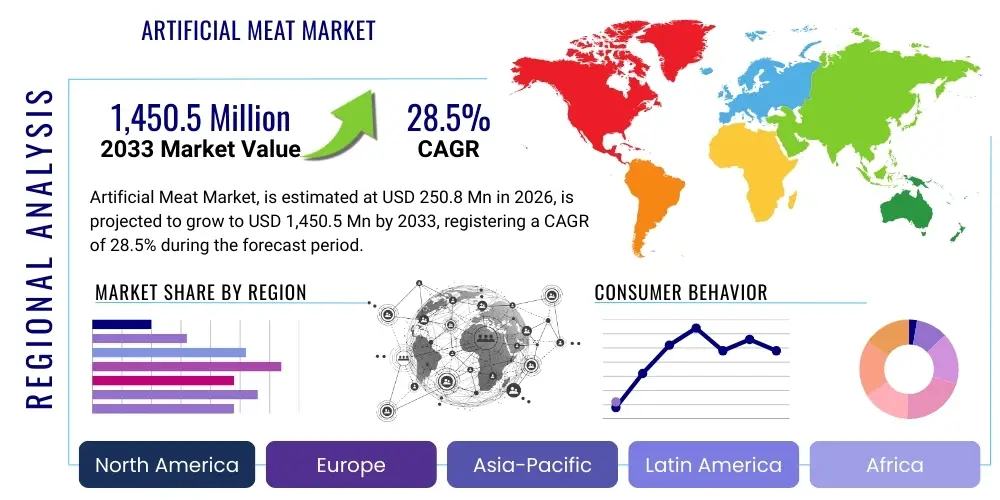

Artificial Meat Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435796 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Artificial Meat Market Size

The Artificial Meat Market, primarily driven by cellular agriculture and advanced fermentation techniques, is poised for explosive growth as regulatory frameworks mature and production costs decline. This market encompasses products derived from animal cells grown in bioreactors, offering a sustainable and ethical alternative to conventional livestock farming. Global investment in cultivated meat infrastructure, coupled with increasing consumer demand for novel protein sources, is rapidly transforming the food industry landscape.

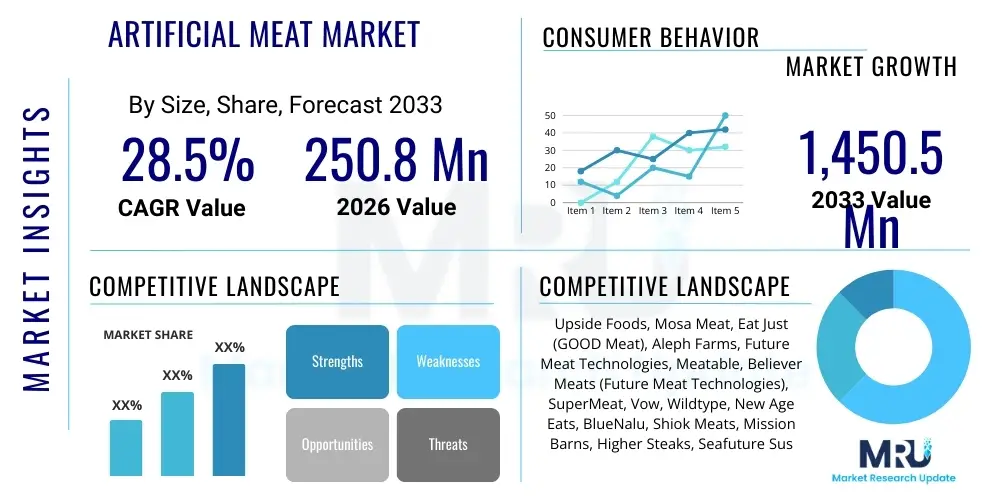

The rigorous R&D cycle currently focused on optimizing cell culture media—reducing reliance on expensive growth factors—is central to achieving commercial viability. Market expansion will be geographically diverse, initially concentrating in regions with favorable regulatory climates, such as North America and specific parts of Asia Pacific. Scaling up production capacity remains the primary challenge, yet successful pilot runs are driving confidence among investors and food manufacturers, positioning artificial meat as a critical component of future food security strategies. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at USD 250.8 Million in 2026 and is projected to reach USD 1,450.5 Million by the end of the forecast period in 2033.

Artificial Meat Market introduction

The Artificial Meat Market, often synonymously referred to as Cultivated Meat or Cell-Based Meat, represents a revolutionary sector within the global food system dedicated to producing genuine animal protein directly from cell cultures, circumventing the need for traditional animal husbandry. This innovative process involves harvesting specific cells (such as muscle, fat, or connective tissue cells) from animals, which are then nourished and grown in controlled laboratory environments known as bioreactors. The resulting product is biologically identical or highly similar to conventional meat in terms of structure, nutritional profile, and sensory attributes. This technology promises significant reductions in environmental impact, including land use, water consumption, and greenhouse gas emissions, addressing critical sustainability concerns associated with industrial meat production.

Major applications of artificial meat currently focus on processed meat forms, such as patties, nuggets, and minced products, which are easier to scale and integrate into existing food supply chains. However, significant ongoing research is dedicated to developing structured meats, including steaks and whole cuts, requiring advanced bio-printing and scaffolding techniques. The immediate benefits driving market adoption include enhanced food safety (as production occurs in sterile, monitored environments), ethical sourcing (eliminating animal slaughter), and the ability to customize nutritional content, potentially offering healthier, leaner meat options. Furthermore, the decoupling of meat production from climate variability and disease outbreaks enhances supply chain resilience.

Key driving factors propelling the market forward include robust venture capital funding directed toward cellular agriculture startups, increasing global awareness regarding climate change and animal welfare, and regulatory breakthroughs in key markets like Singapore, the United States, and Israel. Technological advancements in bioprocessing, particularly in developing cost-effective, serum-free growth media and optimizing large-scale bioreactor operations, are crucial enablers. Moreover, shifting consumer demographics, particularly among younger generations exhibiting a willingness to experiment with sustainable alternatives, are creating a fertile ground for product launch and penetration, positioning artificial meat as a disruptive force in the protein sector.

Artificial Meat Market Executive Summary

The Artificial Meat Market is characterized by rapid technological advancement and highly concentrated investment, predominantly in the North American and European ecosystems. Current business trends indicate a strategic shift from pure R&D to commercial scaling, evidenced by increased investment in large-capacity pilot plants and partnerships between cultivated meat producers and established food processing conglomerates. Profitability remains an immediate challenge due to the high input costs of growth media, but industry projections anticipate cost parity with premium conventional meats within the next five to seven years. Regulatory approval serves as the definitive gatekeeper for commercialization, making governmental policy and consumer education critical success factors in the short term.

Regionally, Asia Pacific, particularly Singapore, remains the pioneering center for commercial approval and initial market sales, providing a blueprint for other nations. North America is leading in capital investment and technological innovation, with numerous startups focused on optimizing bioprocess engineering. Europe exhibits high consumer interest driven by sustainability concerns but faces a more fragmented and cautious regulatory environment, particularly concerning novel food applications. Latin America and the Middle East & Africa are nascent markets, yet they offer significant long-term potential due to growing population centers and increasing concerns over food security, prompting local governments to explore alternative protein strategies seriously.

Segmentation trends highlight that the market is currently dominated by Poultry and Beef segments, primarily due to the easier replication of these cell types and strong consumer familiarity. In terms of end-use, foodservice and specialty retail channels are expected to lead initial adoption, capitalizing on the novelty and premium positioning of the products. Furthermore, the technological segmentation emphasizes a focus on optimizing media formulations and scaffolding techniques. Investors are keenly watching advancements in bioreactor design, moving from traditional stainless steel tanks to more specialized, perfused systems that enhance cell density and product yield, fundamentally improving the economic viability across all segments.

AI Impact Analysis on Artificial Meat Market

Common user questions regarding AI’s impact on the Artificial Meat Market frequently revolve around cost reduction, accelerated R&D timelines, and quality consistency. Users are keen to understand how AI can optimize the highly complex biological and engineering processes inherent in cellular agriculture, particularly concerning the formulation of proprietary, serum-free growth media and the large-scale management of bioreactors. Key concerns often address data privacy in proprietary cell line development and the potential reliance on complex computational models for regulatory approval. Overall user expectation is that AI will be the crucial lever for driving down capital expenditure and operational costs, ultimately making cultivated meat commercially competitive with conventional meat sources by enhancing process control and predictive maintenance across the entire value chain.

- Bioreactor Optimization: AI-driven modeling enhances precision control over temperature, pH, nutrient delivery, and waste removal in bioreactors, maximizing cell yield and efficiency.

- Growth Media Formulation: Machine learning algorithms analyze vast datasets of nutrient requirements to rapidly identify and optimize cost-effective, scalable, and serum-free media components, drastically reducing input costs.

- Cell Line Development: AI accelerates the screening, selection, and genetic optimization of robust, fast-growing, and stable cell lines suitable for industrial production.

- Quality Assurance and Consistency: Computer vision and predictive analytics monitor cell differentiation and tissue structure formation in real-time, ensuring batch consistency and food safety compliance.

- Supply Chain Prediction: Predictive modeling forecasts demand fluctuations and optimizes the logistics of perishable ingredients, minimizing waste and improving just-in-time inventory management.

- Regulatory Pathway Acceleration: AI assists in analyzing and compiling necessary biological and safety data required for submission to regulatory bodies (e.g., FDA, EFSA), streamlining the approval process.

DRO & Impact Forces Of Artificial Meat Market

The Artificial Meat Market is currently experiencing a high-impact phase where innovative technological drivers clash with significant cost and regulatory restraints, balanced by immense sustainability-driven opportunities. Key drivers include accelerating consumer interest in ethical eating and sustainable proteins, substantial private investment injecting capital into scaling R&D, and governmental mandates pushing for climate-friendly food production systems. However, the dominant restraint remains the prohibitively high cost of growth media and the inherent capital expenditure required for establishing Good Manufacturing Practice (GMP) certified facilities. These forces collectively shape a competitive landscape defined by the race to achieve cost parity and secure preemptive regulatory clearance in major economic zones.

Impact forces currently exerting the strongest influence include intense intellectual property (IP) competition surrounding proprietary cell lines and scaffolding technologies, which determines long-term competitive advantage. Consumer acceptance, influenced heavily by ongoing public discourse regarding the ‘naturalness’ of cell-based products and effective public health communication, is a volatile yet decisive impact force. Moreover, the incumbent meat industry, while often resistant, is increasingly recognizing the potential of cellular agriculture, leading to strategic investments and partnerships aimed at diversification, fundamentally altering the competitive dynamics and accelerating market adoption through established distribution networks.

Significant opportunities lie in developing hybrid products that combine cultivated meat cells with plant-based ingredients, offering improved texture and potentially lower costs for immediate market entry. Geographically, expansion into highly populated, meat-intensive markets in Asia and the Middle East presents massive revenue potential, provided regulatory barriers can be navigated efficiently. Furthermore, developing applications beyond human consumption, such as pet food and specialized biochemical manufacturing utilizing cultivated cells, presents valuable diversification avenues. Overcoming the economic restraints through technological breakthroughs in media recycling and continuous bioprocessing methodologies is the critical inflection point that will unlock the market’s full potential and solidify its long-term trajectory toward mass market accessibility.

Segmentation Analysis

The Artificial Meat Market is segmented based on product type, source, end-use application, and technology, reflecting the various stages of maturity and commercial focus within the industry. Understanding these segments is crucial for strategic planning, as different product types face unique technological hurdles and regulatory pathways. For instance, bovine cell lines require different nutritional inputs and scaffolding techniques compared to poultry or aquatic species. The segmentation structure helps market players target specific consumer demographics—such as the premium retail sector or the high-volume foodservice industry—based on their current production capabilities and cost structures.

Analysis reveals that the source-based segmentation (e.g., Poultry vs. Beef vs. Seafood) heavily influences immediate market revenue, with poultry often achieving faster scaling due to its simpler structural requirements. Application segmentation, particularly between ground meat products and whole cuts, directly dictates the technological investment required; whole cuts demand advanced tissue engineering, making ground products the primary revenue driver in the early forecast period. Technology segmentation highlights the competitive race in media formulation and bioreactor design, as these two factors directly control the cost of goods sold (COGS) and the long-term scalability of the entire industry.

- By Source:

- Bovine (Cattle)

- Poultry (Chicken, Duck)

- Seafood (Fish, Shellfish)

- Porcine (Pork)

- Others (Lamb, Exotic Meats)

- By Product Type:

- Ground Meat

- Nuggets and Patties

- Sausages and Hot Dogs

- Whole Cuts (Steak, Fillets)

- By Application/End-Use:

- Foodservice (Restaurants, Cafes)

- Retail (Supermarkets, Specialty Stores)

- By Technology:

- Cellular Agriculture (Cultivated Meat)

- Tissue Engineering and Scaffolding

- Bioreactors and Bioprocessing

- By Media Type:

- Serum-based Media

- Serum-free Media (Recombinant Proteins, Peptides)

Value Chain Analysis For Artificial Meat Market

The value chain for the Artificial Meat Market is fundamentally different from conventional agriculture, involving highly sophisticated bioprocessing and pharmaceutical-grade inputs. The upstream segment is dominated by specialized biotechnology firms and research institutions focused on developing proprietary immortalized cell lines, optimizing genetic modifications for high yield, and crucially, manufacturing high-quality, cost-effective growth media components such as recombinant proteins, amino acids, and growth factors. Sourcing these specialized inputs at a commercial scale and ensuring sterile supply chain integrity are the primary challenges at this stage, directly impacting the final cost structure of the cultivated product.

The midstream segment involves the core production process carried out by the cultivated meat manufacturers themselves. This stage includes cell banking, inoculation, operation of massive, sterile bioreactors for cell proliferation, and complex tissue engineering processes utilizing biocompatible scaffolds to create structured meat products. Efficiency in bioprocessing, particularly achieving high cell densities and continuous harvest cycles, is critical here. Quality control, regulatory compliance (ensuring no contamination or unintended biological risks), and sensory profiling to match traditional meat attributes are intensive processes that demand significant capital investment in specialized manufacturing facilities.

Downstream analysis focuses on distribution and market penetration. Distribution channels initially favor direct-to-consumer models or partnerships with premium foodservice providers, which allow for controlled market introduction and high margin capture. As costs decrease, the shift moves toward mass retail via supermarkets, necessitating robust cold chain logistics and consumer education campaigns. Direct sales, facilitated by proprietary brands, are often employed to maintain brand integrity and communicate the complex value proposition, while indirect channels leverage established food distributors (Sysco, major food processors) to achieve widespread market access efficiently, relying on their existing infrastructure and retailer relationships.

Artificial Meat Market Potential Customers

The potential customer base for the Artificial Meat Market is segmented into three primary groups: environmentally conscious consumers, health and safety focused consumers, and early technology adopters in the premium dining sector. Environmentally conscious individuals, often millennials and Gen Z, seek out artificial meat as a direct solution to climate change and resource depletion caused by industrial livestock. This demographic is willing to pay a premium for verified sustainability claims and transparent production processes, prioritizing the product's ethical footprint over immediate cost savings, particularly in developed Western economies.

The second major group consists of consumers prioritizing food safety and health benefits. Since cultivated meat is produced in sterile, controlled environments, it mitigates risks associated with bacterial contamination (e.g., E. coli, Salmonella) and the routine use of antibiotics and hormones common in conventional farming. This customer segment is highly responsive to messaging around cleanliness, reduced pathogen load, and the potential for nutritionally optimized products, such as meat with customized fat profiles or enhanced omega-3 fatty acid content, particularly in regions prone to supply chain disruptions or food quality concerns.

Finally, the early adopters in the high-end foodservice industry and gourmet retail segment are crucial for initial market validation and brand building. High-profile chefs and innovative restaurants utilize cultivated meat as a unique selling proposition, showcasing culinary innovation and ethical sourcing commitment. These institutional buyers act as critical influencers, educating the public and establishing premium price anchoring before the products transition to mass-market availability. As production scales, the ultimate mass-market consumer will be the price-sensitive buyer seeking cost-parity with conventional meat, marking the critical transition phase from niche innovation to staple food item.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250.8 Million |

| Market Forecast in 2033 | USD 1,450.5 Million |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Upside Foods, Mosa Meat, Eat Just (GOOD Meat), Aleph Farms, Future Meat Technologies, Meatable, Believer Meats (Future Meat Technologies), SuperMeat, Vow, Wildtype, New Age Eats, BlueNalu, Shiok Meats, Mission Barns, Higher Steaks, Seafuture Sustainable Biotech, Avant Meats, cellX, Ivy Farm Technologies, SCiFi Foods. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Artificial Meat Market Key Technology Landscape

The technological landscape of the Artificial Meat Market is centered on three critical areas: cell line development, media optimization, and advanced bioprocessing (bioreactors and scaffolding). Cell line development involves isolating, characterizing, and immortalizing primary animal cells—those capable of robust proliferation—to create master cell banks that serve as the foundation for mass production. This requires significant biotechnology expertise to ensure the cell lines are stable, non-carcinogenic, and capable of differentiating into muscle and fat tissue efficiently. Intellectual property surrounding stable, high-yield cell lines represents a major competitive barrier and technological asset.

Media optimization is arguably the single most critical technological determinant of commercial viability. Traditional cell culture relies on Fetal Bovine Serum (FBS), which is expensive, ethically problematic, and non-scalable. The shift toward proprietary, chemically defined, serum-free media is mandatory. Technologies utilized here include the use of recombinant growth factors produced via precision fermentation (e.g., using yeast or bacteria) and nutrient recycling systems designed to continuously purify and reuse components within the bioreactor, drastically reducing operational costs and waste. Success in media formulation directly dictates the timeline for achieving price parity with conventional meat.

Advanced bioprocessing involves scaling up cultivation from laboratory flasks to industrial-sized bioreactors (up to 10,000 liters or more). This includes designing novel, high-density perfusion bioreactors that allow continuous feeding and harvesting, maximizing volumetric productivity. For structured products like steaks, tissue engineering technologies, including 3D printing and the development of edible, structural scaffolds (made from materials like plant cellulose or hydrogels), are essential. These scaffolds provide the mechanical cues necessary for cells to organize into complex muscle fiber bundles, addressing the texture and mouthfeel challenge necessary for consumer acceptance of whole-cut artificial meat products.

Regional Highlights

Regional dynamics are critical in the Artificial Meat Market, largely dictated by regulatory approval and local consumer attitudes toward novel food technologies. North America, particularly the United States, leads in terms of research funding, startup incubation, and market size potential. The US Food and Drug Administration (FDA) and the Department of Agriculture (USDA) established a joint framework for regulation, signaling strong governmental support for the sector’s development, which has attracted substantial private equity and venture capital. This robust technological and financial ecosystem positions the region as a primary driver of global innovation and scale-up, focusing heavily on achieving cost efficiency through advanced bioprocessing.

Asia Pacific is distinguished by early regulatory success and diverse market opportunities. Singapore was the first country globally to grant regulatory approval for cultivated meat in 2020, establishing itself as a global hub for alternative protein manufacturing and consumption. Markets like China, India, and South Korea, facing immense pressure to secure sustainable and safe protein sources for dense populations, are actively investing in R&D and policy development. Japan’s strong history in high-tech food innovation also makes it a receptive market, focusing on seafood and specialty meats. The region’s proactive stance on food security makes it essential for long-term global market growth, often focusing on species relevant to local diets, such as cultivated aquatic products.

Europe presents a complex scenario characterized by high consumer interest in sustainability but stringent and lengthy regulatory processes governed by the European Food Safety Authority (EFSA). While significant R&D hubs exist in the Netherlands and Israel (geographically often analyzed alongside Europe), the complexity of obtaining Novel Food approval across the European Union remains a considerable bottleneck. Success in Europe hinges on navigating rigorous public perception hurdles and demonstrating unequivocally that cultivated products meet the highest safety standards. Despite these challenges, the European market represents a significant premium opportunity due to the population’s strong propensity for high-quality, ethically sourced, and sustainable food options.

- North America (US and Canada): Leadership in R&D, venture capital funding, and development of regulatory pathways (FDA/USDA). Focus on beef and poultry.

- Asia Pacific (APAC) (Singapore, Israel, South Korea, Japan): Pioneering regulatory approval, strong governmental support driven by food security concerns, and high demand for seafood alternatives.

- Europe (Netherlands, UK): Strong foundational R&D, high consumer interest in ethics and sustainability, but slow and complex Novel Food regulatory processes.

- Latin America (Brazil, Argentina): Emerging market potential driven by traditional meat production expertise and the need for diversification; currently focused on early-stage partnerships and technology transfer.

- Middle East & Africa (MEA): Driven by water scarcity and reliance on imports; significant interest in developing domestic cellular agriculture capabilities, often supported by sovereign wealth funds focusing on long-term food independence.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Artificial Meat Market.- Upside Foods

- Mosa Meat

- Eat Just (GOOD Meat)

- Aleph Farms

- Future Meat Technologies

- Meatable

- Believer Meats (formerly Future Meat Technologies)

- SuperMeat

- Vow

- Wildtype

- New Age Eats

- BlueNalu

- Shiok Meats

- Mission Barns

- Higher Steaks

- Seafuture Sustainable Biotech

- Avant Meats

- cellX

- Ivy Farm Technologies

- SCiFi Foods

- Air Protein

Frequently Asked Questions

Analyze common user questions about the Artificial Meat market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Artificial Meat (Cultivated Meat) and Plant-Based Meat?

Artificial Meat (Cultivated Meat) is real animal protein grown directly from animal cells in a bioreactor, possessing the exact biological and nutritional structure of conventional meat. Plant-Based Meat, conversely, is an imitation product made entirely from plant ingredients (like soy, pea protein, or fungi) designed to mimic the taste and texture of meat.

What is the most significant technological bottleneck currently restricting the mass production of cultivated meat?

The most significant bottleneck is the high cost and scalability challenges associated with the growth media, specifically the need to replace expensive animal-derived components like Fetal Bovine Serum (FBS) with proprietary, cost-effective, serum-free recombinant growth factors and nutrient inputs suitable for industrial-scale bioreactors.

How is the safety and regulatory approval of Artificial Meat handled in major markets?

Regulatory bodies, such as the US FDA/USDA and the European EFSA, evaluate cultivated meat products under novel food legislation. Approval requires rigorous submission of safety data demonstrating cell line stability, absence of contaminants, and nutritional equivalence, ensuring the process and final product are safe for human consumption before market entry.

Will Artificial Meat significantly reduce the environmental impact compared to conventional livestock farming?

Yes, comprehensive life cycle assessments (LCAs) suggest that cultivated meat production could drastically reduce environmental impact, potentially requiring up to 95% less land, reducing water usage significantly, and lowering greenhouse gas emissions, though the exact benefits depend heavily on the energy source used for the production facilities.

When is Artificial Meat expected to achieve price parity with traditional premium meat products?

Industry projections suggest that, driven by breakthroughs in media formulation and the realization of economies of scale through larger bioreactor facilities, cultivated meat is expected to achieve price parity with traditional premium or specialty meats within the next five to seven years, paving the way for eventual mass-market accessibility.

What role does advanced scaffolding play in the production of cultivated meat?

Advanced scaffolding technology is essential for producing structured meat products, such as whole-cut steaks or fillets. Scaffolds (often bio-printed or bio-fabricated) provide the necessary physical framework and cues for muscle and fat cells to align and differentiate into complex, three-dimensional tissues, mimicking the texture and bite of conventional meat.

Which geographical region holds the current leadership in early commercialization and market access?

The Asia Pacific region, specifically Singapore, currently leads in early commercialization, being the first country globally to grant regulatory approval and allow the sale of cultivated meat products to consumers, setting a global precedent for market entry and scaling operations.

How do investments in bioreactor technology influence market growth?

Investments in advanced bioreactor technologies—moving toward perfused and continuous systems—are critical because they directly improve volumetric productivity and reduce cycle times. This scaling efficiency is necessary to move production from laboratory output to commercial volumes, fundamentally lowering the capital and operational expenses (CapEx and OpEx) per kilogram of meat produced.

What are the primary target markets for cultivated meat products during the initial commercial phase?

Initial commercialization primarily targets the high-end foodservice sector (premium restaurants and innovative chefs) and specialty retail. This strategy allows companies to command higher margins, validate product quality with influential consumers, and manage smaller production volumes efficiently before entering high-volume, price-sensitive supermarket channels.

What is the long-term outlook for the sourcing of cells for artificial meat production?

The long-term outlook focuses on establishing proprietary, non-GMO, immortalized cell lines that can proliferate indefinitely without requiring repeated animal biopsies. This ensures ethical sourcing, consistency, and a highly scalable supply chain that is decoupled from conventional animal breeding and farming practices.

Does consumer acceptance pose a major hurdle for the market?

Yes, consumer acceptance, often termed the 'Yuck Factor,' remains a significant non-technological hurdle. Overcoming this requires transparent labeling, effective communication regarding the safety and benefits of the technology, and producing products that perfectly match the sensory experience (taste, texture, aroma) of traditional meat.

How is Intellectual Property (IP) protection handled in this emerging market?

IP protection is critical and focuses heavily on patents covering proprietary cell lines, specific media formulations (especially serum-free components), unique bioreactor designs, and patented scaffolding and tissue engineering techniques. Securing broad IP is vital for companies to maintain competitive advantages in a rapidly evolving, high-stakes biotech sector.

What is the role of large, established meat producers in the Artificial Meat Market?

Established meat producers are playing an increasing role through strategic corporate venture investments and joint ventures with cellular agriculture startups. This involvement secures their future relevance, provides startups with essential distribution channels and supply chain expertise, and hedges against the potential disruption of their traditional business models.

Are there different types of artificial meat products being developed beyond beef and poultry?

Yes, substantial development is focused on cultivated seafood (e.g., fish, shrimp, tuna), porcine products (pork), and exotic meats (e.g., kangaroo, specific bird species). Seafood is a priority due to increasing environmental concerns over unsustainable fishing practices and marine pollution.

How does the sustainability claim of cultivated meat relate to energy consumption?

While cultivated meat significantly reduces land and water use, its current environmental footprint is heavily reliant on energy intensity, specifically electricity used to power bioreactors and sterilize equipment. The sustainability claim improves dramatically when production facilities utilize renewable energy sources, minimizing the carbon footprint associated with manufacturing.

What is the significance of the shift from batch production to continuous bioprocessing?

Continuous bioprocessing, where cells are continuously fed and harvested in the bioreactor over extended periods, is crucial for efficiency. This shift reduces downtime, lowers labor intensity, minimizes equipment requirements per unit of output, and is key to achieving the scale and cost reductions necessary for commercial success.

Do cultivated meat products contain antibiotics or growth hormones?

No. One of the core benefits of cultivated meat is the ability to produce it in sterile environments, eliminating the need for prophylactic antibiotics commonly used in traditional farming. Growth factors are used, but these are defined, purified proteins that drive cell proliferation, not the synthetic hormones sometimes used in livestock production.

What major challenges does the market face in Latin America and Africa?

In these regions, challenges include lower initial capital availability for high-tech manufacturing, the need for establishing robust cold chain infrastructure, and intense price competition from existing, often deeply integrated, conventional meat supply chains. However, long-term opportunities are high due to rapid urbanization and food security imperatives.

How does government support influence the market trajectory?

Government support, through favorable regulatory clearance, direct research grants, or strategic national food security investments (as seen in Singapore and Israel), drastically de-risks the technology for private investors. It accelerates the transition from laboratory R&D to commercial scaling and builds public trust in the novel food category.

What are 'Hybrid Products' in the context of the Artificial Meat Market?

Hybrid products combine a percentage of cultivated animal cells (for flavor and texture) with plant-based ingredients (for bulk and lower cost). This strategy allows companies to introduce cultivated components to the mass market more affordably while leveraging existing plant-based processing infrastructure, serving as an important stepping stone to full cultivated cuts.

What is the importance of texture and sensory attributes for market adoption?

Texture and sensory attributes are paramount for consumer acceptance. If cultivated meat products do not replicate the taste, smell, and mouthfeel of conventional meat, particularly the complex layering found in whole cuts, widespread adoption will be severely limited, regardless of the ethical or environmental benefits.

How does AI contribute to reducing the environmental footprint of production?

AI optimizes resource utilization within bioreactors, minimizing waste and maximizing nutrient uptake efficiency. By creating highly precise, closed-loop systems, AI reduces the need for fresh inputs and energy, leading to a leaner, more sustainable manufacturing process.

Are there limitations to the size of bioreactors currently being utilized?

While lab-scale bioreactors are small, companies are currently piloting facilities ranging up to 10,000 liters. The key limitation is not just size but the engineering complexity of maintaining uniform cell viability and sterility in very large volumes, requiring specialized mixing, aeration, and perfusion systems that are highly energy-intensive.

What measures are being taken to ensure the nutritional value of cultivated meat?

Cultivated meat allows for precise control over nutritional profiles. Manufacturers can modulate the media to optimize fatty acid composition (e.g., increasing Omega-3s), reduce saturated fats, and potentially fortify the product with essential micronutrients, offering health benefits not easily achieved in traditional livestock.

How will the expansion of cultivated meat affect the existing agricultural labor market?

The transition may shift labor demand from traditional animal husbandry toward highly skilled biotechnology, bioprocess engineering, and food science roles. While it could reduce farm labor needs, it simultaneously creates new, high-value manufacturing jobs in urban or industrialized settings.

What role does the patent landscape play in shaping market competition?

The patent landscape is highly competitive, determining which companies control the most cost-effective cell lines and biomanufacturing methods. Extensive patent portfolios are essential for securing investor funding and establishing long-term market dominance, often leading to intense legal disputes over core technologies like media formulation.

Is there a difference in shelf life between cultivated meat and conventional meat?

Cultivated meat, produced in sterile conditions, inherently reduces initial microbial load, potentially offering extended or more reliable shelf life, particularly in processed products. However, the final packaging and cold chain logistics remain crucial factors in maintaining product freshness and preventing spoilage.

How is the industry addressing concerns about genetic modification (GM) in cell lines?

While some companies use techniques involving non-permanent genetic engineering to optimize cell proliferation, the industry is navigating public perception carefully. Many firms emphasize non-GMO approaches, relying instead on classical cell isolation and selection methods, or use temporary genetic adjustments that are not present in the final consumable product, pending regulatory preference.

What are the projected growth sectors by source (e.g., Bovine vs. Poultry)?

Poultry and ground beef segments are expected to see the quickest initial growth due to simpler production requirements and high consumer demand for processed products (nuggets, patties). Cultivated seafood is also forecast for accelerated growth due to strong regulatory interest and pressing sustainability issues in wild fisheries.

Why are large food corporations becoming key partners for startups?

Large corporations provide essential expertise in scaling food production, ensuring food safety compliance across vast supply chains, and offering access to established national and international distribution networks. For startups, these partnerships are crucial for bridging the gap between innovative technology and global market reach.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager