Artificial Pearl Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431797 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Artificial Pearl Market Size

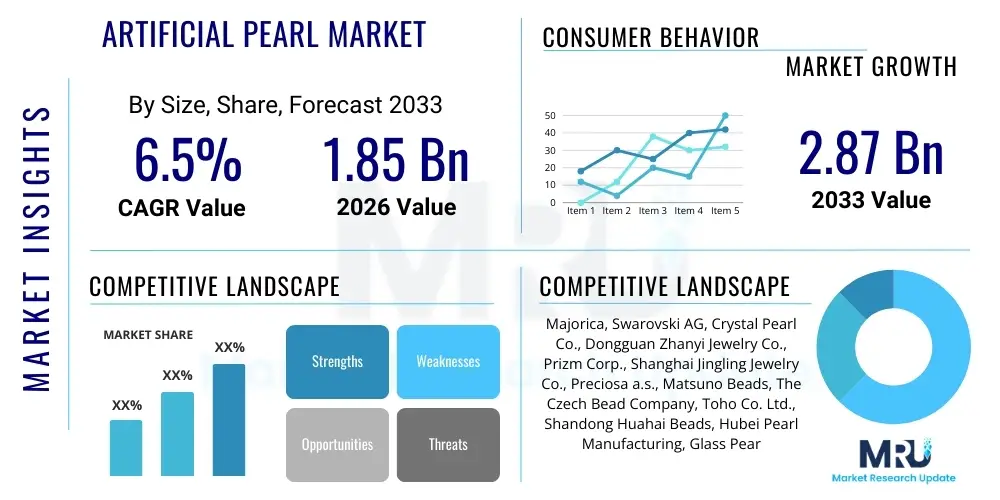

The Artificial Pearl Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.87 Billion by the end of the forecast period in 2033.

Artificial Pearl Market introduction

The Artificial Pearl Market encompasses the manufacturing, distribution, and sale of synthetic or imitation pearls designed to mimic the aesthetic qualities of natural or cultured pearls. These products are typically created using materials such as glass, plastic, shell fragments, or fish scales coated with a lustrous essence, often referred to as 'pearl essence' or 'nacreous layer'. The primary objective is to offer an accessible, affordable, and durable alternative to genuine pearls, fulfilling the surging global demand for fashionable jewelry and ornamental accessories without the high cost and ethical considerations associated with natural pearl farming. The diverse manufacturing techniques, including the renowned Majorca process (utilizing opaline glass cores dipped in liquid nacre substitute), allow for consistency in size, shape, and color, which is highly valued in mass-market production.

Major applications of artificial pearls span across various consumer sectors, most prominently in fashion jewelry, where they are utilized in necklaces, earrings, bracelets, and brooches, complementing both high-street fashion and accessible luxury lines. Beyond traditional jewelry, artificial pearls find substantial application in the apparel and textile industry, used as embellishments on wedding gowns, high-fashion garments, and accessories like handbags and shoes, catering to the aesthetic demands of fast fashion cycles and seasonal trends. The benefits driving market adoption include their superior uniformity, resistance to chipping compared to some natural pearls, and significant cost-benefit analysis for both manufacturers and end-users, facilitating broader market penetration across diverse socio-economic groups globally. Furthermore, the ability to produce these pearls in virtually any color, size, or shape provides unparalleled design flexibility, catering to bespoke and niche market requirements.

Driving factors for sustained market growth are heavily correlated with the globalization of fashion trends, the increasing disposable incomes particularly in emerging economies, and the robust expansion of e-commerce platforms which facilitate wider access to affordable jewelry. The fast-fashion industry's reliance on cost-effective, readily available decorative components sustains high volume demand for artificial pearls. Additionally, evolving consumer preferences toward customization and statement jewelry pieces, coupled with growing awareness regarding the ethical and sustainable sourcing of materials, subtly push consumers towards high-quality synthetic alternatives. The continuous innovation in coating technologies, improving the luster, durability, and authenticity of the imitation product, further reinforces the market trajectory.

Artificial Pearl Market Executive Summary

The Artificial Pearl Market is characterized by robust growth driven primarily by the affordability factor and the escalating demand from the global fashion and apparel industries. Current business trends indicate a strong move towards sustainable and eco-friendly manufacturing processes, with key players investing in biodegradable cores and non-toxic coating materials to address environmental concerns associated with traditional plastic-based imitation pearls. There is a noticeable shift in consumer perception, viewing artificial pearls not merely as substitutes but as fashionable components in their own right, especially when integrated into high-end costume jewelry designs. Strategic partnerships between large-scale pearl manufacturers and global fashion houses are increasing, ensuring a steady supply chain tailored to fluctuating design specifications and short lead times, maximizing inventory turnover and reducing obsolescence risks across the retail landscape.

Regionally, the market exhibits dynamic growth, with Asia Pacific (APAC) maintaining its dominance both as the primary manufacturing hub, owing to lower labor and material costs, and as a rapidly expanding consumption market fueled by burgeoning middle-class populations in China and India. North America and Europe, while being mature markets, show strong demand for premium quality imitation pearls, often sourced from highly reputable producers known for their authentic replication techniques, such as those employing shell core materials. These regions prioritize branding and design innovation. Segment trends highlight that the Glass Pearl segment retains the largest market share due to its superior weight, feel, and perceived quality, closely mimicking genuine pearls. However, the Plastic/Resin segment is experiencing the fastest growth, particularly in applications requiring lightweight components, such as apparel embellishments and children's jewelry, where cost-efficiency and volume are paramount considerations.

Overall, the market is moderately fragmented, with intense competition based on price, quality consistency, and innovation in aesthetic finishes. Investment in advanced coating technologies, such as UV curing and vacuum deposition, is critical for achieving a better depth of luster and resistance to wear, thereby differentiating products in a crowded marketplace. Key challenges revolve around intellectual property infringement, particularly the replication of proprietary coating methods, and maintaining stringent quality standards across varied geographical production sites. The long-term outlook remains highly positive, anchored by the perpetual human desire for luxury aesthetics realized through economical means, ensuring that artificial pearls continue to be an indispensable component of the global accessory supply chain.

AI Impact Analysis on Artificial Pearl Market

Users commonly query how Artificial Intelligence will fundamentally alter the traditional, craft-intensive process of artificial pearl manufacturing, focusing heavily on personalization, defect detection, and supply chain efficiency. A major theme centers on AI's capability to forecast intricate fashion trends—predicting the precise color, size, and shape combinations that will dominate upcoming seasons, thereby drastically reducing excess inventory and improving market responsiveness. Concerns often relate to the ethical implementation of AI in design (potential displacement of human artistry) and the technological barriers (cost of integration) facing smaller, specialized manufacturers. Expectations are high regarding AI-driven quality control, particularly the ability to inspect microscopic flaws in the nacre coating at high throughput rates, something currently challenging for human inspectors, leading to improved consistency and premium product offerings.

The integration of AI is expected to revolutionize several core operational aspects. In the manufacturing phase, AI-powered vision systems are deployed on production lines to continuously monitor the thickness and uniformity of the nacre coating during the dipping or spraying process, providing real-time feedback to robotic arms or machinery to adjust parameters instantly. This results in near-perfect quality consistency and minimizes material waste. Furthermore, Machine Learning algorithms analyze massive datasets related to customer purchase patterns, social media trends, and runway shows to accurately predict demand for specific artificial pearl types (e.g., baroque vs. perfect sphere) and colors up to 18 months in advance. This predictive capability optimizes procurement of core materials (glass, resin) and pigments, significantly mitigating supply chain volatility and reducing stockouts of high-demand items.

Beyond production and forecasting, AI facilitates hyper-personalization in the design phase. Generative AI tools allow jewelry designers to input aesthetic preferences, cost constraints, and material types, instantly generating thousands of novel artificial pearl jewelry designs optimized for manufacturability and current market appeal. This accelerates the product development cycle from months to weeks. Additionally, AI optimizes logistics within the complex, global distribution network of artificial pearls, calculating the most efficient shipping routes and warehousing strategies based on predicted regional demand spikes, leading to lower operating costs and a reduction in carbon footprint related to transportation. This multi-faceted impact solidifies AI as a crucial enabling technology for scale, precision, and market agility in the artificial pearl sector.

- AI-driven quality inspection systems enhance defect detection in coating uniformity, boosting overall product consistency.

- Predictive analytics and Machine Learning models optimize trend forecasting for color, size, and style, minimizing production risk.

- Generative AI tools accelerate novel artificial pearl jewelry design and prototyping, fostering rapid innovation cycles.

- AI optimizes supply chain management by dynamic demand forecasting, improving inventory levels and reducing stockouts globally.

- Robotics integrated with AI algorithms enhance precision in the core material creation and subsequent coating processes, ensuring dimensional accuracy.

- Personalized marketing and recommendation engines utilize AI to match specific pearl styles to individual consumer profiles, increasing conversion rates.

DRO & Impact Forces Of Artificial Pearl Market

The Artificial Pearl Market is driven by substantial cost advantages compared to natural pearls, making high-end aesthetics accessible to the mass market. Key drivers include the exponential growth of the global fast-fashion industry, which requires high volumes of affordable, decorative elements that can keep pace with rapid trend cycles. Furthermore, increasing consumer awareness and preference for sustainable and ethical sourcing practices subtly favors high-quality synthetic alternatives, as the environmental impact and labor ethics of some natural pearl cultivation methods face scrutiny. The robust expansion of e-commerce platforms provides manufacturers direct access to global consumers, simplifying the purchase of customizable and specialty artificial pearl products, contributing significantly to market volume growth. These factors collectively exert a powerful positive force on market valuation and penetration across diverse geographical segments.

Conversely, the market faces several restraining forces, predominantly centered on the pervasive perception of artificial pearls as inherently lower quality compared to natural counterparts, which limits penetration in the truly high-end luxury segments. Material degradation, specifically chipping, peeling, or discoloration of the nacre coating over time, remains a technical challenge that affects consumer trust and repeat purchasing behavior. Moreover, the industry grapples with increasing regulatory scrutiny, particularly in Europe and North America, regarding the use of certain chemicals and plastics (such as plastic core materials) which pose environmental disposal challenges, pushing up the research and development costs associated with compliance and the transition to sustainable materials like bio-resins or glass cores. These restraints necessitate continuous technological improvements to validate product durability and align manufacturing practices with circular economy goals.

Opportunities abound, particularly in the realm of advanced material science and digital integration. Developing bio-degradable or recycled core materials, coupled with novel, highly durable, and environmentally inert coating compositions, offers a significant competitive advantage and addresses key restraints. Customization and personalization capabilities, enabled by 3D printing and digital manufacturing techniques, allow companies to cater to niche and bespoke consumer demands, commanding premium pricing. Furthermore, strategic opportunities exist in expanding non-jewelry applications, specifically within the luxury automotive interior design sector, high-end electronics casing, and sophisticated home decor, positioning the artificial pearl as a versatile decorative material beyond traditional accessories. The combined impact forces of accessibility, design versatility, and technological refinement strongly suggest an upward market trajectory, despite inherent challenges related to product perception and sustainability mandates.

Segmentation Analysis

The Artificial Pearl Market segmentation provides a granular view of market dynamics based on material type, product type, application, and distribution channel, helping stakeholders identify specific growth pockets and competitive advantages. Segmentation is critical because the perceived quality, cost structure, and end-use application vary significantly across these categories. For instance, glass-based pearls compete directly on realism and weight, targeting the mid-to-high-end fashion jewelry sector, whereas plastic or resin pearls prioritize volume and low cost, dominating the apparel embellishment and fast-fashion accessory segments. Understanding these distinctions allows companies to tailor their manufacturing processes, pricing strategies, and marketing efforts efficiently across global markets, ensuring optimal resource allocation and maximum market penetration based on specific consumer demands within each segment.

- By Material Type:

- Glass Pearls

- Plastic/Resin Pearls

- Shell Pearls (Mother-of-Pearl Core)

- Crystal Pearls

- By Type:

- Imitation Pearls (Direct coating on core)

- Simulated Pearls (Higher grade, often using shell cores or multilayer coatings like Majorca)

- By Application:

- Jewelry (Necklaces, Earrings, Bracelets, Rings)

- Apparel & Fashion Accessories (Embellishments on clothing, handbags, shoes)

- Home Decor & Other (Decorative elements, crafts)

- By Distribution Channel:

- Offline (Specialty Stores, Retail Chains, Departmental Stores)

- Online (E-commerce Portals, Direct-to-Consumer Websites)

Value Chain Analysis For Artificial Pearl Market

The Artificial Pearl Market value chain begins with the upstream procurement of essential raw materials, including core materials such as high-grade opaline glass beads, plastic resins (like ABS or acrylic), or natural shell components (mother-of-pearl). Key chemical components, primarily the nacreous coating essence, which often involves formulations containing guanine or bismuth oxychloride for luster, and specialized lacquers or resins, are also sourced. Upstream efficiency is crucial, as the cost and consistency of the core material directly influence the final product quality and manufacturing costs. Suppliers operating in this phase are often specialized chemical producers or glass/plastic molders, necessitating stringent quality control measures to ensure the integrity and compatibility of the raw materials with subsequent coating processes. The competitive advantage at this stage often lies in securing stable, cost-effective supplies of proprietary coating chemicals and ensuring compliance with global environmental standards.

The midstream phase encompasses the core manufacturing processes: creating the sphere (through molding or drawing), followed by the meticulous application of the imitation nacre coating and subsequent finishing steps like polishing and curing. This phase is highly proprietary, with companies like Majorica and Swarovski investing heavily in patented coating and dipping techniques to achieve superior, durable luster that mimics natural pearls. Manufacturers must focus intensely on process optimization, automating dipping and drying cycles, and implementing sophisticated visual inspection systems to maintain uniformity. Efficiency in curing (e.g., UV or thermal curing) is vital for minimizing production bottlenecks and enhancing the durability of the final product, directly influencing perceived quality and market positioning. Manufacturers must manage complex inventory of various pearl sizes, colors, and hole drills necessary for different end applications.

The downstream distribution channels are bifurcated into direct sales (Business-to-Business, supplying high volumes directly to major jewelry brands, apparel manufacturers, and wholesale distributors) and indirect sales (Business-to-Consumer through retail networks and e-commerce). The distribution network for artificial pearls is highly globalized, utilizing established logistics networks to transport finished goods from major production centers (primarily in APAC) to consuming regions (North America and Europe). E-commerce has significantly disrupted the downstream flow, enabling smaller brands and artisans to source directly from manufacturers or wholesalers, thereby streamlining the traditional chain and increasing price transparency. Effective downstream operations require strong relationships with retailers and robust online marketing strategies to manage brand perception and consumer education regarding the quality and durability of the synthetic product.

Artificial Pearl Market Potential Customers

The primary end-users and buyers of artificial pearls are broadly segmented across the fashion and accessory value chain, prioritizing cost-efficiency and aesthetic flexibility. The largest customer base includes large-scale jewelry manufacturers and costume jewelry designers who rely on high-volume, standardized artificial pearls to create accessible, trendy pieces that can be rapidly cycled through retail outlets. These customers prioritize consistency, bulk pricing, and the ability to customize colors and sizes to meet seasonal collections. The second major segment consists of global apparel manufacturers, including fast-fashion giants and haute couture houses, who utilize artificial pearls as decorative embellishments on clothing, shoes, and handbags, demanding lightweight, durable, and highly adhesive-compatible products suitable for textile integration processes.

A rapidly growing segment comprises independent artisans, craft businesses, and small to medium-sized direct-to-consumer (D2C) jewelry brands, who typically procure artificial pearls through specialized wholesale suppliers or online marketplaces. These customers often seek specialized products, such as irregularly shaped baroque-style imitation pearls or unique color finishes, catering to niche, personalized markets. Their procurement decisions are heavily influenced by the perceived 'authenticity' of the imitation and the minimum order quantities offered by suppliers. The expansion of crafting and DIY communities globally further fuels this segment, driven by easy access to instructional content and specialized component suppliers through online platforms. Serving this customer base requires flexible order fulfillment and robust customer support for product selection and application.

Beyond traditional fashion, the market caters to secondary industrial buyers, including manufacturers of high-end home decor items, such as lamps, curtain tiebacks, and luxury furniture. Additionally, specialized segments within the cosmetics and packaging industries sometimes utilize artificial pearls for decorative purposes on premium product packaging. For all potential customers, the purchasing decision matrix balances price against three key variables: durability (resistance to scratching and peeling), aesthetic quality (depth and realism of the luster), and adherence to chemical safety standards (especially for children's jewelry and textile applications). Manufacturers who successfully integrate superior coating technologies and ensure transparent sourcing of core materials are best positioned to capture and retain these diverse customer segments effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.87 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Majorica, Swarovski AG, Crystal Pearl Co., Dongguan Zhanyi Jewelry Co., Prizm Corp., Shanghai Jingling Jewelry Co., Preciosa a.s., Matsuno Beads, The Czech Bead Company, Toho Co. Ltd., Shandong Huahai Beads, Hubei Pearl Manufacturing, Glass Pearl Industries, New Century Pearls, Zhejiang Mingdu Jewelry Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Artificial Pearl Market Key Technology Landscape

The technological evolution within the artificial pearl market centers on achieving superior aesthetic realism, enhancing durability, and ensuring sustainability of materials. One of the cornerstone technologies is the Majorca or Mallorca process, originating in Spain, which involves coating a solid glass sphere core with multiple, meticulous layers of an organic substance derived from fish scales (or synthetic substitutes) mixed with lacquer, followed by specialized polishing and curing techniques. This process ensures a heavy weight and deep, iridescent luster closely mimicking natural nacre. Advancements in this area focus on optimizing the viscosity and composition of the coating material to improve resistance to peeling, abrasion, and chemicals, often utilizing advanced UV-curing technologies for rapid, uniform hardening of the multiple layers. Quality control mechanisms increasingly utilize high-resolution digital imaging and spectrographic analysis to maintain precise color matching and detect minute surface irregularities that impact perceived quality.

Another significant technological cluster involves the development and application of alternative core materials and coating compositions, specifically driven by the demand for lightweight and environmentally friendly options. For the high-volume fashion segment, advanced plastic molding techniques, such as injection molding of acrylonitrile butadiene styrene (ABS) or acrylic, are used to create perfectly spherical or specialized baroque cores. Paired with this is the technology of vacuum deposition or sputtering, which allows for extremely fine, uniform application of pearlescent pigments (often metal oxides or bismuth oxychloride) onto non-porous surfaces. This method offers high efficiency and reduced solvent use compared to traditional dipping. Furthermore, the industry is exploring bio-based polymers and recycled glass as core materials, supported by Green Chemistry principles aimed at reducing the market's reliance on fossil-fuel-derived plastics and heavy metal pigments, enhancing the product's marketability to environmentally conscious consumers.

Beyond material science and coating application, digital manufacturing technologies are shaping the future landscape. High-precision 3D printing is emerging for creating highly customized, complex, or unusually shaped core structures that are difficult or expensive to mold conventionally. This enables rapid prototyping and short-run production for bespoke designer requests. Furthermore, the integration of AI-powered robotics in the handling and dipping stages ensures precision and speed, reducing human error and boosting throughput. Manufacturers are also leveraging advanced surface treatment technologies, such as plasma treatments, to enhance the adhesion of the nacre coating to the core material, dramatically increasing the longevity and wearability of the artificial pearl, positioning these products favorably against their natural counterparts in terms of robust performance and consistent finish quality.

Regional Highlights

The geographical analysis of the Artificial Pearl Market reveals distinct consumption patterns, production capabilities, and regulatory environments across major regions, fundamentally impacting market valuation and growth vectors globally. Asia Pacific (APAC) dominates the market share, driven by its unparalleled capacity as a manufacturing powerhouse, housing the majority of large-scale, high-volume production facilities, particularly in China and India. These countries benefit from well-established supply chains for raw materials (glass, resin) and competitive labor costs, catering to both local and international demand. APAC’s increasing domestic consumption, fueled by rapidly expanding middle-class populations with rising disposable incomes and a strong cultural affinity for jewelry, further cements its position as the engine of market growth. South Korea and Japan also hold specialized segments, focusing on high-quality, simulated pearls with proprietary finishes.

North America represents a mature, high-value consumption market characterized by strong branding, sophisticated retail networks, and a high demand for premium imitation pearls, often sourced from European or specialized Asian producers known for superior quality and compliance. The regional market is largely driven by the fashion and accessories industry, where artificial pearls are frequently integrated into branded costume jewelry lines and wedding attire. Consumer preferences prioritize durability, authenticity in appearance, and, increasingly, transparency regarding the production and environmental footprint of the materials used. The United States accounts for the largest share within North America, reflecting strong consumer spending power and the influence of major international fashion trends and e-commerce platforms, which ensure wide product accessibility.

Europe stands as a critical market, defined by stringent quality standards, a strong heritage in fashion and luxury goods, and evolving sustainability regulations (such as REACH). European consumers, particularly those in France, Italy, and the UK, demand high-quality simulated pearls that meet specific aesthetic and ethical benchmarks. Key European manufacturers often focus on specialized technologies, such as the Majorca process, positioning their products at the higher end of the imitation market, often blurring the lines between costume and fine jewelry. The Middle East and Africa (MEA) and Latin America (LATAM) are emerging regions exhibiting high potential. MEA demand is primarily centered around luxury-oriented jewelry and wedding accessories, while LATAM growth is buoyed by urbanization, expanding retail infrastructure, and a growing consumer base for affordable fashion accessories, making them vital target regions for future market penetration and expansion strategies.

- Asia Pacific (APAC): Dominates production and consumption; highly competitive manufacturing base (China, India); high domestic demand growth due to rising income levels.

- North America: High-value consumption market; emphasis on branded, high-quality simulated pearls; strong e-commerce penetration driving retail sales.

- Europe: Focus on premium quality and sustainability compliance; home to specialized production techniques (e.g., Majorca); strict regulatory environment influencing material selection.

- Latin America (LATAM): Emerging market characterized by rising urbanization and demand for affordable fashion accessories; growth driven by retail infrastructure expansion.

- Middle East & Africa (MEA): Growth concentrated in luxury and wedding segments; imports high-quality products to meet regional consumer affluence.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Artificial Pearl Market.- Majorica

- Swarovski AG

- Preciosa a.s.

- Dongguan Zhanyi Jewelry Co.

- Crystal Pearl Co.

- Shanghai Jingling Jewelry Co.

- Prizm Corp.

- Matsuno Beads

- The Czech Bead Company

- Toho Co. Ltd.

- Shandong Huahai Beads

- Hubei Pearl Manufacturing

- Glass Pearl Industries

- New Century Pearls

- Zhejiang Mingdu Jewelry Co.

- Fujian Tianyi Jewelry Co.

- Hong Kong Jinhui Jewelry

- Guangzhou Yacai Jewelry Co.

- Tiantai Baisheng Jewelry

- Cebu Pearls

Frequently Asked Questions

Analyze common user questions about the Artificial Pearl market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary materials used to manufacture artificial pearls?

Artificial pearls are primarily manufactured using three core materials: glass, which provides weight and superior authenticity; plastic or resin (like ABS or acrylic) for cost-efficiency and lightness; and natural shell (mother-of-pearl) cores, which are coated with specialized nacreous solutions to achieve high-end simulation.

How is the growth of the Artificial Pearl Market influenced by the fast-fashion industry?

The fast-fashion industry significantly drives market growth by creating massive, consistent demand for high-volume, cost-effective decorative elements. Artificial pearls offer the aesthetic appeal required for rapid trend cycles, enabling designers to quickly incorporate pearl elements into affordable, mass-produced garments and accessories.

What is the key technological challenge in producing high-quality simulated pearls?

The key technological challenge is ensuring the long-term durability and adhesion of the nacreous coating. Manufacturers continuously innovate coating formulas and curing methods (such as UV curing) to prevent the surface from chipping, peeling, or discoloring, which is essential for maintaining consumer trust and perceived product quality.

Which geographical region dominates the manufacturing of artificial pearls?

The Asia Pacific (APAC) region, particularly China and India, dominates the manufacturing of artificial pearls. This dominance is attributed to robust production infrastructure, competitive operational costs, and established supply chains for raw materials like glass and plastic cores.

How does the quality of artificial pearls compare between glass core and plastic core types?

Glass core artificial pearls are generally considered higher quality due to their heavier weight, cooler feel, and superior ability to mimic the density of genuine pearls. Plastic core pearls are preferred for low-cost, lightweight applications, such as clothing embellishments, where mass volume and cost efficiency are prioritized over tactile authenticity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager