Atmospheric Sounding System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433879 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Atmospheric Sounding System Market Size

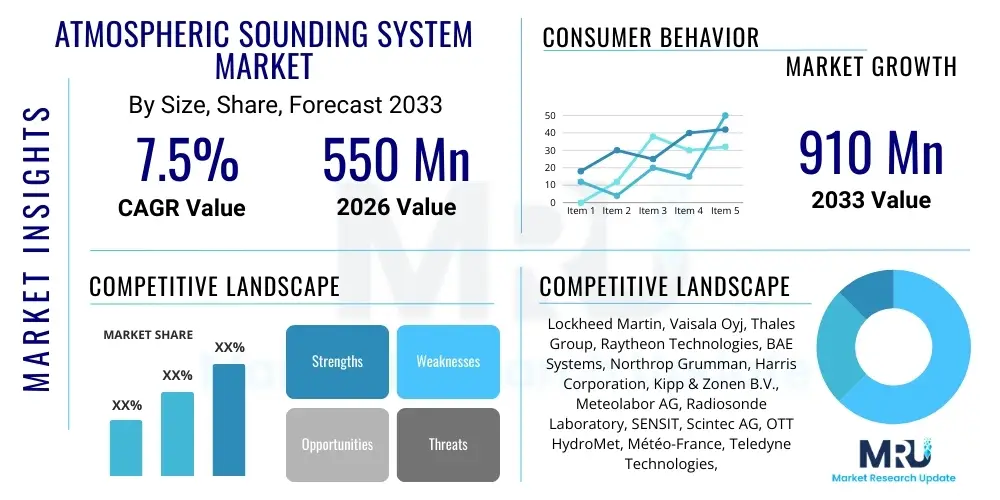

The Atmospheric Sounding System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 910 Million by the end of the forecast period in 2033.

Atmospheric Sounding System Market introduction

The Atmospheric Sounding System Market encompasses advanced technologies and instruments designed to measure various physical properties of the Earth’s atmosphere, particularly in the vertical dimension. These systems provide crucial data regarding temperature, humidity, pressure, wind speed, and wind direction profiles, extending from the surface up to the stratosphere. Accurate and timely atmospheric sounding data is foundational for numerical weather prediction (NWP) models, essential for minimizing property damage, ensuring public safety during severe weather events, and supporting efficient global commerce, particularly in aviation and maritime sectors. The increasing complexity of global climate patterns and the necessity for highly granular localized forecasts are driving significant investment in next-generation sounding instrumentation, including advanced radiosondes, ground-based remote sensing, and sophisticated satellite-based interferometers. The core function remains the precise acquisition of atmospheric state variables to enhance meteorological and climatological research worldwide.

Key products within this market range from traditional balloon-borne radiosondes, which physically ascend and transmit data, to highly sophisticated remote sensing technologies like Lidar (Light Detection and Ranging) and Radar (Radio Detection and Ranging), capable of passive or active measurements from the ground or orbital platforms. Major applications span critical sectors, including national meteorological services, defense and aerospace operations, environmental monitoring agencies, and commercial entities involved in agriculture and renewable energy generation. Benefits derived from these systems are profound, offering improved forecast accuracy, enhanced understanding of climate variability, real-time tracking of pollution plumes, and optimized route planning for aircraft and ships, thereby contributing substantially to economic efficiency and resource management globally. The inherent reliability and continuous operation required by these instruments necessitate robust design and advanced calibration techniques to ensure data integrity across diverse and often harsh operational environments.

The primary driving factors for market expansion include the escalating frequency and intensity of extreme weather events, which demand superior predictive capabilities; sustained governmental and defense spending on meteorological modernization programs; and technological advancements leading to smaller, lighter, and more accurate sensors, particularly in the realm of CubeSats and unmanned aerial systems (UAS). Furthermore, the global mandate for climate change research and mitigation strategies necessitates continuous, high-resolution atmospheric data collection. The integration of data assimilation techniques and high-performance computing further amplifies the value derived from every sounding measurement, establishing these systems as irreplaceable assets in modern Earth sciences and operational meteorology.

Atmospheric Sounding System Market Executive Summary

The Atmospheric Sounding System Market is characterized by robust growth, primarily fueled by global commitments to climate resilience and the continuous modernization of weather monitoring infrastructure across major economies. Business trends indicate a strong shift towards remote sensing technologies, favoring Lidar and advanced satellite-based sounding over traditional radiosonde systems, although radiosondes maintain critical importance in validation and specific operational contexts. Key market players are intensely focused on integrating Artificial Intelligence (AI) and machine learning algorithms into data processing pipelines to accelerate data assimilation into Numerical Weather Prediction (NWP) models, enhancing forecast lead times and accuracy. Strategic mergers, acquisitions, and long-term government contracts remain central to competitive strategy, particularly among providers of complex, integrated satellite systems. Additionally, the proliferation of smaller, more cost-effective sounding platforms, such as small unmanned aircraft systems (UAS) and low-Earth orbit (LEO) satellites, is democratizing access to high-quality atmospheric data, stimulating competition and driving down the marginal cost of data collection across various regions.

Regionally, North America and Europe currently dominate the market due to substantial investments by national weather services (like NOAA and EUMETSAT) and established defense requirements, driving demand for technologically sophisticated ground-based and space-based platforms. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, driven by rapid urbanization, increased susceptibility to monsoons and typhoons, and aggressive governmental initiatives in countries like China, India, and Japan to establish self-sufficient, high-resolution meteorological networks. Latin America and the Middle East and Africa (MEA) are also seeing increasing adoption, supported by international aid and partnerships aimed at strengthening disaster preparedness infrastructure, often focusing on reliable, low-maintenance radiosonde and foundational ground-based systems. These regional dynamics highlight a market bifurcated between high-end research/defense applications and foundational infrastructure development tailored to local climate risks.

Segmentation trends reveal that the Space-Based Platform segment, comprising advanced meteorological satellites utilizing technologies like hyperspectral infrared sounders and microwave sounders, is the largest revenue generator and the fastest-growing segment, reflecting the unparalleled global coverage and high-resolution data provided by orbital assets. Within the Application segment, Weather Forecasting retains its position as the dominant application due to the critical nature of timely atmospheric profiles for short-term and medium-term predictions. Furthermore, the End-User segment is heavily skewed toward the Government and Defense sectors, which represent the primary purchasers and operators of large-scale sounding infrastructure. Technological evolution focuses intensely on improving sensor stability, reducing system latency, and developing passive sounding techniques that offer continuous, cost-effective data collection without requiring dedicated launch platforms or expensive operational maintenance, ensuring robust market development across all defined segments.

AI Impact Analysis on Atmospheric Sounding System Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) on the Atmospheric Sounding System Market frequently center on three main themes: data processing efficiency, sensor accuracy enhancement, and the potential for autonomous system operation. Users are keen to understand how AI can handle the massive influx of hyperspectral and multi-sensor data generated by modern sounding systems, specifically seeking optimization in data assimilation into NWP models and real-time quality control. There is significant concern about reducing latency—the time lag between data acquisition and its use in a forecast—and questions often arise regarding the use of deep learning for noise reduction and feature extraction, enabling the identification of subtle atmospheric phenomena missed by traditional algorithms. Furthermore, the community actively explores the concept of AI-driven adaptive sampling, where sounding systems (particularly radiosondes or UAS) could autonomously adjust their flight paths or sampling density based on real-time atmospheric conditions, optimizing data collection during critical weather events, thereby maximizing the return on investment in sounding infrastructure and significantly enhancing the precision of localized predictions.

- AI-driven data assimilation drastically reduces the latency between measurement acquisition and its integration into Numerical Weather Prediction (NWP) models, improving forecast timeliness.

- Machine learning algorithms enhance the calibration and quality control of raw sensor data, automatically identifying and correcting instrument drift or noise patterns.

- Deep learning facilitates sophisticated pattern recognition in high-dimensional satellite sounding data (hyperspectral images), extracting nuanced vertical profiles of temperature and moisture.

- AI supports adaptive and autonomous sampling strategies for airborne platforms (UAS, radiosondes), allowing systems to target specific atmospheric features like storm fronts or boundary layer instabilities.

- Predictive maintenance uses AI to analyze operational telemetry from ground-based Lidar and Radar systems, forecasting component failure and maximizing system uptime.

- AI models are employed to fuse disparate sounding datasets—combining satellite, ground-based, and in-situ measurements—to create a unified, high-resolution atmospheric profile.

- Enhanced model output statistics (MOS) generated by AI improve the translation of raw NWP output into user-friendly probability forecasts, especially crucial for aviation and energy sectors.

DRO & Impact Forces Of Atmospheric Sounding System Market

The Atmospheric Sounding System market trajectory is powerfully shaped by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively define the market's impact forces. Key drivers include the undeniable impact of climate change, which mandates increased monitoring and predictive capability, coupled with robust governmental spending on security and defense-related meteorological intelligence. These factors create sustained demand for high-fidelity, reliable sounding data. Restraints primarily involve the high initial capital expenditure associated with deploying advanced systems, particularly satellite constellations and complex Lidar setups, alongside regulatory hurdles regarding frequency allocation and launch licensing. Opportunities are abundant in the integration of low-cost platforms like CubeSats and commercial UAS, expansion into emerging geographical markets, and the development of value-added data services leveraging AI and cloud computing, transforming raw data into actionable insights for commercial entities. These collective forces necessitate continuous technological innovation and strong public-private partnerships to overcome fiscal limitations and meet the escalating global demand for atmospheric information.

The overarching impact forces steering the market are primarily regulatory compliance and technological obsolescence. Regulatory bodies, such as the World Meteorological Organization (WMO) and national agencies, set stringent standards for data quality, format, and interoperability, compelling manufacturers to continually upgrade sensor accuracy and calibration protocols. This regulatory pressure ensures a high baseline quality but also raises R&D costs. Simultaneously, the rapid pace of sensor technology development means that existing systems face swift obsolescence, forcing operators, especially government agencies, to plan for frequent replacement or extensive modernization cycles. These forces drive market consolidation, favoring large players capable of sustaining high R&D investments and navigating complex international procurement processes. Furthermore, geopolitical tensions sometimes influence the accessibility and sharing of critical atmospheric data, impacting international collaboration and the deployment of globally standardized systems.

Another significant impact force is the paradigm shift from point-source measurements (like radiosondes) to volumetric and continuous remote sensing (Lidar, Radar, GNSS occultation). This shift fundamentally changes the operational landscape, requiring new skills for data interpretation and management. While remote sensing offers superior temporal resolution and spatial coverage, it also presents challenges related to data volume and complexity. The market’s success hinges on the ability of manufacturers to provide integrated solutions that not only collect the data but also simplify its assimilation for end-users. The continuous cycle of technological refinement, governmental budget cycles, and the urgent need for climate adaptation collectively create a high-growth but highly demanding operational environment for market participants.

Segmentation Analysis

The Atmospheric Sounding System Market is meticulously segmented across platform type, technology, application, and end-user, reflecting the diverse requirements and deployment environments of meteorological monitoring worldwide. Segmentation provides clarity on where investment and technological breakthroughs are concentrated, highlighting the divergence between traditional in-situ measurement techniques and modern remote sensing capabilities. The foundational segmentation by technology differentiates between active systems (e.g., Lidar, Radar) that emit energy and passive systems (e.g., Radiometers, GNSS radio occultation) that measure natural atmospheric radiation. This comprehensive analysis allows manufacturers to tailor product development and sales strategies to specific customer needs, ranging from government-funded research institutions requiring high-precision satellite data to defense departments demanding deployable, robust ground-based systems.

The platform segmentation—ground-based, airborne, and space-based—is perhaps the most critical determinant of market dynamics, as it dictates coverage, resolution, and operational cost. Space-based systems, while costly to launch, offer unparalleled global coverage essential for global NWP models. Ground-based systems provide continuous, high-temporal-resolution data critical for local short-term forecasting and pollution tracking. Airborne systems fill niche roles, such as targeted observations during severe weather campaigns or data collection in remote areas inaccessible to fixed installations. Understanding the interplay between these platforms is vital for market players aiming to deliver holistic sounding solutions that combine the strengths of various data sources to achieve optimal atmospheric characterization.

Furthermore, segmentation by application, primarily dominated by weather forecasting, is expanding significantly into secondary areas such as climate modeling, defense intelligence, and specialized commercial applications like wind farm siting and drone operation safety. This diversification reflects the increasing recognition of atmospheric profile data as a versatile input across various economic sectors. The market’s future growth is increasingly dependent on the ability of suppliers to customize data outputs and system integration for these high-growth, non-traditional meteorological applications, driving demand beyond core government clients and into the commercial domain.

- By Type (Technology):

- Radiosonde and Dropsonde Systems

- Lidar (Light Detection and Ranging)

- Radar (Wind Profilers, Weather Radar)

- Radiometers and Spectrometers (Microwave, Infrared)

- GNSS Radio Occultation Systems

- By Platform:

- Ground-Based Systems (Fixed stations, mobile vehicles)

- Airborne Systems (UAS/Drones, Research Aircraft)

- Space-Based Systems (Satellites: GEO, LEO, CubeSats)

- By Application:

- Numerical Weather Prediction (NWP) and Forecasting

- Climate Research and Monitoring

- Military and Defense Operations

- Aviation Safety and Route Optimization

- Environmental Monitoring (Air Quality, Pollution Tracking)

- By End-User:

- Government and National Meteorological Services

- Defense and Aerospace Agencies

- Commercial Entities (Energy, Agriculture, Insurance)

- Research and Academic Institutions

Value Chain Analysis For Atmospheric Sounding System Market

The value chain for the Atmospheric Sounding System market is highly structured and begins with the upstream segment involving fundamental R&D, component manufacturing, and sensor production. This stage is dominated by specialized technology companies focused on developing high-precision sensors for temperature, humidity, and pressure, as well as advanced optics and microwave components essential for Lidar, Radar, and satellite sounders. Material science and miniaturization are crucial here, as the performance and longevity of the entire system depend on the reliability of these core components. Supplier relationships are long-term and often exclusive due to the highly specialized nature of the components, such as high-frequency radar transmitters or cryogenic coolers required for certain satellite instruments, establishing high barriers to entry for new upstream participants.

The midstream segment involves the system integration, platform assembly, and calibration processes. This is where major aerospace, defense, and specialized meteorological instrumentation firms assemble components into functional platforms—be it launching complex satellites, integrating Lidar into mobile ground units, or packaging radiosondes for mass deployment. Rigorous testing and calibration under simulated environmental extremes are essential to ensure the data quality meets WMO standards. Distribution channels vary significantly based on the platform. Large, costly space-based systems or dedicated radar networks are usually procured through direct government contracts or international consortia (e.g., EUMETSAT). Conversely, smaller, consumable products like radiosondes utilize direct sales or specialized distribution networks that cater to rapid replenishment needs of meteorological stations globally.

The downstream analysis focuses on the end-user deployment, data processing, and value-added service provision. Data collected by the sounding systems is transmitted, often via satellite links or dedicated ground stations, to processing centers where it undergoes quality control, formatting, and assimilation into NWP models. This stage increasingly involves third-party data analytics firms that offer customized insights to commercial users (indirect channel), such as renewable energy companies needing real-time wind profiles or agricultural firms needing boundary layer stability data. The direct channel remains paramount for government meteorological services, which operate and consume their own data internally for public forecasting. The most significant value creation now lies in the ability to rapidly convert raw atmospheric profiles into actionable, sector-specific intelligence using cloud infrastructure and AI tools, driving the market toward a data-as-a-service model.

Atmospheric Sounding System Market Potential Customers

The primary customers for Atmospheric Sounding Systems are overwhelmingly large institutional buyers who require continuous, high-reliability data streams for mission-critical operations. The core customer base consists of Governmental and National Meteorological Services (NMS), such as the National Oceanic and Atmospheric Administration (NOAA) in the US, the European Centre for Medium-Range Weather Forecasts (ECMWF), and their counterparts worldwide. These entities purchase high-end remote sensing equipment, entire satellite constellations, and vast quantities of consumables (radiosondes) to fulfill their public safety and national forecasting mandates. Their purchasing decisions are driven by accuracy standards, long-term reliability, and compatibility with global data exchange formats, often necessitating large, multi-year contracts with established market leaders.

Another major buyer segment is the Defense and Aerospace sector. Military branches require localized, high-resolution atmospheric profiles for critical operations, including missile defense, artillery targeting, and flight path planning for specialized aircraft. This segment demands systems that are rugged, rapidly deployable (e.g., mobile wind profilers, dropsondes), and capable of operating in contested environments. Their procurement focuses on resilience and integration into proprietary intelligence networks. Furthermore, large civil aviation authorities and airport operators are increasingly investing in localized ground-based sounding systems to monitor boundary layer conditions, wind shear, and turbulence, critical for takeoff and landing safety and efficiency.

The third tier of potential customers includes research and academic institutions that utilize sounding systems for climate modeling, atmospheric chemistry studies, and specialized weather research campaigns. While their purchase volumes are smaller than government NMS, they frequently drive demand for cutting-edge, experimental technology and custom-built sensor packages. Finally, the emerging commercial sector, encompassing renewable energy producers (especially wind and solar), agricultural technology firms, and insurance companies, represents a rapidly growing customer base, purchasing specific data services or smaller, dedicated sounding systems (like specialized Lidar) to optimize their operational efficiency and risk assessment models.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 910 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lockheed Martin, Vaisala Oyj, Thales Group, Raytheon Technologies, BAE Systems, Northrop Grumman, Harris Corporation, Kipp & Zonen B.V., Meteolabor AG, Radiosonde Laboratory, SENSIT, Scintec AG, OTT HydroMet, Météo-France, Teledyne Technologies, Furuno Electric Co., Ltd., JMA, L3Harris Technologies, Toshiba Corporation, Safran S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Atmospheric Sounding System Market Key Technology Landscape

The technological landscape of the Atmospheric Sounding System market is rapidly evolving, moving away from purely in-situ measurements toward highly sophisticated, remote, and integrated sensing modalities. A cornerstone technology is Hyperspectral Infrared Sounding, primarily deployed on satellites (like the Cross-track Infrared Sounder - CrIS). These instruments measure radiance across thousands of spectral channels, providing highly accurate vertical profiles of temperature and moisture with unprecedented resolution, crucial for improving the initialization phase of modern NWP models. Complementary to this are Microwave Sounders, which penetrate clouds and are essential for obtaining data in regions where infrared sensors are obscured. The convergence of these two space-based sensing methods forms the backbone of global atmospheric monitoring, requiring extremely stable sensor design and complex on-board processing capabilities.

Ground-based remote sensing technologies, notably Lidar and Radar Wind Profilers, offer high temporal resolution data for the critical boundary layer, where most human activities and severe weather phenomena occur. Doppler Lidar systems, for instance, can measure 3D wind fields and aerosol distribution continuously, providing crucial input for short-term localized forecasts and air quality monitoring. Radar Wind Profilers utilize electromagnetic waves to measure vertical profiles of horizontal and vertical wind components, offering reliability even in adverse weather conditions. The advancement in these ground-based systems focuses on reducing power consumption, increasing mobility, and improving signal processing to retrieve cleaner data in complex terrain or highly polluted urban environments. Furthermore, passive technologies like Ground-Based Microwave Radiometers are gaining traction, providing continuous, cost-effective vertical profiles of temperature and humidity, acting as vital gap-fillers between the infrequent launch of radiosondes.

The most disruptive technological development, however, is the widespread use of Global Navigation Satellite System (GNSS) Radio Occultation (RO). This passive technique measures the bending angle of GNSS signals as they pass through the Earth’s atmosphere, which allows scientists to derive highly accurate profiles of refractivity, temperature, and moisture. GNSS-RO data is unique because it is exceptionally stable, precise, and not subject to instrument calibration drift, making it a critical anchor dataset for calibrating other sensors and improving global NWP accuracy. The deployment of small, inexpensive CubeSats dedicated to RO missions is rapidly increasing the volume of this critical data, challenging traditional methods of data collection by offering a global, cost-efficient, and inherently reliable atmospheric measurement source.

Regional Highlights

- North America: This region holds the largest market share, driven by massive federal spending by organizations like NOAA, NASA, and the Department of Defense. The US is a technological leader, continually investing in cutting-edge satellite programs (e.g., JPSS, GOES-R series) and advanced ground-based infrastructure (e.g., Lidar networks, next-generation radiosonde automation). The high concentration of aerospace and defense contractors also facilitates rapid technological deployment. The market here is mature, focused primarily on system upgrades, data integration, and developing advanced AI-driven analytical tools to maximize the value of existing sensor networks.

- Europe: Europe represents a highly significant market, characterized by strong coordination through pan-European organizations like EUMETSAT (responsible for meteorological satellites) and ECMWF. Investment is focused heavily on shared infrastructure, ensuring data interoperability, and advancing satellite-based sounding capabilities, particularly hyperspectral and microwave sounders. National meteorological services are actively modernizing their ground networks, emphasizing operational efficiency, and integrating more continuous remote sensing technologies to reduce reliance on manual observations. Climate change research funding is a major driver in this region.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region due to escalating climate vulnerability (typhoons, monsoons, droughts) and significant government investment in meteorological infrastructure modernization in countries like China, India, and Japan. These nations are expanding their domestic satellite programs, deploying dense networks of weather radar and Lidar, and increasing the launch frequency of radiosondes to enhance localized forecasting capability for heavily populated coastal and urban areas. The demand is often for high-volume, reliable systems suitable for rapid deployment and often involves significant technology transfer agreements with Western firms.

- Latin America: This region is characterized by fragmented infrastructure but high growth potential, often relying on international partnerships (WMO, US, European agencies) for access to satellite data and equipment modernization. Investment is typically focused on foundational systems, such as basic radiosonde networks and affordable ground-based wind profilers, critical for aviation safety and agricultural planning. Economic stability remains a key challenge, but increasing awareness of climate risks is driving slow but steady technological adoption, particularly in countries like Brazil and Mexico.

- Middle East and Africa (MEA): The MEA region exhibits heterogeneous market characteristics. The Middle East segment, particularly the Gulf nations, shows strong investment in high-end solutions (advanced radar, Lidar) driven by oil and gas operations and defense needs, often requiring climate data for sandstorm prediction and air quality monitoring. The African continent, conversely, requires substantial international support to establish foundational sounding capabilities, primarily focusing on robust, low-maintenance radiosonde and foundational satellite receiving systems essential for basic weather warning services and agricultural planning, with a strong emphasis on capacity building and training.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Atmospheric Sounding System Market.- Lockheed Martin

- Vaisala Oyj

- Thales Group

- Raytheon Technologies

- BAE Systems

- Northrop Grumman

- Harris Corporation

- Kipp & Zonen B.V.

- Meteolabor AG

- Radiosonde Laboratory

- SENSIT

- Scintec AG

- OTT HydroMet

- Météo-France

- Teledyne Technologies

- Furuno Electric Co., Ltd.

- JMA

- L3Harris Technologies

- Toshiba Corporation

- Safran S.A.

Frequently Asked Questions

Analyze common user questions about the Atmospheric Sounding System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Atmospheric Sounding System Market?

The primary driver is the accelerating frequency and intensity of severe weather events globally, necessitating continuous modernization of meteorological infrastructure and the deployment of higher-resolution sounding systems to enhance Numerical Weather Prediction (NWP) accuracy and climate resilience efforts.

How are space-based systems contributing to market expansion?

Space-based systems, specifically satellites utilizing hyperspectral infrared and microwave sounders, are crucial because they provide highly accurate, stable, and continuous vertical profiles of the atmosphere on a global scale, serving as the foundational data source for global forecasting models.

What role does Artificial Intelligence play in atmospheric sounding?

AI is essential for handling massive data volumes generated by modern sounders, improving data assimilation into weather models, performing real-time quality control, and enabling adaptive sampling techniques for airborne platforms, thereby maximizing the actionable output of collected data.

Which technology segment is expected to grow the fastest?

The GNSS Radio Occultation (RO) technology segment, largely driven by the deployment of cost-effective CubeSats, is projected to be among the fastest-growing, offering globally consistent and exceptionally stable atmospheric profile data critical for NWP initialization and sensor calibration.

What are the main restraints facing the widespread adoption of advanced sounding systems?

The key restraints are the extremely high initial capital costs associated with procuring and launching advanced satellite constellations and large-scale ground-based infrastructure (Lidar, Radar), coupled with the complexity of maintaining regulatory compliance regarding spectrum usage and data standardization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager