ATM Managed Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434264 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

ATM Managed Services Market Size

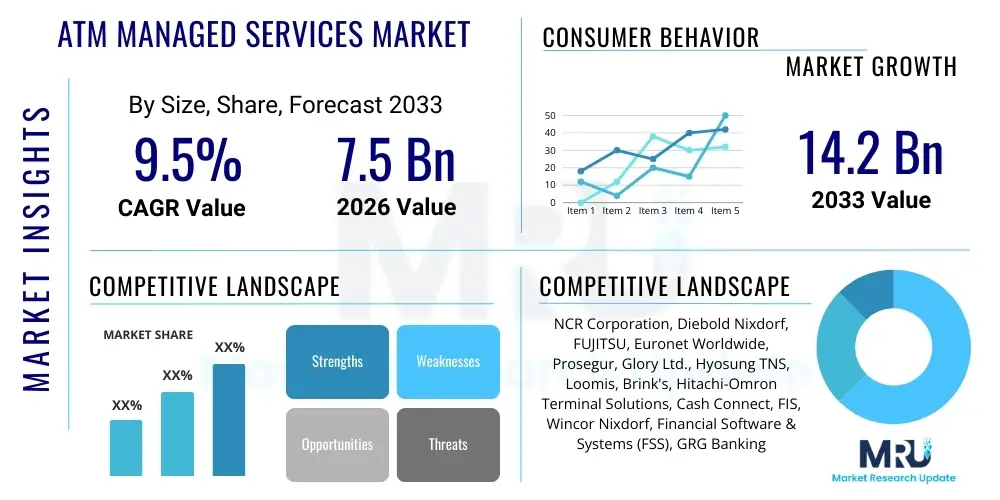

The ATM Managed Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 7.5 Billion in 2026 and is projected to reach USD 14.2 Billion by the end of the forecast period in 2033.

ATM Managed Services Market introduction

The ATM Managed Services Market encompasses the outsourcing of various non-core functions related to Automated Teller Machines (ATMs) by financial institutions and Independent ATM Deployers (IADs) to specialized third-party service providers. This includes comprehensive cash management, first-line and second-line maintenance, software deployment and update management, transaction processing, security monitoring, and network connectivity. The core product offering is a holistic service package designed to ensure optimal uptime, regulatory compliance, and cost efficiency for the ATM network owner. Major applications span retail banking, self-service banking areas, high-traffic commercial zones, and remote locations requiring reliable cash access. The primary benefits derived from these services include reduced operational expenditure, enhanced security protocols, superior customer experience due to high machine availability, and the ability for banks to focus strategic resources on core banking operations rather than hardware management. Driving factors fueling market expansion include the increasing complexity of ATM software, the necessity for robust cybersecurity measures, the growth of outsourcing trends in mature and emerging economies, and the continuous demand for cash transactions despite the rise of digital payments.

ATM Managed Services Market Executive Summary

Current business trends indicate a strong shift toward performance-based contracts, where service providers are incentivized to maintain stringent uptime SLAs, driving innovation in preventative maintenance and remote diagnostic capabilities. Consolidation among smaller regional players and the expansion of global IT service giants into the financial technology space are redefining the competitive landscape, emphasizing end-to-end integration of services, particularly integrating ATM management with broader branch transformation strategies. Segment trends show significant growth in the Cash Management and Security Services segments, driven by regulatory pressure to safeguard funds and the increasing threat of physical and logical attacks on terminals. Furthermore, the rising deployment of smart ATMs capable of advanced functionalities, such as envelope-less deposits and contactless transactions, necessitates specialized maintenance expertise, favoring managed service contracts over in-house support. Regionally, the Asia Pacific (APAC) market is exhibiting the fastest growth due to rapid financial inclusion initiatives, high ATM deployment rates in developing countries, and governmental mandates promoting self-service channels. North America and Europe, while mature, are characterized by high adoption of sophisticated security and software management services focused on modernization and compliance with evolving standards like PCI-DSS and GDPR.

AI Impact Analysis on ATM Managed Services Market

User inquiries frequently center on how Artificial Intelligence (AI) can move ATM management from reactive maintenance to predictive servicing, asking about the feasibility and return on investment of deploying AI-driven anomaly detection and fraud prevention systems. Common concerns involve data privacy when transmitting sensitive usage patterns to AI platforms and the potential for AI tools to displace human technical staff involved in first-line maintenance and cash forecasting. However, the overarching expectation is that AI will be pivotal in enhancing operational efficiency, specifically by optimizing cash replenishment cycles, which is a high-cost component of managed services. Users anticipate that machine learning algorithms will revolutionize uptime guarantees by preemptively identifying component failure based on sensor data analysis, leading to fewer service calls and significantly higher customer satisfaction. This shift leverages AI to transform vast amounts of diagnostic data into actionable insights, making ATM networks more intelligent, resilient, and inherently more profitable for both deployers and service providers.

- AI-driven predictive maintenance forecasts hardware failures, maximizing ATM uptime and reducing unplanned service interruptions.

- Optimized cash logistics management utilizes machine learning to predict cash demand fluctuations, minimizing both out-of-cash situations and excess cash holdings.

- Enhanced fraud detection through behavioral analytics identifies unusual transaction patterns and potential skimming attempts in real-time.

- Automated ticket generation and routing accelerate the resolution process for technical issues, improving mean time to repair (MTTR).

- Personalized user experience delivery, allowing ATMs to adjust services based on recognized customer profiles and historical usage.

- Advanced security monitoring incorporates AI video analytics for perimeter surveillance and unauthorized access alerts.

- AI platforms facilitate automated software updates and configuration management across dispersed networks, ensuring rapid deployment and compliance.

DRO & Impact Forces Of ATM Managed Services Market

The ATM Managed Services Market is strongly driven by the increasing need for financial institutions to reduce non-core operating expenses and the simultaneous pressure to maintain high levels of service availability, necessitating outsourcing expertise. Restraints primarily involve the high initial capital investment required for modern ATM infrastructure and the inherent security risks associated with sharing sensitive operational data with third-party vendors, posing compliance challenges in highly regulated regions. Opportunities lie in the proliferation of new generation smart ATMs and the untapped potential in emerging markets for rapid deployment of financial access points, particularly utilizing customized, smaller-footprint terminals. Furthermore, the integration of Managed Services with cybersecurity and compliance reporting creates value-added offerings. The primary impact force accelerating market growth is the compelling economic argument for operational efficiency; by externalizing complex logistics and maintenance, banks can achieve scalable cost savings and better focus on customer-facing innovations. The secondary impact force is technological convergence, where IoT, cloud computing, and AI are bundled into integrated service offerings, making in-house management increasingly complex and expensive, thus reinforcing the attractiveness of specialized outsourcing partners.

Segmentation Analysis

The ATM Managed Services market is analyzed based on the type of service offered, the specific deployment location, and the functional role the service fulfills. Service type segmentation focuses on differentiating between purely technical maintenance and complex logistical services like cash management, which involves significant regulatory oversight and supply chain expertise. Location-based segmentation distinguishes between urban, high-volume deployments and remote, often off-site installations, each requiring tailored service level agreements (SLAs) and logistical approaches. The market is also segmented by functional roles, highlighting the distinction between services focused on ensuring physical uptime (maintenance) versus services ensuring digital security and transactional capability (software management and security services). This detailed segmentation assists service providers in developing customized, modular packages tailored to the unique operational challenges and regulatory environments faced by different client types, ranging from large global banks to local credit unions and independent operators.

- Service Type:

- ATM Monitoring

- Cash Management (Forecasting, Replenishment, CIT Services)

- ATM Maintenance (First-Line Maintenance (FLM) and Second-Line Maintenance (SLM))

- Security and Anti-Skimming Solutions

- Software and System Management

- Transaction Processing

- ATM Type:

- Conventional ATMs (Cash Dispensers)

- Smart/Advanced Function ATMs (Deposit, Recycling)

- White Label ATMs

- Brown Label ATMs

- Deployment Location:

- On-site (Bank Branches)

- Off-site (Retail Locations, Transit Hubs, Standalone Kiosks)

- End User:

- Banks and Financial Institutions

- Independent ATM Deployers (IADs)

- Retailers and Other Commercial Entities

Value Chain Analysis For ATM Managed Services Market

The value chain for ATM Managed Services begins with upstream activities centered on hardware procurement and software development, where major ATM manufacturers (OEMs) and specialized financial technology developers play crucial roles. This initial stage involves sourcing high-quality, durable terminals and developing secure, compliant operating systems and application software. Midstream activities are dominated by the core managed service providers, who integrate these components, establish extensive service networks, and develop sophisticated remote monitoring and diagnostic tools. They invest heavily in logistics infrastructure, including secure vaults, armored transportation (CIT), and certified technical staff capable of both first-line (basic fault fixing, media replacement) and second-line (complex module repair, component replacement) maintenance, requiring deep collaboration with hardware suppliers for parts inventory and technical training.

Downstream activities focus on the delivery of the specialized service packages directly to the end-user clients—banks, credit unions, and IADs. The distribution channel is predominantly direct, characterized by long-term contractual agreements and Service Level Agreements (SLAs) outlining specific uptime guarantees, response times, and penalty clauses for non-compliance. While the relationship is direct, service execution often involves complex subcontracting arrangements, particularly for cash-in-transit (CIT) and localized maintenance tasks in remote areas, necessitating rigorous vetting and management of these indirect partners to maintain quality standards and security protocols. Effective value realization hinges on the service provider's ability to minimize operational costs through efficiency gains—such as optimized routing for technicians and proactive, data-driven cash forecasting—while simultaneously maximizing terminal availability for the client base.

The optimization of the value chain is increasingly reliant on digitalization. Cloud-based platforms are now integral for centralized network monitoring and reporting, providing clients with real-time visibility into the performance metrics of their entire fleet. This transparency enhances trust and facilitates performance-based contracting. Furthermore, the ability to rapidly deploy security patches and functional upgrades remotely through the service network significantly reduces the time-to-market for new features and ensures continuous adherence to ever-changing regulatory frameworks, such as anti-money laundering (AML) protocols and evolving PCI compliance standards. Service providers that effectively integrate hardware sourcing, logistics, software management, and field services into a seamless, data-driven offering generate the highest value and maintain competitive advantage in the market.

ATM Managed Services Market Potential Customers

The primary customers for ATM Managed Services are categorized broadly into financial institutions and independent deployers, both of whom seek to leverage external expertise for operational optimization. Banks and large financial institutions represent the foundational customer base. These organizations face intense pressure to maintain secure, reliable self-service channels while cutting down on high internal operational costs associated with maintaining a large, distributed fleet of machines, which often involves significant investment in staffing, training, logistics, and proprietary monitoring software. For these established players, outsourcing specific, complex functions like cash management and second-line maintenance allows them to reallocate core banking staff toward strategic initiatives focused on customer relationship management and digital transformation, viewing the service provider as a strategic partner critical for maintaining brand reputation through consistent ATM availability.

Independent ATM Deployers (IADs) constitute the second crucial segment of potential customers. IADs typically focus on placing ATMs in high-traffic or underbanked commercial locations, such as retail stores, transit stations, and entertainment venues, often owning the terminal hardware but requiring comprehensive service bundles to ensure profitability. Since IAD business models are highly dependent on transaction volume and low operating costs, they are significantly more reliant on efficient, cost-effective managed services for everything from cash provisioning and basic upkeep (FLM) to transaction switching and regulatory compliance reporting. The services provided enable IADs to scale their networks quickly across vast geographical areas without needing to build out proprietary maintenance and cash logistics infrastructures, making outsourcing an essential component of their operating model and growth strategy.

Furthermore, specialized segments such as credit unions, non-bank financial service providers, and large national retailers are increasingly becoming potential customers. Credit unions, often lacking the scale and technological resources of multinational banks, utilize managed services to offer competitive ATM access to their members affordably. Retailers deploying proprietary cash management systems or in-store banking kiosks often require customized services that integrate seamlessly with their point-of-sale (POS) systems and internal network architecture. The decision matrix for all these potential buyers revolves around three critical axes: total cost of ownership reduction, guaranteed uptime performance (measured by stringent SLAs), and the proven ability of the service provider to manage evolving cybersecurity and regulatory requirements effectively across heterogeneous hardware and software environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 14.2 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NCR Corporation, Diebold Nixdorf, FUJITSU, Euronet Worldwide, Prosegur, Glory Ltd., Hyosung TNS, Loomis, Brink's, Hitachi-Omron Terminal Solutions, Cash Connect, FIS, Wincor Nixdorf, Financial Software & Systems (FSS), GRG Banking |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ATM Managed Services Market Key Technology Landscape

The technological underpinnings of the ATM Managed Services Market are rapidly evolving, characterized by the integration of IoT, advanced telemetry systems, and cloud-based architecture. Centralized monitoring platforms, often utilizing Software as a Service (SaaS) models, are critical, enabling service providers to gain real-time visibility into the performance, status, and health of thousands of geographically dispersed terminals. These platforms rely on sophisticated telemetry systems embedded within the ATMs that transmit continuous data streams regarding transaction activity, hardware component performance (e.g., cash dispenser lifespan, printer status), and environmental conditions. The adoption of cloud infrastructure ensures scalability, allowing service providers to manage fluctuating network sizes and rapidly deploy new monitoring and diagnostic tools without significant localized hardware upgrades, which is essential for maintaining agility in a diverse deployment landscape.

A significant focus within the current technological landscape is on enhancing security through both physical and logical defense mechanisms. This includes the deployment of advanced anti-skimming technology that uses jamming techniques or dynamic protection layers to thwart physical attacks, coupled with robust, multi-layered cybersecurity software. Technologies such as biometric authentication for service personnel and encryption for data transmission (both at rest and in transit) are standard requirements. Furthermore, modern managed services leverage predictive analytics, often powered by Machine Learning (ML) algorithms, to analyze historical failure patterns and operational metrics. This allows for the transition from costly, scheduled preventative maintenance to highly efficient, condition-based maintenance, significantly reducing operational downtime and optimizing the deployment of specialized technical resources.

The future technology roadmap is heavily influenced by the adoption of automation and deep integration between ATM hardware, back-office systems, and customer self-service channels. APIs and open banking standards are facilitating smoother integration of third-party applications and transaction processing platforms, enabling managed service providers to offer value-added services beyond basic maintenance, such as dynamic digital signage management and targeted marketing at the terminal. Moreover, the increased proliferation of cash recyclers and sophisticated smart ATMs requires service providers to master complex component calibration and software management skills. These technological shifts necessitate continuous investment in IT infrastructure and specialized training for field technicians, solidifying the trend that only technologically advanced third-party specialists can effectively manage these complex, heterogeneous networks at scale.

Regional Highlights

- North America: This region is characterized by high operational maturity and stringent regulatory oversight. Managed services penetration is extremely high, driven primarily by major banks focusing on digital transformation and operational efficiency. The market here emphasizes advanced software management, cybersecurity services (due to high levels of fraud risk), and compliance-driven upgrades (e.g., ADA compliance, terminal operating system migration). The focus is on leveraging managed services to extend the lifespan of existing fleets while incorporating modern features like contactless and cloud connectivity.

- Europe: The European market, particularly Western Europe, shows strong demand for outsourced cash management and regulatory adherence services, especially concerning GDPR and PSD2 directives which impact transaction data handling. Fragmentation across national banking systems necessitates customized service delivery models. The drive toward cash recycling technology and "branch transformation" programs, where the ATM functions as a key self-service hub, accelerates the adoption of comprehensive managed service contracts that integrate technical and logistical support.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, fueled by expansive ATM deployment in rapidly developing economies like India, China, and Southeast Asia, aimed at driving financial inclusion. The sheer volume and geographical dispersion of new installations necessitate comprehensive outsourcing. Demand is high for FLM, SLM, and, critically, cost-effective cash logistics management in both urban and rural settings. White label and brown label ATM growth significantly contributes to the demand for external managed service expertise due to their asset-light operational models.

- Latin America: This region demonstrates a growing need for security-focused managed services due to high levels of physical and logical fraud. Banks are increasingly outsourcing operations to mitigate security risks and achieve cost savings against high inflation and variable local regulatory environments. The market exhibits high growth potential for centralized monitoring and anti-skimming solutions, bundled with reliable cash-in-transit services, which are critical components of maintaining network integrity.

- Middle East and Africa (MEA): The MEA market is marked by rapid financial modernization in the GCC countries and significant financial inclusion initiatives in Africa. This bifurcation results in high demand for high-end, secure ATM maintenance in the Middle East, while African countries prioritize foundational services like basic maintenance and accessible cash logistics infrastructure to support growing populations of first-time bank users. Political instability and challenging infrastructure in certain areas necessitate highly specialized and resilient managed service supply chains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ATM Managed Services Market.- NCR Corporation

- Diebold Nixdorf

- Euronet Worldwide Inc.

- Fujitsu Limited

- Glory Ltd.

- Hyosung TNS Inc.

- Hitachi-Omron Terminal Solutions, Corp.

- FIS (Fidelity National Information Services)

- Wincor Nixdorf International GmbH

- Financial Software & Systems (FSS)

- Prosegur Cash S.A.

- The Brink's Company

- Loomis AB

- Cash Connect (A division of ATD)

- Cardtronics (Now part of NCR Corporation)

- GRG Banking Equipment Co. Ltd.

- Cennox Group

- ASSET Technology Group

- Perto S.A.

- IntelliTrans (Part of TransCore)

Frequently Asked Questions

Analyze common user questions about the ATM Managed Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What specific functions are typically outsourced in ATM Managed Services contracts?

Outsourcing contracts generally cover essential non-core operations including First-Line Maintenance (FLM) for basic repairs, Second-Line Maintenance (SLM) for complex hardware fixes, comprehensive Cash Management (forecasting and replenishment), remote Monitoring and Alerting, and Software Deployment and Security Patch Management across the ATM network.

How does outsourcing ATM management affect operational costs for banks?

Outsourcing significantly reduces Total Cost of Ownership (TCO) by converting high fixed costs (staffing, logistics infrastructure) into manageable variable operating expenses (OpEx). It also drives cost efficiency through economies of scale, optimized cash logistics, and improved technical uptime, reducing penalty costs associated with downtime.

What role does predictive maintenance technology play in modern ATM Managed Services?

Predictive maintenance uses AI and machine learning to analyze real-time telemetry data from ATMs, forecasting potential hardware failures before they occur. This allows service providers to schedule proactive repairs, dramatically increasing terminal uptime, minimizing disruptions, and improving Service Level Agreement (SLA) compliance.

Which geographical region currently leads the growth in the ATM Managed Services Market?

The Asia Pacific (APAC) region is projected to lead market growth, driven by aggressive financial inclusion mandates, rapid deployment of new ATM terminals, and the high adoption rate of outsourcing services by both banks and Independent ATM Deployers (IADs) across developing economies.

What are the primary security concerns managed by service providers in this market?

Key security concerns addressed include physical attacks (e.g., skimming, card trapping, jackpotting) and logical attacks (malware injection). Managed service providers deploy multi-layered defenses, including advanced anti-skimming hardware, real-time fraud monitoring, secure network segregation, and rapid deployment of certified software security patches.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager