Automated Passenger Information System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434687 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Automated Passenger Information System Market Size

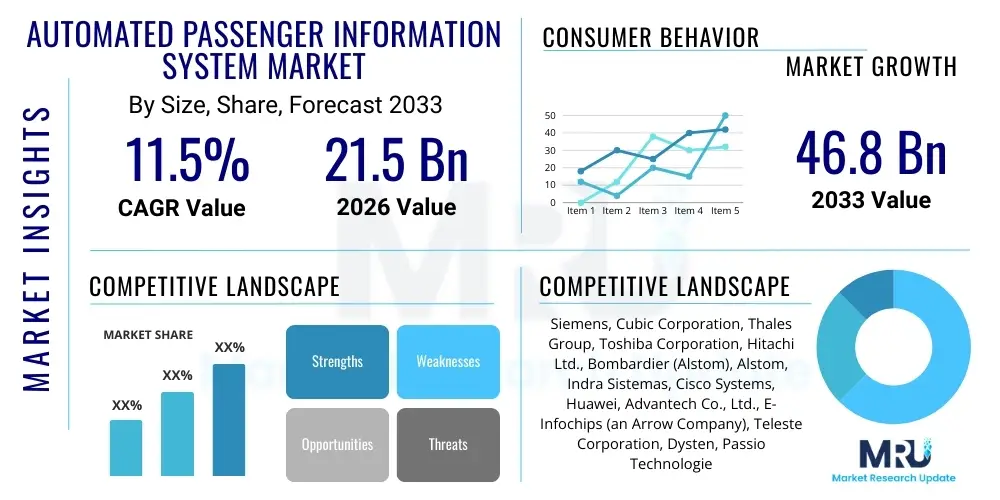

The Automated Passenger Information System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $21.5 Billion USD in 2026 and is projected to reach $46.8 Billion USD by the end of the forecast period in 2033.

Automated Passenger Information System Market introduction

The Automated Passenger Information System (APIS) Market encompasses sophisticated digital ecosystems designed to provide real-time, accurate, and comprehensive data regarding transportation schedules, delays, routes, safety announcements, and commercial information to passengers. These systems integrate hardware components such as high-definition display screens (LCDs, LEDs), public address mechanisms, and sensors with advanced networking and specialized software platforms capable of real-time data processing and dissemination. APIS is critical for enhancing operational efficiency, improving passenger flow management, and ultimately elevating the overall quality and reliability of public transportation services, including rail networks, buses, and airports. The core objective of APIS deployment is to minimize uncertainty and maximize convenience for travelers in increasingly complex urban mobility environments.

Major applications of APIS span various modalities within the transportation sector. In the railway domain, APIS systems are essential for displaying arrival and departure times, platform assignments, and emergency notifications on trains and at stations, significantly reducing operational friction and improving safety compliance. For road transport, particularly modern bus rapid transit (BRT) and municipal bus services, APIS offers real-time vehicle location tracking, estimated time of arrival (ETA) predictions, and dynamic route changes displayed both inside the vehicle and at bus stops. The benefits derived from adopting automated systems are substantial, including reduced customer complaints due improved transparency, increased operational agility during disruptions, and new avenues for revenue generation through targeted digital advertising displayed alongside vital travel information.

Driving factors underpinning the market growth include the rapid urbanization trend globally, which places immense pressure on existing public transit infrastructure to handle higher volumes of passengers efficiently and safely. Governments and transit authorities worldwide are prioritizing investments in smart city initiatives, positioning APIS as a foundational technology for achieving integrated, multimodal transportation networks. Furthermore, the increasing demand for enhanced passenger experience—driven by traveler expectations for instant information access similar to other digitized services—is pushing operators towards adopting predictive analytics and personalized information delivery methods embedded within APIS architectures. Regulatory mandates emphasizing passenger safety and operational transparency also serve as strong catalysts for market expansion.

Automated Passenger Information System Market Executive Summary

The Automated Passenger Information System (APIS) market is experiencing robust expansion, fundamentally driven by accelerating global urbanization and massive governmental investments in smart infrastructure modernization programs across developed and emerging economies. Key business trends indicate a significant shift towards software-centric solutions and cloud-based deployments, moving away from legacy, hardware-intensive systems. This technological pivot facilitates superior scalability, reduced total cost of ownership (TCO), and enhanced integration capabilities with broader smart city platforms, such as intelligent traffic management systems and ticketing platforms. Furthermore, strategic alliances between system integrators, telecommunications providers, and data analytics firms are reshaping the competitive landscape, aiming to offer end-to-end solutions incorporating advanced features like predictive delay forecasting using artificial intelligence (AI) and machine learning (ML).

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market due to extensive infrastructure development in countries like China, India, and Southeast Asian nations, focusing particularly on high-speed rail networks and metro expansions. North America and Europe maintain leading positions in terms of technology adoption maturity, driven by stringent regulatory environments mandating real-time safety and accessibility information, alongside an established appetite for advanced digital public services. European markets, specifically, are characterized by high implementation rates of multimodal transit hubs, requiring highly interoperable APIS solutions. This regional disparity in maturity dictates differing investment strategies, with APAC focused on new installations and Western markets centered on upgrades, digital transformation, and optimization.

Segment trends highlight the dominance of the display systems component segment, though the software and services segment, particularly concerning data analytics and remote management, is projected to exhibit the highest CAGR due to the increasing reliance on complex data processing for operational decision-making. Within applications, the rail segment (including metro and heavy rail) remains the largest consumer of APIS solutions globally, requiring robust, mission-critical systems. However, the application in bus and public transport sectors is rapidly catching up, fueled by the deployment of Bus Rapid Transit (BRT) systems that necessitate real-time location and schedule accuracy. This structural evolution emphasizes the market's trajectory towards integrated, data-driven, and highly resilient information dissemination ecosystems designed to cope with the volatile demands of modern urban mobility.

AI Impact Analysis on Automated Passenger Information System Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Automated Passenger Information System Market often revolve around predictive capabilities, data security, and personalization. Users frequently ask: "How accurately can AI predict delays in real-time, and does this require massive infrastructure upgrades?" and "Will AI lead to highly personalized travel information, and what are the privacy implications of that data collection?" Another major theme addresses the automation of operational processes, specifically: "Can AI fully automate the announcement and decision-making process during major disruptions, replacing human intervention?" Analysis of these concerns reveals a strong expectation that AI will transition APIS from reactive systems (reporting current status) to proactive, intelligent platforms (forecasting future status and advising optimal actions), while simultaneously generating concerns about the complexity of integration, data governance, and the reliance on historical data quality for accurate predictions.

The integration of AI, machine learning (ML), and deep learning algorithms is profoundly reshaping the functional capabilities and operational paradigm of APIS deployments. AI enables sophisticated predictive maintenance scheduling for display hardware and network infrastructure, minimizing unexpected failures that could disrupt information flow. More crucially, AI-driven predictive analytics utilize vast streams of historical and real-time data—including weather conditions, traffic flows, adjacent transit delays, and passenger load measurements—to forecast deviations from schedules with unparalleled accuracy. This predictive capacity allows transit operators to issue timely, actionable warnings to passengers well before delays materialize, dramatically improving traveler satisfaction and reducing cascading delays across interconnected routes. This shift requires significant investments in high-performance computing and centralized data lakes.

Beyond prediction, AI enhances the personalization and accessibility features of APIS. AI-powered algorithms can dynamically tailor information presented to individual users based on their location, known travel patterns, or specific needs (e.g., accessibility requirements), often delivered through mobile applications synchronized with static displays. Furthermore, AI is central to optimizing decision-making during crises; intelligent systems can automatically assess the impact of an incident, generate optimal recovery schedules, and deliver corresponding safety and redirection instructions across all display channels (public address, digital signs, mobile alerts) simultaneously. This automation ensures faster, more consistent crisis communication, a critical feature for high-density transit environments.

- AI-powered Predictive Analytics: Significantly improves ETA accuracy by analyzing multivariate data streams, reducing passenger uncertainty.

- Dynamic Content Generation: Enables real-time tailoring of information and commercial content based on passenger profiles and operational context.

- Automated Incident Response: ML algorithms facilitate rapid assessment of disruptions and automated generation of mitigation strategies and announcements.

- Enhanced Accessibility Features: AI processes and generates multilingual or specialized accessibility information (e.g., audio descriptions) automatically.

- Operational Efficiency Optimization: AI algorithms predict equipment failures, reducing downtime and maintenance costs for display and networking components.

- Computer Vision Integration: Utilization of AI to analyze passenger flow through surveillance feeds, informing crowd management displayed via APIS.

DRO & Impact Forces Of Automated Passenger Information System Market

The Automated Passenger Information System market is characterized by a strong interplay between technological innovation and infrastructure necessity, summarized by key Drivers, Restraints, and Opportunities (DRO). The primary driving force is the global imperative to create intelligent, multimodal transportation networks under the umbrella of smart city initiatives, demanding seamless integration of real-time data across all transport modes (rail, bus, air). This is augmented by increasing regulatory pressure, particularly in developed regions, mandating higher levels of transparency and accessibility for public transport users. Conversely, significant restraints include the high initial capital expenditure required for installing and integrating complex, modern APIS architecture, particularly the network backbone and centralized command centers. Furthermore, challenges related to data security and privacy, especially concerning the processing of large volumes of real-time passenger movement data, present an ongoing technical and legal hurdle that operators must navigate.

The impact forces influencing the market trajectory are multifaceted, primarily stemming from technological shifts and economic pressures. Opportunities are abundantly present in the transition towards Mobility-as-a-Service (MaaS) platforms, where APIS data forms the backbone of integrated journey planning applications, fostering new business models for data monetization and third-party service integration. There is also a substantial opportunity in retrofitting legacy systems in older rail and metro networks, particularly in mature markets like Western Europe and North America, requiring specialized integration services. The key impact force remains the ever-growing passenger expectation for instantaneous, flawless information delivery; systems that fail to meet this standard risk obsolescence and customer dissatisfaction. Economic volatility, particularly fluctuating government budget allocations for public works, acts as an external impact force that can either accelerate or delay large-scale APIS deployment projects.

Furthermore, the competitive dynamic is heavily influenced by the capability to offer integrated, end-to-end solutions that combine hardware robustness with advanced software intelligence (AI/ML). Companies demonstrating superior network security and data handling capabilities gain a significant competitive edge, particularly when dealing with sensitive infrastructure projects. The requirement for systems to be highly resilient against cyber threats is now a critical impact factor, pushing operators to adopt advanced encryption and standardized protocols. Therefore, the long-term growth and stability of the APIS market depend on continuous technological breakthroughs that reduce implementation complexity, enhance data security, and successfully demonstrate substantial returns on investment (ROI) through improved operational efficiency and enhanced passenger trust.

Segmentation Analysis

The Automated Passenger Information System (APIS) market is comprehensively segmented based on the component type utilized, the specific application or mode of transport, and the underlying system architecture (deployment type). This granular segmentation is crucial for understanding spending patterns and technological preferences across different transit environments. The Component segmentation typically divides the market into hardware (display systems, controllers, sensors) and software (real-time processing, content management, analytics), reflecting the shift toward intelligence residing in the software layer. Application segmentation distinguishes between mission-critical environments like Rail (metro and mainline) and high-volume road transport systems, as well as specialized environments such as airports and marine terminals, each having unique requirements for display size, ruggedness, and data synchronization speed. Deployment type differentiates between scalable, cost-efficient Cloud-based platforms and robust, high-security On-premise solutions favored by large, national transport operators.

- By Component

- Display Systems (LCD, LED, E-Paper)

- Network Connectivity & Hardware (Routers, Gateways)

- Software (Data Analytics, Content Management System - CMS)

- Sensors and Data Acquisition Units

- Public Address (PA) and Intercom Systems

- By Application/Mode of Transport

- Rail (Metro, Suburban Rail, High-Speed Rail)

- Road (Buses, Bus Rapid Transit - BRT)

- Airports

- Marine and Waterways

- By System Type/Deployment Model

- On-Premise

- Cloud-Based

Value Chain Analysis For Automated Passenger Information System Market

The value chain for the Automated Passenger Information System market begins with upstream activities focused on the design and manufacturing of specialized electronic components, ranging from high-brightness, vandal-proof display panels to ruggedized networking hardware and high-precision sensors. Key upstream suppliers include component manufacturers specializing in industrial-grade computing platforms and telecommunication equipment providers offering high-bandwidth wireless solutions (4G/5G). Quality control and adherence to specific transport standards (e.g., EN 50155 for rolling stock) are vital at this stage, setting the foundation for system reliability. Effective inventory management and strategic sourcing relationships are crucial for mitigating supply chain disruptions and managing the costs of specialized hardware components essential for harsh operational environments.

Midstream activities involve the crucial steps of system integration, software development, and installation. This phase is dominated by major technology conglomerates and specialized system integrators who customize the generic software platforms (e.g., Content Management Systems) to meet the unique operational logic and branding requirements of specific transit authorities. Integration complexity is high, as the APIS must interface seamlessly with numerous existing subsystems, including signaling, ticketing, and operational control centers. Distribution channels largely follow two primary paths: direct sales and complex tender processes for large national infrastructure projects, often involving government procurement offices, and indirect sales through value-added resellers (VARs) and regional distributors who handle smaller, localized transit deployments.

Downstream activities focus on the deployment, ongoing maintenance, and managed services required to ensure continuous, high-availability operation of the information systems. This stage involves physical installation in stations, vehicles, and control centers, followed by rigorous testing and commissioning. Long-term success is dictated by the quality of after-sales support, including software updates, cybersecurity patches, and hardware maintenance contracts. Many transit agencies prefer comprehensive service contracts where the APIS vendor manages the entire lifecycle, including data monitoring and analytics services, effectively making the vendor a long-term strategic partner in managing passenger communication and operational data.

Automated Passenger Information System Market Potential Customers

The primary customers and end-users of Automated Passenger Information Systems are governmental and quasi-governmental entities responsible for the planning, management, and operation of public transportation infrastructure. These include Municipal and State Transit Authorities, which manage urban bus and metro systems and represent the largest volume of APIS purchasers due to continuous upgrades required by high population density and rapid technology cycles. National Railway Operators, managing mainline, suburban, and high-speed networks, constitute the segment requiring the most robust and safety-certified systems, often engaging in large-scale, decade-long procurement cycles. These entities prioritize reliability, interoperability with national signaling standards, and long-term service agreements.

A secondary, yet rapidly expanding, customer segment includes Airport and Port Authorities. Airports utilize APIS extensively for flight information display systems (FIDS), baggage claim displays, and ground transport connections, demanding seamless integration with complex airport operational databases. Similarly, major marine ports and ferry services require automated systems to manage passenger flow and communicate schedules for multimodal transfers. Private transportation operators, particularly those managing large bus fleets (intercity or corporate shuttles) or specialized private rail lines, also constitute a growing clientele, focusing on cost-effective, cloud-based APIS solutions that offer flexibility and easy scalability without requiring substantial internal IT infrastructure investments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $21.5 Billion USD |

| Market Forecast in 2033 | $46.8 Billion USD |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens, Cubic Corporation, Thales Group, Toshiba Corporation, Hitachi Ltd., Bombardier (Alstom), Alstom, Indra Sistemas, Cisco Systems, Huawei, Advantech Co., Ltd., E-Infochips (an Arrow Company), Teleste Corporation, Dysten, Passio Technologies, Luminator Technology Group, Clever Devices, INIT, Televic Group, Mitsubishi Electric, Axon Public Safety. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automated Passenger Information System Market Key Technology Landscape

The core technology landscape of the Automated Passenger Information System market is rapidly evolving, driven by innovations in display technology, networking standards, and data processing capabilities. Display systems are moving towards high-contrast, energy-efficient technologies, including reflective displays (e-paper) for static, low-power outdoor applications and ruggedized, high-brightness LCD/LED panels optimized for visibility under direct sunlight or harsh vibration environments within vehicles. Crucially, the backbone of APIS relies on robust and reliable communication technologies. The transition from legacy proprietary communication protocols to high-speed commercial standards, particularly the adoption of 4G LTE and emerging 5G networks, is essential for handling the voluminous, real-time data streams required for accurate predictions and multimedia content delivery, especially for moving assets like trains and buses.

Software intelligence forms the critical differentiation factor in the modern APIS market. Key technologies include sophisticated Content Management Systems (CMS) that allow transit operators to remotely manage and synchronize information across thousands of distributed display points simultaneously, often utilizing geographically redundant server architecture for high availability. Furthermore, the integration of advanced data processing techniques, specifically utilizing real-time data streaming platforms and complex event processing (CEP) engines, is vital for transforming raw operational data (GPS coordinates, signaling status, power usage) into synthesized, passenger-ready information. These platforms must maintain low latency to ensure that displayed information reflects the current reality accurately, which is paramount for safety applications.

The rise of edge computing and IoT frameworks is significantly impacting APIS deployment. Placing processing power closer to the data source (e.g., within the vehicle controller or station server) allows for faster local decision-making and filtering, reducing reliance on constant, high-bandwidth connections to a central cloud during data peaks or connectivity drops. Cybersecurity technology is also paramount; as APIS networks become more integrated with critical operational technology (OT) systems, robust security layers, including intrusion detection systems and strict data segregation protocols, are non-negotiable requirements mandated by transit regulators globally to prevent infrastructure compromise and ensure data integrity against sophisticated cyber threats.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to lead market growth, driven by aggressive infrastructure investment, particularly in China, India, and Southeast Asia. These regions are undertaking massive expansion of metro systems, high-speed rail networks, and airport capacity, necessitating the procurement of new, integrated APIS solutions. Governmental support for smart city development and a large, digitally savvy population demanding real-time information are key catalysts. Competition is fierce, with local players often competing strongly against international conglomerates by offering localized customization and aggressive pricing strategies.

- North America: This market is characterized by maturity, stringent safety regulations, and a focus on retrofitting and modernizing existing, often decades-old, transit infrastructure. Demand is concentrated on advanced software upgrades, integration of AI for predictive analytics, and enhancing interoperability between different metropolitan transit systems (e.g., bus, subway, ferry) to support seamless multimodal ticketing and information flow. Cybersecurity compliance and adherence to accessibility standards (e.g., ADA compliance in the US) drive technology choices.

- Europe: Europe is a highly sophisticated market segment known for its high population density and reliance on integrated, cross-border rail and road networks. The market growth is fueled by EU mandates promoting seamless mobility (MaaS) and significant investment in smart corridors. The focus here is on standardized, interoperable APIS solutions that function across multiple languages and national railway systems (like the European Rail Traffic Management System - ERTMS integration), demanding advanced data harmonization capabilities and standardized communication protocols.

- Latin America: Market adoption is moderate but accelerating, primarily driven by investments in major urban centers such as São Paulo, Mexico City, and Santiago, focusing on improving existing Bus Rapid Transit (BRT) systems and expanding metro networks. Affordability and ruggedness of hardware capable of handling challenging environmental conditions are crucial buying criteria. The market often seeks solutions that balance cost-effectiveness with necessary real-time tracking features, often adopting cloud-based systems for lower initial outlay.

- Middle East and Africa (MEA): This region shows significant growth potential, led by major infrastructure projects in the Gulf Cooperation Council (GCC) countries (e.g., Saudi Arabia, UAE) related to new city developments (like NEOM) and preparation for global events. These markets require cutting-edge, integrated systems from the outset, often prioritizing features like ultra-high-definition displays and complex, centralized command and control software. Africa's market penetration is lower but rising, focused on basic real-time bus tracking and communication in key economic hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automated Passenger Information System Market.- Siemens

- Cubic Corporation

- Thales Group

- Toshiba Corporation

- Hitachi Ltd.

- Alstom

- Indra Sistemas

- Cisco Systems

- Huawei

- Advantech Co., Ltd.

- E-Infochips (an Arrow Company)

- Teleste Corporation

- Dysten

- Passio Technologies

- Luminator Technology Group

- Clever Devices

- INIT

- Televic Group

- Mitsubishi Electric

- Axon Public Safety

Frequently Asked Questions

Analyze common user questions about the Automated Passenger Information System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technology driving growth in the APIS market?

The primary technology driving APIS market growth is the integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive analytics. This technology enables APIS to shift from passively displaying current data to proactively forecasting delays and managing passenger flow, significantly enhancing operational efficiency and passenger satisfaction.

How does the shift to cloud-based APIS systems benefit transit agencies?

Cloud-based APIS systems offer transit agencies benefits such as reduced upfront capital expenditure, enhanced scalability for managing growing networks, centralized data processing for multimodal integration, and simplified maintenance through remote software updates and monitoring, resulting in a lower Total Cost of Ownership (TCO).

Which regional market holds the highest growth potential for APIS deployment?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, holds the highest growth potential. This is attributed to unprecedented infrastructure development, large-scale urbanization projects, and substantial governmental investments in expanding and modernizing high-speed rail and metro networks.

What are the main restraints hindering the rapid adoption of new APIS solutions?

The main restraints include the significant initial capital required for hardware and network infrastructure replacement, the complexity involved in integrating new APIS software with legacy operational control systems, and ongoing concerns regarding data privacy and cybersecurity compliance for real-time passenger information.

What role does Mobility-as-a-Service (MaaS) play in the evolution of APIS?

MaaS platforms rely heavily on APIS data, which provides the foundational real-time information regarding transit schedules and disruptions. APIS acts as a critical data feeder, enabling MaaS applications to offer unified, multimodal journey planning, ticketing, and personalized communication to users across integrated public and private transport options.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager