Automated Teller Machine (ATM) Security and Safety Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432900 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Automated Teller Machine (ATM) Security and Safety Market Size

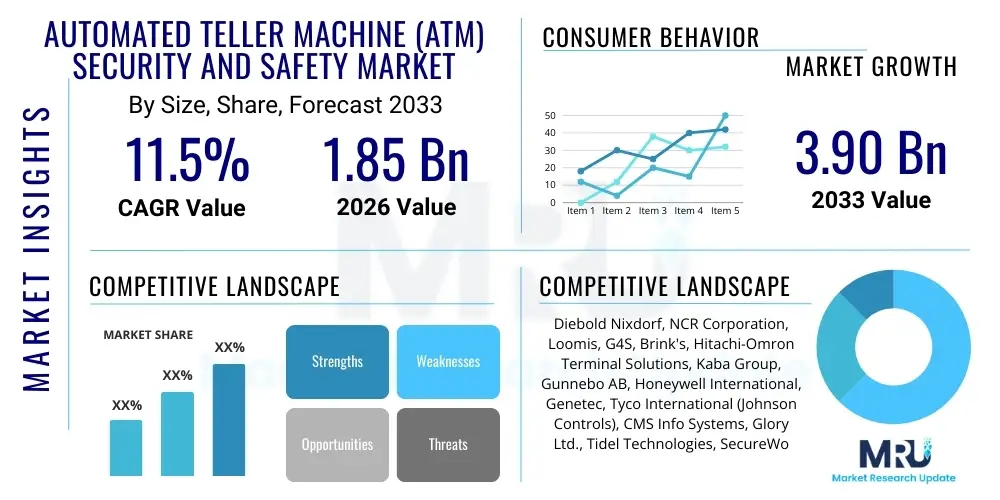

The Automated Teller Machine (ATM) Security and Safety Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 3.90 Billion by the end of the forecast period in 2033.

Automated Teller Machine (ATM) Security and Safety Market introduction

The Automated Teller Machine (ATM) Security and Safety Market encompasses a comprehensive array of hardware, software, and services designed to protect ATMs, the sensitive data they process, and the physical cash they dispense from malicious activities, including physical attacks, logical attacks, and internal fraud. As financial institutions increasingly rely on self-service banking channels to reduce operational costs and enhance customer accessibility, the corresponding necessity for robust security measures has intensified. This market addresses sophisticated threats such as card skimming, jackpotting, shimming, transaction reversal fraud, and the burgeoning risks associated with network vulnerabilities and endpoint security breaches, ensuring continuity of service and maintaining public trust in the financial infrastructure.

Major applications of ATM security solutions extend across various deployment environments, including bank branches, off-site locations (like shopping malls and transit hubs), and specialized independent ATM deployment zones, often managed by independent service operators (ISOs). The product scope ranges from highly physical deterrents, such as anti-skimming devices, reinforced ATM vaults, and advanced surveillance systems, to intricate logical security defenses, including strong encryption protocols, whitelisting software, biometric authentication mechanisms, and fraud detection systems leveraging machine learning. These integrated solutions are pivotal in protecting both the consumer during the transaction process and the financial institution from catastrophic financial losses and reputational damage.

Driving factors contributing to the robust expansion of this market include the global rise in sophisticated cybercrime targeting financial endpoints, stringent regulatory mandates imposed by global bodies like PCI DSS and regional financial authorities requiring enhanced security controls, and the widespread modernization of aging ATM fleets with smart, secure, and internet-connected terminals. Furthermore, the increasing acceptance of cashless payments in many regions is paradoxically pushing criminals to focus intensely on the remaining high-value cash endpoints, necessitating continuous innovation in defense mechanisms. The benefits derived from investing in advanced ATM security are substantial, encompassing reduced operational risk, minimized fraud losses, compliance adherence, improved system uptime, and sustained consumer confidence in accessing their funds securely 24/7.

Automated Teller Machine (ATM) Security and Safety Market Executive Summary

The global Automated Teller Machine (ATM) Security and Safety Market is experiencing dynamic shifts, driven by escalating cyber threats and advancements in defensive technology, positioning it for substantial compound growth over the forecast period. Business trends highlight a strong movement away from purely physical security models towards hybrid, integrated security architectures that combine advanced logical security—like real-time malware protection and network segmentation—with traditional physical hardening measures such as explosive gas detection and smart video monitoring. Financial institutions are increasingly favoring managed security services and outsourced monitoring to leverage specialized expertise and ensure rapid response capabilities to emerging threats, transforming capital expenditure models into operational expenditure commitments for security budgets.

Regional trends indicate North America and Europe currently dominate the market due to early adoption of advanced technologies, high regulatory compliance standards, and the sophisticated nature of organized ATM crime syndicates operating within these established economies. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by massive ATM network expansion, particularly in emerging economies like India and China, and the urgent need to secure newly deployed terminals against rising incidents of skimming and physical attacks. Latin America and the Middle East & Africa (MEA) are also showing strong uptake, driven by persistent vulnerability to physical theft and the necessity to implement basic but highly effective physical security countermeasures.

Segmentation trends reveal that the Logical Security segment, encompassing anti-malware, fraud detection software, and advanced encryption techniques, is poised to demonstrate superior growth compared to Physical Security hardware, reflecting the shift in attack vectors towards digital exploitation (jackpotting and transaction manipulation). Within the service segment, the demand for security consulting, managed services, and comprehensive penetration testing specifically tailored for ATM environments is escalating rapidly. Furthermore, the application segment shows that the Independent ATM Deployer (IAD) market, often operating older or less robust security systems, represents a significant growth opportunity for vendors offering scalable, cost-effective security retrofit solutions, bridging the security gap between bank-owned and third-party deployed terminals.

AI Impact Analysis on Automated Teller Machine (ATM) Security and Safety Market

User queries regarding the impact of Artificial Intelligence (AI) on ATM security frequently revolve around the effectiveness of AI in real-time fraud detection, its ability to preemptively identify new attack patterns (such as zero-day jackpotting methods), and the potential for autonomous monitoring systems to reduce reliance on human surveillance. Users are keen to understand how AI-driven behavioral biometrics can verify legitimate users versus sophisticated imposters and whether machine learning algorithms can reliably analyze vast amounts of log data, video feeds, and transaction histories instantaneously to pinpoint anomalies indicative of ongoing attacks. Concerns often center on the accuracy of AI models (false positives), the privacy implications of facial recognition and biometric data collection, and the integration complexity of AI systems with legacy ATM infrastructure. Overall expectation is that AI will shift security from reactive measures to proactive, predictive defense mechanisms.

- Real-Time Anomaly Detection: AI models analyze transaction data, user behavior, and environmental sensors (e.g., vibration, heat) in real time to instantly detect deviations indicating fraud or physical tampering, surpassing the capabilities of rules-based systems.

- Predictive Maintenance and Security Posture: Machine learning forecasts potential hardware failures or software vulnerabilities before they can be exploited by criminals, enabling proactive patching and physical reinforcement.

- Advanced Surveillance Integration: AI-powered video analytics automatically identify suspicious activities, such as attempts to attach skimming devices, unauthorized loitering, or mask-wearing, immediately alerting security personnel and significantly enhancing situational awareness.

- Biometric Authentication and Verification: Utilizing deep learning for facial recognition, voice recognition, and behavioral biometrics (keystroke dynamics) to establish strong, non-repudiable proof of identity, thereby mitigating card-present fraud and stolen credential attacks.

- Intelligent Anti-Malware Solutions: AI algorithms learn the characteristics of legitimate ATM operating environments (whitelisting) and rapidly identify polymorphic malware or zero-day threats aimed at logical exploitation like jackpotting, often outperforming traditional signature-based antivirus software.

- Optimized Cash Management Security: AI optimizes armored transport schedules and cash loading processes based on predictive modeling of demand and risk assessment, minimizing the window of opportunity for cash-in-transit (CIT) attacks.

DRO & Impact Forces Of Automated Teller Machine (ATM) Security and Safety Market

The ATM Security and Safety Market is influenced by a powerful combination of driving forces that mandate security upgrades, balanced by significant restraints related to cost and deployment complexity, creating substantial opportunities for technological innovation and strategic market penetration. The primary drivers include the constant evolution of criminal methodologies, necessitating continuous investment in advanced security countermeasures, and the rigorous regulatory environment that penalizes financial institutions for security lapses. However, the high initial capital investment required for deploying integrated, multi-layered security solutions across massive, geographically dispersed ATM networks, coupled with the inherent challenge of retrofitting older machines, acts as a primary market restraint. The enduring opportunity lies in developing universally compatible, software-defined security solutions and leveraging cloud-based platforms for centralized, efficient monitoring and rapid response capabilities.

Impact forces dictate the direction of market spending and innovation. The proliferation of digital banking and mobile payment applications, while reducing transaction volumes at some ATMs, paradoxically raises the stakes for the remaining cash withdrawals, concentrating criminal focus on these endpoints, thus driving demand for more robust physical and logical defenses. Furthermore, the global shortage of skilled cybersecurity professionals competent in specialized ATM security architecture pushes institutions towards fully managed security services, transferring risk and expertise acquisition costs to dedicated vendors. The transition to Windows 10 and subsequent operating system upgrades provides a critical, scheduled opportunity for FIs to integrate advanced security features during the hardware refresh cycle, accelerating adoption.

Segmentation Analysis

The Automated Teller Machine (ATM) Security and Safety Market is comprehensively segmented based on the type of security solution offered, the deployment environment of the ATM, and the nature of the application utilizing the security measures. This detailed segmentation aids in understanding the distinct needs of various end-users and the varying levels of technological sophistication required across different regions and regulatory landscapes. The Solution segment differentiates between hardware-centric physical protections and software-driven logical defenses, reflecting the dual nature of threats faced by ATMs—ranging from explosive attacks on the vault to network infiltration and malware deployment. The Application segment highlights the varied security demands of large banks versus independent deployers, influencing purchasing power and security standards implemented.

- By Solution Type:

- Physical Security:

- Anti-Skimming Devices (Deep Insert Skimmers, Shimmers)

- Reinforced ATM Vaults and Safes (UL 291 Standards)

- Alarm Systems and GPS Tracking

- Security Enclosures and Bollards

- Ink-Staining Technology (Intelligent Banknote Neutralization Systems - IBNS)

- Explosive Gas Detection and Anti-Explosion Kits

- Security Fogging Systems

- Logical Security:

- Anti-Malware and Whitelisting Software (e.g., Diebold Nixdorf Vynamic Security, NCR Solidcore Suite)

- Network Security and Endpoint Protection

- Encryption and Tokenization Solutions (PCI Compliance)

- Fraud Detection and Prevention Systems (Cardless and Card-Present Fraud)

- Application Control and Software Integrity Monitoring

- Biometric and Multi-Factor Authentication

- Monitoring and Services:

- Managed Security Services (MSS)

- Video Surveillance and Monitoring (CCTV, IP Cameras, AI Analytics)

- Remote Monitoring and Diagnostics

- Security Consulting and Penetration Testing

- Cash-in-Transit (CIT) Security Services

- Physical Security:

- By Deployment:

- On-site ATMs (Branch Locations)

- Off-site ATMs (Retail, Transit, Kiosks)

- Mobile and Temporary ATMs

- By Application/End-User:

- Bank ATMs (Owned and Operated by Financial Institutions)

- Independent ATM Deployers (IADs) and Retail ATMs

- Credit Unions and Cooperative Banks

- By Geography:

- North America (U.S., Canada)

- Europe (U.K., Germany, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Middle East & Africa (MEA) (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Automated Teller Machine (ATM) Security and Safety Market

The value chain for the ATM Security and Safety Market begins with upstream activities centered on the research and development of specialized hardware components and sophisticated security software, including sensors, proprietary encryption libraries, and deep learning fraud models. Major ATM manufacturers (OEMs) like Diebold Nixdorf and NCR play a critical role here, often developing integrated security suites compatible with their proprietary hardware and operating systems. Component suppliers provide highly specialized items such as reinforced steel plates, biometric readers, and high-resolution cameras, ensuring quality and adherence to stringent security standards such as UL 291, which governs ATM physical security levels. The efficiency of this upstream phase dictates the resilience and innovation capacity of the final products available to the market.

The midstream involves the manufacturing, assembly, and integration of these diverse security components into a holistic system, which is then deployed across vast ATM networks. System integrators and security solution providers (SSPs) are crucial at this stage, adapting standard security packages to meet the unique operational and regulatory requirements of individual financial institutions or IADs. Downstream activities involve distribution channels, installation, ongoing maintenance, and critical managed security services. Direct distribution is common for large-scale purchases where FIs deal directly with OEMs for integrated solutions, ensuring custom configurations and direct support. Conversely, indirect channels, involving specialized security distributors and regional value-added resellers (VARs), are often utilized by smaller banks or IADs seeking localized support and phased upgrades.

The distribution channel is heavily skewed towards specialized sales due to the technical complexity and regulatory sensitivity of the products. Direct channels are preferred for high-value logical security contracts and large-scale physical security rollouts, ensuring direct control over implementation and intellectual property protection. Indirect channels are vital for penetrating geographically dispersed markets and providing localized field services, including rapid response to physical attacks and emergency software patching. The value chain concludes with the end-users—banks, credit unions, and IADs—receiving continuous support, monitoring, and regular security updates, highlighting the shift toward a service-based security model where recurring revenue streams from maintenance and management services are paramount for vendors.

Automated Teller Machine (ATM) Security and Safety Market Potential Customers

The primary customers for ATM security and safety solutions are institutions that own, operate, or manage large fleets of Automated Teller Machines, where transaction integrity and physical asset protection are mission-critical priorities. This core segment includes major international and regional commercial banks, which are required by law and internal risk policy to deploy multi-layered security measures to protect consumer deposits and sensitive data against both physical and logical threats. These institutions demand high-end, integrated solutions encompassing both physical hardening (e.g., smart safes, ink-staining) and advanced logical defenses (e.g., enterprise-level anti-jackpotting software, forensic tools). Their buying decisions are heavily influenced by regulatory compliance requirements, overall total cost of ownership (TCO), and the vendor's proven ability to handle large-scale deployment and remote management.

A rapidly growing segment of potential customers comprises Independent ATM Deployers (IADs) and various retail organizations (such as large grocery chains and convenience stores) that operate ATMs as a service or revenue stream. IADs typically prioritize cost-effective, scalable, and standardized security packages that can be easily deployed and managed across diverse locations, often using off-site or through-the-wall ATM models. While their security requirements might initially focus on basic physical protection (locks, alarms), increasing incidents of logical attacks targeting non-bank ATMs are driving demand for advanced logical solutions, particularly cloud-managed security services that require minimal on-site IT intervention. This segment represents a high-volume market opportunity for modular and retrofit security solutions.

Additional customer groups include credit unions, cooperative banks, and specialized financial service providers operating in niche markets or remote geographical areas. These entities often lack the extensive IT infrastructure of major commercial banks and require robust, easy-to-manage, and highly reliable security systems. Furthermore, organizations responsible for Cash-in-Transit (CIT) security, though not direct buyers of ATM endpoints, are significant users of services related to the market, requiring specialized security solutions for cash handling, tracking, and vault protection both within the ATM and during transportation. All customer groups share the common need to minimize fraud losses, maintain regulatory adherence, and safeguard their brand reputation against security breaches.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.90 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Diebold Nixdorf, NCR Corporation, Loomis, G4S, Brink's, Hitachi-Omron Terminal Solutions, Kaba Group, Gunnebo AB, Honeywell International, Genetec, Tyco International (Johnson Controls), CMS Info Systems, Glory Ltd., Tidel Technologies, SecureWorks, Access Control Technology, Checkpoint Systems, Mitsubishi Electric, Toshiba Global Commerce Solutions, Zicom Electronic Security Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automated Teller Machine (ATM) Security and Safety Market Key Technology Landscape

The technology landscape within the ATM security market is highly advanced and rapidly converging, focusing on multi-layered defense mechanisms that combine physical deterrence with sophisticated digital countermeasures. Core technologies include Intelligent Banknote Neutralization Systems (IBNS), which utilize ink-staining or glue-based mechanisms to render stolen cash unusable immediately upon unauthorized access or attack, thereby significantly reducing the incentive for cash theft, particularly during CIT operations and ATM physical breaches. On the physical side, the implementation of advanced polymer-based anti-skimming modules and "shimmer" detection devices is becoming standard, leveraging sensors and physical design attributes to prevent the insertion and reading of card data by illicit means. This hardware innovation is essential as criminals constantly miniaturize their attack tools.

Logically, the market relies heavily on robust application whitelisting and software integrity verification tools, exemplified by products like NCR Solidcore. Whitelisting ensures that only pre-approved, digitally signed executable files can run on the ATM operating system, effectively blocking known and unknown malware, including sophisticated jackpotting viruses that attempt to command the dispenser unit. Furthermore, the adoption of advanced encryption standards (e.g., Triple DES replacement with AES) for data transmission and storage is mandatory under PCI regulations. These logical defenses are increasingly augmented by machine learning algorithms that analyze network traffic and transaction patterns for behavioral anomalies, often leveraging global threat intelligence feeds to identify emerging attack campaigns targeting financial networks.

The integration of Internet of Things (IoT) sensors and Artificial Intelligence (AI) for surveillance and environment monitoring marks the frontier of technological development. IoT sensors provide real-time data on everything from seismic vibrations (indicating physical attack) to temperature changes (indicating gas usage for explosion attempts) and can autonomously trigger immediate defensive responses or alerts. AI-powered video analytics not only record events but proactively identify suspicious human behavior surrounding the ATM, enhancing the efficiency of remote monitoring centers and reducing dependency on manual security patrols. Furthermore, the push towards utilizing biometric identifiers (fingerprint, iris, vein patterns) offers a high-security replacement for traditional PIN-based authentication, substantially reducing fraud vectors associated with stolen cards and credentials.

Regional Highlights

- North America: This region holds a significant market share, characterized by high technological maturity, stringent regulatory enforcement by bodies like the Federal Reserve, and a concentration of major ATM manufacturers and security solution providers. The focus here is primarily on logical security, advanced fraud detection (especially cardless fraud), and combatting sophisticated network penetration attacks like jackpotting. The retrofit market, driven by the lifecycle management of large bank fleets and the necessary transition to more secure operating systems (like Windows 10 IoT Enterprise), ensures continuous spending on integrated software solutions and managed services.

- Europe: Europe represents a mature but highly fragmented market, with strong regional differences in preferred security methods. The emphasis is dual: combating sophisticated logical attacks (due to high connectivity) and mitigating persistent physical threats, particularly in Eastern and Southern Europe, where explosive attacks (gas and solid explosive use) remain common. Regulations such as the Payment Services Directive 2 (PSD2) influence security spending, pushing adoption of strong customer authentication (SCA) and real-time transaction monitoring. The high adoption of IBNS (ink-staining) systems across many Western European countries underscores the region's commitment to physical cash neutralization.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, driven by the massive expansion of ATM networks, particularly in emerging economies such as India, Indonesia, and Vietnam, where financial inclusion initiatives are rampant. This rapid deployment, often in unsupervised, remote locations, necessitates basic yet robust physical security solutions (strong vaults, alarms, and basic CCTV). While logical attacks are rising in technologically advanced areas like Japan and South Korea, the dominant immediate threat remains card skimming and physical theft. The market is highly price-sensitive, favoring vendors who offer scalable, modular, and cost-effective security packages suitable for mass deployment.

- Latin America: This region faces significant challenges due to high rates of physical theft, including "smash-and-grab" attacks and sophisticated skimming operations often tied to organized crime. Consequently, market demand is heavily concentrated on physical hardening—including anti-theft devices, GPS trackers, and high-security safes—supplemented by basic logical protections. Governments and large banks are increasingly investing in remote monitoring and armed response services to deter criminals. Brazil and Mexico are the largest spenders, continually updating security measures in response to localized crime trends.

- Middle East and Africa (MEA): The MEA region exhibits varied maturity. The Gulf Cooperation Council (GCC) countries focus on deploying state-of-the-art integrated systems mirroring European standards, emphasizing advanced logical security and high-end surveillance due to significant banking investments. Conversely, many parts of Africa focus on basic physical protection and cash transit security services (CIT) to mitigate high risks associated with transportation and remote location deployment. The lack of standardized infrastructure and high connectivity costs in certain African subregions pose restraints, yet they drive opportunities for wireless security solutions and low-bandwidth remote monitoring systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automated Teller Machine (ATM) Security and Safety Market.- Diebold Nixdorf

- NCR Corporation

- Loomis

- G4S

- Brink's

- Hitachi-Omron Terminal Solutions

- Kaba Group (dormakaba)

- Gunnebo AB

- Honeywell International Inc.

- Genetec Inc.

- Tyco International (now part of Johnson Controls)

- CMS Info Systems

- Glory Ltd.

- Tidel Technologies, Inc.

- SecureWorks

- Access Control Technology Ltd.

- Checkpoint Systems, Inc.

- Mitsubishi Electric Corporation

- Toshiba Global Commerce Solutions

- Zicom Electronic Security Systems Ltd.

Frequently Asked Questions

Analyze common user questions about the Automated Teller Machine (ATM) Security and Safety market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the most effective technological countermeasures against ATM jackpotting attacks?

The most effective countermeasures against jackpotting (logical cash dispensing attacks) involve robust application whitelisting solutions, which restrict the execution of unauthorized software; software integrity monitoring to detect modifications to the core ATM operating system; and strong network segmentation to isolate the ATM from the broader banking network, preventing remote command and control attacks. Furthermore, upgrading to modern, supported operating systems and leveraging advanced encryption protocols are crucial defensive layers.

How is the rise of contactless payment technology influencing the demand for physical ATM security?

While contactless payments reduce transaction volumes for some cash withdrawals, they have not diminished the need for physical security. Criminal focus is concentrating on the remaining high-value cash endpoints, leading to more aggressive physical attacks (like explosive or ram raids). Consequently, demand for advanced physical deterrents—such as IBNS (ink-staining systems), reinforced vaults, and explosive gas detection—is increasing to mitigate the high financial and reputational damage resulting from successful physical breaches.

Which market segment, Physical Security or Logical Security, is expected to grow faster?

The Logical Security segment is anticipated to exhibit a higher compound annual growth rate (CAGR). This acceleration is driven by the increasing sophistication and frequency of logical attacks (jackpotting, malware, network fraud) and the necessity for banks to comply with stringent data protection and network security regulations. Investment is shifting toward software-based defenses, AI-driven fraud analytics, and managed security services, reflecting the evolving threat landscape where digital exploitation often yields higher returns for criminals.

What role does regulatory compliance play in driving investment in ATM security solutions?

Regulatory compliance is a major market driver. Global standards such as PCI DSS mandate strict controls over cardholder data encryption, network configuration, and physical access. Failure to comply results in severe financial penalties and liability for fraud losses. Furthermore, regional financial authority guidelines frequently require specific technologies, such as anti-skimming hardware or specific anti-malware software, forcing financial institutions to make periodic, mandatory security investments and upgrades.

What are the key security challenges faced by Independent ATM Deployers (IADs) compared to traditional banks?

IADs often face unique challenges, primarily related to cost constraints and disparate deployment environments. They frequently utilize older or less expensive hardware, making them more vulnerable to basic skimming and unauthorized physical access. Additionally, they often rely less on sophisticated in-house security teams, driving a strong need for outsourced, managed security services (MSS) and easily retrofitted, cost-effective physical and logical defense solutions that minimize manual maintenance requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager