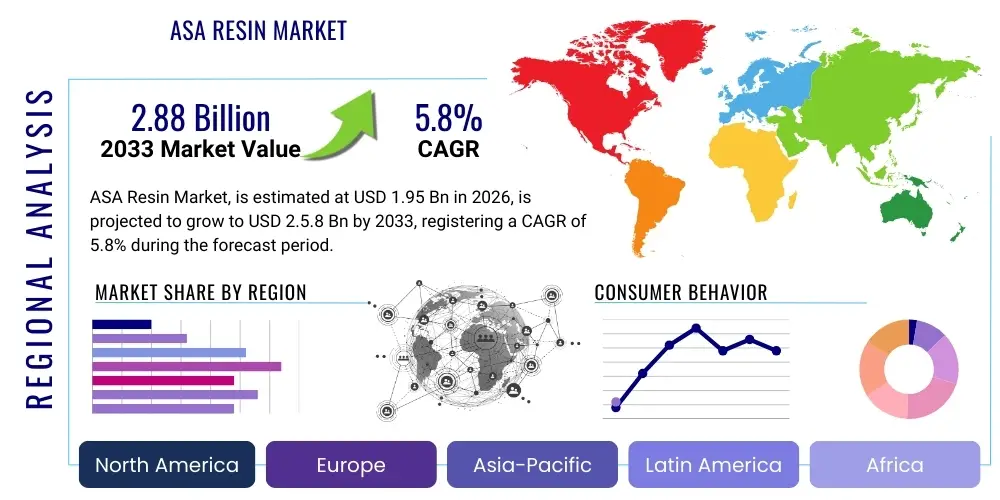

ASA Resin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438052 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

ASA Resin Market Size

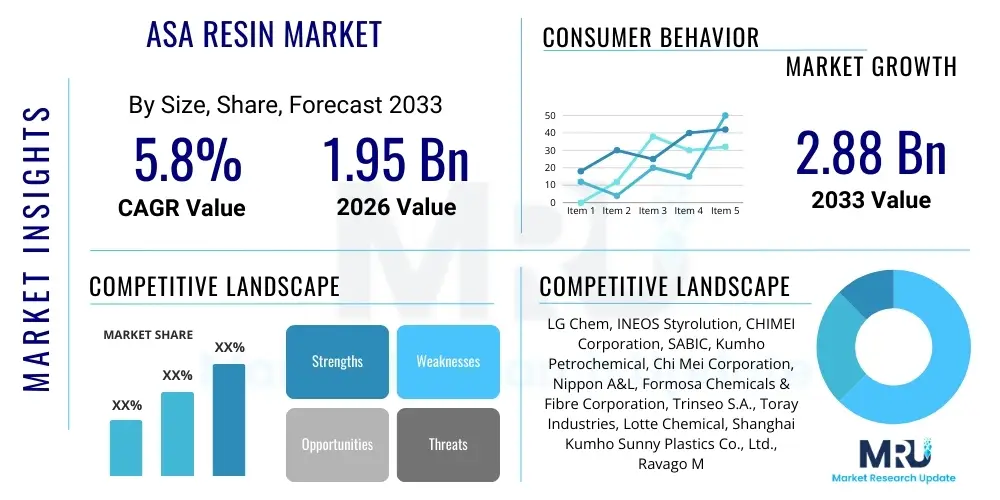

The ASA Resin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.95 Billion USD in 2026 and is projected to reach $2.88 Billion USD by the end of the forecast period in 2033. This robust expansion is primarily driven by the increasing demand for high-performance engineering plastics in outdoor applications, where superior weatherability, heat resistance, and color retention are paramount, particularly within the automotive and construction sectors. The intrinsic chemical resistance and excellent processability of Acrylonitrile Styrene Acrylate (ASA) resins position them favorably against competing materials like ABS, especially in environments exposed to UV radiation and moisture, contributing significantly to market value accretion over the forecast timeline.

ASA Resin Market introduction

The Acrylonitrile Styrene Acrylate (ASA) Resin Market encompasses the global production, distribution, and utilization of this advanced amorphous thermoplastic characterized by its outstanding resistance to ultraviolet (UV) radiation and weathering. ASA resin is fundamentally a terpolymer created by grafting acrylate rubber (acting as the impact modifier) onto a backbone of styrene and acrylonitrile. This unique composition grants it excellent impact strength, rigidity, and superior gloss retention compared to conventional plastics like ABS, which often suffer from significant color shift and mechanical degradation when subjected to prolonged outdoor exposure. As an engineering plastic, ASA maintains crucial mechanical properties, high chemical resistance, and ease of processing, making it a highly valued material across diversified industrial applications.

Major applications of ASA resin span high-demand sectors, including exterior automotive parts (such as mirror housings, radiator grilles, and cowlings), construction materials (like window profiles, siding, and roofing components), and electrical & electronics casings exposed to external elements. Furthermore, the material is extensively utilized in consumer goods, including outdoor furniture and garden tools, due to its aesthetic qualities combined with durability. The primary benefits driving its adoption include exceptional UV stability, allowing for long-term use without painting or coating; high heat deflection temperature, enabling use in demanding thermal environments; and good melt flow characteristics, facilitating complex injection molding and extrusion processes required for intricate component design. These inherent advantages collectively position ASA resin as a preferred substitute for less weather-resistant polymers in critical, high-exposure end-use applications.

Key driving factors accelerating the market growth include stringent regulatory requirements in the automotive sector mandating lightweight, durable, and aesthetically superior materials for vehicle exteriors, contributing to fuel efficiency and longevity. The global surge in construction activities, especially the adoption of sustainable and maintenance-free building materials, further fuels demand for ASA-based window profiles and siding. Moreover, continuous innovation in polymerization techniques is leading to the development of specialized ASA grades, offering enhanced thermal stability and improved dimensional tolerance, thereby broadening the potential application scope into new markets such as marine and agricultural equipment. The shift towards durable, aesthetically pleasing, and high-performance components globally underpins the robust market expansion anticipated throughout the forecast period.

ASA Resin Market Executive Summary

The ASA Resin Market is experiencing dynamic growth, propelled by robust business trends centered on material substitution and sustainability initiatives. Global businesses are increasingly replacing less weather-resistant polymers (such as ABS and PVC) with ASA, particularly in high-exposure applications within the automotive and construction industries, where material performance directly impacts product lifespan and warranty costs. Innovation in compounding technology is enabling the integration of ASA with recycled content and bio-based additives, aligning with global corporate sustainability goals and extending its market viability. Furthermore, strategic partnerships between resin manufacturers and large-scale compounders are optimizing supply chain efficiencies and facilitating customized material solutions tailored for specific regional climate requirements, driving consistent market penetration.

Regionally, the Asia Pacific (APAC) stands out as the dominant growth engine, attributed to the rapid expansion of its automotive production base, coupled with extensive infrastructure development and urbanization projects requiring high volumes of durable construction materials. North America and Europe, characterized by mature automotive aftermarkets and strict building codes emphasizing material longevity and environmental compliance, maintain significant market shares, focusing on premium and specialized ASA grades. Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets, driven by increasing foreign direct investment in manufacturing and infrastructure, though current consumption is lower, the growth rate projection remains strong as local manufacturing capabilities mature and adopt modern engineering plastics.

Segment trends confirm the dominance of the Automotive application segment, followed closely by Construction. Within product grades, Injection Molding Grade ASA resin currently holds the larger market share due to its suitability for complex, high-volume production of automotive components and consumer appliances, while Extrusion Grade is critical for long-profile applications like siding and window frames, particularly in North America. The inherent value proposition of ASA—superior weatherability at a competitive cost point relative to fluoropolymers—ensures its continuous preference across these core segments, mitigating raw material price volatility through long-term performance benefits and reduced maintenance requirements.

AI Impact Analysis on ASA Resin Market

Analysis of common user inquiries regarding the influence of Artificial Intelligence (AI) on the ASA Resin market reveals key thematic areas focusing primarily on production optimization, predictive failure analysis, and material discovery. Users frequently question how AI can enhance polymerization consistency, reduce batch-to-batch variability, and improve material quality control, crucial factors given the precise structural requirements of engineering plastics. Furthermore, there is significant interest in utilizing machine learning algorithms to predict the long-term weatherability performance of new ASA formulations under specific climate conditions, drastically cutting down on lengthy, real-world exposure testing cycles. Finally, inquiries often revolve around AI's role in optimizing supply chain logistics for raw materials (Acrylonitrile, Styrene, Acrylate), ensuring cost stability and timely delivery to large-scale compounders and end-use manufacturers, confirming that user expectations center on AI driving efficiency, quality assurance, and accelerated material innovation in the ASA domain.

The integration of AI and machine learning into the material science workflow for ASA resins promises substantial operational and strategic benefits. AI-driven process control systems can monitor real-time sensor data from polymerization reactors, adjusting temperature, pressure, and catalyst ratios dynamically to ensure optimal molecular weight distribution and consistent grafting efficiency, directly improving the mechanical and weathering properties of the final resin. This precision manufacturing approach minimizes waste, reduces energy consumption, and ensures that ASA grades meet the increasingly tight specifications demanded by high-stakes applications like automotive exteriors and certified construction materials. The ability of AI to model complex chemical interactions and predict material performance under stress or UV exposure is revolutionizing the development pipeline, allowing researchers to screen thousands of virtual formulations before moving to expensive physical experimentation, thereby lowering R&D costs and accelerating time-to-market for specialized ASA products, such as those with enhanced flame retardancy or superior high-gloss finishes.

Moreover, AI algorithms are playing a pivotal role in optimizing the supply chain and demand forecasting for ASA resin. Predictive analytics tools are being deployed to anticipate fluctuations in the price and availability of key feedstocks, allowing manufacturers to strategically manage inventory and hedging activities. On the demand side, AI analyzes global consumption patterns across automotive production schedules, regional construction permits, and consumer electronics cycles to provide highly accurate forecasts, enabling ASA producers to optimize production schedules and capacity utilization. This heightened efficiency not only improves profitability for resin manufacturers but also ensures a reliable supply of specialized ASA grades for critical downstream industries, mitigating supply shocks and ensuring operational continuity across the highly demanding global value chain.

- AI optimizes polymerization processes, ensuring consistent quality and reduced batch variability.

- Machine learning accelerates R&D by predicting weatherability and material performance under UV exposure.

- Predictive analytics enhance raw material procurement and inventory management for feedstocks (acrylonitrile, styrene).

- AI-driven quality control systems minimize defects in extruded and injection-molded ASA components.

- Automation facilitated by AI streamlines downstream compounding and coloring processes, improving throughput.

DRO & Impact Forces Of ASA Resin Market

The ASA Resin market trajectory is fundamentally shaped by a confluence of accelerating drivers, structural restraints, and emerging opportunities, collectively defining the impact forces influencing market dynamics. The primary Driver (D) is the relentless demand for high-performance, weather-resistant plastics in durable goods, particularly catalyzed by the global expansion of the automotive and construction industries seeking maintenance-free, lightweight materials. A significant Restraint (R) is the volatility and dependency on petrochemical feedstock prices (such as styrene and acrylonitrile), which are subject to geopolitical instability and global refining capacity limitations, impacting production costs and final product pricing elasticity. The chief Opportunity (O) lies in developing specialized, functionalized ASA grades, including bio-based or recycled content versions, and expanding penetration into non-traditional markets like marine vessels, agricultural machinery enclosures, and 5G infrastructure components, where durable, aesthetically pleasing protection is essential.

Key impact forces further delineate the market landscape. Technological advancements in polymerization and compounding techniques have significantly improved ASA’s processing window and expanded its blending capabilities, enhancing its competitive edge against materials like PMMA and high-end PVC. However, the regulatory environment presents a dual impact force; while stringent standards for material durability in construction drive demand for weather-resistant ASA, evolving regulations regarding chemical usage and recycling mandates pose challenges requiring significant R&D investment for compliance. Furthermore, the intensified competitive force from other engineering plastics, such as specific grades of polycarbonate (PC) and specialized acrylics, forces ASA manufacturers to continually focus on cost efficiency and performance differentiation. The cumulative effect of these forces suggests a moderately high growth environment, moderated slightly by raw material price risk and the constant necessity for product innovation to maintain market leadership across key application segments.

The market faces structural challenges related to the complexity of achieving the perfect balance of impact resistance, weatherability, and flow characteristics, especially for large, intricate parts. This technical requirement necessitates precise control over the grafting ratio during polymerization. Failure to maintain this control can result in inferior material performance, potentially damaging the brand reputation in demanding applications like automotive exteriors. The opportunity to overcome this restraint lies in advanced manufacturing technologies, including continuous polymerization processes and sophisticated real-time quality monitoring, enabling manufacturers to produce highly consistent, premium-grade ASA resin reliably. Furthermore, the strategic focus on expanding market presence in regions undergoing rapid infrastructure development (e.g., Southeast Asia, Africa) provides avenues for growth, provided robust localized supply chains can be established to mitigate logistical complexities and regional trade barriers.

Segmentation Analysis

The ASA Resin market is comprehensively segmented based on its application, the grade of the material, and the specific end-use sector, providing a multi-dimensional view of consumption patterns and growth pockets. The Application segment is critical as it dictates the required performance specifications, such as heat resistance for automotive parts versus UV resistance and long-term color stability for construction siding. Grading segmentation, distinguishing between injection molding and extrusion grades, reflects the primary processing methods utilized by manufacturers and is essential for optimizing production throughput and part integrity. End-use segmentation provides granular detail on the macro-industries driving demand, highlighting the strategic importance of automotive, construction, and electrical & electronics sectors as primary consumers of high-quality ASA resins globally. This comprehensive categorization allows market players to accurately target their product offerings and R&D efforts towards high-growth, high-value opportunities.

The segmentation structure is crucial for understanding competitive positioning and demand dynamics. For instance, the demand for Extrusion Grade ASA resin is intrinsically linked to the construction sector's health, particularly in regions favoring vinyl siding and durable window profiles, such as North America. Conversely, the growth of Injection Molding Grade ASA is closely tied to global vehicle production rates and the increasing requirement for lightweight exterior components to meet stringent emission standards. Analyzing consumption by geography across these segments reveals regional specialization; APAC dominates consumption in standard and medium-grade ASA due to high-volume manufacturing, whereas Europe tends towards high-performance, customized, and often regulatory-compliant grades for specialized applications. This analytical framework ensures that marketing and capacity planning are aligned with segmented market realities.

Further granularity in segmentation involves distinguishing between neat ASA resin and ASA compounds (blends with other polymers or additives like reinforcing fibers, flame retardants, or anti-static agents). While neat ASA is used for its fundamental weatherability, compounded ASA addresses highly specific performance criteria required by OEMs, such as scratch resistance or high gloss combined with enhanced impact strength. The ongoing trend toward high-value compounding is driving innovation, making the compound segment a key area for high-margin growth. Understanding the interplay between these segmentation categories—from raw resin sales to specialized compound delivery—is vital for manufacturers seeking to maximize their presence in diversified application fields and capture superior economic value across the value chain, ensuring the market analysis remains robust and commercially actionable.

- By Application:

- Automotive (Exterior and Interior Components)

- Construction (Window Profiles, Siding, Roofing, Gutters)

- Electrical & Electronics (Outdoor Enclosures, Connectors)

- Consumer Goods (Outdoor Furniture, Appliances, Garden Equipment)

- Others (Marine, Agricultural Machinery, Telecommunication Infrastructure)

- By Grade:

- Extrusion Grade

- Injection Molding Grade

- Blow Molding Grade

- By End-Use Industry:

- Automotive & Transportation

- Building & Construction

- Consumer Goods & Appliances

- Electronics & Electrical

- Industrial

Value Chain Analysis For ASA Resin Market

The value chain for the ASA Resin market commences with the upstream analysis, focusing on the procurement and processing of key petrochemical feedstocks: acrylonitrile, styrene, and acrylate monomers. This stage is dominated by large chemical and petrochemical companies whose operational stability and pricing strategies directly influence the resin producer's manufacturing costs. Efficiency at this stage is crucial, as volatility in raw material pricing can severely compress the margins of ASA resin manufacturers. Resin producers utilize complex polymerization processes, primarily emulsion polymerization or mass polymerization, to synthesize the ASA terpolymer. Investment in highly efficient, continuous polymerization facilities and advanced quality control systems defines the competitive advantage at this fundamental manufacturing level, ensuring the synthesized resin achieves the necessary balance of impact strength, flowability, and UV stability required for subsequent processing.

Midstream activities involve the primary resin manufacturers who transform the monomers into base ASA pellets. Following polymerization, a significant portion of the value addition occurs in the compounding stage. Specialized compounders either purchase neat ASA resin or utilize their own production, blending it with additives such as colorants, stabilizers, reinforcing fillers (e.g., glass fiber), and flame retardants to create customized compounds tailored to specific OEM requirements. This compounding segment is highly critical as it provides the application-specific performance enhancements demanded by industries like automotive and construction. Downstream analysis involves the final processors—injection molders, extruders, and fabricators—who convert the ASA pellets or compounds into final components, such as automotive grilles or construction profiles. The technological capability and precision of these fabricators directly impact the final product quality and geometric tolerance, often dictating the adoption rate of ASA over competing materials.

The distribution channel is multifaceted, relying on both direct and indirect routes. Large, global resin manufacturers often supply high volumes of standard ASA grades directly to major Tier 1 automotive suppliers or global construction material manufacturers through long-term contracts, ensuring supply reliability and technical support. However, indirect distribution, involving specialized chemical distributors, is vital for reaching small to medium-sized processors and regional manufacturers who require lower volumes, technical support, and localized inventory management. These distributors play a crucial role in providing logistical services, credit facilities, and regional market intelligence, optimizing the supply chain for smaller orders and specialized compounds. Effective management of this integrated value chain, from stable feedstock sourcing to efficient downstream processing and robust distribution networks, is paramount for securing market share and maintaining profitability in the competitive ASA resin market.

ASA Resin Market Potential Customers

Potential customers for ASA resin are diverse, primarily comprising Original Equipment Manufacturers (OEMs), Tier 1 and Tier 2 suppliers in high-performance sectors, and large-scale fabricators specializing in durable exterior applications. Within the Automotive industry, key buyers include manufacturers of exterior components such as side-view mirror housings, radiator grilles, roof racks, and decorative trim, where the resin's excellent UV resistance and color stability are essential for enduring harsh road and environmental conditions. These customers prioritize materials that meet stringent automotive specifications regarding impact resistance, paint adherence (if necessary), and long-term durability, often seeking specific custom-colored or high-gloss ASA compounds that reduce the need for secondary painting processes, thereby lowering production costs and environmental impact, driving substantial long-term volume commitments for premium grades.

The Construction industry represents another significant cohort of potential customers, including manufacturers of building components such as vinyl siding, window profiles (especially co-extruded capstocks), exterior trim, and decorative fence components. These buyers are acutely focused on weather resistance, ease of installation, and low maintenance requirements, making ASA resin, particularly its extrusion grade, a highly desirable material for enhancing the longevity and aesthetic appeal of modern building envelopes. Furthermore, the Electrical & Electronics sector constitutes a growing customer base, specifically targeting manufacturers of outdoor enclosures for telecommunications equipment, exterior junction boxes, and security camera housings, where the material must reliably protect sensitive electronics from extreme weather, temperature fluctuations, and continuous solar exposure while maintaining precise dimensional stability.

Beyond these core industries, a third cluster of buyers includes manufacturers of high-end Consumer Goods and Recreational Products, such as outdoor power equipment (e.g., lawnmower hoods), marine products (e.g., boat dashboards and covers), and sophisticated outdoor furniture. These customers value the combination of high impact resistance, UV protection, and superior surface finish that ASA offers, allowing them to create aesthetically superior, durable products that justify a premium price point. Targeting these niche markets often requires collaboration with material suppliers to develop customized ASA grades that satisfy specialized requirements, such as enhanced chemical resistance against cleaning agents or improved flame retardancy for commercial applications, ensuring that the customer base remains broad and receptive to technological advancements in ASA resin formulations and compounding capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion USD |

| Market Forecast in 2033 | $2.88 Billion USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LG Chem, INEOS Styrolution, CHIMEI Corporation, SABIC, Kumho Petrochemical, Chi Mei Corporation, Nippon A&L, Formosa Chemicals & Fibre Corporation, Trinseo S.A., Toray Industries, Lotte Chemical, Shanghai Kumho Sunny Plastics Co., Ltd., Ravago Manufacturing, Techno-UMG Co., Ltd., Kingfa SCI.&TECH. Co., Ltd., ENTEC Polymers, Jiangsu Seric Chemical Co., Ltd., BASF SE (Compounder Focus), LyondellBasell Industries (Through compounding partners). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ASA Resin Market Key Technology Landscape

The core technology underpinning the ASA Resin market is advanced polymerization, primarily focusing on emulsion polymerization or, less commonly, suspension polymerization, crucial for achieving the desired graft efficiency between the acrylate rubber phase and the styrene-acrylonitrile matrix. Technological advancements are focused on optimizing the reaction kinetics to ensure a highly consistent rubber particle size and uniform shell composition, directly correlating to superior impact resistance and weatherability of the final polymer. Furthermore, continuous process technology, moving away from traditional batch methods, is becoming a key competitive differentiator, enabling manufacturers to produce large volumes of highly consistent material with reduced cycle times and lower energy consumption. The ability to precisely control the molecular weight distribution (MWD) during synthesis allows for the creation of specific grades optimized for different processing methods, such as high-flow grades for complex thin-wall injection molding parts and high-melt strength grades for demanding extrusion profiles.

Beyond the initial synthesis, compounding technology represents a major area of innovation. Manufacturers are increasingly utilizing twin-screw extruders and sophisticated dosing systems to incorporate specialized additives, including highly efficient UV stabilizers, anti-static agents, and specialized pigments. Recent technological progress includes the development of reactive compounding techniques, where additives chemically bond to the ASA backbone during melt processing, resulting in enhanced long-term performance and reduced migration risks, particularly vital for aesthetic parts that require decades of color and gloss retention. Another technological frontier involves blending ASA with other polymers, such as polycarbonate (PC/ASA blends), to combine ASA's weather resistance with PC's high strength and thermal properties, opening up new, high-stress application spaces, demanding advanced mixing technology to ensure homogenous dispersion and interfacial adhesion between the two polymers.

Furthermore, digital transformation technologies, including advanced sensor integration and process analytical technology (PAT), are being deployed throughout the production chain. These technologies allow for real-time monitoring of critical process parameters, enabling rapid intervention and predictive maintenance, significantly improving product yield and reducing operational downtime. The adoption of computer-aided engineering (CAE) and simulation tools is also standard practice among compounders and end-users. These tools allow for the accurate simulation of the molding process (e.g., flow analysis, warpage prediction) and component performance (e.g., stress analysis, failure prediction under UV exposure) before physical prototyping, thereby optimizing part design for ASA resin and reducing development cycles. This continuous technological refinement in synthesis, compounding, and digital simulation ensures that ASA remains a cutting-edge material capable of meeting evolving industry standards for durability, aesthetics, and cost-effectiveness in global markets.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for ASA resin, driven by exponential growth in automotive manufacturing, particularly in China, India, and Southeast Asian nations, where ASA is adopted for lightweight vehicle exteriors. Extensive infrastructure projects and a boom in residential and commercial construction, particularly the usage of durable plastic siding and window profiles in regions like Japan and South Korea, further fuel demand. The presence of major global resin producers and a robust downstream manufacturing ecosystem solidify APAC's dominance, though the market is highly competitive and susceptible to raw material import price fluctuations. The increasing urbanization rates necessitate high-volume, cost-effective durable materials, making APAC the engine of global ASA consumption.

- North America: This region is characterized by high demand for premium, weather-resistant materials in the residential construction sector, specifically for vinyl siding capstock and window components, driven by stringent building codes and consumer preference for low-maintenance exteriors. The automotive sector, particularly the heavy truck and utility vehicle segments, is a significant user of ASA for durable, unpainted exterior parts. North American consumption focuses on high-quality, often customized extrusion grades, supported by advanced compounding capabilities and a mature regulatory environment prioritizing long product lifecycle and resistance to extreme climate conditions prevalent across the continent.

- Europe: The European market is highly mature and innovation-focused, driven primarily by strict environmental regulations and high standards for material quality in both automotive and construction industries. Demand centers around specialized ASA grades, often blended with other polymers to achieve enhanced performance characteristics such as flame retardancy or enhanced aesthetic finishes. Western Europe emphasizes sustainable solutions, driving the adoption of ASA products containing recycled content or bio-based monomers, positioning the region as a leader in high-value, niche ASA applications and advanced material compliance.

- Latin America (LATAM): LATAM is an emerging market for ASA resin, showing strong potential linked to growing domestic automotive production and rapid urbanization, particularly in Brazil and Mexico. The region’s tropical and subtropical climates necessitate highly weatherable materials for construction and outdoor applications, providing a natural fit for ASA. Market growth is currently hampered by economic volatility and reliance on imported resins, but local investment in compounding and manufacturing capacity is expected to drive substantial growth as domestic demand stabilizes and industrialization accelerates across key economies.

- Middle East & Africa (MEA): This region is characterized by high solar irradiance and extreme temperatures, making superior UV and heat resistance mandatory for exterior components, significantly favoring ASA over ABS. Large-scale construction projects, often linked to oil and gas infrastructure and ambitious urbanization plans (e.g., Saudi Arabia, UAE), drive demand for durable building materials and electrical enclosures. Market expansion is dependent on petrochemical investments and the establishment of localized production or compounding hubs to efficiently service the unique performance requirements of the region's harsh climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ASA Resin Market.- LG Chem

- INEOS Styrolution

- CHIMEI Corporation

- SABIC

- Kumho Petrochemical

- Nippon A&L

- Formosa Chemicals & Fibre Corporation

- Trinseo S.A.

- Toray Industries

- Lotte Chemical

- Shanghai Kumho Sunny Plastics Co., Ltd.

- Ravago Manufacturing

- Techno-UMG Co., Ltd.

- Kingfa SCI.&TECH. Co., Ltd.

- ENTEC Polymers

- Jiangsu Seric Chemical Co., Ltd.

- BASF SE (Through Compounding)

- LyondellBasell Industries (Through Compounding)

- Repsol S.A. (Focus on Styrenics)

- Mitsubishi Chemical Corporation

Frequently Asked Questions

Analyze common user questions about the ASA Resin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is ASA Resin and how does it differ from ABS?

ASA (Acrylonitrile Styrene Acrylate) is an engineering thermoplastic prized for its superior weatherability and UV resistance, unlike ABS (Acrylonitrile Butadiene Styrene). While both offer good mechanical properties, ABS uses butadiene rubber, which degrades rapidly under UV exposure, leading to yellowing and embrittlement, whereas the acrylic ester rubber in ASA provides exceptional long-term color and gloss retention, making it ideal for outdoor applications without requiring protective painting.

Which end-use industries primarily drive the demand for ASA Resin?

The primary drivers of ASA resin demand are the Automotive and Building & Construction industries. In Automotive, ASA is critical for exterior parts like grilles and mirror housings due to its durability and color stability. In Construction, it is extensively used for high-performance vinyl siding capstock and window profiles, replacing less durable materials to ensure minimal maintenance and extended product lifespan under various climate conditions.

What are the current technological trends impacting ASA Resin manufacturing?

Current technological trends focus on advanced continuous polymerization processes for improved consistency, specialized reactive compounding techniques for functionalization (e.g., improved scratch resistance or flame retardancy), and the development of sustainable grades incorporating bio-based feedstocks or recycled content, optimizing performance while minimizing environmental impact and aligning with circular economy initiatives.

How significant is Asia Pacific (APAC) in the global ASA Resin Market?

APAC is the dominant regional market both in terms of consumption volume and growth rate. This significance is fueled by massive automotive production output, rapid urbanization, and extensive construction activity, especially in China and India. The region serves as a major manufacturing hub, necessitating large volumes of ASA resin for durable consumer and industrial exterior components.

What is the main challenge faced by ASA Resin manufacturers regarding profitability?

The main challenge is the high dependency on and significant price volatility of key petrochemical feedstocks, specifically styrene and acrylonitrile. Since these are commodity chemicals influenced by global oil prices and refinery outputs, fluctuating costs directly impact the manufacturing margins of ASA resin producers, requiring sophisticated inventory management and strategic hedging to maintain profitability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager