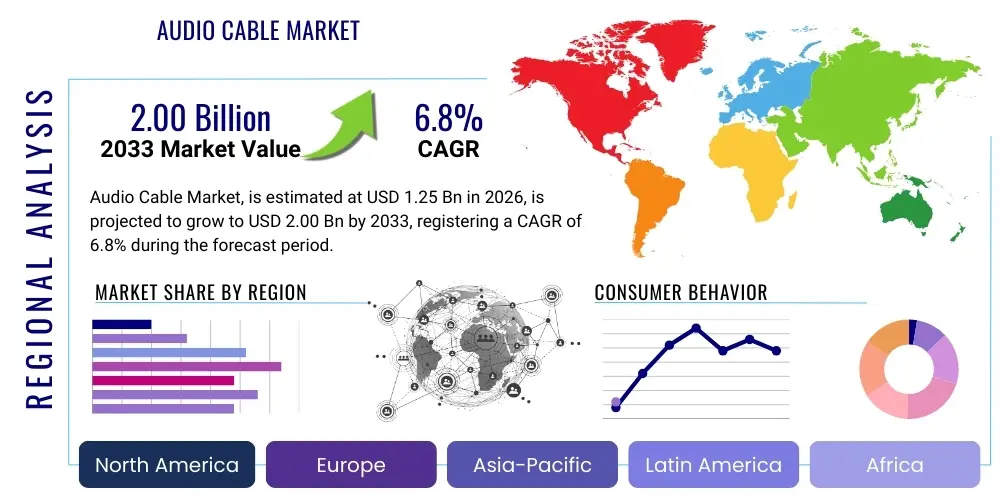

Audio Cable Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435926 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Audio Cable Market Size

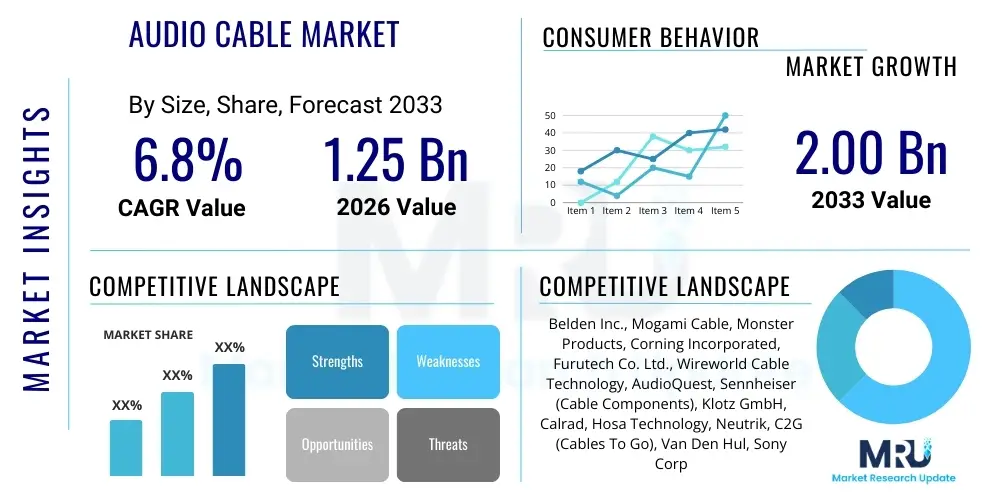

The Audio Cable Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 2.00 Billion by the end of the forecast period in 2033.

Audio Cable Market introduction

The Audio Cable Market encompasses the manufacturing, distribution, and sale of specialized electrical or optical cables designed to transmit audio signals between electronic devices. These cables are critical components in ensuring high-fidelity sound transfer, connecting devices such as speakers, microphones, instruments, amplifiers, digital audio converters (DACs), and various consumer electronics. The quality of the audio cable directly impacts the signal integrity, determining the clarity, frequency response, and noise rejection capability of the final audio output. Historically dominated by analog connections (RCA, XLR, TRS), the market has rapidly transitioned toward digital standards (HDMI, USB-C, Optical), reflecting the pervasive adoption of high-resolution and lossless audio formats that demand greater bandwidth and improved shielding to prevent signal degradation.

The primary applications of audio cables span across diverse sectors, including professional audio (recording studios, live sound, broadcasting), consumer electronics (home theaters, personal audio systems, gaming consoles), automotive infotainment systems, and telecommunications infrastructure. The key benefits derived from high-quality audio cables include minimizing electromagnetic interference (EMI) and radio frequency interference (RFI), maintaining accurate impedance matching, and ensuring durability for repeated connection cycles. Advancements in material science, particularly the utilization of oxygen-free copper (OFC) and specialized insulation materials like polyethylene or Teflon, continue to drive product differentiation and performance optimization, catering to the increasingly discerning demands of audiophiles and professional users seeking pristine sound reproduction.

Driving factors stimulating market expansion include the proliferation of smart home ecosystems requiring seamless multi-room audio connectivity, the sustained growth of the music and entertainment industry (live concerts and digital streaming), and the escalating demand for high-end professional recording equipment. Furthermore, the rise in popularity of immersive audio formats, such as Dolby Atmos and DTS:X, necessitates robust cable solutions capable of handling multi-channel, high-data-rate signals without latency or compression artifacts. The automotive sector's shift towards sophisticated digital audio buses and premium sound packages also contributes significantly to the demand for specialized, vehicle-grade audio cabling solutions that can withstand harsh environmental conditions.

Audio Cable Market Executive Summary

The Audio Cable Market is characterized by a strong dichotomy between high-volume, cost-sensitive consumer segments and the high-value, performance-driven professional and audiophile segments. Business trends indicate a consolidation among specialized high-end manufacturers focusing on intellectual property related to shielding and conductor geometry, while mass-market production increasingly migrates towards Asian manufacturing hubs to capitalize on economies of scale for standard digital cables (USB-C and HDMI). The overall market narrative is shifting from analog replacement cycles to digital upgrade cycles, driven by the rollout of new interface standards designed for 8K video and higher bit-rate audio, such as HDMI 2.1 specifications and Thunderbolt integration in professional workstations. Key strategic moves involve diversification into active optical cables (AOCs) to overcome distance limitations inherent in traditional copper wiring for high-bandwidth applications.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, propelled by booming consumer electronics manufacturing bases in China, South Korea, and Vietnam, coupled with rapidly increasing disposable income leading to higher adoption rates of personal audio equipment and high-fidelity home theater systems. North America and Europe remain mature but vital markets, characterized by high Average Selling Prices (ASPs) due to a concentrated demand from professional recording studios, large broadcast facilities, and affluent audiophile communities that prioritize premium, boutique cable brands. Latin America and the Middle East & Africa (MEA) are emerging regions experiencing robust growth, primarily fueled by infrastructural development in communication networks and increasing investments in commercial entertainment venues requiring reliable audio solutions.

Segment trends demonstrate that the digital cable segment, particularly HDMI and USB variants, holds the largest market share due to their universality in consumer applications and their role as the backbone for modern digital ecosystems. However, the professional audio segment, encompassing XLR and TRS balanced cables, maintains strong revenue stability, benefiting from the consistent replacement and expansion cycles within the music production and live events industries. Furthermore, the rising integration of IoT devices and smart speakers is driving demand for specific short-run, specialized internal wiring and interconnects designed for space constraints and low power consumption, offering specialized opportunities for miniaturization and customized cable assemblies.

AI Impact Analysis on Audio Cable Market

User inquiries regarding AI's influence on the Audio Cable Market primarily revolve around whether Artificial Intelligence (AI) will fundamentally alter the need for physical interconnects, how AI can optimize signal quality and connectivity standards, and if AI-driven analysis will lead to personalized recommendations for cable specifications. The central concern is not displacement, as physical cables remain essential for signal transduction, but rather integration. Users are keen to understand how AI-powered diagnostics and predictive maintenance tools might improve the reliability and troubleshooting of complex professional audio setups, particularly in large-scale broadcast or stadium environments where cable failure is catastrophic. There is also significant interest in AI's role in the automated quality control during cable manufacturing to detect microscopic imperfections that affect electrical characteristics, ensuring higher consistency and performance across product batches.

AI's initial impact is most pronounced in ancillary services and manufacturing processes, rather than directly changing the cable design itself. AI algorithms are being deployed in manufacturing facilities to analyze real-time sensor data from extrusion and winding machines. This allows for immediate fine-tuning of parameters like tension, temperature, and material flow, significantly reducing defect rates and material waste, thereby improving cost efficiency and product consistency. Furthermore, in the consumer space, AI systems integrated within audio equipment (e.g., receivers and soundbars) are beginning to use machine learning to analyze the acoustic environment and automatically compensate for minor signal degradations introduced by non-ideal cabling, optimizing the final sound profile based on predictive models of signal loss.

In the professional domain, especially live sound reinforcement and broadcasting, AI-driven monitoring systems can continuously analyze the impedance and continuity across thousands of meters of deployed cabling. By establishing baseline performance metrics, these systems can predict imminent cable failure or subtle performance degradation well before human operators might notice, allowing for preemptive replacement. This shift from reactive maintenance to predictive maintenance, enabled by AI data processing, enhances operational uptime and reliability, particularly crucial for high-stakes events or mission-critical communication links. This integration elevates the value proposition of high-quality, traceable cables that provide stable data points for AI analysis.

- AI-driven Quality Control: Optimization of cable manufacturing processes using machine learning to detect material defects and ensure electrical consistency, reducing variance.

- Predictive Maintenance: Utilization of AI monitoring systems in professional installations (broadcast, stadiums) to analyze cable performance metrics and predict failure before it occurs.

- Automated System Calibration: Integration of AI into audio components (receivers, DACs) to automatically compensate for minor signal deficiencies introduced by cable characteristics, optimizing sound output.

- Supply Chain Efficiency: Use of AI in demand forecasting and inventory management for complex cable assemblies and specialized connectors, streamlining logistics.

- Personalized Recommendations: Algorithms suggesting optimal cable types and lengths based on user equipment specifications, acoustic environment, and usage patterns.

DRO & Impact Forces Of Audio Cable Market

The Audio Cable Market is primarily driven by the escalating demand for high-definition and lossless audio content, necessitating cables capable of transmitting vast amounts of data with minimal interference and latency. Key drivers include the global proliferation of streaming services offering high-resolution audio (e.g., Tidal HiFi, Apple Music Lossless), the continuous refresh cycle of consumer electronics (e.g., new generations of gaming consoles and 8K displays requiring HDMI 2.1), and sustained capital expenditure in the professional audio sector for studio upgrades and live event infrastructure modernization. The restraints center predominantly on technological substitution threats, particularly the rapid advancement of high-quality wireless technologies like Bluetooth LE Audio, Wi-Fi-based multi-room audio (e.g., AirPlay 2, Sonos), and specialized low-latency wireless systems that erode the necessity for physical interconnects in many consumer applications. Cost sensitivity in the mass market and pervasive counterfeiting of branded cables also present significant hurdles, affecting perceived quality and legitimate vendor profitability.

Opportunities in the market reside heavily in niche, high-growth areas. The expansion of Active Optical Cables (AOCs) presents a major opportunity, allowing for significantly longer runs of high-bandwidth digital signals (like USB 3.0/4.0 and HDMI 2.1) without the signal attenuation issues inherent to copper. This is particularly relevant for large commercial installations, data centers, and sophisticated home automation systems. Furthermore, the specialized automotive segment offers lucrative avenues, driven by the shift towards complex in-vehicle networks (e.g., automotive Ethernet, MOST bus) that require custom, highly durable, and environmentally protected cable assemblies for reliable high-fidelity sound delivery within the cabin. Manufacturers focusing on miniaturization and flexible flat cables (FFC) to serve compact portable device markets are also well-positioned for growth.

The impact forces within the audio cable market operate on multiple tiers, exerting pressure on pricing, innovation, and distribution. The Intensity of Competitive Rivalry is high, driven by numerous players ranging from specialized boutique firms competing on quality and brand reputation to large volume manufacturers competing aggressively on price and accessibility. The Bargaining Power of Buyers (both OEM manufacturers and large retail chains) is moderate to high, especially in the consumer segment where standardization allows for easy substitution. Conversely, the Bargaining Power of Suppliers (raw material providers of copper, polymers, and specialized shielding materials) is moderate, fluctuating based on global commodity prices. The Threat of Substitutes remains the most transformative force, with wireless standards continually evolving to offer comparable quality and superior convenience, forcing cable manufacturers to focus on applications where physical connection is indispensable (e.g., high-power transmission, zero-latency professional recording, or extremely high bandwidth requiring guaranteed throughput).

Segmentation Analysis

The Audio Cable Market is segmented based on critical characteristics including Product Type (Analog vs. Digital), Application (End-User), and Conductor Material. This segmentation is crucial for understanding the diverse demands placed upon cable manufacturers and tailoring product offerings to specific performance requirements. The market structure reflects the historical evolution of audio technology, maintaining strong segments for legacy analog standards while experiencing exponential growth in specialized digital interface categories. Analysis by cable length and jacket material further refines the understanding of applications, differentiating between short-run patch cables used in recording studios and long-run architectural cables used for permanent installations in commercial venues.

The transition toward digital signal processing has fundamentally reshaped the product landscape, favoring high-speed, shielded solutions capable of managing complex data protocols. Manufacturers are increasingly prioritizing robust construction techniques to minimize internal crosstalk and external interference, essential for maintaining signal integrity over distance in environments rich with electromagnetic noise. Furthermore, environmentally friendly and halogen-free materials are becoming a necessary differentiator, especially in European and North American commercial construction markets, driven by stringent fire and safety regulations.

- By Product Type:

- Digital Cables (HDMI, USB Type-A/B/C, Optical/TOSLINK, Coaxial)

- Analog Cables (XLR, RCA, TRS/TS, Speaker Cables, 3.5mm/Aux)

- Proprietary and Specialized Cables (Lightning, DisplayPort Audio)

- By Application:

- Consumer Electronics (Home Theater, Personal Audio, Gaming)

- Professional Audio & Broadcasting (Recording Studios, Live Events, TV/Radio Broadcast)

- Automotive and Transportation

- Telecommunications and Data Centers

- By Conductor Material:

- Oxygen-Free Copper (OFC)

- Silver and Silver-Plated Copper (SPC)

- Optical Fiber (for Active Optical Cables)

- By Cable Length:

- Short Run (Under 1 Meter)

- Medium Run (1 to 5 Meters)

- Long Run (Over 5 Meters)

Value Chain Analysis For Audio Cable Market

The audio cable value chain commences with upstream activities, primarily involving the procurement and processing of raw materials. This includes high-purity conductor materials such as copper, silver, and specialized polymers for insulation and jacketing (PVC, PTFE, PE). Copper refining and drawing processes are critical, as the purity and geometry of the conductor significantly impact performance. Key suppliers in this stage are large commodity providers, often globally dispersed. Specialized manufacturers then focus on unique processes like wire stranding, twisting, and advanced shielding techniques, which constitute the initial manufacturing phase. Maintaining strict quality control here is paramount, as flaws at this stage translate directly into compromised signal fidelity downstream.

Midstream activities involve the specialized assembly and termination of cables, where connectors (e.g., Neutrik, Amphenol, specialized HDMI/USB connectors) are affixed to the prepared conductors. This stage demands precision labor and specialized tooling to ensure perfect soldering or crimping, maintaining impedance consistency across the connector interface. Finished products are then packaged and branded. The distribution channel is multifaceted: Direct sales cater to large OEMs (e.g., selling directly to speaker or electronics manufacturers) and specialized professional installations where customization is required. Indirect channels are dominant in the consumer market, leveraging wholesale distributors, large-format electronics retailers (online and physical), and specialized audio boutique stores that offer higher-margin, expert-advice-driven sales.

Downstream analysis focuses on the end-users. The market is broadly split between institutional/professional consumers (studios, broadcasters, venues) who prioritize technical specifications, reliability, and long-term durability, and mass-market consumers who prioritize price, convenience, and aesthetic appeal. The professional segment often relies on specialized, high-service distributors who provide technical support and bespoke solutions. In contrast, the consumer segment relies on high-volume e-commerce platforms and retail presence. The complexity of the supply chain requires robust inventory management systems to balance the high customization demands of the professional market with the standardized, rapid turnover requirements of the consumer electronics segment.

Audio Cable Market Potential Customers

The potential customer base for audio cables is highly diversified, ranging from global electronics conglomerates requiring billions of units annually to individual recording artists seeking bespoke, artisanal cabling solutions. Major buyers include Original Equipment Manufacturers (OEMs) who bundle audio cables with their primary products (e.g., gaming consoles, soundbars, professional microphones). This OEM segment focuses heavily on cost-efficiency and compliance with safety standards. Another significant customer group is the professional sector, encompassing live event production companies, broadcast networks (television and radio), and large-scale post-production facilities that demand military-grade reliability and specific, often balanced, signal characteristics for noise rejection in complex electromagnetic environments.

The fastest-growing segment of buyers includes high-fidelity enthusiasts and audiophiles who invest heavily in premium, high-purity interconnects and speaker cables, driven by the pursuit of maximizing sound quality from high-end components (DACs, amplifiers). This segment is less price-sensitive and values branding, material science, and positive reviews. Furthermore, the burgeoning smart home and custom installation market represents significant potential customers, including integrators and installers who specify architectural-grade cables for multi-room audio, home theaters, and distributed audio systems, prioritizing long-distance signal maintenance and plenum ratings for safety compliance within building codes.

In summary, the key end-user groups are defined by their application requirements: high-volume commodity needs (OEMs), ultra-reliability and technical standards (Professional/Broadcast), and extreme performance demands (Audiophiles/Custom Installers). Each group requires distinct product portfolios, from bulk spools of standard wire to custom-terminated, individually tested cable assemblies. The market analyst must track capital expenditures in media, entertainment, and consumer electronics production to accurately forecast demand fluctuations across these varied customer segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.00 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Belden Inc., Mogami Cable, Monster Products, Corning Incorporated, Furutech Co. Ltd., Wireworld Cable Technology, AudioQuest, Sennheiser (Cable Components), Klotz GmbH, Calrad, Hosa Technology, Neutrik, C2G (Cables To Go), Van Den Hul, Sony Corporation, Fender Musical Instruments, Pro Co Sound, Planet Waves (D'Addario), RS Pro, Vention Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Audio Cable Market Key Technology Landscape

The technology landscape of the Audio Cable Market is primarily defined by material science, connector standardization, and signal shielding innovation. A core technological focus remains on minimizing signal degradation, which involves optimizing conductor purity—with Oxygen-Free Copper (OFC) being the industry standard for reducing oxide inclusions that impede electrical flow, and crystalline structures (e.g., monocrystalline copper) being explored by high-end brands for further performance gains. Insulation technology is also critical; materials with low dielectric constant (such as PTFE or foamed polyethylene) are used to prevent signal energy absorption and dispersion, ensuring phase coherence and accurate timing across all frequency ranges. These material advancements are crucial in the analog segment where subtle changes in impedance and capacitance profoundly impact audio quality.

In the digital domain, the technological emphasis shifts toward high-speed data integrity and robust error correction mechanisms, particularly concerning HDMI and high-bandwidth USB standards. The adoption of Active Optical Cables (AOCs) represents a significant technological leap. AOCs integrate miniature optical transceivers at both ends of the cable, converting electrical signals into light pulses for transmission over fiber optic strands. This innovation allows for flawless digital signal transmission over distances far exceeding the limitations of passive copper cables (typically restricted to 5-7 meters for high-speed HDMI 2.1), making them indispensable for complex, long-haul installations in commercial cinemas, large conference rooms, and high-end residential setups. The miniaturization and cost reduction of these integrated transceivers are key areas of ongoing technological investment.

Furthermore, shielding technology is constantly evolving to combat the increasing density of electromagnetic interference (EMI) in modern environments. High-performance cables utilize multi-layer shielding, often incorporating braided shields (for lower-frequency noise) and foil shields (for high-frequency noise), coupled with differential twisted pair geometry (especially in XLR and advanced USB cables) to maximize Common Mode Rejection Ratio (CMRR). Connectors themselves are a technology frontier, with robust locking mechanisms (like Neutrik’s professional XLRs) and gold-plating being used to ensure low contact resistance and prevent oxidation, which is vital for long-term reliability and maintaining the integrity of the connection point, often the weakest link in the signal chain.

Regional Highlights

The regional dynamics of the Audio Cable Market exhibit significant variations in market maturity, technological adoption rates, and predominant application focus. North America is characterized by robust demand in the professional audio and broadcasting sectors, driven by Hollywood, Silicon Valley media infrastructure, and a highly active live events industry. Consumers in this region also demonstrate a strong inclination toward premium, high-end audio equipment, sustaining high Average Selling Prices (ASPs) for specialized interconnects. The market here is highly competitive, dominated by established domestic and international brands that leverage strong distribution networks and brand loyalty among audiophiles and professional users. Regulatory compliance, particularly concerning fire safety (e.g., plenum ratings), is a key requirement for installation-grade cabling.

Europe represents a stable and mature market with strong growth underpinned by strict regulatory standards (e.g., REACH compliance, RoHS directives). Germany, the UK, and Scandinavia are key markets, showing high demand for both professional recording equipment and high-quality home audio systems. The European market sees robust competition in the OEM segment, where automotive manufacturers require specialized, durable, and highly reliable cables for integrated infotainment systems. Furthermore, Europe is often an early adopter of sustainable and environmentally conscious cable materials, driving innovation in halogen-free and low-smoke zero-halogen (LSZH) jacketing.

Asia Pacific (APAC) stands out as the primary engine of global market growth. This rapid expansion is twofold: first, APAC is the world’s largest manufacturing base for consumer electronics, leading to massive internal demand for OEM-grade bulk cabling and harnesses. Second, rising urbanization and increasing disposable incomes in countries like China, India, and South Korea fuel burgeoning consumer demand for personal audio devices, gaming consoles, and sophisticated home theater setups. This region is highly sensitive to pricing, making efficient, high-volume production a necessity. The rapid deployment of 5G networks across Asia is also stimulating investment in telecommunications infrastructure, requiring specialized audio and data cables.

Latin America and the Middle East & Africa (MEA) are emerging markets offering high future growth potential, albeit from a lower base. Growth in these regions is heavily reliant on investment in commercial infrastructure, including large-scale entertainment venues, hospitality projects, and the modernization of educational and broadcast facilities. Brazil, Mexico, and the UAE are strategic entry points. These markets often favor cost-effective solutions but increasingly demand products that comply with global technical standards as technological awareness and purchasing power rise.

- North America: Focus on high-end professional audio (XLR, advanced digital), strict plenum compliance, high ASPs due to audiophile demand.

- Europe: Strong regulatory environment (RoHS, LSZH), significant demand from automotive OEMs, high maturity in analog and digital segments.

- Asia Pacific (APAC): Leading market for volume growth, dominant in OEM supply chain, rapidly increasing consumer demand for personal and home audio systems, price competitiveness is high.

- Latin America: Growth driven by infrastructure projects and commercial entertainment sector expansion, increasing demand for reliable, standards-compliant cables.

- Middle East & Africa (MEA): Emerging market, growth tied to hospitality and media investment, favoring digital and robust installation-grade solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Audio Cable Market.- Belden Inc.

- Mogami Cable

- Monster Products

- Corning Incorporated

- Furutech Co. Ltd.

- Wireworld Cable Technology

- AudioQuest

- Sennheiser (Cable Components Division)

- Klotz GmbH

- Calrad

- Hosa Technology

- Neutrik (Primarily Connectors, but integrated into cable solutions)

- C2G (Cables To Go)

- Van Den Hul

- Sony Corporation (OEM and branded products)

- Fender Musical Instruments

- Pro Co Sound

- Planet Waves (D'Addario)

- RS Pro

- Vention Technology

Frequently Asked Questions

Analyze common user questions about the Audio Cable market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for high-end digital audio cables?

The increasing proliferation of ultra-high-definition content standards, such as 8K video and lossless high-resolution audio streaming formats, demands cables (like HDMI 2.1 and specialized USB-C) capable of transmitting significantly higher bandwidths with zero data loss or synchronization errors over increasing distances.

Are wireless audio technologies expected to fully replace physical audio cables?

No. While wireless technologies (e.g., Bluetooth LE Audio) are convenient and competitive in many consumer applications, physical cables remain indispensable for applications requiring zero latency, maximum power transfer (speaker cables), extremely high guaranteed bandwidth (e.g., professional broadcasting), and highly specialized architectural installations.

Which segment, analog or digital, holds the largest market share in revenue?

The digital cables segment, primarily driven by high-volume requirements for HDMI and various USB standards in consumer electronics, holds the largest market share in terms of overall revenue and unit volume due to universal necessity in modern AV ecosystems.

How does the material science of the conductor impact cable performance?

The conductor material, such as Oxygen-Free Copper (OFC) or silver, directly influences electrical resistance and conductivity. High-purity materials minimize signal loss, oxidation, and distortion, ensuring higher fidelity and clearer transmission, particularly critical in sensitive analog systems.

What role do Active Optical Cables (AOCs) play in the current market?

AOCs address the distance limitation of traditional copper wiring for high-bandwidth digital signals (like HDMI 2.1), converting signals to light for transmission over fiber optic cores. They are crucial for large-scale commercial installations, studios, and high-end residential setups requiring long, reliable cable runs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager