ATM Outsourcing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433639 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

ATM Outsourcing Market Size

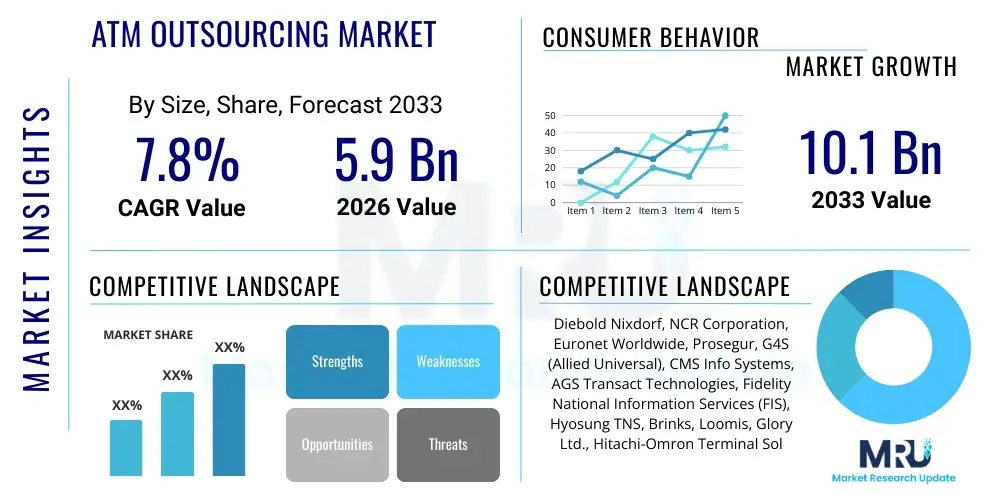

The ATM Outsourcing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 5.9 billion in 2026 and is projected to reach USD 10.1 billion by the end of the forecast period in 2033.

ATM Outsourcing Market introduction

The ATM Outsourcing Market involves contracting third-party service providers (TSPs) to manage, operate, maintain, and sometimes own Automated Teller Machine (ATM) networks for financial institutions (FIs) and independent deployers (IDCs). This practice allows FIs to significantly reduce capital expenditure, transition from fixed costs to variable operational costs, and focus internal resources on core banking services and digital transformation initiatives. Services encompassed under outsourcing range from basic maintenance and cash replenishment to advanced services like software management, network monitoring, security updates, compliance reporting, and integrated digital services delivery at the ATM terminal. The market is driven by the increasing complexity of regulatory standards, the need for enhanced physical and logical security measures, and the high cost associated with upgrading aging ATM fleets to comply with global standards like EMV and biometric integration. The evolution of ATM technology into Automated Deposit Terminals (ADTs) and multi-functional kiosks further necessitates specialized expertise, propelling the adoption of comprehensive outsourcing models across diverse geographical landscapes.

The core product in this market is the comprehensive management service package, structured typically around either managed services (where the FI owns the asset but outsources operations) or full-service outsourcing (where the service provider owns and operates the entire fleet). Major applications of ATM outsourcing extend beyond traditional cash withdrawals, including bill payments, cardless transactions, money transfers, and even basic account opening or loan inquiry services, positioning the ATM as a critical, multi-channel customer touchpoint. Key benefits derived by adopting these outsourced models include improved network uptime and reliability, enhanced fraud protection through specialized security monitoring, reduced Total Cost of Ownership (TCO), and faster deployment of new functionalities compliant with the latest industry protocols. The shift towards next-generation ATMs, which are smarter, connected, and capable of integrating advanced software solutions, further validates the outsourcing proposition, as specialized vendors possess the necessary technical skills and economies of scale to handle these complex systems efficiently.

Driving factors for sustained market growth include the rising global demand for efficient, secure cash access points, particularly in emerging economies where financial inclusion initiatives heavily rely on ATM infrastructure expansion. Furthermore, stringent regulatory requirements, such as Payment Card Industry Data Security Standard (PCI DSS) compliance and regional data protection laws, make in-house management increasingly burdensome for mid-sized and smaller FIs, favoring experienced outsourced partners who guarantee compliance. Technological advancements, notably the integration of cloud-based ATM monitoring platforms and predictive maintenance utilizing Internet of Things (IoT) sensors, are enhancing operational efficiencies, making outsourcing economically attractive. Conversely, the market must navigate challenges posed by the rapid adoption of digital payment methods, though cash remains essential globally, and the capital-intensive nature of initial transition phases, demanding rigorous Service Level Agreements (SLAs) and robust governance frameworks between FIs and outsourcing partners.

ATM Outsourcing Market Executive Summary

The ATM Outsourcing Market is characterized by robust business trends focusing on modernization, security enhancements, and the shift toward outcome-based service contracts rather than traditional fee-for-service models. Financial institutions are increasingly prioritizing full-service outsourcing, allowing providers to take on asset ownership and lifecycle management, thereby accelerating fleet upgrade cycles necessary for implementing advanced features like biometric authentication and contactless interfaces. Key industry movements involve consolidation among service providers seeking economies of scale and specialized technology acquisitions to offer end-to-end management solutions, particularly in cash management logistics and software application handling. The integration of predictive analytics for minimizing downtime and optimizing cash allocation is becoming standard practice, driving efficiency and profitability for both the service provider and the client. The overall business landscape is evolving from merely operational management to strategic partnership focused on enhancing customer experience and leveraging the ATM channel for broader banking services, necessitating higher accountability and transparency in service delivery metrics.

Regionally, the market exhibits divergent maturity levels. North America and Europe, characterized by highly saturated but aging ATM networks, emphasize sophisticated managed services focused on software modernization, security upgrades (especially related to malware and skimmer attacks), and regulatory compliance (like ADA accessibility standards). In contrast, the Asia Pacific (APAC) region and Latin America are the primary growth engines, driven by rapid urbanization, substantial investment in financial inclusion, and new ATM installations, often deployed in non-bank locations (off-site deployment) managed entirely by third-party independent deployers (IDCs) and outsourcing vendors. The Middle East and Africa (MEA) are also witnessing significant growth, spurred by governmental initiatives promoting cashless economies while maintaining robust cash infrastructure reliability, particularly for government benefit disbursements and remittances. Cross-border service delivery standardization and localized customization for unique regulatory environments remain crucial considerations for global outsourcing providers operating across these distinct regional markets.

Segment trends highlight the growing dominance of the Managed Services segment due to its flexibility and lower initial capital outlay compared to hardware sales or maintenance-only contracts. Within the service type, cash management services continue to account for a substantial revenue share, reflecting the complexity and liability associated with physical cash logistics and replenishment optimization. However, the software and security management segment is experiencing the fastest growth rate, propelled by the persistent threat landscape and the continuous need for software patching, remote monitoring, and proactive cyber defense strategies tailored specifically for interconnected ATM systems. Furthermore, the segmentation by end-user shows a strong outsourcing momentum among Tier 1 and Tier 2 banks seeking operational efficiency gains, while Independent Deployers (IDCs) inherently rely on outsourcing for deployment and maintenance, cementing their foundational role in the overall market structure. The convergence of physical and digital security protocols is dictating investment priorities across all service categories.

AI Impact Analysis on ATM Outsourcing Market

User queries regarding AI's influence in ATM outsourcing frequently revolve around the potential for predictive maintenance, fraud prevention capabilities, and the automation of service desk operations. Key themes include how AI can enhance the uptime guarantee provided by outsourcers, whether machine learning models can accurately forecast cash demand in highly variable locations (cash optimization), and the impact of AI-driven security analysis on reducing financial losses from advanced physical and cyber threats. Users also express curiosity about the integration of AI-powered conversational interfaces (chatbots) for level-one technical support and remote troubleshooting, questioning if these technologies will displace human service technicians or merely augment their capabilities. The consensus expectation is that AI will be a core differentiator for outsourcing providers, enabling them to offer superior Service Level Agreements (SLAs) through proactive intervention rather than reactive repair, fundamentally changing the economics and reliability of ATM management.

- AI enhances Predictive Maintenance by analyzing real-time performance data and sensor readings to forecast component failure before downtime occurs.

- Machine Learning (ML) models optimize cash logistics, accurately predicting withdrawal patterns based on historical data, local events, and economic indicators, minimizing vault cash and replenishment costs.

- AI-driven fraud detection systems monitor transaction behavior and physical device anomalies (e.g., subtle changes indicative of skimmers or deep insert attacks) in real-time, improving security effectiveness.

- Natural Language Processing (NLP) is used in automated customer support interfaces deployed at the ATM or through remote monitoring centers, handling routine troubleshooting requests.

- Robotic Process Automation (RPA) streamlines back-office functions like compliance reporting, reconciliation, and automated software patching across the network.

- AI facilitates personalized ATM user experiences, recommending services or limits based on recognized user profiles and habits.

DRO & Impact Forces Of ATM Outsourcing Market

The market dynamics are governed by powerful structural forces originating from technological advancement, evolving regulatory landscapes, and financial imperatives faced by banking institutions globally. Key drivers include the overwhelming pressure on FIs to reduce operational expenditure and divest non-core asset management responsibilities, particularly as ATM networks age and require substantial capital injections for modernization (e.g., implementing Windows 10/11 operating systems and enhanced security hardware). The complexity associated with maintaining diverse, multi-vendor ATM fleets and ensuring continuous compliance with fluctuating data security and accessibility standards provides a strong impetus for professional outsourcing, leveraging vendors' specialized technical personnel and centralized governance frameworks. Furthermore, the rising proliferation of non-traditional ATM locations, often managed by IDCs in retail environments, demands scalable, reliable maintenance and cash management infrastructure, accelerating the adoption of comprehensive outsourcing partnerships that span logistics, monitoring, and software updates across disparate geographical territories.

Restraints primarily stem from inherent risks associated with transferring critical operations to third parties, including potential data breaches, inadequate response times impacting customer satisfaction, and challenges in defining and enforcing stringent Service Level Agreements (SLAs) that align vendor incentives with FI performance metrics. Financial institutions often harbor legitimate concerns regarding loss of control over customer experience and sensitive operational data, necessitating robust contractual frameworks and comprehensive auditing mechanisms. Moreover, the significant initial cost and complexity involved in migrating an existing, large-scale ATM network from in-house management to an outsourced model can present a substantial barrier to entry, particularly for smaller banks with limited IT budgets or legacy infrastructure. The ongoing market transition towards digital payments, while not eliminating cash usage, introduces uncertainty regarding long-term ATM usage growth projections, sometimes tempering large-scale, multi-year outsourcing investment decisions despite short-term operational savings.

Opportunities are abundant in the expansion of value-added services offered through outsourced contracts, moving beyond routine maintenance to encompass complex software management, terminal driving, and security operations center (SOC) monitoring specifically tailored for ATM environments. Geographic expansion into underserved rural and semi-urban areas, especially within the APAC and MEA regions, presents lucrative installation and management opportunities fueled by governmental financial inclusion agendas. A significant opportunity lies in helping FIs implement advanced self-service technologies, transforming ATMs into high-functioning automated banking kiosks capable of handling a wider array of transactional and non-transactional services (e.g., video teller assistance, biometric onboarding), demanding specialized technical expertise that is most effectively delivered through outsourced partnerships. The impact forces acting upon the market are characterized by high substitution threat from digital wallets (medium-to-high, offset by persistent cash reliance), high bargaining power of large FIs (demanding competitive SLAs), and high competitive rivalry among global and regional outsourcing specialists focused on technological differentiation and cost leadership.

Segmentation Analysis

The ATM Outsourcing Market is extensively segmented based on the scope of services delivered, the operational model adopted, the technology deployed, and the specific end-user category. Service type segmentation is crucial, differentiating between foundational activities like cash management and maintenance, and high-growth areas such as network management, security provision, and software implementation/upgrade services. The deployment model dictates ownership structure, differentiating between managed services (where the bank retains asset ownership) and comprehensive outsourcing (including asset ownership transfer), which significantly impacts contract length, capital expenditure, and vendor responsibility scope. End-user classification separates high-volume financial institutions from smaller community banks, credit unions, and non-bank independent deployers (IDCs), each having unique service requirements and cost sensitivities, allowing outsourcing providers to tailor their offerings accordingly.

- By Service Type:

- Cash Management Services (Cash Forecasting, Replenishment, CIT Logistics)

- Maintenance and Repair Services (First-Line Maintenance, Second-Line Maintenance)

- Managed Services (Terminal Driving, Network Monitoring, Disaster Recovery)

- Security Management Services (Physical Security, Logical Security, Anti-Skimming Solutions)

- Software and Application Management

- By Operational Model:

- Managed Services

- Full-Service Outsourcing (Including Asset Ownership)

- By End User:

- Banks and Financial Institutions (FIs)

- Independent ATM Deployers (IADs/IDCs)

- By Location:

- On-site ATMs (Branch Locations)

- Off-site ATMs (Retail, Transit Hubs, Remote Locations)

Value Chain Analysis For ATM Outsourcing Market

The ATM Outsourcing value chain begins with Upstream Analysis, which focuses on the key suppliers providing the foundational assets and technologies. This includes ATM hardware manufacturers (OEMs like NCR, Diebold Nixdorf, etc.), specialized software developers (for operating systems, security patches, and application software), and specialized cash-in-transit (CIT) vendors providing secure logistics infrastructure. Strong supplier relationships are essential for outsourcing providers, ensuring access to the latest hardware, reliable parts inventory for maintenance, and timely software updates to maintain compliance and security integrity. Outsourcing vendors often manage complex multi-vendor environments, demanding sophisticated inventory management systems and robust procurement strategies to minimize component replacement costs and supply chain delays, which directly affect network uptime and profitability.

The core of the value chain involves the Service Delivery and Operations stage, encompassing the physical deployment, cash management optimization, first-line and second-line maintenance, remote network monitoring (terminal driving), and proactive security management. Outsourcing providers must maintain geographically dispersed technician teams, secure centralized monitoring centers, and utilize advanced telemetry and fleet management software to deliver on Service Level Agreements (SLAs). Distribution Channels in this market are predominantly Direct, involving contractual agreements between the outsourcing provider and the Financial Institution (FI) or Independent Deployer (IDC). However, Indirect channels sometimes exist where global outsourcing firms partner with regional or local cash logistics specialists or maintenance subcontractors, particularly in fragmented or difficult-to-access markets, allowing the primary vendor to maintain control over the contract while leveraging local expertise for physical service execution.

The Downstream Analysis focuses on the end-users—the FIs and IDCs—who ultimately derive the benefits of reduced CapEx and enhanced operational efficiency. The effectiveness of the outsourcing arrangement is measured by key performance indicators (KPIs) such as network uptime, fraud incident rate reduction, cash optimization percentage, and overall customer satisfaction at the ATM touchpoint. Feedback loops from these end-users drive continuous service improvement and technological investment by the outsourcing provider. Key elements of competitive success in the downstream segment include demonstrating superior security expertise, providing transparent performance reporting through comprehensive dashboards, and offering flexible, tailored contract structures that adapt to the evolving strategic needs of the client, particularly regarding integrating new digital self-service capabilities into the traditional ATM footprint.

ATM Outsourcing Market Potential Customers

Potential customers for ATM outsourcing services span the entire financial ecosystem, with commercial banks and large, multinational financial institutions representing the largest segment due to the size and complexity of their existing ATM estates. These institutions seek comprehensive, full-service outsourcing models to shed operational liability, optimize balance sheets by eliminating legacy asset ownership, and gain access to advanced security and software management expertise without internal investment. They typically demand high service standards, rigorous compliance adherence, and global scalability from their outsourcing partners, often resulting in multi-year, multi-million-dollar contracts encompassing thousands of terminals across multiple jurisdictions.

Another major buyer category consists of regional banks, community banks, and credit unions, which often lack the internal resources, scale, or technological capability to efficiently manage complex ATM networks, especially concerning mandatory compliance updates and physical security management. For this group, outsourcing provides a cost-effective solution, enabling them to offer competitive customer access points without diverting critical capital from core lending and deposit activities. Their focus is often on robust maintenance and basic cash services, prioritizing operational reliability and cost control over advanced technological deployment, often utilizing managed services where the FI retains asset ownership but outsources the daily operational burden to specialists.

Independent ATM Deployers (IDCs) represent a third crucial segment. IDCs specialize in placing ATMs in non-bank locations (retail stores, travel hubs, entertainment venues) and are intrinsically reliant on comprehensive outsourcing for all aspects of their operations, including hardware provision, cash logistics, and network driving. Since IDCs operate on thin margins derived directly from transaction fees, their primary purchasing criteria are cost efficiency, maximum uptime guarantees, and scalable service models that allow for rapid network expansion and penetration into lucrative, underserved markets. Outsourcing providers tailor solutions for IDCs by offering competitive pricing structures and highly efficient cash optimization algorithms to maximize profitability in diverse off-site locations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.9 billion |

| Market Forecast in 2033 | USD 10.1 billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Diebold Nixdorf, NCR Corporation, Euronet Worldwide, Prosegur, G4S (Allied Universal), CMS Info Systems, AGS Transact Technologies, Fidelity National Information Services (FIS), Hyosung TNS, Brinks, Loomis, Glory Ltd., Hitachi-Omron Terminal Solutions, Cash Connect (ATM Solutions), Perto S.A., GRG Banking, Fujitsu, Sparkle Technologies, Transaction Solutions International (TSI), Cardtronics (NCR). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ATM Outsourcing Market Key Technology Landscape

The technological landscape of the ATM Outsourcing Market is rapidly shifting towards smart, cloud-connected infrastructure designed to enhance security, reduce operational costs, and facilitate rapid deployment of new banking services. Central to this evolution is the widespread adoption of advanced Terminal Driving (TD) and remote monitoring software, utilizing cloud platforms to centralize control, apply patches, and conduct diagnostics across vast, geographically dispersed fleets from a single Security Operations Center (SOC). This capability allows outsourcing providers to guarantee higher uptime percentages through proactive fault detection and remote resolution, minimizing the reliance on costly, time-consuming on-site interventions. Furthermore, the migration of ATM operating systems to newer, more secure platforms (like Windows 11) is a major technological driver, often requiring specialized virtualization and remote deployment techniques managed by expert outsourcing partners.

Security technologies dominate current investment, focusing on layered defense strategies encompassing both physical and logical protections. Logical security relies heavily on encryption, strong authentication mechanisms (e.g., biometric readers), and sophisticated anti-malware solutions specifically tailored for thin-client ATM environments, often managed and updated remotely by the outsourcing partner. Physically, the deployment of intelligent anti-skimming devices, GPS tracking for cash cassettes, and advanced surveillance integration are standard offerings. Additionally, the integration of IoT sensors within ATM hardware components allows for granular monitoring of environmental factors (temperature, vibration) and component health, feeding data into AI-driven predictive maintenance models to optimize component replacement schedules and significantly reduce unexpected machine failures.

Furthermore, there is a substantial trend towards enabling advanced digital interactions at the ATM terminal. This includes Near Field Communication (NFC) support for contactless withdrawals, video teller integration (VTMs) allowing remote human assistance for complex transactions, and the capability to integrate mobile banking applications for pre-staging cash withdrawals. These technological advancements transform the ATM from a basic cash dispenser into a comprehensive self-service banking kiosk. Outsourcing partners are instrumental in deploying and maintaining this complex, integrated software stack, ensuring interoperability between the ATM hardware, the bank’s core processing systems, and third-party digital service platforms, providing FIs with a seamless transition to next-generation banking touchpoints.

Regional Highlights

- North America (NA): This region is characterized by a mature ATM market with high saturation, focusing heavily on fleet modernization, security upgrades, and compliance with stringent regulations like EMV liability shifts and ADA accessibility standards. The growth in outsourcing here is driven by the necessity for advanced security management (fighting sophisticated logical attacks and fraud) and the cost efficiency gained by transitioning aging Windows-based systems to managed services models. Full-service outsourcing is highly popular among large U.S. and Canadian banks aiming to offload capital intensity and operational burden associated with complex terminal driving and compliance reporting.

- Europe: Europe exhibits strong demand for comprehensive cash management and operational efficiency, spurred by the adoption of sophisticated recycling ATMs and VTMs, particularly in Western European nations. Outsourcing demand is segmented, with Central and Eastern Europe seeing higher growth in new deployment and operational management, while mature markets like the UK and Germany focus on advanced software management, cross-border service standardization, and compliance with PSD2 (Payment Services Directive 2) regulations affecting transaction security and data handling.

- Asia Pacific (APAC): APAC is the fastest-growing region globally, fueled by vast unbanked populations and rapid urbanization, particularly in India, China, and Southeast Asian nations. Market growth is dominated by high-volume new ATM installations, often deployed by Independent ATM Deployers (IDCs) in Tier 2 and Tier 3 cities. The focus of outsourcing here is on reliable cash logistics (CIT), robust first-line maintenance to manage large, disparate fleets, and scalable solutions tailored for financial inclusion initiatives, requiring robust, cost-effective service models that can operate efficiently across diverse infrastructures.

- Latin America (LATAM): The LATAM market, including Brazil and Mexico, is experiencing steady growth in outsourcing, driven by banks seeking to mitigate high operational risks associated with local security challenges (both physical and logical) and complex regulatory environments. Outsourcing providers must specialize in robust security protocols, including tamper detection and anti-explosive technologies, alongside efficient cash logistics in geographically challenging areas. The drive for operational cost containment is a primary factor influencing outsourcing contracts.

- Middle East and Africa (MEA): Growth in MEA is accelerating due to government-backed financial inclusion programs and infrastructure modernization projects across the Gulf Cooperation Council (GCC) states and emerging African economies. The demand is high for end-to-end outsourcing services encompassing everything from initial deployment and infrastructure setup (especially in Africa) to advanced service integration (e.g., contactless payments) in the technologically sophisticated GCC countries. Reliability and guaranteed uptime are critical performance metrics across the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ATM Outsourcing Market.- Diebold Nixdorf

- NCR Corporation

- Euronet Worldwide

- Prosegur

- G4S (Allied Universal)

- CMS Info Systems

- AGS Transact Technologies

- Fidelity National Information Services (FIS)

- Hyosung TNS

- Brinks

- Loomis

- Glory Ltd.

- Hitachi-Omron Terminal Solutions

- Cash Connect (ATM Solutions)

- Perto S.A.

- GRG Banking

- Fujitsu

- Sparkle Technologies

- Transaction Solutions International (TSI)

- Cardtronics (now part of NCR)

Frequently Asked Questions

Analyze common user questions about the ATM Outsourcing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between Managed Services and Full-Service ATM Outsourcing?

In Managed Services, the Financial Institution (FI) retains ownership of the ATM hardware assets and is responsible for capital expenditure, while the outsourcing provider manages daily operations, maintenance, and monitoring. In contrast, Full-Service Outsourcing transfers both the operational responsibility and the ownership of the ATM assets (including capital investment and lifecycle management) to the service provider, converting the FI's fixed cost into a predictable variable service fee.

How does ATM outsourcing help reduce operational costs for banks?

Outsourcing reduces operational costs primarily by leveraging the vendor's economies of scale in parts procurement, centralized network monitoring, and efficient cash logistics optimization using advanced forecasting tools. It reduces internal labor costs associated with maintenance technicians and specialized IT personnel needed for software management and complex regulatory compliance, allowing FIs to streamline internal resources.

What role does security management play in outsourced ATM contracts?

Security management is a critical service element. Outsourcing contracts include specialized logical security services (anti-malware, application hardening, remote patching) and physical security protocols (anti-skimming, secure cash handling, surveillance integration). Outsourcing providers utilize dedicated Security Operations Centers (SOCs) to proactively monitor threats, ensuring continuous compliance with industry standards like PCI DSS and minimizing fraud liability for the client bank.

Which geographic region exhibits the highest growth potential for ATM outsourcing?

The Asia Pacific (APAC) region demonstrates the highest growth potential due to expansive financial inclusion initiatives, rapid installation of new ATM terminals in underserved areas, and the increased adoption of outsourcing models by local banks and Independent Deployers (IDCs) seeking scalable and cost-efficient network expansion and management solutions.

How is Artificial Intelligence (AI) being integrated into ATM outsourcing services?

AI is integrated primarily for predictive maintenance, allowing service providers to anticipate hardware failures and schedule repairs proactively before the ATM fails, significantly enhancing uptime. Additionally, AI algorithms optimize cash forecasting and replenishment schedules, minimizing the amount of idle cash held in vaults while ensuring sufficient liquidity for customer withdrawals, thereby reducing cash management costs.

What are the key technological challenges currently faced by ATM outsourcing providers?

Key technological challenges include managing the complex transition of aging ATM fleets from outdated operating systems (like older Windows versions) to modern, secure platforms, ensuring robust defense against increasingly sophisticated cyber threats targeting ATM networks, and maintaining interoperability across disparate, multi-vendor hardware environments while integrating new self-service capabilities.

Are Independent ATM Deployers (IADs) major customers for outsourcing, and why?

Yes, IADs/IDCs are major and essential customers. Since IDCs do not have core banking services, they are intrinsically dependent on outsourcing partners for all aspects of their operation, including hardware procurement, installation, cash handling, and network maintenance. Their business model relies entirely on efficient and scalable outsourced service delivery to maintain profitability through transaction fees.

What regulatory pressures drive the need for outsourced ATM management?

Stringent regulatory pressures, including adherence to global standards like EMV (Europay, Mastercard, and Visa), accessibility standards (e.g., ADA in the US), and local data privacy laws (like GDPR or CCPA) mandate continuous hardware and software updates. Outsourcing partners specialize in managing this complex, evolving compliance burden, shielding FIs from significant fines and legal liabilities.

What is the concept of terminal driving in the context of ATM outsourcing?

Terminal driving is a core managed service where the outsourcing provider connects the ATM terminal to its own host system, managing transaction routing, software deployment, remote diagnostics, and network availability. It centralizes the operational control of the ATM fleet, ensuring high network performance and reliable communication with the bank's core processing systems.

How does outsourcing impact the customer experience at the ATM?

Outsourcing is designed to improve the customer experience by guaranteeing higher network uptime and faster fault resolution through predictive maintenance and specialized technician response. Furthermore, outsourcing facilitates the rapid deployment of new customer-facing features, such as contactless withdrawals and advanced bill payment options, enhancing the utility and modernity of the ATM touchpoint.

What are the primary components of Cash Management Services (CMS) within outsourcing?

CMS components include highly accurate cash forecasting using predictive analytics, secure cash replenishment logistics handled by specialized Cash-in-Transit (CIT) firms, vault management, and reconciliation services. The goal of CMS is to minimize the amount of non-earning cash held in the machines while avoiding stock-outs that impact service availability.

How significant is the shift towards non-branch (off-site) ATM locations for outsourcing vendors?

The shift towards off-site locations (retail stores, malls, transit stations) is highly significant, particularly in growth markets, as it increases the volume of terminals managed by Independent Deployers. These locations often require more agile and robust outsourcing contracts covering full lifecycle management, maintenance, and logistics in high-traffic, non-traditional environments.

What specific types of maintenance services are typically included in an outsourcing agreement?

Outsourcing agreements usually include First-Line Maintenance (FLM), which covers routine tasks like paper roll replacement, minor adjustments, and simple fault resolution, and Second-Line Maintenance (SLM), which involves complex repairs, component replacement, and software/firmware updates, requiring specialized technical expertise and access to spare parts inventory.

What factors determine the bargaining power of a large financial institution in negotiations?

A large FI's bargaining power is high due to the sheer scale of the contract (number of terminals), the long-term nature of the agreement, and the potential for geographic expansion. They leverage this power to demand rigorous Service Level Agreements (SLAs), highly competitive pricing, and customized technological integrations tailored to their specific digital strategy and compliance needs.

How are environmental, social, and governance (ESG) factors affecting outsourcing decisions?

ESG factors are increasingly important. FIs seek outsourcing partners that utilize cash logistics fleets with lower carbon footprints, implement power-efficient ATM hardware (like recycling ATMs), and demonstrate ethical labor practices for their technician workforce. Outsourcing can help FIs meet their sustainability goals through fleet modernization and optimized service routes.

Can outsourcing contracts include the management of Video Teller Machines (VTMs) and advanced kiosks?

Yes, modern outsourcing contracts increasingly encompass the management and maintenance of advanced self-service devices, including VTMs and complex multi-functional kiosks. These require specialized technical skill sets for video conferencing infrastructure, advanced software maintenance, and higher bandwidth connectivity, capabilities often best sourced through expert outsourcing vendors.

What is the impact of rising digital payment adoption on the future demand for ATM outsourcing?

While rising digital payments moderate transaction volume growth in developed markets, they do not eliminate the need for cash access. The impact shifts outsourcing demand from purely transactional maintenance to sophisticated services focused on network efficiency, security hardening, and transforming ATMs into complex multi-channel banking access points, ensuring continued relevance of the physical network.

In which region are Independent ATM Deployers (IDCs) most active and driving the outsourcing market?

IDCs are particularly active and market-driving in the Asia Pacific (APAC) region and North America. In APAC, they drive deployment volume in new markets, whereas in North America, they dominate the placement and operation of machines in off-site retail and commercial locations, relying entirely on comprehensive outsourced logistics and maintenance.

What are the typical risks associated with transitioning an ATM fleet to a new outsourcing provider?

Transition risks include potential disruptions to service availability during hardware tagging and software reconfiguration, integration challenges between the new vendor's terminal driving system and the bank's core system, and the secure transfer of maintenance history and operational data. Meticulous project planning and phased migration are essential to mitigate these risks.

How does fleet modernization relate to the ATM outsourcing trend?

Fleet modernization is a core driver of outsourcing. Banks often lack the capital or desire to undertake large-scale upgrades (e.g., replacement for end-of-life systems). Full-service outsourcing allows the provider to absorb this capital expenditure, immediately upgrading the fleet to modern, compliant, and feature-rich hardware and software, offering the bank immediate operational and security benefits.

Explain the importance of robust Service Level Agreements (SLAs) in outsourcing contracts.

SLAs are paramount as they legally define the expected performance metrics, particularly network uptime percentages, fraud incident response times, and maximum repair times. Robust SLAs ensure accountability, protect the bank's customer service reputation, and include financial penalties if the outsourcing provider fails to meet the agreed-upon standards, aligning provider incentives with client expectations.

What specialized software services are commonly outsourced in this market?

Specialized outsourced software services include terminal application management, security software updates and patching, customized user interface (UI) deployment, remote software distribution, and compliance assurance (ensuring all terminal software adheres to current regulatory standards and APIs for third-party service integration).

How do global outsourcing firms localize their services for different regions like Europe and Asia?

Localization involves adapting cash logistics protocols to local currency rules, ensuring compliance with diverse national banking regulations (e.g., GDPR in Europe, specific fraud reporting laws), and tailoring maintenance response times and inventory management strategies to fit regional infrastructure and technician availability variations (e.g., managing spares in emerging markets).

What is the function of the centralized monitoring center in outsourced operations?

The centralized monitoring center (often a Network Operations Center or NOC) provides 24/7/365 remote surveillance of the entire ATM fleet. Its function is to detect real-time machine faults, remotely diagnose issues, initiate repair tickets, manage software deployment, and coordinate cash replenishment and technician dispatch, serving as the nerve center for efficient operation.

Beyond cash withdrawal, what new services are being delivered through outsourced ATM channels?

New services include cardless transaction initiation via mobile phone integration, foreign currency exchange, bill payment processing, instant account opening capabilities, loan application submission, and advanced account management functions, positioning the ATM as a fully integrated digital self-service banking portal.

How is the outsourcing market addressing the threat of logical attacks (malware) on ATMs?

Outsourcing vendors address logical attacks through advanced, layered security solutions. These include whitelisting applications (only allowing approved software to run), deploying customized anti-malware specific to ATM environments, continuous remote patching, and utilizing security analytics to detect anomalous behavior indicative of targeted malware insertion.

What considerations are critical when selecting an ATM outsourcing partner?

Critical considerations include the provider's proven track record and scale, their technological capabilities (especially in AI and cloud-based monitoring), their security infrastructure and certifications, the flexibility of their contract models, and their capacity to meet specific, localized compliance requirements and rigorous uptime guarantees defined in the SLA.

Does the ATM Outsourcing Market include the physical security guard services for cash delivery?

Yes, while the core market focuses on asset and operational management, outsourcing often includes integrating services from specialized Cash-in-Transit (CIT) firms, which provide armed logistical services for cash replenishment and secure transport, forming a critical, outsourced component of the overall cash management value chain.

What is the typical contract length for comprehensive ATM outsourcing agreements?

Comprehensive, full-service outsourcing agreements, especially those involving asset transfer and fleet modernization, typically span a duration of five to ten years. This longer term allows the service provider to recoup their initial capital investment in new hardware and guarantees the financial institution long-term predictability of operational expenditure.

How does the concept of 'as-a-service' delivery apply to the ATM outsourcing sector?

ATM outsourcing embodies the 'as-a-service' model, where the financial institution consumes the necessary ATM infrastructure, maintenance, software, and cash logistics on a subscription or per-transaction fee basis, moving away from large capital investment and asset ownership towards a flexible operational expenditure (OpEx) model.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager