Assisted Docking Technology Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432666 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Assisted Docking Technology Market Size

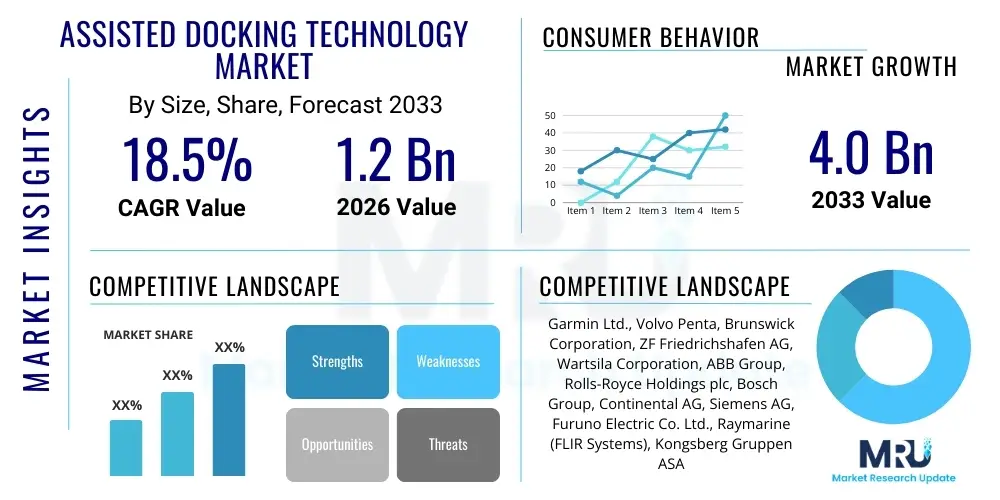

The Assisted Docking Technology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 4.0 Billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by the increasing demand for automation in both maritime and automotive sectors, aiming to enhance safety, efficiency, and reduce operational costs associated with complex maneuvering in confined spaces.

Assisted Docking Technology Market introduction

Assisted Docking Technology encompasses advanced automated systems designed to aid or entirely execute the final stage of vessel mooring or vehicle parking, which involves navigating low-speed, high-precision maneuvers into a predetermined berth or space. These systems rely heavily on sophisticated sensor fusion, encompassing technologies such as LiDAR, radar, ultrasonic sensors, and computer vision, coupled with real-time processing algorithms to determine the optimal path and control propulsion and steering mechanisms. The core objective is to mitigate human error, which is often a critical factor in collision incidents during docking, thereby protecting valuable assets and ensuring personnel safety, especially in challenging environmental conditions like strong currents or high winds.

Major applications of assisted docking technology span across several critical industries. In the marine sector, it is deployed on large commercial vessels, ferries, and increasingly, on recreational yachts, streamlining port operations and reducing turnaround times. For the automotive industry, this technology manifests as Advanced Parking Assist Systems (APAS), offering fully autonomous parking capabilities that simplify the driver experience in dense urban environments. Furthermore, logistics and warehousing operations utilize similar automated guidance technology for the precise positioning of autonomous guided vehicles (AGVs) and forklifts, optimizing material handling flows and maximizing storage density within confined industrial spaces.

The market growth is intrinsically linked to several compelling benefits and driving factors. Benefits include significantly reduced insurance costs due to lower risk of accidents, increased vessel and vehicle utilization rates, and decreased fuel consumption during lengthy manual maneuvers. Key driving factors involve stringent global maritime regulations pushing for higher levels of operational safety, the increasing sophistication and declining cost of integrated sensor technologies, and the industry-wide push toward full autonomy in transportation and logistics networks. The development of standardized communication protocols (such as V2X connectivity in automotive) further accelerates the reliable implementation of these complex systems.

Assisted Docking Technology Market Executive Summary

The Assisted Docking Technology market is experiencing robust global expansion, characterized by rapid technological integration and increasing regulatory acceptance of semi-autonomous operations. Major business trends include the consolidation of the supply chain, where marine equipment manufacturers are actively acquiring specialized software and sensor providers to offer integrated, end-to-end solutions. Furthermore, the shift towards modular, scalable docking assistance platforms is gaining traction, allowing ship owners and automotive OEMs to implement systems incrementally, based on their immediate operational needs and capital expenditure capacity. Investment in cybersecurity measures for these connected systems is also becoming a critical differentiator in vendor offerings.

Regionally, the market exhibits strong leadership from North America and Europe, largely attributable to substantial investments in smart port infrastructure and high adoption rates of advanced driver assistance systems (ADAS) in consumer vehicles. These regions benefit from mature regulatory frameworks that support autonomous system testing and deployment. Conversely, the Asia Pacific (APAC) region is poised for the highest growth trajectory, fueled by extensive government-backed port modernization initiatives in major maritime hubs like Singapore, China, and South Korea, coupled with the rapid expansion of the automotive manufacturing base adopting Level 2 and Level 3 automation capabilities.

Segmentation trends highlight the dominance of the sensor and software components segment due to continuous innovation in algorithms and the complexity required for dynamic environment perception. Within application verticals, the commercial marine sector, particularly large container ships and tankers, represents the largest revenue share, driven by the massive economic impact of docking errors. However, the recreational marine segment (yachts and smaller boats) is showing the fastest growth, primarily due to the democratization of previously high-cost sensor technologies, making sophisticated docking assistance accessible to private consumers seeking ease of operation and enhanced safety.

AI Impact Analysis on Assisted Docking Technology Market

User queries regarding the impact of Artificial Intelligence (AI) on Assisted Docking Technology frequently center on three critical areas: the ability of AI to handle highly dynamic and unpredictable environmental variables (such as sudden wind gusts or unexpected currents), the validation and certification processes required for AI-driven safety-critical systems, and the efficacy of machine learning in reducing system reliance on perfect sensor readings through enhanced predictive maintenance and redundancy. Based on this, the key market themes revolve around leveraging AI for superior situational awareness, establishing robust safety envelopes, and accelerating the path toward fully autonomous operations through continuous learning capabilities.

AI, specifically through machine learning (ML) and deep learning (DL) algorithms, is fundamentally transforming assisted docking by moving systems beyond predefined rule-based operation into adaptive, real-time decision-making. Traditional systems struggle when faced with novel or complex scenarios; AI models trained on vast amounts of real-world operational data can recognize subtle patterns in environmental stimuli and instantaneously generate optimized maneuvers, significantly reducing the required reaction time and improving precision by minimizing the offset errors often seen in manual or basic automated controls. This translates directly into faster, safer berthing or parking sequences, particularly beneficial for massive vessels requiring high degrees of accuracy.

Furthermore, AI algorithms are vital for advanced sensor fusion, serving as the central intelligence hub that synthesizes often conflicting or noisy data streams from LiDAR, radar, cameras, and GPS/INS systems. This intelligent integration allows the system to maintain a reliable, high-definition perception of the immediate docking environment, even when one sensor modality is degraded (e.g., fog obscuring camera view or heavy rain affecting LiDAR). The adoption of reinforcement learning is a key development, allowing docking systems to practice maneuvers in simulation environments under diverse stress conditions, leading to optimal control strategies that enhance system resilience and accelerate deployment timelines across various geographical locations and infrastructure standards.

- AI enables predictive path planning and real-time trajectory correction, optimizing speed and efficiency during final approach.

- Machine Learning enhances sensor fusion reliability, allowing the system to maintain situational awareness despite noisy or incomplete sensor data.

- Deep reinforcement learning accelerates system training and validation across diverse operational environments and weather conditions.

- AI algorithms improve obstacle detection and classification, differentiating between fixed infrastructure, movable debris, and transient objects like small boats or pedestrians.

- Predictive analytics driven by AI minimizes component failure risks in propulsion and steering systems, ensuring high system availability during critical maneuvers.

DRO & Impact Forces Of Assisted Docking Technology Market

The Assisted Docking Technology market is shaped by a confluence of powerful drivers, specific market restraints, substantial growth opportunities, and impactful external forces. The primary market drivers include the imperative for improved safety standards mandated by international bodies like the IMO, the desire among fleet operators and logistics companies to minimize operational downtime, and the chronic industry-wide labor shortage requiring automation to maintain operational throughput. These forces collectively push operators toward investing in automated solutions that ensure consistency and reliability, especially given the rising costs associated with groundings or hull damage in ports.

Conversely, significant market restraints impede faster adoption. High initial capital investment is a major barrier, particularly for retrofitting existing, aging infrastructure and vessel fleets with complex, multi-modal sensor arrays and advanced computing units. Furthermore, the regulatory environment presents challenges; obtaining certification for fully autonomous docking systems requires rigorous safety validation and standardization across different global jurisdictions, which often leads to slow, fragmented deployment. The underlying concern over system reliability, particularly susceptibility to jamming, spoofing, or cyber-attacks that could compromise remote-control capabilities, remains a crucial restraint influencing buyer confidence.

However, compelling opportunities exist, particularly in the rapid commercialization of solid-state LiDAR and advanced radar technologies, which are significantly lowering the overall component costs while improving accuracy and resilience. The large-scale opportunity in integrating assisted docking with shore-side automation, such as automated mooring systems and remote port operations centers, promises to create synergistic efficiencies. Key impact forces include the exponential advancement in Edge Computing, which allows complex AI processing to occur onboard the vessel or vehicle in real-time without relying heavily on cloud connectivity, and the intense competitive rivalry among large automotive Tier 1 suppliers, marine electronics specialists, and technology startups, driving down margins and accelerating innovation cycles.

Segmentation Analysis

The Assisted Docking Technology Market is meticulously segmented based on components, application type, degree of automation, and end-user vertical, allowing for targeted product development and market penetration strategies. Component segmentation distinguishes between hardware (sensors, cameras, processing units) and software (algorithms, control systems, human-machine interface or HMI), reflecting the high value placed on proprietary control logic. Application segmentation focuses on the operational domain, separating solutions required for marine environments, characterized by dynamic fluid movements and large mass inertia, from those for ground vehicles, which involve complex path planning in dense, static environments.

- By Component:

- Hardware (Sensors - LiDAR, Radar, Ultrasonic, Cameras)

- Software (Control Algorithms, HMI, Communication Modules)

- By Application:

- Marine (Commercial Vessels, Recreational Yachts, Ferries)

- Automotive (Passenger Vehicles, Commercial Trucks)

- Industrial (Autonomous Guided Vehicles, Forklifts, Cranes)

- By Degree of Automation:

- Level 1 (Assistance, e.g., trajectory visualization)

- Level 2 (Partial Automation, e.g., steering and propulsion control)

- Level 3 (Conditional Automation, e.g., driver/captain override capability)

- By Technology:

- Sensor Fusion Systems

- Computer Vision & Object Recognition

- Advanced Control & Feedback Systems (Propulsion and Steering Interface)

Value Chain Analysis For Assisted Docking Technology Market

The value chain for Assisted Docking Technology is structured and involves several highly specialized tiers, commencing with upstream raw material suppliers and culminating in complex system integration and aftermarket services. Upstream analysis focuses on the supply of critical high-technology components, including advanced semiconductors for processing units, specialized optical components for LiDAR and cameras, and high-frequency modules for radar systems. Manufacturers in this segment face intense pressure for miniaturization, cost reduction, and performance enhancement, as component quality directly dictates the reliability of the final docking solution. Strong relationships with Tier 2 and Tier 3 suppliers, ensuring stable and quality-controlled input flows, are paramount for maintaining production throughput.

Midstream activities involve the core market players, primarily the system integrators and technology developers who focus on transforming raw sensor data into actionable control logic. This stage involves sophisticated software development, including proprietary algorithms for sensor fusion, path planning, and robust control systems tailored to specific application platforms (marine hydraulics or automotive steering racks). Distribution channels for these complex systems vary significantly by end-user segment. Direct distribution is common in the commercial marine sector, where system integrators work directly with shipyards or fleet owners for custom installations and retrofits, offering high-touch consultation and ongoing maintenance contracts.

Downstream analysis centers on installation, calibration, and aftermarket support. For the automotive sector, systems are integrated during vehicle assembly, making the channel dominated by Tier 1 supplier contracts with OEMs. For marine applications, deployment often occurs through authorized dealerships, specialized marine electronics installers, or shipyard service teams. Indirect channels, such as global dealer networks or regional value-added resellers (VARs), are crucial for reaching smaller end-users, particularly in the recreational boating market. The sustained profitability of the value chain is increasingly reliant on lucrative recurring revenue streams generated through software update subscriptions, maintenance contracts, and operational data analytics services, emphasizing the long-term relationship between technology provider and end-user.

Assisted Docking Technology Market Potential Customers

The market for Assisted Docking Technology is highly diversified, encompassing industrial, commercial, and consumer buyers, each with distinct needs and procurement cycles. In the marine sector, the key buyers are large commercial shipping companies, including major container lines, tanker operators, and bulk carriers, who invest in these technologies primarily to reduce insurance liabilities and optimize high-frequency port calls. Additionally, ferry operators and cruise lines are crucial customers, seeking maximum safety and reduced vessel handling complexity when navigating crowded terminal areas. Private owners of large recreational yachts represent a high-growth customer base, prioritizing ease of use, luxury, and safety features.

In the automotive domain, the primary customers are global Original Equipment Manufacturers (OEMs), who integrate these systems as standard or optional features within their vehicle lineups to enhance product attractiveness and meet increasing consumer expectations for ADAS features. Fleet operators, managing large volumes of commercial delivery vehicles or taxis, are also key buyers, recognizing the value of automated parking assistance in reducing vehicle damage and minimizing driver stress in urban environments. The transition towards autonomous Level 4 vehicles will further solidify OEMs and specialized autonomy developers as the central procurement hubs for this technology.

The industrial and logistics sectors constitute a rapidly expanding customer segment, encompassing large-scale warehouse operators, manufacturing plants, and port logistics firms. These customers utilize assisted docking technology for the precise guidance and automatic coupling of autonomous material handling equipment, such as AGVs and heavy-duty industrial vehicles. Their buying decisions are heavily influenced by the immediate return on investment realized through increased operational throughput, reduced manual labor requirements, and enhanced accuracy in automated processes, making reliability and integration capability paramount purchasing criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 4.0 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Garmin Ltd., Volvo Penta, Brunswick Corporation, ZF Friedrichshafen AG, Wartsila Corporation, ABB Group, Rolls-Royce Holdings plc, Bosch Group, Continental AG, Siemens AG, Furuno Electric Co. Ltd., Raymarine (FLIR Systems), Kongsberg Gruppen ASA, Navico Group, Dockmate, Airmar Technology Corporation, Teledyne Technologies Incorporated, Hella GmbH & Co. KGaA, Valeo SA, Nexteer Automotive. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Assisted Docking Technology Market Key Technology Landscape

The technological landscape of the Assisted Docking Market is dominated by advanced sensor technologies and the computational infrastructure required to fuse and interpret complex environmental data in real-time. The core technologies utilized include high-resolution LiDAR systems, providing precise 3D mapping of the surroundings, coupled with long-range radar that ensures reliable object detection regardless of weather conditions (fog, rain, or darkness). Ultrasonic sensors remain crucial for proximity detection at very short ranges, particularly useful for final alignment and contact avoidance. The convergence of these hardware components with high-performance, low-latency processing units capable of running sophisticated AI models defines the current technological edge.

Central to system performance is the sophisticated sensor fusion architecture. This involves proprietary software algorithms that intelligently weigh the data reliability from each sensor modality, mitigating individual sensor weaknesses and providing a unified, coherent situational awareness picture to the control system. Furthermore, the integration of high-accuracy Global Navigation Satellite Systems (GNSS) with Inertial Navigation Systems (INS) is vital, providing centimeter-level positioning and orientation data necessary for micro-maneuvering in confined docking areas. The transition toward solid-state and frequency-modulated continuous-wave (FMCW) LiDAR is a significant trend, promising reduced size, increased durability, and lower costs, thereby facilitating broader adoption across all vehicle classes.

The control interface technology is also rapidly evolving, moving from simple joystick controls in marine applications to complex, predictive HMI displays that offer captains or drivers intuitive trajectory visualization and control feedback. Propulsion and steering control systems interface seamlessly with the docking computer, often utilizing CAN bus or proprietary communication protocols to modulate thrusters, rudder angles, and engine RPMs with precision. Future technological advancements are focused on creating highly redundant, fault-tolerant architectures, employing techniques like triple modular redundancy (TMR) in computing units, to ensure that system failure in a critical docking phase is practically impossible, meeting the stringent safety requirements for autonomous operation.

Regional Highlights

- North America: This region is a primary innovator and adopter of assisted docking technology, particularly in the automotive and recreational marine segments. Driven by high consumer demand for advanced driver-assistance features (ADAS) and a significant presence of key technology developers (Tier 1 suppliers, specialized software firms), North America commands a substantial market share. Strict safety regulations and the integration of smart infrastructure in major ports further bolster market expansion.

- Europe: Europe is characterized by early adoption in the commercial marine sector, supported by mature regulatory bodies (e.g., European Maritime Safety Agency) and heavy investment in port automation across Northern European hubs like Rotterdam and Hamburg. The region is a leader in maritime autonomy pilot projects, particularly concerning ferry and short-sea shipping applications, emphasizing precision maneuvering in often highly constrained historic ports.

- Asia Pacific (APAC): Positioned as the fastest-growing market, APAC’s expansion is fueled by massive government investments in new port construction and modernization, particularly in China, South Korea, and Singapore. The rapid growth of the automotive manufacturing industry and the increasing demand for advanced features in passenger vehicles, combined with the region’s dominance in global shipping volumes, makes it a critical area for future market revenue generation.

- Latin America: Market growth in Latin America is more nascent, primarily concentrated in commercial shipping hubs related to resource export (e.g., Brazil and Chile). Adoption is currently restraint by infrastructure limitations and fragmented regulatory frameworks. However, increasing foreign investment in port infrastructure development is expected to accelerate the implementation of assisted docking solutions.

- Middle East and Africa (MEA): Growth in the MEA region is sector-specific, heavily driven by large-scale commercial port development projects (e.g., UAE, Saudi Arabia) aiming to establish global logistics dominance. Investments focus mainly on commercial vessel docking and high-end recreational marine markets, leveraging oil revenue to fund advanced automation technologies for increased efficiency and prestige.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Assisted Docking Technology Market.- Garmin Ltd.

- Volvo Penta

- Brunswick Corporation

- ZF Friedrichshafen AG

- Wartsila Corporation

- ABB Group

- Rolls-Royce Holdings plc

- Bosch Group

- Continental AG

- Siemens AG

- Furuno Electric Co. Ltd.

- Raymarine (FLIR Systems)

- Kongsberg Gruppen ASA

- Navico Group

- Dockmate

- Airmar Technology Corporation

- Teledyne Technologies Incorporated

- Hella GmbH & Co. KGaA

- Valeo SA

- Nexteer Automotive

- Marelli Holdings Co., Ltd.

- Veth Propulsion (a Twin Disc Company)

- Honda Motor Co., Ltd. (via marine division)

- Mercury Marine (Brunswick)

Frequently Asked Questions

Analyze common user questions about the Assisted Docking Technology market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of assisted docking technology?

The primary factor is the significant reduction of human error and associated operational risks during low-speed, high-precision maneuvering. This directly enhances safety, minimizes asset damage, and reduces high insurance liabilities for both maritime and automotive operators.

How does AI improve the reliability of assisted docking systems in dynamic environments?

AI, through advanced machine learning and deep reinforcement learning, enables real-time predictive modeling of complex environmental variables (like wind and current) and facilitates robust sensor fusion, ensuring the system maintains accurate trajectory and control even when facing unpredictable conditions or degraded sensor inputs.

Which geographical region is expected to exhibit the highest growth rate in this market?

The Asia Pacific (APAC) region is projected to experience the highest growth rate, driven by massive government investments in modernizing and automating key maritime ports, coupled with the rapid expansion and technological integration within the regional automotive manufacturing sector.

What are the main restraints hindering the full market penetration of assisted docking technology?

Key restraints include the high initial cost of installing complex sensor arrays and processing hardware, along with ongoing challenges related to achieving standardized regulatory certification for autonomous systems across diverse global maritime and transportation jurisdictions.

Is assisted docking technology primarily used for large commercial vessels or recreational boats?

While the commercial marine sector (large container ships, tankers) currently holds the largest market revenue share due to the high economic value of the assets, the recreational boat segment is showing the fastest growth rate due to the increasing accessibility and affordability of sophisticated sensor and control systems for private consumers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager