Automated Spectroscopic Ellipsometry Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435907 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Automated Spectroscopic Ellipsometry Market Size

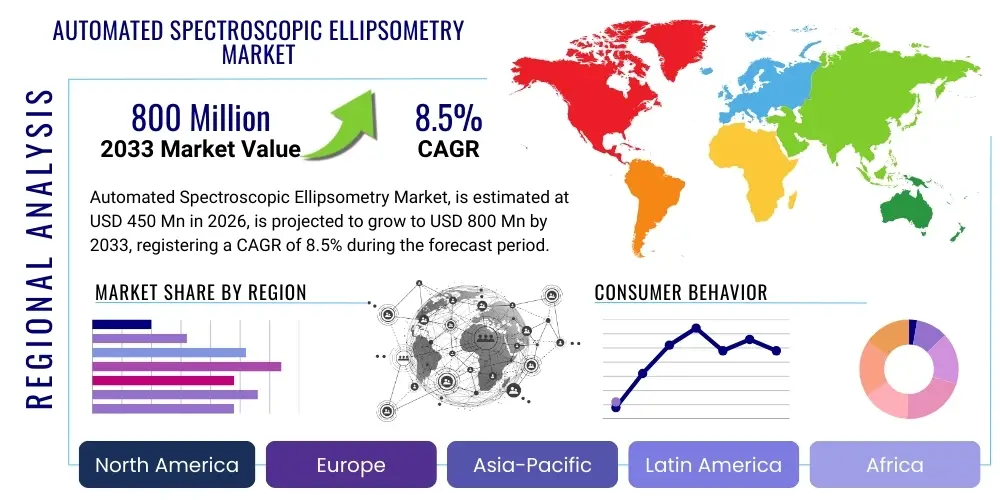

The Automated Spectroscopic Ellipsometry Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 800 Million by the end of the forecast period in 2033.

Automated Spectroscopic Ellipsometry Market introduction

The Automated Spectroscopic Ellipsometry (ASE) market encompasses advanced metrology solutions crucial for non-destructive characterization of thin films and material interfaces across various substrates. ASE systems measure the change in polarization state of light upon reflection or transmission, utilizing a broad spectrum of wavelengths to derive precise parameters such as film thickness, refractive index, extinction coefficient, material composition, and surface roughness. This technique is fundamental to quality control and process monitoring in industries where atomic-level precision is mandatory, primarily semiconductor manufacturing, advanced display fabrication, and solar energy production. The automated aspect enhances throughput and reproducibility, moving ellipsometry from a research tool to a high-volume manufacturing metrology platform, facilitating real-time feedback and stringent process control necessary for device miniaturization.

The core product offered in this market includes fully automated tools capable of handling large wafers (300mm) or large-area substrates (G8+ displays), integrating sophisticated robotic handling systems and advanced pattern recognition capabilities. Major applications span deep ultraviolet (DUV) lithography process control, high-k gate dielectric thickness monitoring, critical dimension (CD) measurements, and analysis of complex multi-layer stacks in memory chips and advanced logic devices. The systems are increasingly being deployed in in-situ and in-line configurations, allowing continuous monitoring within deposition or etching chambers, which drastically reduces cycle time and improves yield management. The precision and non-contact nature of ASE make it an indispensable tool for ensuring performance and reliability of next-generation electronic components.

Key benefits driving the adoption of ASE include its superior sensitivity to sub-nanometer thickness variations and its ability to characterize opaque and transparent films accurately, surpassing the limitations of traditional metrology tools. Furthermore, the development of sophisticated modeling software allows users to analyze complex materials, including anisotropic, graded, and porous films, which are critical in emerging fields like microelectromechanical systems (MEMS) and advanced packaging. Driving factors include the incessant push for smaller transistor sizes, the transition to novel materials (e.g., 2D materials, phase change materials), and the global expansion of high-volume semiconductor fabrication capabilities, particularly in Asia Pacific regions.

Automated Spectroscopic Ellipsometry Market Executive Summary

The Automated Spectroscopic Ellipsometry (ASE) Market is witnessing robust growth, primarily propelled by the sustained demand from the semiconductor industry for advanced metrology tools that can handle 3D device structures, such as FinFETs and GAAFETs. Business trends indicate a strong shift towards system integration, where ASE is combined with other techniques, like reflectometry or photoluminescence, to provide comprehensive material characterization solutions, often marketed as integrated metrology clusters. Vendors are focusing heavily on developing high-speed, parallel measurement capabilities and incorporating sophisticated artificial intelligence (AI) algorithms for real-time data processing and anomaly detection, enhancing the tool's effectiveness in high-mix, high-volume manufacturing environments. Technological innovation centers on improving spectral range capabilities, extending into the vacuum ultraviolet (VUV) and infrared (IR) regions, to address novel material characterization challenges.

Regionally, the Asia Pacific (APAC) stands as the dominant and fastest-growing market segment, primarily due to massive investments in advanced semiconductor fabrication facilities (Fabs) in countries such as Taiwan, South Korea, and Mainland China. Government initiatives and competitive pressure to localize advanced manufacturing capabilities are fueling the high adoption rate of automated metrology systems in this region. North America and Europe, while mature, remain strong markets characterized by intense research and development activities, particularly in photonics, advanced materials, and compound semiconductor devices (GaN, SiC). Regional trends also indicate increased demand in specialized areas such as thin-film solar cell manufacturing in Europe and high-end R&D in materials science across U.S. universities and national labs.

Segmentation trends highlight the dominance of the Semiconductor and Electronics segment, which utilizes ASE extensively for controlling critical processes like atomic layer deposition (ALD) and chemical vapor deposition (CVD). Within the application segment, thickness and optical constant measurements command the largest share, although compositional analysis and stress/strain mapping are emerging as high-growth sub-segments driven by complex material requirements. Equipment type segmentation shows a steady move from offline, lab-based systems to highly integrated, in-line or in-situ automated tools, reflecting the industry's need for actionable, immediate process data. This structural shift necessitates robust software support and high-level automation interfaces compatible with factory automation standards (e.g., SEMI standards).

AI Impact Analysis on Automated Spectroscopic Ellipsometry Market

User queries regarding AI's influence on the Automated Spectroscopic Ellipsometry Market frequently revolve around how AI/Machine Learning (ML) can overcome the limitations associated with complex data modeling and high measurement variability. Users are concerned about the ability of conventional metrology software to accurately analyze highly non-uniform, non-ideal, or complex multi-layer films, which often require extensive manual input and expertise. Key expectations include the use of neural networks for rapid, unsupervised material parameter extraction, especially in novel material stacks where optical models are not readily available. There is significant interest in predictive maintenance capabilities, utilizing AI to monitor tool health, optimize calibration cycles, and minimize downtime in 24/7 manufacturing environments. Furthermore, users anticipate that AI integration will automate the decision-making loop, translating measurement data directly into process corrections, thereby facilitating true closed-loop process control and dramatically enhancing yield management in semiconductor fabrication.

- AI enables rapid, non-linear analysis of complex spectroscopic data, surpassing limitations of conventional physical models.

- Machine learning algorithms enhance measurement precision by correlating subtle spectral variations with film properties and process drifts.

- Predictive modeling optimizes recipe generation and tool calibration, reducing manual intervention and increasing equipment utilization.

- AI facilitates real-time anomaly detection in high-throughput manufacturing lines, identifying defective wafers immediately.

- ML integration supports the development of sophisticated virtual metrology capabilities, reducing reliance on physical measurements for non-critical layers.

- Deep learning models improve pattern recognition for automated feature alignment on highly complex patterned wafers.

DRO & Impact Forces Of Automated Spectroscopic Ellipsometry Market

The Automated Spectroscopic Ellipsometry (ASE) market is primarily driven by the unrelenting need for dimensional and material precision in advanced manufacturing, notably in scaling semiconductor technologies below 10nm, requiring metrology tools with superior sensitivity and repeatability. The proliferation of connected devices, 5G infrastructure, and advanced data centers necessitates massive production of memory chips and high-performance logic, creating consistent demand for robust film characterization tools. Restraints largely center on the high initial acquisition cost of advanced ASE systems and the complexity associated with modeling and interpreting spectroscopic data, which requires highly specialized engineering expertise. This complexity can be a significant barrier to entry for smaller organizations or those outside the core semiconductor cluster. Opportunity lies in the diversification of ASE applications into emerging sectors, specifically the burgeoning area of flexible electronics, advanced battery thin films, and in-vivo biotechnology sensing applications where precise coating thickness is critical. Additionally, the development of easier-to-use, standardized software interfaces and AI-driven model generation tools presents a major avenue for market expansion.

Impact forces currently shaping the market are dominated by the global technology race, particularly the US-China semiconductor rivalry, which mandates massive investments in domestic fabrication capabilities and accelerates the adoption of localized metrology solutions. The cyclical nature of the semiconductor industry, while presenting short-term volatility, consistently drives long-term technological advancement and necessitates cutting-edge metrology. Supplier concentration is another key force, as the market is dominated by a few major players who invest heavily in R&D, creating high barriers for new entrants. Furthermore, the imperative for environmental sustainability is an indirect force, pushing manufacturers towards more efficient deposition processes (like ALD) that inherently require precise, in-situ metrology for yield optimization and material waste reduction.

Segmentation Analysis

The Automated Spectroscopic Ellipsometry Market is meticulously segmented based on equipment type, application, spectral range, and end-user industry, reflecting the diverse technological needs of various sectors. Equipment segmentation differentiates between in-situ/in-line systems, which are fully integrated into process chambers for real-time monitoring, and standalone/offline automated tools used primarily for quality control and R&D. Application analysis includes critical measurements such as film thickness, refractive index determination, composition analysis, and material property characterization (e.g., stress and anisotropy). End-user industries are key differentiators, with the semiconductor sector being the largest consumer, followed by optics/photonics, flat panel displays, and photovoltaics, each requiring customized spectral ranges and levels of automation based on substrate size and throughput requirements.

- By Equipment Type:

- Fully Automated In-line Systems

- Automated Standalone (Offline) Systems

- Automated In-situ Systems

- By Application:

- Film Thickness Measurement

- Optical Constant Determination (n, k)

- Composition Analysis

- Surface Roughness and Interface Analysis

- Stress and Strain Measurement

- By Spectral Range:

- UV-Visible Spectroscopic Ellipsometry (UV-Vis SE)

- Infrared Spectroscopic Ellipsometry (IR-SE)

- Vacuum Ultraviolet Spectroscopic Ellipsometry (VUV-SE)

- Generalized Ellipsometry (Mueller Matrix)

- By End-user Industry:

- Semiconductor and Electronics

- Flat Panel Displays (FPD)

- Photovoltaics and Solar Cells

- Optics and Photonics

- Material Science Research

- Automotive Sensors and Coatings

Value Chain Analysis For Automated Spectroscopic Ellipsometry Market

The value chain for the Automated Spectroscopic Ellipsometry Market initiates with upstream component suppliers responsible for manufacturing high-precision optical components, light sources, and detectors. This includes highly specialized polarizer and analyzer optics, high-intensity Xenon or Deuterium lamps, and sophisticated array detectors (CCD/CMOS sensors) capable of rapid, high-resolution spectroscopic measurements. The quality and stability of these core components directly dictate the performance metrics (precision, repeatability) of the final ASE system. Upstream competition focuses heavily on miniaturization, spectral range extension, and noise reduction, enabling the transition to faster, more sensitive metrology tools necessary for next-generation applications.

The midstream phase involves system integrators and key market players who design, assemble, and calibrate the complex ASE instruments, integrating the optical hardware with sophisticated robotic wafer handlers and advanced software modeling suites. This stage adds the highest value, focusing on developing proprietary algorithms for data processing (e.g., dispersion models like Cauchy or Tauc-Lorentz) and ensuring seamless compatibility with factory automation systems (MES/EAP). Distribution channels are predominantly direct, especially for high-end, fully automated in-line systems sold to major semiconductor fabs. These large capital equipment sales involve extensive pre-sales consultation, customization, installation, and post-sales maintenance contracts, reflecting the complex nature and high investment required for these tools.

The downstream segment focuses on the deployment, service, and continuous optimization of the ASE tools at the end-user site. Indirect channels, such as authorized distributors and local service providers, play a role in supporting smaller R&D labs and specialized industrial applications outside the major semiconductor clusters. Critical downstream activities include ongoing calibration, preventive maintenance, and software updates to incorporate new material models and measurement recipes. The close relationship between the vendor and the end-user is critical here, ensuring the system’s performance evolves with the end-user’s dynamic process requirements, particularly as new deposition materials and device structures are introduced into mass production.

Automated Spectroscopic Ellipsometry Market Potential Customers

The primary consumers of Automated Spectroscopic Ellipsometry systems are large-scale manufacturers and advanced research institutions requiring precise, non-destructive thin film characterization capabilities. Semiconductor foundries and Integrated Device Manufacturers (IDMs) represent the largest purchasing cohort. These entities utilize ASE extensively for critical dimension metrology, controlling the thickness and uniformity of gate oxides, high-k dielectrics, photoresists, and metal interconnect layers across the entire wafer, making them the most crucial end-users. Their purchasing decisions are driven by throughput, tool matching capabilities, and integration with existing factory automation infrastructure. The transition to advanced packaging techniques (3D stacking) is also creating new demand for ASE in characterizing temporary bonding layers and complex inter-layer dielectrics.

Another significant customer segment is the Flat Panel Display (FPD) manufacturing industry, encompassing OLED and LCD panel producers. These customers require large-area metrology solutions to characterize thin-film transistor (TFT) layers, barrier coatings, and optical films over expansive glass substrates. The move towards highly efficient, flexible, and micro-LED displays is driving the demand for specialized automated ellipsometers optimized for large-area, high-speed scanning. Furthermore, manufacturers in the Photovoltaics sector, particularly those producing CIGS or perovskite thin-film solar cells, rely on ASE for monitoring absorber layer thickness and refractive indices to optimize energy conversion efficiency.

In addition to large manufacturers, university research laboratories, government material science institutes, and specialized optics and coatings companies constitute a robust segment of potential customers. These buyers, while purchasing lower volumes, often require highly flexible, generalized systems (like Mueller Matrix Ellipsometers) capable of handling a vast array of materials and experimental setups, including temperature-controlled or environmental chambers. Their demand is driven by the need for fundamental understanding of novel material properties, such as 2D materials (graphene, TMDs) and meta-surfaces, pushing the envelope of spectral range and measurement sensitivity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 800 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | KLA Corporation, Applied Materials Inc., Nanometrics Incorporated (now part of KLA), J.A. Woollam Co. Inc., Rudolph Technologies Inc. (now part of Onto Innovation), HORIBA Ltd., Sentech Instruments GmbH, Nova Measuring Instruments Ltd., Angstrom Advanced Inc., ACCRETECH (Tokyo Seimitsu), Advanced Energy Industries Inc., SCREEN Holdings Co. Ltd., Semilab Inc., Filmetrics Inc. (part of KLA), Thin Film Solutions LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automated Spectroscopic Ellipsometry Market Key Technology Landscape

The technological landscape of the Automated Spectroscopic Ellipsometry market is defined by advancements aimed at increasing measurement speed, expanding spectral coverage, and enhancing the ability to analyze increasingly complex material systems. A key development is the widespread adoption of Mueller Matrix Ellipsometry (MME), often referred to as Generalized Ellipsometry (GE). MME measures all sixteen elements of the Mueller matrix, providing comprehensive polarization information essential for characterizing anisotropic, patterned, and depolarizing samples. This is crucial for advanced semiconductor structures, optical coatings, and liquid crystal layers where simple models are insufficient. The automation aspect relies heavily on high-precision goniometers and multi-angle measurement capabilities, often combined with robotic handling to maintain tool-to-tool matching and wafer traceability within the fab environment.

Another dominant technological trend is the push toward extending the spectral range, specifically into the Vacuum Ultraviolet (VUV-SE) region, typically below 190 nm, and the Far-Infrared (IR-SE). VUV-SE is essential for characterizing crucial thin films utilized in advanced lithography (e.g., photoresists and protective coatings), as the optical properties of many materials change significantly at these shorter wavelengths. Conversely, IR-SE is vital for characterizing films like polymers, low-k dielectrics, and compound semiconductors (SiC, GaN), offering insights into molecular vibrations and lattice properties. The integration of high-speed array detectors and sophisticated light source stabilization techniques is critical to ensuring high signal-to-noise ratios across these extended spectral ranges, even when performing measurements rapidly in high-throughput settings.

Furthermore, the market is characterized by significant investment in software and data processing algorithms. Modern ASE systems utilize advanced global optimization algorithms and library-based regression analysis to fit complex optical models to measured data automatically. The incorporation of real-time data feedback mechanisms allows for immediate process correction, aligning with Industry 4.0 standards. Future technological innovation is focused on developing hybrid metrology solutions, integrating ASE capabilities with Atomic Force Microscopy (AFM) or scatterometry within a single automated platform, providing complementary structural and material information. This confluence of technologies is crucial for solving the intricate metrology challenges associated with nanoscale device fabrication.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market leader, driven by unparalleled growth in semiconductor foundry operations (Taiwan, South Korea, Mainland China) and massive investments in advanced FPD manufacturing (Japan, China). The region benefits from government support for indigenous chip manufacturing and represents the primary market for high-volume, fully automated in-line ASE tools essential for 300mm wafer processing and G8+ display fabrication.

- North America: A mature yet high-value market, characterized by intense research and development activities in materials science, quantum computing, and high-performance computing (HPC). Demand here is focused on advanced MME systems and VUV ellipsometry used in university research labs, national laboratories, and specialized companies focusing on compound semiconductors and advanced optics.

- Europe: Europe exhibits steady growth, primarily fueled by the region's strength in automotive sensor technology, specialized optical coatings, and photovoltaic research. The adoption of ASE is strong in countries like Germany and France, focusing on high-precision metrology for critical components used in autonomous vehicles and advanced thin-film solar technologies.

- Middle East & Africa (MEA): This region is a nascent market, with adoption concentrated in oil and gas research (corrosion coatings) and university R&D facilities. Future growth potential is linked to emerging renewable energy projects and gradual development of localized electronics assembly capabilities.

- Latin America: Growth is moderate, driven mainly by academic research and governmental investments in renewable energy and basic electronics manufacturing. Demand typically favors highly flexible, cost-effective standalone automated systems rather than large, integrated in-line tools characteristic of major APAC fabs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automated Spectroscopic Ellipsometry Market.- KLA Corporation

- Applied Materials Inc.

- J.A. Woollam Co. Inc.

- HORIBA Ltd.

- Onto Innovation (formerly Rudolph Technologies)

- Sentech Instruments GmbH

- Nova Measuring Instruments Ltd.

- ACCRETECH (Tokyo Seimitsu)

- SCREEN Holdings Co. Ltd.

- Semilab Inc.

- Advanced Energy Industries Inc.

- Angstrom Advanced Inc.

- Thin Film Solutions LLC

- Axometrics Inc.

- Hitachi High-Tech Corporation

- Optics Balzers AG (now part of Materion)

- Müller Instruments GmbH

- MicroSense LLC

- Takano Co. Ltd.

- PVA TePla AG

Frequently Asked Questions

Analyze common user questions about the Automated Spectroscopic Ellipsometry market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between automated spectroscopic ellipsometry and standard reflectometry?

ASE provides non-destructive measurement of film thickness and complex optical constants (refractive index n and extinction coefficient k) simultaneously, based on changes in light polarization. Standard reflectometry measures light intensity changes upon reflection, offering high-speed thickness data but limited ability to decouple n and k, especially for complex or multi-layer films, which is critical for precision manufacturing.

Which end-user segment is driving the majority of investment in Automated Spectroscopic Ellipsometry?

The Semiconductor and Electronics segment is the major investment driver, specifically high-volume wafer fabrication facilities (Fabs). The transition to sub-10nm technology nodes, 3D device structures (FinFET/GAAFET), and the mass production of advanced memory and logic chips necessitate high-throughput, automated metrology for critical process control (ALD, CVD) and defect reduction.

How is Mueller Matrix Ellipsometry (MME) impacting the market adoption?

MME, or Generalized Ellipsometry, is accelerating adoption by enabling the characterization of complex, anisotropic, and patterned surfaces that standard ellipsometry cannot fully analyze. This capability is essential for advanced optical devices, photoresist metrology, and the assessment of mechanical stress and strain in semiconductor films, driving demand for high-end automated systems.

What is the role of AI and Machine Learning in modern ASE systems?

AI is integrated to automate data modeling and interpretation, particularly for non-ideal or novel material stacks where traditional physical models are challenging. AI algorithms enhance measurement speed, improve signal-to-noise ratios, facilitate predictive maintenance, and enable direct, closed-loop process control by translating spectral data into actionable process parameters in real-time within the factory environment.

What are the key technological challenges currently restraining market growth?

Key challenges include the high initial capital expenditure for VUV and Mueller Matrix automated systems, the complexity of accurately modeling highly non-uniform and porous films, and the ongoing need for standardized, user-friendly software interfaces that reduce the reliance on highly specialized metrology experts for day-to-day operation in production environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager