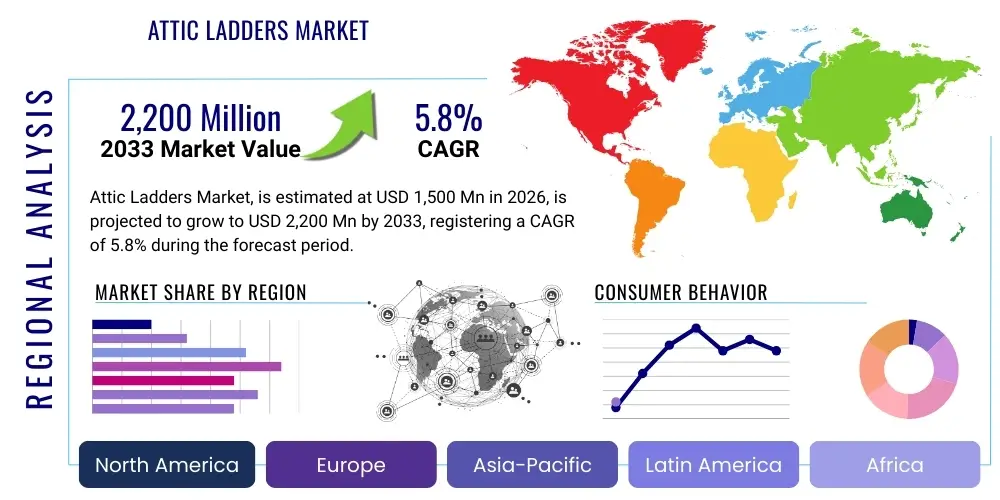

Attic Ladders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435648 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Attic Ladders Market Size

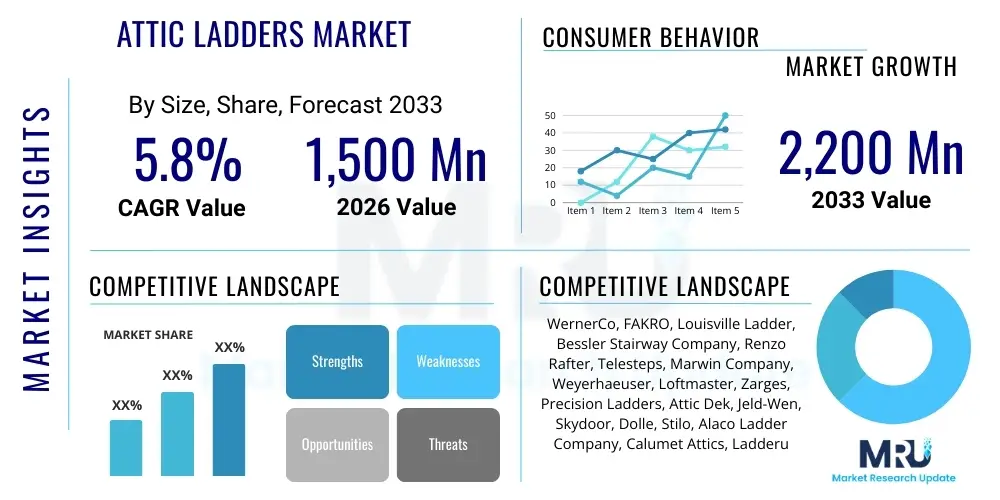

The Attic Ladders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.2 Billion by the end of the forecast period in 2033.

Attic Ladders Market introduction

The Attic Ladders Market encompasses the manufacturing, distribution, and installation of retractable or folding stair systems designed to provide safe and easy access to attic spaces in residential and commercial buildings. These access systems are crucial components in modern architecture, maximizing usable space while maintaining aesthetic appeal and minimizing intrusion when not in use. Key product types include wooden folding ladders, metal (aluminum or steel) telescoping ladders, and heavy-duty fiberglass models, catering to different load-bearing capacities and fire safety requirements. The fundamental functionality revolves around reliable, compact storage and deployment, addressing safety concerns inherent in traditional ladder use.

Major applications of attic ladders primarily reside in residential properties, facilitating storage of seasonal items, light maintenance tasks, and access to HVAC systems or water heaters often situated in the roof cavity. Increasingly, these products are utilized in commercial settings, particularly in smaller retail units or office buildings that require intermittent, safe access to ceiling utilities or secondary storage areas above drop ceilings. The demand is heavily influenced by housing starts, renovation rates, and the growing consumer preference for maximizing every square foot of existing property space, particularly in dense urban areas where dedicated storage solutions are at a premium.

The primary benefits driving market penetration include enhanced safety features, such as deep treads, handrails, and robust locking mechanisms, significantly reducing the risk of accidents compared to standard portable ladders. Furthermore, the convenience of seamless integration into the ceiling structure ensures the system is hidden from view, preserving interior design aesthetics. Driving factors include stringent building codes mandating safe overhead access, the DIY culture encouraging home improvement projects, and continuous innovation leading to lighter, more durable, and easier-to-install units, such as electric-powered or remote-controlled automatic ladders which enhance user comfort and accessibility.

Attic Ladders Market Executive Summary

The Attic Ladders Market demonstrates robust growth, primarily propelled by sustained activity in the residential renovation sector across developed economies and rapid urbanization in emerging markets. Business trends highlight a strong shift toward automation and material diversification; manufacturers are increasingly focusing on aluminum and fiberglass due to their durability, low maintenance, and fire-resistant properties, positioning them favorably against traditional wood options. Furthermore, competitive strategies emphasize direct-to-consumer online channels, streamlining the purchasing and installation process, particularly for standardized models suitable for DIY enthusiasts, while custom, heavy-duty applications continue to rely on professional installation services.

Regional trends indicate North America maintaining market leadership due to high rates of home ownership, strict building safety regulations, and significant expenditure on home improvement projects. Europe follows closely, driven by renovations of aging housing stock and a strong preference for high-quality, sustainable wood and insulated attic ladder systems that contribute to energy efficiency. The Asia Pacific region is rapidly expanding, fueled by booming construction sectors in China, India, and Southeast Asian nations where increasing affluence translates into greater investment in domestic storage and accessibility solutions, although initial product adoption is concentrated in basic, cost-effective metal variants.

Segment trends reveal that the metal (aluminum) segment holds a dominant market share, valued for its strength-to-weight ratio and cost effectiveness. However, the electric or automatic operation segment is exhibiting the fastest growth trajectory, driven by aging populations seeking improved accessibility and the integration of smart home technologies. Application-wise, the residential sector remains the bedrock of demand, though the commercial segment, particularly warehousing and light industrial facilities requiring secondary mezzanine access, presents significant untapped potential for heavy-duty, commercial-grade attic access systems meeting rigorous safety certifications.

AI Impact Analysis on Attic Ladders Market

User queries regarding AI's impact on attic ladders frequently revolve around manufacturing optimization, smart home integration, and enhanced safety diagnostics. Key themes users are concerned about include how AI might streamline complex installation processes, whether automated inspection systems can verify ladder integrity, and the practical application of machine learning in optimizing supply chains for customized products. Expectations center on AI contributing to predictive maintenance, ensuring ladders are deployed only under safe conditions, and enabling highly personalized design specifications that minimize waste and maximize structural fit, thereby enhancing both efficiency and consumer safety in a segment traditionally dominated by manual processes.

While attic ladders are fundamentally mechanical components, AI's influence is transforming upstream manufacturing and downstream consumer experience. In manufacturing, AI-driven simulations and predictive analytics are used to optimize material cutting paths, reducing waste in wood and metal processing, and improving the structural design for maximum load capacity with minimal material use. This results in faster production cycles and reduced operational costs, enabling manufacturers to respond more quickly to custom orders or seasonal demand fluctuations without accumulating excessive inventory. Furthermore, quality control systems utilizing computer vision and machine learning algorithms are now deployed to inspect welds, folding mechanisms, and material defects with greater accuracy than human inspectors, ensuring higher product reliability.

In the consumer-facing market, the primary impact of AI is seen through smart home integration, particularly concerning automatic or electric ladders. AI algorithms can manage deployment schedules, integrate with environmental sensors (e.g., humidity or temperature monitoring in the attic), and enhance safety features. For instance, sensors monitored by an embedded AI system can prevent automatic deployment if obstructions are detected, or notify homeowners of potential mechanical failures or stress fractures before they become critical. Additionally, AI assists in the retail environment by optimizing augmented reality (AR) tools, allowing customers to visualize the installed ladder model accurately within their ceiling space, ensuring proper sizing and fit before purchase.

- AI-enhanced structural design optimization for improved load bearing and material efficiency.

- Machine learning integration in smart automatic ladders for predictive maintenance and obstacle detection.

- Computer vision systems ensuring defect-free manufacturing and high-precision assembly.

- Supply chain optimization using AI for demand forecasting and inventory management of custom components.

- Augmented Reality (AR) tools powered by AI for accurate consumer visualization and installation guidance.

DRO & Impact Forces Of Attic Ladders Market

The market dynamics are defined by a strong confluence of drivers, including accelerating rates of residential refurbishment and a heightened global emphasis on adhering to rigorous building and safety standards. Restraints primarily involve the substantial volatility in the prices of key raw materials like aluminum and timber, alongside the persistent challenge of professional, defect-free installation which often requires specialized labor. Opportunities are significant, centered around the rapid adoption of automated, high-end access solutions and geographic expansion into rapidly developing urban centers, particularly those in the APAC region. These elements create a powerful set of impact forces that collectively dictate market growth trajectory, pricing strategies, and product innovation focus.

Drivers: A primary growth driver is the continuous rise in residential renovation projects, particularly in mature markets like North America and Europe, where homeowners are seeking to monetize or efficiently utilize existing storage spaces. This trend is bolstered by the necessity for accessing essential utilities often placed in the attic, such as networking equipment, ventilation systems, or solar panel components. The increased awareness regarding household safety is another critical driver; consumers are actively replacing outdated or compromised pull-down systems with modern ladders featuring enhanced safety attributes such as non-slip treads, safety railings, and improved insulation components, often spurred by insurance or building code compliance requirements. Furthermore, the convenience and ease of use offered by newer electric and telescopic models appeal strongly to an aging demographic.

Restraints: The market faces significant headwinds primarily related to material input costs. The fluctuation in global commodity prices, specifically for aluminum, steel, and high-quality lumber, directly impacts manufacturing costs and subsequently consumer pricing, potentially dampening volume sales in price-sensitive segments. Another crucial restraint is the inherent complexity of installation for integrated attic ladder systems; professional installation is often required to ensure structural integrity and airtight sealing, adding significantly to the final cost. DIY installation, while popular, carries risks of improper fit, leading to heat loss, structural damage, or eventual safety hazards, which can negatively affect brand perception and necessitate stricter regulatory oversight.

Opportunities: Opportunities abound in technological innovation and market penetration strategies. The shift towards automated and smart access solutions represents a high-value growth area, offering superior convenience and integration with modern smart home ecosystems. Furthermore, manufacturers have a substantial opportunity to develop specialized, fire-rated, and heavily insulated ladder models that meet stringent passive house standards, capitalizing on the global trend toward energy-efficient construction. Geographically, underserved markets, particularly within developing nations that are experiencing a building boom, offer fertile ground for scalable, durable, and affordable aluminum or steel attic ladder products.

- Increasing residential renovation activities.

- Stringent adherence to global safety standards and building codes.

- Growing adoption of automation and electric operation models.

- Volatility in raw material costs (aluminum, timber).

- Complexity and high cost associated with professional installation.

- Expansion into energy-efficient and passive house construction segments.

- Integration of smart home features for enhanced user safety and convenience.

Segmentation Analysis

The Attic Ladders Market is segmented based on Material, Operation, Application, and Distribution Channel, reflecting diverse end-user requirements concerning durability, ease of use, frequency of access, and budgetary constraints. Analyzing these segments provides crucial insights into dominant consumer preferences and future technology adoption trends. While traditional materials like wood maintain a foundational presence, the rapid expansion of the metal and composite segments underscores a market shift towards products offering higher load capacity and superior fire resistance. The segmentation highlights the growing disparity between basic, manual residential systems and complex, often automated, commercial access solutions requiring specialized certification.

The segmentation by Operation is perhaps the most dynamic area of growth, separating manual pull-down models from electric or automatic systems. Automatic ladders, although premium-priced, are penetrating the market rapidly due to demographic shifts (aging population) and the increasing desire for integrated, effortless home technology. Conversely, the segmentation by Application confirms the residential sector's dominance, yet identifies commercial applications—especially in light industrial storage and retail back-of-house areas—as a high-potential segment for specialized, heavy-duty telescoping or concertina-style ladders designed for high-frequency use and industrial environments.

Distribution Channel segmentation further differentiates market approaches, highlighting the established role of traditional offline channels (specialty building supply stores and hardware wholesalers) which cater primarily to professional contractors and custom builders. However, the online channel is gaining substantial traction, driven by the increasing consumer confidence in purchasing larger home improvement items online, supported by detailed product specifications, comparison tools, and direct shipping benefits, catering significantly to the robust and expanding DIY consumer base seeking convenience and competitive pricing on standard models.

- Material

- Wood (Traditional, economical, insulation properties)

- Metal (Aluminum, Steel - Durable, high load capacity)

- Fiberglass/Composites (Lightweight, non-conductive, fire resistance)

- Operation

- Manual (Folding, Telescopic)

- Electric/Automatic (Remote controlled, piston-assisted)

- Application

- Residential (Storage, Utility access)

- Commercial (Retail, Light Industrial, Office access)

- Distribution Channel

- Online Retail

- Offline (Hardware Stores, Specialty Dealers, Wholesalers)

Value Chain Analysis For Attic Ladders Market

The value chain for the Attic Ladders Market begins with the acquisition and processing of core raw materials, predominantly timber (hardwoods and softwoods), aluminum sheets and extrusions, and various polymer resins for fiberglass components. This upstream segment is highly sensitive to global commodity prices and involves specialized processing like wood treatment for fire resistance and moisture control, and metal fabrication for complex hinge and rail systems. Suppliers of specialized hardware, such as springs, counterweights, and pneumatic cylinders for automatic operation, play a crucial role in determining the final product's quality, durability, and cost-effectiveness. Efficiency in material sourcing and minimizing scrap rates are paramount in this initial stage.

The midstream phase involves manufacturing and assembly, where components are integrated into finished products. Automation is increasingly employed to ensure precision in cutting and welding, particularly for metal ladders, while skilled labor remains essential for the assembly of complex folding wooden units and the integration of electrical mechanisms in automatic models. Following manufacturing, the distribution phase involves both direct and indirect channels. Direct distribution is common for large commercial orders or proprietary installer networks. Indirect distribution, encompassing wholesalers, large-format home improvement retailers (e.g., Home Depot, Lowe's), and specialized building supply dealers, manages inventory, handles logistics, and provides necessary point-of-sale support, acting as the bridge between manufacturers and end-users, be they professional contractors or DIY consumers.

Downstream activities center on installation, customer service, and after-sales support. While many standardized residential models are designed for DIY installation, professional contractors are essential for custom fits, compliance with specific local building codes, and complex electric installations. The increasing importance of the online distribution channel means that logistics and robust packaging to prevent transit damage are critical considerations. The final layer of the value chain is consumer feedback, which loops back to inform research and development (R&D) regarding safety enhancements, insulation improvements, and the integration of new technologies, ensuring continuous product relevance and adherence to evolving consumer safety expectations.

Attic Ladders Market Potential Customers

The primary and largest segment of potential customers for the Attic Ladders Market consists of residential homeowners, particularly those residing in single-family houses or townhomes built prior to 2010 who are actively engaged in home remodeling or property maintenance. These buyers seek reliable, space-saving access solutions to utilize underutilized attic space for seasonal storage, or to safely reach mechanical systems. Within the residential segment, key buyer personas include first-time renovators focused on maximizing space value, long-term homeowners prioritizing safety and durability, and older adults who specifically require automatic or low-effort access systems due to mobility concerns. The purchasing decision is often driven by perceived product safety, insulation value (to minimize energy loss), and aesthetic integration into the home ceiling.

A rapidly growing segment of potential customers includes professional residential builders and large-scale developers who integrate high-quality attic access systems into new construction projects as a standard feature, focusing on models that comply with energy efficiency standards and structural codes. These professional buyers prioritize ease of installation, consistent supply reliability, and volume pricing. They act as significant institutional buyers, often preferring pre-assembled units or proprietary systems that streamline the construction timeline. Their preference heavily leans towards highly durable materials, typically metal or composite, capable of long-term performance guarantees.

The commercial sector represents another significant potential customer base, comprising facility managers and procurement officers for commercial properties such as small retail stores, mid-sized office buildings, and light warehousing facilities. These customers utilize attic ladders for less frequent but necessary access to ceiling utilities, inventory overflow storage, or maintenance platforms. Commercial buyers prioritize regulatory compliance, fire ratings, exceptional load-bearing capacity, and industrial-grade durability that can withstand heavier or more frequent usage than typical residential models. Specialized concertina or heavy-duty telescoping aluminum ladders often meet their stringent operational and safety requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,500 Million |

| Market Forecast in 2033 | USD 2,200 Million |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | WernerCo, FAKRO, Louisville Ladder, Bessler Stairway Company, Renzo Rafter, Telesteps, Marwin Company, Weyerhaeuser, Loftmaster, Zarges, Precision Ladders, Attic Dek, Jeld-Wen, Skydoor, Dolle, Stilo, Alaco Ladder Company, Calumet Attics, Ladderup, SEMA. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Attic Ladders Market Key Technology Landscape

The technology landscape of the Attic Ladders Market is characterized by innovations focused on material science, operational mechanization, and insulation effectiveness. Material innovation primarily involves the increased use of high-strength, lightweight aluminum alloys and engineered fiberglass composites. These materials offer superior load capacity and corrosion resistance compared to traditional lumber, alongside benefits such as non-conductivity (for fiberglass) and fire resistance, which are crucial for compliance with modern building safety standards. Advanced manufacturing techniques, including precision extrusion and specialized welding processes, ensure that folding mechanisms are robust, durable, and operate smoothly over extended usage cycles, minimizing maintenance requirements and maximizing product lifespan.

The most significant technological advancements are centered around the Operation segment, specifically the development and refinement of electric and automatic attic access systems. These systems utilize advanced electromechanical components, including high-torque linear actuators, sophisticated control boards, and wireless remote-control capabilities. Integration with safety sensors is paramount; these sensors detect obstructions during deployment or retraction, halting movement to prevent damage or injury. Furthermore, smart technology integration allows these automatic systems to connect with home automation platforms, enabling scheduled operation or status notifications, significantly improving convenience and user experience, especially for older populations or individuals with mobility challenges.

Insulation and sealing technologies constitute another crucial area of focus, driven by increasing regulatory demands for energy efficiency in residential construction. Modern attic ladders incorporate sophisticated hatch designs featuring multi-layer insulation cores (e.g., expanded polystyrene or polyurethane foam) and advanced perimeter weatherstripping. This technology ensures a tight, energy-efficient seal when the ladder is stowed, preventing significant thermal bridging and air leakage between the conditioned living space and the unconditioned attic environment. These insulated and sealed systems are critical differentiators, allowing manufacturers to market their products as contributors to overall home energy savings and compliance with rigorous energy certification standards.

Regional Highlights

- North America: This region holds the largest market share, driven by a strong culture of DIY home improvement, high consumer spending on residential remodeling, and stringent safety regulations enforced by organizations like OSHA and various local building codes. The US market, in particular, exhibits high demand for high-load capacity aluminum and electric ladders.

- Europe: Characterized by a strong focus on energy efficiency and sustainability, the European market shows robust demand for well-insulated wooden and composite ladders that comply with passive house standards. Germany, the UK, and Scandinavia are key markets, prioritizing quality construction and thermal performance.

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily fueled by rapid urbanization, increasing middle-class income, and subsequent growth in new housing construction, especially in China and India. The demand is currently dominated by economical metal ladders, but there is a rising trend toward premium, automated systems in metropolitan areas.

- Latin America (LATAM): Growth in LATAM is steady, driven by infrastructure development and residential construction, though market penetration is moderate. Price sensitivity is a major factor, leading to a preference for basic, durable manual aluminum or steel ladder models.

- Middle East and Africa (MEA): The MEA market is developing, with growth concentrated in the Gulf Cooperation Council (GCC) countries due to massive construction projects. Demand is centered on fire-rated and highly durable metal solutions suitable for high ambient temperatures and large residential compounds.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Attic Ladders Market.- WernerCo

- FAKRO

- Louisville Ladder

- Bessler Stairway Company

- Renzo Rafter

- Telesteps

- Marwin Company

- Weyerhaeuser

- Loftmaster

- Zarges

- Precision Ladders

- Attic Dek

- Jeld-Wen

- Skydoor

- Dolle

- Stilo

- Alaco Ladder Company

- Calumet Attics

- Ladderup

- SEMA

Frequently Asked Questions

Analyze common user questions about the Attic Ladders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the increased demand for automatic attic ladders?

Increased demand is driven by the desire for enhanced convenience, particularly among the aging population seeking effortless access, coupled with the integration of remote-controlled operation and smart home systems for superior safety and ease of use.

How significant is the impact of material choice on attic ladder performance and cost?

Material choice is crucial. Wood is economical and offers good insulation but requires maintenance; Metal (aluminum/steel) offers high durability and load capacity but may be less thermally efficient; Fiberglass provides excellent fire and electrical resistance, catering to high-specification safety requirements.

Which region currently represents the largest market share for attic ladders?

North America holds the largest market share due to extensive residential remodeling activities, high consumer focus on home safety, and regulatory environments that encourage the replacement of old or unsafe attic access solutions.

Are insulated attic ladders required for energy efficiency compliance in new construction?

Yes, in many regions, especially Europe and parts of North America, heavily insulated and sealed attic ladders are essential to meet stringent energy efficiency standards, preventing air leakage and thermal bridging, thus contributing to lower heating and cooling costs.

What are the primary challenges restraining the growth of the Attic Ladders Market?

Key restraints include the volatile cost of raw materials (timber and aluminum), which affects pricing stability, and the reliance on professional installation for complex or customized units, adding significantly to the final cost for the consumer.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager