Auction House Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432398 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Auction House Market Size

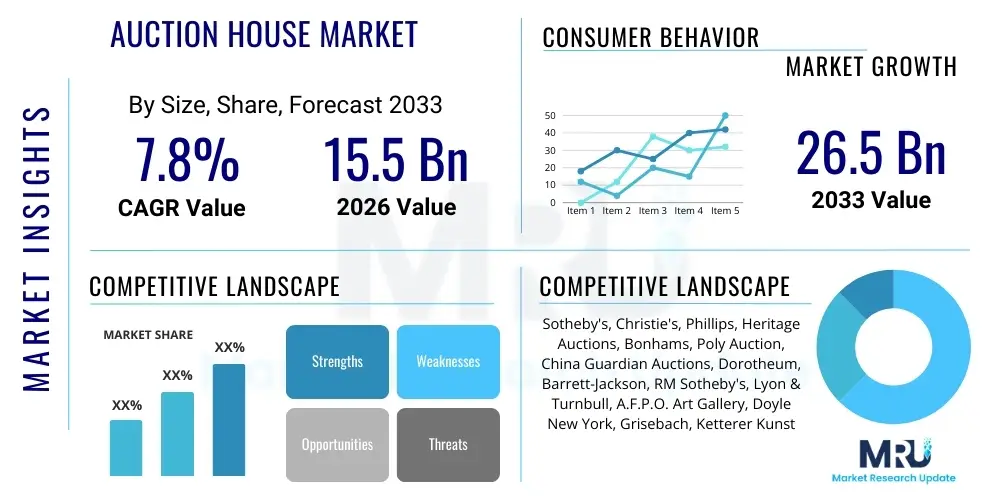

The Auction House Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 26.5 Billion by the end of the forecast period in 2033.

Auction House Market introduction

The Auction House Market encompasses the organized sale of goods and assets through competitive bidding processes, primarily facilitated by established auctioneers and digital platforms. This sector handles a vast array of high-value items, including fine art, antiques, collectibles, luxury real estate, vehicles, and high-end jewelry. Traditionally dominated by physical auction houses like Sotheby's and Christie's, the market has undergone rapid transformation, shifting significantly toward robust online platforms and hybrid models that leverage digital technologies to expand geographical reach and bidder participation. The core function of these houses is to provide expertise in valuation, authentication, and secure transaction execution, bridging the gap between consignors seeking maximum value and collectors seeking verified assets.

The product description within this market involves not just the physical goods but also the associated services, such as professional appraisal, catalog production, global marketing campaigns, and post-sale logistics. Major applications span wealth management, philanthropic fundraising, asset liquidation, and specialized collecting. The increasing digitization, coupled with growing global wealth accumulation, particularly among high-net-worth (HNWI) and ultra-high-net-worth individuals (UHNWI), serves as a primary driving factor. Furthermore, the rising appeal of alternative investment classes, such as contemporary art and rare vintage items, has solidified the market’s growth trajectory, positioning auction houses as crucial intermediaries in the global luxury and asset trading ecosystems.

Key benefits derived from utilizing auction houses include transparent pricing mechanisms, efficient asset monetization, and access to a highly specialized and global pool of motivated buyers, which often results in prices exceeding typical retail values. The market’s dynamism is constantly fueled by economic factors, technological innovation, and cultural trends that dictate the desirability of specific asset classes. Continuous improvements in digital security, enhanced virtual viewing experiences, and the introduction of blockchain-verified provenance are further catalyzing expansion and fostering increased trust among international participants, ensuring the market remains a high-growth area in the global commerce landscape.

Auction House Market Executive Summary

The Auction House Market demonstrates robust growth, primarily driven by the accelerated transition toward digital bidding platforms and the increasing securitization and fractionalization of luxury assets. Business trends indicate a strong focus on merging traditional expertise in connoisseurship with advanced data analytics and artificial intelligence to refine valuations and target specialized collector demographics. Leading firms are heavily investing in proprietary online platforms that offer immersive viewing experiences, secure payment gateways, and transparent provenance tracking, positioning themselves for resilience against economic fluctuations by diversifying their offering across multiple asset categories, including emerging sectors like non-fungible tokens (NFTs) and digital art. Strategic mergers and acquisitions aimed at consolidating regional strengths and technological capabilities are defining the competitive landscape.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, propelled by rapid wealth creation in countries like China and India, leading to heightened demand for established luxury categories, particularly fine art, watches, and rare wines. North America and Europe remain foundational markets, characterized by maturity, sophisticated regulatory frameworks, and dominance in the high-end fine art and jewelry segments. Within these regions, digital participation rates are exceptionally high, pushing auction houses to innovate in mobile accessibility and real-time interactive bidding features. Emerging markets are focused on developing local collector bases and establishing specialized local auction venues to cater to domestic tastes and heritage assets.

Segment trends underscore the significant dominance of the online auction format, which now accounts for a substantial share of total transactions, offering convenience and lower logistical costs compared to traditional live sales. Within asset classes, the Collectibles and Fine Art segments continue to generate the highest revenues, while the Luxury Goods segment (jewelry, watches, handbags) shows impressive year-over-year expansion, driven by younger, digitally native buyers seeking alternative investment stores of value. Furthermore, specialized auction houses focusing solely on niche markets, such as rare automobiles or manuscripts, are experiencing steady growth by capitalizing on deeply engaged, passionate collector communities willing to pay premium prices for verified scarcity and quality.

AI Impact Analysis on Auction House Market

Common user questions regarding AI’s impact on the Auction House Market revolve primarily around authentication reliability, transparency in valuation methodologies, and the ethics of algorithmic pricing. Users often express concern about whether AI models can accurately replicate the nuanced expertise of human appraisers, particularly for subjective categories like contemporary art, and how AI might be used to detect sophisticated forgeries. Expectations are high concerning the ability of AI to provide personalized recommendations for bidders, optimize timing for sales, and enhance the overall security and fairness of the bidding process, addressing historic issues of price manipulation and access barriers. The key theme is the integration of AI not as a replacement for human judgment, but as a powerful, unbiased tool for scaling expertise and enhancing market liquidity and trust.

AI is fundamentally transforming the due diligence phase of auction operations. By leveraging machine learning models trained on vast historical sales data, environmental factors, provenance records, and detailed image analysis, auction houses can now achieve significantly more precise and rapid appraisals. This shift minimizes human error in preliminary valuations, providing consignors with greater confidence and enabling auction houses to manage risk more effectively. Furthermore, advanced predictive analytics are being employed to forecast demand curves and optimal reserve prices, maximizing the realized hammer price while ensuring competitive bidding, which directly benefits both the buyer and the seller.

The operational efficiency gained through AI extends deeply into customer engagement and platform management. Natural Language Processing (NLP) is utilized to analyze buyer feedback and market sentiment derived from social media and specialized forums, giving auctioneers immediate insights into buyer preferences and category momentum. On the bidding side, AI algorithms personalize the user experience by recommending lots based on past behavior and collecting patterns, thereby increasing engagement and potentially conversion rates. Ultimately, the successful integration of AI hinges on its ability to enhance transparency and provide verifiable, data-driven provenance tracking, bolstering the market's integrity against the persistent threat of counterfeiting and misrepresentation.

- Enhanced Valuation Accuracy: Machine learning models analyze millions of historical data points for precise appraisal.

- Automated Authentication and Provenance Tracking: AI image recognition detects anomalies and blockchain integration verifies ownership history.

- Personalized Bidding Experience: Predictive analytics recommend lots and optimal bidding strategies to registered users.

- Optimized Auction Scheduling: Algorithms determine the best time and duration for auctions globally to maximize participation.

- Fraud Detection and Security: Real-time monitoring of bidding patterns to identify and mitigate collusion or unusual activity.

DRO & Impact Forces Of Auction House Market

The Auction House Market is propelled by a confluence of powerful drivers, including the rapid proliferation of digital platforms and the accelerating growth of global ultra-high-net-worth population segments who view luxury assets as essential portfolio diversification tools. Simultaneously, the market faces significant restraints, particularly concerning regulatory complexity surrounding cross-border transactions of cultural property and the enduring threat posed by high-quality counterfeits, which necessitate substantial investment in authentication technology. Opportunities abound in the integration of blockchain for verifiable provenance, the expansion into emerging asset classes like digital collectibles (NFTs), and the development of fractional ownership models that democratize access to high-value items, thus broadening the buyer base significantly. These elements collectively shape the impact forces, creating a dynamic environment where technological adaptation is crucial for maintaining competitive advantage and ensuring market trust.

Drivers that continue to exert upward pressure on the market include the cultural shift toward collecting as a lifestyle pursuit, supported by extensive global marketing and media coverage of record-breaking sales. The enhanced accessibility provided by mobile bidding applications has removed geographical barriers, allowing niche markets to achieve global reach and stimulating competitive bidding among international collectors. Furthermore, favorable macroeconomic conditions in specific wealth centers, coupled with inflation concerns, often push investors towards tangible, rare assets whose value is perceived as resilient against economic downturns. These drivers facilitate higher throughput and transaction volumes across all major auction categories, reinforcing the market’s stability and projected growth.

However, the sector must contend with critical restraints such as the volatility inherent in luxury markets, where demand for specific artists or objects can fluctuate dramatically based on short-term trends or geopolitical events. High operating costs associated with expertise, insurance, and complex logistics for handling rare and fragile items also challenge profitability, particularly for smaller auction houses. Opportunities, conversely, are centered on innovation; the adoption of immersive virtual viewing technologies, such as AR and VR, is enhancing the remote buying experience, mitigating the need for physical inspection. Additionally, focusing on sustainability and ethical sourcing, especially in segments like jewelry and luxury materials, presents a growing opportunity to appeal to increasingly conscious millennial and Gen Z collectors.

Segmentation Analysis

The Auction House Market is extensively segmented across several dimensions, including the type of auction conducted, the specific category of assets sold, and the format used (online, live, or hybrid). This detailed segmentation allows auction houses to tailor their expertise, marketing efforts, and operational structures to meet the highly specialized demands of diverse collector groups. The overarching trend within segmentation is the rapid blurring of lines between traditional physical sales and digital platforms, with hybrid auctions gaining significant traction as they combine the excitement and immediacy of a live event with the expansive reach of online participation. Understanding these segment dynamics is crucial for forecasting which asset classes will outperform others and identifying underserved geographic niches.

Segmentation by asset category demonstrates differing growth rates and buyer profiles. Fine Art remains the most prestigious and highest-value segment, attracting institutional buyers and UHNWIs, whereas Luxury Goods (watches, handbags, wines) exhibits faster volume growth, appealing to a broader, younger demographic focused on tangible investment and lifestyle enhancement. The strategic segmentation based on customer needs dictates specialized service provision, from high-security storage for rare gems to complex insurance and shipping logistics for large-scale sculptures. This targeted approach enables optimization of sales velocity and ensures that specific category expertise is maintained, which is vital for establishing trust and securing high-value consignments.

- By Auction Type:

- Live Auctions (Traditional, in-person events)

- Online Auctions (Timed, fixed-price, or real-time digital bidding)

- Hybrid Auctions (Simultaneous live and online participation)

- By Asset Category:

- Fine Art (Paintings, Sculptures, Drawings, Prints)

- Collectibles (Stamps, Coins, Memorabilia, Books, Manuscripts)

- Luxury Goods (Jewelry, Watches, Rare Wine & Spirits, Designer Handbags)

- Real Estate (High-end residential, Commercial property)

- Vehicles (Classic cars, Rare motorcycles)

- By Revenue Source:

- Buyer’s Premium

- Seller’s Commission (Consignor fees)

- Ancillary Services (Valuation, Storage, Insurance)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Auction House Market

The Auction House Value Chain is a sophisticated sequence of activities beginning with the sourcing and appraisal of assets (upstream analysis) and culminating in the transfer of ownership and logistical delivery (downstream analysis). The upstream phase is critically dependent on establishing and maintaining robust relationships with consignors, including private collectors, estates, museums, and institutions. This stage involves meticulous evaluation, authentication, and agreement on consignment terms, necessitating high-level expertise in connoisseurship and market valuation. The quality and trustworthiness of the initial appraisal directly influence the ultimate success and reputation of the auction house. Effective upstream management requires global outreach and a deep understanding of legal and tax implications for asset transfers.

The central phase involves preparation and marketing. Assets are cataloged, professional photography and detailed condition reports are generated, and extensive global marketing campaigns (digital and print) are executed to attract qualified buyers. The distribution channel is bifurcated into direct sales (in-house physical and online platforms) and indirect methods, primarily through partnerships with third-party digital marketplaces or specialized dealers who bring niche expertise or clientele. Technology providers play an increasingly vital role, offering secure bidding infrastructure and data analytics tools that optimize marketing spend and bidder engagement. The shift to digital has elevated the importance of the direct channel, giving auction houses greater control over the buyer experience and data capture.

Downstream analysis focuses on the transactional aspects and post-sale logistics. Once the auction concludes, the house manages the financial settlement, ensuring collection of the hammer price plus buyer’s premium, and disbursement of proceeds to the consignor, minus commission. The final steps involve complex logistics, including secure packaging, specialized shipping (often international), and customs clearance. Success in the downstream segment is defined by efficiency, security, and exceptional customer service, ensuring that the high-value item reaches the buyer safely and promptly. This seamless execution reinforces buyer confidence and encourages repeat participation, thereby strengthening the entire value chain.

Auction House Market Potential Customers

Potential customers for the Auction House Market are diverse, ranging from sophisticated private collectors and institutional investors to new market entrants seeking alternative asset classes. The primary end-users, or buyers, include high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) who view art, jewelry, and rare collectibles as essential components of their investment portfolios, often using these assets for wealth preservation and social signaling. Institutional buyers, such as museums, corporate collections, and investment funds specializing in tangible assets, also constitute a significant customer base, particularly for masterworks and historically significant items requiring long-term custodianship. The purchasing decision for this cohort is driven by scarcity, historical provenance, and projected capital appreciation.

A rapidly expanding customer segment comprises digitally native millennials and Gen Z buyers, often attracted by the transparency and accessibility of online auctions, particularly for luxury goods, vintage items, and contemporary art. These buyers often prioritize items associated with cultural trends or ethical sourcing. Furthermore, businesses and institutions engaging in asset liquidation—such as bank trusts, estate executors, and governmental agencies disposing of seized or surplus assets—rely on auction houses for efficient, documented, and high-value realization of inventory. These customers require streamlined processes, regulatory compliance, and maximum financial return, positioning the auction house as a critical service provider in asset realization.

The emergence of fractional ownership platforms has introduced a new layer of potential customers—retail investors who previously could not afford whole ownership of high-value assets. By tokenizing or securitizing high-value art or collectibles, auction houses can tap into a mass affluent market seeking exposure to asset classes traditionally reserved for the elite. Consignors, the sellers, are equally critical customers; they are typically individuals or institutions seeking professional appraisal, confidentiality, global market access, and assurance that their assets will achieve the highest possible price through competitive bidding. Their selection criteria for an auction house prioritize reputation, sales track record in their specific category, and competitive commission structures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 26.5 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sotheby's, Christie's, Phillips, Heritage Auctions, Bonhams, Poly Auction, China Guardian Auctions, Dorotheum, Barrett-Jackson, RM Sotheby's, Lyon & Turnbull, A.F.P.O. Art Gallery, Doyle New York, Grisebach, Ketterer Kunst |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Auction House Market Key Technology Landscape

The modern Auction House Market is increasingly reliant on a sophisticated technological landscape designed to enhance security, expand global access, and improve the client experience. Central to this landscape are robust, scalable proprietary online bidding platforms capable of handling high-volume, real-time concurrent transactions without latency issues. These platforms must incorporate advanced encryption and multi-factor authentication to ensure the security and confidentiality of bidder identities and financial information. Furthermore, data analytics and business intelligence software form the backbone of strategic operations, enabling auctioneers to track market trends, predict sales performance, and optimize their inventory acquisition strategy based on real-time collector demand signals, transforming the traditionally intuitive valuation process into a data-driven science.

The integration of disruptive technologies such as Blockchain and Artificial Intelligence (AI) is rapidly moving from novelty to necessity. Blockchain technology is primarily employed to create immutable digital certificates of authenticity and provenance records for high-value items, mitigating the risk of fraud and increasing buyer trust in cross-border transactions. This verifiable digital ledger is especially critical for contemporary art and digital collectibles (NFTs). Concurrently, AI algorithms are leveraged for image analysis, assisting in the initial screening for potential fakes, performing rapid market benchmarking for appraisals, and automating personalized communication with collectors based on their specific buying patterns and stated interests, ensuring hyper-targeted marketing and engagement.

Furthermore, immersive technologies are revolutionizing how potential buyers interact with assets prior to purchase. Augmented Reality (AR) and Virtual Reality (VR) tools allow collectors worldwide to virtually inspect items, ranging from placing a painting on their living room wall (AR) to taking a 360-degree tour inside a classic car (VR). This ability to simulate physical interaction remotely significantly reduces the friction associated with buying high-value items sight unseen, drastically widening the pool of active bidders. The combination of secure transaction technology, data-driven valuation tools, and immersive viewing experiences defines the technological vanguard of the competitive auction sector, providing a distinct advantage to firms capable of seamless implementation and continuous iteration.

Regional Highlights

- Asia Pacific (APAC) Dominance and Growth: APAC represents the market's primary engine of growth, fueled by the explosive increase in high-net-worth individuals, particularly in Greater China, Hong Kong, and Southeast Asia. The region demonstrates a fervent appetite for luxury goods, especially rare watches, high-end jewelry, and Asian contemporary art. Regional auction houses, such as Poly Auction and China Guardian, are rapidly gaining global stature, often capitalizing on the strong demand for items with regional significance. Regulatory environments are evolving, and the push for digital adoption is aggressive, often bypassing the traditional physical-first approach seen in Western markets, leading to high online penetration rates.

- North America Market Maturity and Technology Adoption: North America remains a highly mature and critical market, primarily centered in key hubs like New York and Los Angeles, which dominate the global trade in Fine Art and high-end Real Estate auctions. This region is characterized by early and aggressive adoption of advanced technologies, including AI for valuation and sophisticated online bidding infrastructure. The legal and financial structures supporting high-value transactions are robust and well-established, offering high confidence to international consignors and buyers. Demand is high across all categories, with a particular focus on post-war and contemporary art and vintage collectibles.

- Europe's Enduring Prestige and Regulatory Hurdles: Europe, particularly the UK, France, and Germany, serves as the historical heartland of the auction industry, maintaining strong dominance in Old Masters, antique furniture, and historical artifacts. Major houses like Sotheby's and Christie's maintain large European footprints, leveraging centuries of expertise. While adopting digital platforms rapidly, the region contends with stringent regulations concerning the cross-border movement of cultural heritage and the repatriation of artifacts, which can complicate consignments. Despite these hurdles, London remains a crucial global financial and art market hub.

- Latin America (LATAM) Niche Growth: The LATAM market, while smaller in scale, presents significant niche opportunities, particularly for local and regional art, jewelry, and luxury assets. Growth is often tied to local economic stability, but the increasing digital participation from HNWIs seeking international assets via platforms is noteworthy. Key markets like Brazil and Mexico are seeing specialized houses emerge, catering to domestic collectors and exporting regionally significant pieces to global buyers.

- Middle East and Africa (MEA) Emerging Wealth Focus: The MEA region is characterized by rapidly accumulating wealth, particularly in the Gulf Cooperation Council (GCC) states. Auctions focusing on high-end luxury goods, rare automobiles, and Islamic art are thriving. The region is actively developing cultural infrastructure (e.g., museums and art fairs), positioning itself as a future center for luxury trade. Adoption of international standards for transparency and digital access is crucial for attracting top-tier global consignments and buyers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Auction House Market.- Sotheby's

- Christie's

- Phillips

- Heritage Auctions

- Bonhams

- Poly Auction (China)

- China Guardian Auctions

- Dorotheum

- Barrett-Jackson Auction Company

- RM Sotheby's

- Lyon & Turnbull

- Doyle New York

- Ketterer Kunst

- Grisebach

- Fatima's Auction House

- Mecum Auctions

- Catawiki

- eBay (Auction Platform)

- A.F.P.O. Art Gallery

- Koller Auctions

Frequently Asked Questions

Analyze common user questions about the Auction House market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from traditional live auctions to online platforms?

The primary drivers are enhanced accessibility, lower operational costs, and the ability to reach a global pool of specialized bidders instantaneously. Online platforms facilitate hybrid models, allowing concurrent participation from thousands of users, significantly boosting competitive tension and realized prices, which is critical for maximizing consignment value.

How is blockchain technology used to improve provenance and security in the auction sector?

Blockchain creates an immutable, decentralized record of ownership and transaction history for high-value assets, offering tamper-proof provenance. This technology drastically reduces the risk of counterfeiting and misrepresentation, ensuring authenticity and building vital trust among international buyers in highly specialized and often opaque markets like fine art and collectibles.

Which asset segment currently exhibits the fastest growth rate in the global auction market?

The Luxury Goods segment, encompassing high-end watches, designer handbags, and rare spirits, is experiencing the fastest volume growth. This growth is propelled by younger, affluent buyers who view these items as both luxury consumption and robust, liquid alternative investments, benefiting significantly from online global resale market integration.

What role does Artificial Intelligence play in determining the valuation of auctioned items?

AI utilizes machine learning algorithms to analyze extensive datasets, including historical sales data, comparable market trends, aesthetic factors, and condition reports, to provide highly accurate predictive valuations. This algorithmic approach minimizes human subjectivity, optimizes reserve pricing strategies, and helps auction houses manage risk associated with accepting consignments.

What are the main regulatory challenges faced by international auction houses?

Key regulatory challenges include navigating complex international tax laws (e.g., VAT, import duties), complying with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations for high-value transactions, and adhering to strict laws governing the ethical import and export of cultural property and endangered species materials (e.g., ivory).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager