Aspherical Lense Sales Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432970 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Aspherical Lense Sales Market Size

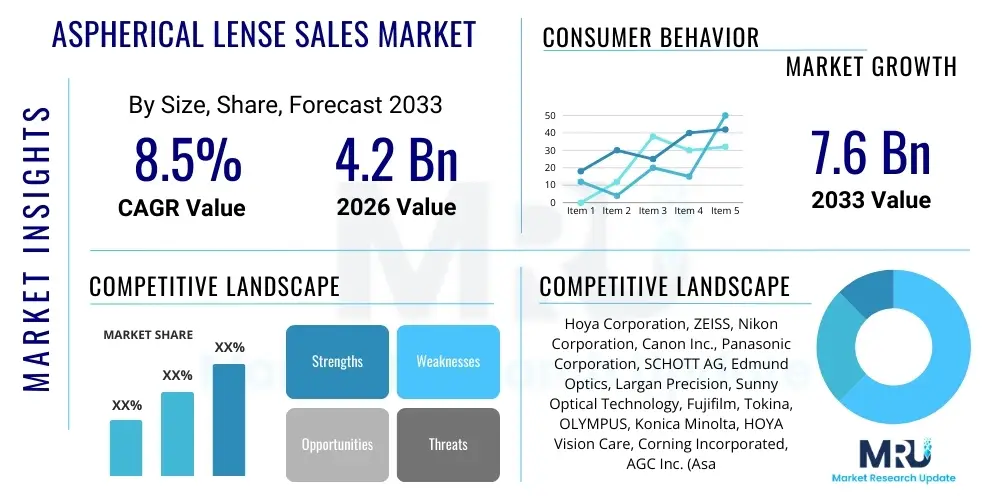

The Aspherical Lense Sales Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 7.6 Billion by the end of the forecast period in 2033.

Aspherical Lense Sales Market introduction

The Aspherical Lense Sales Market encompasses the manufacturing, distribution, and commercial exchange of lenses designed with surfaces whose curvature continuously changes from the center to the edge. Unlike traditional spherical lenses, aspherical lenses eliminate spherical aberration, leading to superior image quality, reduced lens element count, and overall more compact optical systems. These advantages position aspherical lenses as critical components across high-precision and consumer optical applications, driving steady market expansion.

The primary product offerings in this market include glass molded aspheres, plastic molded aspheres, and hybrid lenses, each catering to specific cost, durability, and performance requirements. Major applications span high-end consumer electronics, such as smartphone cameras and virtual reality (VR) headsets, alongside professional domains like medical imaging (endoscopes), automotive lighting systems, advanced military optics, and scientific instrumentation. The inherent benefits, including flatter fields of view and minimal distortion, make them indispensable for modern, high-resolution devices.

Market growth is predominantly driven by the pervasive miniaturization trend in electronic devices, requiring smaller, lighter, yet higher-performing optics. Furthermore, the increasing adoption of advanced driver-assistance systems (ADAS) in the automotive sector, which rely heavily on specialized optical sensors and cameras, significantly boosts demand for robust aspherical solutions. Technological advancements in molding techniques and materials processing are continuously improving manufacturing efficiency and lowering unit costs, thereby broadening the application scope and accessibility of these precision optical components.

Aspherical Lense Sales Market Executive Summary

The Aspherical Lense Sales Market is characterized by robust growth, primarily fueled by the accelerating convergence of consumer electronics and advanced automotive technologies. Business trends indicate a shift toward high-volume, precision plastic molding techniques to meet the intense demand from the smartphone and VR/AR sectors, while high-performance glass molding remains crucial for medical and military-grade optics. Key manufacturers are focusing on vertical integration, controlling both lens design and mass production capabilities to maintain competitive pricing and quality control, leading to strategic partnerships aimed at securing raw material supply chains and optimizing production scalability. Intellectual property protection surrounding complex aspheric designs is a core competitive battleground, dictating market leadership in specific application segments.

Regionally, the Asia Pacific (APAC) dominates the market, largely due to the concentration of major consumer electronics manufacturing hubs in China, South Korea, and Japan, which are the primary consumers of high-volume aspherical lenses. North America and Europe demonstrate strong demand in high-value segments, specifically medical diagnostics, aerospace, and high-performance automotive sensors, driving innovation in glass-molded and custom-designed aspheres. Emerging markets in Latin America and MEA are seeing increased penetration, linked to expanding telecom infrastructure and growing healthcare investments, creating secondary growth pockets for standardized optical components.

Segment trends highlight the dominance of the Plastic Aspherical Lenses segment by volume, driven by its cost-effectiveness and applicability in consumer gadgets. Conversely, the Glass Aspherical Lenses segment commands higher average selling prices (ASPs) due to their superior thermal stability and refractive index characteristics, making them essential for applications requiring environmental durability, such as satellite imaging and high-power laser optics. Application-wise, the Consumer Electronics segment remains the largest revenue generator, but the Automotive segment is exhibiting the fastest growth rate, propelled by the transition toward autonomous and semi-autonomous vehicle technologies requiring multiple sophisticated camera and LiDAR systems.

AI Impact Analysis on Aspherical Lense Sales Market

User inquiries regarding AI's influence on the Aspherical Lense Sales Market frequently center on three main themes: how AI enhances optical design processes, the role of aspherical lenses in advanced AI-driven vision systems, and the potential for AI to optimize lens manufacturing efficiency. Users are keenly interested in whether AI-powered computational optics can replace physical lenses entirely, or if, conversely, the proliferation of AI-enabled systems (like ADAS, machine vision, and robotics) will exponentially increase the demand for precision aspheres. The primary concerns revolve around the integration of AI-optimized lens parameters into existing fabrication workflows and the need for standardized data protocols between AI design software and manufacturing equipment.

AI is fundamentally reshaping the optical design phase by enabling generative design algorithms to explore vast parameter spaces far beyond human capability. This leads to the creation of highly optimized, often novel, aspheric and freeform lens geometries that maximize performance while minimizing material usage and physical footprint. AI tools can rapidly simulate complex optical phenomena, predict manufacturing tolerances, and account for real-world environmental variables during the initial design iteration, drastically shortening the time-to-market for new optical products requiring ultra-precision aspheres. This reliance on computational optics does not diminish the need for physical aspheres; instead, it demands even more complex, high-accuracy lenses to realize the computationally defined performance.

Furthermore, the booming market for edge computing and AI-driven vision systems (such as high-resolution security cameras, facial recognition systems, and specialized medical diagnostics equipment) directly drives the consumption of aspherical lenses. These systems require high clarity, minimal distortion, and wide field-of-view capabilities, all hallmarks of aspheric designs. AI is also being implemented on the production floor for quality control, leveraging machine learning models to analyze surface topography measurements (like interferometry data) in real-time, identifying subtle defects, and adjusting mold or polishing parameters to maintain ultra-tight geometric tolerances required for advanced optics.

- AI-driven generative design optimizes complex aspheric surface profiles, accelerating R&D cycles.

- Increased deployment of AI-enabled machine vision and ADAS systems elevates overall unit demand for precision aspheres.

- AI algorithms enhance quality assurance in manufacturing by predicting and correcting mold deviations in real-time.

- Computational photography, optimized by AI, still necessitates high-quality physical optics, driving demand for specialized lens materials.

- Predictive maintenance based on AI analytics minimizes downtime in high-precision molding and fabrication equipment.

DRO & Impact Forces Of Aspherical Lense Sales Market

The Aspherical Lense Sales Market dynamics are governed by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and internal/external Impact Forces. The primary drivers include the mandatory requirement for compact, lightweight, and high-performance optical systems in modern consumer electronics and the explosive growth in advanced automotive camera systems mandated by safety regulations and autonomous driving initiatives. Restraints predominantly involve the high capital expenditure required for ultra-precision manufacturing equipment (especially for glass molding), the complexity of quality control for non-spherical surfaces, and the scarcity of highly skilled optical engineers capable of designing and fabricating these intricate components. Opportunities are emerging through the expansion of virtual and augmented reality (VR/AR) devices, the development of diffractive optics utilizing aspheric substrates, and the ongoing push toward personalized and portable medical diagnostics requiring miniature optics. These factors generate significant impact forces, particularly in areas of pricing pressure, technological obsolescence, and the fierce competition for specialized talent and intellectual property rights.

The key driver accelerating the market is the continuous pressure for miniaturization across all electronic devices. As sensors increase in resolution (e.g., 200MP smartphone cameras), the need for larger, high-quality optics traditionally increases. Aspherical lenses provide the essential solution, allowing manufacturers to achieve superior optical performance using fewer, thinner lens elements, thereby reducing the size and weight of the final product—a non-negotiable requirement in mobile technology and wearable devices. The convergence of high-resolution requirements and dimensional constraints ensures that demand for molded aspheres remains inelastic to minor price fluctuations, reinforcing their market position. The technological capability to mass-produce reliable plastic and hybrid aspheres further democratizes access to advanced optics, fueling the high-volume segment.

Conversely, the greatest restraint lies in the stringent technical requirements for manufacturing and measurement. Producing glass aspheres often requires diamond turning and precision polishing followed by metrology using specialized instruments like non-contact 3D profilometers or computer-generated holograms (CGHs). These processes are slow, expensive, and highly sensitive to environmental factors. For plastic molded aspheres, maintaining the mold's integrity and dimensional accuracy over tens of thousands of cycles remains a significant technical hurdle. Moreover, the long lead times associated with custom tooling and the high failure rates during prototype phases contribute to the overall manufacturing risk, particularly for new entrants. These high barriers to entry concentrate market power among established players with proprietary manufacturing know-how and advanced capital equipment.

Strategic opportunities lie in disruptive technologies such as freeform optics, which represent an advanced evolution of aspheric surfaces, offering even greater performance and form factor flexibility for next-generation AR/VR displays and aerospace applications. Furthermore, the emerging requirement for multi-spectral imaging in industrial inspection and security systems opens new avenues for specialized glass compositions and coatings compatible with aspheric geometries. The ongoing global expansion of fiber optic networks and high-throughput data centers also demands sophisticated collimating and coupling lenses, providing a high-growth, industrial application niche where thermal stability and extreme precision are paramount, allowing manufacturers to command premium pricing. The cumulative impact forces push the industry towards continuous process innovation, high R&D investment, and a strategic focus on achieving sub-micron precision at scale.

Segmentation Analysis

The Aspherical Lense Sales Market is systematically segmented based on Type, Application, and Manufacturing Technology, providing a detailed view of market dynamics and profitability across various industrial niches. Segmentation by Type distinguishes between the high-volume, cost-effective Plastic Aspherical Lenses and the premium, high-durability Glass Aspherical Lenses, which cater to different performance envelopes and operating environments. Application segmentation is crucial for understanding demand elasticity and technology adoption, ranging from the massive Consumer Electronics segment to the specialized Medical and high-reliability Automotive sectors. Manufacturing Technology differentiates between traditional grinding/polishing, precision glass molding, and injection molding techniques, reflecting the technological maturity and scalability of production across segments.

The Type segmentation is fundamental, as plastic aspheres, created through injection molding, dominate the volume market due to their low production cost and suitability for visible spectrum applications like smartphone cameras. Glass aspheres, conversely, are preferred where resistance to thermal expansion, chemical resistance, and high refractive indices are necessary, such as in high-power laser systems, space optics, and industrial inspection equipment. The inherent material differences dictate their use cases, pricing structures, and competitive landscapes. While plastic dominates consumer adoption, glass components drive innovation and capture the high-margin, professional segments.

Analyzing the Application segmentation reveals significant disparities in growth potential. While Consumer Electronics currently holds the largest market share, driven by smartphones and AR/VR, the Automotive sector is projected to exhibit the highest CAGR, primarily fueled by the mandate for superior vision systems (cameras, LiDAR, HUDs) in Level 3 and Level 4 autonomous vehicles. The Medical segment, although smaller, represents a high-value niche characterized by strict regulatory requirements and specialized optical specifications for advanced endoscopy and ophthalmic imaging. Understanding these application-specific requirements allows market players to tailor material science, design complexity, and production scale to maximize return on investment.

- By Type:

- Glass Aspherical Lenses

- Plastic Aspherical Lenses

- Hybrid Aspherical Lenses

- By Application:

- Consumer Electronics (Smartphones, Digital Cameras, AR/VR)

- Automotive (ADAS, Head-Up Displays, Lighting Systems)

- Medical Devices (Endoscopy, Ophthalmic Instruments)

- Optical Instruments (Microscopes, Telescopes)

- Defense and Aerospace

- Industrial/Machine Vision

- By Manufacturing Technology:

- Precision Glass Molding (PGM)

- Injection Molding (Plastic)

- Diamond Turning/Polishing

Value Chain Analysis For Aspherical Lense Sales Market

The value chain for the Aspherical Lense Sales Market is intricate, spanning from raw material suppliers to specialized end-user integration. Upstream analysis focuses on the provision of highly specialized optical glass blanks (like high-index lanthanum glasses) and high-purity optical polymers necessary for precision molding. Suppliers in this phase, often large chemical or materials science companies, play a critical role as material quality directly impacts final lens performance and yield rates. The midstream involves the core manufacturing processes: advanced tooling fabrication (molds and cutting inserts), precision molding (glass or plastic), coating application, and sophisticated metrology (surface profile measurement). High-precision manufacturers holding intellectual property in mold design and processing are positioned centrally in the chain.

The downstream segment encompasses distribution channels, which vary significantly based on the application. Direct sales channels are typical for highly customized, high-value orders directed toward major Original Equipment Manufacturers (OEMs) in the automotive, defense, and medical sectors, where technical collaboration is essential. Indirect channels utilize distributors, integrators, and specialized optical component houses, particularly for standardized or catalog components frequently used in R&D or smaller volume industrial applications. The efficiency of the downstream relies heavily on fast logistics and specialized packaging to prevent damage to precision optics.

The market structure favors integrated players who control both design (using sophisticated software) and production (possessing advanced molding facilities). This integration allows for rapid feedback between design iterations and manufacturing feasibility, critical for custom projects. The complexity of the product means that traditional commodity distributors often handle lower-end plastic lenses, while high-performance glass lenses require technical representatives capable of advising OEMs on integration and performance specifications. The ultimate value delivery is achieved when the lens integrates seamlessly into the end device (e.g., a smartphone camera module or a LiDAR sensor), optimizing the system's overall imaging capability, demonstrating the critical link between lens fabrication and system integration expertise.

Aspherical Lense Sales Market Potential Customers

Potential customers for Aspherical Lense Sales are predominantly large-scale Original Equipment Manufacturers (OEMs) across technologically intensive industries. The largest customer base, by volume, consists of consumer electronics manufacturers, including major smartphone brands, digital camera producers, and emerging players in the Virtual Reality (VR) and Augmented Reality (AR) headset markets who require massive quantities of cost-effective, high-quality plastic aspheres for compact imaging systems and display optics. This segment is characterized by high volume, short product cycles, and intense price competition, necessitating highly automated production lines.

A second crucial customer segment is the Automotive industry, particularly Tier 1 suppliers specializing in sensor systems, safety features, and advanced illumination. These customers demand highly reliable, thermally stable glass aspheres used in sophisticated applications such as ADAS cameras (operating in harsh environments), automotive LiDAR systems, and high-brightness LED headlamps. Requirements here emphasize durability, long-term reliability (AEC-Q100 compliance), and stringent quality control, leading to higher ASPs for these customized optical solutions.

Further potential lies within the Medical and Scientific Instrumentation fields. Hospitals and medical device companies are key buyers, utilizing precision aspheres in endoscopes, diagnostic imaging systems, and ophthalmic instruments where clarity, wide field-of-view, and minimized distortion are non-negotiable for accurate diagnosis and minimally invasive surgery. Lastly, defense and aerospace contractors represent a high-value niche requiring extremely durable, custom-designed aspheres for surveillance, targeting systems, and satellite imaging, prioritizing optical performance and environmental ruggedness over cost. Each customer segment demands different material compositions, manufacturing tolerances, and integration support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 7.6 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hoya Corporation, ZEISS, Nikon Corporation, Canon Inc., Panasonic Corporation, SCHOTT AG, Edmund Optics, Largan Precision, Sunny Optical Technology, Fujifilm, Tokina, OLYMPUS, Konica Minolta, HOYA Vision Care, Corning Incorporated, AGC Inc. (Asahi Glass), OVD Kinegram AG, OptoSigma Corporation, Carl Zeiss Vision, Kowa Optimed. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aspherical Lense Sales Market Key Technology Landscape

The technological landscape of the Aspherical Lense Sales Market is dominated by two highly precise fabrication methods: Precision Glass Molding (PGM) and high-volume Plastic Injection Molding. PGM involves pressing a precisely shaped optical glass blank into a highly accurate, non-contact polished mold at elevated temperatures, often requiring specialized platinum-based alloy molds for durability and smoothness. This technology allows for the direct creation of aspheric surfaces without the need for traditional, time-consuming grinding and polishing, significantly reducing production costs for high-performance glass optics, especially for lenses used in medical and high-end photographic equipment where environmental stability is key.

Plastic injection molding, conversely, is the bedrock of mass-market lens production. This process utilizes highly durable, heat-resistant steel molds containing the inverse aspheric profile. Molten optical polymers are injected under high pressure, rapidly cooled, and ejected. The primary technological challenge here is maintaining the micron-level accuracy of the aspheric profile throughout the high-cycle production run, mitigating wear and tear on the mold surface, and controlling internal stress in the polymer that can lead to birefringence. Advanced automation and in-line metrology systems, often leveraging AI, are critical to ensuring consistent quality and high yield rates in this cost-sensitive segment.

A crucial supporting technology is Ultra-Precision Diamond Turning, which is essential for manufacturing the high-accuracy molds required for both glass and plastic molding processes. This subtractive process uses monocrystalline diamond tools on specialized machine platforms to achieve surface roughness measured in nanometers, ensuring the mold precisely transfers the required aspheric shape. Furthermore, advanced thin-film coating technology, including anti-reflective (AR) coatings, is universally applied to enhance light transmission and system efficiency. The development of hybrid lenses—where a plastic aspheric layer is bonded to a glass substrate—represents an important innovation, leveraging the cost-effectiveness of plastic while retaining the substrate's thermal stability for certain applications, such as large-diameter camera lenses.

Regional Highlights

Global demand for aspherical lenses exhibits significant regional variation driven by manufacturing concentration, technological adoption rates, and specific regulatory environments across end-use industries. The market is primarily segmented into North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA), with APAC currently maintaining the dominant market share due to its established infrastructure for consumer electronics manufacturing and rapid industrial expansion.

The Asia Pacific region, led by China, Japan, South Korea, and Taiwan, is the undisputed leader in both production and consumption volume. This dominance stems from the region hosting the majority of the world's smartphone, digital camera, and computing device manufacturing ecosystems. Companies in APAC excel in high-volume, cost-competitive plastic injection molding, enabling them to supply the massive demand from global consumer electronics brands. Furthermore, Japan and South Korea retain strong capabilities in high-precision glass molding, catering to specialized optical instruments and high-end camera optics, fostering continuous technological innovation in manufacturing processes and material science.

North America and Europe represent mature, high-value markets characterized by demand for sophisticated, customized aspheres for medical, aerospace, and high-performance industrial applications. In North America, growth is driven by substantial investments in military optics, advanced LiDAR systems for autonomous vehicles, and cutting-edge research in telecommunications and diagnostics. European demand is robust, particularly in Germany and France, fueled by strong automotive manufacturing bases requiring high-reliability lenses for ADAS and superior vehicle lighting systems, alongside significant market presence in high-end scientific instruments and professional photography equipment. These regions prioritize precision and performance over raw volume, leading to higher average selling prices (ASPs) compared to APAC's mass-market offerings.

Latin America and the Middle East and Africa (MEA) are emerging regions for aspherical lens consumption. While production capabilities are limited, demand is growing, largely imported to support expanding local industries, particularly in telecommunications infrastructure, basic automotive assembly, and initial expansion of local healthcare services. Growth in these regions is heavily reliant on foreign direct investment and the deployment of standardized optical products. As urbanization and middle-class populations grow, these regions are expected to increasingly contribute to demand for consumer electronics and basic medical imaging equipment, creating viable, albeit smaller, markets for standardized plastic aspheres.

- Asia Pacific (APAC): Dominates the market due to concentrated consumer electronics manufacturing; high volume production of plastic aspheres; technological leadership in high-end camera optics (Japan, South Korea).

- North America: High-value market segment driven by aerospace, defense, R&D in LiDAR, and advanced medical device manufacturing; strong focus on custom glass and high-performance hybrid lenses.

- Europe: Key consumer in automotive (ADAS and lighting systems), industrial machine vision, and professional optics; regulatory environment encourages high quality and technical standards.

- Latin America: Emerging market with increasing demand linked to telecom infrastructure growth and expanding medical services; primarily relies on imported standard optical components.

- Middle East and Africa (MEA): Growth driven by infrastructure development and government spending on surveillance and defense systems; demand concentrated in defense, security, and rudimentary medical device imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aspherical Lense Sales Market.- Hoya Corporation: A global leader specializing in optical glass, photomasks, and contact lenses. They possess significant expertise in precision glass molding (PGM) technology, supplying high-performance glass aspheres primarily to the camera, medical, and information technology sectors. Their strength lies in material science and large-scale, high-accuracy production.

- ZEISS: Known globally for high-precision optics and optoelectronics, ZEISS supplies custom aspheres for microscopy, medical technology (especially ophthalmology), lithography optics, and professional camera lenses. Their market standing is based on unparalleled quality control and proprietary design expertise in complex freeform and aspheric geometries.

- Nikon Corporation: A major player in the imaging industry, providing sophisticated aspheric lenses for their own DSLR, mirrorless, and industrial metrology equipment. Nikon leverages decades of optical engineering expertise in both glass and plastic molding to maintain competitive advantage in precision and performance.

- Canon Inc.: A primary consumer and manufacturer of aspherical lenses, utilized extensively across their photography, medical imaging, and industrial equipment lines. Canon's integrated approach ensures control over the entire supply chain, from raw material to final integration into high-volume products.

- Panasonic Corporation: Significant in the consumer electronics space, particularly in camera modules and automotive applications. Panasonic utilizes high-volume plastic molding for cost-effective aspheres necessary for its ubiquitous electronic devices and expanding ADAS components business.

- SCHOTT AG: Specialized in high-quality glass materials and components. SCHOTT is critical in the upstream segment, providing specialized optical glass blanks and utilizing PGM to create robust aspheres for medical, industrial, and consumer applications requiring superior optical properties and durability.

- Edmund Optics: A leading supplier of off-the-shelf and custom optical components, including a vast catalog of aspheres for R&D, industrial integration, and prototyping. They cater to a broad base of smaller volume customers and research institutions, offering flexibility and diverse product specifications.

- Largan Precision: A dominant supplier of compact camera modules and lens sets, primarily serving the smartphone market. Largan is a high-volume leader in precision plastic aspheric molding, driving down costs and setting industry standards for miniaturization in consumer optics.

- Sunny Optical Technology: A major Chinese manufacturer focused on integrated optical parts, particularly camera modules and vehicle lenses. They compete aggressively on volume and cost, rapidly expanding their share in the consumer and automotive sectors through massive production scaling.

- Fujifilm: Active in both professional photography and medical systems, Fujifilm produces high-quality aspheric lenses for its cameras and endoscopes, relying on deep knowledge in optical thin films and material optimization.

- Tokina: Known for professional camera lenses, utilizing precision glass and hybrid aspheres to achieve high optical fidelity and minimize aberrations in specialized photographic equipment.

- OLYMPUS: Key player in the medical device industry, relying heavily on miniature, high-precision aspheres for advanced endoscopic and microscopy systems where image quality and size constraints are paramount.

- Konica Minolta: Supplies optics for commercial, industrial, and medical imaging applications, utilizing internal expertise in molding and coating technologies for custom and catalog aspheres.

- HOYA Vision Care: Focused on ophthalmic lenses, including corrective aspheric designs which provide thinner, lighter spectacle lenses with minimized peripheral distortion, serving the massive consumer vision correction market.

- Corning Incorporated: A leading supplier of specialized glass compositions and high-performance components, contributing significantly to the upstream supply chain and PGM capabilities, especially for durable industrial and aerospace optics.

- AGC Inc. (Asahi Glass): Global glass and chemical company involved in manufacturing specialized glass materials and components, including precision optics for automotive displays and industrial applications.

- OVD Kinegram AG: While specialized in security features, their underlying precision micro-optics and tooling expertise is relevant to high-end custom optical fabrication.

- OptoSigma Corporation: Provides a comprehensive range of optical components, including various glass and plastic aspheres for scientific and industrial integration, serving the R&D and instrumentation markets globally.

- Carl Zeiss Vision: Specialized segment of ZEISS focused on precision ophthalmic lenses, utilizing advanced aspheric designs for superior visual performance.

- Kowa Optimed: Offers optical components and systems for industrial machine vision, medical, and photographic applications, utilizing both glass and plastic aspheres tailored for high-resolution industrial inspection.

Frequently Asked Questions

Analyze common user questions about the Aspherical Lense Sales market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of an aspherical lens over a spherical lens?

The primary technical advantage is the elimination or significant reduction of spherical aberration and other monochromatic aberrations. This allows aspherical lenses to achieve superior image quality using fewer lens elements, leading to lighter, smaller, and more cost-effective optical systems, critical for miniaturization in devices like smartphones and medical endoscopes.

Which application segment drives the highest growth rate for aspherical lenses?

The Automotive segment, specifically applications related to Advanced Driver-Assistance Systems (ADAS) and autonomous driving (e.g., cameras and LiDAR sensors), is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to mandatory safety regulations and the integration of multiple high-resolution vision systems per vehicle.

What are the main differences between Precision Glass Molding (PGM) and Plastic Injection Molding in this market?

PGM is used for high-performance Glass Aspherical Lenses, offering superior thermal stability, durability, and refractive index characteristics, suitable for high-power or harsh environments. Plastic Injection Molding is a high-volume, low-cost method used extensively for Plastic Aspherical Lenses in consumer electronics, where environmental ruggedness is less critical than mass scalability and price point.

How does the adoption of AI influence the demand for physical aspherical lenses?

AI adoption increases demand for physical aspherical lenses by driving the need for sophisticated vision systems (machine learning, robotics, AR/VR) that require high-clarity, distortion-free optics. Additionally, AI enhances the design process, leading to more complex, optimally designed aspheres that still require ultra-precision manufacturing techniques.

Which region dominates the global Aspherical Lense Sales Market in terms of volume?

The Asia Pacific (APAC) region, driven primarily by the high concentration of consumer electronics manufacturing hubs (especially China and South Korea), dominates the global market volume due to the massive demand for plastic aspherical lenses used in smartphone cameras and mass-market digital devices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager