Asset Finance and Leasing Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436522 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Asset Finance and Leasing Software Market Size

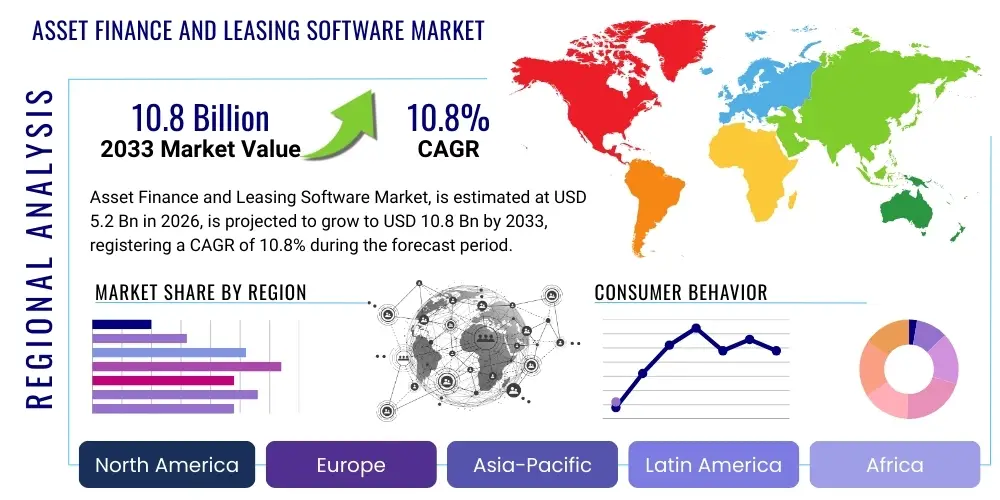

The Asset Finance and Leasing Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 10.8 Billion by the end of the forecast period in 2033.

Asset Finance and Leasing Software Market introduction

The Asset Finance and Leasing Software Market encompasses sophisticated technological solutions designed to manage the entire lifecycle of assets acquired through financing or leasing arrangements. This includes crucial functions such as origination, credit evaluation, contract management, billing, collections, servicing, and end-of-lease management. The core purpose of these software platforms is to streamline complex financial operations, ensure regulatory compliance, reduce operational costs, and enhance the customer experience within captive finance organizations, banks, independent leasing companies, and specialized finance institutions. The solutions range from core lease accounting systems to specialized modules for risk assessment and portfolio optimization.

Major applications of this software span diverse industries, including transportation (vehicle fleets, aviation), construction (heavy machinery), manufacturing (industrial equipment), and IT (hardware and software leasing). Key benefits derived from the adoption of modern asset finance software include accelerated digital transformation of lending processes, improved data accuracy for reporting (especially concerning IFRS 16 and ASC 842 compliance), and enhanced speed in loan or lease approval processes. The transition from legacy, fragmented systems to unified, cloud-based platforms is a significant underlying trend driving market growth.

The market expansion is fundamentally driven by the escalating demand for operational efficiency and transparency across the global finance sector. Factors such as the increasing complexity of regulatory reporting requirements, the necessity for robust credit risk modeling in volatile economic environments, and the competitive pressure to offer rapid, personalized digital customer experiences are propelling organizations to invest heavily in advanced software solutions. Furthermore, the rise of usage-based financing models and flexible subscription services necessitates highly adaptable and integrated software infrastructure.

Asset Finance and Leasing Software Market Executive Summary

The global Asset Finance and Leasing Software Market is experiencing robust growth, primarily fueled by the accelerating shift towards cloud-based deployment models and the integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) for enhanced credit scoring and automated decision-making. Business trends highlight a strong focus on platform unification, where finance companies seek single, end-to-end solutions rather than disparate point products, thereby improving data consistency and reducing integration costs. The market is characterized by intense competition among established vendors offering modular, configurable platforms and newer fintech entrants specializing in digital front-end solutions and instant decisioning capabilities. Furthermore, there is a pronounced trend towards offering integrated solutions that cover both traditional capital leases and newer operating lease standards compliance, ensuring long-term operational viability for clients.

Regional trends indicate North America maintaining market dominance, driven by early technology adoption, the presence of major financial institutions, and stringent regulatory mandates requiring sophisticated compliance solutions. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by rapid industrialization, increasing availability of credit, and the digital transformation initiatives undertaken by emerging economies like India and China. Europe remains a mature market, with growth primarily driven by the need for IFRS 16 accounting standardization tools and the optimization of cross-border leasing operations within the European Union.

Segment trends reveal that the Loan Management segment holds a substantial market share due to the sheer volume of loans processed, while the Lease Management segment is showing accelerated growth driven by the popularity of operating leases and the shift towards usage-based financing models, particularly within the automotive and equipment sectors. In terms of deployment, the Cloud-based segment is universally preferred over On-premise installations, offering scalability, lower total cost of ownership (TCO), and faster deployment cycles. Large enterprises remain the primary consumers, but Small and Medium-sized Enterprises (SMEs) are increasingly adopting specialized, subscription-based solutions to manage smaller, yet rapidly growing, asset portfolios.

AI Impact Analysis on Asset Finance and Leasing Software Market

Common user inquiries regarding the impact of AI focus heavily on automating traditionally manual, high-risk processes such as credit risk assessment, fraud detection, and document processing. Users frequently ask how AI can improve the speed of origination without sacrificing risk quality, the feasibility of using machine learning models for predicting residual asset values, and how large language models (LLMs) can be deployed to streamline customer service and complex contract interpretation. There is a strong expectation that AI will deliver tangible ROI by reducing default rates, accelerating time-to-decision, and enabling highly personalized, dynamic pricing strategies based on granular customer data and real-time behavioral insights. The primary concern often revolves around data privacy, model explainability (XAI), and regulatory acceptance of AI-driven decisions within lending frameworks.

- AI optimizes credit scoring by analyzing thousands of non-traditional data points, leading to more precise risk assessment and reduced bias in lending decisions.

- Machine Learning (ML) algorithms enable accurate prediction of residual values for leased assets, crucial for managing end-of-lease profitability and optimizing pricing strategies.

- Natural Language Processing (NLP) accelerates document processing, automatically extracting key terms and obligations from complex legal contracts and customer documentation.

- Intelligent automation and Robotic Process Automation (RPA) streamline back-office operations such as billing reconciliation, collections prioritization, and regulatory reporting generation.

- AI-driven chatbots and virtual assistants enhance customer self-service capabilities, managing routine inquiries and accelerating the pre-qualification and application process.

- Predictive maintenance analytics, often integrated through IoT data, improve asset utilization and inform leasing terms, particularly in heavy equipment and transportation sectors.

- Enhanced fraud detection mechanisms identify anomalous application patterns and transactional risks in real-time, minimizing financial losses associated with illicit activities.

DRO & Impact Forces Of Asset Finance and Leasing Software Market

The Asset Finance and Leasing Software Market dynamics are shaped by a powerful interplay of technological drivers and regulatory restraints, balanced by substantial opportunities stemming from digitalization and emerging economies. Key drivers include the overwhelming need for compliance with stringent global accounting standards (IFRS 16 and ASC 842), the increasing digitalization of the entire customer journey from application to final payment, and the competitive imperative to offer rapid, instant credit decisions. These forces collectively push financial institutions to abandon legacy systems in favor of modular, integrated, and cloud-native solutions that can handle increasingly complex financial products.

Restraints primarily revolve around the high initial implementation costs associated with comprehensive enterprise resource planning (ERP) level finance software, particularly for large multinational corporations with disparate legacy systems across various jurisdictions. Furthermore, data migration complexity and the shortage of specialized IT talent proficient in both finance regulatory frameworks and modern software integration pose significant hurdles. Regulatory flux, while often a driver, can also be a restraint, as continuous adaptation to evolving data privacy laws (like GDPR) and anti-money laundering (AML) directives requires persistent software updates and revalidation, increasing maintenance complexity.

Opportunities are abundant, particularly in the rapid growth of the usage-based financing and subscription economy models across industrial and consumer goods sectors, which demand sophisticated, real-time calculation capabilities that legacy systems cannot provide. Furthermore, geographical expansion into underserved markets, especially in Latin America and Southeast Asia, presents a lucrative pathway for vendors offering scalable, localized, and multi-currency compliant software. The integration of blockchain for enhanced transparency in asset ownership and smart contracts also represents a long-term transformative opportunity, promising reduced counterparty risk and improved auditability, further solidifying the necessity for advanced software platforms.

Segmentation Analysis

The Asset Finance and Leasing Software Market is comprehensively segmented based on several critical dimensions, including component type, deployment model, enterprise size, application, and industry verticals. This granular segmentation allows vendors to target specific functional needs within the finance sector, ranging from front-office digitalization tools for customer engagement to deep back-office engines for accounting and portfolio management. The component segmentation, which includes solutions and services, highlights the growing importance of professional services (implementation, customization, and consulting) necessary to ensure successful deployment and integration into existing enterprise architectures.

The deployment model segmentation distinctly favors the Cloud-based segment, reflecting the global trend towards operational flexibility, reduced infrastructure burden, and rapid scaling capabilities demanded by modern financial institutions. Application segmentation provides insights into which parts of the leasing lifecycle (origination, servicing, or portfolio management) are receiving the most investment. Simultaneously, the Enterprise Size breakdown confirms that while large enterprises are the dominant revenue generators, the SME segment is adopting increasingly affordable Software-as-a-Service (SaaS) solutions, broadening the overall market base and indicating a high-growth potential for streamlined, low-cost packages tailored for smaller portfolios.

- Component:

- Solution (Core Systems, Analytics Tools, CRM Integration)

- Services (Consulting, Implementation, Support & Maintenance)

- Deployment Mode:

- On-premise

- Cloud-based (SaaS, PaaS)

- Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- Application:

- Lease Origination and Management

- Loan Origination and Management

- Asset Servicing and Collections

- Portfolio and Risk Management

- General Ledger and Regulatory Compliance

- Industry Vertical:

- Banks and Financial Institutions

- Captive Finance Companies

- Independent Leasing Companies

- Automotive and Transportation

- IT and Telecom

- Construction and Industrial Equipment

Value Chain Analysis For Asset Finance and Leasing Software Market

The value chain for the Asset Finance and Leasing Software Market begins with the upstream activities centered on core software development, intellectual property creation, and foundational infrastructure provisioning. This involves significant R&D investment by vendors in developing robust, scalable core processing engines, utilizing modern technologies such as microservices architecture and API integration capabilities. Key upstream players include specialized software developers, cloud providers (like AWS, Azure, Google Cloud), and data analytics providers who supply the foundational tools for the platforms. Ensuring compliance with evolving accounting standards (IFRS 16/ASC 842) is a crucial upstream requirement, requiring deep domain expertise.

Midstream activities primarily involve integration, customization, and implementation services, often performed by specialized system integrators or the software vendors themselves. This phase is highly consultative, requiring tailored configurations to match the complex operational workflows and regulatory mandates of the client financial institution. Effective training and change management are also integral to the midstream process, ensuring end-user adoption and maximizing the efficiency gains promised by the software. This phase also includes ongoing support and maintenance services, which are critical for platform stability and addressing regulatory updates.

Downstream analysis focuses on the distribution channels and the end-users. Direct distribution, where vendors sell and implement their software directly to large financial institutions, ensures maximum control over the client relationship and customization. Indirect distribution involves partnerships with regional resellers, Value-Added Resellers (VARs), and strategic channel partners, often utilized to penetrate smaller markets or specific geographical regions where localized support is essential. The ultimate downstream beneficiaries are financial service providers who leverage the software to offer enhanced customer experiences, manage risk effectively, and achieve substantial operational savings.

Asset Finance and Leasing Software Market Potential Customers

Potential customers for Asset Finance and Leasing Software are diverse yet centered predominantly within the financial ecosystem and sectors heavily reliant on capital expenditure for equipment acquisition. End-users span the full spectrum of lending institutions, from multinational banks with multi-billion dollar asset portfolios to regional credit unions seeking entry-level solutions for managing commercial vehicle loans. These institutions leverage the software to manage compliance complexities, accelerate credit decisions, and provide digital self-service capabilities to their clients, maintaining a competitive edge in a rapidly digitalizing landscape.

A significant segment of buyers comprises Captive Finance Companies, which are the financing arms of large manufacturers (e.g., automotive, heavy machinery). These customers require highly customized software solutions that integrate seamlessly with the parent company's sales and dealer networks, facilitating proprietary financing programs and managing the substantial influx of assets. Independent Leasing Companies, focusing purely on leasing and asset management, represent another core buyer base, demanding flexible software that can handle diverse asset classes and complex funding structures efficiently.

Furthermore, specialized segments such as Equipment Rental Companies and Fintech Lenders are emerging as critical buyers. Equipment rental firms use the software for advanced tracking and billing based on utilization, while fintech lenders require API-first, highly scalable platforms to support their rapid, data-driven origination models. The necessity for advanced reporting, particularly related to asset residual values and liability recognition under new accounting standards, makes the software indispensable for all large organizations dealing with off-balance-sheet financing structures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 10.8 Billion |

| Growth Rate | 10.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mambu, Odessa, Alfa, White Clarke Group (now part of Solifi), Oracle, Sopra Banking Software, FIS, NetSol Technologies, Temenos, Infor, LTi Technology Solutions, HPD Software, LeasePlan Digital, Tavant, Pefin, Exdion Solutions, Cloud Lending (now part of Q2), Cassiopae, Aspire Systems, FICO. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Asset Finance and Leasing Software Market Key Technology Landscape

The technological landscape of the Asset Finance and Leasing Software market is defined by rapid innovation aimed at enhancing scalability, reducing latency, and enabling dynamic data analysis. Modern platforms are increasingly built upon microservices architecture, allowing for modular updates and integration via robust APIs, moving away from monolithic designs that hindered rapid deployment and customization. This architectural shift facilitates seamless connectivity with third-party data providers, credit bureaus, and specialized risk modeling tools, which is essential for instantaneous decision-making in the competitive lending environment. Furthermore, the adoption of public or private cloud environments is a foundational technological shift, providing the elastic compute power necessary for handling volatile transaction volumes and large-scale data processing for compliance reporting.

A critical technology driving market evolution is the sophisticated integration of Artificial Intelligence and Machine Learning. AI is leveraged not only in the front-end for intelligent document processing and customer interaction but also deeply integrated into the core engine for advanced credit scoring, delinquency prediction, and automated asset valuation. For asset tracking and utilization-based leasing, the software relies heavily on integrating with Internet of Things (IoT) sensors and telematics devices. This integration enables real-time data ingestion regarding asset health, location, and usage, which is crucial for determining accurate usage fees, managing maintenance schedules, and projecting residual values with higher fidelity. These technologies ensure that financial institutions can transition smoothly toward performance-based and consumption-based financing models.

Furthermore, technologies enabling high security and compliance are paramount. Blockchain technology is beginning to gain traction, specifically for creating immutable digital records of asset ownership transfers, enhancing transparency, and automating escrow functions through smart contracts, thereby reducing legal and administrative overhead. Cybersecurity enhancements, including multi-factor authentication, advanced encryption protocols, and integrated regulatory reporting features (such as automated generation of reports for GDPR and CCPA compliance), are non-negotiable requirements. The industry is moving towards low-code/no-code platforms for front-end customization, allowing business users to adapt workflows rapidly without heavy reliance on core IT development teams, thereby speeding up time-to-market for new financial products.

Regional Highlights

The global market exhibits distinct regional dynamics, influenced by local economic maturity, regulatory environment, and digitalization pace. North America, encompassing the United States and Canada, stands as the leading region in terms of market size and technological maturity. This dominance is attributed to the presence of the world’s largest banks and leasing institutions, mandatory adherence to complex accounting standards like ASC 842, and high capital expenditure on financial technology. The region is characterized by early adoption of AI-driven origination systems and rapid migration to cloud-based platforms to manage vast, diverse asset portfolios efficiently.

Europe represents the second-largest market, with growth primarily driven by the need for consolidated platforms to manage multi-jurisdictional leasing operations and uniform compliance with IFRS 16 across the European Union. Western European countries, particularly the UK, Germany, and France, showcase high penetration rates, while Eastern European markets offer significant untapped potential. The regulatory landscape, including GDPR, pushes providers to offer highly secure, privacy-compliant solutions, further necessitating investment in advanced, localized software packages.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This accelerated growth is spurred by rapid urbanization, significant infrastructure investment, expanding middle-class access to credit, and government-led initiatives supporting digital finance transformation in high-growth economies such as India, China, and Southeast Asian nations. The need for flexible, scalable software to support micro-leasing and consumer asset finance in these developing markets drives demand. Latin America and the Middle East & Africa (MEA) are emerging markets, where growth is currently concentrated in adopting basic core systems to replace manual processes, driven by the increasing financial inclusion and foreign direct investment into asset-heavy sectors like oil & gas and construction.

- North America: Market leader characterized by mature technology adoption, stringent regulatory environment (ASC 842), and massive cloud migration among large financial institutions.

- Europe: Strong growth driven by IFRS 16 compliance needs and the standardization of cross-border leasing practices within the EU; focus on data privacy (GDPR compliant software).

- Asia Pacific (APAC): Highest CAGR expected, fueled by economic expansion, governmental push for digitalization in finance, and increasing demand for specialized software in emerging markets.

- Latin America (LATAM): Growing adoption driven by increased access to formalized credit and the necessity for multi-currency handling and inflation-aware portfolio management systems.

- Middle East and Africa (MEA): Emerging opportunities concentrated in industrial sectors (energy, construction) and banking, focusing on initial adoption of core leasing platforms to modernize operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Asset Finance and Leasing Software Market.- Odessa

- Alfa

- Solifi (formerly White Clarke Group and IDS)

- NetSol Technologies

- Mambu

- FIS (Fidelity National Information Services)

- Sopra Banking Software

- Oracle Corporation

- Temenos AG

- Infor

- LTi Technology Solutions

- HPD Software

- LeasePlan Digital

- Tavant

- FICO

- Cassiopae (A Sopra Banking Software Company)

- Aspire Systems

- Cloud Lending (A Q2 Company)

- Whitehat Consultancy

- Pefin

Frequently Asked Questions

Analyze common user questions about the Asset Finance and Leasing Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Asset Finance and Leasing Software Market?

The primary driver is the stringent global regulatory requirement for compliance with new accounting standards, specifically IFRS 16 (International Financial Reporting Standard 16) and ASC 842 (Accounting Standards Codification 842), which mandates complex reporting and management of leased assets and liabilities, compelling financial institutions to upgrade their core systems.

How is cloud computing impacting the deployment of asset finance solutions?

Cloud computing, predominantly Software-as-a-Service (SaaS), is fundamentally transforming deployment by offering enhanced scalability, reduced upfront capital expenditure, faster implementation cycles, and automatic regulatory updates, making enterprise-grade software accessible to Small and Medium-sized Enterprises (SMEs).

Which technology is most critical for future asset risk management in this market?

Artificial Intelligence (AI) and Machine Learning (ML) are most critical, as they enable advanced predictive modeling for credit risk assessment, fraud detection, and, most importantly, accurate forecasting of residual asset values, which is vital for profitability in long-term leasing contracts.

What are the key segments by application driving revenue in the market?

The key application segments driving revenue are Loan Management and Lease Origination. Loan Management retains high volume, but Lease Origination is seeing accelerated investment due to the increasing popularity of usage-based financing models and the complexity introduced by IFRS 16 and ASC 842.

Which geographical region is projected to exhibit the highest growth rate?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), driven by rapid digitalization initiatives, significant infrastructure investment, and the expansion of consumer and industrial credit availability across emerging economies in Southeast Asia and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager