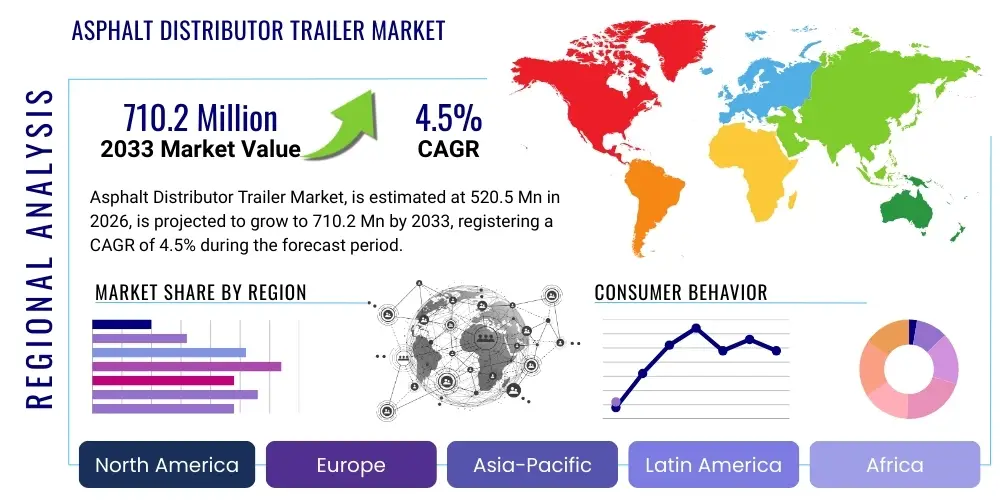

Asphalt Distributor Trailer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439494 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Asphalt Distributor Trailer Market Size

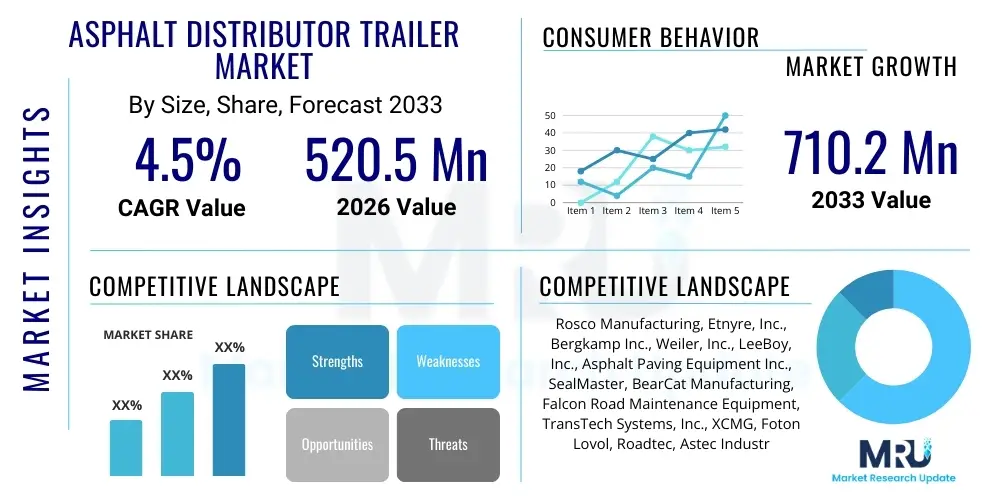

The Asphalt Distributor Trailer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 520.5 Million in 2026 and is projected to reach USD 710.2 Million by the end of the forecast period in 2033.

Asphalt Distributor Trailer Market introduction

The Asphalt Distributor Trailer Market is a critical segment within the broader road construction and maintenance industry, providing specialized equipment essential for the efficient and uniform application of asphalt emulsions, cutbacks, and hot asphalt cements. These trailers are fundamental to creating durable and high-quality road surfaces, driveways, parking lots, and other paved areas. The product, an asphalt distributor trailer, is designed for the precise spraying of various bituminous materials at controlled temperatures and pressures, ensuring optimal bonding between asphalt layers and aggregates. Equipped with insulated tanks, heating systems, spray bars, and sophisticated control mechanisms, these trailers are vital tools for governmental road agencies, private construction companies, and paving contractors.

Major applications of asphalt distributor trailers include prime coating, tack coating, chip sealing, and surface treatment for new road construction, as well as extensive repair and maintenance operations. Prime coating involves applying a low-viscosity asphalt material to an untreated granular base, preparing it for subsequent layers and providing waterproofing. Tack coating, conversely, is used to ensure a strong adhesive bond between an existing pavement surface and a new asphalt overlay, which is crucial for structural integrity and preventing slippage. Chip sealing uses the distributor to apply asphalt, followed by an aggregate layer, enhancing skid resistance and extending pavement life. The versatility of these trailers allows them to be indispensable across a wide spectrum of infrastructure projects, from major highways to local residential streets.

The primary benefits of utilizing asphalt distributor trailers include enhanced efficiency in asphalt application, leading to significant time and cost savings on projects. Their precision control minimizes material waste and ensures consistent application rates, contributing to superior pavement quality and longevity. Key driving factors for market growth include escalating global investments in transportation infrastructure, particularly in developing economies, coupled with a persistent need for road repair and rehabilitation in mature markets. The increasing adoption of advanced technologies for improved operational efficiency, stringent quality standards for road construction, and a growing emphasis on sustainable paving practices further propel market expansion. Additionally, the urbanization trend and the associated need for robust municipal infrastructure underpin sustained demand.

Asphalt Distributor Trailer Market Executive Summary

The Asphalt Distributor Trailer Market is poised for steady expansion, driven by a confluence of favorable business trends, evolving regional demands, and segment-specific technological advancements. Globally, the industry is experiencing increased capitalization on public-private partnerships for infrastructure development, fostering a stable environment for equipment sales and rentals. Manufacturers are focusing on integrating smart technologies and automation to enhance operational efficiency and reduce labor costs, which are becoming critical differentiators in a competitive landscape. Furthermore, the emphasis on environmentally friendly paving solutions and the adoption of cold mix asphalt applications are shaping product development strategies, leading to innovations in heating efficiency and material compatibility for distributor trailers. The shift towards greater sustainability is also influencing procurement decisions among major contractors and governmental bodies.

Regionally, the market exhibits diverse growth patterns. Asia Pacific, particularly countries like China and India, represents a significant growth hub due to massive infrastructure projects, rapid urbanization, and extensive road network expansion initiatives. North America and Europe, characterized by mature road networks, show consistent demand driven by ongoing maintenance, rehabilitation, and upgrade projects, with a strong focus on advanced, high-efficiency equipment meeting strict environmental regulations. Latin America, the Middle East, and Africa are emerging as promising markets, buoyed by economic development, increased trade activities requiring better connectivity, and a rising awareness of the importance of robust transportation infrastructure. Each region presents unique challenges and opportunities, influencing product specifications and market entry strategies for manufacturers.

Segmentation trends reveal a growing preference for higher capacity trailers to handle large-scale projects more efficiently, though smaller and more agile units remain crucial for urban and specialized applications. Technological advancements within the segment are concentrated on features such as GPS-guided spraying, automated control systems for precise material distribution, and enhanced heating mechanisms that reduce energy consumption and improve material consistency. The market for used equipment also plays a vital role, particularly in regions with budget constraints, highlighting the durability and longevity of these machines. Manufacturers are increasingly offering customizable solutions to meet specific client requirements, further segmenting the market based on application, capacity, and technological sophistication, driving incremental value across the industry spectrum.

AI Impact Analysis on Asphalt Distributor Trailer Market

User questions related to AI's impact on the Asphalt Distributor Trailer Market often revolve around how artificial intelligence can enhance operational efficiency, improve application precision, and contribute to predictive maintenance. Key concerns include the initial investment costs, the learning curve for operators, and the reliability of AI systems in harsh construction environments. There is significant interest in understanding how AI might automate spraying processes, optimize material usage to reduce waste, and provide real-time data analytics for better project management. Users also seek clarity on AI's role in improving safety, minimizing environmental impact, and potentially extending the lifespan of road infrastructure through more consistent and accurate asphalt distribution.

- Automated Spraying Precision: AI algorithms can analyze real-time data from sensors (e.g., GPS, LiDAR, thermal cameras) to precisely control spray bar width, flow rate, and temperature, ensuring uniform asphalt application and minimizing overlap or gaps. This leads to reduced material consumption and higher quality pavement.

- Predictive Maintenance: AI-driven analytics can monitor the performance of critical components like pumps, heating systems, and spray nozzles, identifying potential failures before they occur. This enables proactive maintenance schedules, reduces unplanned downtime, and extends the operational life of the trailer, optimizing asset utilization.

- Route Optimization and Logistics: AI can optimize delivery routes for asphalt materials to the job site, considering traffic, weather, and job progress. This ensures timely material supply to the asphalt distributor trailers, reducing idle time and improving overall project scheduling and efficiency.

- Quality Control and Inspection: AI-powered vision systems can conduct real-time quality checks during asphalt application, detecting inconsistencies, temperature deviations, or material defects. This allows for immediate adjustments, ensuring adherence to specifications and reducing rework, thereby improving the overall quality of the road surface.

- Operator Training and Assistance: AI can be integrated into operator training simulations, providing realistic scenarios and feedback for new users. During operation, AI-powered assistance systems can offer real-time guidance and alerts, helping operators maintain optimal performance parameters and react effectively to changing conditions, thereby enhancing safety and operational consistency.

DRO & Impact Forces Of Asphalt Distributor Trailer Market

The Asphalt Distributor Trailer Market is significantly shaped by a dynamic interplay of drivers, restraints, and opportunities, alongside various impact forces that either accelerate or impede its growth trajectory. Key drivers include the global imperative for infrastructure development and maintenance, particularly in rapidly urbanizing regions and countries undertaking extensive road network expansion. Governments worldwide are allocating substantial budgets to improve connectivity, reduce traffic congestion, and ensure the safety of transportation routes, which directly translates into increased demand for efficient asphalt application equipment. Furthermore, the aging infrastructure in developed nations necessitates continuous repair and rehabilitation, providing a stable foundation for market demand. Technological advancements in equipment design, such as improved heating efficiency, enhanced spray control systems, and telematics integration, also act as strong drivers, offering superior operational performance and cost-effectiveness.

However, the market faces notable restraints that temper its growth. High initial capital investment costs for advanced asphalt distributor trailers can be a barrier for smaller contractors or those in developing economies with limited access to financing. The fluctuating prices of raw materials, particularly steel and other components used in manufacturing, can impact production costs and retail prices, affecting market stability. Stringent environmental regulations concerning emissions and noise pollution, especially in developed markets, compel manufacturers to invest in costly R&D for compliance, which can increase product costs. Additionally, the availability of skilled labor for operating and maintaining sophisticated machinery poses a challenge, particularly in regions with a less developed technical workforce. Economic downturns and geopolitical instabilities can also lead to reduced infrastructure spending, thereby impacting market demand.

Opportunities within the market largely stem from the adoption of sustainable paving practices, including the increased use of recycled asphalt pavement (RAP) and warm mix asphalt (WMA) technologies, which require specialized yet adaptable distribution equipment. The burgeoning smart city initiatives globally present avenues for integrated and intelligent construction machinery, where asphalt distributor trailers can play a role in data-driven project execution. Expansion into emerging markets with burgeoning infrastructure needs, coupled with strategic partnerships and localized manufacturing, represents a significant growth opportunity. The aftermarket services segment, including maintenance, spare parts, and retrofitting older models with new technologies, also offers substantial revenue potential. The ongoing innovation in automation and telematics within construction equipment continues to open new frontiers for efficiency and precision in asphalt distribution.

- Drivers:

- Increasing global investment in road infrastructure development and maintenance, driven by urbanization and economic growth.

- Growing demand for efficient and high-quality asphalt application to extend pavement life and enhance safety.

- Technological advancements leading to improved precision, automation, and fuel efficiency in asphalt distributor trailers.

- Government initiatives and funding for smart cities and sustainable transportation networks.

- Restraints:

- High initial capital expenditure for advanced asphalt distributor trailers, especially for small and medium-sized enterprises.

- Volatility in raw material prices (e.g., steel, components) impacting manufacturing costs and profitability.

- Stringent environmental regulations regarding emissions and operational noise, increasing compliance costs for manufacturers.

- Shortage of skilled labor for operating and maintaining sophisticated asphalt distribution equipment.

- Opportunities:

- Rising adoption of sustainable paving materials like recycled asphalt pavement (RAP) and warm mix asphalt (WMA) requiring specialized equipment.

- Expansion into emerging markets with significant untapped potential for infrastructure development.

- Development of integrated digital solutions and telematics for enhanced fleet management and operational insights.

- Growth in aftermarket services, including maintenance, repair, and modernization of existing equipment.

- Impact Forces:

- Economic cycles and government spending on infrastructure projects directly influence market demand.

- Technological innovation in related industries (e.g., sensor technology, GPS) can be integrated into trailers, affecting market competitiveness.

- Environmental policies and climate change concerns push for greener and more energy-efficient equipment.

- Geopolitical stability and trade policies can affect supply chains, raw material availability, and market access.

Segmentation Analysis

The Asphalt Distributor Trailer Market is comprehensively segmented based on various critical attributes including capacity, type, and application, providing a granular view of market dynamics and catering to diverse operational requirements. This multi-faceted segmentation helps to understand purchasing patterns, technological preferences, and the specific needs of different end-user segments within the road construction and maintenance industry. Each segment represents a distinct market niche, influenced by factors such as project scale, geographical location, regulatory environment, and budget constraints. Analyzing these segments individually offers insights into opportunities for product innovation, market penetration, and competitive positioning, allowing manufacturers and service providers to tailor their offerings effectively.

- By Capacity:

- Small Capacity (Under 1,000 Gallons): These trailers are typically used for smaller projects such as driveways, parking lots, and patching repairs. They offer greater maneuverability and are often favored by smaller contractors or for urban applications where space is limited. Their lower material capacity requires more frequent refills but provides flexibility for varied job sizes.

- Medium Capacity (1,000 - 2,000 Gallons): Representing a balanced solution, these trailers are suitable for medium-scale road construction, maintenance of local roads, and municipal projects. They strike a balance between material capacity and operational agility, making them a popular choice for a wide range of contractors seeking versatility and efficiency on mid-sized jobs.

- Large Capacity (Above 2,000 Gallons): Designed for large-scale infrastructure projects like highways, runways, and major road networks, these trailers minimize refilling interruptions, maximizing productivity on extensive paving operations. Their robust construction and higher output capabilities are essential for projects demanding continuous and high-volume asphalt distribution.

- By Type:

- Standard Asphalt Distributor Trailers: These are the conventional trailers equipped with basic features for heating and spraying asphalt materials. They form the backbone of many construction fleets, offering reliable performance for a variety of standard paving applications without extensive advanced functionalities.

- Computerized/Automated Asphalt Distributor Trailers: Featuring advanced control systems, GPS integration, and automated spray bar adjustments, these trailers offer superior precision, consistency, and operational efficiency. They reduce human error, optimize material usage, and provide data for project management, appealing to contractors focused on high quality and productivity.

- By Application:

- New Road Construction: This segment involves the initial laying of asphalt layers for newly built roads, highways, and infrastructure projects. Asphalt distributor trailers are crucial for prime coats, tack coats, and binder applications, ensuring the foundational quality and durability of new pavements.

- Road Maintenance & Repair: This extensive segment includes activities such as chip sealing, surface treatment, patching, and crack sealing on existing roads. Distributor trailers are indispensable for preserving and extending the life of road networks, addressing wear and tear, and ensuring ongoing road safety and functionality.

- Airport & Runway Construction: Demanding exceptionally high standards for smoothness, durability, and load-bearing capacity, this application requires precision asphalt distribution. Specialized trailers with enhanced accuracy are utilized for laying and maintaining airport pavements, which are subject to extreme stresses from aircraft.

- Commercial & Residential Paving: This includes paving for parking lots, driveways, sidewalks, and other private or municipal areas. Smaller to medium-capacity trailers are typically employed, focusing on efficiency and quality for varied project scales in urban and suburban environments.

Value Chain Analysis For Asphalt Distributor Trailer Market

The value chain for the Asphalt Distributor Trailer Market is a complex network involving several key stages, starting from the sourcing of raw materials and extending to the ultimate end-users. This chain encompasses upstream suppliers, manufacturing and assembly, distribution, and critical downstream activities, each contributing to the final product's value and market delivery. Understanding this value chain is crucial for identifying cost efficiencies, quality control points, and opportunities for strategic partnerships that can enhance market competitiveness and operational resilience. The interdependencies among these stages underscore the need for effective supply chain management and collaboration to ensure product quality, timely delivery, and customer satisfaction.

Upstream analysis involves the procurement of essential raw materials and components, which form the building blocks of asphalt distributor trailers. This includes high-grade steel for tanks and chassis, specialized pumps, burners, engines, hydraulic systems, control units, and various electronic components. Key suppliers in this stage include metal foundries, engine manufacturers, hydraulic component specialists, and electronics suppliers. The quality and cost of these raw materials significantly influence the final product's manufacturing cost and performance. Therefore, strong relationships with reliable suppliers, often involving long-term contracts and quality assurance protocols, are paramount. Any disruptions in the supply of these critical components can have a ripple effect throughout the entire value chain, impacting production schedules and delivery timelines.

Downstream analysis focuses on the distribution channels and the end-users of asphalt distributor trailers. Distribution typically involves a mix of direct sales from manufacturers, third-party distributors, equipment rental companies, and dealer networks. These channels are responsible for reaching a diverse customer base, including governmental road agencies, large construction firms, specialized paving contractors, and private developers. The choice of distribution channel often depends on the manufacturer's market penetration strategy, geographical reach, and the specific needs of regional customers. Direct sales may be preferred for large tenders or customized orders, while dealer networks provide local support, maintenance services, and broader market access. Equipment rental companies offer a flexible option for contractors who prefer not to incur the high capital costs of ownership, particularly for short-term projects.

Direct distribution channels involve manufacturers selling their products directly to end-users, often large government entities or major construction companies. This approach allows for closer customer relationships, direct feedback, and greater control over the sales process and pricing. Indirect channels, on the other hand, leverage intermediaries such as dealers, distributors, and rental companies. Dealers often provide sales, after-sales service, parts, and technical support, acting as a crucial link between the manufacturer and local markets. Rental companies cater to projects with varying durations, offering operational flexibility to contractors. The effectiveness of these distribution channels hinges on their reach, efficiency, and ability to provide comprehensive support, ensuring that asphalt distributor trailers reach their intended markets efficiently and are supported throughout their operational life cycle.

Asphalt Distributor Trailer Market Potential Customers

The potential customers for Asphalt Distributor Trailer Market are diverse and span across various sectors of the construction and infrastructure industry, all sharing a common need for efficient and precise asphalt application. These end-users typically include entities involved in the development, maintenance, and rehabilitation of paved surfaces. Their purchasing decisions are influenced by project scale, budget constraints, technical specifications, and the long-term operational costs associated with equipment. Understanding the specific needs and operational environments of these customer segments is vital for manufacturers and distributors to tailor their product offerings, marketing strategies, and after-sales support effectively.

Key end-users include governmental road and highway departments at national, state, and municipal levels. These public bodies are consistently investing in the expansion of road networks and the extensive upkeep of existing infrastructure, making them primary purchasers of asphalt distributor trailers. Their procurement often involves large tenders and stringent compliance with quality and performance standards. In addition, large-scale construction companies specializing in civil engineering projects, such as highway construction, airport runway development, and large commercial developments, represent another significant customer segment. These companies require high-capacity, robust equipment that can operate reliably on demanding, long-duration projects. Their buying decisions are often driven by productivity, durability, and technological sophistication.

Furthermore, specialized paving contractors and smaller general contractors form a substantial portion of the customer base. These entities typically handle a range of projects from residential driveways and parking lots to local road repairs and municipal works. They often seek versatile, medium-capacity trailers that offer a balance of performance, maneuverability, and cost-effectiveness. Equipment rental companies also serve as crucial indirect customers, purchasing trailers to lease out to contractors who prefer renting over direct ownership, particularly for short-term projects or to avoid significant capital outlay. This allows a broader range of smaller contractors to access essential equipment without the burden of full ownership. The diverse operational needs across these customer groups underscore the importance of offering a wide array of trailer capacities, types, and technological features.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 520.5 Million |

| Market Forecast in 2033 | USD 710.2 Million |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rosco Manufacturing, Etnyre, Inc., Bergkamp Inc., Weiler, Inc., LeeBoy, Inc., Asphalt Paving Equipment Inc., SealMaster, BearCat Manufacturing, Falcon Road Maintenance Equipment, TransTech Systems, Inc., XCMG, Foton Lovol, Roadtec, Astec Industries, Caterpillar Inc., Wirtgen Group, LiuGong, Sany Heavy Industry, Sumitomo Heavy Industries, Volvo Construction Equipment |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Asphalt Distributor Trailer Market Key Technology Landscape

The Asphalt Distributor Trailer Market is continuously evolving with the integration of advanced technologies aimed at enhancing efficiency, precision, and operational safety. Manufacturers are investing significantly in research and development to equip trailers with sophisticated systems that optimize asphalt application, reduce material waste, and improve overall project outcomes. The technological landscape is characterized by a push towards automation, digital control, and smart connectivity, transforming traditional equipment into intelligent machines capable of delivering superior performance in diverse construction environments. These technological advancements not only meet the growing demand for higher quality infrastructure but also address environmental concerns by improving fuel efficiency and promoting sustainable paving practices.

One of the paramount technological advancements is the development of computerized control systems. These systems allow operators to precisely manage spray bar width, application rate, and material temperature, ensuring uniform and consistent asphalt distribution across the surface. Integration of GPS and telematics further enhances these systems by enabling automated coverage mapping, tracking of material usage, and real-time monitoring of fleet performance. This data-driven approach not only improves accuracy but also facilitates better project management, cost control, and accountability. Additionally, advanced heating systems, including direct-fired burners and heat exchange coils, ensure that asphalt emulsions and binders are maintained at optimal application temperatures, crucial for proper adhesion and curing, while also improving fuel efficiency and reducing emissions.

Furthermore, the market is witnessing the adoption of sensor technologies and diagnostic tools that provide real-time feedback on equipment status and performance. Infrared sensors can monitor asphalt temperature on the spray bar, while pressure sensors ensure consistent flow rates, immediately alerting operators to deviations. Automated cleaning systems for spray bars minimize downtime and maintenance efforts, ensuring continuous operation. The increasing trend towards modular design allows for easier maintenance, upgrades, and customization, catering to specific project requirements. Overall, the technology landscape is moving towards fully integrated, intelligent systems that not only perform the core function of asphalt distribution but also contribute significantly to the overall efficiency, sustainability, and quality of road construction and maintenance projects.

Regional Highlights

- North America: The North American market for asphalt distributor trailers is mature yet stable, driven primarily by extensive road maintenance and rehabilitation projects across the United States and Canada. Demand is sustained by aging infrastructure, federal and state funding for highway improvements, and a strong emphasis on adopting technologically advanced equipment to enhance operational efficiency and meet stringent environmental regulations. The region sees a preference for high-capacity, automated trailers.

- Europe: Europe represents another significant market, characterized by a strong focus on sustainable infrastructure development and the widespread use of warm mix asphalt (WMA) and recycled asphalt pavement (RAP). Countries like Germany, France, and the UK are investing in eco-friendly paving solutions and advanced machinery that complies with strict EU emission standards. The market is driven by ongoing efforts to modernize road networks and reduce carbon footprints, favoring precision and efficiency.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market due to massive infrastructure development initiatives in countries such as China, India, and Southeast Asian nations. Rapid urbanization, increasing government expenditure on road construction, and the development of new trade corridors are fueling robust demand for asphalt distributor trailers. The market here is diverse, with demand for both cost-effective standard models and technologically advanced equipment for mega-projects.

- Latin America: The Latin American market is exhibiting steady growth, propelled by increasing investments in transportation infrastructure to support economic development and regional trade. Countries like Brazil, Mexico, and Argentina are expanding their road networks and upgrading existing ones, leading to a rising demand for construction equipment. Affordability and durability are key considerations for purchasers in this region, alongside a growing interest in modernizing equipment fleets.

- Middle East and Africa (MEA): The MEA region presents emerging opportunities, driven by significant infrastructure projects, particularly in Gulf Cooperation Council (GCC) countries and parts of Africa. Investments in oil and gas infrastructure, smart cities, and diversified economies are creating demand for advanced asphalt distribution equipment. While initial adoption may be slower in some African nations due to economic constraints, the long-term outlook is positive with increasing urbanization and industrialization requiring robust road networks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Asphalt Distributor Trailer Market.- Rosco Manufacturing

- Etnyre, Inc.

- Bergkamp Inc.

- Weiler, Inc.

- LeeBoy, Inc.

- Asphalt Paving Equipment Inc.

- SealMaster

- BearCat Manufacturing

- Falcon Road Maintenance Equipment

- TransTech Systems, Inc.

- XCMG

- Foton Lovol

- Roadtec

- Astec Industries

- Caterpillar Inc.

- Wirtgen Group

- LiuGong

- Sany Heavy Industry

- Sumitomo Heavy Industries

- Volvo Construction Equipment

Frequently Asked Questions

Analyze common user questions about the Asphalt Distributor Trailer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an Asphalt Distributor Trailer and its primary function?

An Asphalt Distributor Trailer is a specialized piece of construction equipment designed to apply a uniform, controlled spray of heated bituminous materials (asphalt emulsions, cutbacks, or hot asphalt cements) onto road surfaces. Its primary function is to prepare pavement layers for optimal bonding, create waterproof barriers, or perform surface treatments like chip sealing, ensuring the durability and longevity of road infrastructure.

What are the key factors driving the growth of the Asphalt Distributor Trailer Market?

The market's growth is primarily driven by increasing global investments in road infrastructure development and maintenance, particularly in rapidly urbanizing regions. Other key factors include the persistent need for road repair and rehabilitation in mature markets, technological advancements enhancing equipment efficiency and precision, and governmental initiatives promoting sustainable paving practices.

How do computerized asphalt distributor trailers improve operational efficiency?

Computerized trailers integrate advanced control systems, GPS, and automation to precisely manage spray bar width, flow rate, and material temperature. This technology significantly reduces human error, ensures uniform application, minimizes material waste, and provides real-time data for optimized project management and improved pavement quality, leading to substantial cost and time savings.

What are the main types of asphalt distributor trailers available?

Asphalt distributor trailers are primarily categorized by capacity (small, medium, large) and type (standard vs. computerized/automated). Standard trailers offer basic asphalt spraying capabilities, while computerized models feature advanced controls for enhanced precision and efficiency. Capacities vary to suit projects from small repairs to extensive highway construction, ensuring versatility for different applications.

Which regions are leading the demand for Asphalt Distributor Trailers?

The Asia Pacific region, particularly countries like China and India, is currently leading in demand due to extensive infrastructure expansion and urbanization. North America and Europe also maintain significant demand driven by ongoing road maintenance and modernization projects, with a strong focus on advanced, high-efficiency equipment meeting stringent environmental standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager