Aseptic Processing Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438646 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Aseptic Processing Equipment Market Size

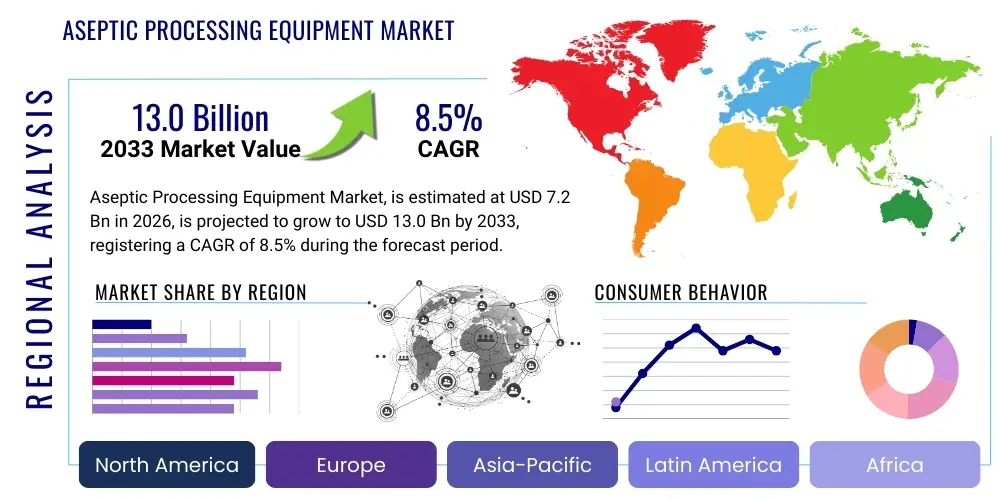

The Aseptic Processing Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $7.2 Billion in 2026 and is projected to reach $13.0 Billion by the end of the forecast period in 2033.

Aseptic Processing Equipment Market introduction

The Aseptic Processing Equipment Market encompasses machinery and systems designed to sterilize and fill pharmaceutical, food, and beverage products without introducing microbial contamination. Aseptic processing is critical for maintaining product safety, extending shelf life, and ensuring consumer health, especially for sensitive products like parenteral drugs, UHT milk, and advanced biopharmaceuticals. This specialized equipment includes sterilizers, isolators, blow-fill-seal (BFS) systems, filling and capping machines, and associated validation technologies, all operating under strictly controlled cleanroom environments.

The core objective of aseptic processing is to prevent recontamination of a product that has been previously sterilized, ensuring that the final packaged item maintains sterility throughout its lifecycle. Major applications span the pharmaceutical sector, where sterile injectables, vaccines, and biologics are handled; the food and beverage industry, particularly for high-acid and low-acid products requiring extended shelf stability without refrigeration; and the cosmetic industry for certain high-purity formulations. The increasing complexity of drug formulations, coupled with the rapid expansion of the global biologics pipeline, necessitates advanced, highly automated aseptic solutions capable of handling sensitive materials efficiently.

Key driving factors propelling market expansion include stringent global regulatory standards set by bodies like the FDA and EMA concerning product sterility and quality assurance, particularly following heightened scrutiny of manufacturing processes. Furthermore, rising global demand for ready-to-use foods and beverages with natural ingredients and longer shelf lives, alongside the significant growth in the geriatric population requiring complex medical treatments delivered via sterile injectables, fuels the demand for sophisticated, high-speed, and reliable aseptic processing lines. The transition towards closed, automated systems, such as isolators and restricted access barrier systems (RABS), further enhances operational safety and reduces the risk of human error.

Aseptic Processing Equipment Market Executive Summary

The Aseptic Processing Equipment Market is poised for substantial growth, driven primarily by robust expansion in the biopharmaceutical sector and increasing global demand for sterile generic and complex drugs. Business trends indicate a strong shift towards fully integrated, modular, and flexible aseptic systems, allowing manufacturers to quickly pivot between different product formats (vials, ampoules, syringes, bags). Technological advancements, particularly in robotics and automation, are addressing labor intensity and contamination risks, making RABS and isolator technologies the preferred solutions across regulated markets. Mergers and acquisitions among equipment providers are concentrating expertise and offering full-line solutions, minimizing complexity for end-users seeking turnkey aseptic facilities.

Regionally, North America and Europe currently dominate the market due to the presence of large pharmaceutical multinationals, rigorous regulatory frameworks that mandate high sterility assurance levels, and extensive investment in advanced manufacturing infrastructure. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth trajectory, fueled by rapid industrialization, increasing healthcare expenditure, and the localization of manufacturing capabilities in emerging economies like China and India. These markets are increasingly adopting Western manufacturing standards to meet both domestic demand and export criteria for sterile products, significantly boosting capital investment in new aseptic processing lines.

Segment trends reveal that the Filling and Packaging Equipment category maintains the largest market share, essential for the final containment of sterile products. Within product types, Isolators and RABS are experiencing rapid uptake, displacing traditional cleanroom technologies due to superior sterility assurance and lower operational costs related to environmental monitoring and personnel gowning. The application segment remains heavily dominated by the pharmaceutical and biotechnology industry, particularly for high-value biologicals and sterile injectables. Continuous aseptic processing technologies and single-use components are emerging trends gaining traction, offering reduced cleaning validation times and enhanced flexibility for small-batch production prevalent in personalized medicine.

AI Impact Analysis on Aseptic Processing Equipment Market

User inquiries regarding the impact of Artificial Intelligence (AI) on aseptic processing equipment frequently center on enhancing quality control reliability, enabling predictive maintenance to maximize uptime, and optimizing complex sterilization cycles. Key themes include concerns about integrating AI systems with legacy equipment, the need for validated AI algorithms in highly regulated environments, and the potential for AI to dramatically reduce human intervention, thereby lowering contamination risk and operating expenditure. Users expect AI to move beyond basic process monitoring to deliver real-time decision-making capabilities, ensuring absolute sterility assurance across variable production conditions.

AI’s primary influence is seen in transforming process validation and monitoring. Machine learning algorithms can analyze vast datasets generated by sensors within RABS and isolators—monitoring variables such as particle counts, temperature differentials, and pressure cascades—to detect subtle deviations indicative of potential contamination risks far faster than human operators or traditional statistical process control. This capability supports continuous process verification (CPV), a crucial component of modern regulatory compliance, by establishing dynamic, high-fidelity sterility assurance thresholds.

Furthermore, AI is pivotal in enabling true predictive maintenance for complex aseptic machinery. By analyzing vibration, temperature, and performance data from critical components like pumps, valves, and robotic arms, AI models can forecast equipment failure probabilities weeks or months in advance. This transition from scheduled maintenance to condition-based maintenance significantly minimizes unplanned downtime, which is exceptionally costly in high-throughput sterile manufacturing environments, thereby enhancing overall equipment effectiveness (OEE) and ensuring consistent compliance with production schedules.

- AI-driven Predictive Maintenance: Reduces unplanned downtime by forecasting equipment failure in pumps and filling systems.

- Real-time Sterility Assurance: Utilizes machine vision and ML models for enhanced visual inspection and detection of container closure integrity defects.

- Optimized Process Parameters: AI algorithms dynamically adjust sterilization cycles (e.g., SIP/CIP) based on real-time environmental data for efficiency and compliance.

- Enhanced Data Integrity and Reporting: Automates comprehensive data logging and deviation reporting required by regulatory agencies (e.g., FDA 21 CFR Part 11).

- Increased Automation and Robotics Integration: Facilitates the seamless operation and coordination of complex robotic handling systems within isolators.

DRO & Impact Forces Of Aseptic Processing Equipment Market

The market dynamics are defined by a confluence of strong regulatory mandates (Drivers), significant capital investment requirements (Restraints), and expanding therapeutic fields (Opportunities), all interacting to shape industry impact forces. The core driver is the increasing global push towards manufacturing excellence and quality assurance, particularly in pharmaceuticals where zero-tolerance for contamination is essential. This regulatory environment mandates the adoption of advanced, closed aseptic technologies, overriding initial investment concerns.

Major restraints revolve around the substantial initial capital investment required to install and validate state-of-the-art aseptic facilities, particularly isolator and RABS technology, which often necessitates costly facility redesigns and specialized training for operational staff. Furthermore, the inherent technical complexity and validation burden associated with high-speed automated systems pose barriers, especially for smaller market players or those in developing regions. Despite these restraints, the overriding pressure from regulatory bodies to eliminate manual interventions in sterile zones strongly favors investment in advanced equipment.

Opportunities are abundant in emerging markets, which are rapidly expanding their domestic pharmaceutical production capacity and upgrading facilities to meet international Good Manufacturing Practice (GMP) standards. Furthermore, the exponential growth in personalized medicine, cell and gene therapies, and bioconjugates—which often require small-batch, highly flexible, and high-containment aseptic filling—presents new avenues for equipment providers specializing in modular and single-use systems. The overall impact force is overwhelmingly positive, driven by the non-negotiable requirement for product safety and the continued innovation in drug delivery technologies.

Segmentation Analysis

The Aseptic Processing Equipment Market is critically segmented based on the type of equipment utilized, the specific applications they serve, and the mode of operation. This structure allows market participants to target specific end-user needs, ranging from high-volume parental drug manufacturing to low-volume, high-value biologic filling. The equipment segmentation highlights the shift from conventional cleanroom methods to modern containment technologies, with isolators and RABS defining the future landscape due to their superior Sterility Assurance Level (SAL).

Segmentation by application clearly delineates the market dominance of the pharmaceutical and biotechnology sector, driven by the massive production of sterile injectables, vaccines, and advanced therapeutic products (ATPs). However, the Food and Beverage segment, particularly in dairy and juice processing (UHT/ESL), represents a stable, high-volume segment continually seeking efficiency improvements through continuous sterilization and aseptic packaging. Geographic segmentation emphasizes the divergence between mature markets that focus on upgrades and technological sophistication, and high-growth emerging markets investing in greenfield facilities.

The segmentation structure reflects current market trends, where flexibility and contamination control are paramount. The emergence of specialized single-use aseptic components is also redefining material handling and integration within various equipment types, offering a path to quicker changeovers and reduced cleaning validation time, which is highly desirable in contract manufacturing organizations (CMOs) handling diverse product portfolios.

- By Equipment Type:

- Sterilization Equipment (Heat, Chemical, Radiation, Filtration)

- Filling and Packaging Equipment (Vial Filling, Ampoule Filling, Pre-filled Syringe Filling, BFS Machines, Capping Machines)

- Cleaning and Sterilization-in-Place (CIP/SIP) Systems

- Containment Systems (Isolators, Restricted Access Barrier Systems (RABS))

- Homogenizers and Mixers

- By Application:

- Pharmaceutical & Biotechnology (Vaccines, Injectables, Biologics, Ophthalmic Preparations)

- Food & Beverage (Dairy Products, Juices, Soups, Ready-to-Eat Meals)

- Cosmetics

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Aseptic Processing Equipment Market

The value chain for aseptic processing equipment begins with upstream suppliers, which provide critical, highly specialized components such as precision pumps, advanced sensors, robotic arms, sterile filters, and high-grade stainless steel required for containment and contact parts. The quality and traceability of these raw materials and components are paramount, as they directly influence the validation process and the final sterility assurance level of the manufactured product. Close collaboration between material suppliers and original equipment manufacturers (OEMs) is vital for integrating cutting-edge materials that withstand aggressive cleaning and sterilization cycles.

Midstream activities are dominated by the OEMs who design, assemble, and validate the complex aseptic machinery, including isolators, BFS units, and high-speed filling lines. This stage is characterized by significant R&D investment focused on automation, modularity, and compliance with global regulatory standards like cGMP (current Good Manufacturing Practice). Equipment integration, factory acceptance testing (FAT), and site acceptance testing (SAT) are crucial services offered by OEMs, ensuring seamless deployment into the end-user’s facility, often involving specialized process engineers and validation experts.

Downstream, the distribution channel primarily involves direct sales from major OEMs to large pharmaceutical companies and multinational food processors, often facilitated by regional service offices and specialized system integrators who customize the equipment layout for specific facility constraints. Indirect channels involve authorized distributors or agents, particularly in smaller or emerging markets, who provide localized sales support and post-installation maintenance. The ultimate consumers (End-Users) demand comprehensive post-sale service, including calibration, preventative maintenance contracts, and rapid access to spare parts to minimize critical production downtime.

Aseptic Processing Equipment Market Potential Customers

The primary customer base for aseptic processing equipment is concentrated within industries that require absolute sterility assurance for their products, dominated by the pharmaceutical and biotechnology sectors. These customers include large multinational drug manufacturers, generic pharmaceutical producers, and increasingly, specialized biotech firms and Contract Development and Manufacturing Organizations (CDMOs) focusing on biologics, personalized medicines, and advanced cell and gene therapies. The stringent regulatory environment in which these firms operate makes high-quality, validated aseptic equipment a non-negotiable capital expenditure.

The second major group of end-users belongs to the food and beverage industry, particularly companies involved in the production of Extended Shelf Life (ESL) and Ultra-High Temperature (UHT) products, such as milk, juices, and specialized nutritional beverages. These clients seek equipment that offers high throughput, energy efficiency, and reliable continuous sterilization, minimizing product degradation while maximizing shelf stability without the need for preservatives or extensive refrigeration. The consumer trend towards natural, minimally processed foods further emphasizes the need for high-integrity aseptic packaging solutions.

Finally, the cosmetic industry, especially manufacturers of high-end, sterile or preservative-free topical and injectable beauty products, also represents a growing segment. While smaller in market share compared to pharma, these companies require specialized small-batch aseptic filling capabilities similar to those used in ophthalmics. Procurement decisions across all customer segments are heavily influenced by the equipment’s validation documentation, compliance track record, long-term reliability, and the OEM’s ability to provide localized technical support and regulatory expertise.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.2 Billion |

| Market Forecast in 2033 | $13.0 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH (Syntegon), GEA Group, IMA Group, Becton Dickinson (BD), Coesia S.p.A. (Flexicon), Romaco Group, Bausch+Ströbel, OPTIMA packaging group GmbH, Shanghai Tofflon Science and Technology Co., Ltd., Dara Pharmaceutical Equipment, Getinge AB, Shibuya Corporation, Krones AG, Tetra Pak, E-BEAM Services, Inc., SP Scientific, SKAN AG, Fedegari Autoclavi SpA, Azbil Telstar S.L. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aseptic Processing Equipment Market Key Technology Landscape

The technological landscape of the Aseptic Processing Equipment Market is rapidly evolving, driven by the need to minimize human intervention and achieve higher sterility assurance levels (SALs). The shift from traditional Grade A/B cleanrooms to closed containment technologies, primarily Restricted Access Barrier Systems (RABS) and Isolators, represents the most significant trend. Isolators, in particular, offer a fully contained environment where sterilization can be performed using vaporized hydrogen peroxide (VHP) or other gaseous sterilants, dramatically reducing the risk of microbiological contamination originating from personnel or the external environment. This transition demands sophisticated integration of robotic and automation systems within the containment area to handle product movement, filling, and stoppering.

Another pivotal technology is Blow-Fill-Seal (BFS), which integrates the container formation, aseptic filling, and sealing processes into a continuous, automated sequence. BFS technology is highly favored in the production of sterile liquid pharmaceuticals and ophthalmic solutions due to its low operating cost, reduced particle generation, and inherent protection against external contamination. Furthermore, sophisticated Clean-in-Place (CIP) and Sterilization-in-Place (SIP) systems are essential complementary technologies, ensuring that all product contact surfaces are thoroughly decontaminated and sterilized without requiring manual disassembly. Modern CIP/SIP systems leverage advanced sensors and automation to ensure consistent and validated cleaning cycles.

The market is also witnessing increasing adoption of single-use (or disposable) aseptic components, particularly in upstream processing equipment like filters, tubing, connectors, and bags. These single-use systems simplify cleaning validation, reduce the risk of cross-contamination between batches, and offer enhanced flexibility for manufacturers handling diverse product types, characteristic of the biopharmaceutical sector. Finally, advanced vision inspection systems leveraging high-resolution cameras and machine learning are becoming standard for detecting minute defects in vials, ampoules, and container closures, thereby enhancing the overall quality control process in the final packaging stage.

Regional Highlights

The dynamics of the Aseptic Processing Equipment Market vary significantly across geographical regions, reflecting differences in regulatory maturity, pharmaceutical production scale, and investment levels in healthcare infrastructure.

- North America (U.S. and Canada): Dominates the market due to the concentration of major pharmaceutical and biotechnology companies, extensive R&D activities focused on novel therapies (like cell and gene therapy), and stringent FDA regulations that necessitate the adoption of state-of-the-art containment technology (Isolators/RABS). High capital expenditure capacity supports early adoption of advanced robotics and continuous aseptic processing.

- Europe (Germany, France, U.K., Italy): Represents the second-largest market, characterized by mature regulatory bodies (EMA) and a strong focus on quality manufacturing (GMP standards). Germany, in particular, is a hub for high-precision equipment manufacturing, driving innovation in filling and sterilization technology. Emphasis is placed on upgrading existing facilities with modular, flexible systems to comply with Annex 1 revisions.

- Asia Pacific (APAC) (China, India, Japan): Projected as the fastest-growing region. This explosive growth is attributed to increasing healthcare expenditure, a rapidly expanding generics manufacturing base, and substantial foreign investment boosting domestic manufacturing capabilities. Countries like China and India are undertaking large-scale modernization of facilities to meet international export standards, leading to high demand for cost-effective yet compliant aseptic equipment like BFS machines and standard vial filling lines.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions show moderate growth, primarily driven by investments in local vaccine production and the expansion of the regional food and beverage sector. Market adoption is often focused on proven, robust technology, with price sensitivity playing a larger role compared to North America and Europe.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aseptic Processing Equipment Market.- Robert Bosch GmbH (Syntegon)

- GEA Group

- IMA Group

- Becton Dickinson (BD)

- Coesia S.p.A. (Flexicon)

- Romaco Group

- Bausch+Ströbel

- OPTIMA packaging group GmbH

- Shanghai Tofflon Science and Technology Co., Ltd.

- Dara Pharmaceutical Equipment

- Getinge AB

- Shibuya Corporation

- Krones AG

- Tetra Pak

- E-BEAM Services, Inc.

- SP Scientific

- SKAN AG

- Fedegari Autoclavi SpA

- Azbil Telstar S.L.

- ACMI S.p.A.

Frequently Asked Questions

Analyze common user questions about the Aseptic Processing Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Aseptic Processing Equipment?

The most significant driver is the increasing stringency of global regulatory standards (e.g., FDA, EMA GMP) demanding minimal human intervention and higher Sterility Assurance Levels (SALs), coupled with the rapid growth in complex sterile injectables and biologics production.

How do Isolators and RABS compare to traditional cleanrooms in aseptic processing?

Isolators and Restricted Access Barrier Systems (RABS) offer superior contamination control by physically separating personnel from the sterile process area. Isolators provide the highest SAL through automated sterilization (VHP), drastically reducing operational risks and high gowning costs associated with traditional cleanrooms.

Which application segment holds the largest share in the Aseptic Processing Equipment Market?

The Pharmaceutical and Biotechnology segment holds the largest market share, predominantly driven by the critical need for sterile manufacturing of vaccines, therapeutic proteins (biologics), and parenteral drugs, which require the most advanced and validated aseptic filling technology.

What role does Artificial Intelligence (AI) play in modern aseptic lines?

AI is used primarily for predictive maintenance, optimizing CIP/SIP cycles, and enhancing quality control through machine vision inspection. AI systems analyze real-time operational data to forecast equipment failure and ensure continuous process verification (CPV) for regulatory compliance.

What is the current market trend regarding aseptic filling technologies?

The dominant trend is the shift toward highly flexible, modular filling lines incorporating robotic handling within closed containment systems (Isolators) to handle diverse container types—vials, pre-filled syringes, and cartridges—necessary for small-batch, high-value personalized medicine manufacturing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager