Aseptic (Sterile) Connectors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434185 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Aseptic (Sterile) Connectors Market Size

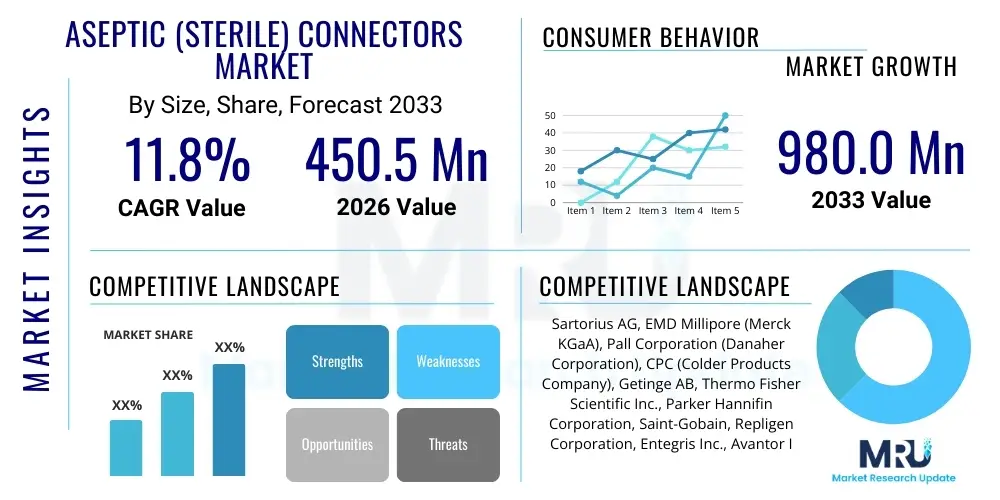

The Aseptic (Sterile) Connectors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2026 and 2033. The market is estimated at $450.5 Million in 2026 and is projected to reach $980.0 Million by the end of the forecast period in 2033.

Aseptic (Sterile) Connectors Market introduction

The Aseptic (Sterile) Connectors Market encompasses specialized coupling devices designed to establish sterile fluid paths between two separate components (such as bags, tubing, and filters) without compromising the sterility of the system, even when connected in non-sterile environments. These critical components are foundational to modern bioprocessing and pharmaceutical manufacturing, primarily facilitating media transfer, sampling, purification, and final filling operations, ensuring patient safety and regulatory compliance. The adoption of these connectors minimizes the risks associated with open processing, reducing the need for costly and time-consuming sterilization procedures like autoclaving or steam-in-place (SIP).

The core products within this market include both single-use (disposable) and multi-use connectors, categorized further by their operating mechanism—such as dry-break, quick-connect, or proprietary weldable designs. Key applications span the entire spectrum of biopharmaceutical production, particularly in the manufacturing of monoclonal antibodies (mAbs), cell and gene therapies, and vaccines. The intrinsic benefits of utilizing aseptic connectors, including enhanced operational flexibility, reduced cross-contamination risk, faster changeover times, and lower validation complexity compared to traditional stainless steel systems, are the primary forces driving widespread adoption across global biotech hubs.

Major market acceleration factors include the robust global pipeline of biologics, the increasing prevalence of personalized medicine which necessitates smaller, more flexible manufacturing batches, and the escalating demand for single-use systems (SUS) in facilities worldwide. Furthermore, stringent regulatory scrutiny from bodies like the FDA and EMA regarding contamination control in sterile environments places aseptic connection technology at the forefront of necessary compliance infrastructure. Technological innovation focusing on ergonomic designs, improved material compatibility with aggressive bioprocessing fluids, and specialized connectors for high-viscosity or low-volume applications continue to expand the market's reach and penetration.

Aseptic (Sterile) Connectors Market Executive Summary

The Aseptic (Sterile) Connectors Market is poised for substantial growth, driven by fundamental shifts in biopharmaceutical manufacturing toward single-use technologies and intensified focus on contamination mitigation. Key business trends indicate a strong emphasis on strategic acquisitions and partnerships among major players to consolidate technology portfolios, particularly concerning specialized connectors compatible with next-generation continuous bioprocessing platforms. Manufacturers are investing heavily in material science R&D to enhance chemical resistance and extractables/leachables profiles, meeting stricter regulatory requirements for advanced therapeutic medicinal products (ATMPs). The rising adoption of modular and mobile manufacturing units further fuels the demand for pre-validated, easily implemented sterile connector assemblies, promoting supply chain resilience and global deployment flexibility.

Regionally, North America maintains market dominance due to a high concentration of leading biopharmaceutical companies, favorable funding for biotechnology R&D, and early adoption of regulatory guidance promoting quality by design (QbD) in manufacturing. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, propelled by massive governmental investments in developing local vaccine production capabilities, expansion of Contract Development and Manufacturing Organizations (CDMOs) in countries like China and India, and increasing penetration of single-use bioreactors requiring robust aseptic fluid management solutions. Europe represents a mature market characterized by stringent quality standards and a strong cluster of specialized suppliers focusing on highly customized connector solutions for specialized cell therapy applications.

Segment trends reveal that the single-use connector segment commands the largest market share and is expected to exhibit the highest CAGR, primarily due to its integration into pre-sterilized disposable bags and assemblies, streamlining manufacturing workflows. By application, pharmaceutical manufacturing, particularly large-scale biologics production and formulation/fill-finish operations, remains the largest consumer base. There is notable growth in the complex connectors segment, which integrates advanced filtration, manifold design, or integrated sensors, reflecting the industry's movement toward smart, automated fluid management systems that minimize human intervention and enhance process monitoring capabilities, directly addressing labor skill shortages and validation complexities.

AI Impact Analysis on Aseptic (Sterile) Connectors Market

Common user questions regarding AI's impact on the Aseptic (Sterile) Connectors Market often revolve around how artificial intelligence can enhance validation protocols, predict component failure, and optimize inventory management within complex bioprocessing supply chains. Users are keen to understand if AI can contribute to real-time quality control by analyzing sensor data integrated into next-generation connectors, thereby improving batch consistency and reducing waste associated with potential contamination incidents. Furthermore, there is significant interest in using predictive maintenance algorithms to determine the optimal replacement timing for multi-use connector components or to forecast demand variability for single-use assemblies based on dynamic clinical trial progress and manufacturing schedules.

The integration of AI, while not directly altering the physical mechanics of the aseptic connection device, profoundly affects the ecosystem surrounding its deployment and management. AI-driven predictive modeling can analyze large datasets from process analytical technology (PAT) and Internet of Things (IoT) sensors embedded near or within the fluid pathway, providing instantaneous feedback on pressure, flow rate, and potential microbiological ingress points. This capability transforms quality assurance from a reactive testing paradigm to a proactive, real-time monitoring system, dramatically improving the security and reliability of sterile connections, especially in continuous manufacturing environments where connection integrity is paramount for extended periods.

In the near term, AI is most influential in optimizing manufacturing efficiency for the connector producers themselves—enhancing molding precision, minimizing material defects, and speeding up quality release processes through automated visual inspection systems. For end-users, AI is crucial for inventory optimization, utilizing machine learning algorithms to manage the complex logistics of thousands of unique single-use assemblies, ensuring timely availability of specific connector configurations while minimizing obsolescence and maximizing shelf-life utilization. This advanced management reduces supply chain bottlenecks, a persistent challenge in high-growth bioprocessing sectors like cell and gene therapy.

- AI facilitates predictive maintenance for multi-use connector components, reducing unexpected downtime.

- Machine learning algorithms optimize single-use assembly inventory and supply chain logistics, minimizing lead times.

- AI enhances real-time quality assurance by analyzing sensor data (IoT integration) related to connection integrity (pressure/flow anomalies).

- Automated visual inspection powered by AI improves manufacturing quality control and defect detection during connector production.

- Predictive modeling assists in optimizing process parameters, ensuring stable fluid transfer conditions across aseptic connections.

- AI supports the digital validation of sterile connections, accelerating regulatory compliance and documentation generation.

DRO & Impact Forces Of Aseptic (Sterile) Connectors Market

The Aseptic (Sterile) Connectors Market is primarily driven by the imperative need for contamination control in high-value biopharmaceutical production and the massive industry shift towards single-use (disposable) technology which inherently relies on these connectors for system integration. Major restraints include the high initial cost of fully validated single-use systems, concerns regarding the long-term chemical compatibility (leachables and extractables) of plastic materials with novel aggressive buffers, and the substantial volume of plastic waste generated by disposable components, which raises sustainability challenges for manufacturers. Opportunities are abundant, centered on expanding applications in cell and gene therapy manufacturing, developing advanced connectors compatible with automated filling lines, and penetrating emerging markets in Asia and Latin America where new bioprocessing facilities are being constructed based entirely on SUS infrastructure.

The primary driving force remains the accelerated growth of the global biologics market, particularly the proliferation of monoclonal antibodies, recombinant proteins, and vaccines, all of which require closed, sterile processing environments achievable only through aseptic connectors. Regulatory pressure from global health agencies further compels manufacturers to adopt these systems to meet stringent sterility assurance levels (SAL). This robust demand trajectory is complemented by the efficiency gains offered by SUS: reduced cleaning validation, faster changeover, and increased flexibility in facility design. The increasing complexity of bioprocessing fluids and the need for high-throughput separation and purification stages mandate the use of connectors capable of handling diverse viscosities and pressures without leakage or particulate generation.

However, the market faces significant hurdles related to standardization and supply chain resilience. The lack of universal standards among manufacturers often leads to compatibility issues between different vendor components, complicating procurement and increasing validation overhead for end-users. Furthermore, the global reliance on a few key polymer suppliers creates vulnerability in the supply chain, as witnessed during recent global events, impacting lead times and pricing. The key impact forces, therefore, lie in the delicate balance between technological innovation (to address material and standardization concerns) and the relentless regulatory push for higher sterility assurance, which continuously reinforces the foundational necessity of high-quality aseptic connection technology in modern pharmaceutical manufacturing.

Segmentation Analysis

The Aseptic (Sterile) Connectors Market is comprehensively segmented based on product type, technology, application, and end-user, reflecting the diverse requirements of the bioprocessing industry. Segmentation by product distinguishes between simple connectors (basic fluid transfer) and complex connectors (integrated with manifolds, sensors, or specialized features), with single-use being the dominant technology driving the market. Analyzing the market through these segments provides critical insights into purchasing patterns, technological adoption rates, and areas of high growth, particularly within the specialized fields of personalized medicine and vaccine production, where rapid deployment and high sterility assurance are paramount.

From a technological standpoint, the market is broadly divided between products relying on membrane-to-membrane welding technology and mechanical connection systems. Single-use mechanical connectors, often referred to as 'quick connect' systems, are dominating the market due to their ease of use, ability to connect disparate sterile assemblies quickly, and robust validation packages provided by suppliers. Conversely, material segmentation, including polycarbonate, polysulfone, and specialized polyolefins, is critical as the choice of material directly affects chemical compatibility, sterilization method (gamma irradiation versus autoclave), and extractables/leachables profile, which are crucial considerations for sensitive drug products.

Geographic segmentation confirms the maturity and strong uptake in North America and Europe, driven by established biopharma ecosystems, while APAC is recognized as the fastest-growing region fueled by governmental healthcare expansion initiatives. The end-user segment highlights pharmaceutical and biopharmaceutical companies as the largest consumer base, although Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs) are demonstrating accelerated procurement of aseptic connectors, driven by their operational model requiring high flexibility and rapid facility changeovers for multiple clients and diverse products.

- By Product Type:

- Simple Connectors (Standard Fluid Transfer)

- Complex Connectors (Integrated Manifolds, Sensors, Specialized Functions)

- By Technology:

- Single-Use (Disposable) Connectors

- Multi-Use (Reusable/Sterilizable) Connectors

- Sterile Welding Technology (Tubing Welders)

- By Material:

- Polycarbonate (PC)

- Polysulfone (PSU)

- Polypropylene (PP) and Polyethylene (PE)

- Others (e.g., specialized elastomers for gaskets)

- By Application:

- Pharmaceutical and Biopharmaceutical Manufacturing (Upstream, Downstream, Fill-Finish)

- Clinical Trials and R&D

- Cell and Gene Therapy Production

- Vaccine Manufacturing

- Blood and Fluid Handling

- By End-User:

- Pharmaceutical & Biopharmaceutical Companies

- Contract Development and Manufacturing Organizations (CDMOs)

- Academic & Research Institutes

- Hospitals and Blood Centers

Value Chain Analysis For Aseptic (Sterile) Connectors Market

The value chain for the Aseptic (Sterile) Connectors Market is characterized by highly specialized stages, beginning with upstream raw material suppliers, predominantly focusing on medical-grade polymers like polycarbonate and polysulfone, which must meet stringent biocompatibility and extractable/leachable standards. This upstream stage is crucial as the quality and validation of the raw polymers directly influence the final product's performance and regulatory acceptability. Connector manufacturing involves complex injection molding and assembly processes carried out by specialized equipment providers. Key value addition occurs during the assembly of these connectors into pre-validated, customized single-use systems (SUS), where integration with tubing, filters, and bags happens under controlled environments (often ISO Class 7 or better).

Downstream activities involve critical steps such as gamma irradiation or E-beam sterilization, packaging, and final quality control release, ensuring the sterility assurance level (SAL) of 10-6 or better. The distribution channel is bifurcated: direct sales channels are heavily utilized for major biopharmaceutical clients requiring customized engineering support, technical consultation, and large volumes, particularly for proprietary systems offered by companies like Pall or Sartorius. Indirect channels involve specialized distributors or third-party logistics (3PL) providers who manage smaller volumes, geographically dispersed customers, or integration into broader catalog sales for consumables used by research institutes and smaller biotech firms.

A significant portion of the value is captured by key players who offer integrated solutions, encompassing not just the connector component, but also the entire single-use fluid management assembly, including validation documentation and technical support. This integrated approach minimizes the complexity for the end-user (buyer) who prefers a single supplier for validated systems. The final downstream link involves the utilization of these connectors in various cleanroom operations, primarily R&D labs, pilot plants, and large-scale commercial manufacturing sites, where their successful implementation directly correlates with product yield, process efficiency, and reduction in batch failure rates due to contamination.

Aseptic (Sterile) Connectors Market Potential Customers

The primary consumers and end-users of aseptic (sterile) connectors are institutions and corporations involved in the handling, processing, and manufacturing of sensitive biological materials, pharmaceuticals, and sterile fluids. These include multinational pharmaceutical companies that require high-volume, reliable systems for vaccine and biologics production, and emerging biotech firms specializing in niche areas like cell and gene therapies, which prioritize flexibility and minimal batch size risk. Contract Development and Manufacturing Organizations (CDMOs) represent a rapidly expanding customer segment, as their business model depends entirely on rapid facility changeover and zero cross-contamination risk between client batches, making single-use, sterile-connect technology indispensable.

Beyond traditional biopharma, clinical trial facilities and academic research laboratories also constitute significant customer groups, procuring connectors for R&D purposes, small-scale process development, and the preparation of clinical trial materials. Furthermore, the blood banking industry and hospitals that manage complex fluid administration or preparation of compounded sterile preparations (CSPs) utilize specialized aseptic connectors to maintain sterility during fluid transfers or pooling. The key characteristic unifying all these potential customers is the mandatory requirement for regulatory compliance (e.g., FDA cGMP) regarding sterility and closure of critical fluid pathways, positioning aseptic connectors as non-negotiable consumable components in their operational budgets.

Growth in personalized medicine is creating a burgeoning customer segment in specialized clinics and decentralized manufacturing centers. These facilities require smaller, highly configurable sterile connector assemblies that support small-batch, patient-specific manufacturing protocols. The demand from these high-growth areas necessitates connectors with enhanced robustness for automation integration and improved ease of use for operators handling highly valuable, limited-quantity materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450.5 Million |

| Market Forecast in 2033 | $980.0 Million |

| Growth Rate | 11.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sartorius AG, EMD Millipore (Merck KGaA), Pall Corporation (Danaher Corporation), CPC (Colder Products Company), Getinge AB, Thermo Fisher Scientific Inc., Parker Hannifin Corporation, Saint-Gobain, Repligen Corporation, Entegris Inc., Avantor Inc., Dockweiler AG, Terumo Corporation, Flexicon (Watson-Marlow Fluid Technology Group), ILC Dover, Qosina Corp., PendoTECH, Nordson Corporation, Masterflex (Cole-Parmer), GEA Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aseptic (Sterile) Connectors Market Key Technology Landscape

The technological landscape of the Aseptic Connectors Market is defined by continuous innovation focused on enhancing sterility assurance, improving ease of use, and ensuring chemical inertness across diverse bioprocessing conditions. Single-use technology (SUT) dominates, with mechanical quick-connectors featuring sophisticated internal valve mechanisms that prevent fluid spillage and maintain sterility during connection and disconnection. A key technological advancement involves proprietary dry-break or membrane fusion methods, which enable aseptic connections outside a Grade A/B cleanroom environment. Furthermore, the development of specialized welding devices for thermoplastic tubing allows for permanent, validated sterile connections under field conditions, significantly contributing to the flexibility of single-use assemblies.

Material science is a pivotal area of research, focusing on developing new medical-grade polymers with superior extractables and leachables (E&L) profiles, particularly critical for high-pH or solvent-based applications common in pharmaceutical formulations. Polysulfone (PSU) and specialized polycarbonates (PC) remain standard, but there is growing exploration of high-performance polyolefins (PE/PP) due to their enhanced resistance to gamma irradiation and reduced E&L concerns. Connectors are also being engineered for compatibility with high-pressure systems used in advanced chromatography and tangential flow filtration (TFF) operations, requiring tighter tolerances and more robust sealing mechanisms than standard gravity-fed systems.

The future technology landscape is moving towards "smart" connectors. This involves the integration of low-profile sensors (e.g., pH, conductivity, temperature) directly into the connector manifold or nearby tubing, enabling real-time process monitoring and data feedback to digital manufacturing platforms. This convergence of sterile fluid management with Industry 4.0 principles, including IoT and data analytics, facilitates remote monitoring and automated batch record keeping, reducing the reliance on manual validation steps and enhancing overall process control, addressing the complex requirements of fully automated biomanufacturing facilities and continuous processing platforms.

Regional Highlights

The global Aseptic (Sterile) Connectors Market exhibits distinct regional dynamics driven by differing regulatory environments, biopharma manufacturing maturity, and investment priorities.

- North America: Market leader, characterized by the highest adoption rate of single-use technologies and a massive presence of global pharmaceutical and biotechnology leaders. Strong regulatory enforcement by the FDA encourages early and robust integration of validated sterile connectors. High R&D spending, especially in cell and gene therapy manufacturing, drives demand for complex, specialized connector assemblies.

- Europe: Second largest market, known for strict quality standards (EMA) and a mature biopharma industry cluster in Germany, Switzerland, and Ireland. The region is a major hub for vaccine production and continuous biomanufacturing, fueling sustained demand for high-reliability, customized connection systems. Focus is increasingly shifting toward local production and supply chain resilience post-Brexit.

- Asia Pacific (APAC): Fastest-growing region, driven by expansion in large economies like China and India, where governments are aggressively investing in domestic vaccine and biologics manufacturing capacity. Rapid growth of CDMOs and CMOs seeking cost-effective and flexible single-use solutions accelerates connector adoption. Regulatory harmonization efforts across the region also support market penetration.

- Latin America (LATAM): Emerging market characterized by selective adoption, primarily concentrated in Brazil and Mexico, focusing on vaccine production and generic drug manufacturing. Growth is moderate, often reliant on imports of pre-validated single-use systems from North America and Europe.

- Middle East and Africa (MEA): Smallest market share, with growth concentrated in healthcare infrastructure modernization in the GCC states (e.g., UAE, Saudi Arabia). Local production is nascent; demand largely stems from clinical trials, specialized hospital pharmacy compounding, and initial steps into local vaccine filling operations, driven by strategic governmental goals for self-sufficiency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aseptic (Sterile) Connectors Market.- Sartorius AG

- EMD Millipore (Merck KGaA)

- Pall Corporation (Danaher Corporation)

- CPC (Colder Products Company)

- Getinge AB

- Thermo Fisher Scientific Inc.

- Parker Hannifin Corporation

- Saint-Gobain

- Repligen Corporation

- Entegris Inc.

- Avantor Inc.

- Dockweiler AG

- Terumo Corporation

- Flexicon (Watson-Marlow Fluid Technology Group)

- ILC Dover

- Qosina Corp.

- PendoTECH

- Nordson Corporation

- Masterflex (Cole-Parmer)

- GEA Group

Frequently Asked Questions

Analyze common user questions about the Aseptic (Sterile) Connectors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using aseptic connectors over traditional stainless steel piping?

Aseptic connectors eliminate the need for costly, time-consuming, and resource-intensive sterilization processes like Steam-In-Place (SIP) and Clean-In-Place (CIP). They drastically reduce the risk of cross-contamination and significantly accelerate batch changeovers, crucial for modern, multi-product biomanufacturing facilities utilizing single-use systems (SUS).

How does the shift to cell and gene therapy manufacturing impact the demand for aseptic connectors?

Cell and gene therapies (ATMPs) typically involve small-scale, high-value, patient-specific batches. This necessitates extremely secure, closed systems to prevent contamination, driving high demand for small-bore, high-integrity single-use aseptic connectors and specialized manifolds suitable for automated, decentralized manufacturing environments.

What are the main regulatory concerns surrounding single-use aseptic connector materials?

The main concern is the risk of extractables and leachables (E&L) from the polymer materials transferring into the drug product. Manufacturers must provide rigorous validation data (USP Class VI, ISO 10993) demonstrating the chemical inertness and biocompatibility of the connector materials when exposed to various pharmaceutical buffers and solvents.

Which geographical region exhibits the fastest growth potential for the aseptic connectors market?

The Asia Pacific (APAC) region, specifically China and India, is projected to show the highest growth rate. This acceleration is driven by major governmental investments in expanding local biomanufacturing capacity, increasing regional demand for vaccines, and the rapid adoption of flexible single-use technologies by emerging Contract Development and Manufacturing Organizations (CDMOs).

Are multi-use (reusable) aseptic connectors still relevant in the market?

Yes, multi-use connectors remain relevant primarily in large-scale, high-volume production facilities (e.g., some older vaccine plants) and specialized process areas where single-use validation may be complex or uneconomical. However, the market trend overwhelmingly favors single-use connectors due to their convenience, reduced validation burden, and zero contamination risk.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager