Atmospheric Plasma Coating Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431711 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Atmospheric Plasma Coating Service Market Size

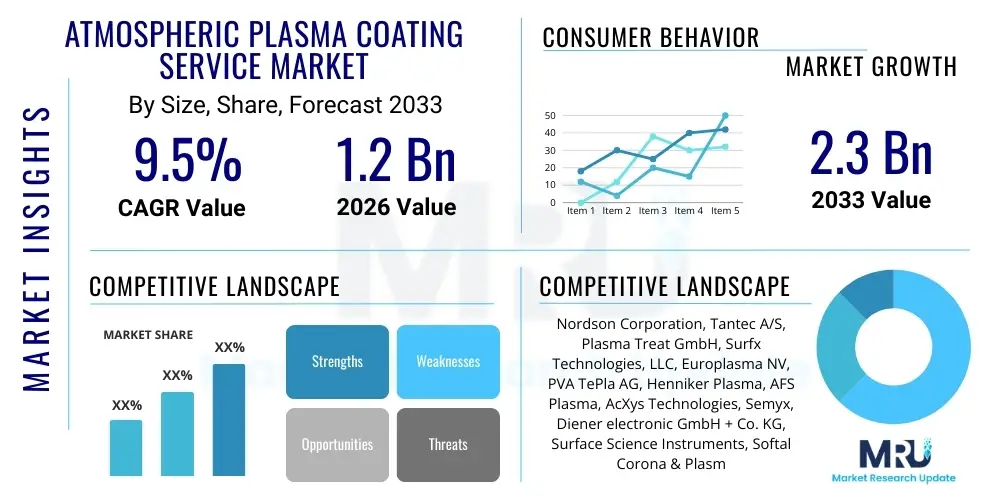

The Atmospheric Plasma Coating Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.3 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the increasing demand for high-performance surface modification techniques across critical industries such as automotive, medical devices, and advanced electronics, where traditional vacuum-based coating methods present limitations regarding throughput and substrate compatibility. The inherent advantage of atmospheric plasma, which allows for continuous, in-line processing at ambient conditions, is catalyzing its rapid adoption, particularly in sectors requiring cost-efficient and environmentally sustainable coating solutions.

Atmospheric Plasma Coating Service Market introduction

The Atmospheric Plasma Coating Service Market encompasses the provision of professional surface treatment solutions utilizing plasma generated at ambient pressure conditions to deposit ultra-thin, functional layers onto various substrates. This technology offers superior surface modification capabilities, including enhanced adhesion, barrier properties, hydrophilicity, and specialized biocompatibility, without the need for expensive vacuum chambers, distinguishing it significantly from conventional PVD or CVD processes. Major applications span protective coatings in the aerospace industry, biocompatible layers on implants in the medical sector, advanced packaging solutions in consumer electronics, and functional textile treatment. The market growth is primarily driven by the increasing complexity and miniaturization of electronic components, demanding precise, residue-free surface preparation, coupled with stringent environmental regulations pushing industries towards solvent-free, energy-efficient coating methodologies. Furthermore, the ability of atmospheric plasma to process heat-sensitive materials, such as polymers and specialized textiles, is unlocking new vertical market opportunities, solidifying its position as a transformative coating technology essential for next- generation material science applications.

Atmospheric Plasma Coating Service Market Executive Summary

The Atmospheric Plasma Coating Service Market is characterized by robust business trends centered on automation integration and strategic partnerships aimed at optimizing service delivery and expanding geographical reach. Key business trends indicate a shift towards modular, customizable plasma units, allowing service providers to cater to diverse client needs ranging from large-scale automotive component manufacturers to specialized medical device developers. Regional trends show that Asia Pacific (APAC) is emerging as the fastest-growing market, primarily fueled by the massive electronics manufacturing base and rapid industrialization in countries like China, South Korea, and Taiwan, demanding high-throughput surface activation and deposition services. North America and Europe, while mature, are focused on high-value applications, including advanced biomedical coatings and specialized aerospace corrosion protection, driving innovation in process control and material science.

Segment trends highlight the dominance of the treatment of polymers and plastics due to the technology’s effectiveness in enhancing adhesion and preparing surfaces for printing or bonding, especially in the packaging and automotive sectors. Simultaneously, the application of hydrophobic and oleophobic coatings is experiencing accelerated demand across multiple segments, driven by requirements for self-cleaning surfaces and durable protective barriers. The technological landscape is evolving towards hybrid plasma systems that integrate atmospheric pressure with precise precursor delivery systems, enabling the deposition of highly complex and multi-layered coatings. This technological advancement is crucial for maintaining market competitiveness and addressing the evolving performance specifications mandated by end-user industries.

Overall, the market trajectory suggests sustained investment in Research and Development (RD) focusing on novel precursor chemistries and enhanced plasma diagnostics. Service providers are increasingly differentiating themselves through certifications (e.g., ISO 13485 for medical applications) and demonstrating superior process repeatability, which is critical for securing long-term service contracts. The integration of IoT and predictive maintenance into coating equipment is enhancing operational efficiency, providing a competitive edge, and mitigating downtime, further stabilizing the service market’s financial performance and ensuring high client satisfaction rates across the value chain.

AI Impact Analysis on Atmospheric Plasma Coating Service Market

Common user questions regarding AI's impact on the Atmospheric Plasma Coating Service Market predominantly focus on process consistency, automation efficiencies, and predictive maintenance capabilities. Users are keen to understand how AI can move beyond simple data logging to actively control complex plasma parameters—such as gas flow, power delivery, and substrate speed—in real-time to maintain deposition uniformity, especially crucial for sensitive applications like semiconductors and medical implants. Concerns often revolve around the cost-benefit analysis of implementing sophisticated machine learning algorithms into existing atmospheric plasma systems, and the ability of AI models to generalize across different substrate geometries and material compositions. The expectation is that AI integration will substantially reduce waste, minimize human error, and accelerate the development of new coating formulations by rapidly analyzing experimental data. Essentially, users anticipate AI will transform plasma coating from an art form reliant on expert intuition into a highly precise, data-driven industrial process, thereby reducing operational variability and increasing service profitability.

- AI-driven Predictive Maintenance: Enables forecasting of equipment failure (e.g., power supply fluctuations, nozzle wear) by analyzing sensor data, minimizing unplanned downtime and optimizing service schedules.

- Real-time Process Optimization: Machine learning algorithms dynamically adjust plasma parameters (temperature, pressure, power density) to ensure coating thickness and uniformity meet specifications, crucial for quality control.

- Automated Quality Inspection: AI vision systems analyze treated surfaces instantly for defects (pinholes, inconsistencies), dramatically accelerating post-processing inspection compared to manual or traditional methods.

- Precursor Formulation Acceleration: AI simulates and predicts the performance of novel precursor chemistries under atmospheric plasma conditions, shortening the time-to-market for specialized functional coatings.

- Energy Efficiency Management: Optimized power management using neural networks ensures the minimum necessary energy is utilized for effective treatment, reducing operational costs and environmental impact.

DRO & Impact Forces Of Atmospheric Plasma Coating Service Market

The dynamics of the Atmospheric Plasma Coating Service Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively exert significant Impact Forces on its overall trajectory. Key drivers include the global push for sustainable manufacturing, favoring solvent-free plasma processes over wet chemical methods, and the growing demand for surface functionalization in advanced materials used in high-tech industries. Restraints mainly stem from the technical challenges related to maintaining coating uniformity over very large or complex 3D substrates at high throughput, and the initial capital expenditure associated with high-precision atmospheric plasma equipment, which can deter smaller players. Opportunities lie primarily in expanding applications into new sectors like flexible electronics, photovoltaics, and large-scale industrial textile production, coupled with technological advancements in plasma jet design that enhance process scalability and efficiency. These forces dictate the market's pace of adoption and technological maturity.

Driving forces center around the versatility and precision offered by atmospheric plasma coating, especially its capacity for selective surface treatment without affecting bulk properties. The continuous shift in the medical device industry toward complex, smaller implants requiring precise biocompatible coatings, such as antibacterial or drug-eluting surfaces, strongly propels the service market forward. Furthermore, the automotive sector’s rapid electrification requires new methods for battery component surface treatment and corrosion protection, areas where atmospheric plasma excels. The increasing awareness among manufacturers regarding the environmental and economic benefits of in-line, localized surface treatment further amplifies the demand, positioning plasma services as an indispensable part of modern manufacturing workflows.

Conversely, the primary restraints involve the inherent sensitivity of atmospheric plasma systems to environmental conditions (like humidity and ambient temperature), which can affect process stability and coating reproducibility, demanding advanced process monitoring and control systems. Additionally, the limited number of established industry standards for atmospheric plasma coatings, compared to mature vacuum-based methods, presents hurdles in client acceptance and qualification for critical applications. The market, however, is significantly bolstered by opportunities derived from synergistic technologies; for instance, combining plasma deposition with specialized printing techniques (like inkjet printing) to create functional micro-patterns opens highly lucrative niches in display technology and microfluidics. Successfully addressing uniformity challenges through advanced nozzle design and incorporating AI for environmental compensation will be critical to overcoming current restraints and maximizing these future growth opportunities.

Segmentation Analysis

The Atmospheric Plasma Coating Service Market is fundamentally segmented based on Technology, Application, Material Coated, and Service Type, providing a comprehensive view of market dynamics and specialized offerings. Segmentation allows market players to tailor their strategic investments towards high-growth areas, such as the increasing demand for hydrophobic coatings in the consumer electronics sector or specialized barrier layers for advanced pharmaceuticals. The primary segmentation by technology often distinguishes between dielectric barrier discharge (DBD), plasma jets, and atmospheric pressure plasma torches, each offering unique advantages in terms of throughput, penetration depth, and substrate capability. This structured approach helps in identifying specific end-user requirements, optimizing service pricing models, and forecasting future demand patterns based on technological shifts and industrial adoption rates across different geographical regions.

- By Technology:

- Dielectric Barrier Discharge (DBD)

- Plasma Jet Systems

- Atmospheric Pressure Plasma Torches

- Capacitively Coupled Plasma (CCP)

- By Application:

- Adhesion Promotion & Surface Activation (Pretreatment)

- Protective Coatings (Barrier, Corrosion Resistance)

- Biocompatible Coatings (Medical Devices)

- Hydrophobic/Oleophobic Coatings

- Functionalization for Printing and Bonding

- By End-Use Industry:

- Automotive

- Aerospace and Defense

- Medical and Healthcare (Implants, Disposables)

- Electronics and Semiconductors

- Packaging and Consumer Goods

- Textiles

- By Material Coated:

- Polymers and Plastics

- Metals and Alloys

- Glass and Ceramics

- Textile and Fabrics

Value Chain Analysis For Atmospheric Plasma Coating Service Market

The value chain for the Atmospheric Plasma Coating Service Market begins with upstream analysis, which involves the supply of critical raw materials and components, including specialized high-purity process gases (Argon, Helium, Oxygen), proprietary liquid precursors for deposition (siloxanes, fluorocarbons), and advanced hardware components like plasma generators, high-voltage power supplies, and precision nozzle assemblies. Key upstream suppliers are focused on maintaining high quality and consistent supply of these materials, as fluctuations directly impact coating performance and cost effectiveness. Innovation at this stage is driven by developing safer, more environmentally friendly precursors that enable the deposition of novel functional layers. Strong partnerships between service providers and precursor manufacturers are vital to ensure the continuous development of tailored coating chemistries suitable for atmospheric pressure operation.

Midstream activities encompass the actual provision of coating services, involving the operation and maintenance of sophisticated plasma systems, process development, and quality control (QC). Service providers invest heavily in certified operational personnel, advanced metrology tools (like profilometers and contact angle meters), and ensuring compliance with industry-specific regulations (e.g., FDA requirements for medical coatings or aerospace material standards). The midstream focus is on maximizing throughput, maintaining excellent coating uniformity across high volumes, and offering customized batch or continuous processing options. Distribution channels are predominantly direct, where service providers interact directly with end-user manufacturers, especially for high-value contracts. However, indirect channels involve partnerships with equipment integrators or regional distributors who offer plasma services as part of a larger manufacturing solution package, particularly in geographically fragmented markets.

The downstream analysis focuses on the end-use applications and the ultimate realization of value through enhanced product performance, durability, or functionality, such as improved device sterilization protocols or extended corrosion lifetime of automotive parts. The relationship between service provider and end-user is highly collaborative, often involving joint development programs to fine-tune coating specifications for specific products. Success in the downstream market is determined by the demonstrated cost-effectiveness and superior technical performance of the plasma-treated components compared to alternatives. The increasing complexity of materials and performance demands ensures that specialized plasma coating services remain an essential, high-value component of the overall manufacturing value chain, requiring constant feedback loops between all stakeholders to drive continuous improvement and address emerging material challenges.

Atmospheric Plasma Coating Service Market Potential Customers

Potential customers for the Atmospheric Plasma Coating Service Market are primarily large Original Equipment Manufacturers (OEMs) and specialized Tier 1 suppliers operating in regulated and high-technology sectors that demand stringent surface property modifications. These buyers prioritize quality, scalability, regulatory compliance, and process repeatability, often outsourcing complex coating needs to specialized plasma service providers rather than investing in costly internal infrastructure. The primary segments include medical device manufacturers requiring biocompatibility for surgical tools and implants, automotive companies seeking corrosion resistance and improved bonding for lightweight composite structures, and electronics manufacturers needing surface preparation for fine-line printing or advanced barrier films for flexible displays. These customers look for providers who can integrate seamlessly into their production lines and offer comprehensive documentation supporting material qualification.

A secondary, yet rapidly growing, customer base consists of manufacturers in consumer goods and packaging, particularly those focused on increasing product shelf life, enhancing aesthetic features, or developing sustainable, recyclable packaging materials. For instance, the textile industry requires atmospheric plasma services to impart water-repellent or antibacterial properties to fabrics without resorting to harmful chemical finishes. These buyers are often driven by sustainability goals and cost-efficiency, valuing the plasma service’s low environmental footprint and high throughput capabilities. Furthermore, research institutions and defense contractors represent niche but high-value buyers, often requiring highly specialized, customized coatings for novel material development or extreme environment protection, demanding the highest level of technical expertise and confidentiality from service providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.3 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nordson Corporation, Tantec A/S, Plasma Treat GmbH, Surfx Technologies, LLC, Europlasma NV, PVA TePla AG, Henniker Plasma, AFS Plasma, AcXys Technologies, Semyx, Diener electronic GmbH + Co. KG, Surface Science Instruments, Softal Corona & Plasma GmbH, RelyOn Plasma GmbH, Advanced Plasma Solutions, Vetaphone A/S, Covaprotect GmbH, 3DT LLC, H&T Plasma, Plasmatreat North America. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Atmospheric Plasma Coating Service Market Key Technology Landscape

The technology landscape within the Atmospheric Plasma Coating Service Market is characterized by continuous innovation aimed at improving plasma stability, precursor delivery efficiency, and substrate handling capabilities. Key technologies utilized include Dielectric Barrier Discharge (DBD) systems, which are highly effective for large-area surface activation and sterilization, typically employing parallel plate configurations. Plasma Jet systems, conversely, are preferred for localized, high-definition treatment and coating deposition on complex 3D parts or in high-speed, continuous manufacturing environments. The advancement in plasma jet nozzle design, focusing on creating laminar flow and minimizing unwanted gas entrainment, is crucial for ensuring homogenous coating characteristics and mitigating localized heating effects. Furthermore, the precise control over precursor vaporization and delivery, often achieved through ultrasonic or atomizing nozzles, is central to depositing complex functional thin films like SiO2 or fluoropolymers efficiently at atmospheric pressure.

A significant trend involves the development of hybrid plasma systems that combine different atmospheric pressure sources or integrate plasma with other surface treatment techniques, such as UV curing or thermal processes, to achieve synergistic performance benefits. For instance, combining plasma surface activation with subsequent localized atmospheric pressure chemical vapor deposition (APCVD) allows for rapid, multi-step functionalization necessary in microelectronics packaging. Material science innovation is focused on developing novel liquid and gaseous precursors that are non-toxic, have low volatility, and decompose effectively within the plasma environment to form high-quality, dense coatings. This focus on precursor chemistry is instrumental in expanding the material library accessible through atmospheric plasma processes, enabling applications requiring ultra-high barrier properties or specific electrical insulation characteristics.

The future technology landscape is heavily invested in digital transformation, particularly the integration of advanced process monitoring tools. Spectroscopic analysis (OES), coupled with temperature and flow sensors, provides real-time feedback on plasma parameters and coating chemistry, feeding into sophisticated control systems. This emphasis on Industry 4.0 readiness and digital traceability ensures that atmospheric plasma services can meet the exacting demands of regulated industries like medical devices, where every treatment parameter must be documented and repeatable. The continuous push towards higher power density systems, while maintaining a lower gas temperature, is the key challenge driving hardware development, allowing for increased treatment speeds without causing thermal damage to sensitive substrates like thin polymer films or specialized composite materials, thereby solidifying the market's technical maturity and broadening its operational scope across diverse manufacturing environments.

Regional Highlights

The regional dynamics of the Atmospheric Plasma Coating Service Market are highly diversified, reflecting different industrial bases, regulatory environments, and technological adoption rates across continents. North America, driven primarily by robust aerospace, defense, and advanced medical device manufacturing sectors, remains a dominant force. The demand here is concentrated on high-specification, critical coatings, such as anti-icing layers for aircraft components and certified biocompatible surfaces for surgical implants. European markets, particularly Germany and Switzerland, showcase strong adoption due to their pioneering role in advanced automotive manufacturing and stringent environmental standards, which favor the solvent-free nature of plasma treatment. The regulatory framework, such as REACH compliance, pushes manufacturers towards cleaner technologies, thus boosting the service market in this region.

Asia Pacific (APAC) is currently the most dynamic and fastest-growing region, owing to the massive concentration of electronics manufacturing (e.g., semiconductors, displays, consumer electronics) in countries like China, Japan, South Korea, and Taiwan. The need for surface activation for fine-pitch soldering, ultra-thin barrier coatings for flexible displays, and enhanced adhesion for advanced packaging drives significant demand for high-throughput atmospheric plasma services. Investment in new manufacturing capacity and government initiatives supporting high-tech domestic production are major accelerators in APAC. Meanwhile, Latin America and the Middle East & Africa (MEA) are emerging markets, primarily focused on automotive components, oil and gas infrastructure, and basic packaging applications, where the cost-efficiency and reduced environmental impact of plasma treatments are increasingly valued, albeit starting from a smaller market base compared to the established regions.

- North America (NA): Focuses on high-reliability, low-volume applications in Aerospace and Medical sectors; strong emphasis on process validation and regulatory compliance (FDA/FAA).

- Europe: Driven by automotive lightweighting trends, strict environmental regulations (REACH), and advanced materials research; high adoption rate in industrial manufacturing and precision engineering.

- Asia Pacific (APAC): Leads in volume demand, dominated by Consumer Electronics, Semiconductor packaging, and high-throughput textile applications; fastest expected CAGR due to rapid industrial expansion.

- Latin America: Growing demand in the automotive assembly and general industrial sector, seeking cost-effective surface preparation solutions and regional manufacturing localization.

- Middle East and Africa (MEA): Niche but growing adoption, primarily focusing on corrosion protection for oil and gas infrastructure and improving adhesion for industrial packaging and local manufacturing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Atmospheric Plasma Coating Service Market.- Nordson Corporation

- Tantec A/S

- Plasma Treat GmbH

- Surfx Technologies, LLC

- Europlasma NV

- PVA TePla AG

- Henniker Plasma

- AFS Plasma

- AcXys Technologies

- Semyx

- Diener electronic GmbH + Co. KG

- Surface Science Instruments

- Softal Corona & Plasma GmbH

- RelyOn Plasma GmbH

- Advanced Plasma Solutions

- Vetaphone A/S

- Covaprotect GmbH

- 3DT LLC

- H&T Plasma

- Plasmatreat North America

Frequently Asked Questions

Analyze common user questions about the Atmospheric Plasma Coating Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Atmospheric Plasma Coating over traditional Vacuum Coating methods?

Atmospheric Plasma Coating, unlike conventional vacuum methods, operates at ambient pressure, allowing for seamless integration into existing production lines without costly vacuum chambers or batch processing limitations. This results in significantly higher throughput, lower energy consumption, and the ability to treat heat-sensitive substrates like polymers and textiles effectively. The process is also environmentally cleaner, often eliminating the need for wet chemical primers or hazardous solvents, thereby aligning with stringent sustainability mandates and reducing overall operational complexity in high-volume manufacturing sectors.

Which industries are driving the highest demand for Atmospheric Plasma Coating Services?

The highest demand is primarily driven by three core industries: Electronics and Semiconductors (requiring precise surface activation for advanced packaging and flexible displays), Automotive (seeking enhanced adhesion for lightweight composite structures and corrosion protection), and Medical Devices (needing certified biocompatible and sterilizable thin films for implants and surgical tools). These sectors value the technology's ability to deliver ultra-clean, functional surfaces with exceptional uniformity and repeatability, crucial for product reliability and meeting critical performance specifications required for highly regulated products.

What is the typical cost structure involved in utilizing atmospheric plasma coating services?

The cost structure for atmospheric plasma coating services typically includes labor and overhead, consumption of high-purity process gases (like Argon or Helium), and the cost of specialized liquid precursors necessary for deposition. Costs are heavily influenced by the complexity of the part geometry, the required coating thickness, the material being treated, and the volume (throughput). While initial service setup costs may be higher than simple chemical treatment, the long-term economic benefit comes from improved product quality, reduced failure rates, and the elimination of expensive, multi-step wet processes, often yielding a superior return on investment for critical applications requiring high material integrity.

How does the integration of Industry 4.0 technologies affect the future of plasma coating services?

Industry 4.0 integration, specifically IoT sensors, advanced diagnostics, and Artificial Intelligence (AI), is transforming plasma coating services by enhancing process repeatability and reliability. These technologies enable real-time monitoring and adaptive control of plasma parameters, compensating for environmental variations and equipment wear automatically. This leads to predictive maintenance capabilities, significantly reducing downtime and ensuring traceable quality assurance for every treated component. Ultimately, this integration facilitates higher precision, greater efficiency, and seamless data exchange within smart factory ecosystems, positioning atmospheric plasma services as a fully optimized digital manufacturing solution.

What are the main technical challenges service providers face regarding coating uniformity and process stability?

Service providers primarily face challenges in ensuring absolute coating uniformity, particularly when processing large surfaces or substrates with highly complex, non-planar geometries, due to the inherent localized nature of many atmospheric plasma jets. Maintaining plasma stability is also critical, as atmospheric conditions (temperature, humidity) can easily interfere with the plasma chemistry and precursor delivery, leading to inconsistencies. Overcoming these challenges requires investment in advanced, multi-array nozzle designs, sophisticated gas mixing control, and utilizing closed-loop feedback systems integrated with real-time spectroscopic analysis to guarantee consistent and reliable treatment outcomes across diverse manufacturing specifications and environmental conditions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager