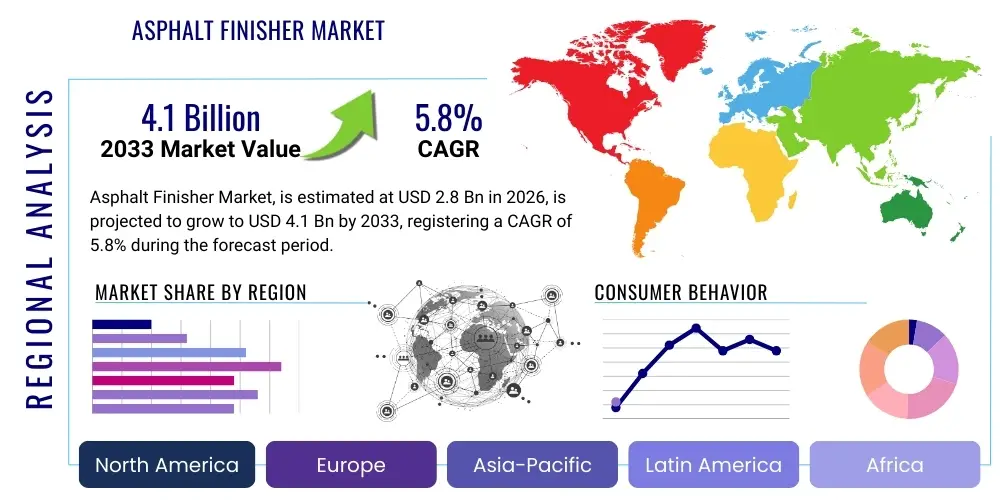

Asphalt Finisher Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438850 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Asphalt Finisher Market Size

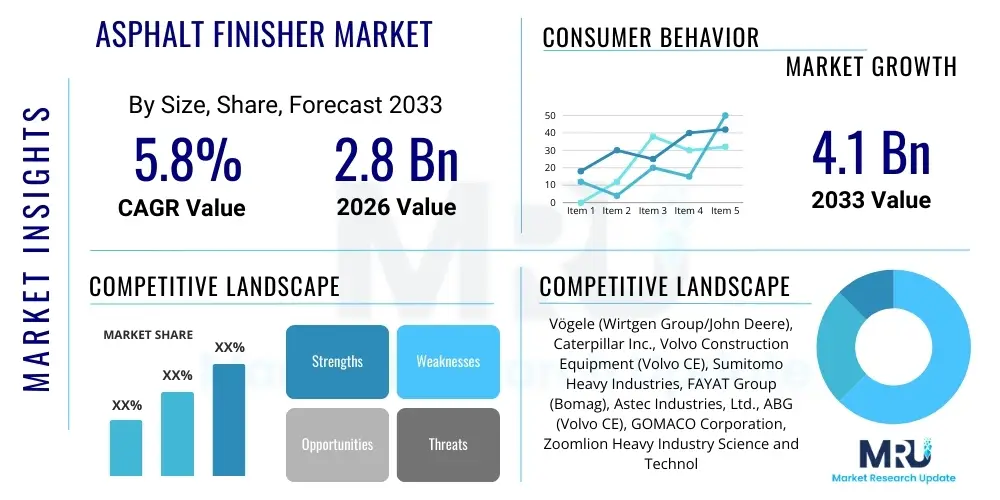

The Asphalt Finisher Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $2.8 Billion in 2026 and is projected to reach $4.1 Billion by the end of the forecast period in 2033.

Asphalt Finisher Market introduction

The Asphalt Finisher Market encompasses specialized heavy construction machinery utilized primarily for laying asphalt on roads, bridges, airports, and other large surface areas. These machines, often referred to as paving machines or paver spreaders, are critical components in infrastructure development globally, ensuring the uniform and precise placement and compaction of asphalt mixtures. The fundamental design involves a hopper for receiving the mix, a conveying system, and a screed which is responsible for placing the material at a specified thickness and width. The efficiency and accuracy of modern asphalt finishers directly impact the longevity and quality of paved surfaces, making them indispensable assets for civil engineering and construction firms.

Technological advancements are rapidly transforming this market, moving traditional hydraulic systems towards electronic controls and advanced telematics. Key product segments include tracked pavers, which offer superior traction and stability for high-volume, continuous paving tasks like highways, and wheeled pavers, preferred for their maneuverability and speed, making them suitable for urban environments and smaller job sites. The performance characteristics, such as paving width, engine horsepower, and material handling capacity, dictate the machine's suitability for different project scales, ranging from mainline highway construction to patchwork and residential street repairs.

Major applications driving market demand include massive governmental investments in upgrading aging road networks in developed economies and the rapid expansion of infrastructure in developing nations, particularly across Asia Pacific. Benefits derived from using high-quality asphalt finishers include reduced paving time, enhanced ride quality due to smoother surface finish, minimized material waste through precision spreading, and improved operational safety. Driving factors primarily revolve around legislative requirements for surface durability, increasing urbanization necessitating new road construction, and the push for environmentally compliant machinery that meets stringent emission standards.

Asphalt Finisher Market Executive Summary

The global Asphalt Finisher Market is navigating a phase of sustained expansion, driven significantly by large-scale public infrastructure initiatives and a strong focus on maintenance activities worldwide. Business trends indicate a marked shift towards rental models, particularly among small-to-medium enterprises (SMEs), which prefer operational flexibility and reduced upfront capital expenditure over outright ownership. Furthermore, manufacturers are increasingly emphasizing the integration of digital technologies, such as advanced fleet management systems and predictive maintenance tools, transforming the sales landscape from purely equipment provision to comprehensive service delivery contracts, enhancing customer lifetime value and establishing stronger vendor-client relationships.

Regional trends highlight the Asia Pacific (APAC) region as the undeniable powerhouse of market growth, fueled by massive government-led projects like China’s Belt and Road Initiative and India’s extensive national highway development programs. While North America and Europe maintain stable demand primarily through equipment replacement cycles and strict mandates for superior paving quality, APAC’s sheer volume of new construction activities ensures its dominant share. Simultaneously, emerging markets in Latin America and the Middle East & Africa (MEA) are showing robust potential, driven by oil revenue-supported diversification projects and necessary urban development to accommodate fast-growing populations.

Segmentation trends indicate a strong preference for medium-sized pavers (paving width between 6m and 9m), balancing versatility and high output capacity, suitable for both arterial roads and major highways. There is also a burgeoning trend towards compact and mini pavers, especially in dense urban areas where maneuverability is paramount for patching and utility repair work. Environmentally, the demand for machines compliant with Tier 4 Final/Stage V emission standards is non-negotiable in highly regulated markets, pushing manufacturers towards advanced engine technologies and the nascent adoption of hybrid or fully electric finisher prototypes to address sustainability goals and reduce operating noise levels in residential zones.

AI Impact Analysis on Asphalt Finisher Market

Common user questions regarding AI's influence in the Asphalt Finisher Market typically revolve around operational autonomy, predictive maintenance accuracy, and optimization of material usage. Users inquire whether AI can enable fully autonomous paving operations, significantly reducing labor dependency and ensuring millimeter-level precision. Concerns frequently center on the necessary computational infrastructure, the cost of retrofitting existing machinery, and the reliability of AI algorithms in handling unpredictable job site conditions, such as varying material composition or uneven terrain. Expectations are high regarding AI's ability to analyze real-time telematics data combined with external factors (e.g., weather, traffic flow) to recommend optimal paving speeds, material temperatures, and compaction patterns, moving the industry towards 'intelligent paving' that guarantees surface durability and minimizes costly rework. The summarized key theme is the shift from operator-dependent machinery to data-driven, quality-assured paving processes, leveraging machine learning to enhance every stage of the finishing operation.

The application of Artificial Intelligence within asphalt finishing is primarily focused on enhancing efficiency and quality control far beyond traditional manual methods. AI algorithms can ingest terabytes of data related to engine performance, hydraulic system pressure, screed temperature, and material flow rates. By analyzing these complex datasets, AI systems can immediately detect anomalies that signal potential component failure, enabling contractors to schedule proactive repairs rather than reacting to catastrophic breakdowns. This predictive maintenance capability dramatically improves asset utilization rates and reduces unexpected downtime, which is often severely costly in time-sensitive road construction projects.

Furthermore, AI plays a crucial role in optimizing the paving process itself. Integrating AI with GPS and sensor data allows the finisher to analyze the surface profile in real-time, adjusting the screed position and material laydown thickness dynamically to maintain perfect uniformity, even on highly variable sub-bases. This ensures maximum material efficiency by avoiding unnecessary over-application and achieving specified density requirements on the first pass. This level of precision is increasingly vital as regulatory bodies worldwide demand higher quality pavement standards with tighter tolerances for surface evenness (International Roughness Index - IRI), directly tying AI-enhanced operation to project compliance and superior roadway longevity.

- AI-Powered Predictive Maintenance: Utilizing machine learning models to forecast component failures, maximizing machine uptime and reducing unexpected operational stoppages.

- Autonomous Paving Trajectories: AI integrating with GPS and laser scanning to guide the finisher, optimizing paving path, overlap, and material logistics coordination.

- Real-time Material Quality Control: Analyzing sensor data (e.g., asphalt temperature, vibration frequency) to automatically adjust screed settings for optimal compaction and mat quality.

- Operator Assistance Systems: Providing intelligent recommendations and alerts to human operators to maintain consistent speed and flow, minimizing human error during complex paving sequences.

- Data-Driven Fleet Optimization: AI managing logistics, deployment scheduling, and maintenance protocols across an entire fleet based on project timelines and machine wear rates.

DRO & Impact Forces Of Asphalt Finisher Market

The Asphalt Finisher Market is strongly influenced by a robust combination of growth drivers, critical restraints, and transformative opportunities, creating a dynamic competitive environment. The primary driving force remains substantial global expenditure on civil infrastructure, particularly road construction and rehabilitation initiatives funded by public sectors seeking economic stimulus. Restraints largely center on the prohibitively high initial capital investment required for technologically advanced finishers and the cyclical nature of the construction industry, which can lead to unpredictable demand volatility. Opportunities are emerging mainly through the integration of sustainable technologies, such as electric powertrains and digitalization, offering pathways to greater operational efficiency and compliance with increasingly stringent environmental regulations.

Impact forces within the market dictate how these external factors translate into tangible commercial results. The bargaining power of buyers (large construction conglomerates and public works departments) is relatively high due to the standardization of core machine functions and the availability of global suppliers, driving intense competition on pricing and after-sales service quality. Conversely, the threat of substitute products is low, as asphalt finishing machinery remains the indispensable and most efficient method for laying modern pavement materials. However, the bargaining power of suppliers, especially those providing specialized components like high-performance engines, sophisticated hydraulic systems, and advanced electronic controls, is moderate to high, influencing manufacturing costs and lead times.

Regulatory frameworks, such as strict mandates on emission standards (e.g., EU Stage V, EPA Tier 4 Final) and quality specifications for road surface evenness, act as both a driver and a barrier. They necessitate continuous R&D investment (driver) but increase manufacturing complexity and cost (barrier). Furthermore, the shortage of skilled machine operators capable of handling technologically complex finishers poses an operational constraint across several key regions, necessitating the development of simplified digital interfaces and increased investment in training programs by both manufacturers and construction companies to mitigate labor force deficiencies.

- Drivers: Intensified infrastructure spending globally, rapid urbanization leading to road network expansion, increasing replacement demand for aging machinery in developed regions, and demand for automated features ensuring higher quality pavement output.

- Restraints: High initial purchase cost and maintenance expenses, susceptibility to cyclical economic downturns affecting construction budgets, complexity of training operators on sophisticated digital control systems, and regulatory hurdles concerning equipment financing and imports.

- Opportunity: Electrification and development of hybrid asphalt finishers, leveraging telematics for optimized fleet management and fuel efficiency, integration of AI and sensor technology for autonomous paving, and expansion into untapped emerging markets in Africa and Southeast Asia.

- Impact Forces: High rivalry among existing competitors (due to global presence of key players), moderate to high bargaining power of large buyers, moderate bargaining power of specialized component suppliers, high threat of new entrants (due to capital requirements and technology gap), and very low threat of substitution.

Segmentation Analysis

The Asphalt Finisher Market segmentation provides a granular view of market dynamics based on machine characteristics, operational requirements, and end-use applications. Key dimensions for segmentation include product type (tracked vs. wheeled), operating width (mini, standard, highway class), and application (highways, urban roads, non-road applications like airport runways or industrial yards). This detailed classification allows stakeholders to precisely identify market niches and tailor product development strategies to specific regional and operational needs. The tracked segment historically dominates in terms of revenue due to its superior power and stability required for high-volume highway paving, whereas the wheeled segment gains traction in densely populated areas requiring high mobility and frequent site changes.

Analysis by operating width reveals that the medium-to-large category (6m to 9m width) captures the largest share, reflecting the continuous focus on building and maintaining arterial and national highways. However, the compact segment (under 3m width) is growing rapidly, fueled by increasing maintenance activities, especially utility trench restorations and urban street patchwork, where large machines are impractical. Understanding these segmentation nuances is crucial for strategic planning, enabling manufacturers to forecast demand shifts between heavy-duty highway machines and lighter, more versatile urban equipment based on prevailing governmental infrastructure priorities.

- By Type:

- Tracked Asphalt Finishers (Superior traction, large projects)

- Wheeled Asphalt Finishers (High mobility, urban projects)

- By Operating Width:

- Less than 3 meters (Compact/Mini)

- 3 to 6 meters (Standard)

- 6 to 9 meters (Medium/Highway Class)

- Above 9 meters (Large/Airport Class)

- By Application:

- Highways and Expressways

- Urban and Municipal Roads

- Airports and Runways

- Residential and Commercial Paving

- By End-User:

- Construction Contractors

- Government/Public Works Departments

- Equipment Rental Companies

Value Chain Analysis For Asphalt Finisher Market

The value chain for the Asphalt Finisher Market commences with upstream analysis, focusing on the procurement of critical components and raw materials. Key inputs include specialized steel alloys for structural integrity and high-wear components like the screed and conveyor belts, advanced diesel engines compliant with global emissions standards (often sourced from highly specialized engine manufacturers like Cummins or Caterpillar), and sophisticated hydraulic systems and electronics (including telematics modules, sensors, and GPS guidance units). Strong relationships with these Tier 1 suppliers are paramount, as component quality directly impacts machine reliability and performance. Manufacturers typically maintain significant control over the design and assembly phase, optimizing integrated systems to differentiate their products in terms of fuel efficiency and paving accuracy.

The midstream process involves manufacturing, assembly, and rigorous quality testing. Leading manufacturers utilize highly automated production lines and robust testing facilities to ensure compliance with international safety and performance standards. Distribution channels form the critical link to the downstream market. Due to the high value, size, and need for specialized service, direct distribution through captive dealer networks is the predominant model, especially for major global players like Vögele, Caterpillar, and Volvo. These direct channels ensure specialized technical support, spare parts availability, and training services, which are crucial differentiators for large buyers.

Indirect distribution involves third-party distributors or rental companies, which are increasingly important for penetrating regional markets where a direct presence is not economically viable, or for serving smaller contractors who prefer leasing options. The downstream segment involves end-users—primarily large road construction contractors, specialized paving firms, and municipal public works departments. The lifecycle of the finisher is extended through comprehensive aftermarket services, including maintenance contracts, provision of certified spare parts, and technology upgrades (e.g., adding advanced telematics post-purchase), representing a significant revenue stream for manufacturers long after the initial sale. Efficiency in logistics and specialized maintenance capabilities are the key value enhancers in the downstream phase.

Asphalt Finisher Market Potential Customers

The primary customers in the Asphalt Finisher Market are large-scale infrastructure construction contractors who specialize in road building, highway expansion, and airport development. These entities require high-output, reliable machines capable of continuous, heavy-duty operation over long durations. Their purchasing decisions are heavily influenced by factors such as machine reliability, total cost of ownership (TCO), fuel efficiency, and the integration of precision paving technology (like automated grade and slope control systems) that guarantee compliance with strict governmental quality specifications. For these customers, minimizing downtime and maximizing the quality of the paved mat are critical determinants of profitability and contract eligibility.

A secondary but rapidly growing customer base includes equipment rental and leasing companies, particularly in mature markets like North America and Western Europe. These companies purchase finishers in large volumes to satisfy the fluctuating needs of smaller and medium-sized regional contractors who cannot justify the high capital expenditure of purchasing new, specialized equipment outright. The rental market demands robust, easily maintained, and highly versatile machines. Furthermore, national and local government public works departments represent potential customers, often purchasing smaller, more maneuverable finishers directly for internal road maintenance, patchwork, and utility service reinstatement projects within their specific jurisdiction, prioritizing ease of operation and local dealer support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.8 Billion |

| Market Forecast in 2033 | $4.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vögele (Wirtgen Group/John Deere), Caterpillar Inc., Volvo Construction Equipment (Volvo CE), Sumitomo Heavy Industries, FAYAT Group (Bomag), Astec Industries, Ltd., ABG (Volvo CE), GOMACO Corporation, Zoomlion Heavy Industry Science and Technology Co., Ltd., Hyundai Construction Equipment, SANY Group, Roadtec (Astec Industries), XCMG Group, LiuGong Machinery Co., Ltd., LeeBoy, Shantui Construction Machinery Co., Ltd., Atlas Copco (Dynapac), Terex Corporation, JiangSu Huatong Construction Machinery Co., Ltd., Ammann Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Asphalt Finisher Market Key Technology Landscape

The contemporary Asphalt Finisher Market is defined by the integration of sophisticated digital and precision technologies aimed at optimizing mat quality, minimizing fuel consumption, and improving operational oversight. Central to this technological evolution is advanced telematics, which allows for real-time remote monitoring of machine performance metrics such as fuel usage, idle time, engine load, and component diagnostics. This data connectivity enables contractors and fleet managers to proactively schedule maintenance, analyze operational efficiency, and ensure optimal utilization across multiple job sites. Furthermore, sophisticated control systems, often referred to as Pave-by-Number or GPS-guided paving, utilize 3D machine control to precisely dictate the screed position and material laydown rate, eliminating reliance on traditional string lines and significantly improving surface smoothness and accuracy, thereby meeting the stringent IRI requirements increasingly imposed by government bodies.

Another crucial technological advancement involves the development of hybrid and electric powertrains. Driven by global mandates to reduce carbon emissions and noise pollution, manufacturers are investing heavily in hybrid finishers that utilize battery power alongside optimized diesel engines, primarily for non-propulsion functions like heating the screed or powering hydraulics. This innovation reduces fuel consumption by up to 15-20% and drastically lowers noise output, making these machines ideal for urban and night paving operations. While fully electric finishers are still in early development phases for high-power applications, the hybrid model represents an immediate, viable solution for sustainability-focused clients in European and North American markets seeking to minimize their environmental footprint without sacrificing power or productivity.

Moreover, the incorporation of thermal imaging and sensor technology directly onto the screed unit is rapidly becoming a standard requirement for quality assurance. Thermal sensors continuously monitor the asphalt mat temperature across the width of the spread, ensuring the material remains within the optimal working temperature range necessary for effective compaction and long-term durability. Any significant temperature deviation indicates a potential flaw in the material transfer process, allowing the operator to adjust the paving speed or material supply instantly. This focus on real-time, data-driven quality checks represents a major shift from reactive inspection to proactive quality management, underpinned by the high integration capabilities of modern electronic control systems (ECS) and CAN bus communication networks throughout the machine architecture.

Regional Highlights

The global Asphalt Finisher Market exhibits strong regional disparities in demand drivers, technology adoption, and regulatory landscapes. Understanding these regional dynamics is essential for market players seeking strategic expansion and product localization.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market globally, driven by massive investments in national and regional connectivity projects, particularly in China, India, and Southeast Asian nations. High population density and associated urbanization require continuous expansion of road networks, favoring the high-volume tracked paver segment. Technology adoption is accelerating, though price sensitivity remains a key factor, leading to a strong presence of local and regional manufacturers alongside global giants.

- North America: This region is characterized by high demand for machine replacement and strict environmental compliance (Tier 4 Final). The market is mature, focusing heavily on technology integration, including advanced telematics, automation, and precision paving systems (3D GPS). Due to a strong emphasis on road longevity and quality, buyers prioritize performance, uptime, and comprehensive dealer support over initial purchase cost, driving demand for high-specification, reliable equipment from established OEMs.

- Europe: Europe is defined by stringent emission regulations (Stage V) and an intense focus on sustainability, leading to strong early adoption of hybrid and low-emission finishers. The market size is substantial, driven by continuous road maintenance and reconstruction within dense urban and inter-city networks. Buyers value maneuverability (favoring the wheeled segment for urban work) and adherence to strict noise and vibration limits, with German manufacturers playing a globally influential role in design standards.

- Latin America (LATAM): Market demand is highly dependent on governmental budgetary cycles and commodity prices. While infrastructure needs are extensive, volatile economic conditions often necessitate the preference for cost-effective solutions and high usage of rental fleets. Brazil and Mexico are key growth hubs, but technological adoption generally lags behind North America and Europe, focusing on reliability and basic operational efficiency.

- Middle East and Africa (MEA): Growth is primarily fueled by oil-funded infrastructure diversification projects, particularly in the UAE, Saudi Arabia, and Qatar. Extreme operating conditions (high heat, abrasive materials) necessitate specialized machine designs focused on robust cooling systems and durable components. Africa presents long-term potential, though challenges related to political instability, inconsistent funding, and underdeveloped distribution networks must be addressed for substantial growth realization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Asphalt Finisher Market.- Vögele (Wirtgen Group/John Deere)

- Caterpillar Inc.

- Volvo Construction Equipment (Volvo CE)

- Sumitomo Heavy Industries

- FAYAT Group (Bomag)

- Astec Industries, Ltd.

- GOMACO Corporation

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- Hyundai Construction Equipment

- SANY Group

- Roadtec (Astec Industries)

- XCMG Group

- LiuGong Machinery Co., Ltd.

- LeeBoy

- Shantui Construction Machinery Co., Ltd.

- Atlas Copco (Dynapac)

- Ammann Group

- Terex Corporation

- JiangSu Huatong Construction Machinery Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

Frequently Asked Questions

Analyze common user questions about the Asphalt Finisher market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Asphalt Finisher Market?

The Asphalt Finisher Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, driven by increasing global infrastructure spending and the necessity for road maintenance and rehabilitation activities across all major regions.

What are the key differences between tracked and wheeled asphalt finishers?

Tracked finishers offer superior traction and stability, making them ideal for high-volume, heavy-duty applications like mainline highway construction where continuous paving is required. Wheeled finishers provide greater mobility and faster transport speeds between urban job sites, prioritizing maneuverability over sheer tractive effort.

Which geographic region dominates the global Asphalt Finisher Market?

The Asia Pacific (APAC) region currently dominates the market share and is projected to maintain the fastest growth rate. This dominance is attributable to extensive governmental investments in new road infrastructure development and urbanization projects across countries such as China and India.

How is technology, such as AI and telematics, influencing asphalt paver operations?

Technology is crucial for enhancing precision and efficiency. Telematics enables real-time remote diagnostics and fleet management, while AI integration focuses on predictive maintenance and optimizing paving parameters (like material flow and screed temperature) to guarantee superior pavement quality and adherence to stringent surface smoothness standards (IRI).

What are the primary restraints affecting the growth of the Asphalt Finisher Market?

The primary restraints include the high initial capital investment required for purchasing advanced machinery, the vulnerability of the construction sector to cyclical economic downturns, and increasing operational complexity requiring specialized training for machine operators.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager