Automated Food Sorting Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437925 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Automated Food Sorting Equipment Market Size

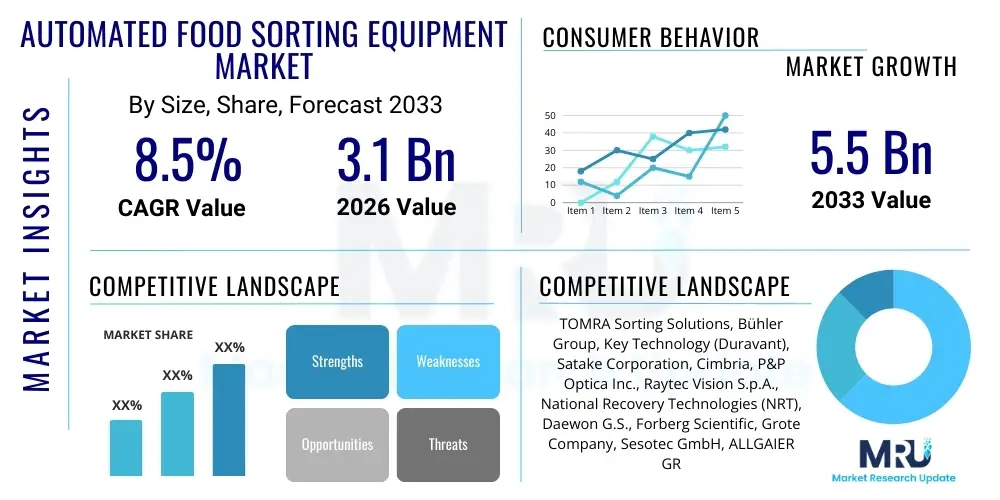

The Automated Food Sorting Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 3.1 Billion in 2026 and is projected to reach USD 5.5 Billion by the end of the forecast period in 2033.

Automated Food Sorting Equipment Market introduction

The Automated Food Sorting Equipment Market encompasses a specialized sector focused on machinery designed to inspect, analyze, and separate food items based on quality parameters such as size, shape, color, density, and defect presence. These systems utilize advanced sensor technologies, including high-resolution cameras, laser scanners, near-infrared (NIR) spectroscopy, and X-ray imaging, to achieve high-speed, non-destructive sorting. The primary goal of deploying automated sorting equipment is to enhance food safety, improve product quality consistency, and significantly reduce operational costs associated with manual labor. This technology is critical across various stages of the food processing lifecycle, from raw material inspection upon harvest or delivery to final packaging quality control, ensuring compliance with stringent global regulatory standards and consumer expectations for premium quality.

Products within this market range from conventional mechanical screen sorters to highly sophisticated optical sorting machines integrated with artificial intelligence (AI) for complex defect detection. Major applications span the processing of grains, seeds, nuts, fruits, vegetables, seafood, and processed foods. The adoption of these machines is driven primarily by the escalating demand for flawless food products, the necessity for high throughput in large-scale industrial farming and processing operations, and the continuous challenge of managing labor scarcity and rising minimum wages in developed economies. Furthermore, the increasing complexity of food supply chains necessitates robust quality assurance mechanisms that only automated systems can reliably provide, pushing manufacturers towards greater investments in advanced sorting capabilities. These investments are particularly crucial in maximizing usable yield while adhering to sustainability mandates aimed at minimizing global food waste.

The core benefits derived from automated food sorting are manifold, including superior sorting accuracy, minimized false rejects, and maximized yield recovery. Driving factors involve technological advancements such as the integration of deep learning algorithms for complex pattern recognition, enabling sorters to differentiate subtle defects invisible to standard optical systems and analyze internal composition. Regulatory pressures, especially concerning foreign material detection (e.g., plastics, metal shards, glass), further compel food producers to invest in X-ray and high-definition spectral sorting technologies. The move towards sustainable practices also favors automation, as precision sorting can reduce food waste by accurately differentiating between usable and unusable items, thereby optimizing resource utilization across the food industry value chain and bolstering environmental responsibility claims.

Automated Food Sorting Equipment Market Executive Summary

The Automated Food Sorting Equipment Market is undergoing a rapid technological transformation, shifting from basic color sorting mechanisms to integrated multi-sensor platforms driven by artificial intelligence and machine learning. Key business trends include the consolidation of specialized technology providers and the increasing prevalence of subscription-based or Equipment-as-a-Service (EaaS) models, making advanced equipment more financially accessible to small and medium-sized enterprises (SMEs). Manufacturers are focusing heavily on modular design, standardized software interfaces, and enhanced data connectivity, allowing sorting machines to seamlessly integrate with wider factory automation systems and IoT platforms for real-time performance monitoring, predictive maintenance, and overall line optimization. This emphasis on connectivity and data analysis is driving efficiency, ensuring uptime maximization, and improving traceability throughout the production line, catering to the growing regulatory demand for verifiable quality data.

Regional trends indicate that North America and Europe currently hold the largest market shares, primarily driven by long-established food safety infrastructures, high levels of technological investment, and the critical need to offset significantly high operational and labor costs. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) over the forecast period. This accelerated growth is fueled by massive governmental and private investments aimed at modernizing food processing infrastructure in key emerging economies like China, India, and Southeast Asian nations. Rising consumer affluence in these regions translates directly into increased demand for higher quality, safer, and consistently graded imported and domestically produced foods. Latin America and the Middle East and Africa (MEA) are also showing promising market momentum, particularly in the sorting of high-value agricultural commodities and seafood primarily intended for lucrative international export markets, necessitating compliance with stringent global quality standards.

Segment trends reveal that optical sorters, particularly those employing sophisticated high-definition cameras, lasers, and Near-Infrared (NIR) spectroscopy, continue to dominate the market in terms of volume due to their versatility across a vast range of bulk products including grains, nuts, and fresh produce. Segmentation analysis highlights the strong, escalating demand from the processed food sector, where automated sorting is critical for foreign material detection and maintaining uniformity in packaged snacks and frozen meals. The increasing consumer preference for healthy, minimally processed whole foods is simultaneously accelerating the demand for extremely gentle, high-speed sorters capable of handling delicate fresh items without bruising or damage. Furthermore, within the technology segment, the integration of deep learning architectures and sophisticated algorithms for complex sorting tasks (such as structural analysis and defect grading) is driving premiumization, leading to higher Average Selling Prices (ASPs) for new generation equipment that promises superior and consistent classification accuracy far beyond human limits.

AI Impact Analysis on Automated Food Sorting Equipment Market

Users frequently inquire about how Artificial Intelligence, specifically machine learning and deep learning, is fundamentally changing the capabilities, operational parameters, and economic viability of automated food sorting equipment. Common user questions extensively cover AI’s ability to handle highly complex and variable defects—for example, accurately differentiating subtle, early-stage rot from simple surface moisture or naturally occurring discoloration—and its role in reducing costly false reject rates, which directly impact yield. There is significant interest in AI's capacity to enable sorting based on internal composition parameters (like nutritional content, specific gravity, or internal ripeness), moving beyond simple surface analysis. Furthermore, users often ask about the practical requirements for implementing AI-driven systems, including the necessary data infrastructure, sensor compatibility requirements, and the level of specialized expertise required for setup and operation. The core themes emerging from these inquiries are the expectation of ultra-high precision, guaranteed adaptability to diverse and seasonally changing product streams, and the desire for sorting machines that learn and autonomously improve their decision-making over extended operational periods, thereby moving beyond the limitations of rigid, predefined sorting criteria. This consistently points toward a broad market expectation that AI integration will be the single most crucial differentiator in achieving near-perfect quality assurance while simultaneously minimizing product loss and maximizing process efficiency across the entire food processing spectrum.

- Enhanced Defect Recognition: AI algorithms, particularly Convolutional Neural Networks (CNNs) utilized in deep learning, allow sorters to recognize subtle, highly complex, and evolving defects, challenging types of mold, or minute foreign material that traditional, legacy rule-based algorithms are unable to reliably identify, leading to a dramatic improvement in reliable detection accuracy.

- Reduced False Rejects: Machine learning models optimize the complex sorting decisions by precisely differentiating acceptable, natural product variations (such as size or minor color fluctuation) from critical, quality-compromising defects, consequently resulting in demonstrably higher commercially viable product yields and significantly minimized food waste.

- Internal Quality Analysis: The crucial integration of advanced AI with hyperspectral or advanced Near-Infrared (NIR) sensors enables automated sorting based on internal quality parameters, including accurate assessments of sugar content, fat levels, internal moisture percentage, ripeness, and comprehensive structural integrity, which is absolutely vital for optimizing product flavor profiles, nutritional consistency, and overall predictable shelf life.

- Adaptive Learning Capabilities: Sophisticated AI-driven sorting systems possess the unique capability to continuously self-calibrate and adapt their sorting logic to natural, systemic variations in product characteristics (e.g., accommodating seasonal changes in raw crop appearance or variability between different source farms) without demanding constant, time-consuming manual re-programming, significantly enhancing the overall operational flexibility and reducing required operator input.

- Predictive Maintenance Integration: Utilizing sophisticated AI techniques to comprehensively analyze vast quantities of sensor data and complex machine performance patterns allows the system to generate highly accurate predictive maintenance alerts. This proactive approach ensures that necessary servicing is performed before critical failure, substantially increasing the operational uptime of the equipment and boosting the overall overall equipment effectiveness (OEE).

- Traceability and Reporting: AI systems generate exceptionally highly detailed, rich data logs regarding every rejected item, the specific reason for its rejection, and pervasive quality trends across production batches. This instantaneous data feedback provides robust, auditable traceability insights that are essential for regulatory compliance, targeted process optimization, and immediate quality intervention.

DRO & Impact Forces Of Automated Food Sorting Equipment Market

The market dynamics for Automated Food Sorting Equipment are primarily driven by the intensification of stringent global food safety mandates and the critical economic necessity for operational efficiency across all processing stages to effectively combat continually rising global labor costs. Restraints frequently encountered include the substantial high initial capital expenditure required for purchasing and installing advanced multi-sensor sorting systems, coupled with the organizational requirement for specialized technical skills necessary for the precise operation and complex maintenance of modern, particularly AI-integrated, units. However, opportunities are highly abundant in emerging global markets that are actively focused on rapidly modernizing their agricultural post-harvest processing facilities, and through the strategic development and deployment of more affordable, highly scalable sorting solutions specifically tailored for adoption by Small and Medium-sized Enterprises (SMEs). The overarching impact forces clearly indicate a high degree of technological substitution pressure, where continuous innovations in sensor technology, coupled with the aggressive integration of AI, are rapidly rendering older mechanical and basic optical sorting methods obsolete, thereby compelling continuous and substantial investment from industry participants to remain competitive.

Drivers: The global acceleration of intensified food safety regulations, such as HACCP compliance, the Food Safety Modernization Act (FSMA) in the US, and similar European directives, necessitates advanced automated foreign material detection and robust, verifiable quality checks across all product lines. The pervasive and worsening issue of labor scarcity, particularly for low-skilled manual sorting tasks, combined with the continuous rise in minimum wages globally, makes capital investment in automation an unavoidable economic imperative for high-volume processors aiming to maintain profitability. Furthermore, the increasing global consumer expectations for premium, consistently defect-free, and high-quality food products places direct commercial pressure on manufacturers to implement the highest possible standards of automated sorting technology. The burgeoning global demand for specialized, high-value agricultural commodities (such as exotic nuts, organic coffee beans, and specialty fruits) rigorously requires absolute precision sorting capabilities to consistently maintain and secure crucial export quality standards and associated market premiums.

Restraints: The primary and most significant restraint remains the substantial initial investment cost associated with procuring, installing, and integrating advanced optical, X-ray, and specialized laser sorting equipment. This significant financial outlay can often be prohibitively high, especially for smaller-scale processors or those operating under severe financial constraints and characterized by thin operational margins. Effectively integrating these technologically complex and often proprietary systems into existing, sometimes decades-old, legacy processing lines poses substantial technical, logistical, and compatibility challenges that can lead to unexpected delays and costs. Additionally, the widespread lack of universally standardized training protocols and the documented scarcity of personnel proficient in accurately operating, calibrating, and troubleshooting sophisticated, data-driven sorting machinery can seriously hinder the technology’s widespread and successful adoption, particularly noticeable within rapidly developing and rural regions globally.

Opportunities: Significant future growth opportunities are clearly present in the ability to customize and engineer advanced sorting solutions tailored for highly specialized niche applications, such as the gentle sorting of fragile organic produce, the complex differentiation of meat cuts, or the detailed analysis of specific pharmaceutical-grade ingredients. The strategic development of modular, highly scalable, and comprehensively cloud-connected sorting systems, often flexibly offered through innovative leasing, rental, or Equipment-as-a-Service (EaaS) models, provides a robust and clear pathway for deep market penetration into the previously underserved Small and Medium-sized Enterprise (SME) segment. Moreover, the increasing global alignment with ambitious sustainability goals—specifically utilizing precision sorting technology to drastically reduce the amount of salvageable food waste that enters the waste stream—effectively positions the technology as an essential investment for eco-friendly and resource-optimized processing, which in turn opens doors to preferential government incentives, favorable regulatory treatment, and access to sustainable impact investment capital.

Segmentation Analysis

The Automated Food Sorting Equipment market is broadly and analytically segmented based on several critical dimensions including the underlying technology deployed, the specific product application, the physical type of product handled, and the end-user demographic. Technology segmentation fundamentally highlights the current market dominance of optical sorters but also tracks and predicts the rapidly accelerating adoption rate of X-ray and highly advanced combined multi-sensor systems, which offer significantly superior detection capabilities for complex or internal contaminants. Application segmentation meticulously details the primary use cases, spanning raw material primary processing, subsequent value-added secondary processing, and highly critical final packaging and quality control stages. Product type differentiation is critically important because the machinery often requires highly specialized engineering to effectively handle specific items like irregular nuts, delicate berries, standardized grains, or complex frozen vegetables, directly influencing essential design parameters such as conveyor width, operational speed, and the mechanism utilized for gentle product handling. Analyzing these detailed segments provides market stakeholders with a clear and actionable roadmap of current and projected demand drivers and indicates the specific technological maturity levels within specialized niches of the vast food processing industry.

- By Type:

- Camera/Vision Sorters (Color, Monochromatic, RGB, Hyperspectral)

- Laser Sorters (Shape and Structure Analysis)

- NIR (Near-Infrared) Sorters (Compositional Analysis)

- X-ray Sorters (Density and Foreign Material Detection)

- Combined/Multi-Sensor Sorters (Integrated Platforms)

- By Application:

- Grains, Pulses, and Seeds Sorting (Wheat, Rice, Beans)

- Fruits and Vegetables Sorting (Fresh and Frozen)

- Nuts and Dried Fruits Sorting (Almonds, Walnuts, Raisins)

- Processed Foods Sorting (Snack Foods, Ready Meals, French Fries)

- Meat, Poultry, and Seafood Sorting (Bone, Shell, and Cartilage Detection)

- Spices and Coffee Sorting (Grade and Defect Classification)

- By End-User:

- Large Multinational Food Processing Companies

- Small and Medium-sized Enterprises (SMEs) and Regional Processors

- Dedicated Food Packaging Facilities and Co-packers

- Contract Food Manufacturers and Private Label Producers

- By Platform:

- Freefall Sorters (High throughput, granular products)

- Belt Sorters (Delicate products, 360-degree inspection)

- Channel Sorters (Specific volume sorting, customized applications)

Value Chain Analysis For Automated Food Sorting Equipment Market

The intricate value chain for Automated Food Sorting Equipment commences with a meticulous upstream analysis, which centrally focuses on the highly selective procurement of critical, advanced components. These essential inputs include ultra-high-resolution cameras, specialized sensory arrays (such as precise NIR sensors, powerful X-ray tubes, and high-efficiency laser arrays), complex and resilient electronic control units, and precision mechanical components, particularly the high-speed pneumatic ejector mechanisms which are core to the system’s performance. Key suppliers in this initial phase are highly specialized technology providers focusing on advanced optics, high-performance computing hardware, and cutting-edge materials science. The quality, durability, and computational reliability of these upstream inputs directly and fundamentally dictate the overall sorting performance, accuracy, and operational longevity of the final sorting machinery, making robust, long-term supplier relationships and meticulous component vetting absolutely essential. Intensive research and development activities, predominantly focused on dramatically improving sensor accuracy, enhancing computational processing speed, and refining AI decision-making algorithms, are largely localized at this critical upstream stage, thereby fiercely driving competitive advantages among the primary equipment manufacturers.

The middle segment of the value chain involves the crucial activities of industrial design, precision assembly, complex software integration, rigorous testing, and final quality control of the sorting machines by Original Equipment Manufacturers (OEMs). This core manufacturing phase necessitates substantial internal engineering expertise, particularly in the seamless integration of proprietary software, sophisticated AI and machine learning algorithms, and high-speed mechanical handling systems designed to withstand harsh processing environments. Manufacturing efficiency, coupled with the ability to adhere strictly to highly customized client specifications regarding throughput and product type, are paramount factors for success in this segment. OEMs often strategically specialize by target application, offering specific product lines expertly tailored for distinct product handling requirements (e.g., highly sensitive, fragile fresh produce versus robust, high-volume dry bulk grains). Rigorous performance testing, adherence to relevant international certifications for food contact safety (e.g., USDA, EHEDG standards), and verification of operational reliability are integral, mandatory parts of the manufacturing process before the equipment is released for deployment.

The subsequent downstream analysis covers all aspects related to distribution channels, on-site installation, commissioning, and comprehensive post-sale service and support. Distribution channels typically operate as a strategic mix of dedicated direct sales forces (especially utilized for securing large, complex, and customized enterprise systems) and highly specialized regional distributors or agents who are responsible for providing localized installation, training, and immediate technical support. Post-sale activities, including structured maintenance contracts, essential software upgrades, remote diagnostics, and detailed operator training programs, represent a critically important recurring revenue stream and a core strategy for maximizing customer retention and satisfaction. The direct sales channel allows OEMs to maintain close, invaluable customer relationships and gather proprietary, real-time feedback crucial for rapid product improvement cycles, while the indirect channel, by expertly leveraging local expertise and established networks, ensures significantly wider geographical market penetration, quicker response times for critical technical service issues, and ultimately maximizes the equipment’s crucial operational uptime for the end-user food processor.

Automated Food Sorting Equipment Market Potential Customers

The primary and most significant potential customers for Automated Food Sorting Equipment are large-scale entities engaged in the industrial handling, processing, and packaging of consumable goods, where consistent quality assurance, high throughput volumes, and regulatory safety compliance are absolutely paramount organizational concerns. These essential customers include globally dominant multinational food and beverage conglomerates that require centralized, high-throughput sorting operations capable of handling vast volumes, alongside specialized agricultural cooperatives focused intensely on the critical primary processing of raw grains, fruits, and vegetables immediately post-harvest. The seafood and meat processing industries represent high-value customer segments, frequently necessitating the deployment of advanced X-ray technology for the precise detection of bone fragments, cartilage, or metallic foreign objects, driven by the highly sensitive nature of these products and the potential for severe regulatory penalties, brand damage, and expensive recalls resulting from contamination.

A rapidly expanding and increasingly influential segment of potential customers includes smaller, dynamically high-growth food production facilities, specialized contract manufacturers, and innovative food start-ups focused on producing niche, premium quality, or certified organic products. These entrepreneurial entities strategically leverage automated sorting technology not solely for foundational safety compliance but also critically for maintaining brand integrity, justifying premium pricing for their guaranteed superior product quality, and maximizing the efficiency of small-batch runs. Furthermore, packaging companies that perform highly sensitive final quality checks immediately prior to sealing products constitute a sizable end-user base, strategically utilizing advanced sorters to accurately catch late-stage contaminants or incorrectly sized/colored items that may have passed previous checks. As strategic vertical integration continues to increase across the food supply chain, major global retailers or large restaurant chains that manage and operate their own internal supply preparation facilities are also rapidly becoming direct, major purchasers of specialized sorting equipment to ensure total control over their specific product specifications and quality standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 5.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TOMRA Sorting Solutions, Bühler Group, Key Technology (Duravant), Satake Corporation, Cimbria, P&P Optica Inc., Raytec Vision S.p.A., National Recovery Technologies (NRT), Daewon G.S., Forberg Scientific, Grote Company, Sesotec GmbH, ALLGAIER GROUP, Steinert GmbH, Hefei Meyer Optoelectronic Technology Inc., Anzai Manufacturing Co., Ltd., JBT Corporation, Unitec S.p.A., Clarity Sorting, Next Generation Sensors. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automated Food Sorting Equipment Market Key Technology Landscape

The current technological landscape of automated food sorting is robustly characterized by a powerful convergence of advanced optical science, sophisticated spectral imaging techniques, and high-speed computational power, increasingly centralized on board the equipment. The foundational standard remains high-speed optical sorting, which primarily utilizes high-resolution industrial RGB cameras to accurately detect superficial parameters such as color, defined shape inconsistencies, and visible surface blemishes. However, the true market differentiator and driver of premium pricing is the increasing, specialized incorporation of advanced sensory technologies far beyond the visible spectrum. Near-Infrared (NIR) spectroscopy, for instance, has become vital for efficiently analyzing the internal chemical composition of products, effectively enabling the detection of essential parameters like moisture content, accurate fat levels, sugar content, and the presence of foreign materials such as specific types of plastic, low-density wood fragments, or shells that are completely invisible to standard color cameras. Simultaneously, advanced sensor technologies like InGaAs (Indium Gallium Arsenide) sensors are rapidly becoming prevalent, offering significantly superior spectral sensitivity, which is particularly critical for the precision sorting of high-value commodities such as specialty nuts and complex grains based on subtle internal structural integrity differences.

X-ray technology is recognized as indispensable for maintaining stringent food safety standards, and its use is primarily focused on reliably detecting high-density contaminants such as metal fragments, dense stone, minute glass shards, and calcified bone fragments within complex matrices like meat, poultry, and heavily processed food products. The latest generation of X-ray sorters utilizes proprietary dual-energy technology, which provides vastly superior material discrimination capabilities compared to single-energy systems. This technological leap significantly minimizes false positives, which increases efficiency, and maximizes throughput rates. A crucial and overriding technological trend currently shaping the industry is the swift development and deployment of ‘Multi-Sensor Integration’ systems. In these integrated platforms, high-definition optical, NIR, and advanced X-ray technologies are seamlessly combined and operated from a single central platform. These sophisticated integrated systems are engineered to simultaneously process multiple complex quality metrics, offering unprecedented, comprehensive sorting accuracy, significantly reducing the overall machine footprint, and simplifying operational complexity for end-users, thereby maximizing the critical return on investment (ROI) for food processors who must deal with complex, highly variable production streams.

Crucially, the rapid advancement and implementation of Artificial Intelligence (AI) and Machine Learning (ML) are fundamentally transforming sorting decisions, moving them decisively away from rigid, manually predefined parameter setting toward dynamic, truly adaptive classification capabilities. ML algorithms empower sorters to autonomously recognize complex, evolving patterns and subtle defects based on continuous input from vast operational datasets, allowing for the automatic, continuous refinement of sorting criteria based on real-time performance feedback loops. This adaptive technology is absolutely essential for effectively handling naturally variable products like diverse fresh produce, where intrinsic biological defects may manifest in highly subtle, unique, and unpredictable ways that human operators cannot consistently grade. Furthermore, the pervasive industry push towards comprehensive IoT connectivity and industrial network integration allows these sophisticated machines to accurately report granular performance metrics, seamlessly manage software updates remotely, and integrate flawlessly into overarching plant management and Enterprise Resource Planning (ERP) systems. This continuous connectivity is paving the way for the creation of fully autonomous, interconnected smart factory environments across the entire food processing sector, setting new standards for efficiency and quality control.

Regional Highlights

Regional market dynamics significantly influence both the adoption rate and the specific type of automated food sorting equipment deployed, driven by localized agricultural practices, prevailing labor cost structures, and the stringency of regional regulatory bodies. North America, characterized by vast, highly consolidated food processing operations and extremely strict regulatory oversight from bodies like the FDA and USDA, maintains a high demand for extremely high-speed, robust multi-sensor systems. There is a particularly strong demand for high-end X-ray sorting for robust contaminant detection and advanced AI-driven optical sorting essential for premium processed goods. The exceptionally high cost and increasing scarcity of manual labor are the dominant economic factors accelerating the region's rapid transition from traditional manual sorting to comprehensive, full automation across all major processing lines.

Europe generally mirrors the stringent food safety standards (enforced by EFSA) and maintains high automation rates, particularly within industrialized countries such as Germany, the Netherlands, and Belgium, which function as major global exporters of technologically complex processed foods and specialized agricultural products. The European regional focus is heavily centered on principles of circular economy and sustainability, which significantly drives demand for specialized sorters engineered to minimize food waste and optimize resource utilization. This focus has led to a high regional adoption rate of advanced NIR and hyperspectral imaging technologies, which are required for precise compositional quality analysis and internal defect detection that helps prolong shelf life and reduce spoilage.

The Asia Pacific (APAC) region stands out as the fastest-growing market globally, buoyed by colossal government and private sector investments in critical food infrastructure modernization. This trend is particularly evident in populous nations undergoing rapid urbanization, like China, India, and Indonesia, where a rapidly growing middle class demands consistently higher quality, safer, and reliably graded food products. While initial price sensitivity remains a market factor in APAC, the increasing, urgent necessity for local processors to meet rigorous international export standards—especially for high-volume products such as rice, tea, specialty spices, and valuable seafood—is driving significant and accelerating purchases of advanced automated sorters to secure competitive global market access.

Latin America (LATAM) and the Middle East and Africa (MEA) are correctly categorized as key emerging growth markets. Adoption in these regions is primarily driven by the export-oriented processing of high-value cash crops (including premium coffee, cocoa, tropical fruits, and specialized grains). Investment is highly concentrated in facilities specifically geared toward achieving full compliance with the strict import standards mandated by the EU and North American markets, consequently requiring high-specification optical and multi-sensor sorters. Growth in MEA is uniquely bolstered by large-scale regional food security initiatives and governmental investment aimed at modernizing essential post-harvest handling processes and drastically reducing high levels of historical post-harvest crop losses.

- North America: Market leader driven by high labor costs, stringent FSMA regulations, and massive scale of agricultural output; dominant demand for advanced X-ray and integrated AI-driven sorters.

- Europe: High focus on sustainability, achieving minimal food waste, and adherence to severe EFSA quality standards; leading adoption of advanced NIR and hyperspectral sorting technologies for internal quality assessment.

- Asia Pacific (APAC): Highest projected CAGR fueled by rapid infrastructure modernization, escalating international export demands, and rapidly growing consumer preference for guaranteed quality consistency in major regional economies like China and India.

- Latin America: Accelerated necessity for achieving rigorous international standard compliance, particularly critical in the precise sorting of high-value commodities such as coffee, exotic fruits, and specialty crops exclusively destined for profitable export markets.

- Middle East and Africa (MEA): Emerging market adoption driven by ambitious regional food security mandates, targeted investment in modernizing the processing of high-value crops, and efforts dedicated to reducing significant pre- and post-harvest losses.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automated Food Sorting Equipment Market.- TOMRA Sorting Solutions

- Bühler Group

- Key Technology (Duravant)

- Satake Corporation

- Cimbria

- P&P Optica Inc.

- Raytec Vision S.p.A.

- National Recovery Technologies (NRT)

- Daewon G.S.

- Forberg Scientific

- Grote Company

- Sesotec GmbH

- ALLGAIER GROUP

- Steinert GmbH

- Hefei Meyer Optoelectronic Technology Inc.

- Anzai Manufacturing Co., Ltd.

- JBT Corporation

- Unitec S.p.A.

- Clarity Sorting

- Next Generation Sensors

Frequently Asked Questions

What primary technologies are driving improvements in sorting accuracy?

The primary technologies driving improved accuracy are the integration of Artificial Intelligence (AI) and deep learning algorithms with advanced multi-sensor platforms, particularly high-definition cameras, Near-Infrared (NIR) spectroscopy, and proprietary dual-energy X-ray systems, enabling highly precise, dynamic detection of subtle defects and analysis of internal composition.

How do automated sorters contribute to food safety compliance?

Automated sorters, especially high-sensitivity X-ray and spectral optical systems, instantaneously detect and physically reject foreign materials such as metal, glass, dense plastic, and stone, providing robust, verifiable, time-stamped data necessary for meeting stringent international safety standards like HACCP and the FSMA.

What is the typical Return on Investment (ROI) period for new sorting equipment?

The ROI period typically ranges efficiently from 18 to 36 months, primarily achieved through significant and immediate reductions in high manual labor costs, minimization of valuable product loss (increased usable yield), and critical avoidance of financially devastating product recalls due to guaranteed superior quality control.

Which food processing segment is showing the fastest growth in equipment adoption?

The fastest growth in equipment adoption is clearly observed in the highly competitive processed foods and sensitive fresh produce segments, driven by unwavering consumer demand for extreme consistency in convenience items and the necessity for gentle, ultra-high-speed sorting solutions for delicate fruits and vegetables to reduce pervasive spoilage.

Is AI primarily used for defect detection or operational efficiency in sorting?

AI is absolutely crucial for both functions: it fundamentally enhances defect detection capability by accurately recognizing complex, evolving defect patterns, and it drastically improves operational efficiency by enabling autonomous, rapid calibration, significantly reducing false rejects, and facilitating optimized predictive maintenance schedules based on real-time machine learning analysis of performance data.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager