Asynchronous Squirrel Cage Induction Generators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434100 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Asynchronous Squirrel Cage Induction Generators Market Size

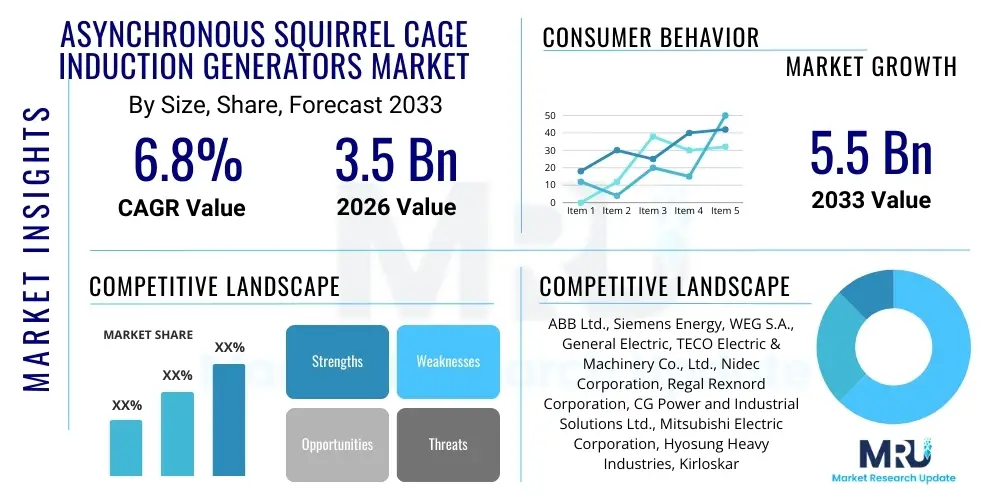

The Asynchronous Squirrel Cage Induction Generators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.5 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the accelerating global transition towards renewable energy sources, particularly wind and small-scale hydro power generation, where these generators offer reliability and cost-effectiveness. The inherent simplicity and robust design of squirrel cage induction generators make them highly attractive for distributed power generation schemes.

Asynchronous Squirrel Cage Induction Generators Market introduction

The Asynchronous Squirrel Cage Induction Generator (ASCIG) market encompasses electrical machinery that converts mechanical energy into electrical energy, operating slightly above synchronous speed, utilizing a rotor that resembles a squirrel cage. These generators are highly valued for their ruggedness, low maintenance requirements, and simple construction, making them foundational components in small-to-medium scale power generation systems, especially those interfaced with unstable energy sources like wind and biogas. Major applications include wind turbines, micro-hydro plants, waste-to-energy facilities, and combined heat and power (CHP) systems, capitalizing on the generator's ability to efficiently feed power back into the utility grid while providing reliable torque characteristics during startup and operation.

The primary benefit of ASCIGs lies in their cost-efficiency and operational simplicity, eliminating the need for complex excitation systems typically required by synchronous generators. They naturally absorb reactive power from the grid, simplifying grid synchronization. Driving factors for market expansion include escalating investments in renewable energy infrastructure, supportive government policies promoting decentralized power generation, and continuous advancements in power electronics, which enhance the grid integration capabilities and control precision of these asynchronous machines. The inherent durability of the squirrel cage design also contributes significantly to a longer operational lifespan and reduced total cost of ownership (TCO).

The technological evolution within this market focuses heavily on optimizing the material composition of the rotor and stator, improving cooling systems, and integrating advanced monitoring sensors to predict maintenance needs. Furthermore, the rising demand for reliable backup power solutions in industrial settings, coupled with the shift towards smaller, modular power units in remote areas, reinforces the crucial role of ASCIGs in the evolving global energy landscape, ensuring flexible and scalable power delivery solutions across diverse geographical regions.

Asynchronous Squirrel Cage Induction Generators Market Executive Summary

The market exhibits robust growth driven by favorable business trends centered around renewable energy integration and industrial efficiency improvements. Regional dynamics show Asia Pacific dominating in terms of installed capacity due to aggressive wind farm development and government subsidies supporting electrification projects, while Europe focuses heavily on replacement cycles and efficiency upgrades. Segment trends highlight the dominance of low voltage generators used in distributed generation schemes and the 1 MW to 5 MW power output range capturing significant investment in mid-sized wind applications. The shift towards variable speed operation, facilitated by advanced frequency converters, is a crucial technological vector shaping competitive strategies.

Business strategies are increasingly focusing on vertical integration, particularly among manufacturers who are integrating generator production with power converter technologies to offer complete drive train solutions optimized for specific renewable sources like offshore wind. Mergers and acquisitions are common as established players seek to acquire expertise in digital twins and predictive maintenance software tailored for asynchronous machines. Geographically, North America demonstrates steady growth, propelled by the repowering of older wind assets and increasing adoption in biomass facilities, requiring robust ASCIG solutions capable of handling intermittent loads and harsh environmental conditions effectively.

In terms of segment evolution, the material segment is witnessing innovation in high-grade copper and specialized electrical steel usage aimed at minimizing losses and improving efficiency metrics (IE4 and beyond), directly addressing the stringent energy efficiency regulations enforced globally. This focus on material science, coupled with standardization efforts across voltage classes, is helping streamline manufacturing processes and reduce production costs, making ASCIGs an even more viable alternative compared to traditional synchronous counterparts for numerous utility and independent power producers (IPPs).

AI Impact Analysis on Asynchronous Squirrel Cage Induction Generators Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can enhance the efficiency, reliability, and lifespan of Asynchronous Squirrel Cage Induction Generators (ASCIGs). Key concerns revolve around the practical implementation of predictive maintenance using vibration and thermal data, optimizing generator control under variable grid conditions, and integrating AI for better fault detection within complex wind turbine systems. Users are seeking definitive proof points regarding AI's ability to minimize downtime, extend Mean Time Between Failures (MTBF), and ultimately reduce operational expenditures (OPEX) in renewable energy farms utilizing these generators. The consensus expectation is that AI will move ASCIG operations from reactive maintenance schedules to highly precise, condition-based maintenance, thereby maximizing asset utilization and profitability across the entire generator fleet. This shift requires sophisticated sensor integration and real-time data analysis capabilities that traditional supervisory control and data acquisition (SCADA) systems often lack.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms on sensor data (vibration, temperature, current signatures) to forecast imminent mechanical or electrical failure, significantly reducing unplanned downtime and optimizing component replacement cycles.

- Enhanced Control System Optimization: Implementing adaptive control algorithms based on AI to instantaneously adjust generator performance parameters (e.g., reactive power output, torque control) in response to fluctuating grid conditions and varying wind speeds, improving power quality and grid stability.

- Digital Twin Creation: Developing high-fidelity digital models of ASCIGs powered by AI for real-time simulation, performance testing under extreme scenarios, and accelerated design validation, leading to faster deployment of optimized units.

- Automated Fault Diagnosis: Using deep learning models to rapidly identify and classify subtle electrical faults (e.g., winding shorts, broken rotor bars) that might be missed by conventional protection relays, ensuring higher operational safety and minimizing secondary damage.

- Optimized Energy Harvesting: Deploying AI to manage the collective operation of multiple ASCIGs within a distributed generation network, maximizing overall energy capture efficiency and coordinating power flow for maximum revenue generation, particularly in microgrid environments.

- Supply Chain and Inventory Management: AI application in forecasting the demand for specific generator components and spare parts, leading to optimized inventory levels and reduced logistics costs for maintenance providers globally.

DRO & Impact Forces Of Asynchronous Squirrel Cage Induction Generators Market

The market's dynamics are dictated by a balanced interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively shape the Impact Forces. The primary driver is the global imperative for decarbonization and the subsequent surge in wind and small-scale hydro power projects, where ASCIGs are the preferred machine due to their ruggedness and low integration cost. Conversely, a significant restraint is the operational requirement of ASCIGs to draw reactive power from the grid for excitation, necessitating external power factor correction equipment or advanced power electronic interfaces, which adds complexity and cost compared to self-exciting synchronous machines. However, the market is presented with substantial opportunities through technological innovation, specifically in advanced power electronics (like full-scale converters) that allow for variable speed operation and decoupled control of active and reactive power, mitigating the reactive power dependence and broadening the application scope of these generators into larger utility-scale projects.

Impact forces are currently leaning positively, heavily influenced by robust government incentives, such as production tax credits and feed-in tariffs, which stabilize the economics of renewable projects utilizing ASCIGs. The increasing demand for distributed generation (DG) and microgrids further accelerates adoption, as ASCIGs are inherently suited for modular, decentralized applications. Nevertheless, the market faces intense competition from permanent magnet synchronous generators (PMSGs), especially in high-efficiency, direct-drive wind turbine applications, pushing ASCIG manufacturers to continuously innovate in rotor design and material science to maintain a competitive edge based on cost and reliability metrics.

The resilience of ASCIGs to harsh environments, particularly in remote or offshore installations, coupled with their inherent mechanical simplicity—meaning fewer points of failure—continues to drive their long-term adoption. Manufacturers are strategically capitalizing on the opportunity presented by the refurbishment and repowering segment of the aging global wind fleet, offering enhanced, higher-efficiency ASCIG replacements that integrate seamlessly with existing infrastructure. This focus on lifecycle management and operational reliability reinforces the market's stable growth trajectory over the forecast period, cementing the ASCIG as a core technology in the transition toward sustainable energy systems globally.

Segmentation Analysis

The Asynchronous Squirrel Cage Induction Generators market is extensively segmented based on power output, voltage level, application, and end-use industry, providing a comprehensive view of market penetration and growth opportunities across diverse operational requirements. Segmentation by power output reveals that units below 1 MW dominate the volume sales, primarily serving decentralized generation, biogas, and small hydro segments, valued for their compactness and ease of installation. Conversely, the 1 MW to 5 MW segment drives revenue growth, being the standard capacity range for onshore wind turbine applications. Analysis by application further differentiates the market, with wind power generation being the leading consumer, though significant growth is observed in biomass and combined heat and power (CHP) sectors, particularly in industrial clusters seeking energy self-sufficiency and improved efficiency through waste utilization.

- By Power Output:

- Below 1 MW

- 1 MW to 5 MW

- Above 5 MW

- By Voltage Level:

- Low Voltage (Below 1 kV)

- Medium Voltage (1 kV to 35 kV)

- High Voltage (Above 35 kV)

- By Application:

- Wind Power Generation

- Hydro Power Generation (Micro/Small Hydro)

- Biomass & Biogas Generation

- Combined Heat and Power (CHP)

- Industrial Waste Heat Recovery

- By End-Use Industry:

- Utility/Grid Operators

- Independent Power Producers (IPPs)

- Industrial & Manufacturing Sector

- Commercial & Residential (Small-scale DG)

Value Chain Analysis For Asynchronous Squirrel Cage Induction Generators Market

The value chain for ASCIGs begins with upstream activities focused on securing high-quality raw materials, predominantly electrical steel (laminations), copper wire for windings, specialized insulation materials, and robust cast iron or fabricated steel for the housing. Upstream analysis highlights the critical importance of secure supply chains for high-grade, low-loss electrical steel, as its quality directly impacts generator efficiency (IE rating). Manufacturers often collaborate closely with material suppliers to ensure compliance with stringent metallurgical specifications and to integrate novel materials that improve thermal management and reduce acoustic noise, driving competitive advantage through optimized efficiency profiles and reduced material waste during fabrication processes.

The core manufacturing and assembly stage involves precise stamping of laminations, meticulous winding of coils, advanced rotor bar construction (squirrel cage design), balancing, and rigorous testing. Distribution channels are typically complex, involving direct sales to Original Equipment Manufacturers (OEMs), particularly those specializing in wind or hydro turbines (Direct Channel), or indirect sales through specialized industrial distributors, electrical equipment wholesalers, and EPC (Engineering, Procurement, and Construction) firms who manage large renewable project installations. The choice of channel depends heavily on the scale and application of the generator; large utility-scale projects almost exclusively utilize direct contracts, whereas smaller DG units often rely on extensive distributor networks for localized support and inventory management.

Downstream activities involve installation, commissioning, operation, and maintenance (O&M) services, representing a significant revenue stream for both generator manufacturers and specialized third-party service providers. The long lifespan of ASCIGs necessitates robust maintenance contracts, focusing on condition monitoring, bearing replacement, and winding integrity checks. The trend toward digital services means downstream providers are increasingly offering AI-enabled monitoring platforms, generating substantial revenue from data analytics and predictive maintenance subscriptions. This focus on long-term service agreements (LTSAs) transforms the downstream relationship from a transactional interaction into a long-term partnership focused on maximizing asset availability and energy yield for the end-user.

Asynchronous Squirrel Cage Induction Generators Market Potential Customers

The primary customer base for Asynchronous Squirrel Cage Induction Generators is diverse, spanning large utility operators and smaller, independent power producers (IPPs), extending into the specialized industrial and manufacturing sectors that prioritize on-site distributed generation (DG). Utilities purchase high-capacity ASCIGs for integration into large-scale renewable energy farms, particularly in regions with established wind resources, valuing the generator's mechanical resilience and straightforward interface capabilities. IPPs, often focused on mid-sized projects (1 MW to 5 MW), are key buyers across wind, small hydro, and emerging geothermal applications, prioritizing total cost of ownership (TCO) and operational reliability over the life cycle of the renewable asset, making ASCIGs highly appealing due to their low maintenance demands.

Beyond traditional energy producers, the industrial sector represents a rapidly expanding segment of potential buyers. Manufacturing facilities, such as those in the chemical, pulp and paper, and food processing industries, utilize ASCIGs extensively in combined heat and power (CHP) systems, biogas recovery from waste, and small-scale waste-to-energy projects. These end-users seek energy independence, reduced reliance on fluctuating grid prices, and enhanced sustainability credentials, which are directly supported by efficient on-site generation using robust ASCIG technology, often integrated with steam or gas turbines for efficiency maximization.

Furthermore, EPC companies and specialized electrical equipment integrators serve as crucial intermediaries, acting as buyers who integrate ASCIGs into complete turnkey power solutions for various public and private sector projects, including remote microgrids and off-grid electrification schemes in developing economies. The reliability of the squirrel cage design is particularly beneficial in these remote deployments where maintenance access is limited. These customers value standardized designs, ease of grid synchronization, and global serviceability, ensuring high levels of technical support throughout the project lifecycle.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.5 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens Energy, WEG S.A., General Electric, TECO Electric & Machinery Co., Ltd., Nidec Corporation, Regal Rexnord Corporation, CG Power and Industrial Solutions Ltd., Mitsubishi Electric Corporation, Hyosung Heavy Industries, Kirloskar Electric Company, VEM Group, Leroy-Somer (Nidec Group), Marathon Electric, Tatung Company, Emerson Electric Co., Toshiba Corporation, Jinle Electric, Rotor Elektrik Motor San. ve Tic. A.S., China Electric Equipment Group (CEEG). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Asynchronous Squirrel Cage Induction Generators Market Key Technology Landscape

The technological landscape of the Asynchronous Squirrel Cage Induction Generators market is characterized by continuous refinement aimed at improving efficiency (IE standards compliance), enhancing power density, and optimizing grid integration capabilities. A crucial technology driving market evolution is the sophisticated integration of Power Electronic Converters, specifically Variable Frequency Drives (VFDs) and Active Front End (AFE) converters. These components allow the ASCIG to operate efficiently across a wide range of speeds (variable speed operation), decoupling the generator frequency from the grid frequency. This is particularly vital in wind applications, maximizing energy capture and mitigating torque fluctuations, while also allowing the ASCIG to provide crucial grid support functions, such as fault ride-through and reactive power compensation, effectively overcoming one of the historical constraints of induction machines.

Material science and manufacturing precision are also key technological focus areas. The adoption of high-performance electrical steel with superior magnetic properties (lower core losses) and optimized conductor materials, such as specialized copper alloys, directly contributes to achieving IE4 (Super Premium Efficiency) and potentially IE5 ratings, satisfying global regulatory pressures for energy efficiency. Furthermore, advancements in bearing technology, including magnetic bearings or specialized lubricated ceramic bearings, are being adopted in high-speed or high-vibration applications to significantly reduce friction losses, enhance operational robustness, and extend the maintenance intervals required for the generator units deployed in remote locations, like offshore wind farms.

Digitalization technologies, encompassing advanced sensor integration, industrial Internet of Things (IIoT) platforms, and cloud-based monitoring systems, are becoming standard features in modern ASCIG packages. These technologies enable real-time collection of operational data (temperature, vibration, current harmonics), facilitating condition-based monitoring and predictive maintenance protocols. This shift enhances the overall reliability and availability of the generator fleet. Additionally, novel cooling techniques, such as liquid cooling systems integrated directly into the stator frame, are essential for managing the thermal burden in high-power density generators, ensuring optimal performance and longevity, particularly when operating under frequent peak load conditions typical of fluctuating renewable energy sources.

Regional Highlights

Regional analysis reveals stark differences in market maturity, growth drivers, and technology adoption rates across continents, reflecting varied government renewable energy mandates and industrial infrastructure maturity. Asia Pacific (APAC) currently dominates the market, driven primarily by massive governmental investments in wind energy development in China and India, coupled with rapid industrialization and the need for decentralized power generation in Southeast Asia. This region exhibits the highest volume growth, characterized by strong demand for both small-scale DG units and utility-scale generators (1 MW to 5 MW) for new installations. Regulatory support and declining component costs are major accelerators in APAC.

Europe represents a highly mature market, where growth is largely attributed to the replacement and modernization (repowering) of older wind farms, focusing intensely on high-efficiency ASCIGs that meet stringent IE standards and possess advanced grid synchronization capabilities. Policies favoring offshore wind projects, particularly in the UK, Germany, and the Nordic countries, drive demand for large-scale, robust generators optimized for challenging marine environments. Furthermore, Europe leads in the adoption of ASCIGs for biomass, biogas, and waste-to-energy projects, leveraging decades of established industrial waste management infrastructure.

North America maintains steady growth, fueled by renewable portfolio standards (RPS) in the US and Canada, stimulating investment in onshore wind farms and the burgeoning microgrid sector, especially in remote communities and industrial zones. The market here emphasizes robust, high-reliability generators capable of operating in diverse climatic conditions, ranging from extreme cold to intense heat. Latin America and the Middle East & Africa (MEA) are emerging regions, where infrastructure development and rural electrification initiatives provide significant opportunities for small to medium-sized ASCIGs, particularly in hydro and solar hybridization applications where their ruggedness and simplicity offer distinct logistical advantages.

- Asia Pacific (APAC): Leading market share due to aggressive wind energy expansion in China and India, substantial government subsidies, and high volume demand for generators below 5 MW capacity.

- Europe: Focus on high-efficiency repowering projects, stringent IE standards compliance, and substantial investments in offshore wind and bio-energy generation capacity.

- North America: Stable growth driven by established wind energy infrastructure, increasing adoption of microgrids, and the repowering of aging wind turbine fleets across the U.S. and Canada.

- Latin America: Emerging market potential centered on small-scale hydro projects and regional biomass applications, prioritizing cost-effective and reliable machinery.

- Middle East & Africa (MEA): Growth prospects in localized distributed generation schemes, rural electrification, and leveraging ASCIGs in conjunction with large industrial co-generation facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Asynchronous Squirrel Cage Induction Generators Market.- ABB Ltd.

- Siemens Energy

- WEG S.A.

- General Electric

- TECO Electric & Machinery Co., Ltd.

- Nidec Corporation

- Regal Rexnord Corporation

- CG Power and Industrial Solutions Ltd.

- Mitsubishi Electric Corporation

- Hyosung Heavy Industries

- Kirloskar Electric Company

- VEM Group

- Leroy-Somer (Nidec Group)

- Marathon Electric

- Tatung Company

- Emerson Electric Co.

- Toshiba Corporation

- Jinle Electric

- Rotor Elektrik Motor San. ve Tic. A.S.

- China Electric Equipment Group (CEEG)

Frequently Asked Questions

Analyze common user questions about the Asynchronous Squirrel Cage Induction Generators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of Asynchronous Squirrel Cage Induction Generators (ASCIGs) over synchronous generators?

ASCIGs offer superior mechanical simplicity, requiring no external DC excitation system or brushes, resulting in lower manufacturing costs, less maintenance, and higher ruggedness. They are inherently suited for direct connection to small-to-medium renewable sources like wind and hydro due to their robust design and simple integration requirements, often requiring only reactive power support from the connected grid.

In which power range are ASCIGs most commonly deployed in renewable energy applications?

ASCIGs are predominantly deployed in the power range below 5 MW. The segment ranging from 1 MW to 5 MW is crucial for onshore wind turbines and utility-scale hydro applications, balancing efficiency and cost-effectiveness. Smaller units (below 1 MW) are highly favored for decentralized generation, biogas recovery, and microgrid applications due to their compactness and ease of installation.

How do technological advancements address the reactive power consumption issue inherent to ASCIGs?

The reliance on reactive power is mitigated through the integration of modern power electronic converters, such as Variable Frequency Drives (VFDs) and Active Front End (AFE) technologies. These converters enable the generator to operate at variable speeds while allowing independent control over reactive power output, minimizing grid impact and enhancing the generator's contribution to grid stability, often surpassing the capabilities of older fixed-speed models.

Which geographical region exhibits the highest growth potential for the ASCIG market?

The Asia Pacific (APAC) region, led by China and India, presents the highest growth potential. This is driven by aggressive governmental targets for renewable energy deployment, ongoing rapid industrialization requiring localized power solutions, and substantial infrastructure spending focused on establishing large-scale wind and small hydro projects utilizing standardized and reliable ASCIG technology.

What role does digitalization play in enhancing the reliability and lifespan of Asynchronous Generators?

Digitalization, powered by IIoT sensors and AI algorithms, enables highly accurate predictive maintenance (PdM). By continuously monitoring parameters like vibration, winding temperature, and current signatures, operators can identify potential faults well before failure, thereby maximizing Mean Time Between Failures (MTBF), optimizing maintenance schedules, and significantly extending the overall operational lifespan of the generator assets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager