Audiometry Room Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435560 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Audiometry Room Market Size

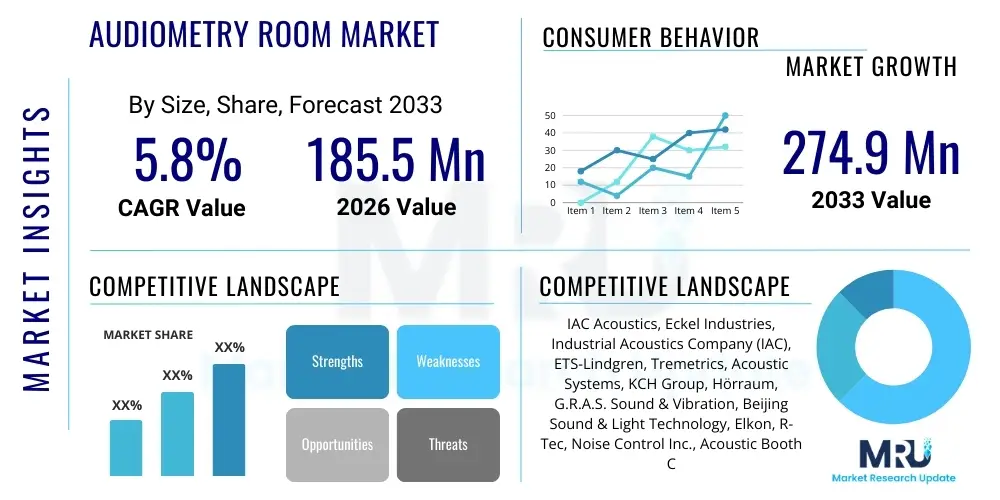

The Audiometry Room Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 185.5 million in 2026 and is projected to reach USD 274.9 million by the end of the forecast period in 2033.

Audiometry Room Market introduction

The Audiometry Room Market encompasses the design, manufacture, and installation of specialized sound-isolated booths and chambers utilized for conducting highly accurate hearing tests (audiometry). These rooms, critical infrastructure in clinical and occupational health settings, are engineered to meet stringent acoustic performance standards, typically specified by organizations like ANSI and ISO, ensuring minimal background noise interference during measurement. The primary product is a self-contained environment, ranging from small portable booths to large, double-wall chambers, designed to attenuate external noise significantly, thereby establishing a consistent and calibrated environment essential for diagnosing hearing loss, fitting hearing aids, and monitoring auditory health across different populations. The sophisticated construction often involves multiple layers of specialized materials, floating floors, and silent ventilation systems to maintain acoustic integrity.

Major applications for audiometry rooms span across hospitals, private audiology clinics, diagnostic centers, and crucially, within industrial and military settings for occupational health surveillance. In clinical environments, they facilitate newborn screening, pediatric audiology, and complex diagnostic testing. For occupational health, they are indispensable in monitoring employees exposed to high noise levels, ensuring compliance with regulatory bodies like OSHA. The rooms are categorized based on their acoustic performance requirements, typically single-wall or double-wall, with the latter offering superior noise reduction necessary for advanced testing in noisy urban environments or for specific research purposes. The foundational requirement remains absolute acoustic isolation to guarantee the validity and repeatability of auditory thresholds measured.

Key driving factors for market expansion include the global increase in age-related hearing loss (presbycusis), rising awareness regarding occupational noise-induced hearing loss (NIHL), and stringent government regulations mandating routine hearing assessments in industrial sectors. Furthermore, advancements in diagnostic audiology, necessitating higher precision and control over testing environments, spur demand for modern, high-performance acoustic enclosures. The increasing prevalence of noise pollution in general society also necessitates more robust testing facilities to accurately differentiate between true hearing impairments and environmental interference. The benefits provided by these specialized rooms—accurate diagnosis, regulatory compliance, and improved patient outcomes—cement their position as indispensable medical devices within the healthcare infrastructure.

Audiometry Room Market Executive Summary

The Audiometry Room Market is poised for stable growth, driven predominantly by demographic shifts, including an aging global population, and heightened regulatory enforcement concerning workplace noise exposure. Current business trends indicate a strong move towards modular and portable audiometry solutions, favored by smaller clinics and mobile health units due to their flexibility and ease of installation, contrasting with the traditional, large fixed installation model favored by major hospitals. Technological innovation centers around enhancing sound attenuation capabilities while reducing the overall footprint and weight of the booths, leveraging advanced material science and vibration isolation techniques. Investment in research and development is also focusing on integrating audiometry equipment seamlessly within the booth structure, often incorporating telemedicine capabilities to expand diagnostic outreach, especially in underserved rural areas.

Regional trends highlight North America and Europe as mature markets characterized by replacement demand and strict healthcare standards, fostering a demand for premium, double-wall configurations. Conversely, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, propelled by rapid infrastructure development in healthcare, expanding access to medical services, and increasing industrialization leading to a greater necessity for occupational screening facilities. China and India, specifically, are emerging as critical demand hubs due to massive population bases requiring enhanced audiological care and regulatory adoption of mandatory health checks. The Middle East and Africa (MEA) market, though smaller, is showing promising growth linked to government investments in specialized medical infrastructure and burgeoning medical tourism sectors.

Segmentation trends indicate that the double-wall audiometry room segment commands a higher market share in terms of value, owing to its complex engineering and high cost, justified by its necessity in research and clinical specialty centers demanding near-perfect acoustic environments. However, the single-wall and portable segment is projected to exhibit faster volume growth, capitalizing on the expansive network of primary care settings and corporate occupational health programs that require compliance testing rather than highly complex diagnostic procedures. Application-wise, hospitals and audiology clinics remain the largest end-users, but the occupational health segment is gaining momentum as industries like manufacturing, construction, and mining globally prioritize worker safety and implement proactive hearing conservation programs to mitigate costly liabilities associated with noise exposure claims.

AI Impact Analysis on Audiometry Room Market

Common user questions regarding AI's influence in the Audiometry Room Market typically revolve around whether AI could automate or entirely replace traditional testing procedures, thereby reducing the need for physical rooms, or conversely, if AI could enhance the efficiency and diagnostic capability within these specialized environments. Users are keenly interested in the integration of AI-driven data analysis tools to process audiometric results faster, identify complex patterns indicative of specific pathologies, and automate calibration checks for the acoustic environment itself. Key concerns include the standardization of AI algorithms across different testing environments and the privacy implications of handling vast quantities of sensitive patient hearing data. The general expectation is that AI will function as a powerful assistive tool, optimizing workflow and enhancing diagnostic accuracy rather than replacing the fundamental requirement for a standardized, acoustically isolated testing space.

- AI algorithms facilitate automated interpretation of complex audiograms, reducing clinician variability and speeding up diagnosis time within the booth.

- Predictive maintenance analytics, powered by AI, monitor the acoustic integrity of the audiometry room, flagging early potential structural or mechanical issues (e.g., ventilation noise creep).

- Integration of AI-driven voice recognition and speech-in-noise testing capabilities, utilizing sophisticated algorithms to generate personalized and adaptive auditory stimuli within the controlled room environment.

- AI assists in optimizing scheduling and workflow management for high-volume occupational health screenings conducted in mobile or fixed audiometry units.

- Development of AI-enhanced tele-audiology platforms, where remote clinicians utilize AI tools to guide and monitor the technical setup and acoustic conditions remotely, validated by the controlled environment of the room.

DRO & Impact Forces Of Audiometry Room Market

The market dynamics for audiometry rooms are shaped by a strong combination of clinical necessity and legislative mandates. Key drivers include global demographic shifts, specifically the rapid increase in the geriatric population, which correlates directly with a higher incidence of presbycusis, necessitating diagnostic facilities. Coupled with this is the escalating global focus on workplace safety, with governments and regulatory bodies continuously tightening standards for noise exposure monitoring and mandatory hearing conservation programs, creating a baseline demand for audiometric testing facilities across industrial sectors. Opportunities lie predominantly in developing economies, where healthcare infrastructure investment is accelerating, and in the integration of advanced digitalization and modular design to facilitate broader access to screening services.

However, the market faces significant restraints. High initial capital investment is required for manufacturing and installing high-specification, double-wall rooms, making entry difficult for smaller healthcare providers. Furthermore, the reliance on specialized acoustic materials and certified installation expertise limits the speed of deployment and raises overall costs. The lengthy and complex regulatory approval processes in various jurisdictions, particularly for specialized medical devices, can slow down market entry for innovative designs. The market is also slightly constrained by the durability of existing installations; audiometry rooms typically have long operational lifespans (15–20 years), meaning demand often hinges on replacement cycles rather than continuous new construction.

The impact forces influencing the market are multifaceted. Technological advancements act as a positive force, driving demand for more efficient, lighter, and higher-performance isolation materials. Societal awareness regarding hearing health is growing, leading to increased patient self-referral and preventative screening. Conversely, economic volatility and fluctuating construction material costs represent negative impact forces, potentially delaying procurement decisions by hospitals and corporate entities. The regulatory environment remains the most potent external force; any new mandates on noise exposure limits or compulsory screening requirements immediately translates into accelerated demand for certified audiometry facilities, solidifying the market's stability.

Segmentation Analysis

The Audiometry Room Market is systematically segmented based on the structural design, the degree of acoustic performance, and the primary application area. This granular classification allows manufacturers to tailor solutions to specific end-user requirements, ranging from the necessity for basic sound booth screening in primary care settings to the ultra-low noise requirements of specialized auditory brainstem response (ABR) testing in research institutions. Segmentation by type differentiates between fixed, site-built rooms and modular units, with the latter offering critical flexibility for temporary setups or relocations. The core distinction lies in the structural complexity—single-wall configurations offer standard noise reduction adequate for typical environments, while double-wall configurations provide maximum isolation essential for highly sensitive testing or extremely noisy locations.

The market’s segmentation by end-user illustrates the diverse applications of the technology. Hospitals and large specialized audiology clinics represent the largest segments due to their comprehensive testing requirements, often demanding multiple rooms of varying specifications. However, the occupational health sector, encompassing large manufacturing plants, military bases, and transport hubs, is rapidly expanding as companies prioritize employee welfare and comply with stringent regulatory standards for periodic hearing assessments. Furthermore, academic and research institutions form a niche but highly demanding segment, often requiring custom-designed, low-vibration chambers for advanced psychoacoustic and neurological studies, driving demand for the highest-end, double-wall products. Understanding these segments is crucial for strategic market penetration and product development.

- By Type:

- Single-Wall Audiometry Rooms

- Double-Wall Audiometry Rooms

- Portable/Modular Booths

- By Application/End-User:

- Hospitals and Clinics

- Diagnostic Centers and Imaging Centers

- Occupational Health & Industrial Screening Centers

- Academic and Research Institutions

- Military and Aerospace Bases

- By Product Specification (Noise Reduction Rating - NRR):

- Standard (Low Attenuation)

- High Performance (Medium Attenuation)

- Premium (Maximum Attenuation for Research/ABR)

Value Chain Analysis For Audiometry Room Market

The value chain for the Audiometry Room Market begins upstream with the procurement of highly specialized raw materials, primarily high-density acoustic paneling (mass-loaded vinyl, plasterboard, specialized composites), sound-dampening insulation (mineral wool, fiberglass), and high-performance sealing mechanisms for doors and windows. Upstream efficiency is critical, as the acoustic performance of the final product is directly dependent on the quality and consistency of these inputs. Key suppliers often specialize in noise control technology and vibration damping. Manufacturing involves precision engineering, cutting, assembly, and integration of silent ventilation and lighting systems. The fabrication phase requires stringent quality control to ensure acoustic seals are perfect and structural integrity meets both safety and acoustic standards (e.g., ISO 8253-1 compliance).

The midstream component focuses on design, customization, and installation. Unlike off-the-shelf medical equipment, audiometry rooms often require site-specific design modifications to account for ambient noise levels and physical space constraints of the end-user facility. This phase involves extensive acoustic modeling and consultation services. Distribution channels are varied, including direct sales teams for large hospital contracts, specialized medical equipment distributors who handle regional logistics and service, and, increasingly, niche distributors focused solely on occupational health and safety equipment. The direct channel often provides higher profit margins but requires significant internal infrastructure, whereas distributors offer wider geographic reach and localized support.

Downstream activities center on installation, calibration, and ongoing maintenance. Installation is highly specialized, requiring certified technicians to ensure the room maintains its acoustic rating post-assembly; poor installation can render an expensive room ineffective. Calibration services are mandatory and recurring, ensuring the audiometer and the room’s ambient noise floor comply with current standards. Direct interaction with the end-users (audiologists, occupational health physicians) provides valuable feedback loops for product improvement, particularly concerning user ergonomics, access, and integration with modern diagnostic equipment. The indirect channel often relies on third-party calibration and maintenance providers, while larger manufacturers may offer comprehensive, direct service contracts.

Audiometry Room Market Potential Customers

Potential customers for audiometry rooms are primarily institutional and regulatory-driven entities requiring certified and accurate measurement of human hearing thresholds. The largest customer segment comprises public and private hospitals, ranging from regional general hospitals to specialized tertiary care centers that host dedicated audiology and ENT departments. These facilities purchase high-specification, multi-room complexes to handle a broad range of diagnostic procedures, including behavioral audiometry, electrophysiological testing (ABR, ASSR), and specialized pediatric assessment. Their purchasing decisions are heavily influenced by regulatory compliance, durability, and the supplier's reputation for high acoustic performance.

Another significant customer base is the occupational health sector, which procures rooms for mandatory, periodic screening of employees in environments deemed hazardous due to high noise exposure. These customers include large manufacturing companies (automotive, aerospace, heavy machinery), mining operations, construction firms, and governmental organizations (military, naval yards, flight centers). This segment frequently demands robust, often portable or modular units that can be deployed quickly and withstand industrial use. Cost-efficiency, ease of relocation, and adherence to OSHA/MESA standards are paramount factors guiding their purchasing decisions, often favoring single-wall or standard-performance configurations for screening purposes.

Furthermore, specialized research laboratories and academic institutions represent a crucial, high-value customer group. These entities require custom-built, premium double-wall enclosures with exceptional isolation capabilities necessary for sensitive psychoacoustic research, hearing aid development, and cochlear implant studies. Finally, independent audiology clinics and primary care physicians transitioning to offering in-house hearing services constitute the growing small-to-medium enterprise (SME) customer base, typically opting for cost-effective, easily installable modular booths to meet basic diagnostic needs and improve patient convenience.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.5 million |

| Market Forecast in 2033 | USD 274.9 million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IAC Acoustics, Eckel Industries, Industrial Acoustics Company (IAC), ETS-Lindgren, Tremetrics, Acoustic Systems, KCH Group, Hörraum, G.R.A.S. Sound & Vibration, Beijing Sound & Light Technology, Elkon, R-Tec, Noise Control Inc., Acoustic Booth Company, WhisperRoom, Inc., Advanced Acoustical Technologies, Koppers, NMT Group, Kuma Acoustics, Acoustic Solutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Audiometry Room Market Key Technology Landscape

The technology landscape of the Audiometry Room Market is dominated by advances in material science and noise isolation engineering aimed at maximizing sound reduction while minimizing footprint and construction complexity. A core technology involves multi-layered wall systems utilizing heterogeneous materials—such as steel, mass-loaded vinyl, and acoustic gypsum—to effectively block and dampen sound transmission across a broad frequency spectrum. Advanced composites are being increasingly employed to achieve superior Sound Transmission Class (STC) ratings in lighter structures, improving the viability of modular and portable units. Furthermore, innovation focuses heavily on vibration isolation, particularly the implementation of floating floor systems (using neoprene pads or spring isolators) to decouple the booth structure from the building's floor, eliminating structure-borne noise which can severely compromise test accuracy, particularly at lower frequencies.

Another crucial area of technological advancement is in specialized peripheral equipment integration. This includes silent ventilation systems, which are essential for maintaining air quality without introducing measurable background noise. These systems often employ baffled ducts and specialized low-velocity fans to achieve near-silent operation, a requirement crucial for meeting the stringent Noise Reduction Rating (NRR) standards of the internal environment. Furthermore, electromagnetic shielding technology is increasingly being incorporated into high-end audiometry rooms, especially those used in research or neurodiagnostic settings, to prevent interference from nearby electronic devices or power lines which can distort sensitive electrophysiological measurements (like ABR). The seamless integration of data connectivity and monitoring ports, compatible with modern computer-based audiometers, also represents a significant technological requirement.

The rise of modular construction techniques, leveraging interlocking panel systems and quick-assembly mechanisms, constitutes a major shift in the technological landscape. This modularity reduces installation time, decreases on-site disruption, and facilitates easier relocation, appealing strongly to corporate and mobile health customers. Coupled with these structural innovations is the development of advanced acoustic modeling software used in the design phase. This software allows manufacturers to predict the acoustic performance of a customized room design based on the client's site-specific ambient noise profile before construction even begins, ensuring compliance and optimizing material use, thereby lowering project risk and cost. The convergence of material science, mechanical engineering for vibration control, and digital modeling defines the state-of-the-art in audiometry room technology.

Regional Highlights

- North America: This region holds a significant market share, characterized by high healthcare expenditure, established regulatory mandates (e.g., OSHA's noise standard), and a mature audiology market. The demand is driven primarily by replacement cycles for existing infrastructure and continuous technological upgrades in large hospital systems and military installations. The U.S. remains the core contributor, emphasizing high-performance, often double-wall rooms due to stringent clinical requirements and high ambient urban noise levels.

- Europe: Europe represents a stable market, propelled by mandatory occupational health screening programs governed by EU directives and high standards of public healthcare provision. Germany, the UK, and France are leading consumers, focusing on energy-efficient designs and robust, compliant modular systems. The region shows strong adoption of mobile screening units to cater to remote industrial sites and smaller enterprises, maximizing efficiency and compliance outreach.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, fueled by rapid urbanization, massive investment in public and private healthcare infrastructure (particularly in China and India), and a growing middle class capable of accessing specialized medical services. Demand here is characterized by new construction projects, necessitating large volumes of standard single-wall rooms for mass screening, alongside growing demand for premium rooms for newly established specialist diagnostic centers. Regulatory implementation across the region is also becoming increasingly strict.

- Latin America (LATAM): The LATAM market is developing, with growth concentrated in Brazil and Mexico. Expansion is closely linked to government initiatives aimed at modernizing hospital infrastructure and addressing occupational health deficiencies in resource-intensive industries like mining and agriculture. Price sensitivity is higher in this region, leading to a preference for locally manufactured or economically priced standard modular solutions.

- Middle East and Africa (MEA): Growth in the MEA region is patchy but significant in high-income Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) due to government investment in specialized healthcare facilities and medical tourism initiatives. The African market remains nascent, driven primarily by international health organizations and large infrastructure projects requiring occupational health oversight, favoring durable, easy-to-install mobile units suitable for challenging environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Audiometry Room Market.- IAC Acoustics

- Eckel Industries

- Industrial Acoustics Company (IAC)

- ETS-Lindgren

- Tremetrics

- Acoustic Systems

- KCH Group

- Hörraum

- G.R.A.S. Sound & Vibration

- Beijing Sound & Light Technology

- Elkon

- R-Tec

- Noise Control Inc.

- Acoustic Booth Company

- WhisperRoom, Inc.

- Advanced Acoustical Technologies

- Koppers

- NMT Group

- Kuma Acoustics

- Acoustic Solutions

Frequently Asked Questions

Analyze common user questions about the Audiometry Room market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between single-wall and double-wall audiometry rooms?

The distinction lies in the degree of noise attenuation. Single-wall rooms provide standard noise reduction (typically 30-45 dB reduction) suitable for environments with moderate background noise. Double-wall rooms, featuring a room-within-a-room design with an air gap and independent structural support, offer superior noise isolation (often 45-70 dB reduction), essential for sensitive diagnostic procedures like ABR and testing conducted in high ambient noise locations.

What standards govern the acoustic performance and certification of audiometry rooms globally?

The primary global standard is ISO 8253-1, which specifies the required ambient noise levels within the booth for pure-tone and speech audiometry. In the US, ANSI S3.1 is the relevant standard, while occupational health testing often adheres to specific guidelines set by organizations like OSHA. Compliance with these standards is mandatory for clinical use and professional certification.

How frequently should an audiometry room and its equipment be calibrated?

Audiometry equipment (the audiometer) typically requires electro-acoustic calibration annually, though daily biological checks are recommended. The acoustic environment of the room itself (measuring the ambient noise floor) should be checked periodically, often annually, or immediately following any significant structural alteration or relocation to ensure it still meets the minimum requirements set by the applicable standards (e.g., ISO or ANSI).

Are modular or portable audiometry rooms acoustically as effective as fixed installations?

Modern modular rooms are engineered to achieve equivalent acoustic performance (STC/NRR ratings) to fixed installations, particularly within the single-wall category. While high-end double-wall performance might still favor certain fixed, site-built solutions, modular designs offer sufficient isolation for the vast majority of clinical and occupational screening needs, with the added benefit of reduced installation time and future flexibility.

What major factors are driving the demand for audiometry rooms in the Asia Pacific region?

Demand in the Asia Pacific is driven primarily by rapid growth in healthcare infrastructure investment, government mandates expanding access to audiological care, the high prevalence of noise-induced hearing loss due to intense industrialization and urbanization, and the significant elderly population requiring hearing loss diagnosis and management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager