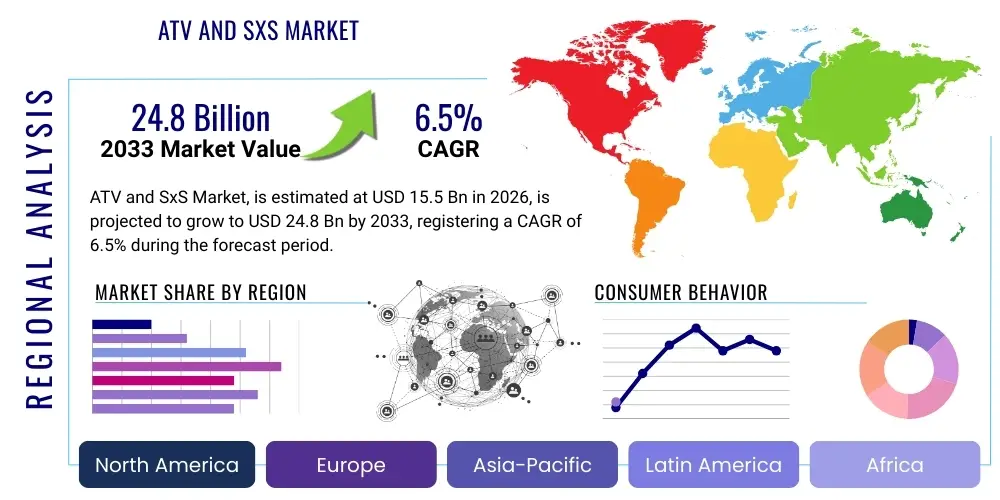

ATV and SxS Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436698 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

ATV and SxS Market Size

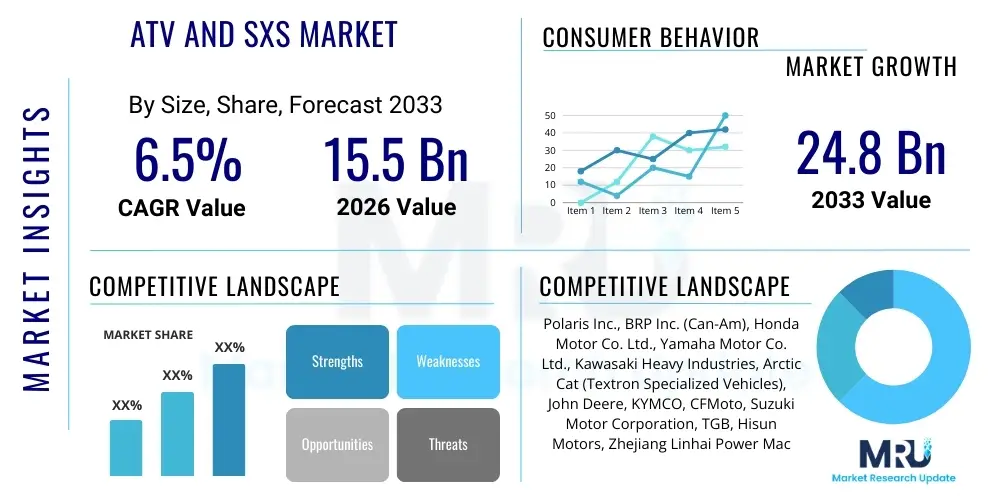

The ATV and SxS Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 24.8 Billion by the end of the forecast period in 2033.

ATV and SxS Market introduction

The All-Terrain Vehicle (ATV) and Side-by-Side (SxS), also known as Utility Terrain Vehicles (UTVs) or Recreational Off-Highway Vehicles (ROVs), market encompasses rugged, powerful motorized vehicles designed for off-road use across diverse landscapes including dirt, sand, mud, and snow. ATVs typically accommodate a single rider who straddles the machine, while SxS vehicles are designed for two or more passengers seated side-by-side and feature roll cages, seatbelts, and steering wheels, offering enhanced safety and utility capabilities. These vehicles are primarily utilized in agricultural, military, and recreational applications, serving as essential tools for transportation, towing, and hauling equipment in environments inaccessible to standard vehicles.

Product descriptions vary significantly based on intended use. Sport models emphasize high horsepower, robust suspension systems, and lightweight frames, catering to competitive racing and high-speed recreational riding. Conversely, Utility models prioritize durability, cargo capacity, and lower speed torque, making them indispensable in farm management, construction sites, and forestry operations. The ongoing evolution of engine technology, material science, and safety features continues to redefine market standards, driving increased consumer adoption across both developed and emerging economies.

Major applications include farming and livestock management, where SxSs replace tractors for certain tasks due to their maneuverability and efficiency; military and defense operations requiring stealthy, all-terrain reconnaissance and transport; and recreational activities such as trail riding, hunting, and camping. Key benefits of these vehicles include superior ground clearance, exceptional traction, robust payload and towing capacity, and versatility across extreme weather conditions. Driving factors propelling this market growth include increasing disposable incomes globally, a rising consumer preference for outdoor and adventure tourism, continuous technological integration such as advanced transmission systems, and strong demand from the agricultural sector for efficient utility transportation.

ATV and SxS Market Executive Summary

The ATV and SxS market demonstrates robust expansion, driven primarily by strong consumer spending on outdoor recreation and significant capital investment in farm mechanization, particularly across North America and Asia Pacific. Business trends indicate a marked shift towards the Side-by-Side segment, which is increasingly favored over traditional ATVs due to superior safety features, greater payload capacity, and broader utility applications. Manufacturers are focusing heavily on electrification and advanced connectivity features to meet evolving regulatory standards and consumer demands for eco-friendly and technologically integrated off-road experiences. Competition remains high, prompting firms to invest heavily in specialized dealerships and robust aftermarket service networks to capture customer loyalty and maximize lifetime value.

Regionally, North America maintains its dominance, spurred by a mature recreational culture, expansive private land ownership, and intensive agricultural activities necessitating rugged utility vehicles. However, the Asia Pacific region, led by China and India, is emerging as the fastest-growing market, driven by rapid urbanization pushing industrial activities further into remote areas and increasing defense modernization efforts. Regulatory environments concerning emissions and safety standards vary geographically, influencing product design and market entry strategies; for instance, European safety regulations often necessitate specialized vehicle configurations.

Segment trends highlight the growing importance of the 800cc and above engine displacement category, signifying a preference for high-performance and heavy-duty utility models capable of managing complex tasks. Furthermore, the emerging Electric ATV and SxS segment, while currently nascent, is poised for explosive growth due to global decarbonization initiatives and battery technology advancements that are overcoming range and charging infrastructure limitations. Utility applications consistently represent the largest market share, though the Sport segment continues to see innovation in suspension and transmission technology aimed at maximizing the thrill of performance riding.

AI Impact Analysis on ATV and SxS Market

User queries regarding AI in the ATV and SxS market frequently center on safety enhancements, the feasibility of autonomous operation in unpredictable terrain, and the utility of predictive maintenance systems. Users are concerned about how machine learning algorithms can improve dynamic stability control, particularly when navigating steep inclines or traversing uneven surfaces at speed. There is significant interest in telematics and data analytics powered by AI to monitor engine health, optimize fuel consumption, and track fleet utilization in commercial or military applications. Furthermore, consumers expect AI integration to personalize the riding experience, potentially adjusting throttle response and suspension settings in real-time based on rider input and environmental conditions, transforming these vehicles from mechanical assets into intelligent transportation platforms.

The implementation of Artificial Intelligence and Machine Learning (ML) is shifting the focus of ATV and SxS design from purely mechanical power to intelligent power delivery and environmental awareness. AI algorithms are crucial for developing Advanced Driver Assistance Systems (ADAS) tailored for off-road challenges, such as automatic collision avoidance in forested areas or adaptive cruise control optimized for rugged trails. These systems rely on sensor fusion (Lidar, radar, cameras) and real-time data processing to enhance operator safety and reduce the risk of rollovers or critical mechanical failures. Fleet management services, commonly utilized by rental companies or large agricultural operations, are leveraging ML to optimize vehicle scheduling, track asset location, and minimize unauthorized usage through sophisticated geo-fencing and usage monitoring tools, providing unprecedented operational efficiency.

Moreover, AI is playing a transformative role in manufacturing and supply chain management within the ATV and SxS industry. Predictive analytics are being employed to forecast material demands, manage inventory levels, and schedule maintenance downtime for production machinery, significantly improving operational throughput. The use of generative design powered by AI allows engineers to rapidly iterate on structural components, optimizing chassis rigidity and reducing weight while ensuring compliance with stringent safety standards. This integration of smart technology is raising the total cost of ownership slightly but delivering substantial returns in terms of efficiency, reduced downtime, and enhanced safety profile, thereby solidifying the technology's long-term value proposition.

- Implementation of AI-driven Advanced Driver Assistance Systems (ADAS) for off-road navigation and stability control.

- Development of predictive maintenance programs utilizing machine learning to forecast component failure and optimize service schedules.

- Integration of smart telematics for fleet management, usage tracking, and geo-fencing capabilities in commercial fleets.

- Optimization of manufacturing processes and component design through AI-powered generative design techniques.

- Enhancement of real-time diagnostics and remote monitoring systems accessible via connected vehicle platforms.

DRO & Impact Forces Of ATV and SxS Market

The ATV and SxS market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO). Key drivers include the escalating popularity of powersports activities and off-road tourism, supported by a growing network of dedicated recreational trails and state parks. Simultaneously, the persistent demand from the agricultural sector for mechanized utility vehicles capable of covering vast, uneven terrains efficiently provides a foundational demand base. Restraints primarily involve stringent government regulations pertaining to emissions and safety standards, particularly the rising enforcement of limits on permissible off-road use in ecologically sensitive areas. Furthermore, the high initial cost of premium SxS models and associated maintenance expenses, coupled with rising interest rates impacting consumer financing, can impede widespread adoption among budget-conscious buyers.

Opportunities in this sector are strongly tied to technological advancements, notably the rapid development and commercialization of Electric Vehicles (EVs) designed for off-road use. These electric variants offer reduced noise pollution, lower running costs, and exemption from certain emission restrictions, appealing to environmentally conscious consumers and utility users operating in noise-sensitive areas. Furthermore, expanding geographical penetration into emerging markets in Latin America and Southeast Asia, where infrastructure development necessitates rugged transport solutions, presents substantial long-term growth potential. Manufacturers are also finding opportunities in offering highly customizable and modular platforms that cater specifically to niche requirements, such as search and rescue operations or specialized mining transport.

The impact forces influencing the market are multifaceted, encompassing macroeconomic stability, regulatory shifts, and technological disruption. Economic downturns significantly impact recreational vehicle sales, classifying them as discretionary purchases susceptible to immediate cutbacks. Conversely, sustained investment in smart agriculture and infrastructure projects acts as a stabilizing force, driving utility segment sales. The push for cleaner energy sources and the development of lightweight, durable materials (e.g., advanced composites) represent powerful technological impacts that reduce vehicle weight, increase payload capacity, and improve overall energy efficiency. Safety legislation, particularly mandatory features like Electronic Stability Control (ESC) and enhanced rollover protection, significantly impacts design and production costs but ultimately improves market perception and expands the user base by reducing accident rates.

Segmentation Analysis

The ATV and SxS market segmentation is critical for understanding varied consumer preferences and industrial requirements, enabling manufacturers to tailor product development and marketing efforts effectively. The market is primarily divided based on Vehicle Type (ATV and SxS), Application (Utility, Sport, Military/Defense), Displacement (ranging from sub-400cc to above 800cc), and Fuel Type (Gasoline and Electric). The detailed analysis of these segments reveals that the SxS segment is rapidly gaining market share over ATVs, driven by its superior payload capacity, multi-passenger capability, and inherent safety advantages. Furthermore, the application split confirms the utility sector as the largest revenue generator, while the Sport segment dictates innovation in performance technology.

- By Vehicle Type: ATV (All-Terrain Vehicle), SxS (Side-by-Side)/UTV (Utility Terrain Vehicle)

- By Application: Utility, Sport, Military & Defense, Recreation & Touring

- By Displacement: Below 400cc, 400cc – 800cc, Above 800cc

- By Fuel Type: Gasoline/Diesel, Electric/Hybrid

- By Drive Type: 2WD, 4WD, AWD

Value Chain Analysis For ATV and SxS Market

The value chain for the ATV and SxS market begins with upstream analysis, focusing heavily on raw material sourcing, which includes specialized high-strength steel, lightweight aluminum alloys for chassis and suspension components, and advanced polymer composites for body panels. Manufacturers maintain complex relationships with tier-one suppliers for critical components like engines (often proprietary or sourced from specialized powertrain companies), transmission systems, and advanced electronic control units (ECUs). Quality control and inventory management at the upstream level are critical due to the high regulatory requirements for safety and performance, often necessitating vertical integration or exclusive supplier contracts to ensure material quality and consistent supply, mitigating volatility in raw material prices.

Midstream activities encompass the sophisticated manufacturing process, which involves high-precision welding, painting, final assembly, and rigorous testing. This stage is characterized by significant capital expenditure on robotic assembly lines and quality assurance procedures to meet varied global safety standards. Product differentiation is achieved through engineering specialization, particularly in suspension tuning, drive train configuration (2WD, 4WD, AWD), and integration of digital features. Downstream analysis involves distribution channels, predominantly relying on an established network of authorized dealerships. These dealerships provide vital sales, financing, and critical aftermarket services such including parts supply, scheduled maintenance, and warranty support, ensuring sustained customer satisfaction and brand loyalty.

Distribution is managed through both direct and indirect channels. Direct sales are often utilized for large institutional customers, such as military procurement or major industrial fleet purchases, allowing manufacturers closer control over pricing and specifications. However, the majority of retail sales flow through indirect channels—the independent dealer network—which is crucial for localized marketing, customer demonstration rides, and servicing geographically dispersed end-users. Aftermarket revenue, driven by accessories, performance upgrades, and replacement parts, constitutes a substantial and high-margin segment of the downstream value chain, often equaling or surpassing the initial vehicle sale profit over the machine's lifespan. Optimization of the logistics chain, ensuring timely delivery of assembled vehicles and spare parts, is essential for maintaining operational competitiveness.

ATV and SxS Market Potential Customers

Potential customers for the ATV and SxS market span a diverse range of end-users, categorized primarily into recreational consumers, utility operators, and government agencies. Recreational consumers, the largest segment, include adventure enthusiasts, hunters, campers, and private landowners utilizing the vehicles for pleasure and land maintenance. These buyers prioritize features such as high-performance engines, premium comfort features, and advanced suspension systems. Marketing to this segment often focuses on lifestyle branding, safety, and the ability of the vehicles to navigate challenging off-road terrain effectively for leisure pursuits. Seasonal purchasing trends, often spiking before summer and hunting seasons, characterize this user group.

Utility operators constitute the core commercial demand, comprising farmers, ranchers, construction companies, mining operators, and industrial facilities requiring heavy-duty transportation solutions. For this group, the selection criteria revolve around reliability, towing capacity, cargo bed size, durability, and low operational costs. SxS vehicles are particularly favored in this segment due to their enhanced payload and passenger capacity. Procurement decisions are often based on long-term value, maintenance schedules, and the availability of specialized attachments (e.g., snow plows, sprayers) that maximize the vehicle's utility in specialized work environments. Fleet purchasing and lease agreements are common transactional structures for large-scale utility customers.

Government and institutional buyers represent a consistent, albeit specialized, customer base. This includes military and defense organizations, law enforcement agencies (border patrol, parks services), and emergency services (search and rescue, firefighting). These organizations require highly specialized, rugged vehicles often customized with specific communication systems, armor, or stealth capabilities. Purchases are typically governed by lengthy tender processes and strict compliance requirements related to performance, safety, and reliability under extreme operational stress. The demand from the military segment often drives innovation in electrification and stealth technology, which eventually trickles down into the commercial and recreational markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 24.8 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Polaris Inc., BRP Inc. (Can-Am), Honda Motor Co. Ltd., Yamaha Motor Co. Ltd., Kawasaki Heavy Industries, Arctic Cat (Textron Specialized Vehicles), John Deere, KYMCO, CFMoto, Suzuki Motor Corporation, TGB, Hisun Motors, Zhejiang Linhai Power Machinery Corp., Kubota Corporation, Massimo Motors, Intimidator UTV, Caterpillar Inc., Caterpillar Defense, Land Pride. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ATV and SxS Market Key Technology Landscape

The ATV and SxS market is experiencing rapid technological evolution centered around improving vehicle performance, safety, and connectivity. Key advancements include sophisticated suspension technologies, such as dynamically adjustable damping systems that adapt automatically to changing terrain (e.g., Fox Live Valve or Polaris DYNAMIX). These electronic suspension controls utilize sensor data to stiffen or soften shocks in milliseconds, significantly enhancing ride comfort, vehicle stability, and high-speed handling, which is crucial for both sport and utility applications. Engine technology is also evolving, with continuous variable transmissions (CVT) being refined to deliver smoother power delivery and improved fuel efficiency, alongside the increasing adoption of turbocharged engines in high-end SxS models to achieve superior power-to-weight ratios without significantly increasing engine displacement.

A major focus of technological development is the transition toward electrification. While gasoline engines dominate, significant research and development investment is flowing into high-capacity lithium-ion battery packs and optimized electric powertrains for off-road environments. Electric ATVs and SxSs address the need for quiet operation and zero tailpipe emissions, making them ideal for regulated areas, hunting, and enclosed spaces. Challenges remain regarding battery longevity, charging infrastructure in remote locations, and the impact of weight on handling, yet improvements in energy density and thermal management systems are rapidly closing these gaps. Furthermore, regenerative braking systems are being integrated to maximize battery range, providing a competitive advantage over traditional powertrains in certain duty cycles.

Beyond mechanical and powertrain innovations, digital technology integration is vital. Telematics systems, GPS navigation optimized for off-road trails, and smartphone connectivity are standardizing the user experience. Vehicle health monitoring systems, often utilizing Internet of Things (IoT) sensors, transmit real-time diagnostic data to dealers and operators, facilitating proactive maintenance and minimizing unscheduled downtime. This digital landscape extends to safety, with roll-over protection structures (ROPS) being coupled with inertial measurement units (IMUs) and AI-driven stability control systems. This comprehensive technological push ensures that modern ATVs and SxSs are not just rugged machines but sophisticated, connected devices optimized for safety and efficiency in the most challenging conditions.

Regional Highlights

- North America: Dominates the global market share, largely due to the robust recreational off-roading culture, extensive network of maintained trails, and high usage in agriculture and ranching sectors in the U.S. and Canada. The region exhibits high demand for high-displacement (above 800cc) SxS vehicles and is a primary driver for innovation in electric off-road technology.

- Europe: Characterized by stringent regulatory oversight regarding emissions and safety, which drives demand for smaller, more efficient, and often electric utility vehicles suitable for farming and municipal tasks. Eastern European markets show increasing demand due to infrastructure development and rising disposable incomes.

- Asia Pacific (APAC): Expected to register the highest CAGR, propelled by rapid industrialization, defense modernization efforts in countries like India and China, and increasing affluence leading to greater demand for recreational vehicles in markets such as Australia. Utility vehicles find massive application in large-scale agriculture across Southeast Asia.

- Latin America: Growth is primarily driven by the mining, construction, and agricultural sectors, especially in Brazil and Mexico, where ATVs and SxSs serve as indispensable workhorses in remote, often poorly developed areas. Price sensitivity is higher in this region, favoring cost-effective utility models.

- Middle East and Africa (MEA): Market growth is steady, supported by defense spending requiring robust tactical vehicles and significant deployment in oil and gas exploration and facility management in harsh desert environments. Demand for high-performance desert recreational vehicles is also notable in the Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ATV and SxS Market.- Polaris Inc.

- BRP Inc. (Can-Am)

- Honda Motor Co. Ltd.

- Yamaha Motor Co. Ltd.

- Kawasaki Heavy Industries

- Arctic Cat (Textron Specialized Vehicles)

- John Deere

- KYMCO

- CFMoto

- Suzuki Motor Corporation

- TGB

- Hisun Motors

- Zhejiang Linhai Power Machinery Corp.

- Kubota Corporation

- Massimo Motors

- Intimidator UTV

- Caterpillar Inc.

- Kioti Tractor (Daedong Industrial)

- Mahindra & Mahindra Ltd.

- Bennche LLC

Frequently Asked Questions

Analyze common user questions about the ATV and SxS market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between an ATV and an SxS vehicle?

ATVs (All-Terrain Vehicles) are designed for a single straddled rider and utilize handlebar steering, suitable for high-agility, personal recreation. SxS (Side-by-Side) vehicles, also called UTVs, feature automotive-style seating for two or more passengers, a steering wheel, and a protective roll cage, prioritizing utility, payload capacity, and enhanced safety.

How are environmental regulations impacting the future growth of the ATV and SxS market?

Environmental regulations, particularly stringent emission standards (like EU Stage V and US EPA limits), are forcing manufacturers to invest heavily in electric and hybrid off-road powertrains. While this increases initial research costs, it drives long-term market opportunities by catering to consumer demand for quieter, zero-emission vehicles suitable for ecologically sensitive areas.

Which application segment accounts for the largest share of the ATV and SxS market?

The Utility application segment consistently holds the largest market share. This dominance is driven by persistent demand from the agricultural sector, construction, mining, and large private land management, where these vehicles are essential tools for transport, towing, and maneuvering equipment in challenging off-road conditions.

What role does Artificial Intelligence play in modern ATV and SxS design?

AI is increasingly used to power Advanced Driver Assistance Systems (ADAS) for improved stability and collision avoidance off-road. Furthermore, AI-driven predictive maintenance utilizes telematics data to forecast mechanical issues, optimizing fleet uptime and reducing operational costs for commercial and rental operators.

Which geographic region is projected to exhibit the fastest growth rate in this market?

The Asia Pacific (APAC) region is projected to show the highest Compound Annual Growth Rate (CAGR) due to rapid infrastructure development, growing disposable incomes fueling recreational purchases, and increased military modernization efforts demanding rugged, all-terrain transport capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager