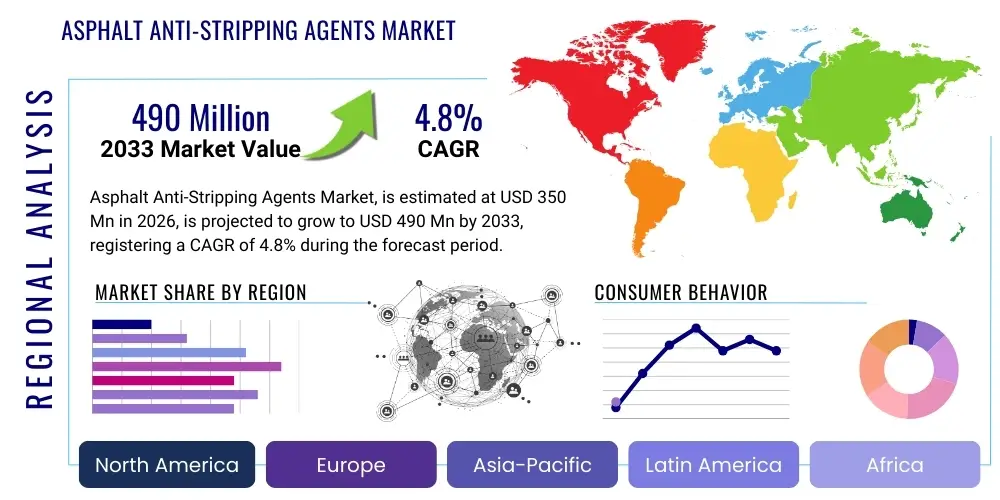

Asphalt Anti-Stripping Agents Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434975 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Asphalt Anti-Stripping Agents Market Size

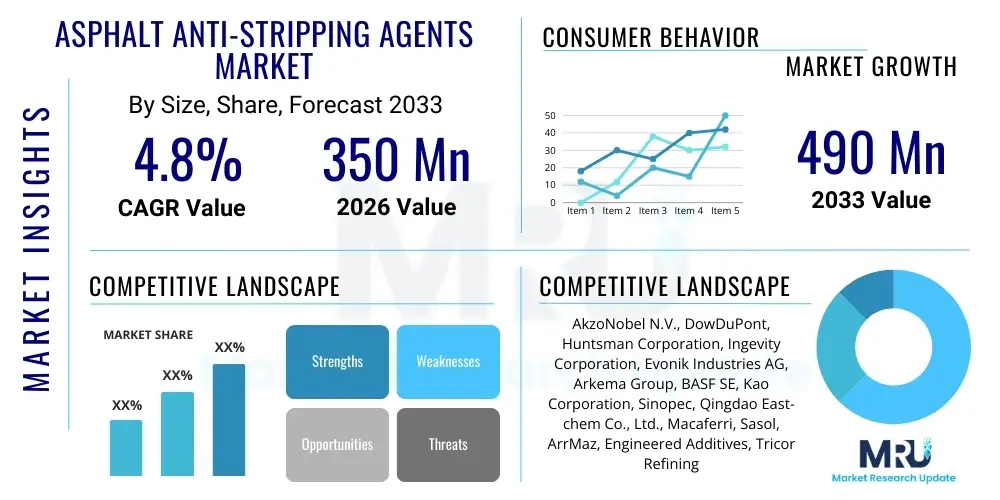

The Asphalt Anti-Stripping Agents Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 490 Million by the end of the forecast period in 2033.

Asphalt Anti-Stripping Agents Market introduction

Asphalt anti-stripping agents (AASAs) are crucial chemical additives incorporated into asphalt mixtures to enhance the adhesion between the bituminous binder and the aggregate material. The primary function of these agents is to mitigate the detrimental effects of moisture intrusion, a phenomenon known as stripping, which severely compromises pavement integrity, leading to premature failure, cracking, and pothole formation. Stripping occurs when water penetrates the asphalt-aggregate interface, displacing the asphalt film due to water's higher affinity for the aggregate surface. AASAs, predominantly derived from chemical amines or proprietary polymer formulations, alter the surface chemistry of the aggregate, ensuring a durable, moisture-resistant bond crucial for long-lasting infrastructure.

The market growth is intrinsically linked to global infrastructure spending, particularly investments in road construction, rehabilitation, and maintenance across developing and developed economies. AASAs find major applications in high-stress environments such as highways, airport runways, and heavy-duty industrial pavements where superior durability and resistance to environmental stress are mandatory. The utilization of these agents not only extends the service life of pavement structures significantly, thereby reducing the lifecycle cost of roads, but also contributes substantially to improving road safety and reducing traffic disruption associated with frequent repairs. Furthermore, the increasing global adoption of Warm Mix Asphalt (WMA) technologies, which operate at lower temperatures, necessitates the use of anti-stripping agents to compensate for the potentially reduced adhesion effectiveness at these lower mixing temperatures.

Key benefits driving the adoption of AASAs include enhanced pavement longevity, improved resistance to freeze-thaw cycles, and overall structural stability under heavy traffic loads and adverse weather conditions. The driving factors for this market expansion include stringent government regulations mandating improved pavement quality standards, growing environmental awareness pushing for highly efficient and durable construction materials, and the escalating need to maintain and expand the global network of public and private transportation infrastructure. As asphalt pavements age and encounter greater climatic variability, the preventative maintenance provided by these chemical agents becomes increasingly vital for infrastructure resilience.

Asphalt Anti-Stripping Agents Market Executive Summary

The global Asphalt Anti-Stripping Agents Market demonstrates robust growth, primarily fueled by massive governmental investment in infrastructure renewal programs, particularly in the Asia Pacific region, which currently leads in both production capacity expansion and consumption volume. Business trends indicate a strong shift towards advanced liquid anti-stripping agents, which offer superior handling characteristics and better dispersion compared to traditional solid or powdered forms. Furthermore, there is a pronounced commercialization drive focused on developing bio-based or environmentally benign agents to meet escalating regulatory demands for sustainable construction practices, moving away from heavily petrochemical-dependent formulations. Strategic partnerships between chemical manufacturers and large-scale road contractors are becoming standard practice, ensuring optimized product integration and performance guarantees.

Regional trends highlight distinct market dynamics. North America and Europe, characterized by mature infrastructure, focus heavily on repair and rehabilitation projects, emphasizing performance enhancers compatible with recycling technologies like Reclaimed Asphalt Pavement (RAP). Conversely, emerging economies, particularly China, India, and Southeast Asian nations, are dominated by new construction projects, driving higher volume demand for basic, cost-effective amine-based anti-stripping agents. Regulatory heterogeneity across regions, specifically regarding the permissible levels of nitrogen and heavy metals in chemical additives, significantly influences product formulation and regional market penetration strategies for global suppliers.

In terms of segment trends, amine-based anti-stripping agents currently dominate the market due to their proven effectiveness, cost efficiency, and established regulatory acceptance, especially in standard Hot Mix Asphalt (HMA) applications. However, the non-amine based segment, encompassing specialized polymers, silanes, and inorganic compounds, is registering the highest growth rate. This accelerated growth is attributed to their superior thermal stability, suitability for demanding applications like high-performance asphalt mixes, and their reduced environmental toxicity profile, aligning with modern construction sustainability mandates. The liquid form segment remains the preferred choice due to ease of dosing and integration into automated asphalt production plants.

AI Impact Analysis on Asphalt Anti-Stripping Agents Market

Users frequently inquire whether Artificial Intelligence (AI) and Machine Learning (ML) can predict the optimal concentration and type of anti-stripping agent required for specific aggregate-asphalt combinations, thereby minimizing material waste and ensuring maximum pavement lifespan. Key themes revolve around AI's ability to analyze vast datasets concerning aggregate mineralogy, bitumen chemistry, environmental conditions (temperature, humidity), and traffic load characteristics to preemptively model stripping potential. Expectations are high that AI-driven quality control systems integrated into asphalt mixing plants will enable real-time adjustments, offering a personalized approach to mixture design rather than relying on generalized specifications, ultimately enhancing material performance and lowering infrastructure costs.

- AI algorithms facilitate predictive modeling of moisture susceptibility based on input parameters (aggregate type, binder grade, AASA chemistry).

- Machine learning optimizes AASA dosage rates, ensuring minimal usage while achieving maximum performance in asphalt mix designs.

- Computer vision and deep learning enhance quality control during asphalt production, detecting inconsistencies in mixing and application of agents.

- AI tools improve supply chain efficiency for raw materials used in anti-stripping agent synthesis by predicting demand and optimizing logistics routes.

- Data analytics derived from pavement monitoring systems feed back into AI models, continuously refining the understanding of AASA effectiveness under various real-world stresses.

DRO & Impact Forces Of Asphalt Anti-Stripping Agents Market

The Asphalt Anti-Stripping Agents Market is propelled by powerful macro-economic drivers, chiefly the unprecedented global commitment to infrastructure development and maintenance. The imperative to upgrade and expand existing road networks, particularly in rapidly urbanizing regions across Asia and Africa, necessitates the use of high-performance additives to ensure the resilience of new pavements against escalating traffic volumes and harsher climate variability. Furthermore, increasing regulatory pressures from transportation departments worldwide mandate the use of anti-stripping agents to meet stringent quality and durability standards (e.g., AASHTO standards, specific European directives). This regulatory environment effectively converts the use of AASAs from an optional additive into a necessary component for public works projects, thereby providing a stable foundational demand for the market.

However, significant restraints temper the market's trajectory. The most notable constraint is the volatility and unpredictability of raw material prices, as many anti-stripping agents are petrochemical derivatives. Fluctuations in crude oil prices directly impact the production cost of amine-based agents, creating margin instability for manufacturers and pricing uncertainty for end-users. Additionally, growing environmental scrutiny surrounding the chemical composition of certain traditional amine-based agents, particularly concerning toxicity and handling requirements, imposes high regulatory compliance costs and necessitates costly reformulations. This focus on environmental compatibility, while an opportunity for innovation, acts as a short-term barrier to widespread adoption of older, cost-effective technologies.

Opportunities for market growth are strongly centered around technological innovation and niche application expansion. The increasing adoption of Warm Mix Asphalt (WMA) and Cold Mix Asphalt (CMA) technologies presents a unique opportunity, as these low-temperature mixes often require specially formulated anti-stripping agents to ensure proper adhesion, boosting demand for high-performance liquid additives compatible with these processes. The development and commercialization of sustainable, bio-based anti-stripping agents derived from non-petroleum resources (such as vegetable oils or lignin) offer a pathway to mitigate environmental concerns and raw material price volatility, positioning these novel products for substantial market penetration in environmentally conscious jurisdictions. These dynamics collectively define a market influenced by mandatory performance requirements but constrained by cost and environmental complexity.

Segmentation Analysis

The Asphalt Anti-Stripping Agents Market is broadly segmented based on the product type, which reflects the underlying chemical composition, the physical form in which the agent is supplied, and the specific application where it is utilized. Analyzing these segments provides critical insights into purchasing patterns and technological preferences across different geographies and construction methodologies. The segmentation by type is crucial as it dictates performance characteristics, cost structure, and compliance with various health and safety regulations, while segmentation by form (liquid versus solid) governs ease of integration and handling at the mixing plant.

Understanding the application segmentation, particularly the distinction between road construction, which dominates the market volume, and other infrastructure uses (such as bridge decks, airport runways, and waterproofing membranes), is vital for targeted marketing and R&D efforts. This structure allows suppliers to tailor their product offerings—for example, providing high-temperature stable agents for specialized high-performance pavements or cost-optimized amine agents for high-volume standard road projects. The ongoing evolution within these segments, particularly the shift towards high-performance non-amine agents, underscores the industry's focus on long-term pavement reliability and sustainability.

- By Type:

- Amine-based Anti-Stripping Agents (e.g., Primary, Secondary, Tertiary Amines, Quaternary Ammonium Compounds)

- Non-amine based Anti-Stripping Agents (e.g., Silanes, Polymers, Lime, Specialized Proprietary Blends)

- By Form:

- Liquid Anti-Stripping Agents

- Solid/Powder Anti-Stripping Agents (e.g., Hydrated Lime)

- By Application:

- Road Construction and Pavement (Highways, Streets, Urban Roads)

- Airport Runways and Taxiways

- Bridge Decks and Waterproofing

- Other Infrastructure Applications (Parking Lots, Industrial Pavements)

Value Chain Analysis For Asphalt Anti-Stripping Agents Market

The value chain for the Asphalt Anti-Stripping Agents Market begins with upstream activities involving the sourcing and refinement of raw materials, which are predominantly petrochemical derivatives for amine-based agents, including various fatty acids and specialized chemicals. For non-amine agents, the upstream process involves sourcing specialized polymers, silane compounds, or calcium oxides (in the case of lime). Manufacturers focus on complex chemical synthesis and formulation processes to transform these raw materials into highly specialized, proprietary anti-stripping formulations, requiring significant investment in R&D and quality control facilities to ensure product efficacy and consistency.

The midstream phase focuses on distribution and logistics. Due to the high-volume, low-margin nature of infrastructure materials, efficient distribution is paramount. The primary distribution channels are mixed: direct sales models are often employed for large-volume government or flagship projects, allowing manufacturers to provide technical support and customized solutions directly to major contractors or public works departments. Indirect distribution relies heavily on specialized chemical distributors and regional asphalt material suppliers who maintain stock and service smaller, dispersed asphalt mixing plants and regional construction firms. The physical form of the product (liquid vs. solid) dictates specific storage and handling requirements throughout this channel, influencing logistical costs.

Downstream analysis centers on the end-users: asphalt producers, paving contractors, and government transportation agencies. The agents are integrated into the asphalt mixing process, often via automated dosing systems for liquid agents, requiring technical expertise and on-site support from the supplier. Performance validation, including laboratory testing (e.g., AASHTO T 283 for moisture susceptibility), is a critical part of the downstream value delivery. Customer value is measured not just by the chemical cost but by the long-term performance benefits—reduced maintenance costs and extended pavement life—making technical service and post-sale performance monitoring essential competitive differentiators in the market.

Asphalt Anti-Stripping Agents Market Potential Customers

The primary consumers, or potential customers, in the Asphalt Anti-Stripping Agents Market are organizations involved in the planning, funding, construction, and maintenance of transportation infrastructure. These include major government bodies, such as Ministries of Transportation, State Departments of Transportation (DOTs), and local municipal public works departments, which are the largest procurers due to their responsibility for public road networks, highways, and national infrastructure projects. Their purchasing decisions are driven by mandatory specifications requiring the use of performance-enhancing additives to meet long-term warranty periods and durability standards.

A second crucial customer segment comprises large-scale private paving contractors and vertically integrated construction companies that operate their own asphalt mixing plants. These companies purchase AASAs in bulk to fulfill contracts awarded by both government and private sector clients (e.g., housing developers, industrial park owners). For this segment, the buying decision is centered on maximizing operational efficiency, ensuring compliance with job specifications, and minimizing risk related to pavement failure. Consistency in product quality, ease of use (especially for automated dosing), and competitive pricing are key purchasing criteria for this commercially focused group.

A specialized segment includes airport authorities and developers of large-scale civil engineering projects, such as seaports and heavy-duty logistics hubs. These environments demand ultra-high-performance asphalt mixes capable of withstanding extreme loads, shear forces, and continuous stress. These customers often require specialized, high-cost, non-amine based anti-stripping agents that offer superior thermal stability and adhesion properties, demonstrating a lower price sensitivity compared to high-volume road construction projects, favoring highly engineered solutions over standard chemical additives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 490 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AkzoNobel N.V., DowDuPont, Huntsman Corporation, Ingevity Corporation, Evonik Industries AG, Arkema Group, BASF SE, Kao Corporation, Sinopec, Qingdao East-chem Co., Ltd., Macaferri, Sasol, ArrMaz, Engineered Additives, Tricor Refining |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Asphalt Anti-Stripping Agents Market Key Technology Landscape

The technological evolution in the Asphalt Anti-Stripping Agents market is primarily driven by the need for enhanced performance compatibility with modern asphalt production methods, particularly Warm Mix Asphalt (WMA) and the increased utilization of recycled materials like Reclaimed Asphalt Pavement (RAP). Traditional technologies focused heavily on primary and secondary amine chemistries, which rely on electrochemical bonding with acidic aggregates. Current innovation concentrates on developing multi-functional, high-performance liquid additives that not only prevent stripping but also act as adhesion promoters, enhancing the overall mechanical strength and durability of the binder-aggregate system under varied climatic conditions.

A significant technological advancement involves the formulation of non-amine based agents, including organosilane compounds and specialized polymeric additives. Silane-based agents offer exceptional thermal stability and are highly effective in difficult mixes, exhibiting superior bonding performance, especially when dealing with chemically complex or highly absorptive aggregates. Furthermore, technological shifts are focusing on environmental mitigation. There is intensive research and development into bio-based anti-stripping agents, which utilize materials derived from agricultural waste or industrial by-products. These bio-agents aim to replicate the adhesion properties of traditional chemicals while offering a lower carbon footprint and reduced health hazards during handling, aligning with global green construction trends.

Moreover, the integration of dosing and quality control technologies is rapidly changing the application landscape. Advanced, automated dosing systems ensure precise, consistent inclusion of liquid anti-stripping agents into the asphalt mixing plant, minimizing human error and optimizing material efficiency. This precision technology is critical, especially in sophisticated mixes where slight variations in additive concentration can drastically affect pavement performance. Future technology will likely involve smart sensors and AI integration to monitor the aggregate surface potential in real-time and recommend dynamic adjustments to the AASA dosage for optimized performance.

Regional Highlights

The market exhibits distinct regional growth patterns driven by local infrastructure spending cycles, regulatory environments, and climate conditions.

- Asia Pacific (APAC) is the dominant and fastest-growing region, primarily due to massive investments in new road construction, national highway projects, and urbanization in countries like China, India, and Indonesia. High demand for cost-effective amine-based agents characterizes this market, though regulatory changes are gradually pushing for higher quality standards.

- North America represents a mature market focusing heavily on pavement preservation, rehabilitation, and maintenance. The stringent pavement quality specifications imposed by state DOTs ensure consistent high demand for AASAs. Adoption of WMA technology is increasing, driving demand for compatible, high-performance liquid anti-stripping agents.

- Europe is characterized by stringent environmental and safety regulations, fostering a strong preference for non-amine based and sustainable, low-toxicity formulations. Scandinavian countries, in particular, lead in the adoption of bio-based agents and sophisticated polymer additives to combat severe freeze-thaw cycling and high moisture exposure.

- Latin America (LATAM) shows emerging growth, particularly in Brazil and Mexico, driven by localized infrastructure upgrades. Market penetration is often linked to major foreign investments in resource extraction and transportation corridors, leading to volatile but significant project-based demand.

- Middle East and Africa (MEA) features unique challenges, including extreme heat and sandstorms, necessitating highly thermally stable anti-stripping agents. Infrastructure development in the GCC states (Saudi Arabia, UAE) is a major driver, focusing on durable, specialty asphalt mixes for high-performance highway systems and mega-projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Asphalt Anti-Stripping Agents Market.- AkzoNobel N.V.

- DowDuPont

- Huntsman Corporation

- Ingevity Corporation

- Evonik Industries AG

- Arkema Group

- BASF SE

- Kao Corporation

- Sinopec

- Qingdao East-chem Co., Ltd.

- ArrMaz

- Engineered Additives

- Tricor Refining

- W.R. Meadows, Inc.

- Road Science (A wholly owned subsidiary of Ingevity)

- Iterchimica S.p.A.

- Specialty Chemical Solutions (SCS)

- Fujian Longhai Chemical Co., Ltd.

- CEMEX S.A.B. de C.V.

- Sasol

Frequently Asked Questions

Analyze common user questions about the Asphalt Anti-Stripping Agents market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of asphalt anti-stripping agents?

The primary function of asphalt anti-stripping agents (AASAs) is to enhance the bond between the asphalt binder and the aggregate material, preventing moisture-induced damage known as stripping. This mitigation process significantly extends the pavement's operational life and structural integrity.

What are the key drivers for the growth of the anti-stripping agents market?

Market growth is predominantly driven by increasing global infrastructure investments, particularly in road construction and rehabilitation, coupled with the enforcement of stringent government regulations mandating durable, moisture-resistant pavements to reduce maintenance lifecycle costs.

How do amine-based and non-amine based agents differ in performance?

Amine-based agents are highly effective and cost-efficient, relying on chemical reactions for adhesion. Non-amine agents, including polymers and silanes, offer superior thermal stability, reduced environmental impact, and specialized performance required for high-stress applications like Warm Mix Asphalt (WMA) or complex aggregate types.

Which geographical region dominates the consumption of asphalt anti-stripping agents?

The Asia Pacific (APAC) region currently dominates the consumption market due to massive government-led infrastructure expansion projects, rapid urbanization, and high-volume demand for road construction materials in emerging economies such as China and India.

Are bio-based anti-stripping agents a viable alternative to traditional chemicals?

Yes, bio-based agents, often derived from renewable resources, are rapidly becoming viable alternatives. They offer comparable performance to traditional petrochemical agents while addressing growing concerns about environmental impact and raw material price volatility, supporting sustainable construction objectives.

Asphalt anti-stripping agents are fundamentally essential for modern infrastructure resilience, acting as a chemical bridge that stabilizes the critical interface between binder and aggregate. Their market trajectory is directly correlated with global macroeconomic stability and legislative focus on construction quality assurance. The shift from Hot Mix Asphalt (HMA) to lower-temperature technologies, specifically Warm Mix Asphalt (WMA), is not merely an operational change but a strategic pivot that necessitates the development of sophisticated, thermally stable anti-stripping formulations. WMA processes, while saving energy and reducing emissions, often present adhesion challenges due to lower mixing energy and shorter duration of aggregate drying, thereby increasing reliance on high-performance chemical additives to ensure the mixture meets specified stripping resistance requirements.

The competitive landscape is characterized by established global chemical giants alongside specialized regional players who focus on tailored solutions for local aggregate mineralogy, which varies significantly worldwide. For instance, aggregates derived from highly acidic volcanic rocks require different chemical approaches compared to basic limestone aggregates. This geological variability necessitates continuous research into highly customizable, dual-action agents that can perform effectively across a wide spectrum of material inputs. Furthermore, the market is seeing increased regulatory harmonization attempts across blocs like the European Union, which standardize testing protocols (e.g., European standard EN 12697-12) to ensure that anti-stripping agents deliver verifiable performance benefits across borders, fostering greater cross-regional trade and technical collaboration.

Technological refinement is also focused intensely on the logistical and handling aspects of these chemicals. Liquid agents are favored because they allow for precise, automated dosing and offer immediate dispersion into the asphalt binder line, optimizing efficiency in high-output asphalt plants. However, the safe storage and transfer of large volumes of liquid chemical concentrates pose specific operational and environmental challenges that manufacturers are addressing through advanced packaging and delivery systems designed to minimize exposure risk and simplify integration into existing plant infrastructure. Solid anti-stripping agents, such as hydrated lime, while cost-effective, require specialized silo storage and separate, careful dry dosing into the aggregate stream, a complexity that limits their growth compared to the convenience offered by advanced liquid formulations in modern, high-tech mixing operations.

The ongoing trend of pavement recycling, involving high percentages of Reclaimed Asphalt Pavement (RAP), further complicates the function of anti-stripping agents. RAP materials often contain aged, stiffened bitumen and have variable surface energy characteristics. Anti-stripping agents used in high-RAP mixes must not only promote adhesion but also aid in the rejuvenation and performance enhancement of the aged binder component, often requiring a multi-component chemical formulation that acts both as an adhesion promoter and a mild rheology modifier. This intricate requirement is pushing R&D towards hybrid chemical solutions that transcend the simple anti-stripping function, making them indispensable components in sustainable, circular-economy asphalt mixtures globally. This shift underscores the high value placed on innovation and chemical specificity within the market.

Crucially, the sustainability mandate extends beyond just bio-based sourcing; it also involves minimizing the environmental impact throughout the pavement's lifecycle. By significantly extending the service life of roads—potentially from 10–12 years to 15–20 years—AASAs indirectly contribute to a reduction in resource consumption associated with frequent pavement reconstruction. This extended durability provides a powerful economic argument for their mandatory inclusion in public infrastructure projects, justifying the initial investment in higher-quality chemical additives. The long-term cost savings in maintenance and the reduction in traffic disruption serve as compelling arguments for transportation agencies, transforming the market narrative from one of mere cost addition to one of essential lifecycle value creation.

The penetration of AASAs into specialized construction sectors, such as high-speed rail track beds or heavily trafficked intermodal yards, represents a critical area of opportunity. In these applications, the asphalt layer is subjected to constant, severe dynamic loading and vibration, requiring performance characteristics far exceeding standard road applications. Suppliers targeting these niche markets must demonstrate exceptional fatigue resistance and moisture stability performance under laboratory conditions that simulate extreme operational stresses. This specialized demand drives premium pricing and incentivizes the development of proprietary, polymer-modified anti-stripping agents that offer superior mechanical enhancement in addition to standard moisture protection.

In terms of market access, suppliers face regulatory hurdles concerning product approval, which often involves lengthy field trials and compliance checks against national specifications. For instance, many European nations require that any additive must not adversely affect other key pavement properties, such as resistance to permanent deformation (rutting) or thermal cracking. Navigating this complex regulatory labyrinth requires robust technical support and extensive certification documentation, creating high barriers to entry for smaller manufacturers and favoring established companies with global testing and certification capabilities. This institutional requirement reinforces the dominance of major international chemical corporations in highly regulated markets like North America and Western Europe.

Furthermore, the educational and technical support provided by manufacturers forms an integral part of the service offering in this market. Since the effectiveness of an anti-stripping agent is highly dependent on correct dosage, proper mixing temperature, and the specific chemistry of the asphalt binder being used, comprehensive training for asphalt plant operators and quality control personnel is essential. Leading suppliers often differentiate themselves by offering sophisticated technical consultancy, assisting clients in optimizing their mix designs based on local aggregate sources, ensuring maximum efficiency and guaranteed pavement performance, thereby creating stronger customer loyalty and long-term contracts.

The future technology pipeline for AASAs is expected to include advanced surface modification techniques, possibly involving nanotechnology or microencapsulation, to deliver agents with controlled release capabilities or superior affinity for difficult-to-treat aggregate surfaces. These cutting-edge materials aim to overcome current limitations, offering unprecedented levels of moisture resistance and durability, particularly in regions facing severe climatic events exacerbated by climate change. As the global focus shifts towards building resilient infrastructure, the role of these specialized chemical additives will only become more centralized and technically demanding within the civil engineering domain.

The economic impact of high-performing AASAs is quantified by the tangible reduction in public sector maintenance budgets. By preventing stripping, which is often the precursor to major pavement distress, transportation authorities avoid premature reconstruction costs, translating into billions of dollars in savings annually across large network operators. This economic benefit strengthens the case for mandatory inclusion policies, especially where public funds are rigorously scrutinized for long-term value. The perceived shift from optional performance enhancer to essential cost-saving chemical drives substantial, sustained market growth, independent of short-term economic fluctuations in the construction sector, reinforcing the agents' position as fundamental components of modern pavement engineering.

The integration of digital twins and predictive maintenance models based on real-world sensor data (IoT) deployed in smart roads further elevates the importance of anti-stripping agents. When AI models accurately predict where and when moisture damage is likely to occur, it validates the efficacy of high-quality AASAs used in those specific sections. This data-driven validation loop provides quantifiable proof of product performance, aiding manufacturers in marketing premium, tested formulations and assisting transportation departments in making informed material choices that maximize infrastructure resilience based on empirical evidence rather than solely relying on theoretical laboratory testing protocols.

In summary, the Asphalt Anti-Stripping Agents Market is transforming from a basic chemical additives sector into a highly specialized field of performance engineering chemistry. Driven by regulatory mandates, sustainability goals, and the need for resilient infrastructure, the market demands continuous innovation in compatibility (WMA/RAP), environmental profile (bio-based), and integration technology (automated dosing). The regional variance in raw materials and climate necessitates localized, technically sound solutions, securing the long-term strategic importance of these specialized construction chemicals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager