Asphalt Anti Strip Agent Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434484 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Asphalt Anti Strip Agent Market Size

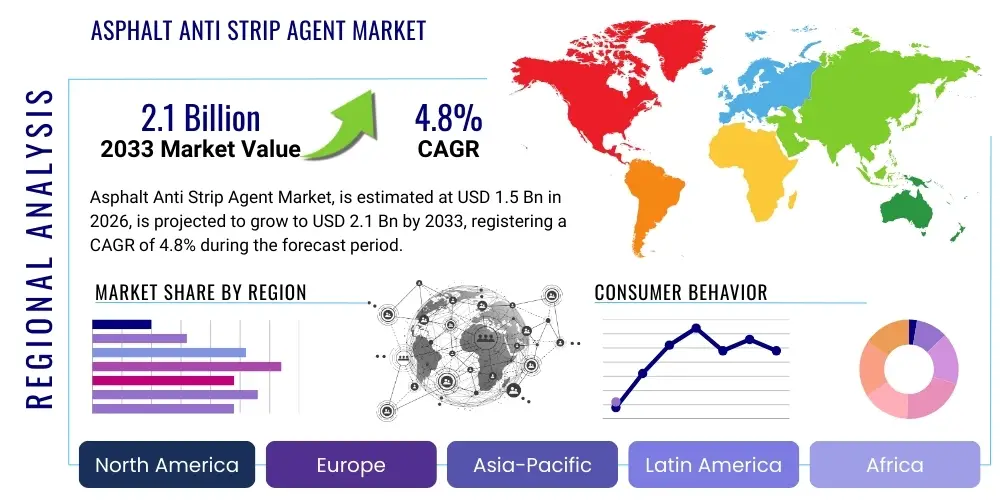

The Asphalt Anti Strip Agent Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.1 Billion by the end of the forecast period in 2033.

Asphalt Anti Strip Agent Market introduction

The Asphalt Anti Strip Agent Market encompasses specialized chemical additives designed to enhance the adhesion between asphalt binders (bitumen) and mineral aggregates, thereby preventing moisture-induced damage, known as stripping. Stripping occurs when water penetrates the asphalt mixture, weakening the bond between the binder and the stone aggregate, leading to premature pavement failure, cracking, and pothole formation. These agents are critical components in modern road construction and maintenance, particularly in regions subjected to high moisture levels, freeze-thaw cycles, and heavy traffic loads, ensuring the longevity and structural integrity of asphalt pavements.

Product descriptions typically involve a range of chemical compositions, primarily focusing on amine-based products, polymers, and specialized hydrated lime derivatives. Amine-based anti-stripping agents, being cationic, chemically interact with the negatively charged surface of aggregates, creating a strong, water-resistant bond. The application of these agents is crucial across major infrastructure projects, including national highways, local roads, airport runways, and heavy-duty industrial pavements. The primary benefits derived from their use include significantly extended pavement service life, reduced life-cycle maintenance costs, and improved resistance to environmental stressors, contributing directly to sustainable infrastructure development.

The market is predominantly driven by increasing global governmental expenditure on infrastructure development and rehabilitation, especially in rapidly urbanizing economies in Asia Pacific and the necessary maintenance of aging road networks in North America and Europe. Stricter quality standards imposed by transportation authorities regarding pavement performance, coupled with the growing necessity to utilize marginal or hydrophilic aggregates, further propel the demand for high-performance anti-stripping additives. Furthermore, continuous innovation aimed at developing bio-based and environmentally friendly anti-strip agents is fostering new growth opportunities within the industry.

Asphalt Anti Strip Agent Market Executive Summary

The global Asphalt Anti Strip Agent Market is poised for stable expansion, underpinned by robust business trends focusing on sustainable infrastructure and performance-driven materials. A key business trend involves the shift toward high-performance polymeric agents, which offer superior thermal stability and durability compared to traditional amine-based products, satisfying the stringent requirements of heavy-duty traffic corridors. The industry is also seeing consolidation among major chemical producers aiming to offer integrated asphalt modification solutions, bundling anti-strip agents with warm mix asphalt (WMA) additives and polymer modified bitumen (PMB) for comprehensive pavement solutions. Demand is increasingly influenced by public-private partnerships (PPPs) that emphasize long-term performance guarantees for road projects, making anti-stripping technology indispensable for risk mitigation.

Regionally, Asia Pacific is projected to lead market growth, driven primarily by massive investments in new highway construction, particularly in China, India, and Southeast Asian nations, where urbanization and economic expansion necessitate extensive road networks. North America and Europe, characterized by mature markets, will focus predominantly on rehabilitation projects, demanding sophisticated anti-stripping solutions to combat damage caused by harsh weather and high traffic volumes. Regulatory trends in these Western regions, favoring the use of recycled asphalt pavement (RAP) and specific aggregate types, inadvertently increase the need for effective anti-strip agents to maintain mix quality and performance specifications.

Segment trends highlight the dominance of liquid anti-strip agents due to their ease of application and consistent blending performance in hot mix asphalt (HMA) production. Among product types, amine-based agents currently hold the largest market share due to their cost-effectiveness and proven efficacy, though polymeric agents are gaining traction rapidly in high-specification applications demanding enhanced durability against moisture damage. The Paving application segment remains the largest end-user, consuming the majority of anti-strip agents, followed by specialized applications in roofing and industrial linings, where adhesion and moisture resistance are paramount for product longevity and safety standards compliance.

AI Impact Analysis on Asphalt Anti Strip Agent Market

User inquiries regarding AI's influence in the Asphalt Anti Strip Agent market often revolve around optimizing material efficiency, improving quality control during mixing, and predicting pavement life cycles under various environmental conditions. Users seek to understand how AI and machine learning (ML) algorithms can be integrated with real-time sensor data from asphalt plants to dynamically adjust the dosage of anti-strip agents based on varying aggregate moisture content and temperature profiles. Key concerns include the feasibility of developing digital twins of pavement structures and leveraging predictive maintenance models to identify areas where moisture damage is imminent, thereby prioritizing repairs and extending the effective service life of anti-strip treatments. Expectations focus on AI's potential to standardize and automate material testing, replacing time-consuming manual procedures with faster, data-driven quality assurance protocols.

AI's primary impact involves enhancing the precision of asphalt mix design and quality assurance, transitioning the industry from empirical formulas to data-driven optimization. By analyzing vast datasets comprising aggregate chemistry, weather patterns, traffic loads, and performance test results (such as the Tensile Strength Ratio test), ML models can recommend the precise type and dosage of anti-strip agents required for specific geographic locations and applications, minimizing material waste and maximizing pavement life. Furthermore, AI-powered predictive analytics can forecast the rate of moisture damage, allowing chemical suppliers to tailor agent formulations based on anticipated road stressors, leading to more resilient infrastructure solutions and higher customer satisfaction regarding product efficacy.

- AI algorithms enable predictive maintenance scheduling by analyzing sensor data for early signs of moisture damage, ensuring timely application or repair.

- Machine learning optimizes the dosage of anti-strip agents in real-time at asphalt mixing plants, accounting for variations in aggregate quality and moisture content.

- Computer vision and AI-enhanced material testing accelerate the quality control process, verifying the adequate dispersion and effectiveness of the anti-stripping chemical in the final mixture.

- AI facilitates the development of customized anti-strip agent formulations tailored to specific local aggregates and climate conditions, enhancing overall performance.

- Advanced analytics provide comprehensive performance feedback loops, connecting pavement failure data back to the initial material selection and agent usage, driving continuous product improvement.

DRO & Impact Forces Of Asphalt Anti Strip Agent Market

The market for Asphalt Anti Strip Agents is defined by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively generating significant Impact Forces. Key drivers include the global imperative for maintaining and expanding critical road infrastructure, especially in developing regions where new construction is booming. Simultaneously, regulatory pressures in developed nations demanding increased pavement durability and the effective utilization of lower-quality or recycled aggregates necessitate the consistent use of high-performance anti-stripping agents. These factors create a strong, structural demand base for effective moisture protection solutions, particularly as climate change introduces more extreme weather events.

Restraints primarily revolve around the high initial cost associated with premium anti-strip agents, which can sometimes deter adoption in budget-constrained government projects or smaller private contracts where initial material costs outweigh long-term life-cycle cost analysis. Furthermore, inconsistent testing standards and lack of uniform enforcement across various jurisdictions can lead to variability in product specification and usage, occasionally undermining the perceived necessity of these chemical additives. The technical challenge of achieving perfect compatibility between complex chemical additives and diverse bitumen sources and aggregate types also presents a continuous restraint requiring specialized expertise and ongoing research and development (R&D) investment.

Opportunities are abundant in the innovation space, particularly through the development of environmentally friendly, bio-based anti-strip agents that align with sustainability goals and reduce reliance on petrochemical derivatives. The burgeoning market for warm mix asphalt (WMA) additives presents a symbiotic opportunity, as anti-strip agents are often required to maintain performance when mixing temperatures are lowered, addressing energy consumption concerns. The most potent Impact Force is the demonstrable reduction in pavement life-cycle costs and failure rates achieved through the correct use of these agents, providing a compelling economic justification that overrides initial cost concerns, thereby solidifying their position as essential components in modern road engineering specifications globally.

Segmentation Analysis

The Asphalt Anti Strip Agent Market is structurally segmented based on crucial attributes including Product Type, Application, and Formulation Technology, which reflect the diverse needs and technical specifications within the construction and chemical industries. This segmentation is crucial for understanding specific market dynamics, technological preferences, and the dominant end-user applications driving demand. The analysis below provides granular insights into which formulations and end-use sectors are exhibiting the most vigorous growth and technological evolution, ensuring stakeholders can accurately target their strategic efforts and product development pipelines to capture emerging opportunities in the specialized additives space.

- By Product Type: Amine Anti Strip Agents, Polymer Anti Strip Agents, Hydrated Lime.

- By Application: Paving (Road Construction, Highways, Airport Runways), Roofing, Others (Industrial Linings, Waterproofing).

- By Formulation Technology: Liquid Anti Strip Agents, Powder Anti Strip Agents.

- By End-User: Government Agencies (Public Works), Private Construction Firms, Asphalt Producers, Specialized Waterproofing Companies.

Value Chain Analysis For Asphalt Anti Strip Agent Market

The value chain for the Asphalt Anti Strip Agent Market begins with the upstream sourcing of raw materials, primarily focusing on petrochemical derivatives like fatty amines, polyethylene glycols, and various specialized surfactants, depending on the chemical structure of the agent. This phase is characterized by high capital intensity and reliance on global commodity chemical prices. Manufacturers then undertake complex chemical synthesis and formulation processes, requiring specialized blending and purification technologies to ensure the anti-strip agent meets stringent performance criteria for heat stability, storage, and compatibility with diverse asphalt binders. Efficiency in the upstream segment directly impacts the manufacturing cost and, subsequently, the pricing power in the downstream market.

The distribution channel is crucial in connecting manufacturers to the end-users. Direct sales and distribution are common for large volume clients, such as major asphalt producers and large-scale government contractors, ensuring technical support and consistent supply quality. Indirect channels, involving regional chemical distributors and specialized construction material traders, cater effectively to smaller contractors and regional public works departments, providing localized inventory and technical assistance. The effectiveness of the anti-strip agent hinges significantly on its consistent application and successful integration into the asphalt mixing process, making post-sale technical support a critical value-add in the midstream and downstream segments.

Downstream activities center on the end-users: asphalt mixing plants, construction firms, and governmental bodies responsible for road maintenance. The final product value is realized when the anti-strip agent successfully mitigates moisture damage, extends the pavement's life, and reduces long-term maintenance expenditure. Key downstream drivers include the enforcement of quality specifications (e.g., state Department of Transportation requirements) and the increasing focus on life-cycle cost analysis. Effective value chain management, from raw material procurement to final application monitoring, ensures product integrity and maximizes the functional and economic benefits derived from these specialized chemical additives, reinforcing market loyalty and competitive positioning.

Asphalt Anti Strip Agent Market Potential Customers

The primary consumers and end-users of asphalt anti-strip agents are organizations deeply involved in the planning, construction, and maintenance of transportation infrastructure and building materials requiring superior waterproofing. These agents are essential purchases for asphalt mixing plant operators who are mandated by contract specifications to produce highly durable asphalt concrete mixes resistant to moisture-induced degradation. These plants, whether captive operations of large construction conglomerates or independent commercial suppliers, represent the most direct and consistent customer base, integrating the agents directly into their bitumen storage and mixing procedures before delivery to the paving site.

Government agencies and public works departments, especially State Departments of Transportation (DOTs) and their equivalent international bodies, act as powerful indirect customers. While they may not physically purchase the agents, their strict project specifications and material acceptance criteria mandate the use of anti-strip agents in virtually all publicly funded road construction, rehabilitation, and maintenance contracts. Their purchasing power dictates material standards and drives product selection among direct buyers (the construction firms and asphalt producers), making engagement with regulatory and specifying bodies critical for market penetration and establishing product acceptance in various regions.

Additional potential customers include large private construction and infrastructure development companies engaged in building toll roads, industrial parks, airport runways, and major commercial developments where long-term pavement durability is a contractual necessity. Furthermore, specialized roofing material manufacturers and companies focused on protective coatings and industrial waterproofing constitute a secondary but growing customer segment. These users require the anti-strip agents for their ability to enhance adhesion and water resistance in bitumen-based membranes and coatings, securing a diverse application portfolio beyond traditional road paving activities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.1 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AkzoNobel N.V., Dow Chemical Company, Evonik Industries AG, ArrMaz, Kao Corporation, BASF SE, Ingevity Corporation, Engineered Additives, Huntsman Corporation, Sika AG, Kraton Corporation, Arkema Group, Tricor America, Inc., Road Science, Inc., Sasol Limited, Wirtgen Group, Colas Group, McConnaughay Technologies, Inc., PQ Corporation, Cargill Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Asphalt Anti Strip Agent Market Key Technology Landscape

The technological landscape of the Asphalt Anti Strip Agent market is characterized by ongoing innovation aimed at developing more effective, dosage-efficient, and environmentally responsible formulations. Traditional technologies primarily relied on cationic surfactant chemistries, notably fatty polyamines, which function by lowering the surface tension of the asphalt mixture and establishing a chemical bond with acidic aggregate surfaces. Contemporary R&D is focusing heavily on refining these amine-based agents to improve their thermal stability during high-temperature asphalt production and to ensure consistent performance across a wider variety of binder grades and aggregate mineralogies, crucial for global applicability and enhanced infrastructure resilience.

A significant technological shift involves the increasing use of advanced polymeric and composite anti-strip agents. These next-generation products often incorporate specialized polymers (e.g., reactive polymers or elastomers) that not only prevent stripping but also simultaneously modify the binder, enhancing its overall elasticity, rutting resistance, and fatigue life. This multi-functional approach offers superior value to end-users, especially in high-stress applications like airport runways and heavy-haul roads. Furthermore, advancements in nano-technology are being explored to incorporate nano-sized particles or modified layered silicates, which can significantly enhance the interface adhesion area, leading to superior moisture resistance at extremely low additive dosages.

Another pivotal technological area is the development of liquid-based, cold-applied agents optimized for use in lower-temperature asphalt production processes, such as Warm Mix Asphalt (WMA) and Cold Mix Asphalt (CMA). These formulations must exhibit excellent dispersion characteristics at lower temperatures and maintain performance comparable to hot-applied agents, aligning with global trends toward reduced energy consumption and lower emissions during construction. The focus is also on green chemistry, driving the creation of bio-based anti-stripping additives derived from renewable resources, reducing the environmental footprint of the pavement construction industry while meeting all requisite performance specifications for long-term durability.

Regional Highlights

- Asia Pacific (APAC) Market Dominance and Growth: APAC is the fastest-growing and largest regional market, driven by expansive national infrastructure programs in China, India, and Indonesia. Governments in these nations are prioritizing massive highway construction and urban road development to support rapid industrialization and population growth. The region's need to utilize locally available, sometimes lower-quality, aggregates makes the use of anti-strip agents mandatory for achieving durability specifications. Regulatory bodies are steadily adopting international quality standards, compelling contractors to invest in reliable chemical additives to ensure long-term pavement performance and secure contractual warranties.

- North America Market Maturity and Rehabilitation Focus: North America, particularly the United States and Canada, represents a mature yet highly quality-driven market. Growth here is primarily driven by rehabilitation, repair, and resurfacing projects for aging interstates and urban roadways, rather than new construction. State Departments of Transportation (DOTs) implement rigorous testing standards (such as the AASHTO T 283 standard) that mandate the use of highly effective anti-strip agents. Furthermore, the extensive use of Recycled Asphalt Pavement (RAP) requires specialized agents to re-establish strong bonds between the aged binder, recycled materials, and new aggregates, thereby sustaining consistent demand for premium, high-performance formulations.

- Europe Market Emphasis on Sustainability and WMA Adoption: European demand is characterized by a strong regulatory focus on environmental sustainability, driving the adoption of Warm Mix Asphalt (WMA) technologies and bio-based anti-strip agents. Countries like Germany, France, and the UK have well-established infrastructure networks, meaning market activity centers on maintenance and compliance with stringent environmental norms regarding construction emissions and material sourcing. The requirement for anti-strip agents is vital in WMA processes to maintain adhesion efficacy at reduced mixing temperatures, positioning advanced liquid and bio-derived agents as preferred solutions in this highly specified market segment.

- Latin America and MEA Emerging Infrastructure Spending: Latin America and the Middle East & Africa (MEA) are emerging markets witnessing significant infrastructure investment, particularly in Brazil, Mexico, Saudi Arabia, and the UAE. These regions face challenging climate conditions—heavy tropical rainfall in parts of Latin America and extreme temperature variations in the Middle East—which accelerate pavement deterioration. The necessity to build resilient infrastructure capable of withstanding these environmental extremes is fueling the initial phases of market adoption for anti-strip agents, particularly those formulations offering robust thermal and moisture resistance, presenting long-term growth potential.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Asphalt Anti Strip Agent Market.- AkzoNobel N.V.

- Dow Chemical Company

- Evonik Industries AG

- ArrMaz

- Kao Corporation

- BASF SE

- Ingevity Corporation

- Engineered Additives

- Huntsman Corporation

- Sika AG

- Kraton Corporation

- Arkema Group

- Tricor America, Inc.

- Road Science, Inc.

- Sasol Limited

- Wirtgen Group

- Colas Group

- McConnaughay Technologies, Inc.

- PQ Corporation

- Cargill Inc.

Frequently Asked Questions

Analyze common user questions about the Asphalt Anti Strip Agent market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an Asphalt Anti Strip Agent?

The primary function of an Asphalt Anti Strip Agent is to prevent moisture-induced damage, known as stripping, by enhancing the chemical and physical adhesion between the asphalt binder (bitumen) and the mineral aggregate, thus ensuring the long-term structural integrity and durability of the pavement surface.

How do Amine-based Anti Strip Agents differ from Polymeric Agents?

Amine-based agents are typically cationic surfactants that provide adhesion through chemical bonding with aggregates and are cost-effective. Polymeric agents, however, often provide multi-functional benefits, including enhanced temperature stability, elasticity, and superior long-term water resistance, making them suitable for high-performance applications.

Is the use of Asphalt Anti Strip Agents mandatory in road construction?

The mandatory use of anti-strip agents is determined by specific project requirements and regional regulations, particularly by State Departments of Transportation (DOTs). They are typically required when utilizing hydrophilic aggregates, working in high-moisture environments, or for contracts demanding extended performance warranties to mitigate risk of premature pavement failure.

What impact does Warm Mix Asphalt (WMA) technology have on the demand for anti-strip agents?

The adoption of WMA increases the demand for specialized anti-strip agents. Lower mixing temperatures associated with WMA can reduce the natural affinity between asphalt and aggregates, requiring highly effective, low-dosage agents to ensure adequate coating and bond formation that prevents stripping under operational conditions.

Which geographical region is expected to experience the highest market growth rate?

Asia Pacific (APAC) is projected to exhibit the highest market growth rate. This accelerated expansion is fueled by massive governmental investments in new national highway construction and urbanization infrastructure projects across countries such as China, India, and Indonesia, which require durable paving materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager