Augmented Reality Mobile Games Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435876 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Augmented Reality Mobile Games Market Size

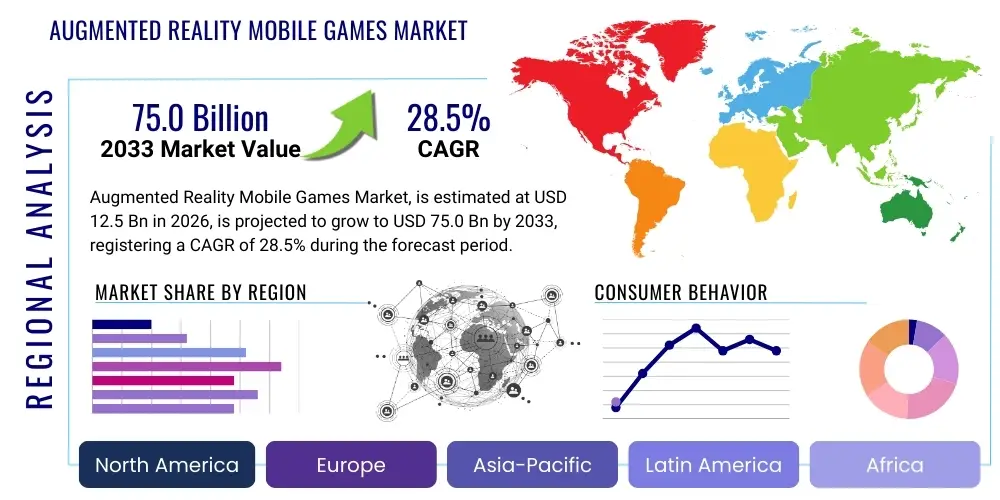

The Augmented Reality Mobile Games Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 75.0 Billion by the end of the forecast period in 2033. This substantial expansion reflects the accelerating consumer shift towards immersive digital experiences that integrate seamlessly with the physical world, leveraging advanced mobile computing capabilities and widespread network improvements, particularly the global rollout of 5G connectivity. The robust growth trajectory underscores the successful commercialization of location-based gaming models and the increasing investment from major technology ecosystem providers (Apple, Google, Meta) who view AR mobile gaming as a crucial gateway to broader spatial computing adoption and the eventual market penetration of AR wearable devices.

Augmented Reality Mobile Games Market introduction

Augmented Reality (AR) mobile games represent a profound evolution in digital entertainment, fundamentally shifting the paradigm from screen-confined experiences to interactive engagements layered upon real-world environments. Utilizing sophisticated smartphone features—including high-resolution cameras, GPS sensors, gyroscopes, and increasingly powerful mobile processors—AR titles overlay dynamic, 3D graphical content onto the user’s immediate surroundings, enabling players to interact with virtual objects and characters situated within their physical space. This market is defined by its ability to provide unprecedented levels of immersion and novelty, transforming mundane locations, such as parks, streets, and living rooms, into personalized digital playgrounds. The technological sophistication required involves real-time environmental mapping and precise synchronization between the digital overlay and the physical movements of the user, ensuring a consistent and believable augmented experience.

The core product offering within this market spans diverse genres, including highly successful location-based Massive Multiplayer Online (MMO) games, interactive educational titles, and spatial puzzle games. Major applications extend beyond simple entertainment; AR mobile games are increasingly leveraged for fitness promotion, urban exploration, and localized social interaction, effectively bridging the gap between digital community and physical activity. The commercial benefits are multifaceted: developers gain access to novel monetization streams, including location-specific microtransactions, sponsored placements tied to real-world businesses, and valuable geo-fenced advertising opportunities. This inherent linkage to physical locations provides unique data insights and substantial revenue potential unmatched by traditional mobile game models. The market’s continued expansion is intricately linked to the improvement of battery life, the ubiquity of high-speed mobile data, and the continuous enhancement of underlying spatial computing software development kits (SDKs) provided by platform owners.

Key driving factors accelerating the market’s growth include the near-universal adoption of high-performance mobile devices capable of running graphic-intensive AR applications without significant performance degradation, particularly in developed and rapidly developing economies. Furthermore, the standardization provided by platforms like ARKit (Apple) and ARCore (Google) has democratized the development process, lowering the barrier to entry for smaller, innovative studios. The success of high-profile franchises transitioning to AR, such as Pokémon GO, has firmly established consumer willingness to engage with the technology, validating the business model and attracting substantial venture capital and corporate investment aimed at developing next-generation persistent and collaborative AR worlds that leverage cloud computing for shared experiences across wide geographical areas.

Augmented Reality Mobile Games Market Executive Summary

The Augmented Reality Mobile Games Market is characterized by vigorous growth underpinned by continuous technological refinement and robust strategic alliances within the digital media ecosystem. Current business trends emphasize the consolidation of Intellectual Property (IP) rights, where established entertainment and media brands are licensing their assets to seasoned AR developers to mitigate risk and guarantee initial audience traction. This strategy is coupled with a pronounced focus on developing 'meta-AR' experiences—games designed to be highly social, leveraging persistent world features, and integrating seamless cross-platform functionality that anticipates the transition to dedicated AR glasses. Monetization strategies are becoming more sophisticated, moving beyond simple in-app purchases to integrate non-fungible tokens (NFTs) and digital asset ownership into the gameplay loop, capitalizing on the broader trends of web3 integration and digital scarcity.

Regionally, North America and the Asia Pacific region collectively command the dominant share, driven by distinct but equally powerful dynamics. North America’s strength is rooted in its highly mature mobile technology consumer base, significant discretionary spending, and a robust environment for technological innovation led by Silicon Valley’s platform providers. Conversely, APAC, specifically East Asia, demonstrates the highest rate of user engagement and market velocity, capitalizing on extremely high population density and cultural acceptance of mobile gaming as a primary form of entertainment. The development and regulatory environments in these regions significantly influence global product release schedules and localization strategies, requiring developers to tailor content and connectivity requirements based on specific regional infrastructure capabilities and network latencies.

Analysis of market segments highlights the enduring dominance and massive revenue potential of location-based AR titles, which mandate physical movement and exploration. This segment benefits from high retention rates and strong community formation, making it highly attractive for brand partnerships and geo-fenced advertising campaigns. Meanwhile, the software component segment—encompassing advanced rendering engines, AI integration tools, and specialized networking protocols—is projected to achieve the fastest Compound Annual Growth Rate (CAGR). This acceleration is due to the necessity for developers to adopt advanced tools to differentiate their offerings through superior graphical fidelity, reduced battery consumption, and improved environmental understanding (occlusion, light estimation). The future success of the market hinges on optimizing the synergy between these technological advancements and compelling narrative design that fully utilizes the immersive potential of the physical world as a backdrop for digital storytelling.

AI Impact Analysis on Augmented Reality Mobile Games Market

A comprehensive analysis of user sentiment and industry inquiry reveals that the integration of Artificial Intelligence (AI) into the Augmented Reality Mobile Games Market is primarily viewed through the lens of enhancing environmental realism, personalizing the gaming narrative, and optimizing resource management. Users are particularly concerned with how AI can move beyond predictable scripting to create Non-Player Characters (NPCs) that exhibit genuine, adaptive intelligence, reacting logically not only to the player’s virtual actions but also to their physical location and real-world timing. Key discussions also revolve around AI’s role in improving the technical foundations, specifically stabilizing the persistence and accuracy of virtual object placement across diverse mobile hardware and mitigating the substantial computational load associated with rendering complex AR scenes in real-time environments, a crucial challenge for mainstream adoption.

Technically, AI, particularly deep learning models, is critical for refining Simultaneous Localization and Mapping (SLAM) algorithms. These models analyze complex visual and sensor data streams faster and more accurately than traditional methods, drastically improving the ability of a mobile device to recognize the geometry of its surroundings and anchor virtual elements without drift or jitters. This capability is paramount for creating truly stable and believable persistent AR content, such as a virtual structure that remains precisely where it was placed days earlier. Furthermore, AI is employed in optimizing the rendering pipeline by dynamically adjusting the level of detail (LOD) and texture resolution based on the device's current processing capacity and battery level, ensuring smooth, uninterrupted gameplay regardless of the real-world thermal or computational constraints faced by the mobile hardware.

Strategically, AI is reshaping content creation and player retention. Developers utilize predictive analytics powered by machine learning to analyze massive datasets of user movement, interaction frequency, and purchasing habits. This analysis informs procedural content generation systems that can automatically create unique missions, tailor difficulty curves, or deploy specific virtual assets (e.g., rare items or enemy encounters) to maximize user engagement based on their historical behavior and location history. By providing highly personalized and constantly evolving game content, AI fundamentally elevates the replay value and emotional investment of the AR title, turning passive observation into active, personalized exploration and addressing the industry need for scalable content generation solutions that reduce the reliance on costly manual design. This level of dynamic personalization is essential for maintaining a competitive edge in a rapidly maturing entertainment sector.

- AI-driven procedural content generation for dynamic maps and missions based on real-world topology and time-of-day dynamics.

- Enhanced spatial computing through Machine Learning (ML) for superior Simultaneous Localization and Mapping (SLAM) accuracy, reducing virtual object drift and enhancing persistence.

- Adaptive difficulty scaling and personalized gameplay experiences based on real-time user performance, physical movement patterns, and demographic data.

- Creation of highly sophisticated Non-Player Characters (NPCs) with complex behavioral trees, realistic emotional responses, and nuanced conversational capabilities using advanced NLP models.

- Optimization of game assets, resource loading, and rendering pipelines to dynamically adjust graphical fidelity based on diverse mobile hardware specifications and current battery status, ensuring smooth AR performance.

- Advanced fraud detection, anti-cheat mechanisms, and bot mitigation in highly competitive, location-based AR environments to maintain fair play integrity.

- Real-time moderation of user-generated content and analysis of player feedback using Natural Language Processing (NLP) to inform rapid deployment of patches and content updates.

- Predictive analytics for optimizing microtransaction timing and content offerings, enhancing monetization strategy based on learned user purchasing behaviors and location context.

DRO & Impact Forces Of Augmented Reality Mobile Games Market

The core momentum of the Augmented Reality Mobile Games Market is derived from powerful drivers, most notably the continuous advancements in mobile device technology, characterized by faster processors, improved cameras, and increased RAM capacity, making high-fidelity AR experiences accessible to a global audience. The global proliferation of high-bandwidth 5G network infrastructure significantly reduces latency, which is critical for real-time interaction in multiplayer AR environments and the smooth streaming of large spatial data sets. This technological readiness is strongly complemented by the massive commercial validation provided by successful early market entrants, establishing consumer confidence and fostering rapid investment across the entire development value chain, including specialized hardware components and sophisticated software tools that accelerate development cycles and improve user experience consistency.

However, the market faces inherent restraints that temper explosive growth. The most significant technical challenge remains the substantial drain on mobile device battery life caused by the simultaneous and continuous operation of the camera, GPS, screen, and processing unit necessary for AR rendering and world tracking. Furthermore, the global heterogeneity of mobile hardware capabilities creates a fragmented experience, where high-end graphics are only accessible to a limited segment, forcing developers to build multiple versions or settle for lower common denominators. Non-technical restraints include growing regulatory scrutiny regarding data privacy, particularly concerning persistent user location tracking, and the need for rigorous content moderation in games that overlay digital elements onto public, real-world spaces, creating potential legal and ethical ambiguities that must be proactively managed by publishers to avoid consumer distrust.

Vast opportunities exist in bridging the current technological gaps and capitalizing on emerging consumer trends. The most significant opportunity lies in the anticipated maturation and mass adoption of dedicated AR wearables (smart glasses), which promise to eliminate screen-based limitations and battery drain issues associated with smartphones, ushering in truly hands-free, immersive AR experiences. Strategically, integrating AR mobile games with broader 'metaverse' initiatives and enabling cross-platform digital asset ownership will secure long-term revenue streams. Economically, the market presents immense potential for hyper-local advertising, where brands can pay for contextual, location-specific placements within the game world—a powerful form of experiential marketing that directly incentivizes real-world visitation and consumer engagement, transforming the gaming environment into a valuable commercial property.

Segmentation Analysis

The strategic analysis of the Augmented Reality Mobile Games Market relies heavily on detailed segmentation across key dimensions, allowing stakeholders to pinpoint high-growth areas and tailor product development to specific market needs. The segmentation by Component (Software vs. Hardware) is crucial, as the performance ceiling of the software is inextricably linked to the underlying mobile hardware capabilities, driving continuous innovation in both areas. The distinction between platforms (iOS and Android) dictates development priorities, tool optimization, and market reach, with developers often focusing on maximizing performance parity across these dominant operating systems while managing fragmentation issues specific to the Android ecosystem globally.

The segmentation by Technology provides insight into developmental maturity and consumer adoption. While marker-based AR, often utilizing QR codes or printed images, offers high stability but limited scalability, markerless AR—the technology underpinning location-based giants—utilizes sophisticated sensor fusion and Simultaneous Localization and Mapping (SLAM) to provide expansive, persistent world interaction. Markerless AR is the primary driver of market revenue due to its capacity for large-scale, real-world exploration and its integration with global positioning systems, making it the most strategically important technological subset for future investment and expansion into urban environments worldwide.

Finally, segmentation by Genre (e.g., Action/Adventure, RPGs) and End-User Age Group provides crucial demographic and behavioral insights. Role-Playing Games (RPGs) often leverage persistent digital asset collection and complex narrative structures to drive long-term engagement and high Average Revenue Per User (ARPU). Conversely, Puzzle and Casual games cater to broader, less technically demanding audiences. Understanding these genre preferences, alongside the specific needs and technological access points of distinct age groups (from minors to adult commuters), allows publishers to precisely target marketing efforts and design monetization strategies that resonate effectively with intended consumers, maximizing market penetration and securing sustainable recurring revenue streams across multiple market segments.

- By Component:

- Software (AR SDKs, Game Engines specializing in spatial computing, Content Creation Tools, Cloud Services for persistent world data)

- Hardware (Smartphones optimized for AR processing, Tablets, Peripheral AR accessories, Future AR Glasses/Headsets used for mobile connectivity)

- By Platform:

- iOS (Benefiting from standardized hardware specifications and high-quality AR frameworks like ARKit)

- Android (Representing the largest global installed base but facing challenges due to device fragmentation and varying performance levels)

- Others (Including proprietary platforms or dedicated gaming handhelds exploring AR integration)

- By Technology:

- Marker-based AR (Used for targeted interactions, packaging, and specific product recognition)

- Markerless AR (Dominant segment, utilizing GPS and sophisticated SLAM algorithms for massive, location-based, real-world interactions)

- By Genre:

- Action and Adventure (Highly immersive titles focusing on exploration, combat, and large-scale real-world missions)

- Role-Playing Games (RPGs) (Emphasis on character progression, virtual item collection, and persistent narrative arcs tied to geographic locations)

- Strategy and Simulation (Games requiring spatial planning, resource management, and often involving territorial control in real-world map views)

- Puzzles and Casual Games (Focus on simple, accessible mechanics suitable for short sessions and broad consumer appeal)

- By End-User Age Group:

- Below 18 (Targeted by educational and family-friendly IP, driven by social trends and parental approval)

- 18-35 (Core demographic, high spending power, tech-savvy, heavily engaged in competitive and social LBS games)

- 36 and Above (Growing segment interested in light exploration and health-focused AR applications)

Value Chain Analysis For Augmented Reality Mobile Games Market

The foundational stage of the Augmented Reality Mobile Games value chain resides in the Upstream segment, dominated by key technology providers and foundational infrastructure creators. This includes semiconductor manufacturers (e.g., Qualcomm, MediaTek) providing highly specialized mobile application processors and dedicated neural engines necessary for real-time computer vision and SLAM processing with minimal energy consumption. Crucially, this segment also encompasses the developers of operating system-level AR tools—Apple’s ARKit and Google’s ARCore—which establish the standards for environmental tracking, light estimation, and virtual object occlusion. Without continuous innovation in the upstream layer, particularly concerning efficiency and sensor data fusion, the downstream development potential would be severely restricted, thereby highlighting the immense leverage held by hardware and platform ecosystem creators in this market.

The central phase involves the Content Creation and Development process. Game studios, ranging from multi-national publishers to independent teams, utilize the upstream SDKs and commercial game engines (like Unity or Unreal) to design, program, and iterate on the AR gameplay experience. This stage demands a unique blend of traditional game design skills and expertise in spatial computing and geo-fencing technologies. Post-development, the Distribution Channel is overwhelmingly indirect, relying almost exclusively on the centralized, highly controlled mobile application storefronts (Apple App Store and Google Play Store). These platforms not only facilitate mass market access but also manage critical services such as payment processing, updates, and compliance checks, acting as gatekeepers that extract a significant portion of the revenue, thus defining the economic structure of the market.

The Downstream segment focuses on consumption and external integration. This includes the end-users—the millions of mobile gamers whose retention and lifetime value dictate profitability—and the various commercial partners who utilize the AR ecosystem. Direct revenue streams come primarily from in-app purchases and advertisements. Indirectly, the value chain extends to location-based service providers, retail chains, and tourism boards who partner with game publishers to integrate geo-fenced promotions and sponsored virtual content. The efficiency of the entire chain is reliant on feedback loops from the downstream users influencing the upstream technological improvements, particularly regarding bug reports, performance bottlenecks, and demands for greater battery optimization, ensuring that the market continuously evolves toward a more seamless, power-efficient, and universally accessible AR experience.

Augmented Reality Mobile Games Market Potential Customers

The primary target demographic and largest segment of potential customers for AR mobile games are technologically affluent millennials and Gen Z individuals, typically aged 18 to 35, residing in urban or suburban environments with reliable access to high-speed mobile data. This group is characterized by a strong affinity for social engagement, an openness to new gaming mechanics, and high purchasing power for digital goods and microtransactions. They are motivated not just by competition or collection but often by the opportunity for shared experiences that bridge their digital community with their physical explorations. These customers are the heavy users of location-based services (LBS) and are actively seeking games that incentivize physical movement and social interaction, viewing AR gaming as an integral component of their active lifestyle and social media presence, thus ensuring high daily active user counts and sustainable engagement over prolonged periods.

Secondary, yet rapidly expanding, customer segments include the older demographic (36+) seeking low-impact, accessible casual entertainment, and parents looking for engaging, educational alternatives for their children (below 18). For the older segment, AR games offer non-intrusive entertainment that often integrates elements of health and fitness tracking, providing perceived utilitarian value alongside leisure. For the younger audience, the value proposition rests on leveraging popular children's media franchises to deliver interactive learning or collaborative play that encourages exploration under parental supervision. Targeting these diverse age groups requires developers to meticulously adjust complexity, interface design, and monetization strategies to align with varying levels of technical literacy and disposable income, ensuring broad market capture across the socio-economic spectrum.

Beyond the individual consumer, a critical cohort of potential customers consists of business-to-business (B2B) partners, primarily spanning the retail, tourism, and real estate sectors. These organizations purchase integration opportunities, seeking access to the highly engaged, location-aware AR user base. For example, a global fast-food chain may partner with an AR game publisher to place virtual items or special events exclusively at their physical store locations, driving crucial foot traffic and increasing impulse purchases. In this context, the potential customer is not the gamer but the corporation utilizing the game’s infrastructure as a high-tech, highly effective marketing channel. These corporate relationships necessitate sophisticated data reporting and measurable return-on-investment (ROI) metrics, positioning the AR publisher as both an entertainment provider and a cutting-edge experiential advertising platform vendor, significantly diversifying their total revenue stream.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 75.0 Billion |

| Growth Rate | 28.5% CAGR ( Include CAGR Word with % Value ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Niantic Inc., Microsoft Corporation, Google LLC, Apple Inc., Sony Corporation, Tencent Holdings Ltd., Nintendo Co., Ltd., The Walt Disney Company, Reality Gaming Group, Zappar Ltd., Blippar, Magic Leap, Scanta, Ludia Inc., Next Games (A Netflix Company), Maze Theory, Resolution Games, Zero Latency VR, Snap Inc. (Snapchat), Kabam Games, Inc., Unity Technologies, Epic Games (Via Unreal Engine), Samsung Electronics Co., Ltd., Huawei Technologies Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Augmented Reality Mobile Games Market Key Technology Landscape

The technological backbone of the Augmented Reality Mobile Games Market is anchored in the precision and efficiency of Simultaneous Localization and Mapping (SLAM) systems. SLAM is fundamental, enabling the mobile device to construct a persistent 3D map of the environment while simultaneously tracking its own precise position and orientation within that map. Advanced SLAM algorithms utilize sensor fusion—integrating data from the camera, gyroscope, accelerometer, and depth sensors—to achieve highly robust world tracking that can handle complex scenarios like low light, movement blur, and feature-poor environments. The continuous improvement of SLAM capabilities, often leveraging dedicated AI chipsets (neural processing units or NPUs) within smartphones, is directly responsible for increasing the stability and believability of virtual objects overlaid onto the real world, mitigating common issues such as visual jitter and spatial drift, thereby significantly enhancing the critical metric of user immersion.

Complementary to SLAM is the continuous development of commercial-grade Augmented Reality Software Development Kits (SDKs), notably Apple's ARKit and Google's ARCore, which provide developers with standardized, high-level tools to implement complex AR features efficiently. These SDKs are constantly introducing features like advanced occlusion management, where virtual objects correctly appear behind real-world physical barriers, and environmental light estimation, ensuring that the shadows and reflections cast by virtual objects match the ambient lighting of the real scene. Furthermore, the trend toward shared AR experiences is driving the need for sophisticated cloud anchors and persistent mapping technologies, allowing multiple users to view and interact with the same virtual world at different times and locations, fostering massively multiplayer online AR environments that are critical for long-term user retention and social dynamics.

Looking forward, the integration of 5G connectivity is rapidly altering the technology landscape by allowing high-throughput, low-latency communication between the device and edge servers. This capability enables the offloading of highly computational tasks—such as complex physics calculations, deep AI learning model inference, and the streaming of high-definition virtual assets—from the mobile device to the cloud. By reducing the local processing burden, 5G helps conserve device battery life and allows for the creation of richer, more complex AR worlds than previously feasible solely on local hardware. Moreover, the emergence of volumetric capture and neural rendering techniques is promising photorealistic digital assets and characters that blend seamlessly into the camera feed, setting a new expectation for visual quality and pushing the technological boundaries far beyond the capabilities of the first generation of AR mobile games.

Regional Highlights

The global Augmented Reality Mobile Games Market exhibits pronounced regional dynamism, heavily influenced by disparities in mobile infrastructure, consumer spending power, and cultural propensity toward mobile digital entertainment. North America, encompassing the United States and Canada, remains a central powerhouse, primarily due to its leading role in digital content creation, the presence of major platform operators (Apple, Google), and the high average transaction value per user. The mature market here is driven by continuous innovation in AR hardware and software, supported by robust venture capital investments, leading to the rapid deployment and testing of cutting-edge AR mechanics and complex monetization strategies targeting a tech-savvy consumer base accustomed to premium digital products.

The Asia Pacific (APAC) region is indisputably the engine of future growth, projected to register the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This growth is fueled by the region's immense mobile user base, unparalleled smartphone penetration, and the high population density across major cities in China, Japan, and South Korea, which provides an optimal environment for location-based games that thrive on social density and accessible points of interest. Governments across APAC are actively promoting digital transformation, creating favorable regulatory landscapes for technology investment. The strong cultural acceptance of mobile gaming in these economies translates directly into high levels of daily user engagement and considerable spending on microtransactions, positioning APAC as the most lucrative destination for expansion and localized content development efforts.

Europe, driven by the Western European nations, represents a steadily maturing market, distinguished by high digital literacy and reliable 4G/5G infrastructure rollouts. While culturally diverse, the region shows consistent growth, focusing on quality over sheer volume, with consumers demonstrating loyalty to well-executed, sophisticated AR titles. Conversely, emerging markets such as Latin America (LATAM) and the Middle East and Africa (MEA) are currently smaller in scale but hold immense untapped potential. Growth in these regions is contingent upon overcoming challenges related to infrastructure unevenness, high mobile data costs relative to income, and device affordability. However, as connectivity improves and device costs fall, the large, youthful populations in these areas represent critical long-term targets for accessible and culturally relevant AR mobile games, marking them as important strategic development zones for the latter half of the forecast period.

- North America: Market leader by revenue and technological innovation; high consumer spending and concentration of key AR software developers and platform owners; high adoption rate of premium AR devices and services.

- Asia Pacific (APAC): Highest expected CAGR; characterized by the largest mobile gamer population, high urban density driving successful location-based AR models, and strong cultural engagement in mobile gaming, particularly in key markets like China and Japan.

- Europe: Stable and significant growth in Western Europe; driven by advancements in 5G deployment, favorable regulatory environment for digital commerce, and a consumer base prioritizing quality and innovative gameplay mechanics.

- Latin America: Rapidly emerging market potential; growth tied to expanding smartphone accessibility and improving mobile network infrastructure, requiring localized content strategies and flexible monetization models.

- Middle East & Africa (MEA): Nascent market undergoing digital transformation; future growth potential reliant on infrastructure investment, especially in the GCC countries and South Africa, targeting youthful demographics eager for novel entertainment forms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Augmented Reality Mobile Games Market.- Niantic Inc.

- Microsoft Corporation

- Google LLC

- Apple Inc.

- Sony Corporation

- Tencent Holdings Ltd.

- Nintendo Co., Ltd.

- The Walt Disney Company

- Reality Gaming Group

- Zappar Ltd.

- Blippar

- Magic Leap

- Scanta

- Ludia Inc.

- Next Games (A Netflix Company)

- Maze Theory

- Resolution Games

- Zero Latency VR

- Snap Inc. (Snapchat)

- Kabam Games, Inc.

- Unity Technologies

- Epic Games (Via Unreal Engine)

- Samsung Electronics Co., Ltd.

- Huawei Technologies Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Augmented Reality Mobile Games market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the AR mobile games market?

The market is primarily driven by the mass proliferation of AR-capable smartphones, the global deployment of low-latency 5G networks, and the continuous standardization and innovation in spatial computing technologies like ARKit and ARCore, which enhance the realism, stability, and accessibility of immersive experiences for users worldwide.

How is AI specifically enhancing the Augmented Reality mobile gaming experience?

AI integration significantly improves gameplay quality and retention through adaptive difficulty scaling, real-time optimization of environmental tracking (SLAM), and the creation of dynamic, procedurally generated content and complex NPC behaviors, ensuring highly personalized and contextually accurate interactions within the physical environment.

What is the most popular type of technology used in AR mobile games and why does it dominate?

Markerless AR technology, which utilizes GPS, Simultaneous Localization and Mapping (SLAM), and advanced sensor fusion, dominates the market. It is preferred because it enables large-scale, persistent, location-based games that require no specific markers, making it ideal for real-world exploration and wide-area multiplayer engagement.

Which geographical region holds the largest market share and which is the fastest growing?

North America currently holds the largest revenue market share due to high consumer spending and robust technological infrastructure. However, the Asia Pacific (APAC) region is projected to be the fastest-growing market, driven by its massive mobile user base, high urban density, and strong mobile gaming culture.

What are the biggest challenges facing the long-term sustainability and mainstream adoption of AR mobile gaming?

Key challenges include resolving significant mobile device battery consumption associated with continuous camera and GPS usage, addressing complex data privacy and security concerns related to persistent location tracking, and ensuring consistent, high-quality performance across the fragmented global ecosystem of mobile hardware platforms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager