Assistive Devices for Vulnerable Groups Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432791 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Assistive Devices for Vulnerable Groups Market Size

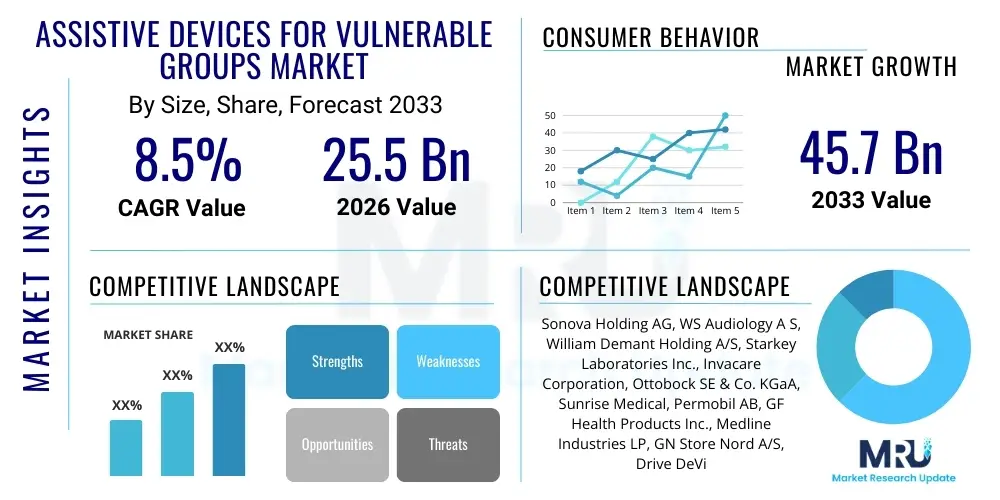

The Assistive Devices for Vulnerable Groups Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 45.7 Billion by the end of the forecast period in 2033.

Assistive Devices for Vulnerable Groups Market introduction

The Assistive Devices for Vulnerable Groups Market encompasses a wide range of specialized products designed to enhance the functional capabilities, independence, and overall quality of life for individuals facing physical, cognitive, or sensory limitations. These devices span technologies from basic mobility aids like canes and wheelchairs to complex digital communication systems, hearing aids, and advanced prosthetic limbs. The core mission of this market is to bridge the gap created by disabilities and age-related decline, enabling vulnerable populations, primarily the elderly and those with chronic conditions, to participate more fully in societal and daily activities. The rapid global aging population, coupled with increasing prevalence of non-communicable diseases leading to long-term impairment, serves as a fundamental market driver.

Major applications of these devices include rehabilitation, homecare support, workplace accommodation, and public accessibility enhancement. In rehabilitation settings, assistive technology accelerates recovery and maximizes functional gains post-injury or surgery. In homecare, devices like patient lifts, smart monitoring systems, and adaptive furniture significantly reduce the burden on caregivers while promoting user autonomy. The benefits are substantial, including reduced healthcare expenditures by preventing secondary complications, improved mental health through greater independence, and enhanced social integration. Furthermore, government initiatives promoting inclusive design and universal access standards are shaping product development and adoption rates across various regions, standardizing requirements for effective product implementation.

Key driving factors fueling market expansion involve continuous technological advancements, particularly the integration of Internet of Things (IoT), miniaturization, and AI in devices such as smart hearing aids and robotic exoskeletons. Economic factors, such as rising disposable incomes in emerging economies and increasing insurance coverage for assistive technology, are also pivotal. The shift from institutional care models to home-based care necessitates sophisticated assistive tools. Regulatory frameworks, particularly in developed regions like North America and Europe, mandate accessibility standards, creating a consistent demand base for high-quality, certified assistive devices. The confluence of demographic shifts and technological innovation positions this market for robust long-term growth.

Assistive Devices for Vulnerable Groups Market Executive Summary

The Assistive Devices for Vulnerable Groups market is characterized by resilient growth driven primarily by demographic changes, specifically the exponential increase in the global elderly population and the corresponding rise in age-related chronic disabilities. Business trends indicate a strong focus on personalization, digitalization, and integration, moving away from standalone devices toward connected ecosystems that provide continuous monitoring and adaptive support. Strategic mergers, acquisitions, and collaborations between traditional medical device manufacturers and technology firms (especially AI developers) are accelerating product innovation and market penetration. Companies are increasingly investing in cloud-based platforms to manage data generated by smart assistive devices, optimizing device performance and enabling predictive maintenance, which enhances the overall user experience and device efficacy.

Regional trends reveal that North America and Europe currently dominate the market share due to high healthcare expenditure, sophisticated reimbursement policies, and early adoption of advanced technologies like robotic assistance and neuro-controlled prosthetics. However, the Asia Pacific (APAC) region is projected to register the fastest CAGR over the forecast period. This accelerated growth is attributed to massive population bases, improving healthcare infrastructure, increasing awareness of assistive technology benefits, and growing governmental support for elder care services in countries such as China, India, and Japan. Latin America and the Middle East and Africa (LAMEA) are developing markets, with growth influenced heavily by infrastructure development and accessibility mandates.

Segment trends highlight the significant dominance of mobility aids and medical furniture, driven by the immediate need for basic accessibility among the aging cohort. Nevertheless, the sensory aids segment, particularly hearing aids and advanced vision enhancement devices, is expected to exhibit the highest technological growth rate, fueled by miniaturization, superior sound processing capabilities, and aesthetic improvements. The homecare settings segment continues to expand rapidly as consumers prefer aging-in-place solutions, pushing manufacturers to develop user-friendly, non-intrusive devices suitable for domestic environments. This shift requires devices to be robust yet simple to operate, favoring design iterations focused on user experience (UX) and intuitive controls.

AI Impact Analysis on Assistive Devices for Vulnerable Groups Market

Common user inquiries regarding AI’s impact on the Assistive Devices market frequently revolve around how artificial intelligence can personalize rehabilitation protocols, improve the responsiveness of mobility devices, and enhance the clarity and understanding offered by communication aids. Users are keen to know if AI integration will make these devices significantly more expensive or difficult to use, and they question the security and privacy implications of continuous data collection by AI-enabled assistive technologies. Key concerns center on the reliability of machine learning algorithms in critical applications, such as fall detection systems or automated insulin delivery, and the potential for AI to truly understand and adapt to highly individualized user needs, moving beyond generic support functions. This analysis indicates a broad expectation that AI should deliver smarter, proactive, and more seamlessly integrated support, but simultaneously underscores anxieties related to cost, privacy, and clinical efficacy validation.

AI is transforming the assistive device landscape by enabling predictive capabilities and deep personalization that were previously unattainable. Machine learning algorithms are crucial in developing sophisticated neuro-prosthetics that can interpret neural signals with greater accuracy, allowing amputees to control limbs more naturally. In the realm of sensory aids, AI noise reduction and spatial awareness algorithms in hearing aids are drastically improving speech recognition in complex listening environments. For mobility, AI-powered wheelchairs use computer vision and pathfinding algorithms to navigate challenging terrains autonomously, significantly enhancing independence for users with severe physical limitations. The application of AI extends to cognitive assistance, where personalized digital coaches and memory aids are tailored based on learned user behavior patterns and cognitive status fluctuations.

The implementation of AI also drives the shift towards preventative care and real-time intervention. For vulnerable groups living independently, AI-driven monitoring systems analyze biometric and environmental data to predict health crises, such as impending cardiovascular events or increased fall risk, allowing for timely caregiver intervention. This predictive maintenance extends to the devices themselves; AI analyzes usage patterns to flag potential mechanical failures before they occur, improving device reliability and user safety. Despite the immense potential, successful AI integration requires overcoming challenges related to data standardization across diverse patient populations and ensuring ethical guidelines are strictly followed, particularly concerning algorithmic bias that could disadvantage certain demographic groups seeking assistance.

- AI enables highly personalized and adaptive control in prosthetics and exoskeletons based on user intent and gait analysis.

- Machine learning algorithms significantly enhance noise cancellation and speech clarity in advanced hearing aids.

- AI powers predictive analytics for continuous health monitoring, identifying subtle changes that indicate health deterioration (e.g., fall risk prediction).

- Natural Language Processing (NLP) improves the functionality and ease of use for communication aids (e.g., text-to-speech customization).

- Computer vision and sensor fusion allow smart wheelchairs and robotic assistants to navigate complex environments safely and autonomously.

- AI optimizes manufacturing processes (e.g., custom 3D printing of orthotics) reducing production time and costs for personalized devices.

DRO & Impact Forces Of Assistive Devices for Vulnerable Groups Market

The market is predominantly driven by profound demographic shifts, particularly the global acceleration of population aging and the resultant surge in chronic conditions necessitating long-term care and functional support. Technological innovation, including the incorporation of IoT, AI, and advanced robotics, acts as a pivotal force, continually delivering more effective and aesthetically pleasing solutions. Restraints include the high initial cost of advanced devices, especially complex neuro-prosthetics and customized digital aids, often limiting accessibility in lower-income settings. Furthermore, insufficient reimbursement policies in many developing nations and a general lack of user training and technical support can hinder widespread adoption. Opportunities lie in expanding telehealth services that integrate assistive devices, developing robust subscription or rental models to mitigate high upfront costs, and targeting emerging markets with basic, affordable, and durable aids. The impact forces are characterized by strong regulatory push for accessibility and standardization (Positive), countered by complex intellectual property challenges in high-tech segment (Neutral/Negative), and pervasive public health crises demanding better homecare solutions (Positive).

The sustained impact of increasing global longevity cannot be overstated; as life expectancy rises, so does the incidence of age-related vision loss, hearing impairment, mobility issues, and cognitive disorders, creating a foundational, non-cyclical demand for assistive devices. This demographic driver is coupled with supportive government policies and public health campaigns emphasizing independent living and community integration for the disabled. For instance, legislation like the Americans with Disabilities Act (ADA) and similar European directives mandate certain levels of accessibility, forcing institutions and public spaces to invest in necessary assistive infrastructure, thereby stabilizing market demand.

However, the market faces significant headwinds. The specialized nature of many advanced devices means production volumes are lower than mass-market consumer electronics, contributing to high pricing. Regulatory hurdles, particularly in obtaining clinical validation and approval for novel technologies like brain-computer interfaces (BCIs) or robotic aids, can be time-consuming and expensive, slowing down innovation adoption. Furthermore, user resistance or discomfort with bulky, stigmatizing, or technologically complex devices remains a restraint. Overcoming these challenges necessitates a multi-pronged approach involving public subsidies, consumer education, and manufacturers prioritizing human-centered design principles that enhance usability and acceptance.

Segmentation Analysis

The Assistive Devices for Vulnerable Groups Market is systematically segmented based on Type, Vulnerability Group, and End-User, reflecting the diverse applications and specific needs within the industry. This structural breakdown helps analyze specialized demand patterns and technological focal points. Segmentation by type differentiates between devices addressing physical mobility (e.g., wheelchairs, scooters), sensory limitations (e.g., hearing aids, magnifiers), and daily living assistance (e.g., accessible furniture, adaptive kitchen tools). Analyzing these segments reveals varying growth rates, with advanced technological segments demonstrating faster adoption due to incremental performance improvements and regulatory encouragement. The dominant segment remains mobility aids, driven by sheer volume of units required for the elderly.

- By Type:

- Mobility Aids

- Wheelchairs (Manual and Powered)

- Scooters

- Canes and Crutches

- Walkers and Rollators

- Prosthetics and Orthotics

- Sensory Aids

- Hearing Aids (Behind-the-Ear, In-the-Ear, Cochlear Implants)

- Vision and Reading Aids (Braille Devices, Screen Readers, Magnifiers)

- Communication and Information Aids

- Speech Generating Devices (SGDs)

- Assistive Listening Devices (ALDs)

- Medical Furniture and Accessibility Aids

- Patient Lifts and Transfer Equipment

- Medical Beds and Mattresses

- Bathroom and Toilet Aids

- Ramps and Stair Lifts

- By Vulnerability Group:

- Elderly Population

- Physically Disabled

- Sensory Impaired (Hearing and Vision Loss)

- Cognitively Impaired (Alzheimer’s, Dementia)

- By End-User:

- Hospitals and Rehabilitation Centers

- Homecare Settings

- Specialty Clinics (Audiology and Optometry Centers)

- Long-Term Care Facilities

Value Chain Analysis For Assistive Devices for Vulnerable Groups Market

The value chain for assistive devices begins with upstream activities, focusing heavily on raw material sourcing and highly specialized component manufacturing, such as microprocessors for smart devices, lightweight alloys for mobility aids, and advanced materials for biocompatible prosthetics. Key upstream suppliers include specialized electronics manufacturers, material science companies, and battery providers. Innovation in this stage is critical, as improvements in battery life or material strength directly translate to better user experience and device longevity. Manufacturers then convert these components into finished devices, requiring significant investment in research and development, clinical testing, and strict adherence to medical device regulations (e.g., FDA approval, CE marking). Customization capabilities, especially for prosthetics and hearing aids, add complexity and value at the manufacturing stage.

The distribution channel is multifaceted, relying on both direct and indirect routes. Direct distribution often involves large manufacturers selling high-value, specialized equipment (like complex rehabilitation robotics or cochlear implants) directly to major hospitals, governmental healthcare systems, or specialized rehabilitation centers. This channel allows for greater control over installation, training, and maintenance services. The indirect channel utilizes a vast network of medical equipment distributors, regional dealers, specialized assistive technology retailers, and increasingly, e-commerce platforms. These intermediaries play a crucial role in reaching individual consumers, homecare settings, and smaller clinics, providing necessary local support, fitting, and insurance navigation assistance.

Downstream analysis focuses on service delivery, fitting, maintenance, and consumer support, which are paramount in this sector given the personal nature of the products. Audiologists, occupational therapists, physical therapists, and certified prosthetists often act as gatekeepers and final service providers, ensuring the device is correctly prescribed, fitted, and integrated into the user’s life. The success of an assistive device is highly dependent on appropriate training and follow-up care. Therefore, the value chain emphasizes strong post-sales service and ongoing technical support, which not only ensures device efficacy but also builds customer loyalty and trust, particularly crucial when dealing with vulnerable populations requiring consistent reliability.

Assistive Devices for Vulnerable Groups Market Potential Customers

The primary end-users and potential buyers of assistive devices are diverse, encompassing institutional purchasers and individual consumers across multiple care environments. Institutional customers include large public and private hospital networks, which purchase high-volume items such as medical beds, patient lifts, and standard wheelchairs for their inpatient facilities. Rehabilitation centers are also major buyers, focusing on advanced technology like robotic exoskeletons, specialized therapy equipment, and complex diagnostic aids used to maximize patient recovery outcomes. These institutions prioritize durability, ease of sterilization, and integration with existing medical records systems.

The rapidly growing segment of potential customers consists of homecare settings and individual consumers, especially the aging population committed to "aging in place." These buyers seek practical, user-friendly solutions such as stairlifts, home accessibility modifications, automated medication dispensers, and personalized sensory aids (hearing aids, smart glasses). Purchasing decisions for individuals are often influenced by personal preference, ease of use, aesthetic design, and the extent of insurance or government subsidies available. The purchasing power and technical literacy of family caregivers are also significant factors influencing product selection in this segment.

Beyond direct consumers and healthcare providers, governmental agencies and non-profit organizations focused on disability support represent another key segment. These entities often procure devices in bulk for subsidized distribution programs or to equip public infrastructure, such as schools, public transportation, and municipal buildings, to meet accessibility mandates. Specialized clinics, including audiology centers, orthotics practices, and vision centers, represent a crucial B2B customer base, purchasing diagnostic equipment and high-precision customizable devices that require professional fitting and calibration before being dispensed to the end-user.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 45.7 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sonova Holding AG, WS Audiology A S, William Demant Holding A/S, Starkey Laboratories Inc., Invacare Corporation, Ottobock SE & Co. KGaA, Sunrise Medical, Permobil AB, GF Health Products Inc., Medline Industries LP, GN Store Nord A/S, Drive DeVilbiss Healthcare, ReWalk Robotics Ltd., Ekso Bionics Holdings Inc., Bioness Inc., Freedom Scientific, ResMed Inc., Philips Healthcare, Handicare Group AB, Joerns Healthcare LLC |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Assistive Devices for Vulnerable Groups Market Key Technology Landscape

The current technology landscape in the assistive devices market is defined by a convergence of miniaturization, advanced sensor technology, and connectivity, moving devices beyond simple mechanical aids into complex, integrated systems. Miniaturized components, particularly in hearing and vision aids, allow for devices that are less conspicuous and more comfortable, significantly increasing user acceptance and compliance. Sensor technology, including accelerometers, gyroscopes, and pressure sensors, is integrated into mobility devices and personal alarms to provide real-time data on movement patterns, fall detection, and posture monitoring, essential for proactive health management and reducing risks for vulnerable users living alone. Furthermore, the use of advanced battery technologies ensures longer operational life and faster charging cycles, critical for devices that users rely on throughout the day, mitigating anxiety about power failures.

Connectivity, enabled by IoT standards and Bluetooth Low Energy (BLE), is transforming device functionality. Smart assistive devices can now seamlessly connect to smartphones, cloud platforms, and remote monitoring centers, enabling tele-rehabilitation and remote adjustments by healthcare professionals. This capability is particularly vital for managing complex devices like cochlear implants or robotic exoskeletons, where frequent fine-tuning is often necessary. The data gathered through these connected systems facilitates longitudinal studies and provides invaluable insights into the efficacy of the devices in real-world environments, supporting evidence-based adjustments to care plans and optimizing device algorithms for better performance and energy efficiency.

Looking forward, the development of sophisticated neuro-technologies and robotics represents the technological frontier. Brain-Computer Interfaces (BCIs) are emerging for controlling advanced prosthetic limbs and communication systems, offering unprecedented levels of intuitive control for individuals with severe paralysis. Similarly, soft robotics and advanced lightweight materials are making exoskeletons more accessible, less cumbersome, and capable of performing more natural movements, moving them from clinic-only tools to potential daily assistance aids. Additive manufacturing (3D printing) is also crucial, enabling the rapid production of highly customized orthotics and prosthetic sockets that perfectly match the user's anatomy, improving fit, comfort, and functional outcome while reducing manufacturing lead times and waste associated with traditional fabrication methods.

Regional Highlights

- North America: This region holds a commanding market share, characterized by high disposable income, sophisticated healthcare infrastructure, and favorable reimbursement policies for medical devices. The US and Canada are pioneers in adopting advanced technologies like robotic rehabilitation systems and AI-powered personalized hearing aids. Strong regulatory frameworks and significant R&D investment drive continuous innovation.

- Europe: The European market is mature, driven by an extremely high elderly demographic, particularly in Western countries (Germany, Italy, France). Government-funded social care programs ensure widespread access to basic and intermediate assistive technology. Key focus areas include standardization (CE marking), independent living solutions, and integrating digital health records with assistive device data.

- Asia Pacific (APAC): Expected to be the fastest-growing region, driven by the sheer scale of aging populations in Japan, China, and South Korea, coupled with rapidly expanding healthcare budgets and increasing awareness. While costs remain a factor, local manufacturing and government initiatives supporting disability inclusion are accelerating market penetration, particularly for mobility and basic sensory aids.

- Latin America (LATAM): This region is characterized by fragmented but developing markets. Growth is tied to improved economic stability and urbanization, which increases the demand for accessible public spaces and medical infrastructure. Market expansion is concentrated in major economies like Brazil and Mexico, focusing initially on essential mobility and daily living aids.

- Middle East and Africa (MEA): Growth is primarily confined to GCC countries (UAE, Saudi Arabia) which possess the necessary capital for adopting advanced assistive technologies, often driven by government investments in specialized rehabilitation facilities. Challenges include low consumer awareness and limited access to professional fitting and maintenance services across broader African countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Assistive Devices for Vulnerable Groups Market.- Sonova Holding AG

- WS Audiology A S

- William Demant Holding A/S

- Starkey Laboratories Inc.

- Invacare Corporation

- Ottobock SE & Co. KGaA

- Sunrise Medical

- Permobil AB

- GF Health Products Inc.

- Medline Industries LP

- GN Store Nord A/S

- Drive DeVilbiss Healthcare

- ReWalk Robotics Ltd.

- Ekso Bionics Holdings Inc.

- Bioness Inc.

- Freedom Scientific

- ResMed Inc.

- Philips Healthcare

- Handicare Group AB

- Joerns Healthcare LLC

Frequently Asked Questions

Analyze common user questions about the Assistive Devices for Vulnerable Groups market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Assistive Devices market?

The primary driver is the accelerating global aging population, leading to a substantial increase in the prevalence of chronic diseases and age-related functional limitations, which necessitate specialized devices for independent living and rehabilitation support worldwide.

How is Artificial Intelligence (AI) being utilized in modern assistive devices?

AI is used to enable personalized experiences, improve device responsiveness, and enhance functionality through machine learning algorithms. Specific applications include advanced noise reduction in hearing aids, predictive fall risk analysis in home monitoring systems, and intuitive control in robotic prosthetics.

Which geographic region exhibits the highest growth potential for assistive devices?

The Asia Pacific (APAC) region is projected to show the highest Compound Annual Growth Rate (CAGR) due to its vast and rapidly aging population base, increasing healthcare investments, and growing government focus on long-term care infrastructure and accessibility mandates.

What are the main segments covered within the Assistive Devices for Vulnerable Groups Market?

Key segments include Type (Mobility Aids, Sensory Aids, Communication Aids, Medical Furniture), Vulnerability Group (Elderly, Physically Disabled), and End-User (Hospitals, Homecare Settings, Specialty Clinics). Mobility aids currently dominate the market volume.

What are the major challenges restraining market expansion?

Major restraints include the high initial purchase cost of technologically advanced devices, often complex and limited reimbursement policies in developing economies, and the critical need for specialized training and technical support services to ensure effective device utilization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager