chain is maintaining compliance with stringent construction standards (e.g., ASTM, EN standards) and environmental regulations regarding the handling and processing of industrial wastes, ensuring that the sustainability narrative remains robust and verifiable throughout the product lifecycle from sourcing to final application.

Artificial Lightweight Aggregate Market Potential Customers

The primary customers and end-users of Artificial Lightweight Aggregate (ALA) products are entities within the vast global construction and infrastructure ecosystem whose project requirements prioritize structural integrity combined with weight reduction, thermal efficiency, or environmental sustainability. The largest customer segment encompasses Ready-Mix Concrete (RMC) Suppliers and Precast Concrete Manufacturers. These businesses procure ALAs in bulk to formulate specialized lightweight concrete (LWC) mixes for high-rise buildings, bridge decks, and prefabricated structural panels. Their decision-making process is heavily influenced by quality consistency, supply reliability, and the certified performance data of the ALAs, as these materials directly impact the structural calculations and safety factors of their final products. The ability of ALAs to reduce transportation costs for precast elements and speed up on-site assembly further enhances their attractiveness to this segment, driving repeated bulk purchasing decisions necessary for large-scale construction projects.

A second crucial segment includes Geotechnical and Civil Engineering Contractors specializing in ground stabilization, road construction, and infrastructure development on challenging terrain, such as soft soils or steep slopes. These customers utilize ALAs extensively as lightweight fill materials to reduce vertical and lateral pressure, thereby preventing soil settlement and structural failure of retaining walls and embankments. The high internal friction angle and drainage properties of ALAs make them superior to conventional lightweight soil alternatives, positioning them as essential materials in critical public works projects. Moreover, governmental infrastructure agencies and public works departments are increasingly adopting ALAs for large-scale projects like bridge rehabilitation, where minimizing added dead load is critical for extending the service life of existing structures. These customers prioritize long-term durability and proven performance in demanding environmental conditions, often requiring extensive technical documentation and specialized certification.

Finally, a rapidly growing segment consists of specialized Green Building Developers and contractors focused on constructing Net-Zero Energy Buildings (NZEBs) and sustainable residential and commercial properties. For these customers, the superior thermal insulation and sound absorption provided by ALAs, particularly when used in insulating concrete blocks or roof screeds, are key buying criteria. They prioritize materials that contribute maximally to achieving high environmental rating systems (like LEED or BREEAM) and comply with stringent energy performance codes. In addition, Horticultural and Hydroponic Suppliers represent a niche, but specialized customer base, purchasing ALAs for use as inert, lightweight growing media, valued for their porous structure, excellent aeration, and moisture retention capabilities, illustrating the product’s versatility beyond traditional structural applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Holcim Group, CEMEX, CRH Plc, Argos USA, Boral Ltd., Saint-Gobain, Aggregate Industries, LafargeHolcim, Sibelco, Utelite Corporation, Fibo ExClay, Euroslag, RMC Group, HeidelbergCement, Tarmac |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Artificial Lightweight Aggregate Market Key Technology Landscape

The manufacturing of Artificial Lightweight Aggregate (ALA) is highly reliant on sophisticated thermal processing technologies designed to induce controlled expansion and porosity in raw materials while ensuring mechanical durability. The primary technologies employed are the Rotary Kiln process and the Sintering Process. The rotary kiln method is dominant for naturally occurring materials like clay, shale, and slate. In this process, raw materials are pre-treated, pelletized, and fed into an inclined, rotating kiln where they are heated rapidly to temperatures between 1,000°C and 1,200°C. This sudden heating causes internal gases to expand (bloating), creating a porous structure before the exterior surface fuses into a hard shell. Key technological innovations in rotary kilns focus on advanced burner systems for optimized fuel efficiency (often utilizing renewable or low-carbon fuels) and precise temperature control systems employing infrared sensors and IIoT connectivity to manage the highly sensitive bloating phase and ensure uniform aggregate size and density across high-volume production runs.

The Sintering Process is the preferred technology for manufacturing ALAs from fine industrial byproducts, notably fly ash and certain slags. Sintering involves mixing fine feedstock with binders and moisture to form pellets, which are then passed through a traveling grate where they are ignited and exposed to controlled temperatures, causing the particles to fuse together without full melting. The inherent carbon content in fly ash often aids in the internal heating process, reducing external energy inputs. Technological advances in sintering focus on optimizing the pelletizing equipment to achieve consistent green pellet strength, essential for surviving the grate process, and designing improved grate systems that maximize airflow and heat transfer uniformity. The increasing use of carbon capture technologies integrated into the sintering plant exhaust systems is also a key technological trend, aimed at decarbonizing the production process and meeting emerging environmental compliance requirements in regions like Europe.

Beyond the core thermal processing, the technological landscape includes advanced process control and material characterization systems crucial for maintaining competitive edge. Sophisticated laser particle size analyzers and automated density measurement systems are now standard, providing instantaneous feedback to the production line control systems, which adjust material feed rates and firing profiles in real-time. Furthermore, the development of specialized binding agents and pelletizing additives is critical for producers utilizing highly variable waste streams, enabling them to consistently meet structural performance standards. This integration of chemical formulation expertise, high-efficiency mechanical handling, and AI-driven process optimization defines the modern, competitive ALA manufacturing landscape, ensuring superior product reliability demanded by high-specification structural applications globally.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for Artificial Lightweight Aggregates, driven by unprecedented rates of urbanization and monumental government investments in infrastructure, particularly in countries like China, India, and Southeast Asia. The demand is heavily focused on structural applications for rapid construction of high-rise commercial and residential buildings, where reduced material weight significantly lowers foundation costs and expedites project timelines. Furthermore, the massive production of industrial waste (fly ash and slag) in the region provides a readily available and cost-effective raw material base, driving the dominance of waste-derived ALAs. Regulatory efforts to manage industrial pollution also encourage the diversion of these materials into value-added construction products, solidifying the region's position as the global production hub.

- North America: North America is characterized by a mature market focused on high-performance, specialized ALA applications. Demand is strongly driven by stringent seismic design requirements, particularly in coastal regions, and the continuous need for rehabilitation of aging infrastructure (bridges and tunnels) where minimizing additional structural load is paramount. The region emphasizes quality and technical specification, often utilizing ALAs for high-strength, low-density concrete in bridge decks and oil platform structures. Although overall construction volume growth is slower than in APAC, the value generated per ton of ALA is high, underpinned by strict quality standards and a high consumer willingness to pay for certified, high-durability products that offer long-term life-cycle cost savings and energy efficiency benefits in residential construction.

- Europe: Europe exhibits leadership in adopting sustainable and energy-efficient building standards, making ALAs crucial for meeting thermal performance targets. Regulatory pressures, especially the EU's directives on energy performance of buildings and waste management, strongly favor lightweight aggregates that incorporate recycled content and offer superior insulation properties. The market here is fragmented, focusing on tailored solutions for prefabricated housing, geothermal applications, and insulating screeds. Scandinavian and Central European countries are particularly advanced in using ALAs for geotechnical fills in areas with low bearing capacity soils. Innovation is centered on improving the thermal conductivity of aggregates and perfecting the circular economy model by utilizing locally sourced industrial and municipal waste streams.

- Latin America (LATAM): The LATAM market is growing steadily, propelled by increasing residential construction and the recognition of ALAs' benefits in mitigating earthquake risk. Countries like Chile and Mexico, prone to seismic activity, are seeing higher adoption of lightweight structural materials to improve building resilience. The market potential is vast, but growth is occasionally hampered by economic volatility and the challenge of scaling local production facilities to meet demand consistently. Logistics costs for importing materials drive interest in developing local fly ash and clay-based production capabilities.

- Middle East & Africa (MEA): Growth in the MEA region is strongly tied to large-scale infrastructure visions (e.g., Saudi Arabia’s Vision 2030) and the critical need for thermally efficient buildings in extremely hot climates. ALAs are highly valued for their role in reducing the heat transfer coefficient of building envelopes, leading to massive reductions in cooling energy consumption. The market is developing rapidly, with a focus on importing high-quality products while simultaneously exploring opportunities for local production, particularly utilizing regional slag from large metallurgical operations and applying them to mega-projects in the UAE and Qatar.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Artificial Lightweight Aggregate Market.- Holcim Group

- CEMEX

- CRH Plc

- Argos USA

- Boral Ltd.

- Saint-Gobain

- Aggregate Industries

- LafargeHolcim

- Sibelco

- Utelite Corporation

- Fibo ExClay

- Euroslag

- RMC Group

- HeidelbergCement

- Tarmac

- Buzzi Unicem S.p.A.

- Votorantim Cimentos

- Federal White Cement Ltd.

- Tarmac/Aggregate Industries (joint ventures)

- Artopex

Frequently Asked Questions

Analyze common user questions about the Artificial Lightweight Aggregate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of using Artificial Lightweight Aggregates (ALAs) in construction?

The primary technical advantage is the significant reduction in structural dead load, achieved by incorporating low-density, high-strength ALAs into concrete. This reduction allows for smaller foundational requirements, reduced structural steel usage, diminished seismic mass, and lower overall transportation costs for precast elements, leading to substantial life-cycle cost savings and improved design flexibility in high-rise and long-span structures.

How do ALAs contribute to sustainable and green building practices?

ALAs promote sustainability primarily by utilizing vast quantities of industrial waste materials, such as fly ash and slag, thereby diverting them from landfills and supporting the circular economy. Additionally, ALAs enhance the thermal performance of concrete and masonry products, significantly improving building energy efficiency and helping projects achieve stringent green building certifications like LEED or BREEAM.

What are the main raw material sources for Artificial Lightweight Aggregate production?

The main raw material sources are natural deposits, including specific types of expansive clay, shale, and slate, which are thermally processed in rotary kilns. Increasingly, industrial byproducts constitute a major source, including coal combustion fly ash and blast furnace slag, which are converted into functional aggregates through advanced sintering or foaming processes.

Which application segment holds the largest market share for Artificial Lightweight Aggregates?

The Structural Concrete application segment holds the largest market share. This segment encompasses high-value uses such as precast panels, bridge decks, and high-rise building cores, where the superior strength-to-weight ratio and durability of ALAs are indispensable performance requirements, driving high volume and revenue generation.

What is the impact of Artificial Intelligence (AI) on ALA manufacturing processes?

AI integration is focused on optimizing energy-intensive thermal processes (sintering and rotary kilns) and enhancing quality control. AI algorithms analyze real-time sensory data on material composition and temperature, enabling prescriptive adjustments that minimize energy consumption, reduce material wastage, and ensure consistent aggregate quality despite variability in raw material feedstock.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager