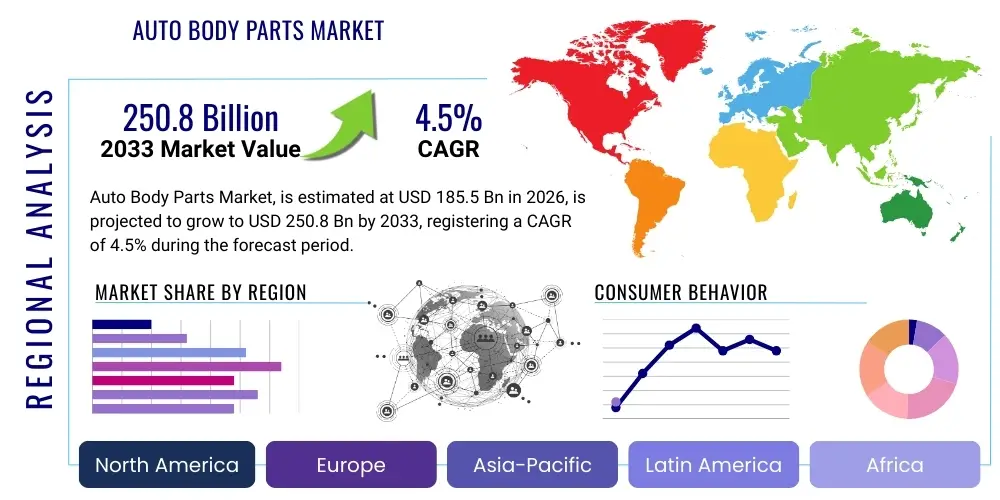

Auto Body Parts Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435235 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Auto Body Parts Market Size

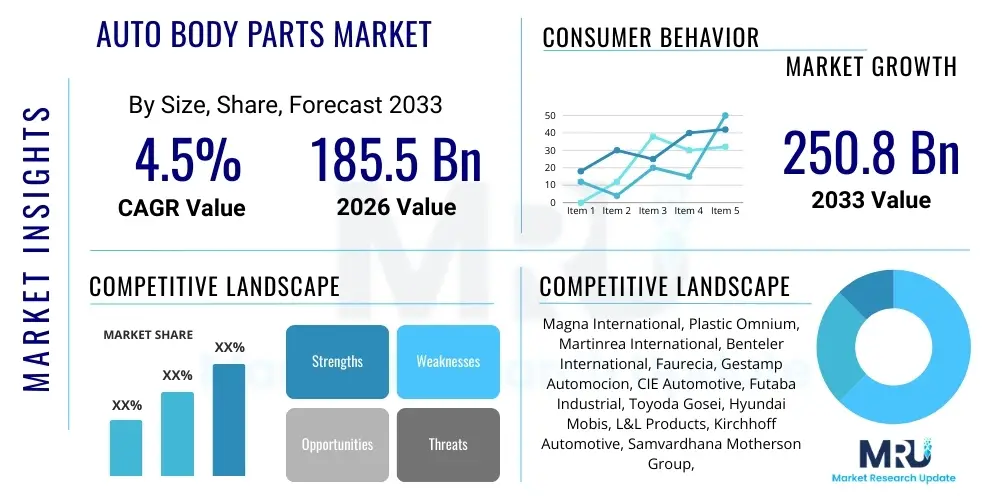

The Auto Body Parts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 185.5 Billion in 2026 and is projected to reach USD 250.8 Billion by the end of the forecast period in 2033.

Auto Body Parts Market introduction

The Auto Body Parts Market encompasses the manufacturing and distribution of components that form the exterior structure, interior fittings, and overall chassis integrity of vehicles. These parts are critical for aesthetics, aerodynamic efficiency, occupant safety, and overall vehicle performance. The market's stability is inherently tied to global automotive production cycles, vehicle ownership rates, and, crucially, the frequency and severity of road accidents requiring repair or replacement of damaged components. Modern auto body parts are increasingly sophisticated, incorporating advanced materials like high-strength steel, aluminum alloys, and carbon fiber composites to achieve weight reduction goals mandated by stringent fuel efficiency and emission regulations across major geographies.

The product description for this market includes a vast array of components, ranging from exterior panels such as bumpers, fenders, hoods, and doors, to structural elements like frames, pillars, and cross-members, and internal components essential for vehicle integrity. Major applications span Original Equipment Manufacturing (OEM) for new vehicle assembly and the robust Aftermarket sector, which is driven by collision repair, customization, and vehicle refurbishment activities. The growing complexity of vehicle design, particularly the integration of sensor technology within external panels (critical for Advanced Driver Assistance Systems—ADAS), places high demands on the precision and quality of auto body parts supplied to both sectors.

Key benefits derived from this market include enhanced passenger safety through improved crashworthiness, reduced operational costs for vehicle owners via parts longevity and durability, and increased fuel efficiency resulting from lightweighting initiatives. Driving factors propelling market expansion include the consistent rise in the global vehicle parc, the rapid adoption of electric vehicles (EVs) which often utilize unique structural components, and the necessity of maintaining older vehicles through the Aftermarket. Furthermore, advancements in manufacturing technologies, such as 3D printing for specialized or low-volume parts, are contributing to supply chain flexibility and efficiency.

Auto Body Parts Market Executive Summary

The Auto Body Parts Market is characterized by a high degree of integration between OEM suppliers and major automotive manufacturers, though the aftermarket segment exhibits significant fragmentation. Current business trends indicate a strong pivot towards sustainability, pushing manufacturers to utilize recycled materials and develop processes that minimize waste and energy consumption. Consolidation among Tier 1 suppliers is a continuous feature, driven by the need to invest heavily in research and development for lightweight materials and complex component integration required by modern vehicle platforms. The transition toward electric vehicles necessitates redesigning traditional body structures, focusing on protecting large battery packs and managing crash forces differently than traditional Internal Combustion Engine (ICE) vehicles, thus creating lucrative opportunities for specialized structural component providers.

Regional trends highlight the dominance of the Asia Pacific (APAC) region, primarily driven by mass vehicle production in China, India, and Japan, coupled with rapidly increasing urbanization and disposable incomes boosting vehicle ownership. North America and Europe, while mature markets, emphasize advanced repair technologies and high-quality, certified replacement parts (CAPA certified), driven by strict insurance industry standards and consumer safety expectations. The emergence of digital sales platforms and sophisticated inventory management systems is streamlining the distribution channels globally, allowing smaller repair shops quicker access to specialized or rare components, thereby sustaining growth in the independent aftermarket sector.

Segmentation trends reveal significant growth in the structural body parts segment, directly correlating with the implementation of stricter global crash test standards, necessitating more robust and complex chassis designs. The distribution landscape sees the aftermarket expanding rapidly, fueled by the aging global vehicle fleet—vehicles over eight years old require body repairs more frequently than newer counterparts. Material segmentation shows a definitive shift away from traditional steel components toward hybrid compositions that incorporate high-strength steel (HSS), aluminum, and polymer composites, addressing the dual demands of safety and fuel economy. This shift requires continuous technological upgrades in molding, joining, and welding processes across the manufacturing base.

AI Impact Analysis on Auto Body Parts Market

Common user questions regarding AI’s impact on the Auto Body Parts Market frequently revolve around efficiency gains in manufacturing, optimization of supply chains, and the future role of AI in accident assessment and repair. Users are keenly interested in how Artificial Intelligence can automate quality inspection processes, predicting material fatigue or defects before components leave the factory floor. There is also significant inquiry into AI's capability to analyze vast collision data sets to inform better, safer structural designs (Generative Design). Furthermore, the role of AI in streamlining the aftermarket—specifically, through automated damage assessment tools utilized by insurance companies and body shops—is a primary concern, focusing on accuracy, speed, and cost reduction in the repair process.

The integration of AI is transforming the design and manufacturing lifecycle of auto body parts. In the design phase, Generative Design algorithms allow engineers to quickly explore thousands of structural variations, optimizing components for minimal weight while maximizing rigidity and crash energy absorption—a task impossible using traditional simulation methods. On the factory floor, AI-powered vision systems are performing non-destructive testing and quality control inspections at unprecedented speeds, significantly reducing the probability of flawed parts entering the supply chain. Predictive maintenance applied to manufacturing machinery, powered by AI, ensures minimal downtime, thereby increasing overall production throughput and reducing operational costs associated with large-scale stamping and molding operations.

In the aftermarket, AI is revolutionizing the collision repair sector. Advanced image recognition and machine learning models are now used to instantly calculate the extent of vehicle damage from photographs, providing instantaneous repair estimates and determining the exact body parts required. This technology drastically shortens the claims processing cycle for insurance companies and enhances customer satisfaction. Moreover, AI is being deployed in optimizing inventory management for large distributers and regional warehouses, predicting demand fluctuations based on seasonal factors, traffic density, and regional accident rates, ensuring that essential replacement parts are stocked precisely where and when they are needed.

- AI-driven Generative Design optimizes structural components for lightweighting and crash performance.

- Machine learning algorithms enhance predictive maintenance in manufacturing, reducing equipment downtime.

- AI vision systems automate quality control and non-destructive testing of finished body panels.

- AI-powered damage assessment tools streamline insurance claims and collision repair estimates in the aftermarket.

- Predictive analytics optimize inventory and logistics for spare body parts distribution globally.

DRO & Impact Forces Of Auto Body Parts Market

The dynamics of the Auto Body Parts Market are fundamentally shaped by the intersection of regulatory pressure (safety standards), technological innovation (materials and manufacturing), and consumer behavior (vehicle maintenance and replacement cycles). Key drivers include the mandatory implementation of stringent vehicle safety regulations, such as those imposed by Euro NCAP and NHTSA, which constantly demand stronger, more complex, and accurately fitted body structures. Simultaneously, the global push toward electrification (EV adoption) acts as a powerful driver, necessitating new body architectures optimized for battery protection and structural rigidity, inherently requiring the development and production of specialized components. However, growth is tempered by significant restraints, primarily centered around the volatility of raw material prices (steel, aluminum, resins) and the high cost associated with tooling and capital investment for complex modern parts production, which acts as a barrier to entry for smaller manufacturers.

Opportunities in this sector are abundant, particularly in the rapid expansion of the certified aftermarket parts segment, driven by insurance companies seeking cost-effective yet quality-assured alternatives to OEM parts for routine collision repairs. Furthermore, the global proliferation of autonomous vehicles (AVs), while nascent, presents a long-term opportunity, as AVs will rely heavily on precisely fitted exterior panels to house complex sensor arrays (LiDAR, radar, cameras). The most critical impact force influencing this market is the shift toward multi-material vehicle construction, driven by the need to meet global fleet-wide average fuel economy (CAFE) standards. This technological shift creates both a challenge (complex joining techniques) and an opportunity (higher value-added components), forcing traditional suppliers to quickly adapt their manufacturing processes and material science expertise.

The interconnected nature of the global automotive supply chain further amplifies market sensitivity to external economic shocks and geopolitical tensions. Disruptions, such as those experienced during the recent global logistics crisis, severely impact the timely delivery of body parts, especially within the just-in-time (JIT) manufacturing environment used by OEMs. The push for localized production, often mandated by regional trade policies and the desire for supply chain resilience, represents a long-term shift that will restructure regional manufacturing footprints. Successfully navigating these constraints requires advanced technological solutions, investment in vertically integrated operations, and robust risk management strategies pertaining to material sourcing and complex logistics networks.

Segmentation Analysis

The Auto Body Parts Market segmentation provides a granular view of demand based on component functionality, vehicle application, and route to market. The primary segmentation categories—Product Type (Exterior, Interior, Structural), Vehicle Type (Passenger, Commercial), and Distribution Channel (OEM, Aftermarket)—reflect the varied demands arising from new vehicle production versus repair and maintenance activities. The exterior segment, including highly visible panels like bumpers and fenders, generally dominates in volume due to frequent collision damage, while the structural segment drives higher revenue per unit owing to the complexity and material cost associated with chassis and frame components essential for safety.

The distinction between the OEM and Aftermarket channels is crucial for strategic analysis. The OEM channel focuses on supplying high-volume, precisely engineered parts for assembly lines, demanding stringent quality standards and long-term contracts. Conversely, the aftermarket is characterized by diverse demand patterns, price sensitivity, and shorter production runs, catering to collision repair centers and independent garages. Growing regulatory efforts to ensure the safety of aftermarket parts, alongside the rise of branded, certified replacement parts, are gradually closing the quality gap between the two major distribution channels.

Analyzing segmentation by Vehicle Type confirms that the passenger vehicle segment holds the largest share due to the sheer volume of global passenger car sales and the higher incidence of minor collisions requiring body repairs. However, the commercial vehicle segment (trucks, buses, heavy goods vehicles) represents a stable, high-value market, as downtime for these vehicles is extremely costly, pushing operators to prioritize fast, durable repairs using high-quality body components. The overall market trajectory indicates that investment will focus on sophisticated structural parts tailored for next-generation electric and autonomous passenger vehicles, ensuring long-term technological relevance.

- By Product Type:

- Exterior Parts (Bumpers, Fenders, Doors, Hoods, Grilles)

- Structural Parts (Frames, Chassis, Pillars, Cross-members, Rocker Panels)

- Interior Body Parts (Dashboards, Console Frames, Interior Trim Structures)

- By Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles)

- By Material Type:

- Metals (Steel, Aluminum)

- Plastics/Polymers (Polypropylene, Polycarbonate)

- Composites (Carbon Fiber, Fiber Reinforced Polymers)

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Independent Distributors, Certified Repair Shops)

Value Chain Analysis For Auto Body Parts Market

The value chain for the Auto Body Parts Market is complex and highly integrated, beginning with upstream raw material suppliers and culminating with the end-user. Upstream analysis focuses on the procurement of primary materials—specifically steel coils, aluminum sheets, various polymers, and advanced composite precursors. The pricing and availability of these materials significantly dictate the cost structure for component manufacturers. Key upstream activities involve material processing, alloying, and preparation, where technological advancements in lightweighting—such as the development of specialized high-strength steels and novel composite layup techniques—are initially realized. Suppliers in this phase hold substantial bargaining power, particularly those providing specialized, high-grade materials essential for meeting stringent safety and environmental standards.

The midstream comprises the core manufacturing activities, where Tier 1 suppliers execute processes such as stamping, molding, welding, assembly, and surface finishing. These manufacturers invest heavily in advanced robotics, automation, and tooling specific to complex auto body geometry. The distribution channel dictates the next steps: OEM parts move directly to vehicle assembly plants via dedicated logistics, adhering to strict just-in-time delivery schedules. Aftermarket parts, conversely, are channeled through national and international distributors, large retailers, or increasingly through e-commerce platforms, eventually reaching independent repair garages and franchised dealer service centers. The complexity here lies in managing vast stock-keeping units (SKUs) required to service diverse vehicle models across multiple model years.

Downstream analysis highlights the critical role of repair and insurance sectors. Direct distribution encompasses OEM parts sold through franchised dealerships or proprietary supply networks. Indirect distribution is dominated by independent aftermarket suppliers who source parts globally and distribute them through third-party networks. The end-users—vehicle owners—interact with this chain primarily through collision repair shops and insurance adjusters. The ability to efficiently assess damage, locate, and install the correct, quality-assured part is the final and often most customer-facing segment of the value chain. Technological innovation in the distribution phase, such as digital tracking and automated warehousing, is paramount for maintaining supply chain efficiency and reducing vehicle repair times.

Auto Body Parts Market Potential Customers

The customer base for the Auto Body Parts Market is bifurcated into two primary segments: the Original Equipment Manufacturers (OEMs) and the expansive Aftermarket ecosystem, each with distinct purchasing criteria and volume requirements. OEMs, including global automotive giants such as Toyota, Volkswagen Group, General Motors, and Tesla, are the primary buyers of new body parts, integrating them directly into the assembly of millions of new vehicles annually. Their purchasing decisions are driven by factors like component performance (meeting precise specifications for crashworthiness, fit, and finish), supplier capacity, technological partnership for future vehicle platforms, and, crucially, long-term cost containment through high-volume contracts. These customers prioritize zero-defect quality and robust logistics management.

The Aftermarket customer segment is far more diverse and includes independent collision repair centers, franchised dealership service departments, major national and international auto parts retailers (like LKQ Corporation and Genuine Parts Company), and increasingly, direct-to-consumer e-commerce platforms. For collision repair centers, the primary purchasing drivers are immediate availability, competitive pricing, and certified quality (e.g., CAPA certification) to ensure seamless repair processes and compliance with insurance mandates. Insurance companies, though not direct purchasers, exert immense influence by dictating which types of replacement parts (OEM, certified aftermarket, or used) are approved for covered repairs, fundamentally steering the demand in the collision repair sector.

Another crucial, though sometimes overlooked, segment includes large fleet operators (e.g., rental car companies, logistics firms, public transport agencies) who maintain large vehicle inventories and require steady access to durable body components for fleet maintenance and minor accident repair. These customers often negotiate bulk purchasing agreements directly with distributors or manufacturers. The common thread among all end-users is the fundamental requirement for durability and precise fitment, minimizing installation labor costs and maximizing vehicle longevity and safety, solidifying the market's emphasis on high manufacturing precision across all customer types.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.5 Billion |

| Market Forecast in 2033 | USD 250.8 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Magna International, Plastic Omnium, Martinrea International, Benteler International, Faurecia, Gestamp Automocion, CIE Automotive, Futaba Industrial, Toyoda Gosei, Hyundai Mobis, L&L Products, Kirchhoff Automotive, Samvardhana Motherson Group, Continental AG, Denso Corporation, Aisin Seiki, ZF Friedrichshafen, Grupo Antolin, Hella GmbH, Adient plc |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Auto Body Parts Market Key Technology Landscape

The technological landscape of the Auto Body Parts Market is defined by intense innovation aimed at improving safety, reducing vehicle weight, and enhancing manufacturing efficiency. One dominant technological trend is the proliferation of multi-material design strategies, where manufacturers are increasingly combining high-strength steel (HSS), ultra-high-strength steel (UHSS), aluminum, and advanced plastic composites within a single body structure. This requires sophisticated joining technologies such as friction stir welding, laser welding, flow drill screws, and advanced adhesive bonding, moving beyond traditional resistance spot welding. Suppliers must invest heavily in proprietary joining solutions to manage the dissimilar materials effectively while maintaining structural integrity and crash performance.

Another pivotal technology is the adoption of advanced simulation and predictive engineering tools. Finite Element Analysis (FEA) and Computational Fluid Dynamics (CFD) are routinely employed during the design phase to optimize component shapes for maximum rigidity and aerodynamic performance before physical prototyping begins. Crucially, the rise of Generative Design, powered by Artificial Intelligence, is accelerating the optimization process, allowing for the rapid creation of complex, organic body structures that minimize material usage without sacrificing crash safety. This technology is vital for electric vehicles, where efficient structural design is paramount for extending battery range.

On the manufacturing front, large-scale automation, specifically using high-precision robotics in stamping, molding, and painting, is standard across Tier 1 suppliers to ensure dimensional accuracy and repeatability. The market is also witnessing increasing application of additive manufacturing (3D printing), particularly for specialized tooling, jigs, and fixtures used in low-volume or customized vehicle programs, significantly reducing lead times and costs associated with traditional hard tooling. Furthermore, the development of lightweight, sustainable materials, including bio-based polymers and advanced recycled aluminum alloys, represents a long-term technological focus driven by global environmental mandates and corporate social responsibility goals.

Regional Highlights

The Asia Pacific (APAC) region stands as the dominant force in the Auto Body Parts Market, primarily due to its colossal production base, particularly in China and India, which are both major manufacturing hubs and rapidly expanding consumption markets. China's enormous domestic demand, coupled with its role as a global exporter of vehicles, drives exceptional volume in both OEM and high-volume, cost-competitive aftermarket body parts. The region benefits from a relatively lower manufacturing cost base and continuous investment in new automotive production capacity. Furthermore, the rapid uptake of New Energy Vehicles (NEVs) in APAC necessitates swift evolution in local body parts manufacturing capabilities to accommodate new platform architectures, especially in structural battery enclosures and lightweight exterior panels.

Europe represents a mature market characterized by stringent regulatory environments concerning safety and emissions, driving demand for premium, lightweight, and complex body structures. Western European nations, notably Germany, France, and Italy, are centers for high-value manufacturing and advanced material development, emphasizing components made from aluminum and advanced composites. The aftermarket in Europe is highly regulated, often preferring certified or OE-quality replacement parts, which sustains high average selling prices for body components compared to other regions. Furthermore, the aggressive timelines for phasing out ICE vehicles are forcing European suppliers to rapidly retool for high-performance EV body structures.

North America maintains a robust market position, driven by high average vehicle ownership, a large vehicle fleet size, and a highly sophisticated collision repair and insurance sector. The U.S. aftermarket is highly developed, with organizations like CAPA (Certified Automotive Parts Association) playing a critical role in standardizing quality for replacement parts, thereby enhancing consumer confidence in non-OEM alternatives. The shift toward larger vehicles (SUVs and trucks) in the North American market influences demand for larger, more robust body panels and structural components. Investment in Mexico, serving as a lower-cost manufacturing gateway for the U.S. and Canadian markets, continues to be a crucial element in the North American supply chain strategy.

- Asia Pacific (APAC): Dominates the market share due to high-volume vehicle production, especially in China and India; strong growth driven by electric vehicle adoption and expanding middle-class vehicle ownership.

- North America: Characterized by a highly developed aftermarket supported by strict insurance standards and certification bodies; high demand for components used in SUVs and light trucks; major focus on supply chain resilience with production hubs in Mexico.

- Europe: Focuses on premium, high-tech components driven by stringent safety (Euro NCAP) and sustainability regulations; leading region for adopting advanced lightweight materials like aluminum and composites in serial production.

- Latin America (LATAM): Growth is primarily tied to economic stability and local automotive manufacturing activities in Brazil and Argentina; faces challenges related to infrastructure and reliance on imported specialized parts.

- Middle East and Africa (MEA): Emerging market characterized by increasing vehicle parc and subsequent demand for aftermarket collision repair parts, although local manufacturing capacity remains limited, relying heavily on imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Auto Body Parts Market.- Magna International

- Plastic Omnium

- Martinrea International

- Benteler International

- Faurecia (now part of Forvia)

- Gestamp Automocion

- CIE Automotive

- Futaba Industrial

- Toyoda Gosei

- Hyundai Mobis

- L&L Products

- Kirchhoff Automotive

- Samvardhana Motherson Group

- Continental AG

- Denso Corporation

- Aisin Seiki

- ZF Friedrichshafen

- Grupo Antolin

- Hella GmbH (now part of Forvia)

- Adient plc

Frequently Asked Questions

Analyze common user questions about the Auto Body Parts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the demand for specialized body parts in the EV sector?

The primary driver is the necessity for unique structural components that protect the large, heavy battery pack from crash impact and moisture intrusion. EVs require optimized body shells, often integrating aluminum or specialized high-strength steel cages, to manage crash energy differently than traditional internal combustion engine vehicles, directly impacting the demand for specialized body parts.

How does lightweighting impact the manufacturing processes for auto body parts?

Lightweighting necessitates the shift from singular material usage (steel) to multi-material vehicle architectures (aluminum, composites, plastics). This requires significant investment in complex manufacturing processes, including advanced joining technologies (laser welding, structural adhesives) and sophisticated stamping/molding equipment to ensure material integrity and precise dimensional accuracy.

What is the significance of the Aftermarket segment in the overall Auto Body Parts Market?

The Aftermarket segment is critical as it accounts for the replacement and repair of components necessary due to collisions or wear over the vehicle's lifespan. Its growth is stable, driven by the increasing global vehicle parc and the aging of the vehicle fleet, providing reliable, continuous demand for bumpers, fenders, and other easily damaged exterior panels.

What role do certification standards like CAPA play in the market?

Certification standards like CAPA (Certified Automotive Parts Association) ensure that aftermarket body parts meet stringent quality, fit, and performance criteria comparable to OEM components. These certifications are crucial for gaining approval from insurance companies and collision repair shops, mitigating concerns about safety and quality differences between OE and replacement parts.

Which technology is most rapidly transforming the body parts design process?

Generative Design, powered by AI and machine learning, is the most rapidly transforming technology. It enables engineers to utilize computational algorithms to explore vast design spaces, generating structural components automatically optimized for minimum weight and maximum crash performance in a fraction of the time required by traditional, manual simulation methods.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager