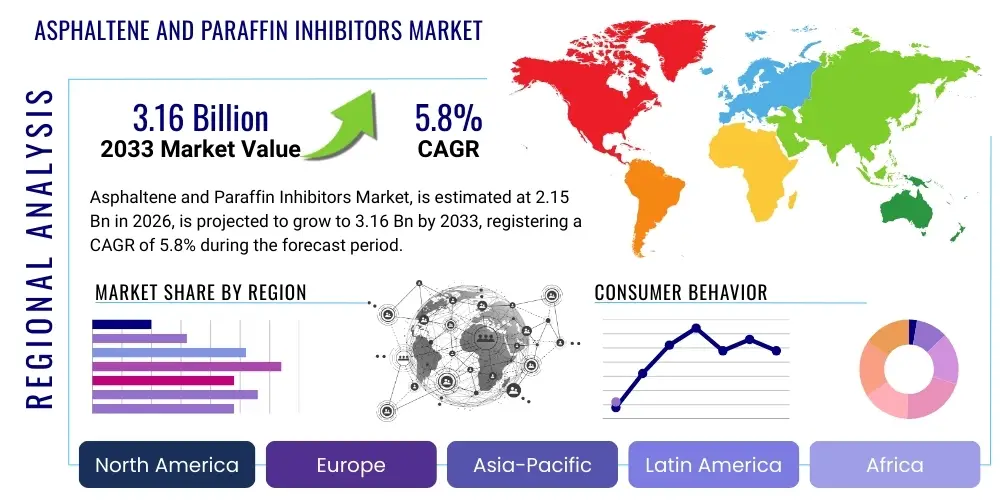

Asphaltene and Paraffin Inhibitors Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440062 | Date : Jan, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Asphaltene and Paraffin Inhibitors Market Size

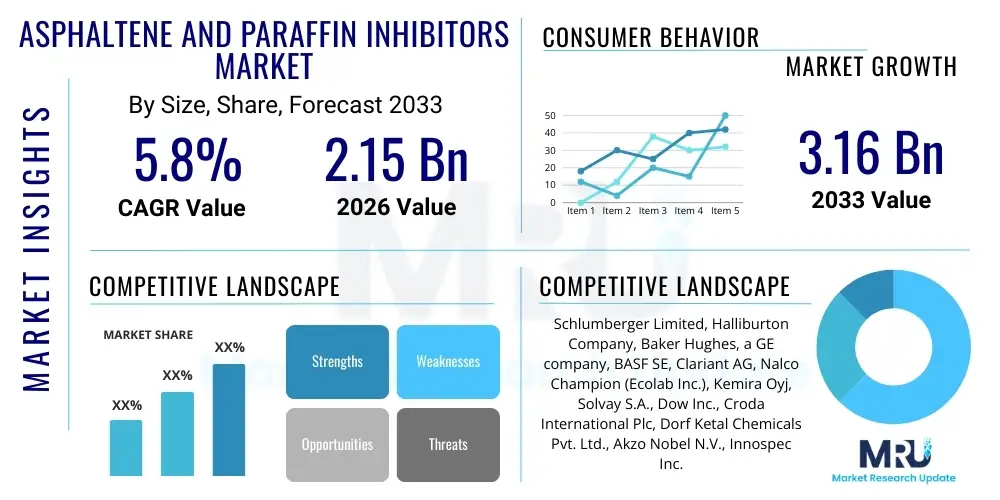

The Asphaltene and Paraffin Inhibitors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 2.15 billion in 2026 and is projected to reach USD 3.16 billion by the end of the forecast period in 2033.

Asphaltene and Paraffin Inhibitors Market introduction

The Asphaltene and Paraffin Inhibitors market encompasses a critical segment within the oil and gas industry, providing specialized chemical solutions designed to prevent the deposition of organic solids, namely asphaltenes and paraffins (waxes), throughout the hydrocarbon production and transportation value chain. Asphaltenes are heavy, polar molecules that can precipitate out of crude oil under certain pressure, temperature, or compositional changes, leading to severe blockages in reservoirs, wellbores, pipelines, and processing equipment. Similarly, paraffins are long-chain alkanes that solidify at lower temperatures, causing wax deposition and flow assurance challenges.

These inhibitors are chemical additives formulated to mitigate or prevent such depositions. Asphaltene inhibitors typically function by modifying the asphaltene particles, keeping them dispersed in the crude oil and preventing aggregation and precipitation. Paraffin inhibitors, on the other hand, often work by crystal modification, altering the growth and size of paraffin crystals to prevent them from forming a cohesive, obstructive layer, or by acting as wax dispersants. The primary applications span the entire upstream and midstream sectors, including drilling, production operations, subsea pipelines, and crude oil transportation.

The benefits of utilizing asphaltene and paraffin inhibitors are substantial, ranging from ensuring continuous flow and optimizing production rates to minimizing costly downtime for mechanical cleaning and remediation. By preventing blockages, these chemicals reduce operational expenses, enhance safety, prolong equipment lifespan, and ultimately contribute to the economic viability of oil and gas assets. The market's growth is predominantly driven by the increasing exploration and production activities in challenging environments such as deepwater and unconventional reservoirs, where the risk of organic deposition is significantly higher, coupled with the need to maintain flow assurance in aging infrastructure.

Asphaltene and Paraffin Inhibitors Market Executive Summary

The Asphaltene and Paraffin Inhibitors market is undergoing dynamic shifts driven by global energy demands and technological advancements within the oil and gas sector. Current business trends indicate a strong focus on developing more environmentally friendly, biodegradable, and high-performance inhibitor formulations. Companies are increasingly investing in research and development to create smart chemical solutions that offer superior efficacy at lower dosages, addressing both economic and environmental concerns. There is a growing demand for customized inhibitor packages tailored to specific crude oil compositions and operational conditions, moving away from generic solutions towards more targeted and efficient treatments. Furthermore, the integration of digital technologies and advanced analytics for monitoring and optimizing inhibitor injection is emerging as a key trend.

Regional trends highlight robust growth in areas with significant ongoing and planned oil and gas projects. North America, particularly the U.S. shale plays and deepwater Gulf of Mexico, represents a major market due to complex crude compositions and challenging extraction conditions. The Middle East and Africa regions are experiencing substantial demand driven by large-scale oil production and export activities, requiring effective flow assurance solutions for extensive pipeline networks. Asia Pacific is also emerging as a high-growth region, fueled by increasing energy consumption, new offshore discoveries, and the expansion of refining capacities, particularly in countries like China, India, and Southeast Asian nations. Latin America, with its heavy oil reserves and deepwater exploration, continues to be a crucial market for these specialized chemicals.

Segmentation trends within the market reveal a notable preference for advanced polymeric and surfactant-based inhibitors, known for their enhanced performance and versatility across various crude oil types. The application segment continues to be dominated by production and pipeline operations, where flow assurance is paramount. However, there is an increasing adoption in drilling and cementing operations to prevent initial deposition problems. From an end-use perspective, major E&P companies, oilfield service providers, and pipeline operators remain the primary consumers. The competitive landscape is characterized by a mix of large multinational chemical companies and specialized niche players, all striving to differentiate through innovation, service integration, and strategic partnerships.

AI Impact Analysis on Asphaltene and Paraffin Inhibitors Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize the Asphaltene and Paraffin Inhibitors market, particularly in optimizing chemical dosage, predicting deposition risks, and developing novel formulations. Key concerns revolve around the accuracy of AI models in complex oilfield environments, the cost-effectiveness of integrating AI solutions, and the potential for AI to lead to more sustainable and efficient operations. Expectations include AI's ability to provide real-time insights, automate decision-making for inhibitor injection, and accelerate the discovery of advanced inhibitor chemistries, ultimately minimizing operational disruptions and environmental impact.

- AI-driven predictive analytics for early detection of asphaltene and paraffin deposition risks based on real-time sensor data and crude oil properties.

- Optimization of inhibitor injection rates and locations through machine learning algorithms, reducing chemical overuse and operational costs.

- Development of smart monitoring systems utilizing AI to analyze flow patterns, pressure changes, and temperature fluctuations for enhanced flow assurance.

- Accelerated discovery and design of novel inhibitor molecules using AI for high-throughput screening and molecular modeling, leading to more effective and environmentally benign solutions.

- Implementation of autonomous or semi-autonomous chemical injection units controlled by AI for precise and adaptive treatment strategies in remote or challenging environments.

- Improved supply chain management and inventory optimization for inhibitor chemicals through AI-powered demand forecasting and logistics planning.

DRO & Impact Forces Of Asphaltene and Paraffin Inhibitors Market

The Asphaltene and Paraffin Inhibitors market is influenced by a complex interplay of Drivers, Restraints, and Opportunities, collectively shaped by various Impact Forces. Key drivers include the escalating global demand for crude oil and natural gas, necessitating increased exploration and production, often in challenging deepwater and unconventional reservoirs where organic deposition is prevalent. The pervasive issue of aging oilfield infrastructure and pipelines also contributes significantly, as older systems are more susceptible to blockages and require consistent flow assurance solutions. Furthermore, the economic imperative to maximize production efficiency and minimize operational downtime acts as a strong motivator for the adoption of effective inhibitor technologies, driving continuous market growth.

However, several restraints temper this growth. The inherent volatility and unpredictability of global crude oil prices significantly impact investment decisions in exploration and production, subsequently affecting the demand for related chemical additives. Stringent environmental regulations and increasing societal pressure for sustainable practices compel manufacturers to invest heavily in the research and development of eco-friendly and biodegradable inhibitor formulations, which can raise production costs. Moreover, the high capital expenditure associated with advanced flow assurance technologies, coupled with the competitive landscape from alternative mechanical or physical remediation methods, can pose challenges for widespread adoption, particularly for smaller operators.

Despite these challenges, substantial opportunities exist for market expansion and innovation. The growing focus on unconventional oil and gas resources, such as shale oil and gas, which often exhibit complex fluid compositions prone to deposition, presents a burgeoning market for specialized inhibitors. Advancements in digitalization, including the integration of real-time monitoring, predictive analytics, and artificial intelligence, offer opportunities for optimizing inhibitor performance and dosage, leading to more efficient and cost-effective solutions. The development of nanotechnology-based inhibitors and multi-functional chemistries that address multiple flow assurance issues simultaneously further represents a promising avenue for innovation and market differentiation, alongside the expansion into new geographic regions with untapped hydrocarbon potential.

Segmentation Analysis

The Asphaltene and Paraffin Inhibitors market is comprehensively segmented to provide a detailed understanding of its diverse components and dynamics. This segmentation typically dissects the market based on critical factors such as product type, chemical formulation, application area, and end-use industry, reflecting the varied needs and operational contexts within the global oil and gas sector. Understanding these segments is crucial for market participants to identify niche opportunities, tailor product offerings, and develop targeted marketing strategies, ensuring that specialized solutions are deployed where they can deliver maximum value and efficiency.

- By Product Type:

- Asphaltene Inhibitors

- Paraffin Inhibitors

- Combined/Multi-functional Inhibitors

- By Chemical Formulation:

- Polymeric Inhibitors

- Surfactant-based Inhibitors

- Solvent-based Inhibitors

- Crystal Modifiers

- Dispersants

- Other Formulations (e.g., Green Chemistry Inhibitors)

- By Application:

- Upstream (Drilling, Production, Enhanced Oil Recovery)

- Midstream (Pipelines, Transportation, Storage)

- Downstream (Refineries, Processing Facilities)

- By End-Use Industry:

- Oil & Gas Exploration & Production Companies

- Pipeline Operators

- Refineries

- Oilfield Service Providers

Value Chain Analysis For Asphaltene and Paraffin Inhibitors Market

The value chain for the Asphaltene and Paraffin Inhibitors market begins with the upstream segment, encompassing the procurement of raw materials. This stage involves sourcing a wide array of specialized chemicals, including polymers, surfactants, solvents, and various organic compounds, from chemical manufacturers and suppliers. The quality and availability of these raw materials significantly impact the final product's efficacy and cost. Suppliers in this segment often specialize in producing specific chemical building blocks required for inhibitor formulation, necessitating strong relationships between inhibitor manufacturers and their raw material providers to ensure consistent supply and competitive pricing. Research and development activities, which focus on synthesizing novel compounds and improving existing formulations, are also a crucial part of this initial phase.

Moving downstream, the value chain progresses to the manufacturing and formulation of the inhibitors. This involves chemical companies that process raw materials into finished inhibitor products, often through proprietary blending and synthesis techniques. These manufacturers invest heavily in R&D to develop high-performance, cost-effective, and environmentally compliant solutions tailored to specific crude oil characteristics and operational challenges. Once manufactured, these inhibitors are then distributed to the end-users through various channels. Direct distribution involves sales teams engaging directly with large oil and gas exploration and production (E&P) companies, pipeline operators, and major refineries, often providing customized technical support and on-site services.

Indirect distribution channels involve third-party distributors, chemical supply companies, and oilfield service providers who integrate these inhibitors into their broader service offerings. Oilfield service companies, in particular, play a crucial role by packaging inhibitor solutions with their well intervention, production chemistry, and flow assurance services, providing a comprehensive solution to the end-users. These channels allow inhibitors to reach a wider customer base, including smaller independent operators. The final stage involves the actual application and technical support provided by the manufacturers or service providers, ensuring optimal performance and troubleshooting any deposition issues. Effective logistics, technical expertise, and ongoing customer support are paramount throughout this downstream segment to maintain product effectiveness and client satisfaction.

Asphaltene and Paraffin Inhibitors Market Potential Customers

The primary potential customers for asphaltene and paraffin inhibitors are entities operating within the global oil and gas industry that face challenges related to organic solid deposition. This encompasses a broad spectrum of companies involved in the entire hydrocarbon value chain, from exploration to refining. Upstream oil and gas exploration and production (E&P) companies represent a significant customer segment. These companies operate oil and gas wells, both onshore and offshore, and are directly impacted by asphaltene and paraffin issues that can reduce productivity, damage equipment, and necessitate expensive interventions. Their need for effective flow assurance is critical to maintain reservoir productivity and ensure the smooth flow of hydrocarbons from the subsurface to the surface.

Another key customer segment includes midstream companies, primarily pipeline operators and crude oil transporters. These entities are responsible for the safe and efficient movement of crude oil and gas from production sites to refineries or export terminals. Pipelines, especially those traversing diverse temperature zones or transporting waxy crude oils, are highly susceptible to paraffin and asphaltene deposition, leading to reduced throughput, increased pumping costs, and the risk of complete blockages. Inhibitors are essential for maintaining pipeline integrity and operational continuity, making these operators consistent purchasers of these chemicals.

Additionally, oilfield service companies serve as important intermediaries and direct customers. These companies often provide integrated solutions to E&P and midstream operators, including chemical supply, injection services, and comprehensive flow assurance management. They procure inhibitors from manufacturers and then deploy them as part of their broader service packages, offering expertise in chemical selection, dosage optimization, and real-time monitoring. Finally, although less directly, refineries also constitute a segment of potential customers, particularly in their crude oil intake and initial processing units where heavy crude oils can still pose deposition challenges before further refining processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 3.16 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schlumberger Limited, Halliburton Company, Baker Hughes, a GE company, BASF SE, Clariant AG, Nalco Champion (Ecolab Inc.), Kemira Oyj, Solvay S.A., Dow Inc., Croda International Plc, Dorf Ketal Chemicals Pvt. Ltd., Akzo Nobel N.V., Innospec Inc., Evonik Industries AG, Chemtura Corporation (Lanxess AG), Ashland Global Holdings Inc., Lubrizol Corporation (Berkshire Hathaway), Fike Corporation, ProLabTech, Infinium Chemical Private Limited |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Asphaltene and Paraffin Inhibitors Market Key Technology Landscape

The Asphaltene and Paraffin Inhibitors market is continually evolving with technological advancements aimed at enhancing performance, cost-efficiency, and environmental sustainability. A key area of innovation lies in the development of advanced chemical formulations. This includes designing novel polymeric structures, optimized surfactant blends, and solvent systems that can effectively prevent or mitigate deposition across a wider range of crude oil compositions and operational conditions. Research is focused on creating multi-functional inhibitors that can address both asphaltene and paraffin issues simultaneously, or offer additional benefits such as corrosion inhibition, thereby simplifying treatment regimes and reducing overall chemical consumption. The pursuit of "greener" chemistries, including biodegradable and low-toxicity formulations, is also a significant technological driver, aligning with global environmental regulations and corporate sustainability goals.

Another critical technological frontier involves the integration of smart monitoring and predictive analytics. This includes the deployment of real-time sensors and inline analytical tools that can monitor crude oil properties, flow conditions, and the onset of deposition more accurately. These data streams are then fed into advanced software platforms that utilize machine learning and artificial intelligence algorithms to predict deposition risks, optimize inhibitor dosage, and recommend precise injection points. This shift from reactive treatment to proactive, data-driven management helps to prevent issues before they occur, significantly improving flow assurance efficiency and reducing the need for costly mechanical interventions. Such smart systems enable operators to achieve higher levels of operational uptime and asset integrity, especially in remote or challenging environments where manual interventions are difficult.

Nanotechnology is also emerging as a transformative force in the inhibitors market. Nanoparticles can be engineered to interact with asphaltene or paraffin molecules at a molecular level, offering enhanced dispersion, crystal modification, and stability benefits. These nano-inhibitors often exhibit superior performance at much lower concentrations compared to conventional chemicals, providing a more efficient and potentially more environmentally benign solution. Furthermore, the development of encapsulated or time-release inhibitor systems is gaining traction. These technologies allow for a sustained and controlled release of chemicals over extended periods, reducing the frequency of treatment and improving the longevity of inhibitor effectiveness, particularly beneficial for long-distance pipelines and subsea tie-backs where continuous access for injection is challenging.

Regional Highlights

- North America: This region is a major market, driven by extensive unconventional (shale oil and gas) production and deepwater exploration activities in the Gulf of Mexico, both of which are prone to severe asphaltene and paraffin deposition. The presence of mature fields requiring enhanced flow assurance and robust R&D infrastructure also contributes significantly.

- Europe: The North Sea and other European offshore fields present a significant market, primarily due to aging infrastructure, declining production rates in mature fields, and the need for optimized flow assurance in cold-water environments. Strict environmental regulations also drive demand for eco-friendly inhibitor solutions.

- Asia Pacific (APAC): Characterized by rapidly increasing energy demand and growing exploration and production activities, particularly in offshore areas like the South China Sea and Australian basins. Developing economies in countries such as China, India, and Indonesia are expanding their energy infrastructure, necessitating effective flow assurance solutions.

- Latin America: This region holds vast reserves of heavy crude oil, particularly in countries like Venezuela and Brazil (with its pre-salt discoveries), which are highly susceptible to asphaltene precipitation and paraffin deposition. Deepwater exploration and production initiatives are key drivers for inhibitor demand here.

- Middle East and Africa (MEA): As a major global hub for oil and gas production and exports, MEA represents a substantial and growing market. Extensive pipeline networks and large-scale crude oil production facilities in countries like Saudi Arabia, UAE, and Nigeria require continuous flow assurance management to maintain operational efficiency and reliability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Asphaltene and Paraffin Inhibitors Market.- Schlumberger Limited

- Halliburton Company

- Baker Hughes, a GE company

- BASF SE

- Clariant AG

- Nalco Champion (Ecolab Inc.)

- Kemira Oyj

- Solvay S.A.

- Dow Inc.

- Croda International Plc

- Dorf Ketal Chemicals Pvt. Ltd.

- Akzo Nobel N.V.

- Innospec Inc.

- Evonik Industries AG

- Chemtura Corporation (Lanxess AG)

- Ashland Global Holdings Inc.

- Lubrizol Corporation (Berkshire Hathaway)

- Fike Corporation

- ProLabTech

- Infinium Chemical Private Limited

Frequently Asked Questions

Analyze common user questions about the Asphaltene and Paraffin Inhibitors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are asphaltene and paraffin inhibitors?

Asphaltene and paraffin inhibitors are specialized chemical additives used in the oil and gas industry to prevent the unwanted precipitation and deposition of organic solids (asphaltenes and paraffins/waxes) from crude oil, ensuring continuous flow and operational efficiency.

Why are these inhibitors important in the oil and gas industry?

They are crucial for maintaining flow assurance in oil and gas production and transportation. Without them, depositions can cause severe blockages in wellbores, pipelines, and equipment, leading to reduced production, costly downtime, increased maintenance, and safety hazards.

What types of asphaltene and paraffin inhibitors are available?

Inhibitors are broadly categorized into asphaltene inhibitors, paraffin inhibitors, and combined/multifunctional inhibitors. They come in various chemical formulations such as polymeric, surfactant-based, solvent-based, crystal modifiers, and dispersants, each tailored for specific crude oil compositions and operating conditions.

How does crude oil composition affect inhibitor selection?

Crude oil composition, including its asphaltene and paraffin content, wax appearance temperature, and overall stability, is a primary factor. Inhibitors are selected based on their chemical compatibility and effectiveness in preventing deposition for the specific crude oil properties encountered.

What are the environmental considerations for these inhibitors?

Environmental concerns drive the development of "green" or eco-friendly inhibitors that are biodegradable, have low toxicity, and minimal environmental impact. Regulatory frameworks increasingly encourage the use of sustainable chemical solutions to protect marine and terrestrial ecosystems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager